Wage data is a powerful tool for crypto traders. It influences Federal Reserve decisions on interest rates, which in turn impacts market sentiment and cryptocurrency prices. Here's what you need to know:

- Rising wages can boost crypto markets as investors take on more risk, but excessive growth may signal inflation, leading to "risk-off" behavior.

- Key reports like the Employment Situation Report, Real Earnings Report, and Employment Cost Index (ECI) provide critical insights.

- Timing matters. Wage data releases often trigger immediate market reactions, making it essential to stay informed about release schedules and revisions.

- Practical use: Combine wage data with other metrics like CPI or unemployment rates to predict crypto price movements more accurately. This often involves learning how to read crypto charts to identify entry points.

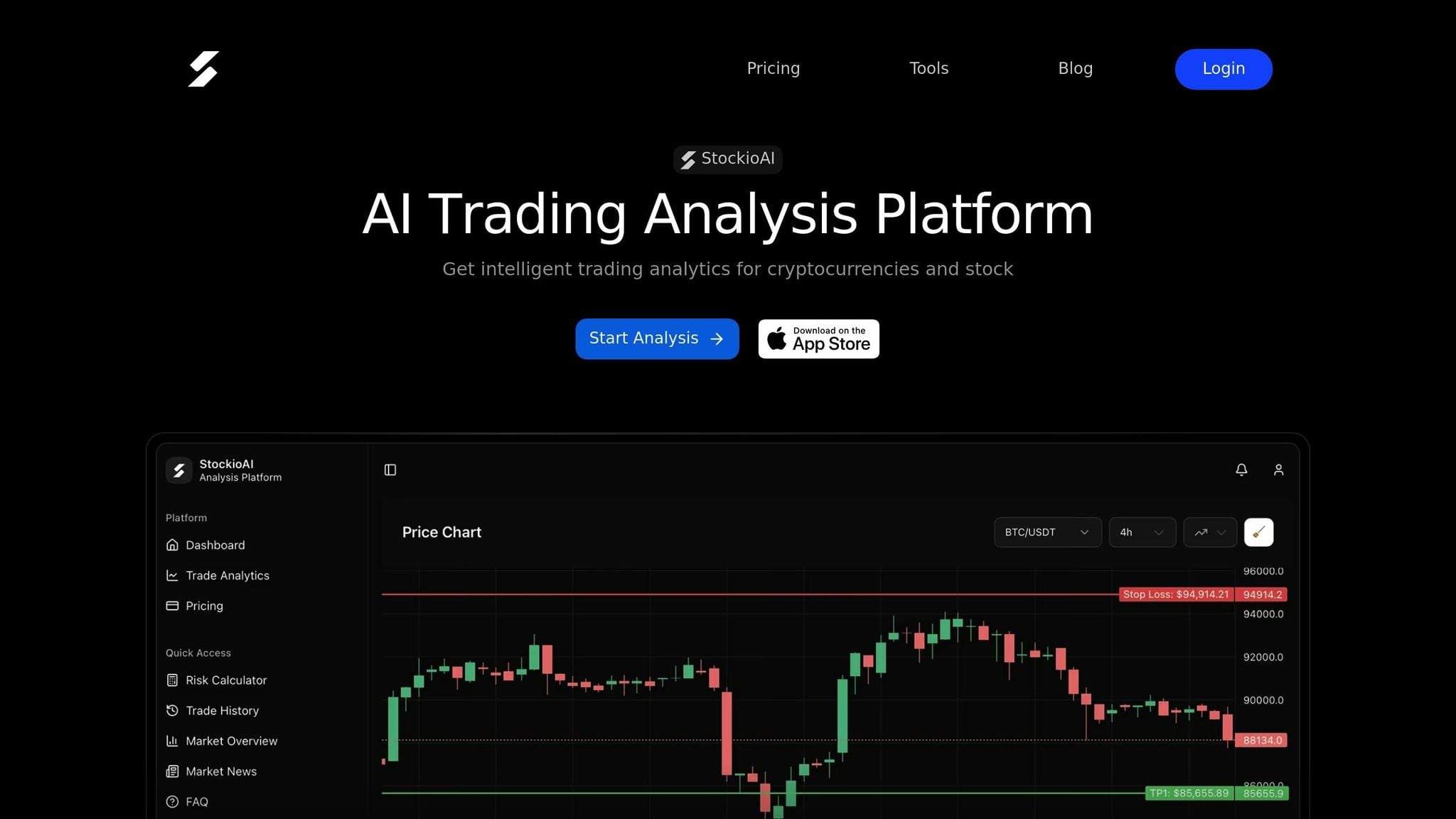

Platforms like StockioAI can help traders analyze wage trends and refine their strategies by integrating real-time data and sentiment and technical analysis.

Takeaway: Wage trends are a leading indicator for crypto price shifts. By understanding these dynamics, you can better anticipate market movements and make informed trading decisions.

[DANGER] Volatility Incoming Prior To CPI

| Huge Issues with Non-Farm Payroll

Key US Wage Data and Cryptocurrency Markets

Wage data plays a significant role in shaping market dynamics, including cryptocurrency trends. Traders can use a crypto market trend analyzer to confirm these shifts. Here’s a closer look at the key U.S. wage reports and their impact.

Important Wage Data Reports

The BLS Employment Situation Report, released monthly, is a cornerstone for wage-related insights. It includes key figures like Nonfarm Payrolls, the unemployment rate, and Average Hourly Earnings (AHE) - all of which influence Federal Reserve policy and crypto market sentiment. For instance, in December 2025, AHE rose by $0.12 to $37.02, marking a 3.8% annual increase. Such data often guides Fed decisions on interest rates, which in turn ripple through cryptocurrency markets.

The Employment Cost Index (ECI) captures total labor costs, offering a broader perspective on wage pressures. Meanwhile, the Real Earnings Report adjusts wages for inflation, providing a clearer picture of consumer purchasing power. In Q3 2025, the ECI rose 0.8%, reflecting steady wage pressure that could keep interest rates elevated. The Real Earnings Report, released mid-month alongside the Consumer Price Index (CPI), helps assess whether wage growth is genuinely driving consumer spending or just keeping up with inflation.

Release Schedules and Market Timing

Timing is crucial when it comes to these reports, as they often trigger immediate market reactions. The Employment Situation Report is released on the first Friday of each month at 8:30 AM ET. For example, on December 6, 2024, Bitcoin saw a quick jump from $97,900 to $98,749 within 48 minutes after the November jobs report showed a 0.4% rise in AHE. Following this, the CME FedWatch Tool indicated a 90.5% probability of a December rate cut, sparking a broader market rally.

Here’s a quick reference for upcoming release dates in 2026:

| Report Name | Frequency | Release Time | Upcoming 2026 Release Dates |

|---|---|---|---|

| Employment Situation (incl. AHE) | Monthly | 8:30 AM ET | Feb 6, Mar 6, Apr 3, May 8 |

| Real Earnings | Monthly | 8:30 AM ET | Feb 11, Mar 11, Apr 10, May 12 |

| Employment Cost Index | Quarterly | 8:30 AM ET | Late Jan, Apr, Jul, Oct |

Traders should also pay close attention to data revisions. The Bureau of Labor Statistics (BLS) frequently updates prior months’ figures, which can lead to unexpected market volatility even when current numbers meet expectations. During such periods, identifying crypto support and resistance levels helps manage entry and exit points. Additionally, prolonged government shutdowns - like the 43-day deadlock in late 2025 - can delay reports and result in larger-than-normal revisions later. To stay ahead, checking the official BLS calendar at least a week before scheduled releases is a smart move.

How Wage Trends Influence Cryptocurrency Prices

Wage trends play a surprisingly important role in shaping cryptocurrency markets. When wages rise, they often signal economic growth and more disposable income, which can make investors more confident about riskier assets like Bitcoin and Ethereum. This "wealth effect" not only encourages spending but also supports speculative investments. For example, in January 2025, the total cryptocurrency market capitalization hit a record $3.8 trillion, partly fueled by strong wage growth throughout 2024 [10].

However, rising wages can also stoke inflation, leading some investors to see Bitcoin as a hedge. On the flip side, the Federal Reserve often responds to inflation by raising interest rates, which can reduce trading volumes [9]. As one analysis puts it:

"Cryptocurrency price shocks generate positive financial market spillovers, accounting for 18% of equity and 27% of commodity price fluctuations" - Economics Department, Wilson College of Business [10].

These dynamics create a tug-of-war between risk-on and risk-off behaviors in the crypto space.

Rising Wages and Risk-On Behavior

When wages are climbing, the crypto market tends to thrive in a "risk-on" environment. Higher wages mean more disposable income, which often translates into increased investment in volatile assets. For instance, Bitcoin surged past $111,000 in May 2025, coinciding with steady wage growth during the first half of the year [10]. Another milestone: spot Bitcoin ETFs collectively managed over $100 billion by mid-2025, holding around 5% of all Bitcoin in circulation [10]. Data from Coinbase's order books backs this up:

"Rising sentiment is associated with positive price changes while declining sentiment is associated with negative price changes" - Dimitrios Koutmos, Texas A&M University [8].

Stagnant or Declining Wages and Risk-Off Sentiment

When wages stagnate or decline, the mood in the crypto market can sour quickly. Flat or falling wages suggest weaker consumer spending and increased recession risks, prompting investors to retreat from high-risk assets [11]. On average, Bitcoin's price drops about 0.7% when U.S. payroll data falls short of expectations [11].

Take September 2025, for example. After a disappointing jobs report, Bitcoin briefly touched $90,000 before sliding into the mid-$80,000s, leading to $2 billion in liquidations [11]. The selloff worsened in November 2025, as Bitcoin plunged from $105,000 to below $82,000, erasing its year-to-date gains. Mixed economic signals amplified risk aversion. As one market analyst noted:

"Rising unemployment, slower hiring and weaker wage gains make markets more cautious about future earnings and default risks. In that environment, investors often cut exposure to the riskiest parts of their portfolio" - Cointelegraph [11].

The impact wasn’t limited to Bitcoin. Altcoins often experience sharper declines during risk-off periods. In late 2025, while Bitcoin dropped 8%, major altcoins like Ethereum, Solana, and XRP saw losses exceeding 10% within just 24 hours. Ethereum’s realized volatility spiked near 90%, and its value traded 45% below its August 2024 peak. This illustrates how economic uncertainty can amplify risk aversion across the broader crypto market [13].

Step-by-Step: Using Wage Data to Generate Crypto Trading Signals

Step 1: Accessing and Interpreting Wage Data

When it comes to official wage data, the U.S. Bureau of Labor Statistics (BLS) is your go-to source. Specifically, keep an eye on the Employment Situation Report, which is released on the first Friday of each month at 8:30 a.m. ET [5]. This report often triggers immediate reactions in crypto markets, so timing is everything.

To drill down into the numbers, check Table B-3, which provides seasonally adjusted data on average hourly and weekly earnings [16]. For instance, in December 2025, average hourly earnings for private nonfarm employees increased by $0.12 (0.3%) to $37.02, reflecting a 3.8% rise over the past year [5]. You can access this data directly from the BLS website or through their Public Data API [17].

For a broader view, consider the quarterly Employment Cost Index (ECI), which includes insights into wages and benefits. In Q3 2025, the ECI showed a 0.8% rise in compensation costs, providing clues about wage growth and inflation risks [15]. Tracking these trends over time can help paint a clearer picture of where the economy - and potentially the crypto market - might be heading.

To fully understand the impact of wage data, it’s helpful to cross-reference it with other economic metrics.

Step 2: Cross-Referencing with Other Economic Indicators

Wage data alone doesn’t tell the full story. To get a clearer picture, compare Average Hourly Earnings with the Consumer Price Index (CPI). For example, if wages rise by 0.3% but the CPI also increases by 0.3%, real earnings remain flat. This means consumers don’t gain extra purchasing power, which could limit their appetite for riskier assets like Bitcoin [7]. The BLS CPI Inflation Calculator can quickly help you make these comparisons [17].

Another key metric to watch is productivity relative to unit labor costs. In Q3 2025, productivity surged by 4.9%, while unit labor costs dropped by 1.9% [6]. This dynamic can ease inflation concerns and reduce the likelihood of Federal Reserve rate hikes. Additionally, keep an eye on the unemployment rate. For example, December 2025’s 4.4% unemployment rate, combined with rising wages, points to a tight labor market that could stoke inflation fears [5].

Step 3: Mapping Wage Data to Crypto Market Trends

Once you’ve gathered wage data and cross-referenced it with other economic indicators, the next step is to connect these insights to crypto market behavior.

For instance, wage growth exceeding 4% year-over-year often signals inflation concerns, which can put bearish pressure on Bitcoin as traders brace for potential Fed rate hikes. On the flip side, wage growth in the 3% to 3.5% range might indicate a "soft landing" scenario, raising expectations for rate cuts and potentially boosting crypto sentiment [1].

It’s also important to factor in revisions to previous data. The BLS frequently updates past figures, and these adjustments can quickly shift market sentiment. In October 2025, for example, payroll data was revised downward by 68,000 jobs [5]. Always review the "Revision of Seasonally Adjusted Data" section to stay informed about these changes.

Finally, compare these findings with Bitcoin’s historical price movements during similar economic periods. In late 2025, for instance, nonfarm employment growth averaged just 49,000 jobs per month - a sharp decline from the 168,000 monthly average in 2024. This slowdown, coupled with easing wage pressures, contributed to a range-bound crypto market as traders speculated on the likelihood of Fed rate cuts.

Improving Wage-Based Trading Strategies with StockioAI

StockioAI takes wage-driven insights and combines them with macroeconomic data and technical analysis, creating a more informed approach to crypto trading.

Integrating Wage Data with StockioAI Indicators

Once wage data is analyzed, you can validate your trading bias using StockioAI's technical signals. The platform processes over 60 real-time data points every second - covering market sentiment, whale activity, and order flow - to generate BUY, SELL, and HOLD signals with an accuracy rate of 80–90% [18].

For example, if wage data points to modest growth, hinting at economic stability, you might lean toward a bullish crypto outlook. Before making a move, check StockioAI's confidence score. Enter trades only when the platform shows high confidence, helping you avoid false signals. Its 7-Tier Priority System is designed to cut through market noise during volatile periods tied to wage data releases, so you can focus on high-probability opportunities.

Market Regime Classification is another key feature to watch. If wage data suggests bullish conditions, but StockioAI identifies a quiet or ranging market, it might be better to hold off until a clear trend emerges. Tools like Volume Point of Control (VPOC) and Order Flow Analysis can help you confirm whether institutional players are influencing the market. Once you've aligned these insights, use StockioAI's risk management tools to adapt to shifting market dynamics and protect your positions.

Using StockioAI's Risk Management Tools

StockioAI's risk management tools are designed to safeguard your capital. Start with the Risk Calculator, which helps you set optimal stop-loss levels based on current market liquidity and volatility. For example, if January 2026 wage data sparks a Bitcoin rally, the calculator can guide you in placing a stop-loss that accounts for the market's conditions.

The platform also includes the Key Price Levels feature, which highlights critical support, resistance, and pivot zones. This helps you avoid entering trades at unfavorable price points. Additionally, StockioAI's Entry Recommendations provide precise timing and price levels for executing trades after wage data is released. To further protect your investments, the integrated Risk Assessment Tool evaluates risk-reward ratios, ensuring you're prepared for any unexpected macroeconomic shifts. And since StockioAI operates 24/7, you’ll always have access to up-to-date market insights [18].

Case Studies: Wage Data-Driven Crypto Trades

These examples show how wage trends influence movements and generate crypto trading signals.

2025 Fed Rate Cuts and Bitcoin Rally

In October 2025, the Federal Reserve lowered its benchmark interest rate to 3.75%–4.00%[14], a decision that came after months of declining wage growth. By late 2025, ADP data revealed private-sector job additions had slowed to just 14,250 per week on a four-week moving average[14], while unemployment climbed to the mid-4% range, the highest in years[11].

This cooling in wage growth allowed the Fed to ease monetary policy, officially ending Quantitative Tightening on December 1, 2025. The resulting liquidity boost created a favorable environment for risk-on assets like Bitcoin. However, the anticipated Bitcoin rally didn’t happen immediately. As Marcel Pechman from Cointelegraph explained:

"Improved sentiment among crypto investors tends to come after there is some confirmation of better macroeconomic conditions. This explains why the 105-day lag is not unusual"[12].

In October, Bitcoin’s price dipped below $111,000 following hawkish signals from the Fed, and spot Bitcoin ETFs saw a $470.71 million outflow as institutional investors turned cautious[14].

The key takeaway? Weak wage data doesn’t lead to instant rallies. Historical trends show a lag of 105–130 days before crypto markets respond. Traders who acted early during the wage cooling phase, instead of chasing quick gains, were better positioned for the eventual uptrend.

This contrasts sharply with the 2022 bear market, which highlighted how wage stagnation can create prolonged risk-off conditions.

2022 Bear Market and Wage Stagnation

While 2025 demonstrated the delayed benefits of eased monetary policy, the 2022 bear market emphasized the immediate challenges of wage stagnation. U.S. wage inflation peaked at 5.8% in March–April 2022 but steadily declined to 4.3% by December[3]. This drop signaled a weakening labor market, with workers switching jobs less frequently and losing bargaining power. At the same time, the cross-industry standard deviation of wage growth hit 2.9, showing uneven wage trends across sectors[2].

As wage growth slowed and recession fears grew, investors pulled back from high-risk assets. Missed employment forecasts further pressured the market, dragging Bitcoin’s price down by approximately –0.7% as traders reduced their exposure[11].

This downturn highlighted the dominance of the growth channel over the liquidity channel. Although stagnant wages eventually opened the door for Fed rate cuts - potentially bullish for crypto - the immediate effect was sustained risk-off sentiment. Traders who avoided chasing the market during the wage decline were able to preserve their capital and take advantage of improved conditions later on.

Conclusion: Using Wage Data for Better Crypto Trading

Wage data plays a significant role as a leading indicator, influencing Federal Reserve policy and shaping crypto market liquidity. For example, the quits rate alone accounts for 55% of the variation in wage growth, and when paired with the vacancy-to-job seeker ratio, this figure rises to 78%. These factors are key drivers behind Bitcoin price movements[4].

However, weak wage data doesn’t lead to immediate market rallies. It takes time for labor market shifts to ripple through the economy before risk-on sentiment returns.

To get the most out of wage data's predictive power, traders can dig deeper by cross-referencing multiple metrics. For instance, comparing wage sources like the Employment Cost Index (ECI), Average Weekly Earnings (AWT), and ADP data helps cut through the noise of less reliable indicators like Average Hourly Earnings (AHE). Adjusting nominal wages with the Consumer Price Index (CPI) also provides a clearer picture of real purchasing power[2][20].

Platforms like StockioAI simplify this process by filtering out market noise and automatically linking wage trends to crypto price movements. Its 7-tier priority system and conflict resolution matrix help traders navigate scenarios where wage data clashes with technical indicators. With an analysis accuracy of 80–90%, it’s particularly useful during volatile events like ECI data releases[18].

Pay attention to catalysts like unemployment spikes above 4.5% or steep wage declines, which often signal Federal Reserve liquidity injections[19]. As analyst Michaël van de Poppe observed during December 2025’s 4.6% unemployment reading:

"The money printer is inevitably going to be fired on and that's going to activate the bull run on Bitcoin"[19].

FAQs

How do wage trends affect cryptocurrency prices?

Wage trends play a key role in shaping cryptocurrency prices by influencing market expectations about monetary policy. When there’s weak wage growth or signs of a cooling labor market - like rising unemployment or fewer job openings - investors often anticipate Federal Reserve actions such as stimulus measures or interest rate cuts. These expectations can increase confidence in riskier assets, including Bitcoin and other cryptocurrencies, often pushing their prices upward.

On the flip side, strong wage growth can raise concerns about inflation, potentially prompting the Federal Reserve to tighten monetary policy through interest rate hikes. This tends to dampen demand for cryptocurrencies, leading to lower prices. Keeping an eye on wage data can offer valuable clues for forecasting movements in the crypto market.

Which wage data reports are most important for cryptocurrency trading signals?

Keeping an eye on wage data reports can be a game-changer when it comes to generating cryptocurrency trading signals. Some of the most important reports to track include the BLS Employment Cost Index, BLS area and occupational wage releases, ADP Pay Insights report, Federal Reserve’s Wage Growth Tracker, and the monthly Non-Farm Payroll (NFP) report.

These reports shed light on wage trends, which play a big role in shaping economic conditions and consumer spending. Since these factors often ripple into the cryptocurrency market, analyzing wage data can help you spot trends and make smarter trading decisions.

How does StockioAI use wage data to provide crypto trading insights?

StockioAI taps into wage data from sources like the Federal Reserve and the Bureau of Labor Statistics to create actionable cryptocurrency trading signals. By examining trends such as wage growth, job openings, and other labor market indicators, the platform uncovers patterns that often align with shifts in crypto market sentiment.

Through its AI-driven analytics, StockioAI transforms these findings into real-time recommendations - Buy, Sell, or Hold. Traders also gain access to interactive charts, risk management tools, and timely alerts, offering a clearer view of how fluctuations in wage trends might impact the prices of major cryptocurrencies. This efficient system empowers traders to make better-informed decisions using insights drawn from U.S. labor market data.