AI-driven charting tools are transforming trading by offering faster, more accurate, and consistent analysis compared to human efforts. Key benefits include:

- Speed: AI processes data in milliseconds, analyzing hundreds of markets simultaneously.

- Accuracy: Pattern detection accuracy reaches 92%, far surpassing human analysts at 65%.

- Consistency: AI maintains a 95% consistency rate, eliminating emotional biases like fear and greed.

- Market Growth: The AI trading platform market was valued at $11.23 billion in 2024 and is projected to reach $33.45 billion by 2030.

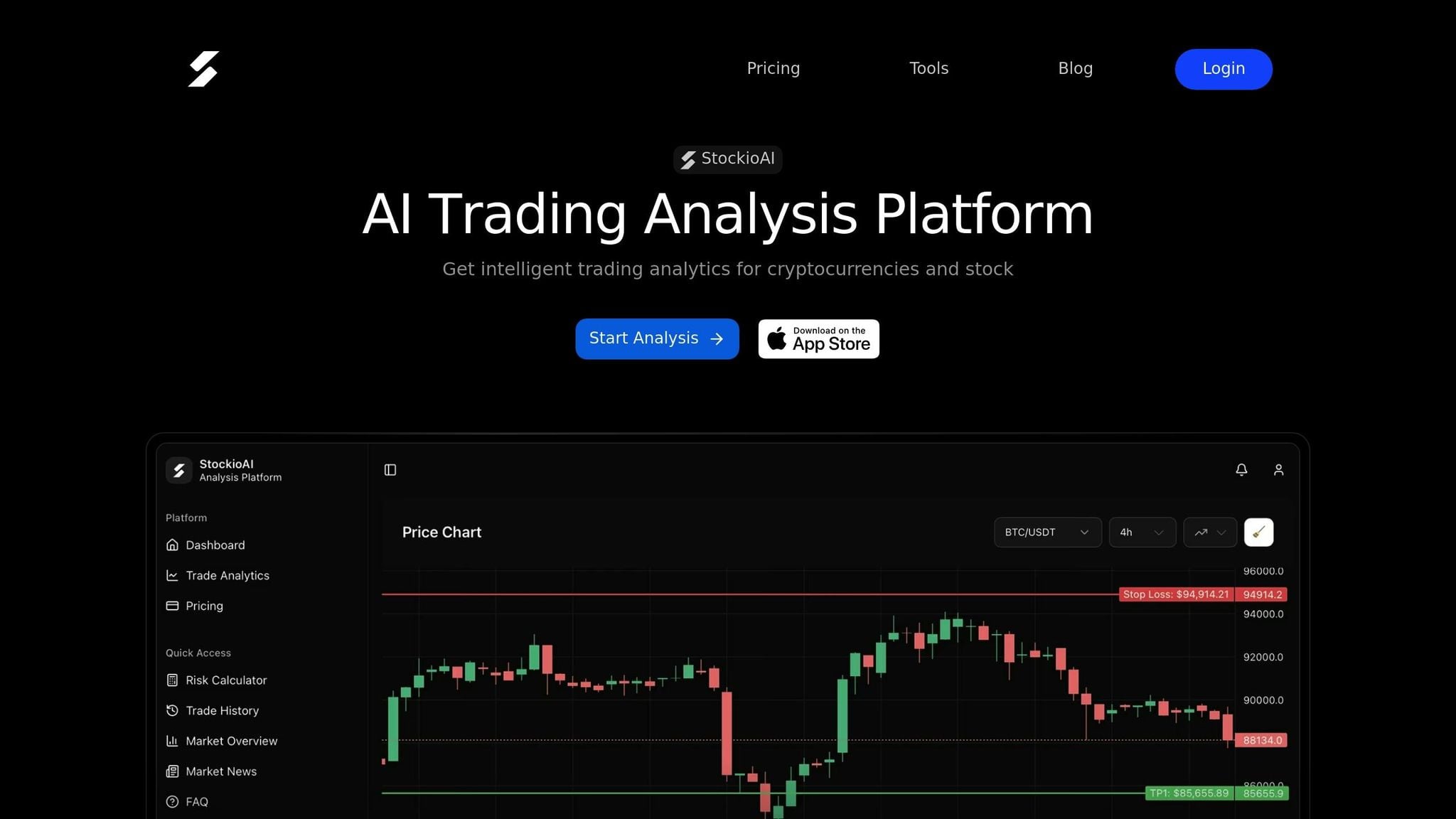

These tools excel in identifying patterns, generating real-time trading signals, managing risk, and analyzing multi-timeframe data. For example, AI systems can detect intricate chart patterns like Head and Shoulders or wedges with far greater precision. They also integrate technical analysis with sentiment data for more reliable signals. Platforms like StockioAI make these capabilities accessible, offering features such as automated pattern recognition, risk management tools, and real-time alerts to support smarter trading decisions.

AI doesn't replace human traders but serves as a powerful assistant, removing guesswork and improving decision-making. By combining AI insights with your expertise, you can navigate markets more effectively.

How AI Improves Chart Pattern Recognition

AI Pattern Detection Technology

AI has revolutionized the way traders identify price patterns by converting candlestick formations into geometric sequences [5]. This method allows advanced AI systems to instantly recognize over 16 distinct patterns, including classics like Head and Shoulders, Cup and Handle, Double Tops and Bottoms, as well as more complex formations like wedges, triangles, and harmonic patterns such as Gartley, Butterfly, and Bat [4][1].

The precision of AI in this realm is undeniable. For example, it identifies Head and Shoulders patterns with an accuracy of 83%, compared to just 61% by human traders. Similarly, it achieves 81% accuracy for wedges and 79% for bull and bear flags [1]. One striking case comes from 2025, when a leading investment bank reported a 68% drop in false signals and an increase in profitable trades from 51% to 73% within six months. They also expanded their monitoring capacity from 50 to over 2,000 securities without adding staff [1].

To maximize AI's effectiveness, clean your chart data by removing grids, indicator lines, and manual trend marks. Adjusting the zoom level can also help capture more precise details of patterns [4]. Beyond just detection, AI enhances analysis by eliminating subjective interpretations that often cloud human judgment.

Eliminating Human Bias in Pattern Analysis

AI's objective approach is a game-changer for generating reliable, real-time trading signals. Human traders often fall into the trap of forcing patterns to align with their trading strategies [5]. AI avoids this by maintaining a 95% consistency rate in pattern identification, compared to a much lower 58% consistency rate among human analysts, whose performance can vary due to factors like mood or fatigue [1]. Financial strategist Rudy Zayed highlights this advantage:

"AI tools don't need breaks. They don't get overconfident. They don't force patterns where none exist" [5].

AI also shields traders from common cognitive pitfalls like recency and confirmation bias. While humans might focus too heavily on recent trades or selectively interpret data to fit preconceived ideas, AI evaluates every data point without prejudice. It can simultaneously analyze patterns across multiple timeframes - minute, hourly, and daily - ensuring that short-term signals align with broader trends. This reduces the risk of acting on isolated, biased observations [1].

For the best results, consider a hybrid approach: let AI handle the heavy lifting of rapid detection and scaling, then use your expertise to validate the broader context [5].

Real-Time Trading Signals with AI

How AI-Driven Signals Work

AI takes raw market data and transforms it into actionable recommendations - whether to Buy, Sell, or Hold - by analyzing a wide range of real-time data points. This process is powered by a multi-agent system, where specialized agents focus on different trading aspects and a Portfolio Manager agent brings everything together. The result? Clear signals that include confidence scores, entry and exit targets, dynamic stop-loss levels, and even classifications of current market conditions [2][6][1].

These signals go far beyond simple market directions. For instance, they provide confidence scores (like an 85% probability), precise price targets for entering or exiting trades, and stop-loss levels that adapt to market volatility. Some systems even optimize order slicing to reduce slippage and improve trade execution [6].

AI doesn’t rely on a single source of information. It combines technical chart analysis with real-time sentiment data from news outlets and social media, cross-checking what the charts suggest [1]. This layered strategy explains why AI systems can correctly identify 92% of significant chart patterns, compared to just 65% for seasoned human analysts [1]. This advanced signal generation sets the stage for real trading advantages, as we’ll explore further.

Benefits of Real-Time Signals

AI’s ability to detect patterns with precision gives traders a significant edge by delivering fast and consistent insights [3][8]. Speed is one of AI’s biggest advantages. While a human trader might be able to track 5–10 stocks at a time, AI can monitor thousands of symbols across hundreds of markets simultaneously [3][8]. This scalability reduces the chances of missing out on opportunities.

Quant strategist Maaz_BA highlights this unique strength:

"The best use of AI in trading isn't prediction - it's decision-making around the edges that already exist" [6].

For those looking to integrate AI signals into their trading, think of them as a confirmation tool rather than a complete replacement for your analysis [3]. If you’re a beginner, start by using AI for scanning markets and setting alerts. Once you’re comfortable, you can explore automated execution [7].

AI for Risk Management in Trading

Risk Assessment and Position Sizing

AI takes the uncertainty out of deciding how much capital to allocate to each trade. By analyzing factors like your account balance, historical win rates, and asset volatility, AI models calculate the ideal position size for every trade [9][11]. This ensures that each trade aligns with your overall risk tolerance, whether you're dealing with steady stocks or highly volatile cryptocurrencies.

The impact of this approach can be game-changing. For instance, a reinforcement learning system reduced maximum drawdown by 23% compared to a fixed-percentage strategy by dynamically adjusting position sizes based on real-time market conditions [6].

AI also handles the heavy lifting of complex risk calculations. For example, it can apply the Kelly Criterion - a formula designed to calculate the optimal bet size based on probabilities and potential rewards - without requiring traders to do the math themselves [11].

Volatility and Market Regime Analysis

AI doesn't just stop at position sizing; it also fine-tunes trading strategies by continuously monitoring market volatility. Using methods like K-means clustering and Hidden Markov Models, AI identifies different market conditions - whether the market is trending, flat, or experiencing high volatility [6]. This insight allows traders to adapt their strategies as market dynamics shift.

The benefits are especially evident during turbulent times. Take the March 2020 pandemic crash, for example: a high-frequency trading bot equipped with a 5% drawdown circuit breaker automatically paused trading, shielding users from significant losses [9]. Similarly, during a 48-hour period in 2023 when Bitcoin plummeted by 30%, a trader using an AI-powered DCA bot with optimized stop-losses limited their loss to just 8%, while others without such tools endured drawdowns of up to 45% [10].

AI also helps curb impulsive decisions. After triggering a stop-loss, AI systems can enforce a cooldown period, preventing traders from engaging in revenge trading during volatile market phases [9][10].

Advanced AI Features for Better Trading Decisions

Multi-Timeframe Analysis

AI takes the concept of multi-timeframe analysis to an entirely new level, processing trends across countless timeframes and assets in mere milliseconds - something no human could achieve. While you might manually toggle between a daily chart and a 4-hour view, AI can simultaneously assess thousands of assets across dozens of timeframes, revealing opportunities that could easily slip past human observation [1][8].

But it doesn't stop at surface-level analysis. AI dives deeper, identifying nested patterns - complex formations like a flag pattern emerging within a larger head-and-shoulders structure [12][1]. These intricate insights are often missed in manual charting. A great example? Between 2023 and 2024, the MarketSenseAI 2.0 system combined multi-timeframe chart data with macroeconomic indicators and SEC filings, achieving a total return of 125.9%. That’s a staggering 52.4 percentage points higher than the S&P 100’s 73.5% return during the same period [2].

Another key advantage is accuracy. Machine learning models reduce false pattern identifications by 65% compared to human analysis [1]. And it gets even smarter - traders can cross-check AI-generated technical signals with sentiment analysis from news outlets and social media chatter to confirm potential breakouts [13]. This layered approach makes AI a game-changer in technical analysis and sets the stage for its predictive capabilities.

AI Predictive Analytics

AI predictive analytics take trading strategies from reactive to proactive, offering a forward-looking edge. By employing advanced techniques like Bayesian inference and Monte Carlo simulations, AI can model potential price paths and assign probability scores to different outcomes [12][13]. For instance, it might calculate an 85% likelihood of a resistance level breaking based on historical and current data.

These models don’t just rely on technical charts. They integrate a wide range of data - from economic indicators to market sentiment - to forecast price movements. Instead of giving rigid predictions, AI provides confidence levels, helping traders weigh the reliability of each scenario. For example, AI-powered "what-if" simulations can predict how a stock might respond to events like Federal Reserve rate decisions or earnings announcements [13].

That said, while AI offers powerful insights, it’s crucial to pair its predictions with your own research. Combining AI’s data-driven forecasts with a solid understanding of fundamentals ensures more informed and balanced trading decisions [14][15].

Getting Started with StockioAI Charting Tools

Key Features of StockioAI

StockioAI brings together AI-driven charting and analytics for U.S. stocks and cryptocurrencies, analyzing over 60 real-time data points every second. These include sentiment analysis, whale activity, and institutional order flow, which help generate BUY, SELL, and HOLD signals with an impressive accuracy rate of 80-90% [16].

One standout feature is the AI Pattern Recognition engine. This tool automatically identifies intricate chart patterns like head-and-shoulders, triangles, flags, and wedges, across multiple timeframes. It sends instant alerts whenever a pattern is detected. Plus, it integrates seamlessly with TradingView, allowing you to overlay support and resistance zones, pivots, and technical indicators directly on your charts.

What makes StockioAI unique is its Conflict Resolution Matrix and 7-Tier Priority System. These tools handle conflicting signals - like a bullish setup on a 15-minute chart versus bearish momentum on a daily chart - by analyzing 15 different scenarios. This system prioritizes signals based on factors like market structure, volume, and higher-timeframe momentum, ensuring you get clear, actionable recommendations without the usual market noise.

The platform also includes a Risk Management Suite, featuring a calculator that helps you determine optimal position sizes, stop-loss levels, and leverage based on your account equity and current market conditions. It also offers Market Regime Classification, which identifies whether the market is trending, ranging, volatile, or quiet, so you can adjust your strategy accordingly. Additional tools like advanced VPOC analysis and real-time order flow tracking provide insights into institutional trading activity.

With these powerful features, StockioAI simplifies both your market analysis and trade execution.

How to Use StockioAI for Trading

Getting started with StockioAI is straightforward. Sign up for a free account at https://stockio.ai - no credit card required. The free plan includes 5 AI trading signals, giving you a chance to explore what the platform can do. Once registered, you can either connect your exchange accounts via API or manually input your portfolio details for real-time tracking.

Visit the "Signals" section to access AI-generated trade ideas. Each signal includes entry points, stop-loss levels, profit targets, and a confidence score that explains the reasoning behind the recommendation. These scores are important - they reflect the AI's assessment of the trade's probability based on current market conditions. Use the TradingView integration to validate these signals by comparing them with your own technical analysis on interactive charts.

Next, focus on risk management. Use the built-in Risk Calculator to input your account balance and set a risk tolerance (typically 1-2% per trade). This step is critical as it helps you determine the right position size, avoiding overleveraging and protecting your capital during volatile periods. After placing a trade, monitor your positions using the Portfolio Tracking dashboard, which provides real-time P&L analytics and alerts for market movements that may require adjustments or exits.

For $29.99 per month, premium users unlock unlimited AI signals, automated analysis every 4 hours for major cryptocurrencies (like BTC, ETH, SOL, XRP), and daily stock analysis for popular tickers such as AAPL, META, GOOGL, TSLA, NVDA, and AMZN. Premium features also include priority support, real-time alerts, and access to a custom indicator library. The Complete Analysis Dashboard streamlines your workflow by offering one-click access to technical indicators, chart patterns, and multi-timeframe views, making it easier to move from signal discovery to trade execution.

Find Chart Patterns With AI (ChatGPT o3, Claude Opus, Gemini...)

Conclusion: The Future of AI in Trading

Trading is undergoing a major transformation, shifting from intuition-based decisions to strategies driven by data. AI is no longer just an optional tool - it's quickly becoming essential for staying competitive. The widespread adoption of AI is reshaping how both retail and institutional traders approach the markets, blending technical analysis, fundamental data, and sentiment insights into more dynamic strategies.

The way strategies are built is also changing. Instead of relying on a single indicator or rigid systems, traders are moving toward multi-signal models. These advanced approaches combine technical patterns, fundamental metrics, order flow, and sentiment analysis into a cohesive framework that adapts to changing market conditions [8]. Static, rule-based systems are giving way to flexible models designed to adjust as the market evolves [8].

Looking ahead, the future of trading lies in the synergy between AI systems and human expertise. AI isn’t here to replace traders - it’s here to eliminate guesswork and undisciplined approaches. As one TradingView contributor aptly said:

"The most realistic future isn't 'AI replaces traders' it's AI replaces undisciplined, unstructured traders who bring nothing but guesses to the table." [8]

This collaboration between humans and machines is where the real advantage lies. AI excels at speed, consistency, and spotting patterns, while traders bring context, narrative understanding, and judgment to the table. Together, they create a powerful partnership.

Cutting-edge tools like advanced pattern recognition, real-time risk modeling, and multi-timeframe analysis - once reserved for hedge funds - are now accessible to retail traders through cloud-based platforms [12][17]. This democratization of technology highlights AI's growing influence in trading.

To make the most of AI, use it to complement your strengths and address your weaknesses. For example, let AI help with tasks where emotions might cloud your decisions, such as timing your exits [8]. Always backtest AI-driven strategies on historical data before applying them to live trading [18][3]. The traders who thrive in the future will be those who see AI as a co-pilot, enhancing their decision-making rather than replacing it. Platforms like StockioAI are leading this charge, equipping traders with real-time, actionable insights to navigate the markets effectively.

FAQs

How does AI enhance chart pattern recognition for better trading decisions?

AI takes chart pattern recognition to the next level by automating the process of spotting intricate price formations like triangles, head-and-shoulders, and flags. Unlike manual analysis, which can be prone to human error, fatigue, or bias, AI leverages machine learning and computer vision to sift through massive amounts of market data with speed and precision. This enables it to detect subtle patterns that even the most experienced traders might overlook, offering more dependable trend predictions and trading signals.

What’s more, AI doesn’t just stick to a single timeframe or market. It can simultaneously analyze multiple timeframes and inter-market relationships, all while adjusting to real-time market shifts without being influenced by emotions. This level of precision and consistency equips traders with better insights, helping them make smarter decisions and improve their trading outcomes.

How does AI help with risk management and position sizing in trading?

AI plays a crucial role in improving risk management and position sizing by leveraging real-time data and sophisticated algorithms to make well-informed, data-driven decisions. It adjusts stop-loss and take-profit levels dynamically, taking into account factors like market trends, volatility, and sentiment. This helps traders limit losses and secure gains, while also removing the emotional element from decision-making, leading to a more steady and reliable trading approach.

On top of that, AI determines the ideal position sizes by considering a trader’s risk tolerance, current market conditions, and overall portfolio exposure. By constantly keeping an eye on these variables, AI tools help traders steer clear of over-leveraging and taking on unnecessary risks. This approach supports portfolio stability and encourages disciplined trading practices - especially in fast-moving markets like stocks and cryptocurrencies, where adaptability is key.

How can traders use AI signals to enhance their trading strategies?

Traders can sharpen their strategies by integrating AI-generated signals, like those from StockioAI, which delivers real-time recommendations to buy, sell, or hold. These signals are powered by in-depth analysis of market data, technical indicators, and trends, offering insights that support more precise and well-informed trading decisions.

However, it’s important to view AI signals as tools to complement, not replace, human judgment. For example, traders can use AI alerts to confirm their own analysis, determine position sizes, or even automate trades with tools like dynamic stop-loss and take-profit features. By blending AI’s speed and analytical capabilities with their personal expertise, traders can enhance decision-making, manage risks more effectively, and boost overall trading performance.