AI Charting Tools for TradingView Users

How AI charting tools speed TradingView analysis by automating pattern recognition, non-repainting signals, and dynamic risk management.

How AI charting tools speed TradingView analysis by automating pattern recognition, non-repainting signals, and dynamic risk management.

How AI uses NLP, social media, news and on-chain data to read crypto market sentiment and generate more accurate trading signals.

AI pattern recognition is reshaping trading in 2026 with faster multi-source signals, higher accuracy, automated risk controls, and emerging tech like quantum and federated learning.

AI charting tools speed up pattern detection, boost accuracy and consistency, generate real-time trade signals, and improve risk management for traders.

AI trading platforms must balance cybersecurity with regulatory transparency—covering model integrity, audit trails, real-time monitoring, and vendor oversight.

Master crypto support and resistance zones to spot bounces, breakouts, and high-confidence trade setups using moving averages, volume, and risk controls.

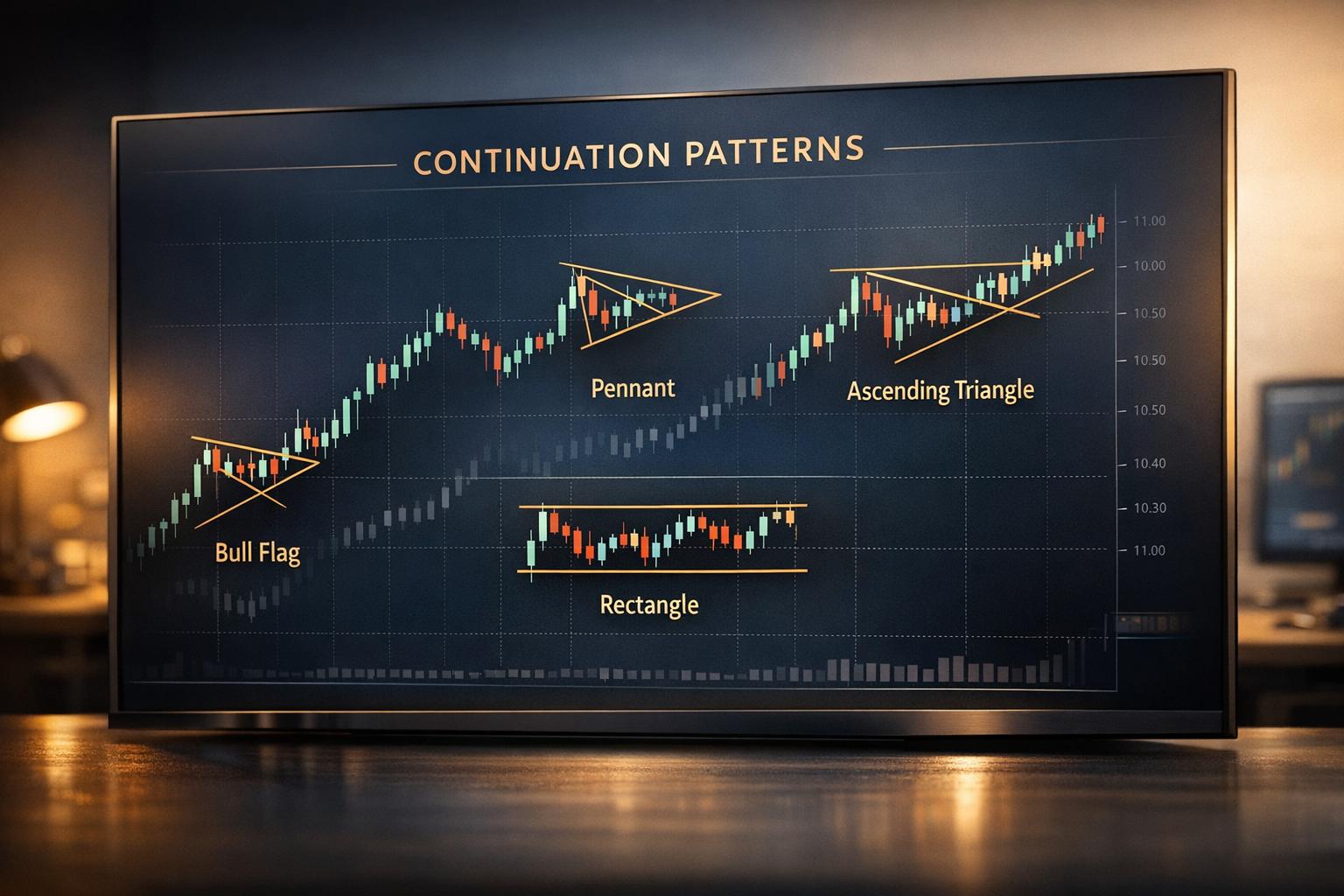

Identify flags, pennants, triangles and rectangles, confirm breakouts with volume and indicators, and set stops and profit targets for crypto trades.

MACD remains essential in crypto: five tactical strategies—signal & zero-line crossovers, divergence, histogram reversals, and multi-timeframe alignment with risk controls.

Use U.S. wage reports to forecast Fed moves and generate crypto trading signals; combine AHE, ECI and CPI with technical and risk analysis.

Get weekly insights, trading tips, and market analysis delivered straight to your inbox. Join thousands of traders who trust our expert analysis.

No spam. Unsubscribe at any time. We respect your privacy.