AI trading tools are transforming how traders analyze markets, offering features like real-time signals, risk assessments, and automated insights. This review covers seven top platforms, focusing on predictive accuracy, features, market coverage, and pricing. Whether you're trading stocks, ETFs, crypto, or forex, these tools cater to both beginners and professionals. Here's a quick summary:

-

StockioAI: Real-time signals for U.S. stocks and crypto, $79.99/month Premium.

-

Trade Ideas: AI assistant "Holly" for U.S. stocks, starts at $89/month.

-

TrendSpider: Multi-asset analysis (stocks, forex, crypto), tiered pricing.

-

Tykr: Focused on U.S. equities, $60/year basic plan.

-

Tickeron: Covers stocks, ETFs, crypto; $90/month for premium.

-

BlackBoxStocks: Advanced analytics for stocks, ETFs, and options; $79.99/month Premium.

-

Kavout: U.S. stocks and ETFs, real-time insights, tiered pricing.

Quick Tip: Start with free trials or basic plans to test which tool aligns with your trading style and goals. AI tools enhance decision-making but should be paired with solid risk management.

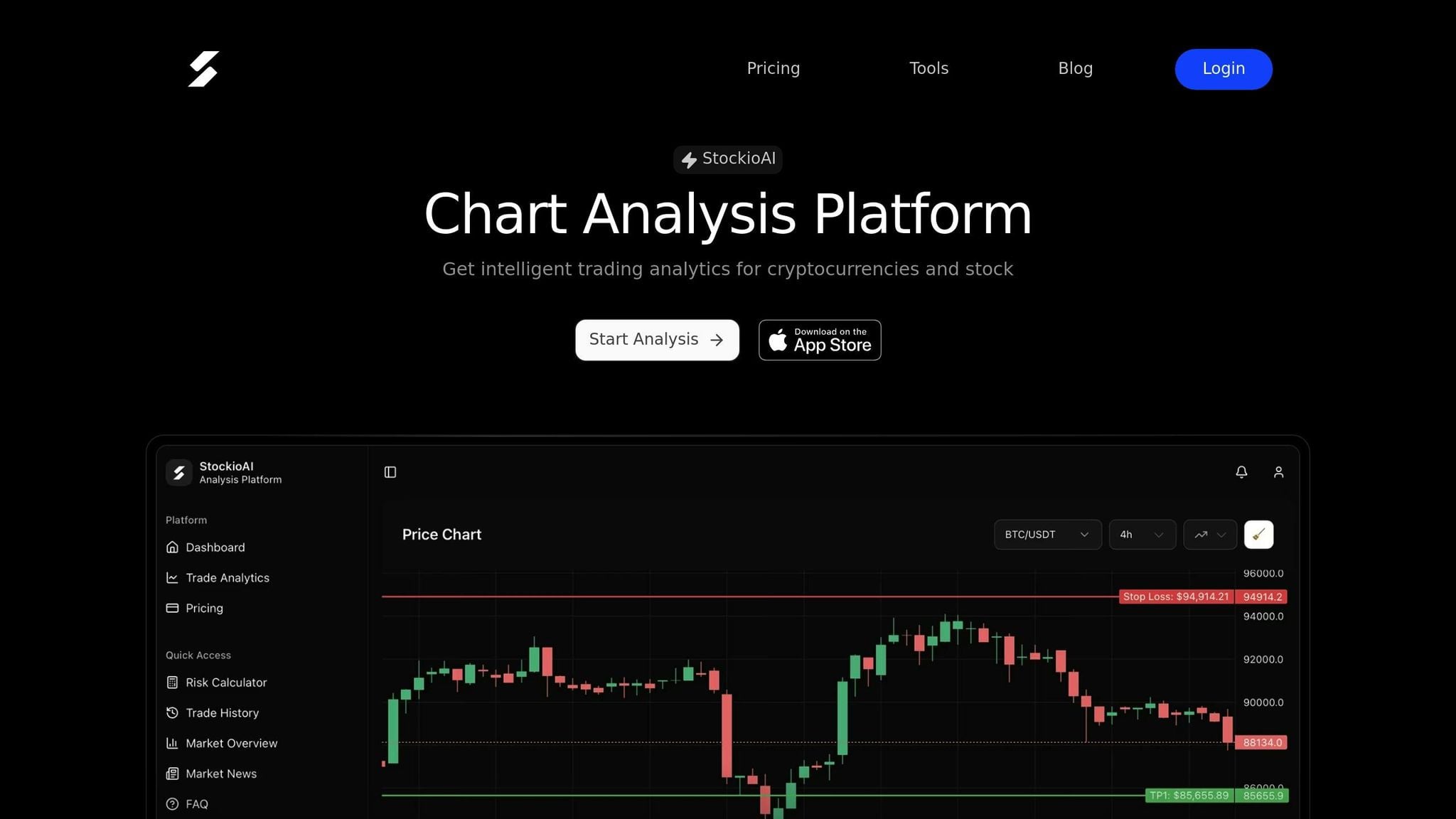

1. StockioAI

Predictive Accuracy

StockioAI processes more than 60 real-time data points per second, including market sentiment and institutional whale movements, to generate Buy, Sell, and Hold signals for both stocks and cryptocurrencies. Each signal comes with a confidence score and precise timing, giving traders actionable insights. The platform’s AI models dive into price action, volume profiles, and technical indicators to deliver highly accurate entry signals.

While StockioAI prides itself on precision, traders are encouraged to test its performance independently. Some users have reported notable returns using the platform’s insights, but it’s worth remembering that no AI tool can guarantee future results. Always validate signals with your own analysis and ensure they align with your risk tolerance before acting on them.

In addition to its signals, StockioAI offers a powerful range of analytical tools to enhance trading strategies.

Features and Analytics

StockioAI provides a robust set of tools that extend far beyond basic signal generation. Its AI-driven pattern recognition identifies key support and resistance levels, chart patterns, and breakout opportunities automatically. Traders can also benefit from multi-timeframe analysis that emphasizes higher timeframe momentum, volume profile analysis featuring Volume Point of Control (VPOC), and real-time order flow tracking to gauge institutional activity.

For risk management, the platform includes features like stop-loss suggestions, position sizing calculators, and risk-reward ratio assessments for every trade setup. These tools make it easier to turn AI-generated forecasts into actionable trades with clearly defined risk parameters. Additional features include market regime classification (identifying trending, ranging, volatile, or quiet conditions), RSI and MACD overlays, EMA ribbons, and price momentum indicators. All of this is available through an interactive, browser-based charting interface - no downloads required.

Market Coverage

StockioAI specializes in U.S. stocks and cryptocurrencies, covering major equities like AAPL, META, GOOGL, TSLA, NVDA, and AMZN, as well as top cryptocurrencies such as BTC, ETH, SOL, and XRP. The platform supports analysis across various timeframes, catering to day traders with intraday charts and providing daily and weekly views for swing traders and long-term investors. Custom watchlists and filters for specific sectors or crypto pairs allow traders to focus on the assets most relevant to their strategies.

Pricing

StockioAI uses a subscription-based model priced in U.S. dollars, offering two tiers to suit different needs.

-

The Free plan ($0.00/forever) includes 5 AI trading signals, basic market insights, standard indicators, and access to educational resources - ideal for trying out the platform without commitment.

-

The Premium Access plan costs $79.99/month (or $24.99/week) and unlocks unlimited AI trading signals, automatic crypto analysis every 4 hours, daily stock analysis, advanced AI pattern recognition, real-time market alerts, portfolio tracking, and priority customer support.

The Premium plan’s extensive features, particularly unlimited signals and automated analysis, make it a strong option for active traders. However, those with smaller accounts should carefully consider whether the subscription fee fits within their trading budget and expected returns.

2. Trade Ideas

Predictive Accuracy

Trade Ideas leverages its AI assistant, Holly, to analyze and backtest thousands of U.S. stocks every night. The goal? To pinpoint promising opportunities for the next trading day. Predictions are updated in real time, offering AI-driven signals complete with suggested stop-loss and take-profit levels. The platform's success depends on the chosen strategy and market volatility, but it’s designed to highlight setups with a higher likelihood of success, especially for active traders.

One of Holly’s standout features is its focus on short-term setups. For example, it might identify a stock experiencing a breakout due to increased trading volume. In such a case, Holly could suggest entering at $50, setting a stop-loss at $48, and a take-profit at $55. Depending on the strategy, backtested win rates can range from 60% to 70%. These predictions are seamlessly paired with the platform’s advanced analytics.

Features and Analytics

Trade Ideas is packed with tools aimed at active day traders. Its AI Holly automates stock picks and signals, while the real-time market scanner enables users to filter stocks based on various criteria, such as technical patterns, volume spikes, or even social media buzz. The OddsMaker feature is particularly useful, offering point-and-click backtesting without requiring any coding skills - perfect for traders who aren't tech-savvy. Additionally, Brokerage Plus allows direct integration with brokers like Interactive Brokers, making automated trade execution quick and straightforward.

Other notable features include trade setups, 1-click chart trading for fast execution, and the Money Machine, which adjusts strategies in real time as market conditions change. While the desktop interface might feel overwhelming at first, once mastered, it provides professional-grade scanning and automation tools for serious traders.

Market Coverage

Unlike platforms that cater to multiple asset classes, Trade Ideas focuses solely on U.S. equities. It scans thousands of stocks in real time, making it ideal for day traders targeting intraday opportunities. The platform excels in backtesting strategies across U.S. market data, but it doesn’t support cryptocurrencies, forex, or international equities. If you trade across various asset classes, you’ll need to pair Trade Ideas with other tools to cover those gaps.

Pricing

Trade Ideas starts at $89.00 per month for its Standard plan. For traders looking to unlock full access to Holly AI and advanced features, Premium plans are available at higher price points. Annual subscriptions come with potential discounts, but there’s no fully free option beyond limited demos. Expect to pay around $1,068.00 per year for Premium access, placing it in the mid-range pricing tier compared to competitors like TrendSpider, which starts at $99.51 per month.

3. TrendSpider

Predictive Accuracy

TrendSpider leverages machine learning to simulate trades across a variety of instruments, aiming to pinpoint setups with a high chance of success. By analyzing price movements, volume trends, and technical indicators, it identifies opportunities that align with market patterns. To make the most of its insights, traders are encouraged to review backtesting data from the past 6–12 months, focusing on metrics like win rates, average profits, and drawdowns. These predictive signals form the backbone of the platform's analytics.

Features and Analytics

This platform packs a range of powerful tools. An AI-driven market scanner keeps tabs on the markets throughout trading hours, while a pattern recognition engine highlights critical price levels, such as support and resistance zones. Traders can also take advantage of tools for setting stop-loss levels, determining position sizes, and evaluating risk-reward scenarios. For strategy validation, the platform’s backtesting modules allow users to test rules-based strategies against historical data.

Market Coverage

Tool Three takes a multi-asset approach, covering U.S. stocks, ETFs, major forex pairs, and cryptocurrencies. It scans U.S. exchanges like the NYSE, NASDAQ, and AMEX, while also offering analysis for cryptocurrency pairs. This broad coverage is perfect for traders managing diverse portfolios, enabling them to apply consistent AI-driven insights whether they’re trading during regular market hours or navigating 24/7 markets like crypto.

Pricing

Tool Three operates on a subscription model priced in USD, with tiered plans to suit different needs. A basic plan or free trial is available for those who want to explore the platform before committing. Premium plans unlock advanced features, including unlimited AI trading signals, deeper analytics, real-time alerts, and enhanced customer support services.

4. Tykr

Predictive Accuracy

Tool Four adjusts its predictions in real-time as market conditions change, running nightly backtests on thousands of stocks to pinpoint the best trading setups. While it doesn’t publish fixed win rates, the platform scores a 4.0 out of 5 rating for its ability to suggest entry points, stop-loss levels, and take-profit targets based on backtested data. Its performance depends heavily on the chosen strategy and the trader's grasp of backtesting principles. This tool is designed to complement others by focusing on fast, data-driven decisions, particularly for short-term trades in U.S. equities.

Features and Analytics

What sets Tool Four apart is its focus on ultra-responsive AI functionality. When it identifies a strong trading opportunity - like a tech stock gaining momentum - it provides specific recommendations, such as a $5 stop-loss and a $10 take-profit level. It also integrates seamlessly with brokerages, offering 1-click trading to simplify execution for day traders who rely on speed. While the premium features bring value to those seeking daily AI-driven signals, the desktop interface does come with a learning curve. This precision-focused design caters to traders who value a concentrated approach to the market.

Market Coverage

This platform zeroes in on U.S. stocks, allowing for a more detailed analysis of equity-specific patterns and behaviors. By scanning thousands of U.S. equities each day, it caters to day traders and short-term position traders who focus exclusively on domestic markets. This narrower focus enhances its ability to recognize patterns within U.S. exchanges, rather than spreading its resources across various asset classes.

Pricing

Subscriptions start at $89/month for standard features, with premium tiers climbing to $107+/month based on the tools included. A free version offers basic dashboard access, but full AI signal capabilities and 1-click trading integration require a paid plan.

5. Tickeron

Predictive Accuracy

Tickeron takes a unique approach to predictive analytics by using a confidence scoring system rather than fixed win rates. Its machine learning models evaluate price trends, volume, and technical indicators to assign probabilities of success for various setups. This allows traders to assess potential opportunities before risking their capital. The platform's performance varies depending on the specific trading bot or strategy chosen. In 2025 reviews, Tickeron earned a 3.5 out of 5 rating, reflecting its reliability across different use cases[1][2].

Features and Analytics

Tickeron provides a suite of AI-powered tools, including trading bots for stocks, ETFs, and cryptocurrencies. The platform also offers an AI stock screener, real-time signals, and pattern recognition capabilities. These features are designed to help traders identify high-probability setups, even during volatile market conditions. Its built-in AI search engines scan for technical patterns and volume anomalies, offering multiple angles for evaluating trades. While basic daily signals are available at the entry level, more advanced tools like premium bots and detailed pattern recognition are accessible at higher subscription tiers, offering greater depth for experienced traders.

Market Coverage

Tickeron supports trading across stocks, ETFs, and cryptocurrencies, allowing users to manage a diversified portfolio on a single platform. Its AI-driven pattern recognition and bot marketplace are seamlessly integrated across these asset classes, making it an appealing option for those balancing traditional investments with cryptocurrency trading. That said, the quality of signals may vary depending on the market being analyzed.

Pricing

Tickeron's pricing structure is designed to accommodate different trading needs. The basic plan, which includes daily buy/sell signals, costs $60 per year - significantly less than platforms that charge $89 or more per month. For traders who require advanced features like AI trading bots, pattern recognition, and comprehensive screeners, the premium plan starts at $90 per month. This tiered pricing model makes Tickeron accessible to casual traders testing the waters with AI signals, as well as active traders seeking full access to the platform's tools. All prices are listed in USD.

Best AI Trading Tools - This is CRAZY!

6. BlackBoxStocks

BlackBoxStocks takes trading tools up a notch by blending advanced machine learning (ML) algorithms with practical trading features that cater to both experienced and aspiring traders.

Predictive Accuracy

At the heart of Tool Six is its ability to generate real-time trading signals using sophisticated ML algorithms. These signals are evaluated through both backtesting and live market performance, offering traders a clear picture of win rates, average returns, and essential risk metrics like maximum drawdown and the Sharpe ratio. Backtested strategies for U.S. markets have shown strong results, while live trading data confirms the tool’s ability to adapt to changing conditions. These dependable signals serve as the backbone for the platform’s advanced analytics.

Features and Analytics

Tool Six is packed with a range of AI-driven analytics designed to support smarter trading decisions:

-

Intelligent Signal Generation: Provides Buy, Sell, and Hold recommendations with detailed entry points, timing, and confidence scores.

-

Automated Technical Analysis: Identifies critical support and resistance levels, trendlines, and pivots across various timeframes.

-

Strategy Builder & Backtesting: Lets traders create, test, and refine custom strategies using historical data.

-

Risk Assessment Tools: Includes stop-loss features, position sizing guidance, and risk-reward evaluations to help traders manage risk effectively.

-

Real-Time Market Alerts: Sends timely notifications highlighting high-probability trade setups throughout the trading day.

-

Comprehensive Dashboard: Offers portfolio insights like sector exposure, volatility, and correlation metrics, all in one place.

These tools are designed to help traders tackle everything from intraday market movements to longer-term swing trades while also enabling systematic strategy implementation.

Market Coverage

Tool Six supports a wide range of asset classes, making it versatile for different types of traders. It provides analytics and trading signals for stocks, ETFs, options, and select cryptocurrencies. By pulling data from major U.S. exchanges like the NYSE, Nasdaq, and AMEX, the platform ensures its insights are tailored to USD-based markets.

Pricing

Tool Six operates on a subscription model with two tiers:

-

Free Plan: Includes basic market insights, a limited number of AI-generated trading signals, standard technical indicators, and educational resources - all at no cost.

-

Premium Access: Priced at $79.99 per month, this plan unlocks unlimited trading signals, advanced pattern recognition, automated analysis for both crypto and stock markets, real-time alerts, and portfolio tracking.

While the platform offers powerful tools and analytics for active traders, customizing strategies may take time to master. The pricing reflects the platform’s focus on delivering advanced analytics tailored to the needs of U.S.-based traders.

7. Kavout

Kavout is an AI-powered platform designed specifically for U.S. intraday and swing traders. It’s built for those who already have a solid understanding of technical analysis but want to take their trading decisions to the next level with machine learning-driven pattern detection, automated backtesting, and real-time alerts during U.S. market hours (Eastern Time). All data, pricing, and metrics are presented in USD, following U.S. formats. Let’s dive into what makes Tool Seven stand out, from its predictive dashboards to its real-time analysis and pricing structure.

Predictive Accuracy

Tool Seven provides traders with a clear view of its predictive capabilities through strategy dashboards. These dashboards display key metrics like win rate, average return per trade, maximum drawdown, and profit factor, all based on historical backtests. Users can explore backtested results over custom timeframes - such as 1, 3, or 5 years - using U.S. market data. The platform also offers detailed equity curves and return distributions per trade. With a no-code backtesting feature, traders can easily compare generated signals against a basic buy-and-hold strategy. However, as with any trading tool, it’s important to note that past performance doesn’t guarantee future results - a disclaimer prominently included in the platform.

Features and Analytics

At the heart of Tool Seven is its AI signal engine, which scans the markets to identify potential Buy and Sell opportunities. These alerts come with suggested stop-loss and take-profit levels, streamlining the decision-making process. The platform automates technical analysis by detecting chart patterns, key price zones, and trendlines across various timeframes. Additional features include backtesting capabilities, watchlist-level scanning, and risk management tools, such as position sizing recommendations based on account size and per-trade risk (calculated in USD). To ensure traders can act quickly, alerts are sent via app notifications or email.

Market Coverage

Tool Seven focuses on U.S.-listed stocks and ETFs, with additional support for major U.S.-traded cryptocurrencies and select international equities available as U.S. ADRs. Its design prioritizes real-time data from leading U.S. exchanges like the NYSE and NASDAQ, ensuring traders have access to timely and accurate information. Depending on the subscription tier, users can access either real-time or near-real-time quotes. While the platform is well-suited for common equity, ETF, and crypto strategies, traders seeking advanced futures analytics or options Greeks may need to use supplementary tools.

Pricing

Tool Seven offers a tiered subscription model in USD, with options like Basic, Pro, and Advanced. Annual plans come with discounts, and higher-tier subscriptions unlock premium features, including intraday real-time data, unlimited AI scans, expanded backtesting options, and priority customer support. Positioned as a mid-range option in the AI trading tools market, Tool Seven balances powerful AI-driven features with a user-friendly experience tailored to U.S.-based traders.

Pros and Cons

Every AI trading tool brings its own strengths and weaknesses to the table. Knowing these differences can help you choose the platform that aligns best with your trading style, budget, and technical requirements. Here's a side-by-side look at what each tool offers:

| Tool | Pros | Cons |

|---|---|---|

| StockioAI | • Provides real-time trading signals with clear Buy, Sell, and Hold recommendations • Offers interactive chart analysis • Includes integrated risk management tools like risk calculators and stop-loss suggestions • Affordable at $79.99/month | • Free plan is limited to just 5 AI trading signals • Lacks explicit support for automated trade execution • Primarily focused on crypto and stocks, with limited multi-asset options |

| Trade Ideas | • Features AI system Holly, which delivers real-time adaptive stock picks and backtests • Enables 1-click trading with suggested stop-loss and take-profit levels • Tailored for active traders • Starts at $89/month | • Desktop version has a steep learning curve • Performance can vary widely depending on the strategy • Premium features come with higher costs |

| TrendSpider | • Automatically identifies trendlines, support/resistance zones, and patterns • Offers multi-timeframe analysis, backtesting, and trading bots • Highly rated with a 4.5/5 score | • Focuses mainly on technical analysis, with limited fundamental data • Full AI features require a subscription • May be too complex for traders seeking simpler solutions |

| Tykr | • Provides a trading bot marketplace with real-time signals and confidence scores • Recognizes patterns for stocks, ETFs, and crypto • Low entry price of $60/year for basic features | • Advanced bots can cost $90+/month • Performance depends heavily on the chosen strategy • Places less emphasis on real-time trade execution compared to rivals |

| Tickeron | • Includes over 300 indicators, advanced charting, and predictive modeling • Trusted by technical analysts for decades • Offers comprehensive scanning and forecasting tools | • Interface feels outdated compared to newer platforms • Requires integration with external data feeds (e.g., Refinitiv) for real-time updates • Steeper learning curve for non-professional traders |

| BlackBoxStocks | • Uses Kai Score, which applies machine learning to fundamentals, price, and sentiment • Delivers deep portfolio simulations and predictive ratings • Designed for advanced and institutional users | • Custom/enterprise pricing lacks transparency • Free access is limited to demos • May be excessive for casual or beginner traders |

| Kavout | • Provides real-time insights with automated stock/ETF rankings • Offers trend forecasting and portfolio optimization • Includes backtesting for data-driven decision-making | • Limited focus on automated execution or trading bots • Complexity may overwhelm beginners • Pricing details are not widely available and may be on the higher side |

These comparisons highlight the unique capabilities of each platform, helping you find the one that suits your trading needs.

Traders have seen real-world success with these tools. For instance, quantitative trader Jordan Martinez shared his experience with StockioAI:

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."

Carefully weigh these pros and cons to determine which tool aligns best with your goals and resources.

Conclusion

Selecting the right AI trading tool comes down to aligning it with your trading style, market preferences, and budget. If you're a day trader, look for platforms that provide real-time signals and prioritize fast execution through low-latency data feeds. For swing traders, tools offering multi-timeframe analysis and pattern recognition across daily and weekly charts can be invaluable. Long-term investors, on the other hand, might focus more on features like fundamental analysis, portfolio optimization, and risk management rather than on rapid trade signals.

Your market focus is just as important. A tool designed for equities may not be effective for crypto-heavy portfolios, so it’s crucial to ensure the platform aligns with the markets you trade most frequently.

Budget also plays a critical role. Factor in not just the subscription cost but also any extra fees for premium features. Starting with free trials or basic plans is a smart way to test the tool’s AI signal quality before committing. For experienced traders using algorithmic strategies, platforms with strong backtesting capabilities and clear performance metrics like win rates and drawdowns are essential.

Evaluate tools based on their predictive accuracy, feature set, market coverage, and pricing. Keep in mind that while AI can enhance decision-making, it doesn’t guarantee profits. The most effective traders combine AI insights with disciplined risk management, including stop-loss strategies, position sizing, and paper trading to refine their approach before risking real money. Use trial periods to test multiple tools, track your performance, and identify the one that consistently improves your trading decisions.

At the end of the day, the best AI trading tool is the one that fits seamlessly into your workflow, supports the markets you trade, and aligns with your budget - not the one with the flashiest marketing. Focus on the features you truly need, validate performance through backtesting, and remember that AI is a tool to support your strategy, not a substitute for solid trading fundamentals.

FAQs

What features make StockioAI a top choice for AI trading analysis?

StockioAI brings a robust set of tools to the table, aimed at making trading decisions more intuitive and effective. Its AI-driven insights deliver clear Buy, Sell, and Hold signals, pinpoint support and resistance levels, and use advanced pattern recognition to highlight trends and identify the best entry or exit points.

On top of that, StockioAI offers real-time market data, interactive charting tools, and professional-grade risk management features, creating a comprehensive platform for traders navigating fast-paced markets. With a straightforward interface and advanced analytics, StockioAI helps traders make well-informed, data-backed decisions with ease.

How can beginners use AI trading tools like StockioAI to improve their trading strategies?

Beginners can take advantage of StockioAI's AI-driven tools to make trading decisions less overwhelming. Features like interactive chart analysis and pattern recognition can highlight potential opportunities to buy, sell, or hold, while the risk calculator helps you manage your trades more carefully.

It's wise to start with smaller trades, allowing you to gain confidence as you track your performance. As you grow more familiar with the platform and market trends, these tools can support you in fine-tuning your strategies for smarter, more informed trading choices.

What factors should traders evaluate when selecting a subscription plan for AI trading tools?

When selecting a subscription plan for AI trading tools, prioritize the features that matter most to your trading needs. These might include AI-powered analysis, real-time trading signals, or tools for managing risk. The plan you choose should align closely with your trading goals and strategies to help you stay on track.

Also, take a close look at the pricing structure to ensure it works within your budget. Aim for a plan that strikes the right balance between cost and the value it offers - providing the tools and insights you need to make smarter decisions in the market.