AI Charting Tools for TradingView Users

How AI charting tools speed TradingView analysis by automating pattern recognition, non-repainting signals, and dynamic risk management.

AI Trading Analysts

The StockioAI Team combines expertise in artificial intelligence, quantitative finance, and cryptocurrency markets. Our mission is to democratize professional-grade trading analysis through cutting-edge AI technology, making institutional-level insights accessible to traders worldwide.

Explore all articles written by this author

How AI charting tools speed TradingView analysis by automating pattern recognition, non-repainting signals, and dynamic risk management.

AI pattern recognition is reshaping trading in 2026 with faster multi-source signals, higher accuracy, automated risk controls, and emerging tech like quantum and federated learning.

AI charting tools speed up pattern detection, boost accuracy and consistency, generate real-time trade signals, and improve risk management for traders.

AI trading platforms must balance cybersecurity with regulatory transparency—covering model integrity, audit trails, real-time monitoring, and vendor oversight.

Master crypto support and resistance zones to spot bounces, breakouts, and high-confidence trade setups using moving averages, volume, and risk controls.

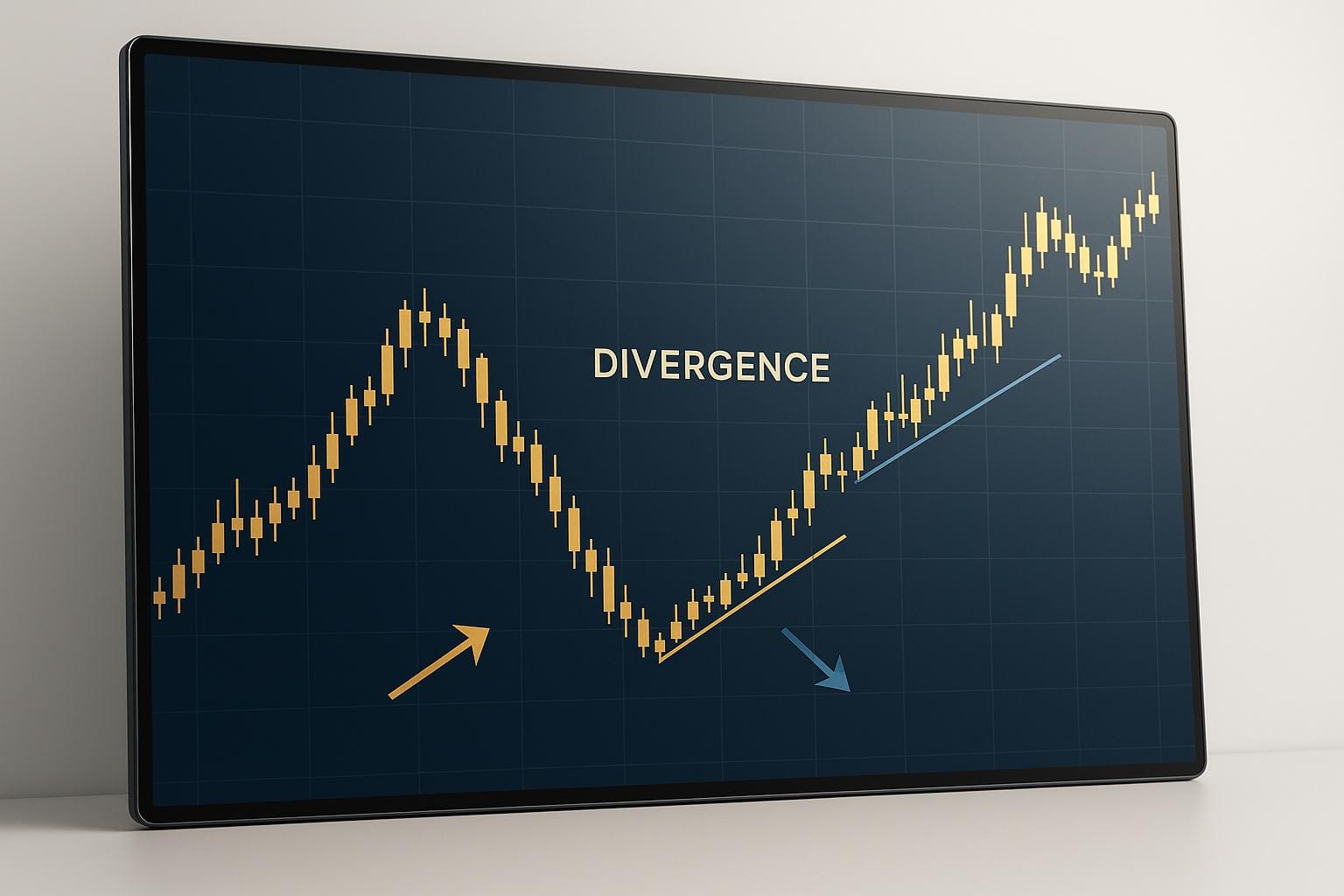

MACD remains essential in crypto: five tactical strategies—signal & zero-line crossovers, divergence, histogram reversals, and multi-timeframe alignment with risk controls.

Compare five AI platforms that detect stock chart patterns, covering accuracy, assets, and pricing to help choose the best tool for your trading style.

Align chart timeframes with your goals, schedule, and risk tolerance—from scalping to position trading—using liquidity windows and demo testing.

Chart patterns reveal whether bulls or bears control price action, but volume, market context and strict risk controls decide which setups actually work.

Compare six platforms for testing AI trading models—backtesting, paper trading, no-code tools, and pricing to validate strategies and avoid bias.

How inflation, rates, dollar strength, geopolitics and growth move crypto markets and prices, with data-driven examples and real-time analytics.

Ten essential metrics to evaluate algorithmic trading—Sharpe, drawdown, profit factor, MAE/RMSE, win rate and transaction volume to monitor strategy health.

How AI sets dynamic stop-loss and take-profit levels, calculates position size, and monitors portfolio risk to reduce emotion and improve trade exits.

How live price, order-book and sentiment feeds boost AI trading signal accuracy, reduce drawdowns, and enable sub-millisecond execution.

Discover key trade levels and market insights for Bitcoin, Ethereum, Solana, and XRP. Learn strategies for navigating crypto trends.

Learn how dynamic position sizing can transform your trading strategy with expert tips on risk management, conviction, and market conditions.

Calculate your stock trading risks instantly with our free tool. Input entry price, stop-loss, and more to see your risk percentage and total loss!

Master the art of reading crypto chart signals with insights on key levels, trading strategies, and market patterns.

Compare AI chart analysis platforms that automate trend detection, support/resistance mapping, and risk management for U.S. stock and crypto traders.

Real-time AI signals convert live market data, sentiment, and pattern recognition into instant buy/sell/hold recommendations with entry, stop-loss, and targets.

Easily convert stock prices between currencies with our free tool. Perfect for international investing—get accurate conversions in seconds!

Explore the differences and synergies between sentiment and technical analysis in crypto trading to enhance decision-making and strategy.

High-quality data is essential for AI trading success, directly influencing signal accuracy and trader decision-making.

Explore how AI enhances real-time data ingestion in crypto trading, improving decision-making and profitability in volatile markets.

Explore how AI enhances crypto trading through data integration, real-time analytics, and adaptive algorithms for improved decision-making.

Understand the crucial differences between position sizing and risk exposure in crypto trading to enhance your risk management strategy.

Learn how to identify trend reversals and continuations in crypto trading using divergence analysis with key indicators and effective strategies.

Learn how a cryptocurrency platform transformed its data pipeline for lightning-fast processing and improved user experience, achieving sub-second latency.

Explore the evolving standards of audit trails in crypto algorithmic trading, comparing traditional and decentralized market challenges.

Learn how to effectively use Fibonacci tools in crypto trading to identify entry and exit points, enhance strategies, and improve risk management.

Explore the best AI trading bots for cryptocurrency, featuring insights on key platforms, their features, pricing, and risk management tools.

Explore the role of technical indicators and AI in crypto trading, revealing how they enhance decision-making and signal accuracy.

Learn how to read the MACD indicator: MACD line, signal line, histogram, crossovers, centerline moves, and divergence to turn momentum into actionable trades...

Explore effective strategies for managing crypto investments amid market volatility, from risk scaling to portfolio diversification.

Explore the reliability and effectiveness of AI chart pattern tools in cryptocurrency trading, analyzing their strengths and limitations.

Explore how AI-driven allocation strategies enhance cryptocurrency portfolio management through machine learning and reinforcement learning techniques.

Assess the risk of your crypto investments with our free tool. Input key details and get a clear risk score to guide your decisions!

Explore the top 7 signal parameters for optimizing crypto trading strategies, enhancing accuracy, and managing risk effectively.

Explore how historical data and AI models enhance cryptocurrency predictions, improving trading strategies and risk management.

Explore how AI enhances cryptocurrency trading through advanced pattern recognition, real-time analytics, and effective risk management strategies.

Explore how AI analyzes market volatility, enhancing trading strategies through advanced data insights and predictive modeling techniques.

Explore how AI tools enhance both long-term and short-term crypto portfolio management, optimizing strategies and managing risks effectively.

Calculate crypto trading volume instantly with our free tool. Enter trades and price to get precise results—perfect for traders!

Manage risk like a pro with our Crypto Position Sizing Calculator. Input your balance, risk %, and trade details to get precise position sizes fast!

Analyze crypto trends with our free tool! Check BTC, ETH, and more for uptrends or downtrends with simple charts and clear insights.

Assess your crypto portfolio risk in minutes! Input your assets and risk tolerance to get a personalized score and tips to stay secure.

Simulate crypto trades with our free tool! Test BTC/USD signals, calculate profit/loss, and refine your strategy without risking a dime.

Explore how AI revolutionizes multi-timeframe market alerts, enhancing decision-making and analysis for traders in volatile markets.

Explore how AI sentiment analysis is revolutionizing risk management in crypto trading by providing real-time insights and identifying market trends.

Explore how AI enhances cryptocurrency trading by increasing execution speed, automating analysis, and managing risks effectively.

Explore seven risk-adjusted automated trading strategies suitable for cryptocurrency markets, focusing on balancing returns and risks.

Explore how AI-powered multi-timeframe signals enhance crypto trading by providing accurate insights, risk management, and adaptive strategies.

Calculate your crypto tax liability easily with our free tool. Input gains, holding periods, and region to get a quick estimate of what you owe!

Explore how AI enhances crypto trading with real-time analysis, automated bots, and advanced risk management to boost accuracy and profits.

Learn essential technical analysis techniques for crypto trading, including chart reading, key indicators, and AI tools for better decision-making.

Explore the top AI trading platforms transforming crypto trading with real-time insights and automated strategies for 2026.

Explore how AI tools enhance crypto trading by analyzing data, predicting trends, and executing trades without emotional bias.

Explore the essential buy, sell, and hold signals in cryptocurrency trading, their creation, application, and how to maximize their effectiveness.