AI is transforming crypto trading by analyzing market sentiment from social media, news, and blockchain data. Here's the core takeaway:

- Market Sentiment: Reflects investor emotions like fear, greed, and FOMO. Tools like the Fear and Greed Index (0–100 scale) help gauge this.

- AI's Role: AI processes massive data from platforms like Twitter, Reddit, and Discord in real time, detecting trends faster than humans.

- Advanced NLP Models: Tools like GPT-4 and BERT decode crypto slang, sarcasm, and subtle emotional tones for accurate sentiment analysis.

- On-Chain Data: AI tracks wallet activity and token transfers to validate sentiment with real market behavior.

- Trading Signals: Platforms like StockioAI combine sentiment with technical analysis to generate buy, sell, and hold signals with up to 90% accuracy.

AI helps traders predict price movements, manage risks, and act on emerging trends more effectively. Sentiment analysis, paired with technical data, offers a smarter way to navigate the volatile crypto market.

How Natural Language Processing Powers AI Sentiment Analysis

What Is NLP and How Does It Work?

Natural Language Processing (NLP) is a branch of artificial intelligence that helps computers interpret and make sense of human language in text form [5][7]. Instead of just tallying up word counts, NLP transforms raw text (like tweets, Reddit posts, or news articles) into structured sentiment signals that AI systems can analyze [2][7].

The process starts with cleaning the text, which involves removing unnecessary elements, breaking it down into individual words (tokenization), eliminating common filler words, and reducing terms to their root forms (stemming). These steps prepare the text for sentiment analysis [4][6]. From there, modern NLP methods refine these signals, making the data more meaningful for AI to process.

Main NLP Techniques for Sentiment Analysis

AI uses a variety of techniques to measure market sentiment. One popular method is sentiment lexicons - tools like VADER assign predefined scores to words, marking terms like "bullish" as positive and "crash" as negative. These dictionary-based approaches are quick and rule-driven but often struggle to grasp the context of a sentence [5][3].

More advanced methods involve deep learning models such as Long Short-Term Memory (LSTM), which process text in sequence to better understand context. For example, a March 2024 study led by Michael Nair at Helwan University analyzed 1.5 million Bitcoin-related tweets (spanning February 2021 to January 2022) using an LSTM model. The results were impressive, with the model achieving a sentiment classification accuracy of 95.95% - outperforming older techniques like RNN (80.59%) and GRU (95.82%) [6].

The cutting edge of sentiment analysis relies on Transformer-based models like BERT, FinBERT, and GPT-4. These models use "attention mechanisms" to evaluate the relationships between all words in a sentence simultaneously. This allows them to interpret nuanced crypto slang and complex emotional tones that simpler tools might miss [3]. Researchers Kirtac and Germano highlighted this advancement:

The emergence of LLMs has significantly enhanced sentiment analysis, providing deeper contextual understanding and greater accuracy in financial text [3].

Challenges in Using NLP for Crypto Sentiment

Despite these advancements, NLP faces unique challenges in the crypto world. Terms like "diamond hands", "HODL", and "WAGMI" often don’t appear in standard dictionaries, and sarcasm is a frequent feature of crypto discussions. Traditional models can misinterpret both slang and sarcastic remarks, leading to inaccurate sentiment readings [2][3].

Another major issue is bot manipulation. Coordinated "pump and dump" schemes often flood social media with fake enthusiasm, creating misleading sentiment spikes that don’t reflect actual market sentiment [3][7]. Models like FinBERT are designed to handle these challenges, and graph analysis techniques can help filter out bot-generated content before it influences trading decisions [3][7].

Analyzing Cryptocurrency Sentiment on Twitter with LangChain and ChatGPT

| CryptoGPT

Data Sources for AI-Driven Crypto Sentiment Analysis

Social Media Platforms and Forums

AI's ability to analyze massive amounts of text through natural language processing (NLP) makes social media platforms and forums invaluable for crypto sentiment analysis. Platforms like Twitter (now X) are essential for gauging real-time momentum and tracking influential voices. Reddit communities, such as r/cryptocurrency and r/Bitcoin, provide insights into community consensus through discussions and upvote trends. Meanwhile, private channels on Discord and Telegram offer a window into insider sentiment, often reflecting the views of project communities or large investors, commonly referred to as "whale groups" [2].

To put this into perspective, AI processes around 50,000 crypto-related tweets every hour - an overwhelming task for any human analyst [2]. Across all platforms, over 250,000 pieces of crypto-specific content are generated daily, making automated tools indispensable for extracting meaningful insights [8]. A recent survey also revealed that 80% of young adults have received financial advice through social media, with a significant chunk of it focusing on cryptocurrencies [9].

"By the time you see a price movement, the emotion that caused it has already swept through social media, Discord channels, and Reddit threads hours or even days earlier." – Zachary James Lowrance, Crypto Analyst [2]

While social platforms offer immediate sentiment signals, news outlets and blogs provide a broader context and institutional perspective.

News Articles and Blogs

AI also sifts through headlines, press releases, financial news sites, and industry blogs to capture the broader picture. These sources provide insights into regulatory updates, macroeconomic trends, and institutional viewpoints that influence long-term sentiment shifts.

Modern AI tools, powered by advanced models like GPT-4, excel at understanding the nuances of financial jargon and context - something older dictionary-based systems struggled to do [3]. Combining news analysis with social media monitoring helps AI distinguish between genuine trends and artificially generated hype, offering a more balanced view of market sentiment.

Beyond online sentiment, on-chain data provides a tangible look at market behaviors, offering an additional layer of validation.

On-Chain Data and Trading Activity

The transparency of blockchain technology allows AI to track real capital movements, offering insights that go beyond speculation. For instance, large token transfers to exchanges often indicate bearish sentiment, while moving assets to cold wallets signals long-term holding, which is typically bullish [11]. AI also keeps tabs on whale wallet activity, staking trends, and daily active addresses to ensure that social sentiment aligns with actual market behavior.

A clear example of this can be seen in the analysis of the Pendle (PENDLE) token between July 2023 and February 2024. During this period, high-profile holders like Arthur Hayes and the Spartan Group accumulated significant amounts of PENDLE despite market volatility. Hayes alone added 500,000 tokens over 30 days, signaling long-term confidence that preceded a major price surge [10]. Research shows that integrating sentiment analysis with on-chain data can predict Bitcoin's next-day price direction with approximately 63% accuracy [2][3]. By combining these verified on-chain signals with social media and news sentiment, AI-driven trading strategies become even more robust.

| Data Source | Primary Value | AI Processing Speed |

|---|---|---|

| Twitter/X | Real-time momentum & influencer tracking | 50,000+ tweets/hour [2] |

| Community consensus & discussion depth | Medium volume | |

| Discord/Telegram | Private sentiment & whale signals | High frequency |

| News/Blogs | Institutional narratives & macro trends | Continuous scanning |

| On-Chain Data | Actual capital movement & holder behavior | Real-time blockchain monitoring |

AI Techniques for Measuring and Interpreting Market Sentiment

Sentiment Scoring and Classification

AI tools analyze crypto-related text to assign sentiment scores, ranging from –1 (bearish) to +1 (bullish), with 0 representing neutrality. These scores are generated using methods like VADER and advanced machine learning models such as BERT and GPT-4[3][2]. Transformer models, in particular, have shown impressive results. For instance, one context-aware model achieved 89.6% accuracy in predicting the market impact of 227 major Bitcoin news events[12].

Some systems go beyond traditional methods by using approaches like Triple Barrier Labeling. Instead of relying on subjective human interpretation, this technique assigns sentiment scores based on actual market outcomes - whether profits were taken, stop-loss limits were hit, or a set time expired[12].

"Market-driven labels, learned from actual market movements, can better inform sentiment analysis models... letting the market itself teach the model the significance of words." – Hamid Moradi-Kamali et al., Iran University of Science and Technology[12]

Additionally, AI evaluates the credibility of sources, giving more weight to verified accounts and institutional news outlets while discounting anonymous posts or suspected bot activity[2].

Trend Detection Through Sentiment Patterns

Once sentiment scores are calculated, AI systems analyze how these sentiments evolve over time. One effective method is tracking sentiment velocity, which measures how quickly positive or negative emotions spread across platforms[2]. For example, a rapid increase in bullish language might signal an upcoming market momentum shift, often 24–72 hours before price changes become evident.

AI also identifies sentiment divergence, where market prices and sentiment trends move in opposite directions. For instance, if Bitcoin's price is dropping while sentiment grows more positive, it could suggest an accumulation phase. During the May 2022 Terra/LUNA collapse, researchers noticed a "wagmi" campaign where crypto enthusiasts tweeted optimistically despite the crash. This created an echo chamber that disconnected sentiment from the market's actual conditions[3].

When comparing machine learning models for Bitcoin sentiment analysis, LSTM models outperformed simpler RNN models. LSTM achieved an impressive 95.95% accuracy, compared to RNN's 80.59% accuracy[6].

Real-Time Sentiment Updates for Fast-Moving Markets

Real-time sentiment tracking allows AI to detect rapid shifts in market sentiment, often hours or even days before these changes are reflected in price charts. This capability gives traders a proactive edge, enabling them to respond swiftly to emerging trends.

These updates also play a critical role in risk management. For example, if AI detects a sudden spike in negative sentiment, traders can tighten stop-loss orders or reduce their exposure immediately[1]. Research on high-frequency Twitter sentiment has shown that AI classifiers can predict Bitcoin's price direction and magnitude with about 63% accuracy[3]. Additionally, sentiment-based trading signals have demonstrated Sharpe ratios as high as 5.07 during trending markets in backtesting[12].

Modern trading platforms now integrate sentiment scores directly into algorithmic trading bots. These bots can execute buy or sell orders automatically when specific emotional thresholds are met[4][13]. This automation is particularly useful during extreme sentiment events, where sharp spikes in fear or greed often signal major market turning points[2].

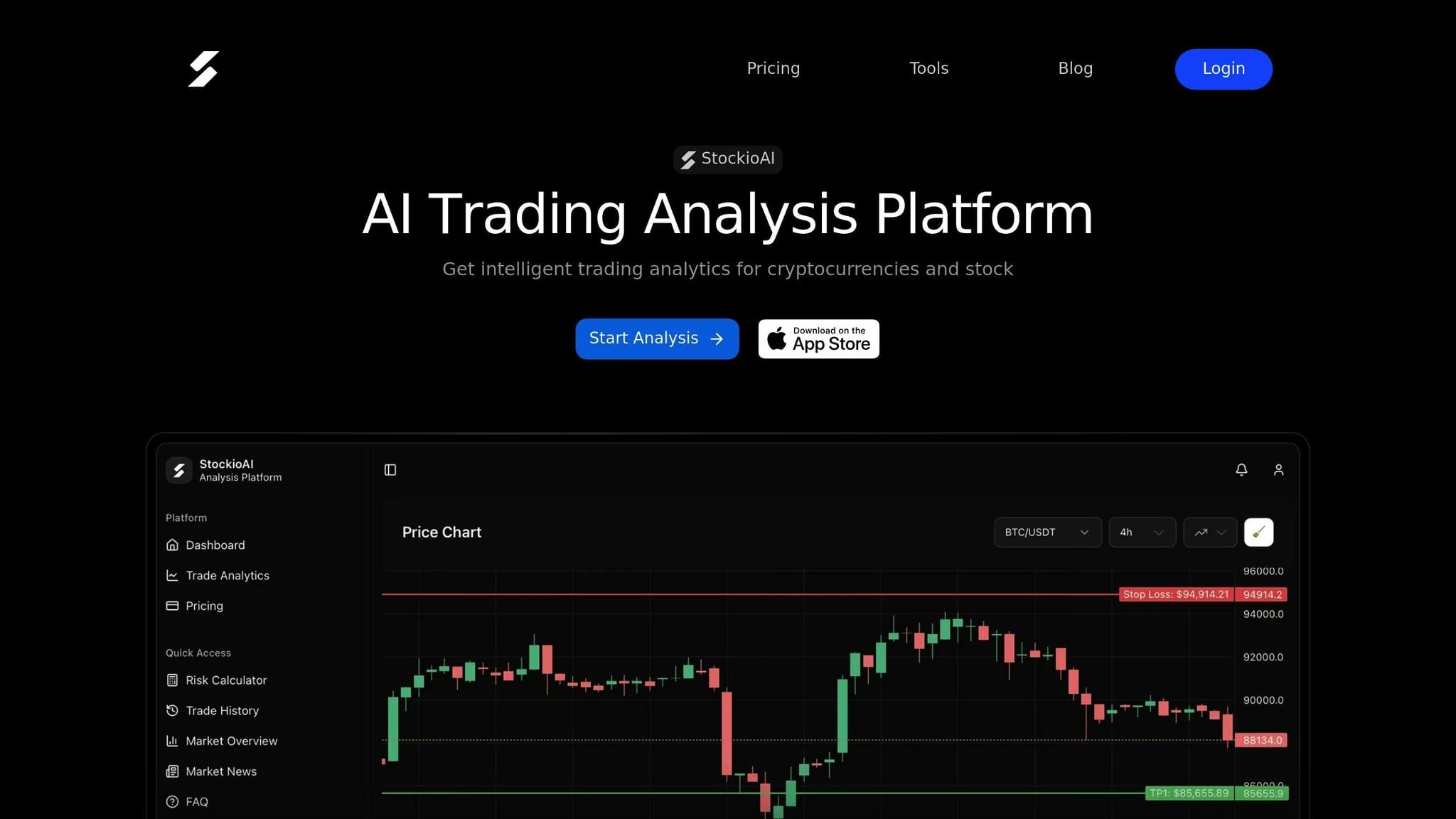

How StockioAI Uses Sentiment Analysis for Crypto Trading

StockioAI's AI-Powered Trading Signals

StockioAI processes over 60 real-time data points every second, blending sentiment analysis, technical indicators, whale activity, and market microstructure to generate Buy, Sell, and Hold signals with an impressive 80–90% accuracy rate[14]. To ensure these signals are reliable, the platform employs a 7-Tier Priority System, which evaluates factors like market structure, trading volume, and trend phases. This ensures that sentiment data is always interpreted in the context of broader technical patterns.

For Buy signals, StockioAI pinpoints entry points, sets stop-loss levels, outlines profit targets, and assigns confidence scores, giving traders a clear framework for managing risk. Sell signals are crafted by continuously tracking market dynamics, enabling traders to exit positions at the right time as sentiment or price action shifts. Meanwhile, Hold recommendations are based on sideways trends, asset correlations, and market microstructure, helping traders avoid unnecessary moves during periods of market stagnation.

When faced with conflicting data - such as bullish sentiment clashing with bearish technical indicators - StockioAI uses a Conflict Resolution Matrix that navigates 15 possible scenarios. This system ensures consistent signals and optimal position sizing, reducing the risk of contradictory advice that could lead to poor decisions. This meticulous approach to signal generation seamlessly integrates with technical analysis, creating a comprehensive trading strategy.

Combining Sentiment with Technical Analysis

StockioAI pairs sentiment analysis with technical tools like Volume Profile, Volume Point of Control (VPOC), and market microstructure to turn market noise into actionable insights[14]. By combining on-chain volume and price action with real-time social sentiment, the platform provides traders with a complete view of the market[1].

The Multi‑Timeframe Analysis feature allows traders to cross-check sentiment signals across various timeframes. For instance, a bullish signal on a 15-minute chart becomes more compelling if it aligns with upward trends on 4-hour or daily charts. Additionally, the platform's Market Regime Classification system identifies whether the market is trending, ranging, volatile, or quiet, enabling traders to tailor their strategies to current conditions.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns"[14].

Research supports the effectiveness of combining sentiment analysis with technical confirmation, showing a 70%+ accuracy rate in identifying market turning points when extreme sentiment indicators are validated by technical data[2]. This integration enhances risk management and improves trade execution.

Benefits of Using StockioAI for Sentiment Analysis

StockioAI’s integrated analytics empower traders to act on timely market insights without needing to constantly monitor the market. The platform provides automatic 4-hour crypto updates for major assets like Bitcoin, Ethereum, Solana, and XRP, ensuring traders receive alerts when it matters most[14].

The built-in Risk Calculator helps traders determine optimal position sizes and leverage based on the confidence scores included with each AI-generated signal. This feature is especially useful during periods of high volatility, helping traders manage exposure as sentiment shifts. Additionally, the platform’s AI pattern recognition identifies trading formations influenced by sentiment changes, while real-time alerts ensure traders can respond swiftly to market developments.

StockioAI offers a free plan that includes 5 AI trading signals and basic market insights. For those seeking more, the Premium Access plan is available for $29.99 per month, offering unlimited trading analysis, automatic updates, and priority support. This ensures precision and efficiency for traders looking to harness market sentiment effectively.

Conclusion

Key Takeaways for Traders

AI, powered by advanced data sources and natural language processing (NLP), is transforming the way market sentiment is understood. By processing thousands of data points every minute from platforms like Twitter, Reddit, Telegram, and Discord, these tools can detect sentiment shifts before they translate into price movements[2]. Models like GPT-4 and BERT have even mastered the interpretation of crypto slang and subtle nuances in language[2][3].

Sentiment analysis often serves as a contrarian indicator. For instance, extreme fear in the market frequently signals a bottom, while excessive greed can hint at an impending top. When paired with technical analysis, this approach has demonstrated over 70% accuracy in identifying these turning points[2]. That said, sentiment analysis should complement - not replace - thorough technical and fundamental research. Traders must also remain cautious of echo chambers, which can intensify market volatility and lead to impulsive decisions[3].

To make the most of AI-driven sentiment tools, it’s essential to pull data from a variety of sources to minimize bias. Tools that evaluate sentiment based on credibility and engagement, rather than just the number of mentions, tend to provide more dependable insights[2]. Additionally, waiting for price action to confirm sentiment signals can help traders align extreme sentiment with technical setups, increasing the probability of successful trades[2]. These strategies highlight the growing potential of AI in predicting market sentiment and shaping trading decisions.

The Changing Role of AI in Crypto Trading

The role of AI in crypto trading is evolving rapidly. In the near future, AI is expected to move beyond reactive sentiment analysis to predictive modeling - forecasting sentiment changes before they even occur[2]. This includes analyzing video content on platforms like YouTube and TikTok, alongside text-based data. Moreover, future AI systems will integrate sentiment insights across multiple languages, helping traders identify regional market trends, such as how sentiment in Asian markets might influence the U.S. market open[2].

"Integrating AI into trading strategies is not just about keeping up with technology; it's about gaining a competitive edge." – SYGNAL[13]

With AI-driven algorithms now responsible for roughly 70% of trading volume, incorporating sentiment analysis into trading strategies can enhance price prediction accuracy by up to 20%. Traders who combine these insights with disciplined technical analysis will be better equipped to navigate the ever-changing and complex world of crypto markets.

FAQs

How does AI identify real market sentiment versus bot-driven activity in cryptocurrency trading?

AI leverages sophisticated methods to separate genuine market sentiment from bot-driven manipulation in the crypto trading space. By sifting through massive datasets, it can pinpoint patterns like sudden activity surges from a limited number of accounts or synchronized posting behavior. When accounts display unusual activity or appear to stem from fake sources, they’re flagged and excluded from sentiment evaluations.

Machine learning models take this a step further by filtering out irrelevant noise. They assess social media activity, account behaviors, and how these align with market trends. This process ensures the sentiment data represents real investor opinions rather than skewed signals from bots. Platforms such as StockioAI use these AI-powered techniques to provide accurate sentiment insights, enabling traders to make smarter decisions in the ever-changing crypto market.

What challenges do AI models face when analyzing crypto market sentiment?

AI models encounter several hurdles when it comes to analyzing sentiment in the cryptocurrency market. A key challenge lies in understanding the nuances of human language. Things like sarcasm, slang, and ever-evolving terminology can trip up even the most advanced systems, leading to errors in sentiment classification.

On top of that, the cryptocurrency market is notoriously volatile and heavily influenced by context. This makes it tough to distinguish genuinely meaningful sentiment from surface-level noise or misleading commentary. Adding to the difficulty, social media and news - common sources for sentiment analysis - are often riddled with biased opinions and misinformation, which only complicates the process further.

Another obstacle is the sheer speed at which the crypto market moves. Real-time data processing is essential, but it puts significant strain on computational resources and demands highly efficient AI models. Even with these challenges, ongoing progress in natural language processing (NLP) is helping to refine and enhance the accuracy of sentiment analysis tools.

How does StockioAI use sentiment analysis and technical indicators to create trading signals?

StockioAI blends real-time sentiment analysis with cutting-edge technical indicators to deliver precise trading signals. By sifting through data from social media trends, news headlines, whale activity, and key market metrics like order book depth and volume patterns, the platform captures the pulse of market sentiment. This sentiment data is then paired with traditional technical indicators, such as support and resistance levels, to offer clear Buy, Sell, or Hold recommendations, complete with confidence scores.

Leveraging AI-driven pattern recognition and natural language processing, StockioAI not only tracks price trends but also deciphers crowd psychology to fine-tune its signals. This comprehensive strategy ensures traders gain actionable insights that account for both the emotional and technical forces shaping the cryptocurrency market, empowering them to make timely and informed decisions.