The Federal Reserve's monetary policies significantly influence cryptocurrency prices, driving volatility through liquidity shifts, interest rate changes, and dollar strength. Here's what you need to know:

- Interest Rates: Higher rates increase the cost of holding non-yielding assets like Bitcoin, often leading to price drops.

- Liquidity: Quantitative easing (QE) injects liquidity, boosting speculative assets like cryptocurrencies, while tightening (QT) reduces valuations.

- Dollar Strength: A stronger dollar, driven by Fed tightening, makes Bitcoin less attractive globally, while a weaker dollar supports crypto as an alternative asset.

- Market Behavior: Cryptocurrencies are highly reactive to Fed announcements, with institutional trading amplifying these effects since 2020.

For example, during the aggressive rate hikes of 2022, Bitcoin fell from $47,000 to $16,000, showcasing its sensitivity to monetary tightening. Conversely, when the Fed cut rates in December 2024, Bitcoin surged to $94,000 as liquidity improved.

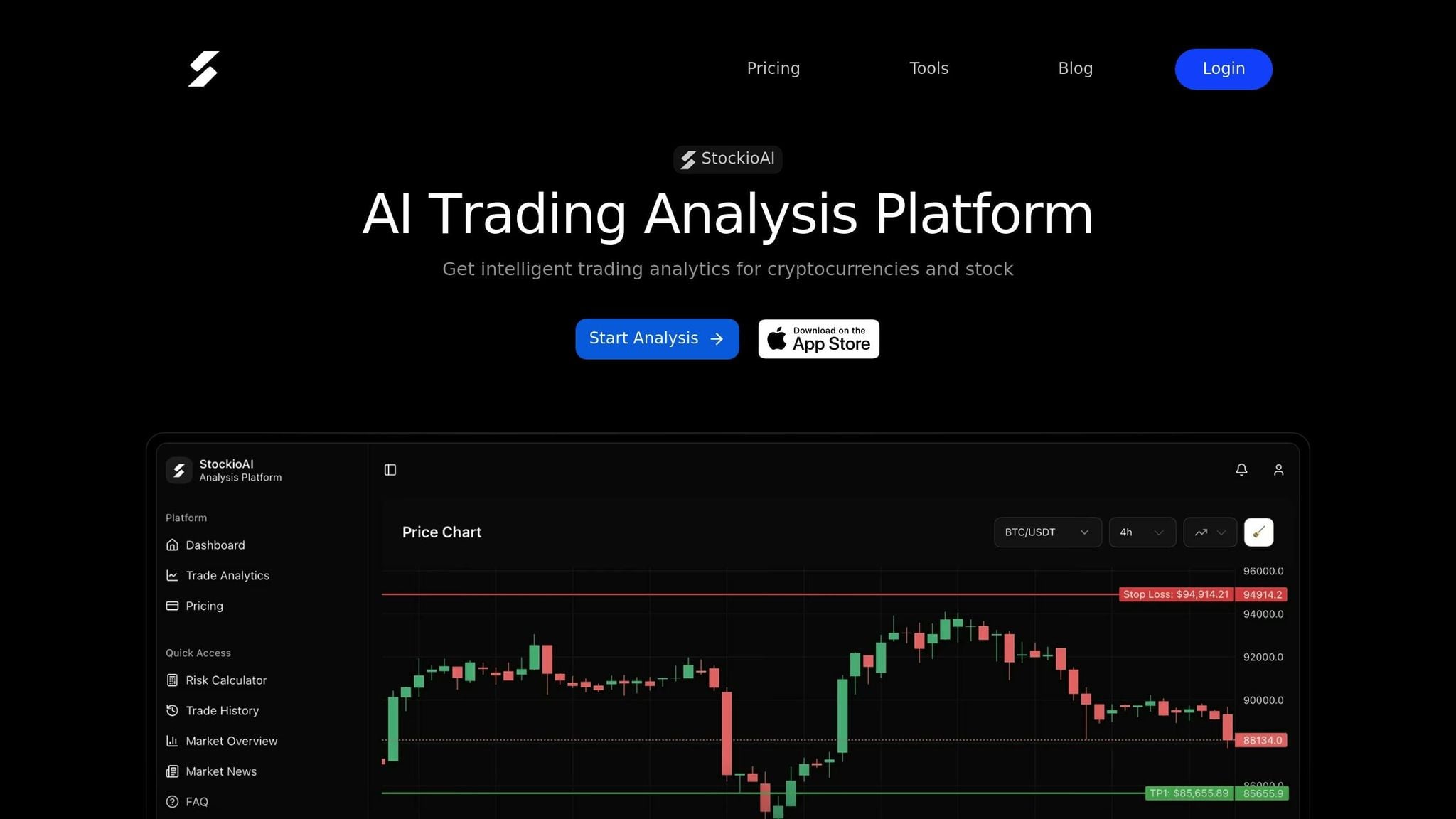

Understanding these dynamics helps traders anticipate market moves, especially during Federal Open Market Committee (FOMC) announcements or shifts in monetary policy. Platforms like StockioAI leverage macroeconomic data to provide real-time insights, helping traders navigate these volatile markets.

How the Fed Lost Control of Liquidity (and What It Means for Bitcoin)

How Fed Policy Affects Crypto Prices

The Federal Reserve's monetary policies ripple through financial markets, and cryptocurrencies are no exception. The mechanisms through which Fed actions influence crypto prices help explain why Bitcoin can experience wild swings—which you can track using a crypto market trend analyzer— after an FOMC announcement or why trading activity slows during periods of monetary tightening.

Risk Appetite and Liquidity Effects

When the Fed lowers interest rates or implements quantitative easing (QE), it injects liquidity into the financial system. This often drives investors toward riskier assets, including cryptocurrencies, which are known for their high volatility and potential for growth. A clear example of this occurred in March 2020, when the Fed slashed rates to near-zero and initiated massive QE measures in response to the COVID-19 pandemic. Bitcoin, riding this wave of liquidity, surged from around $5,000 in March to $29,000 by December 2020 [5].

On the flip side, monetary tightening has the opposite effect. Higher interest rates tend to redirect capital toward safer assets like Treasury bonds, pulling money out of riskier markets. During the Fed's aggressive rate hikes in 2022, Bitcoin tumbled from $47,000 in March to $16,000 by December [5]. Research indicates that tighter monetary policy reduces investor risk appetite, which dampens the "crypto factor" - a key price component explaining most of the market's movement [6].

These liquidity-driven shifts also influence crypto valuations through changes in discount rates.

Discount Rates and Asset Valuation

Unlike traditional investments, cryptocurrencies don't generate cash flows or dividends, making them especially sensitive to changes in discount rates. When the Fed raises interest rates, the present value of future speculative gains diminishes. Higher real interest rates make holding Bitcoin less appealing, as the opportunity cost of tying up capital in non-yielding assets increases.

"Bitcoin's value hinges on future expectations and liquidity, similar to other long-duration assets." – Nic Tse, Managing Editor, Crypto.com [5]

This dynamic explains why Bitcoin often mirrors the behavior of tech stocks. Both asset classes rely on plentiful liquidity and low discount rates to sustain their valuations. For instance, when Treasury yields jump from 1% to 4%, the cost of holding Bitcoin rises sharply, steering investors toward interest-bearing alternatives [5].

Additionally, fluctuations in the dollar's strength and inflation expectations further shape crypto market behavior.

Dollar Strength and Inflation Expectations

The Fed's monetary policies directly influence the U.S. Dollar Index (DXY), which has a notable impact on cryptocurrency valuations. Higher interest rates typically strengthen the dollar, making dollar-denominated assets like Bitcoin more expensive for international investors. This inverse relationship becomes particularly evident during periods of aggressive Fed tightening.

In contrast, when the Fed eases monetary policy, the resulting expansion of the money supply can weaken the dollar and heighten inflation concerns. Tayfun Tuncay Tosun of Istanbul Aydın University highlights that "rising inflation and an expanding monetary base may lead investors to turn to high-risk alternative assets, such as volatile cryptocurrencies, to safeguard against the dollar" [1]. A notable example occurred in December 2024, when the FOMC cut rates by 25 basis points and injected $13.5 billion via repo operations, driving Bitcoin to $94,000 as investors reassessed its appeal in a softer monetary environment [9].

Leverage, Funding Costs, and Liquidations

The Fed's policies also impact the crypto derivatives market, where leverage plays a significant role. When the Fed raises rates, the cost of borrowing increases, making it more expensive for traders to maintain leveraged positions. This often forces traders to reduce their exposure or face liquidations. For instance, in October 2023, during an intense rate hike cycle aimed at controlling inflation, Bitcoin dropped from $28,500 on October 2 to roughly $27,000 by mid-month. During the same period, BTC/USDT trading activity on Binance fell by 12%, while ETH/USDT trading volume on Kraken declined by 15% [8].

Rising funding costs can trigger margin calls and forced liquidations, further driving down prices. This creates sharp, short-term price swings that amplify the inherent volatility of the crypto market, often wiping out overleveraged positions in minutes.

Research Findings: Fed Policy and Crypto Markets

The relationship between Federal Reserve policies and cryptocurrency markets has shifted over time, largely influenced by the growing maturity of the crypto market and increased involvement from institutional investors. Let’s examine how these dynamics unfolded across different key periods.

2016–2019: Pre-Pandemic Period

In the years leading up to the pandemic, Bitcoin operated somewhat independently from Federal Reserve policy changes. Research from 2011 to 2018 showed that while Chinese monetary policy had a noticeable impact on crypto prices, U.S. policy announcements had minimal influence [3].

Interestingly, U.S. monetary tightening during this period occasionally aligned with rising Bitcoin prices [1]. This seemingly paradoxical trend reflected a market primarily driven by retail investors. The correlation between Bitcoin’s monthly returns and stock market indices fluctuated significantly, ranging from –0.35 to 0.80 [4]. Researcher Pietrzak observed:

Bitcoin systemically reacts to monetary and central bank information shocks... these reactions vary over time: not only by changing the magnitude but sometimes sign of reaction [4].

These early patterns highlighted the unique behavior of the crypto market, setting the stage for the liquidity-driven transformations that followed during the pandemic years.

2020–2021: QE and the Pandemic Bull Market

The Federal Reserve’s emergency measures in response to COVID-19 dramatically reshaped the crypto landscape. With interest rates slashed to near-zero and massive quantitative easing (QE) programs underway, Bitcoin skyrocketed from roughly $7,000 in early 2020 to over $60,000 by early 2021 [10]. The total cryptocurrency market capitalization ballooned from about $300 billion to $2.5 trillion during this period [2].

This liquidity surge wasn’t limited to Bitcoin. Speculative fervor swept across the crypto space, leading to extraordinary gains for many altcoins. For instance, Dogecoin saw an astonishing rise of over 10,000% during this bull market [10]. Bitcoin itself reached a market capitalization of over $1 trillion for the first time in early 2021 [2].

The narrative of Bitcoin as "digital gold" gained prominence, with institutional investors increasingly viewing it as a hedge against fiat currency devaluation amid unprecedented stimulus measures. Fed Chair Jerome Powell offered his perspective on crypto assets at the time:

Highly volatile (...) They're more of an asset for speculation, so they're not particularly in use as a means of payment. It's more of a speculative asset. It's essentially a substitute for gold rather than for the dollar [2].

However, the bullish momentum reversed sharply when the Fed began tightening monetary policy in 2022.

2022–2024: Rate Hikes and Market Drawdowns

The Federal Reserve’s aggressive tightening cycle starting in 2022 had a severe impact on cryptocurrency prices. Bitcoin, which had peaked near $70,000 in late 2021, fell to around $10,000 by the end of 2022 [3]. Research indicated that a 1 percentage point increase in the shadow federal funds rate triggered a sustained 0.15 standard deviation decline in the "crypto factor", a key component explaining 80% of crypto price movements, over the following two weeks [6].

The Fed’s Quantitative Tightening (QT) program, which withdrew approximately $2 trillion from financial markets over three years starting in 2022 [11], drained the liquidity that had previously fueled speculative activity in crypto markets. An IMF working paper highlighted:

US Fed tightening reduces the crypto factor through the risk-taking channel - in contrast to claims that crypto assets provide a hedge against market risk [6].

During this period, Bitcoin became closely tied to traditional markets, with its performance increasingly mirroring the S&P 500 [1]. This shift underscored the growing integration of crypto into broader financial systems and its heightened sensitivity to conventional market forces.

Comparing Research Results

Strength of the Fed-Crypto Connection

Research consistently shows that Federal Reserve policies have become a major force behind cryptocurrency price movements, with this relationship growing much stronger since 2020. One study highlights that a single "crypto factor" accounts for about 80% of the variation in crypto prices, emphasizing the dominant role Fed policies now play in shaping crypto trends [6].

Interestingly, cryptocurrencies are more reactive to Fed policy changes than traditional equities. For example, a one percentage point increase in the shadow federal funds rate leads to a 0.15 standard deviation drop in the crypto factor. In comparison, global equity factors only decline by 0.1 standard deviations under the same conditions [6]. This heightened sensitivity reflects the speculative nature of cryptocurrencies. Larger assets like Bitcoin and Ethereum show stronger swings following Fed announcements, while smaller altcoins tend to be more influenced by network-specific developments [7].

Institutional trading has further solidified this connection. The International Monetary Fund observed that institutional trading volumes on crypto exchanges skyrocketed by 1,700% between Q2 2020 and Q2 2021. This surge caused the crypto market to align more closely with the S&P 500 and made cryptocurrencies more responsive to changes in the U.S. Federal Reserve’s shadow rate [6]. These findings set the stage for exploring how Fed policies impact crypto markets differently in the short and long term.

Immediate vs. Sustained Policy Effects

Studies draw a clear line between short-term price volatility and long-term market trends. For instance, Federal Open Market Committee (FOMC) announcements often spark immediate price swings in crypto. A surprising monetary tightening of just one basis point can cause Bitcoin prices to drop by 0.25% [1]. However, long-term policy shifts tend to reshape broader price trajectories.

Between 2019 and 2025, Bitcoin and Ethereum prices have generally responded positively to expansions in the U.S. monetary base, acting as a hedge against the weakening dollar [1]. This creates an interesting paradox: while sudden tightening shocks hurt crypto prices in the short term, prolonged liquidity expansion supports their growth over time. The difference lies in whether traders are reacting to unexpected announcements or adjusting to a steady policy environment. To navigate these shifts, traders often use a crypto risk assessment calculator to adjust their exposure.

High-frequency data from 2017 to 2022 reveals another layer of complexity. Bitcoin often shows little to no reaction to macroeconomic news within narrow 30-minute windows, unlike traditional assets that tend to respond almost instantly [2]. Gianluca Benigno from the Federal Reserve Bank of New York commented on this phenomenon:

Unlike other U.S. asset classes, Bitcoin is orthogonal to monetary and macroeconomic news... this disconnect is puzzling [2].

Macro Factors vs. Crypto-Specific Drivers

While Federal Reserve-driven macroeconomic factors dominate the price movements of major cryptocurrencies like Bitcoin and Ethereum, crypto-specific elements still play a role, especially for smaller altcoins. Factors such as network upgrades, protocol changes, and adoption levels remain relevant, but macro trends have emerged as the primary drivers for the larger assets. For instance, the U.S. dollar index (DXY) influences Bitcoin prices 21 to 27 times more strongly than gold prices [12].

Here’s a breakdown of key market drivers and their relative impact:

| Driver Category | Specific Driver | Relative Importance | Time Horizon |

|---|---|---|---|

| Macroeconomic | Fed Interest Rate (SFFR) | High (Risk-taking channel) | Short to Medium Term |

| Macroeconomic | US Dollar Strength (DXY) | Very High (Inverse correlation) | Long Term |

| Macroeconomic | Monetary Base (QE) | High (Liquidity effect) | Long Term |

| Crypto-Native | Network Adoption/Users | Moderate | Sustained |

| Crypto-Native | Protocol Upgrades/Halving | Moderate to Low (often priced in) | Event-driven |

| Regulatory | SEC/Global Regulations | Moderate (Impacts sentiment) | Immediate/Short Term |

The IMF’s research underscores this hierarchy, noting:

Most variation in crypto markets is highly correlated with equity prices and highly influenced by Fed policies [6].

For traders, this means that staying informed about Fed policy changes and the strength of the U.S. dollar offers more predictive insights into Bitcoin and Ethereum price movements than focusing solely on crypto-specific developments. However, network fundamentals remain critical for smaller altcoins and long-term investment strategies.

Using AI to Analyze Fed Policy and Crypto Markets

Adding Macro Data to AI Models

AI platforms now incorporate macroeconomic indicators like BOGMBASE, real interest rates, and the U.S. dollar index to predict cryptocurrency price trends. These indicators help models evaluate the opportunity cost of holding non-interest-bearing assets, such as Bitcoin, compared to traditional investments.

To refine predictions, advanced modeling techniques like ARDL bounds testing, GARCH, and Markov-switching regression are used. These methods are particularly effective in capturing long-term trends and volatility spikes that often follow Federal Reserve announcements [1][3].

Real interest rates play a crucial role in these models. Research indicates that a one-basis-point increase in the two-year Treasury yield correlates with a 0.25% drop in Bitcoin prices [1]. By focusing on real rates instead of nominal ones, AI systems provide a clearer picture of the actual cost of holding cryptocurrency under different monetary conditions. This approach paves the way for real-time analysis of Federal Open Market Committee (FOMC) events.

Tracking FOMC Events in Real Time

FOMC announcements are known for triggering immediate volatility in financial markets, creating both risks and opportunities for crypto traders. For example, after the Fed cut rates by 0.25% in September 2025, Bitcoin surged 3.76% within a week [13]. Timing AI analysis to such events helps traders manage rapid price changes more effectively.

Modern AI platforms also use tools like the CME FedWatch to assess market-implied probabilities of future rate changes. This enables traders to anticipate market sentiment shifts even before official announcements. Additionally, generative AI models like GPT-4o can analyze FOMC meeting minutes with impressive precision. Using a "chunking" method - where models process text in segments of up to 100 sentences - GPT-4o achieved an F1-score of 0.95 in identifying key topics such as "Fed Funds Rate", "Balance Sheet", and "Financial Stability" [14].

"Generative AI models offer the promise of quickly ingesting and interpreting large amounts of textual information... [they] showed great potential, performing our assigned task with high accuracy."

- Wendy Dunn, Ellen E. Meade, Nitish Ranjan Sinha, and Raakin Kabir, Federal Reserve Board [14]

How StockioAI Helps Traders Navigate Fed-Driven Markets

StockioAI builds on these AI advancements to turn macroeconomic insights into actionable trading strategies. The platform updates its analysis every four hours for major cryptocurrencies, capturing market shifts following FOMC announcements or unexpected Treasury yield changes.

A key feature of StockioAI is its use of the "crypto factor", a single metric that explains about 80% of cryptocurrency price movements. This factor tends to decline when the Federal Reserve tightens monetary policy, reflecting reduced risk-taking in the market [6]. The platform also tracks correlations between Bitcoin and traditional assets. For instance, in 2025, Bitcoin's correlation with gold hit an all-time high of 0.9 [13]. This allows StockioAI to use movements in assets like gold and the S&P 500 as leading indicators, as Bitcoin often lags behind these markets by several weeks.

StockioAI also classifies market conditions into states like trending, ranging, volatile, or quiet. This helps traders understand how monetary tightening might stabilize markets during low-price periods or reduce prices and volatility in high-price environments [3]. With real-time alerts and advanced risk management tools, StockioAI empowers traders to adapt their strategies as Fed policies evolve.

Conclusion

Federal Reserve policies significantly influence cryptocurrency prices through liquidity, risk appetite, the strength of the dollar, and opportunity costs. When policies are loose, liquidity increases, and borrowing costs drop. However, tightening measures - like the rate hikes between 2022 and 2024 - reduce the "crypto factor", which accounts for about 80% of crypto price variability [6].

Today, Bitcoin and Ethereum behave more like high-beta tech stocks rather than traditional inflation hedges. For instance, a one-basis-point increase in the two-year Treasury yield leads to a 0.25% drop in Bitcoin's price [1]. This sensitivity has increased since 2020, driven by a staggering 1,700% surge in institutional trading, which has tied cryptocurrency market cycles more closely to traditional equity markets [6].

Traders can use these patterns to their advantage by focusing on Federal Open Market Committee (FOMC) events, tracking institutional capital flows, and differentiating between mid-cycle rate adjustments and emergency cuts. The approximately nine-month lag between Federal Reserve actions and their full impact on the market [16] offers a valuable timeframe for strategic positioning.

Platforms like StockioAI turn these macroeconomic insights into actionable tools. By updating its analysis every four hours and categorizing market conditions, StockioAI provides real-time alerts on Treasury yield changes and Federal Reserve announcements. This enables traders to adjust their strategies effectively - whether it's navigating the $7.2–$7.5 trillion rotation out of money market funds [15] or managing volatility during FOMC statement releases [7].

FAQs

How do changes in Federal Reserve interest rates influence Bitcoin prices?

Federal Reserve interest rate changes play a key role in shaping Bitcoin's price movements by influencing risk-taking behavior, the strength of the U.S. dollar, and borrowing costs. When the Fed lowers interest rates, borrowing becomes more affordable, Treasury yields drop, and investors often turn to higher-risk assets like Bitcoin. This shift can drive Bitcoin prices upward. Conversely, when rates are increased, the dollar becomes more attractive, financial conditions tighten, and cryptocurrencies often see price declines.

Historical data highlights this relationship. Bitcoin has typically surged during periods of monetary easing, such as in 2016–2017, 2020–2021, and late 2023. On the flip side, periods of monetary tightening - like those leading up to the 2018 and 2022 market downturns - have often coincided with bearish trends in crypto markets. Because these effects can vary depending on market dynamics and unexpected policy moves, having access to advanced tools is crucial for traders.

StockioAI steps in with AI-driven analytics, real-time trading signals, and risk management solutions, helping investors make informed decisions and better understand how rate changes impact Bitcoin.

How does the strength of the U.S. dollar impact cryptocurrency prices?

The value of the U.S. dollar has a noticeable impact on cryptocurrency prices. When the dollar gains strength, it often attracts investors as a reliable safe-haven asset. This can make non-yielding assets like cryptocurrencies seem less attractive, potentially causing their prices to decline.

Conversely, when the dollar weakens, cryptocurrencies tend to gain appeal. In these situations, digital assets are frequently viewed as an inflation hedge and an alternative store of value. This perception can increase demand for cryptocurrencies, driving their prices higher.

How does Federal Reserve policy impact cryptocurrency prices through liquidity?

Liquidity is a key factor in how Federal Reserve policies, like interest rate adjustments, affect cryptocurrency prices. When the Fed changes monetary conditions, the ability of traders to buy or sell crypto assets without triggering large price swings determines how quickly and intensely prices react. Larger, more liquid cryptocurrency markets tend to handle these shifts more steadily, while smaller or less-liquid tokens often experience sharper price fluctuations and increased volatility.

During times of monetary easing, when liquidity increases and borrowing costs drop, investors are more likely to embrace riskier assets, often pushing crypto prices higher. On the other hand, when the Fed tightens monetary policy, reduced liquidity can lead risk-averse investors to pull out of crypto markets, potentially causing steep price declines, especially in less-liquid tokens. Even stablecoins, which depend on short-term securities, may face liquidity challenges during these periods, amplifying market instability.

For traders, keeping an eye on real-time liquidity metrics is crucial to navigating these shifts. Tools offered by platforms like StockioAI - such as order-book depth and spread analysis - can help users better anticipate the effects of Fed policy changes and manage their risk more effectively.