Crypto trading can be unsafe, but having a strong plan to manage risk can keep your money safe and up your odds of doing well. Here's what to know:

- Why Control Risk Matters: The crypto market runs all day and night with big price moves, so it's key to be ready and avoid choices led by fear or the urge to follow others.

- Main Risks in Crypto Trading:

- Market Ups and Downs: Prices can shift fast, even for big coins like Bitcoin and Ethereum.

- Selling Problems: Letting go of coins that not many want might lead to loss.

- Online Safety Dangers: Hacks, tricks, and exchange fails can make you lose a lot.

- Sudden Law Changes: Quick moves in law can mess up your trading plans.

- Issues with Platforms: Problems or mistakes in exchanges can mess up trades.

- Ways to Take Care of Risks:

- Set stop-loss orders to cut losses.

- Put your money in different coins and areas.

- Keep most of your cash in cold storage to be safe.

- Often update a risk list to watch and handle possible dangers.

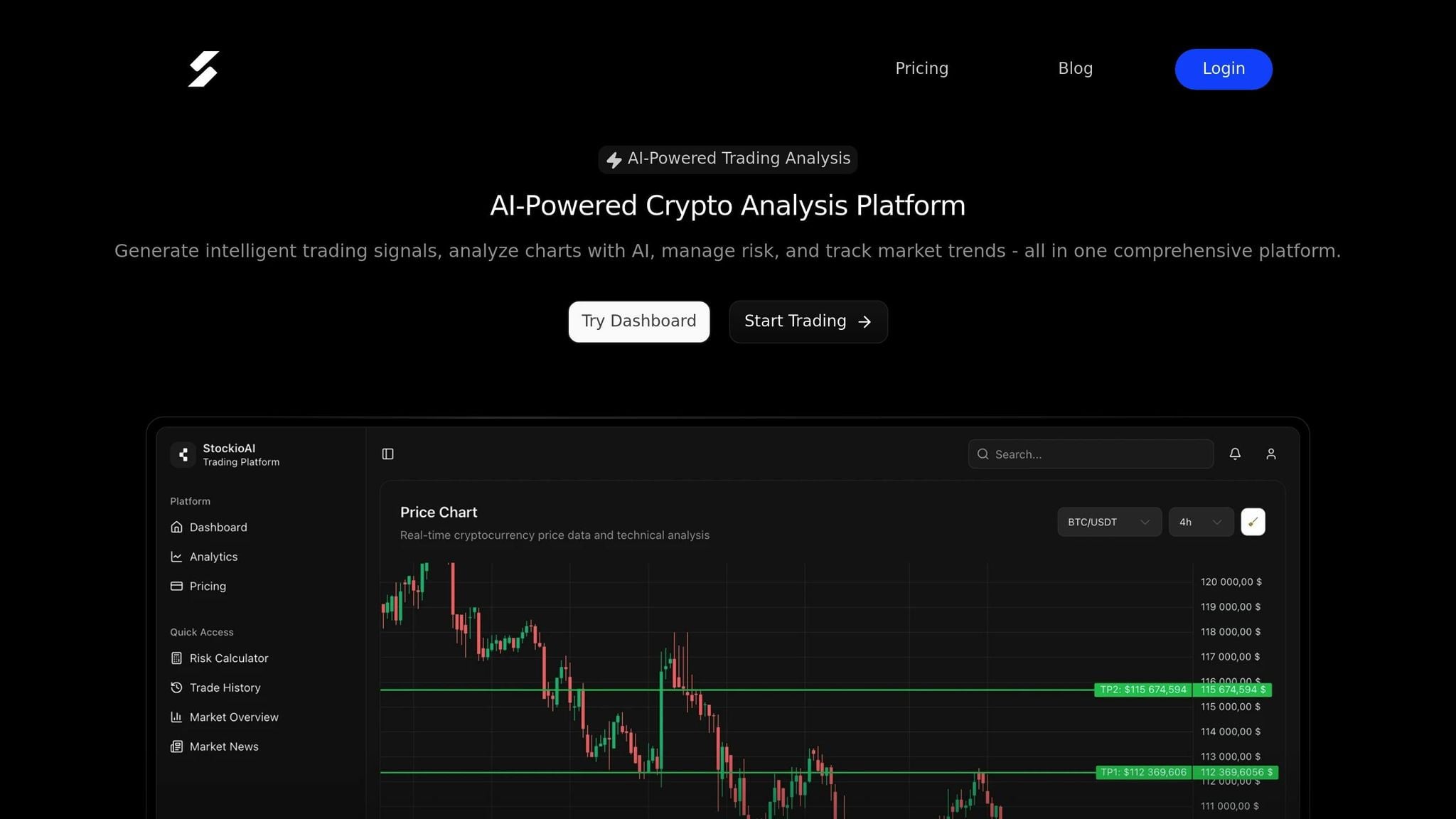

- Tools to Help Manage Risk: AI tools like StockioAI give live updates, alerts set by the app, and ways to keep track of your portfolio to help you stay on top of market changes.

- Following Laws: Stay true to U.S. laws like the GENIUS Act for stablecoins and keep good records for taxes.

Risk Management in Crypto Trading: Your MUST-DO's

How to Spot and Sort Out Trading Risks

Before you start your day of trading, it's key to spot and sort out risks you might face. By seeing these risks early, you can make a strong plan to manage them.

The crypto world is full of risks that could hurt your money. Some risks are clear, like quick drops in prices, while others are less clear - think of times when exchanges break down or when rules from the government change. Once you've seen these risks, your next move is to weigh how they could hurt your trading plan.

Kinds of Risks in Crypto Trading

-

Market Change Risk: Crypto prices can go up and down a lot. Even big names like Bitcoin and Ethereum can see big swings in price in no time, which can mess with your money.

-

Trade Speed Risk: This happens when you can't buy or sell things fast at the price you want. This is often a problem with smaller, less traded coins. For example, trying to sell a lot of a coin that isn't traded much might make you take a much lower price.

-

Web Threats: Bad guys often go after traders by tricking them or making fake sites to steal their sign-in info or money.

-

Doing Things Risks: These come from tech issues or mistakes made by people. An exchange might stop working when you need to make a trade, or problems with connecting could mess up your trades. Even small slip-ups, like typing in the wrong trade size, can lead to losing more than you thought.

-

Rule Change Risks: Changes in rules or laws from the government can really change how trading works and what your stuff is worth.

-

Other Side Risk: This is about the chance that the person or place you're trading with might not do what they should. This could be an exchange going under or spots that lend out coins failing to give them back.

How to Use Risk Lists and Check Sheets

A risk list is a good way to keep track of risks to your money. Think of it like a book where you write down each risk, how likely it is, what its effects could be, and how you plan to deal with it.

For example, you could write: "Exchange hack – Medium chance – Big effect – Keep money in a hardware wallet." A simple chart with columns for risk type, chance, effect, and plans to stop problems works well.

It's important to keep your risk list up-to-date. Look at it often - either every week or after big news in the market - to make sure it shows new threats. Whether it’s a new cheat aiming at traders or money troubles at an exchange, being ahead of the game helps you avoid shocks.

Your daily trading list should also have key risk checks. Before trading, make sure your stop-loss orders are set, look for big news that could touch your stuff, and make sure your security settings are right. Taking a few moments for these checks can stop big losses.

Lots of traders add a "lessons learned" part in their risk log. When things go wrong, write down what failed and how to dodge it later. This way, slips turn into key tips, making your trading safer as time goes on. Keeping close track of details makes you more set for any hard times ahead.

How to Check and Rank Risks

Once you spot possible trading risks, the next thing is to see which ones need your eye the most. Use your time, work, and help on the risks that could hurt the most.

Start by finding key risk signs, checking how likely each risk is and how bad it could hit. This isn't just about what you feel - make those thoughts into clear steps.

Ways to Look at Risks

A few methods can help you understand risks better:

-

Scenario Analysis: This plan looks at "what if" events, like a quick market drop or a safety break at an exchange. It lets you plan ways out and backup plans early.

-

Stress Testing: By acting out tough market times, you can see how your stocks would do under stress.

-

Sensitivity Analysis: This way finds out the things - like big price moves in cryptocurrency or new trading costs - that hit your stocks the most.

To sort out risks, place them on a chance-versus-harm chart. The aim? Focus on risks that are both very likely and could hurt a lot, while putting less focus on those with small impacts.

Scoring Risks and Heat Maps

A clear scoring way can make sorting risks even easier. Give each risk a score from 1 to 5 for both how likely it is and its impact, then multiply them to find out the total severe size. Use a heat map to show the results:

- Red: High-risk spots that need quick action

- Yellow: Medium-risk spots to keep an eye on

- Green: Low-risk spots with little worry

When scoring, build your views on what's happening in the market now and write down your reasons to keep them the same. Keep updating these scores to stay on top of new risks and tweak your plans as needed.

Ways to Cut Down Risk

Keeping your money safe in times of big market moves is vital for long-term wins. The best traders don't just count on luck - they have clear plans to protect their money when the market dips.

Stop-Loss Orders and How Much to Buy

Stop-loss orders work like a safety net for your trades. They automatically sell your stock if the price drops to a set point, helping you dodge big losses. Most skilled crypto traders risk only 2-3% of their total money on any one trade.

Using stop-losses right along with buying the right amount is key. Say you have $10,000 and you're okay with risking 2%, that’s $200 per trade. If Bitcoin is worth $50,000 and your stop-loss is at $48,000 (a $2,000 drop), you’d buy just 0.1 BTC to keep your risk low.

Trailing stop-losses are also smart to use. They move up as the price goes up, locking in your gains as you go. For example, if you buy Ethereum at $2,000 with a 10% trailing stop, and it goes up to $2,500, your stop-loss moves up to $2,250. This lets you keep a lot of your profit without having to watch the market all the time.

The main thing here is to stick to your plan. Follow your stop-loss rules and don’t let emotions sway you. Set your stops based on real market data or how much prices swing, not on a hunch.

Next, we'll look at spreading out your investments - another key part of cutting down risk.

Spreading Your Investments

Having varied investments cuts down risk and lessens the blow if one asset fails. A good crypto mix might be:

- 40% in big coins like Bitcoin and Ethereum

- 30% in middle-sized coins with solid basics

- 20% in small, fast-growing projects

- 10% in stablecoins to jump on new chances

This blend helps you grow while keeping down the risk of big losses.

But spreading out doesn't just mean holding different cryptocurrencies. Put your money in different parts of the crypto world. For instance, instead of only buying DeFi tokens, which often follow the same trends, think about gaming tokens, main blockchain layers, or setup projects. If one area drops, others might stay steady or even grow.

Spreading over time is wise too. By putting in a set amount at set times, you cut down the risk of buying when prices are at their highest. For instance, rather than putting $5,000 in at once, spread it over 10 weeks with $500 each time.

But keep in mind, during big market drops, links between assets can grow. Even a well-spread crypto mix can see big losses. To plan for this, think about keeping some traditional assets or cash as a safety net.

Now, let’s see why having a strong trading plan is as important as these tips.

A good trading plan is your map when the market gets wild. It should set your start points, end points, how big to go, and how much to risk - all before you make a trade. This plan stops you from quick, rushed choices when things get shaky.

Your plan needs to think about different cases too. Like, what will you do if a trade goes down by 10%? Or how to keep gains if it goes up by 20%? By fixing these steps early, you cut out the guesswork driven by feelings.

To make your method better, keep a trading journal. Write down every choice, check if you stuck to your plan or changed it. As time goes on, this record can show you your common moves and help you tweak your plan.

Put a cap on daily losses to block big downfalls. For example, if you drop 5% in one day, stop trading. Many traders try to win back losses, often sinking further.

Cut down on trading too much, which can come from doubting your plan. Look at your trades each week to see how you're doing and adjust as needed. Let your plan do its work, yet be ready for big shifts in the market.

The tough part of trading isn't just making a plan - it's keeping to the plan when feelings kick in. The best traders see their rules as firm, keeping steady even when the market is rough.

AI-Powered Risk Help Tools

AI tools are changing how traders deal with risk in the quick-moving world of crypto trade. Even though old plans stay key, these tools bring a new speed, giving fast insights to help traders change fast to market moves.

AI Risk Check Tools

Look at StockioAI, for one. This tool checks over 60 real-time info points, like tech signs, volume moves, market feel, order book depth, big player moves, and even talk on social media. From this info, it makes clear BUY, SELL, and HOLD hints, with exact points to get in, stop-loss levels, and profit goals [1].

StockioAI also has a risk calc built-in. If you put in your account size, risk likes, and trade details, it works out your risk size and says what sizes fit your stop-loss gap.

The tool does more. Its live chart study shows key up and down points, line trends, and chart shapes as they happen. This lets traders tweak their plans as market ways move.

Keeping Track and Auto Work

Good risk help goes with up-to-date portfolio keeping. Handling many crypto spots can seem too much, but StockioAI eases this by sending notes when any spot nears your set risk ends.

It keeps an eye on risk for different coins and trade pairs all the time, giving updates - even when off. You can watch live profit and loss for each trade and know how near you are to your stop-loss or profit goals, making sure you’re set for big choices.

Auto work is a big change, too. When the AI sees risk points that need closing a spot, it sends clear notes to explain why. This cuts out feeling-based choices and keeps you on your plan.

Why Pick StockioAI?

StockioAI is known for its quick and right data use, studying info from many cryptocurrencies in seconds. This quick look not only spots risks but also finds chances, giving traders an edge.

Its steady and full insights make risk control better, while auto checks save much time. Plus, trust scores for each hint make it easy to size spots in line with your risk likes.

Rules and Safety Tips for Trading

To keep your trading safe, following rules is key in managing risks well. By 2025, rules for trading cryptocurrency in the United States have become much clearer, giving better peace of mind to those trading digital money.

Following U.S. Rules

The GENIUS Act set on July 18, 2025, made a new rule for dollar-based stablecoins. This law says that the ones who make these coins must always have 100% good, quick-to-sell assets and share their asset details every month [2][3][4]. Now, these coin makers must follow the Bank Secrecy Act, which means they must check more carefully for money-laundering and follow strict penalty rules. For traders, this means you need to verify more often and watch transactions closer on stablecoin platforms. To stay within the rules, keep detailed records of all stablecoin deals for both rule-following and tax reasons.

The Digital Asset Market CLARITY Act and the SEC's Project Crypto have made who watches over what clearer. These rules ask traders to keep track of their buying costs for taxes and stay up to date on new rules [2][4]. It's smart to use tools or systems to keep eye on your costs and stay in the know by checking updates from places like the CFTC, SEC, and Treasury Department.

Keeping Your Digital Money Safe

Just following rules isn't enough; you also need to protect your digital money well. Security issues in the crypto world have led to big money losses, so having strong protection is crucial for any trader. For big amounts of crypto, cold storage is the safest choice. Hardware wallets, which keep your funds not online, are the top pick. But, since you can't use cold storage for quick trading, only keep the money you need for quick trades on trading platforms, and put most of it in cold storage.

Boost security by turning on two-factor authentication (2FA) through apps or hardware keys. Don't use SMS-based 2FA, as it can be attacked by SIM-swapping.

When picking trading platforms, choose those known for good security. Search for places that give customer insurance and keep most money in cold storage. Use strong, unique passwords for each one, and use a trusted password manager to not reuse passwords.

To keep wallets safe, write your key phrase on paper and keep it in several safe spots. Check who accesses your account often, update software, and think about using multi-signature wallets for big money. These wallets need more than one private key to say yes to deals, lowering risks from both online attacks and mistakes.

Lastly, make your home network secure by using a special network for trading. Keep your devices updated and stay away from public Wi-Fi to cut risks. Mixing rule-following with tight security steps makes sure your investments stay safe from both rule and online dangers.

Regular Checks and Always Getting Better

In the quick world of crypto, you can't let your risk plan stay the same. What worked last month may not work now. Keep updating your plan to make sure it fits and works well. Keep looking at your ways, you'll make your list better and understand your trade moves more.

Making Your Risk List Better

The crypto market is always full of surprises. With new rules, sudden mood swings or big world news, prices can change a lot. To keep up, your risk list needs to change as things happen.

Make time every week - or after big market news - to look at your stuff and improve your plan [5]. This helps you act fast and well to risks. For example, if you lose money too often or your mix of investments isn't doing well, change your way fast [7]. These regular checks help you see how your ways are doing right now.

Watch for big news like rule changes, rate changes from the Federal Reserve, or big world news. These can really change your game. For example, new crypto rules in a big place might make you change how you mix your investments or think again about how much money you put in.

Being able to change is key in crypto trading. Be ready to shift your ways as new info comes or things change in the market. It's also good to check how much risk you're okay with now and then. What seemed okay half a year ago might now feel too risky - or too safe - based on your trade results and life right now.

Change things where needed. This might mean fixing when to stop losses or when to take profits, looking at new kinds of assets, or being more strict during risky times. For example, you might be more relaxed with stop losses when things are calm but tighten them when things get shaky. These changes make sure your way stays strong and can change.

Learning from Trade Results

Your better list is just the start. Looking at each trade is key to make your whole risk plan better. Each trade, good or bad, teaches you something - so write down what happens and what you learn.

After a loss, stop and think on your plan before jumping back in [7]. This break helps you avoid quick choices and lets you see clearly to learn from mistakes.

Watch for repeat problems in your game. If you keep making the same mistakes or losing in certain market times, it's time to fix your plan. Keep good notes on your trades, including how big market news affected you. These learnings help you choose smarter next time.

Keep an eye on big economy trends, world news, and rule changes [6]. Mix looking at charts with deep research to get a full view of the market. This constant learning is key to make clear choices about crypto chances.

Keep checking and tweak your plan as you see how you do and as market changes [7]. Each month, make time to look at your trade log, spot trends, and change your risk plan. This loop of learning and shifting is key in setting apart traders who do well from those who give up too soon.

End Thoughts: Keeping Your Money Safe in Wild Markets

Trading crypto doesn't need to be a risky bet if you use a good plan for managing risk. Pay attention to how much you invest and watch your money's moves closely to trade with more sureness.

Using key ways like having stop-loss orders, spreading out your money, and keeping up-to-date are important. These steps get much easier with new tech tools. For example, StockioAI brings together quick risk checks, smart trade signals from AI, and watching your money all on one site. It spots risks fast, helping you choose wisely before your money is hit.

Moving through the often unsure world of crypto markets asks for strict rules and the best tools. Keep making your risk plan better to stay ready, as AI tools make it simpler to shift with market moves.

No matter if your trading plan is simple or complex, AI help lets you focus on making your money grow while keeping it safe. The best tools can change everything in making money and staying safe in wild markets.

FAQs

What's the best way to use stop-loss orders to keep risk low in crypto trading?

Stop-loss orders are a smart move to bring down risk in trading cryptocurrencies. These orders automatically sell your asset if its price hits a set level you pick, helping to cut possible losses. To make them work right, set a price lower than what you paid that fits both how much risk you can take and the asset's ups and downs. Many traders use a percent rule, like placing the stop-loss 5-10% under the buy price.

As market scenes change, it's key to go back and fix your stop-loss levels. For example, if an asset gets near a big support level or its price jumps a lot, updating your stop-loss can help you hold on to gains or face less risk if prices fall fast. Always putting and tweaking these orders is a main plan to keep your money safe in the fast-moving crypto market.

How does StockioAI help crypto traders keep risks low?

StockioAI gives crypto traders a clever plan to cut down risks using AI-based tools that watch market moves and spot risks as they pop up. These tools aid traders to pick wisely, even in the always shifting and hard to guess world of cryptocurrency.

Key parts of this are instant risk checks, auto warnings, and keeping an eye on portfolios. These features let traders put plans like stop-loss moves and mix up portfolios into action. With these tools, traders can guard their money and move with sure steps in the quick crypto market.