How AI Reads Market Sentiment for Crypto Trading

How AI uses NLP, social media, news and on-chain data to read crypto market sentiment and generate more accurate trading signals.

Explore all articles written by this author

How AI uses NLP, social media, news and on-chain data to read crypto market sentiment and generate more accurate trading signals.

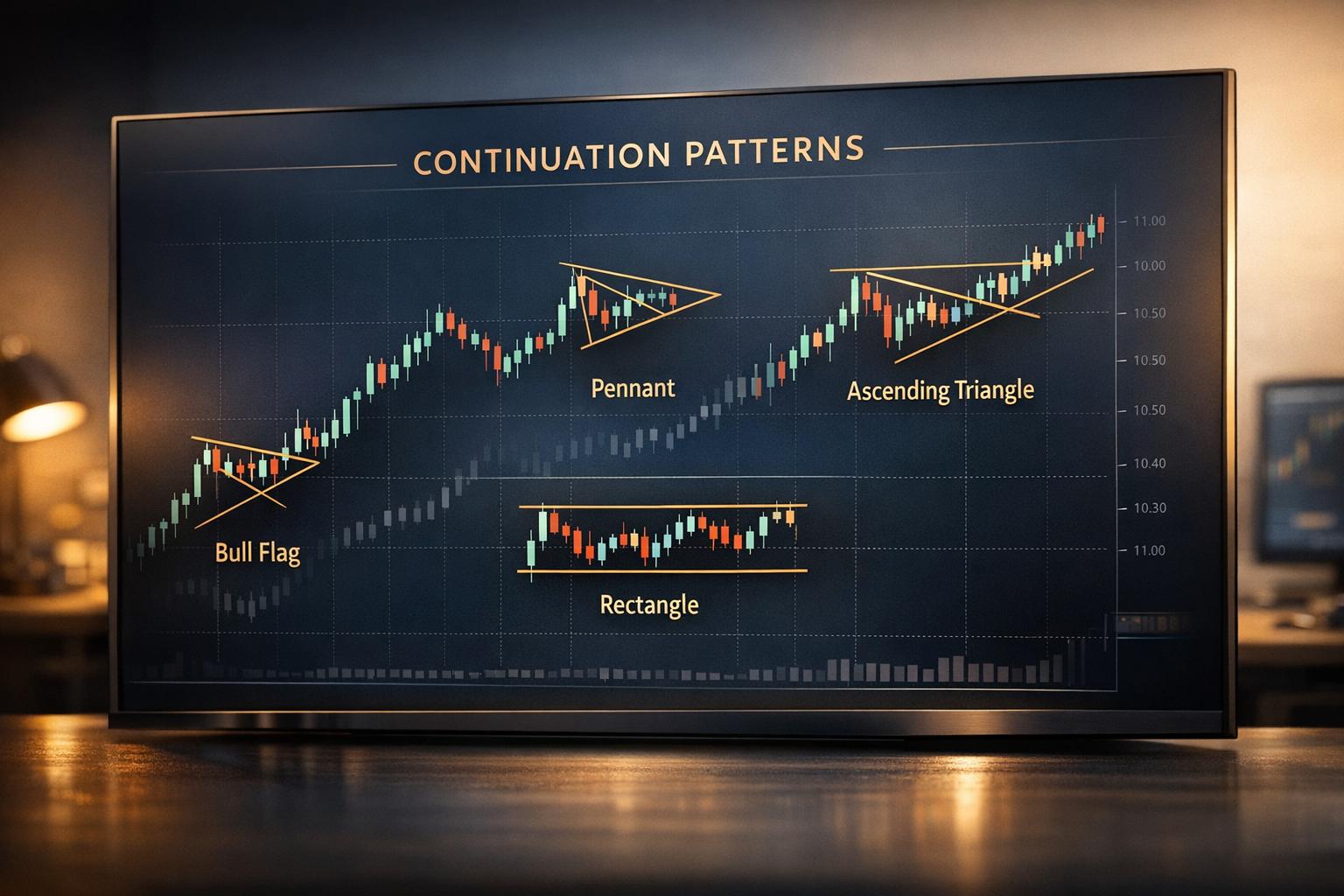

Identify flags, pennants, triangles and rectangles, confirm breakouts with volume and indicators, and set stops and profit targets for crypto trades.

Use U.S. wage reports to forecast Fed moves and generate crypto trading signals; combine AHE, ECI and CPI with technical and risk analysis.

How Fed rate moves, liquidity and dollar strength drive crypto volatility and Bitcoin's price swings, with institutional flows amplifying market reactions.

How AI emotion detection analyzes social media and news to give early sentiment signals, improve timing, manage risk, and cut trading bias.

The stochastic oscillator is a must-use momentum tool for crypto traders when paired with trend filters, proper settings, and strict risk controls.

Explains how AI trading tools provide real-time and daily BUY/SELL/HOLD signals, multi-timeframe analysis, and risk management for short- and long-term traders.

Clear overview of SEC crypto rules for traders: Howey Test, registration, custody, exchange obligations, fraud risks, and compliance tools for managing risk.

A practical guide to using the Awesome Oscillator to spot momentum shifts—zero-line crossovers, saucer and twin-peaks, divergences—and confirm signals with risk controls.

Learn essential risk management techniques for stocks and crypto traders. Protect your capital, master strategies, and thrive in volatile markets.

Plan your financial future with our Investment Growth Planner! See how your savings grow with contributions and returns over time. Try it free!

Compare seven top AI trading analysis tools for stocks, ETFs, crypto and forex — features, accuracy, market coverage, pricing, pros and cons.

Compare seven crypto trading strategies—day trading, scalping, swing, trend, range, breakout, and DCA—plus time, risk, and AI tool integration.

Compare three AI stock analysis platforms—real-time signals, intraday AI picks, and automated technical charting—with pricing and best-use cases for U.S. traders.

Compare seven leading chart analysis platforms with features, pricing, AI signals, and best-use cases for stock and crypto traders.

How reinforcement learning (DQN, PPO) generates adaptive crypto buy/sell/hold signals, accounts for fees and risk, and combines with AI analytics for robust trading.

AI-driven crypto signals offer an edge but remain probabilistic; accuracy is typically 60–80%, so strict stop-loss and position sizing are essential.

Analyze stock momentum with our free tool! Input closing prices to calculate trends and rate of change. Perfect for traders—try it now!

Read crypto charts confidently: learn candlesticks, volume, support/resistance, RSI/MACD, pattern recognition, AI signals, and risk management.

Calculate your stock investment returns easily! Enter initial and final values to see total and annualized returns in seconds.

Understand trendline breakouts, learn to distinguish real signals from false ones, and explore strategies for successful trading.

Learn how to effectively trade using EMA crossovers, including strategies, setups, and risk management for cryptocurrency markets.

Explore a comprehensive guide to a leading crypto trading app that combines AI tools, risk management, and transparent pricing for all traders.

Explore effective momentum trading strategies using key indicators to optimize crypto trading decisions and enhance risk management.

Learn best practices for tuning algorithm parameters in crypto trading to enhance performance and manage risk effectively.

Explore how AI enhances cryptocurrency trading by tracking volatility in real-time, improving decision-making, and optimizing risk management.

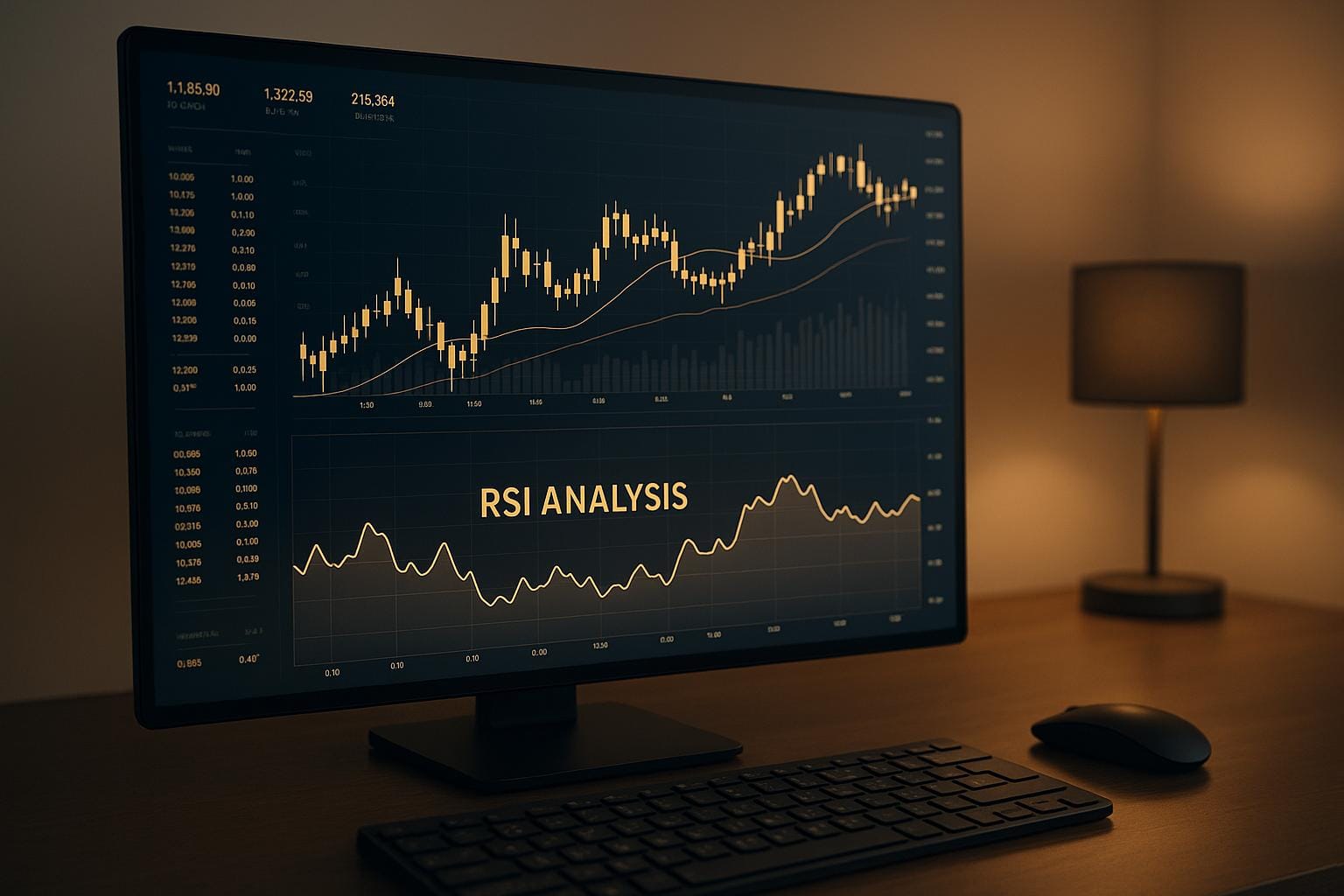

Explore how AI is revolutionizing RSI analysis in cryptocurrency trading, enhancing speed, accuracy, and decision-making.

Explore how AI revolutionizes market depth visualization in cryptocurrency trading, enhancing decision-making, risk management, and execution speed.

Explore AI-driven crypto trading signals that enhance decision-making and risk management for traders navigating volatile markets.

Explore top AI tools for candlestick pattern detection that enhance trading accuracy and decision-making in the fast-paced cryptocurrency market.

Explore how AI models like LSTM and CNN-LSTM are revolutionizing cryptocurrency trading by analyzing patterns and providing actionable insights.

Explore how AI trading systems revolutionize cryptocurrency markets by automating decision-making and providing real-time insights.

10 Crypto Algorithm Trading Strategies for 2025 The crypto market operates 24/7, driven by volatility and complex data streams that are impossible for humans t...

Explore how AI revolutionizes cryptocurrency compliance through real-time monitoring, automated decision-making, and reduced false positives.

A Practical Guide to margin trading in cryptocurrency Margin trading in crypto is one of those topics that sounds more complicated than it is.

Explore how feature engineering enhances volatility predictions in crypto trading using AI models and diverse data sources.

Explore the psychological triggers that influence cryptocurrency prices, from panic selling to social media impact, and learn how to navigate market volatility.

Explore how AI-powered chart alerts are revolutionizing trading by providing real-time insights and reducing emotional decisions, enhancing strategy effectiveness.

Explore how AI signal monitoring enhances cryptocurrency trading by providing real-time insights and reducing risks through data-driven strategies.

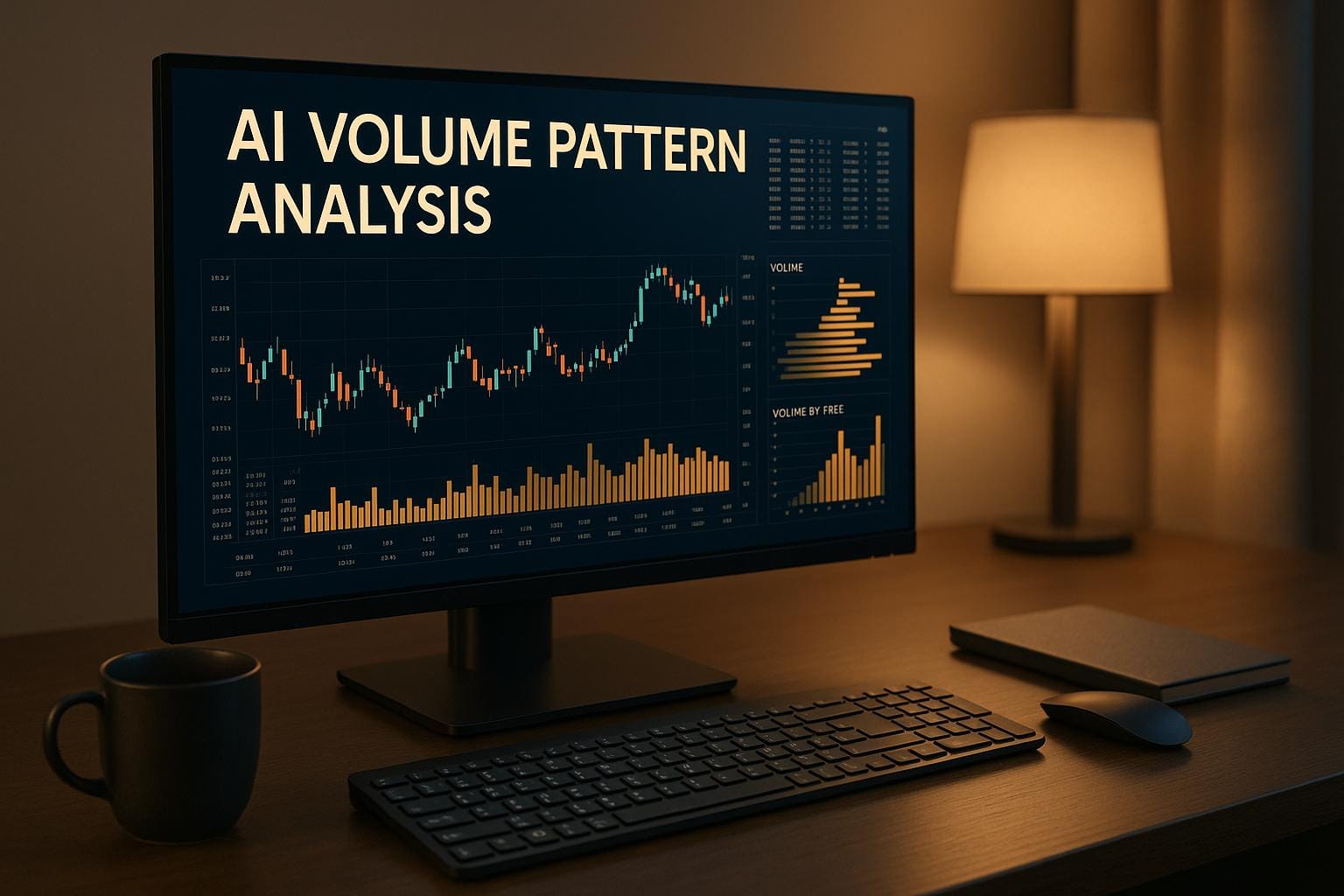

Explore how AI revolutionizes volume pattern analysis in cryptocurrency trading, enhancing accuracy, speed, and decision-making for traders.

Explore how AI sentiment analysis transforms cryptocurrency trading with key metrics like sentiment polarity and engagement metrics to predict price movements.

Find key support and resistance levels for any cryptocurrency with our free tool. Enter price data and get instant, actionable insights!

Check the volatility of any cryptocurrency like BTC or ETH with our free tool. Get a simple score and insights to make smarter trading decisions!

Explore how AI transforms trading through advanced chart pattern recognition, enhancing accuracy, speed, and decision-making in cryptocurrency markets.

Explore the transformation of crypto trading through AI, comparing template-based and machine learning methods for signal generation.

Curious about crypto market swings? Use our Crypto Volatility Index tool to check risk levels for Bitcoin, Ethereum, and more in just a click!

Convert crypto to fiat instantly with our Crypto Converter. Get live rates for Bitcoin, Ethereum, USD, EUR, and more. Fast, accurate, and free!

Calculate your cryptocurrency profits easily with our Crypto Profit Calculator. Input trades, fees, and prices to see your returns instantly!

Worried about your crypto investments? Use our Crypto Risk Calculator to evaluate your portfolio’s risk level and make smarter decisions today!

Explore the top crypto analysis platforms for 2025, focusing on AI-driven insights, risk management, and US compliance for traders.

Explore the top five AI-powered pattern recognition tools for crypto trading, comparing features, pricing, and suitability for different trader levels.

Effective risk management strategies are essential for successful crypto trading, helping to protect investments and navigate market volatility.

Explore the strengths and weaknesses of AI-driven and manual crypto analysis to enhance your trading strategy and decision-making process.

Learn how to effectively read crypto charts, analyze trends, and utilize AI tools for smarter trading decisions in the volatile market.