Unlocking Market Potential with Crypto Margin Trading Let's use a real-world analogy. Imagine you want to buy a house but only have enough cash for a small down payment. You get a mortgage from the bank to cover the rest, which allows you to control a much larger asset. Margin trading works on the same principle. The crypto exchange acts as your "bank," lending you funds to boost your buying (or selling) power. This borrowed capital is what we call leverage. For example, if you use 10x leverage, every $1 you put up from your own funds—your "margin"—lets you control $10 worth of crypto in the market. This mechanism is the engine that drives both the immense appeal and the serious dangers of trading on margin.

Let's use a real-world analogy. Imagine you want to buy a house but only have enough cash for a small down payment. You get a mortgage from the bank to cover the rest, which allows you to control a much larger asset. Margin trading works on the same principle. The crypto exchange acts as your "bank," lending you funds to boost your buying (or selling) power. This borrowed capital is what we call leverage. For example, if you use 10x leverage, every $1 you put up from your own funds—your "margin"—lets you control $10 worth of crypto in the market. This mechanism is the engine that drives both the immense appeal and the serious dangers of trading on margin.

The Core Components You Must Know To really get the hang of margin trading, you need to understand a few key moving parts. These concepts are at the heart of every single margin trade you'll ever place. - Margin: This is your skin in the game—the initial capital you put up from your own account to open a leveraged position. It serves as collateral for the loan from the exchange. - Leverage: This is the ratio of borrowed funds to your own margin. So, 5x leverage means you're controlling a position five times larger than your initial capital. - Collateral: These are the assets in your account that secure the loan. If a trade goes sour, the exchange can take this collateral to cover its losses. - Liquidation: This is the worst-case scenario. If your trade loses too much value, the exchange will automatically close your position to repay its loan. This almost always results in the total loss of your initial margin. This style of trading has become a cornerstone of the modern crypto market, largely because of the inherent volatility and traders' growing appetite for bigger opportunities. Today's platforms offer features like real-time risk controls and different margin modes, which has made it more accessible. In fact, many industry watchers are forecasting a breakthrough year for margin, with record engagement expected on exchanges. You can dig into some of these market trends on alwin.io.

The Double-Edged Sword of Margin Trading The main reason traders are drawn to margin is its power to generate big returns from relatively small price swings. But this amplification is a two-way street. A tiny price movement against your position can lead to incredibly fast and severe losses.>Margin trading provides the potential for amplified gains from minor market movements, but this power comes with the equal and opposite risk of amplified losses. A disciplined approach is non-negotiable. To help you weigh the decision, it's useful to see the pros and cons side-by-side.

Margin Trading At a Glance: Pros vs Cons Here’s a quick summary comparing the potential benefits against the significant risks you'll face when trading with leverage.

| Aspect | Potential Upside (Pros) | Potential Downside (Cons) | |:--- |:--- |:--- | | Profit Potential | Amplifies gains, allowing for significant profits from small capital.

| Magnifies losses, which can easily exceed the initial investment if not managed.

| | Capital Efficiency | Frees up capital to be used for other trades or investments.

| Requires constant monitoring to avoid liquidation.

| | Market Access | Enables traders to open larger positions than their balance would allow.

| The risk of a margin call and forced liquidation is always present.

| | Trading Flexibility | Allows for both long (betting prices go up) and short (betting prices go down) positions.

| High leverage dramatically reduces the margin for error.

| Ultimately, while margin trading can open up new opportunities, it demands respect. Understanding both sides of the coin is the first step toward using it responsibly.

How Leverage and Margin Work Together Leverage and margin are the two engines that power every single trade in crypto margin trading. You can’t have one without the other. Think of them as two sides of the same coin: leverage determines the size of your trade, while margin is the collateral that secures it. Getting a feel for their dynamic relationship is absolutely essential for managing risk and jumping on market opportunities when they appear. Leverage is basically a multiplier for your trading capital. If you have $100 and decide to use 10x leverage, you're suddenly controlling a $1,000 position in the market. This amplification is what allows traders to turn relatively small price movements into significant profits. But—and this is a big but—that magnifying glass works both ways. A small price move in your favor can lead to huge gains, but an equally small move against you can wipe out your capital just as quickly. It’s a powerful tool, and you have to treat it with respect.

Leverage and margin are the two engines that power every single trade in crypto margin trading. You can’t have one without the other. Think of them as two sides of the same coin: leverage determines the size of your trade, while margin is the collateral that secures it. Getting a feel for their dynamic relationship is absolutely essential for managing risk and jumping on market opportunities when they appear. Leverage is basically a multiplier for your trading capital. If you have $100 and decide to use 10x leverage, you're suddenly controlling a $1,000 position in the market. This amplification is what allows traders to turn relatively small price movements into significant profits. But—and this is a big but—that magnifying glass works both ways. A small price move in your favor can lead to huge gains, but an equally small move against you can wipe out your capital just as quickly. It’s a powerful tool, and you have to treat it with respect.

The Mechanics of Amplified Trading Let's walk through a quick example to see exactly how this plays out in the real world. Say you're bullish on Bitcoin and want to open a leveraged long position. - Your Capital: You're starting with $100 of your own money. - Leverage Applied: You select 10x leverage. - Total Position Size: Your $100 multiplied by 10 gives you a $1,000 position. You are now controlling $1,000 worth of Bitcoin. So, what happens if the price of Bitcoin moves by just 5%? - Scenario 1 (Profit): The price of BTC jumps 5%. Your $1,000 position is now worth $1,050. That’s a $50 profit, which amounts to a massive 50% return on your initial $100. - Scenario 2 (Loss): The price of BTC drops 5%. Your $1,000 position shrinks to $950. That’s a $50 loss, meaning you've lost 50% of your initial $100. See how that works? The 10x leverage turned a simple 5% market move into a 50% outcome for your funds. This is the double-edged sword of margin trading in a nutshell. Before you get too deep into crypto specifics, it helps to have a solid grasp of the basics. Brushing up on understanding Forex trading basics like order types, margin, leverage, and lot size can build a really strong foundation.

Initial Margin and Maintenance Margin To keep your leveraged trade open, the exchange requires you to meet certain collateral requirements. This is where two critical concepts come into play: Initial Margin and Maintenance Margin. These are the financial guardrails keeping your position on the road.>Think of your Maintenance Margin as the "health bar" for your trade. If your account equity drops to this critical level, your position is in immediate danger of being automatically closed by the exchange. The Initial Margin is the amount of your own capital you need to put up just to open the position. It’s your down payment. In our $1,000 trade with 10x leverage, your $100 deposit is the initial margin. The Maintenance Margin, on the other hand, is the minimum amount of equity you must have in your account to prevent the trade from being liquidated (force-closed). This threshold is set as a percentage of your total position value and acts as a safety net for the exchange loaning you the funds. If your losses start eating into your margin and your equity dips to the maintenance level, you’ll get a margin call or, more likely in crypto, an instant liquidation. This is why getting your position size right from the start is so important. A professional crypto position sizing calculator can be a huge help here, ensuring you don't accidentally take on too much risk.

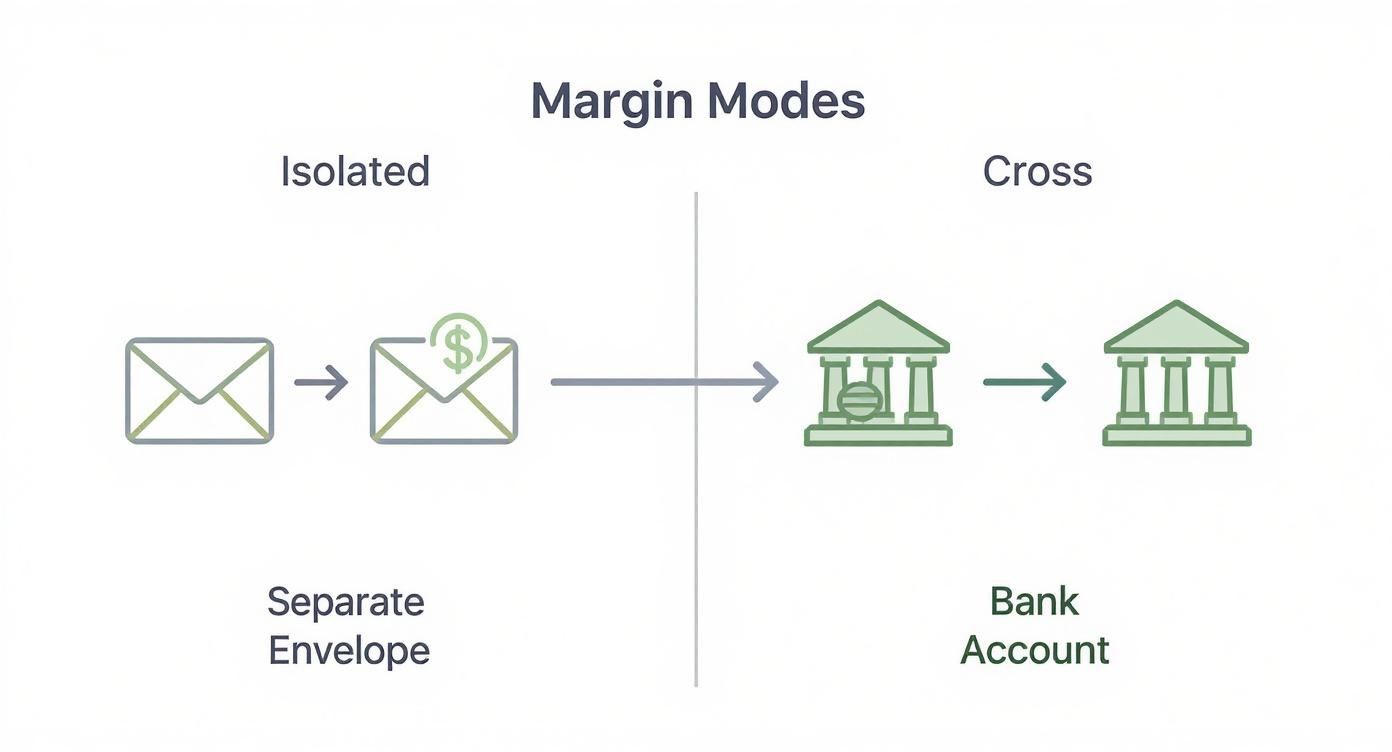

Isolated Margin vs Cross Margin When you open a leveraged trade, the exchange will ask you to choose between two ways of managing your collateral: Isolated Margin and Cross Margin. This isn't just a technical setting; it's a critical risk management decision that defines how your funds are either protected or exposed if a trade goes south. Think of it like this: are you setting aside a specific budget for one part of a project, or are you pulling from a single, large fund to cover everything? The choice you make here could be the difference between losing one trade and wiping out your entire account.

Understanding Isolated Margin Isolated Margin is the surgical approach. It’s like putting money in separate, sealed envelopes for each individual trade. When you open a position this way, you allocate a specific chunk of collateral that is completely walled off from the rest of your account. If that trade turns against you and heads for liquidation, the exchange can only touch the money inside that one "envelope." Your main account balance and any other open positions are safe. This containment is its biggest advantage, giving you precise, trade-by-trade risk control. Let's say you have $1,000 in your account. You decide to open a trade using $50 as isolated margin. Only that $50 is on the line. Even if the market tanks and your position gets liquidated, the other $950 in your account remains untouched.>Isolated Margin is perfect for limiting your potential loss on any single position to the exact amount you allocate. It's the go-to mode for traders who want to manage risk with precision, especially when testing a new strategy or trading a highly volatile asset. This method is fantastic for beginners who are still getting a feel for margin trading in cryptocurrency. It's also great for seasoned traders opening speculative positions that they want to keep separate from their core portfolio. It effectively prevents one bad trade from starting a disastrous domino effect.

Exploring Cross Margin Cross Margin, on the other hand, pools your entire account balance into one large pot of collateral for all of your open trades. It works like a shared family bank account where anyone can draw funds to cover their expenses. If one of your positions starts losing money, it automatically dips into the available balance in your account to stay afloat and avoid liquidation. This can even include unrealized profits from your winning trades. It’s a great way to give a struggling position a bit more breathing room. But this flexibility comes with a huge catch. If the market moves sharply against all your positions at once, your entire account balance is at risk of being drained to cover the combined losses. One catastrophic market event could wipe out the whole account. - Benefit: A winning trade can help prop up a losing one, preventing it from being liquidated too early. * Risk: Puts your entire account balance on the line, not just the margin for a single trade. Ultimately, the choice between isolated and cross margin boils down to your personal trading strategy and how much risk you're willing to stomach. Do you prefer the contained, predictable risk of isolated "envelopes," or the flexible—but far riskier—nature of a shared account? Getting this right is fundamental to trading responsibly.

Isolated Margin vs Cross Margin Which Should You Use Making the right choice between Isolated and Cross Margin depends entirely on your trading strategy, risk tolerance, and how you want to manage your capital. To make it clearer, here’s a direct comparison of how they stack up.

| Feature | Isolated Margin | Cross Margin | |:--- |:--- |:--- | | Collateral Scope | Funds are ring-fenced for a single position.

| Entire account balance is shared across all positions.

| | Risk Exposure | Limited to the margin allocated for one trade.

| Your entire account balance is at risk.

| | Liquidation Impact | Only the specific position is liquidated.

| A large loss can trigger a cascade of liquidations.

| | Management Style | Requires active, trade-by-trade management.

| More hands-off, as positions support each other.

| | Best For | Beginners, testing new strategies, high-risk trades.

| Experienced traders, managing a hedged portfolio.

| | Flexibility | Less flexible; can’t use profits from other trades.

| Highly flexible; unrealized profits can prevent liquidation.

| In short, Isolated Margin offers precision and control, making it ideal for managing risk on individual trades. Cross Margin provides flexibility by allowing positions to support each other, but it exposes your entire account to potential liquidation. Choose wisely based on what best fits your approach to the markets.