AI is reshaping trading strategies for both short-term and long-term investors. Tools like StockioAI analyze over 60 data points per second, offering actionable signals - BUY, SELL, and HOLD - tailored to various trading styles. With features like multi-timeframe analysis, automated risk management, and real-time alerts, these platforms simplify decision-making while addressing challenges like emotional bias and time constraints.

Key Highlights:

- For Short-Term Traders: Real-time crypto analysis every 4 hours, order flow insights, and precise entry/exit targets.

- For Long-Term Investors: Daily stock analysis, advanced pattern recognition, and risk management tools.

- Accuracy: Claims of 80–90% signal reliability.

- Pricing: Free tier (5 analyses/month) or $24.99/month for unlimited signals and premium features.

StockioAI combines speed, precision, and risk management, making it a useful tool for traders seeking efficiency and clarity in dynamic markets.

1. StockioAI

AI Trading Signals

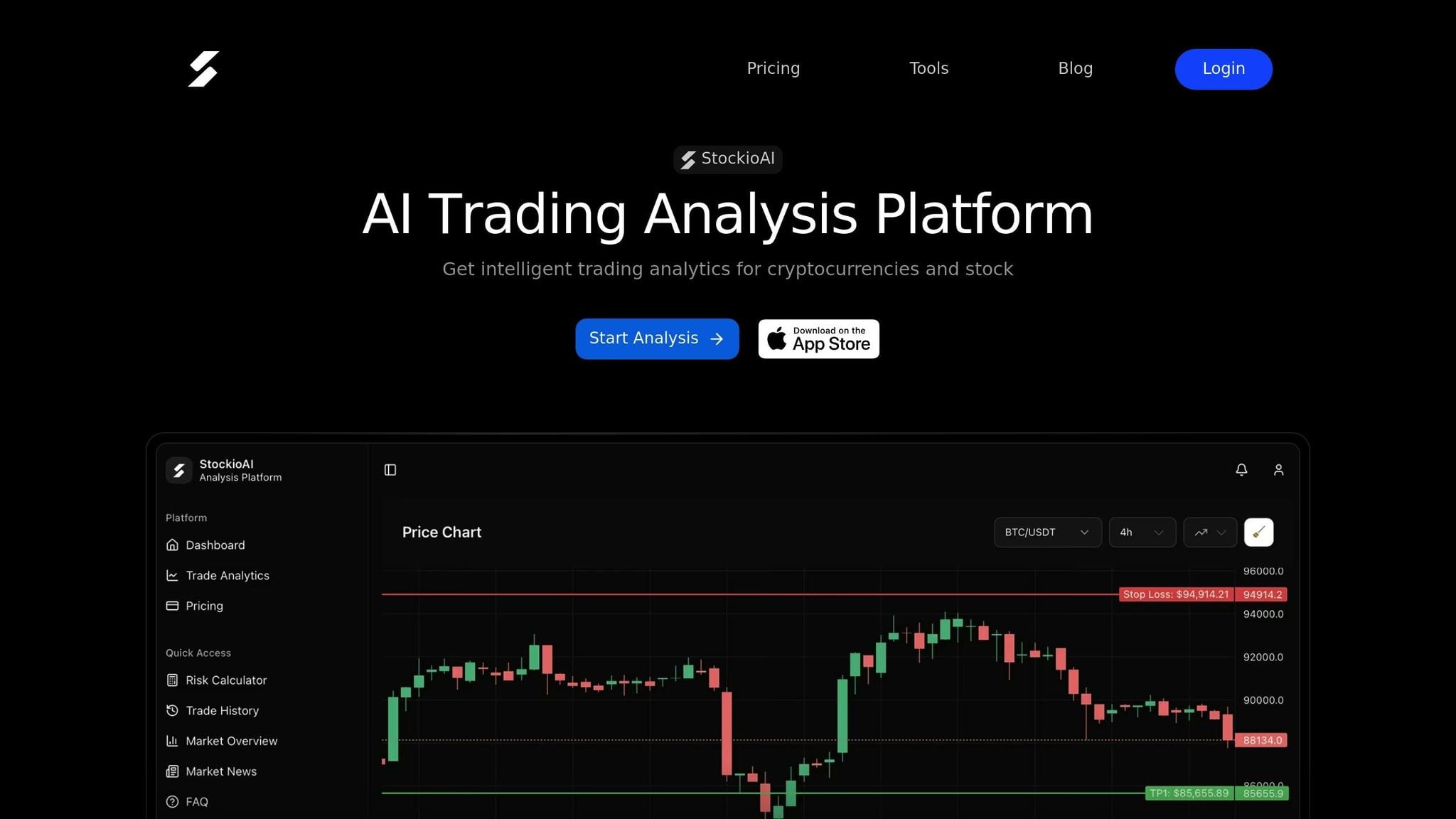

StockioAI processes over 60 real-time data points every second, analyzing factors like sentiment and technical analysis, whale movements, and order flow. Based on this data, it generates straightforward "Long", "Short", and "Hold" recommendations. Each signal comes with detailed trade parameters, including entry points, profit targets, stop-loss levels, and confidence scores. This structured approach contributes to the platform's claimed accuracy rate of 80–90%, helping traders navigate diverse market conditions while safeguarding their capital [1].

For short-term traders, the platform offers automatic cryptocurrency analysis on every 4-hour candle, paired with real-time alerts to capture quick price changes [1]. Day traders can utilize order flow analysis and volume profiles to identify emerging trends rapidly. On the other hand, long-term investors benefit from daily stock analysis and advanced pattern recognition tools, which help uncover sustainable trends and institutional activity. The AI also keeps an eye on whale movements and institutional trades to forecast potential price shifts [1].

Timeframe Analysis

StockioAI enhances its trading signals with in-depth timeframe analysis, ensuring consistent strategies across different market conditions. The platform evaluates markets across multiple timeframes, prioritizing higher timeframe momentum over shorter-term signals. This ensures that short-term trades align with broader market trends [1]. Additionally, it classifies market conditions - whether trending, ranging, volatile, or quiet - so traders can adjust their strategies accordingly [1]. For better results, users can filter signals by confidence levels and leverage tools like Volume Point of Control (VPOC) and order flow analysis to pinpoint zones with high institutional activity. The platform also integrates with TradingView, offering easy access to advanced indicators and chart formations with just one click [1].

Risk Management Tools

StockioAI pairs its signals with a suite of risk management tools to support safer trading decisions. The Risk Calculator helps traders determine the ideal position size by factoring in account balance, risk tolerance, and stop-loss distance [1]. By analyzing current market volatility, the system provides tailored risk recommendations for each trade. Every signal includes detailed stop-loss levels and risk–reward ratios, helping traders manage potential losses effectively [1]. It's recommended to use the Risk Calculator before executing any trade and to monitor confidence scores to assess the strength of a setup. Additionally, the Portfolio Tracking feature provides real-time insights into profits, losses, and overall performance, allowing traders to make timely adjustments if their strategy isn't delivering as expected [1].

Portfolio Tracking

StockioAI's portfolio tracking integrates seamlessly with its signal and risk management tools, offering a complete trading solution. Premium users can access real-time tracking features that analyze strategy performance across varying market conditions [1]. The system provides automated cryptocurrency updates for major coins like BTC, ETH, SOL, and XRP every 4 hours. It also delivers daily stock analysis for leading companies such as AAPL, META, GOOGL, TSLA, NVDA, and AMZN, keeping traders informed about market shifts [1]. For details on pricing and subscription plans, visit the StockioAI website [1].

AI Crypto Trading Bots: Which One Is Best?

Pros and Cons

Building on StockioAI's analysis, let’s dive into how its features stack up for different trading styles. Whether you're a short-term trader chasing quick gains or a long-term investor focused on steady growth, understanding these nuances can help you make the most of what StockioAI offers.

Short-Term Traders will appreciate the platform's lightning-fast responsiveness, analyzing over 60 data points per second to track market shifts. It also provides cryptocurrency analysis on every 4-hour candle and tools like Volume Point of Control (VPOC) to pinpoint market trends [1]. However, this rapid-fire approach demands quick decision-making, and any technical delays could result in missed opportunities.

Long-Term Investors can benefit from the platform’s daily analysis and "Hold" signals, which focus on key support and resistance levels. Risk management tools, including position sizing calculators and stop-loss recommendations, add an extra layer of security for extended holding periods. That said, daily updates might lag during sudden market volatility or fail to account for major macroeconomic changes.

| Trading Style | Strengths | Weaknesses |

|---|---|---|

| Short-Term (Day/Swing) | Real-time sentiment tracking, 4-hour crypto analysis, and precise entry/exit targets | High-frequency noise may lead to false signals; technical delays could mean missed trades |

| Long-Term (Position) | Daily stock analysis, volume profiles for institutional activity, and risk management tools | Daily updates may overlook intraday volatility; limited response to broader market changes |

As Steven Hatzakis, Global Director of Online Broker Research at StockBrokers.com, wisely points out: "You should treat any LLM-powered trading tool as a co-pilot, not a fiduciary" [2]. Always pair AI-generated signals with your own analysis and use protective measures like stop-loss orders to safeguard your investments.

Conclusion

When it comes to selecting an AI trading tool, the key is finding one that aligns with your trading style and goals. Day traders often prioritize tools that offer real-time alerts and frequent signals, while long-term investors focus on features that emphasize risk management and capital preservation over time.

StockioAI brings together real-time crypto alerts and daily stock analysis, offering insights across multiple timeframes. Its structured signals - complete with entry points, stop-loss levels, and profit targets - provide actionable steps for traders. Think of StockioAI as a co-pilot for your trading journey, complementing your personal market analysis rather than replacing it. With features like a built-in risk calculator to help size positions and protective tools like stop-loss orders, the platform caters to both active traders and long-term investors. Whether you're executing trades daily or holding positions for the long haul, StockioAI's combination of speed, precision, and risk management tools makes it a platform worth considering for your trading strategy.

FAQs

How does StockioAI help manage risk for short-term and long-term trading?

StockioAI employs cutting-edge AI technology to evaluate market volatility and conditions in real time, providing traders with tools to manage risk more effectively. It automatically determines the best position sizes, stop-loss levels, profit targets, and leverage ratios, all customized to fit both short-term and long-term trading approaches.

With these capabilities, StockioAI enables traders to make smarter decisions, reducing potential losses while optimizing returns across various trading horizons.

What features does StockioAI provide for cryptocurrency traders?

StockioAI equips cryptocurrency traders with AI-driven Buy, Sell, and Hold signals, pulling insights from over 60 real-time data sources. These include technical indicators, volume trends, market sentiment, and even social media discussions. Each signal is paired with precise entry and exit points, stop-loss and profit-target levels, plus confidence scores to help traders make well-informed decisions.

Beyond signals, StockioAI offers interactive charting tools, risk calculators, and continuous market trend analysis. With its AI-powered features, traders can uncover patterns and gain actionable insights designed to align with their specific trading strategies.

How does StockioAI deliver accurate trading signals?

StockioAI provides precise trading signals by processing more than 60 real-time market data points every second. These data points cover a wide range of factors, including technical indicators, volume trends, support and resistance levels, market sentiment, order book depth, large-scale (whale) transactions, and social media activity.

For every BUY, SELL, or HOLD recommendation, StockioAI includes a detailed explanation along with a confidence score. This ensures traders can make informed decisions with a clearer understanding of the market dynamics.