Crypto trading requires more than just luck - it’s about making informed decisions in a volatile, fast-moving market. Two key tools traders rely on are sentiment analysis and technical analysis. Here's the difference:

- Sentiment Analysis: Focuses on market mood by analyzing social media, news, and forums to gauge optimism or fear. It’s forward-looking and helps detect trends early, especially during major news events or social media buzz.

- Technical Analysis: Examines past price data, trading volumes, and chart patterns to predict future movements. It provides precise entry/exit points and works best in stable markets.

Quick Takeaway: Sentiment analysis is great for spotting early emotional shifts, while technical analysis excels in timing trades using historical data. Combining both can give traders a sharper edge.

Quick Comparison:

| Aspect | Sentiment Analysis | Technical Analysis |

|---|---|---|

| Focus | Market mood and psychology | Historical price data and patterns |

| Data Sources | Social media, news, forums | Price charts, trading volumes, indicators |

| Best For | Early trend detection | Trade timing and risk management |

| Limitations | Prone to misinformation, quickly outdated | Lagging indicators, struggles with emotion-driven moves |

Traders often combine both methods for a well-rounded strategy. AI tools like StockioAI simplify this by merging sentiment and technical insights, analyzing over 60 real-time data points for precise signals. Whether it’s a tweet sparking a price jump or a chart pattern signaling a breakout, this dual approach helps traders stay ahead.

What is Sentiment Analysis in Crypto Trading

Sentiment Analysis Definition

Sentiment analysis in cryptocurrency trading is all about understanding how investors feel about digital assets [2][3]. Instead of focusing solely on historical price trends or economic fundamentals, it dives into the psychology behind market movements. Are traders feeling optimistic (bullish) or pessimistic (bearish)? That’s the key question this method seeks to answer.

This approach can be especially useful when emotions, rather than logic, drive price changes. Sometimes, market psychology leads to extreme volatility or even creates self-perpetuating trends that technical charts or intrinsic valuations can't fully explain [2][3].

How Sentiment Analysis Works

Sentiment analysis combines two key approaches - qualitative and quantitative - to provide a clearer picture of market sentiment [3].

-

Qualitative analysis involves interpreting news articles, expert opinions, and social media discussions to identify emotional cues. This method can highlight the market's mood early on [3].

-

Quantitative analysis uses measurable data like trading volume, price movements, and sentiment metrics to determine whether the market leans bullish or bearish [3].

Popular data sources include platforms like Twitter, Discord, Telegram, financial news websites, and forums such as Reddit [2]. With tools like Natural Language Processing (NLP) and machine learning, sentiment analysis can process vast amounts of text in real time to uncover patterns [3].

Traders often rely on tools like the Fear & Greed Index, which consolidates metrics like volatility, momentum, and social media trends into a 0–100 scale. This index helps traders decide when to buy or sell: buying during periods of fear (index below 30) and selling when greed takes over (index above 75) [2].

While these methods are powerful, they come with their own set of challenges that traders must navigate carefully.

Pros and Cons of Sentiment Analysis

Sentiment analysis offers several benefits for crypto traders, but it’s not without its challenges.

Advantages

One major upside is its ability to detect trends early. By identifying shifts in market sentiment before they show up in price charts, traders can gain a head start in the fast-moving crypto world [3]. It also helps traders avoid decisions driven by FOMO (fear of missing out) by providing a clearer picture of genuine opportunities [7]. When combined with technical and fundamental analysis, sentiment data becomes an additional layer of insight [2][7].

Challenges

However, there are hurdles to consider. For one, bot activity and misinformation can skew sentiment signals, making it harder to interpret the data accurately [3]. The crypto market moves quickly, and sentiment analysis can become outdated just as fast. Additionally, the specialized language often used in crypto discussions can pose challenges for NLP tools, potentially reducing their accuracy [3]. Finally, sentiment can sometimes act as a self-fulfilling prophecy, where collective buying or selling amplifies trends, leading to price movements that may not align with an asset’s true value [2].

| Advantages | Limitations |

|---|---|

| Detects trends before price movements | Bot activity and misinformation can distort data |

| Helps avoid FOMO-driven decisions | Struggles to keep up with rapid market changes |

| Provides insights into market psychology | NLP tools may misinterpret crypto-specific language |

| Complements other analysis methods | Can reinforce market trends artificially |

For traders, the key to success lies in balance. Sentiment analysis works best when paired with technical indicators and fundamental research. By combining emotional insights with data-driven strategies, traders can create a more well-rounded and effective approach [3][4].

What is Technical Analysis in Crypto Trading

Technical Analysis Definition

Technical analysis in cryptocurrency trading is all about studying past price data, trading volumes, and chart patterns to predict future price movements and spot trading opportunities [5]. Unlike sentiment analysis, which looks at market emotions and psychology, technical analysis assumes that everything you need to know about a cryptocurrency is already reflected in its price. This approach focuses on what the market is doing rather than why it's doing it.

At its core, technical analysis relies on charts to highlight key signals like support and resistance levels, trend lines, and recurring patterns [5]. The belief here is that price movements tend to follow repeatable patterns over time, making it possible to anticipate what might happen next based on historical trends. This method is especially popular in the fast-moving crypto world because it provides traders with objective, data-based insights - even when the market is buzzing with noise. To make the most of this approach, traders use a variety of tools and indicators.

Common Tools and Indicators

Technical analysis uses a range of tools to help traders decide when to buy or sell. Some of the most popular ones include moving averages, the Relative Strength Index (RSI), the Moving Average Convergence Divergence (MACD), Bollinger Bands, and candlestick patterns [8].

-

Moving Averages: These are essential for spotting trends and potential reversals. For example, a "golden cross" happens when the 50-day moving average rises above the 200-day moving average, which is often seen as a bullish signal. In March 2023, Bitcoin experienced a golden cross, followed by several months of upward movement [8].

-

RSI: This indicator measures momentum and identifies overbought or oversold conditions. If the RSI goes above 70, it might mean a cryptocurrency is overbought and could see a pullback. On the other hand, an RSI below 30 suggests oversold conditions and potential buying opportunities [8].

-

MACD and Bollinger Bands: These tools help traders spot trend shifts and gauge market volatility. Meanwhile, candlestick patterns like doji or engulfing patterns can signal potential reversals [8].

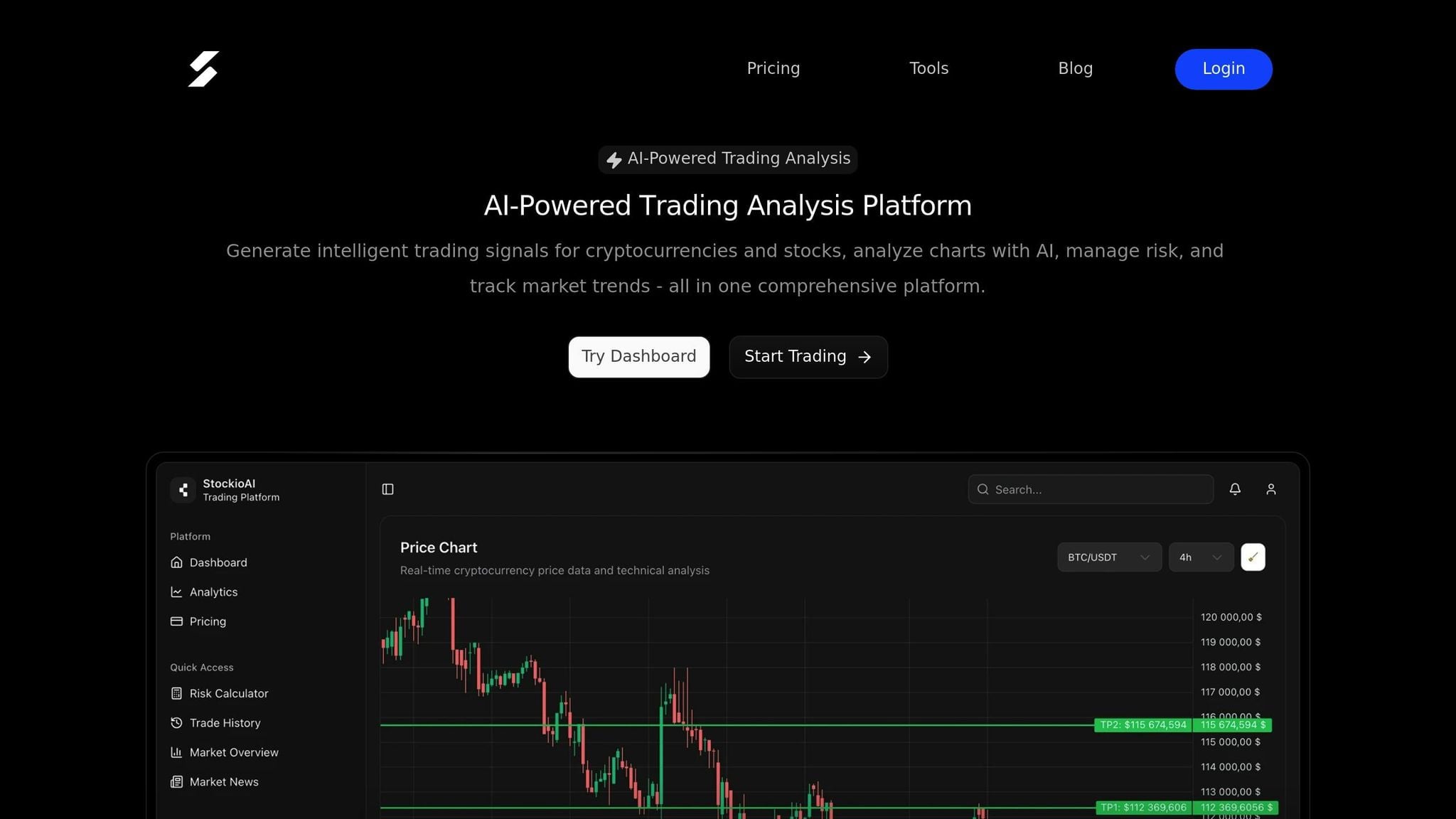

AI-powered platforms like StockioAI take these tools a step further. They analyze over 60 real-time data points - everything from technical indicators to volume patterns and support levels. Using machine learning, StockioAI identifies chart patterns, trend reversals, and the best entry and exit points. It even provides detailed reasoning for its signals, complete with specific entry points, stop-loss levels, and profit targets [1].

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."

– Jordan Martinez, Quantitative Trader [1]

Another key factor in technical analysis is trading volume. High trading volume during a breakout often confirms the strength of a price move, while low volume might indicate a weak move that's more likely to reverse [8].

While these tools offer actionable insights, they’re not without their challenges.

Pros and Cons of Technical Analysis

Technical analysis has its strengths, but it also has some drawbacks that traders should keep in mind.

Advantages

One of its biggest benefits is the ability to provide clear, measurable signals. Unlike sentiment analysis, which can be subjective, technical analysis offers precise entry and exit points, as well as stop-loss levels and profit targets [8]. It’s also versatile, working across different timeframes, making it useful for both day traders and long-term investors. Additionally, it helps with risk management by using support and resistance levels to reduce emotional decision-making [8].

Limitations

However, technical analysis isn’t perfect. Many of its indicators are lagging, meaning they reflect past price movements rather than predicting the future. This delay can result in missed opportunities [2]. It also struggles during periods of extreme market sentiment, like the 2021 Dogecoin rally driven by social media hype. In such cases, technical indicators can fail to predict rapid, emotion-driven price swings [2]. Lastly, the method is prone to false signals. A breakout might look promising on a chart but could reverse quickly if it lacks strong underlying fundamentals or if major holders decide to sell.

| Advantages | Limitations |

|---|---|

| Provides clear, data-based signals | Indicators often lag behind price action |

| Works across different trading timeframes | Struggles during highly emotional market events |

| Helps manage risk with support/resistance levels | Prone to false signals in volatile markets |

| Reduces emotional decision-making | Cannot account for sudden fundamental changes |

Research backs up the effectiveness of technical analysis, especially for short-term trading in crypto markets. For example, a 2022 study on Bitcoin found that moving average strategies outperformed a buy-and-hold approach during trending periods [8]. Still, many experts suggest combining technical analysis with other methods to build a more well-rounded trading strategy.

Sentiment Analysis vs Technical Analysis: Direct Comparison

Side-by-Side Comparison Table

Understanding the differences between sentiment analysis and technical analysis is essential for traders looking to refine their strategies. These two approaches rely on distinct principles and serve unique purposes in the world of crypto trading.

| Aspect | Sentiment Analysis | Technical Analysis |

|---|---|---|

| Core Principle | Focuses on market mood and collective psychology | Examines historical price data and chart patterns |

| Primary Data Sources | Social media, news outlets, forums, Fear & Greed Index | Price charts, trading volume, candlestick patterns |

| Key Tools | AI sentiment trackers, social media monitoring, sentiment indices | Moving averages, RSI |

| Main Strengths | Detects early trends and captures market emotion before price shifts | Offers precise entry/exit timing and aids in risk management |

| Notable Limitations | Can be skewed by bots or misinformation | May lag during sudden sentiment-driven events |

| Best Use Cases | Spotting trend reversals, major news impacts, and social media-driven moves | Timing trades in stable markets using pattern-based strategies |

| Time Sensitivity | Forward-looking – predicts potential moves | Backward-looking – relies on historical price data |

For example, the Fear & Greed Index operates on a 0–100 scale. Values below 30 suggest extreme fear, often seen as buying opportunities, while values above 75 indicate extreme greed, which could signal selling points [2]. In contrast, technical indicators like RSI focus solely on price momentum over specific periods, offering a different perspective.

Next, let’s dive into scenarios where each method excels and how timing plays a critical role.

When to Use Each Method

Sentiment analysis is particularly effective during periods of heightened social media activity or significant news events. For instance, a surge in social media discussions can hint at price movements even before technical indicators confirm them [2]. On the other hand, technical analysis performs best in stable market conditions, where precise timing is vital. Historical patterns in Bitcoin's bull and bear markets have demonstrated the effectiveness of tools like moving averages and RSI in identifying ideal entry and exit points [6].

Sentiment analysis is most useful when:

- Major news events could shift market psychology.

- Social media buzz around specific cryptocurrencies gains momentum.

- Fear or greed in the market reaches extreme levels.

- Early trend detection is more critical than pinpointing exact trade timing.

Technical analysis excels when:

- Pinpointing exact entry and exit points during established trends.

- Setting clear stop-loss levels and profit targets.

- Trading in markets with defined support and resistance levels.

- Managing risk using quantitative methods.

In essence, sentiment analysis provides early signals of potential market shifts, while technical analysis offers guidance on when and how to act.

Combining Both Approaches

Recognizing the strengths of both methods, many traders now integrate sentiment and technical analysis into a unified strategy. This combination allows for a more comprehensive approach - using sentiment analysis to anticipate market mood shifts and technical analysis to fine-tune entry and exit points.

Platforms like StockioAI have embraced this dual approach, leveraging over 60 real-time data points to deliver precise trading signals [1].

"Our intelligent trading system generates precise BUY positions based on 60+ real-time data points analyzed every second. Technical indicators, volume patterns, support levels, market sentiment, order book depth, whale movements, and social media trends are processed instantly." – StockioAI [1]

Here’s a practical three-step process for combining these methods:

- Start with sentiment analysis to assess overall market mood and identify potential trend shifts.

- Use technical analysis to confirm these signals and ensure price action aligns with the sentiment data.

- Apply technical indicators to determine the best execution points and manage risk effectively.

This integrated approach helps traders avoid false signals. For instance, a sudden spike in bullish sentiment might look promising, but if technical analysis shows strong resistance ahead, traders can adjust their plans accordingly. While sentiment analysis provides early warnings, technical analysis ensures disciplined execution, enhancing overall risk management.

AI Tools for Sentiment and Technical Analysis

AI-Powered Trading Platforms Overview

The world of crypto trading has seen a major shift with the rise of AI-powered platforms that blend sentiment and technical analysis into seamless systems. Unlike traditional manual tracking, these platforms analyze vast amounts of data from social media, news outlets, and trading charts to generate real-time trading signals. By processing this data instantly, they enable traders to act quickly and decisively.

These AI platforms are constantly scanning for updates, whether it’s a trending social media post, breaking news, or changes in chart patterns and trading volumes. This ability to monitor and analyze data in real time gives traders an edge, especially in the fast-paced crypto markets where sentiment can shift dramatically in mere minutes. This approach ties back to the importance of combining sentiment and technical analyses for smarter decision-making.

StockioAI Features and Tools

StockioAI is a great example of how AI is transforming crypto trading by combining sentiment analysis with technical tools into one powerful platform. It generates precise BUY, SELL, and HOLD signals by analyzing over 60 real-time data points every second. These include technical indicators, trading volumes, support and resistance levels, market sentiment, order book depth, whale activity, and trends on social media platforms [1].

The platform also offers advanced charting tools, integrating TradingView charts with AI-driven trading levels, support and resistance zones, and technical indicators. A built-in risk calculator provides professional-grade tools to help traders determine optimal position sizes, stop-loss levels, and leverage settings tailored to current market conditions and volatility.

One standout feature is StockioAI’s AI pattern recognition, which merges sentiment data with chart analysis to refine trading signals. For instance, if a bullish technical pattern is detected but social media sentiment is overwhelmingly negative, the system adjusts its confidence level accordingly. Additional features include real-time market alerts, portfolio tracking, and a tailored news feed that aligns with each trader's preferences.

The platform’s performance metrics speak for themselves: a 75.0% win rate over 35 closed trades, yielding a +2.9% total return on a $1,000 starting capital without leverage. It also boasts a profit factor of 2.95 [1].

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." – Jordan Martinez, Quantitative Trader [1]

How AI Improves Crypto Trading

The integration of sentiment and technical analysis is crucial for effective trading, and AI makes this process faster and more efficient. Traditional methods often fall short because manually tracking social media trends, news updates, and technical indicators all at once is nearly impossible. In contrast, AI systems process this data instantly, identifying relationships and patterns that might take human traders hours or even days to uncover.

Speed is a game-changer in crypto markets, where prices can swing dramatically in minutes due to a single tweet or viral post. Take Elon Musk’s tweet about Dogecoin on April 2, 2019, as an example. Following his post, DOGE’s price skyrocketed by 24,500% over two years [2]. AI-powered sentiment analysis picked up on the sharp increase in positive mentions and news coverage, allowing traders to get ahead of the bullish trend before it fully showed up in price charts.

Beyond speed, AI enhances trading strategies by improving risk management. These systems adapt to changing market conditions, adjusting risk parameters based on sentiment shifts, volatility, and technical signals. This helps traders avoid common pitfalls like fear of missing out (FOMO) or panic selling. While human traders often focus on well-known patterns like head and shoulders or triangles, AI detects subtle connections between sentiment changes, volume trends, and price movements, leading to more accurate predictions and better-timed trades.

AI also provides objective, data-driven insights that help traders stay disciplined. In a market as volatile as crypto - where emotions like fear and euphoria can cloud judgment - AI’s steady, analytical approach supports rational and consistent decision-making.

Choosing the Right Analysis Method

Main Points to Remember

In crypto trading, sentiment and technical analysis each bring unique advantages, and knowing when to rely on them can significantly impact your results. Sentiment analysis shines in detecting market mood and predicting price changes influenced by collective psychology - often before these shifts are reflected in price charts. It’s especially useful during major news events or when influential figures make statements that can sway the market. For instance, a single high-profile tweet can spark dramatic price jumps, illustrating how sentiment shapes market behavior.

While sentiment analysis captures the early emotional pulse of the market, technical analysis provides structured, objective signals that guide precise trade execution. However, technical analysis may overlook sudden, emotion-driven price swings, while offering a consistent framework for decision-making.

The real edge comes from combining both approaches. Aligning technical breakouts with positive sentiment can improve your trading outcomes by blending the emotional drivers of the market with data-backed signals. This strategy helps you tap into both the psychological and statistical forces that influence crypto prices.

AI-powered tools like StockioAI simplify this process by integrating over 60 real-time data points, merging sentiment and technical insights for more efficient decision-making.

Final Recommendations

To navigate the crypto market’s constant volatility and 24/7 nature, a balanced strategy is essential. Relying solely on manual monitoring isn’t practical, given the numerous factors affecting price movements. Instead, combining sentiment and technical analysis with automated tools can provide a more effective approach.

Start by tracking key sentiment indicators like the Crypto Fear & Greed Index, which condenses social trends and market data into a score from 0 to 100. Many traders use this index as a guide - buying when the score drops below 30 (indicating extreme fear) and selling when it climbs above 75 (indicating extreme greed) [2]. Pair these sentiment signals with technical analysis for confirmation. For example, during periods of fear, look for oversold conditions, and during periods of greed, watch for overbought signals.

Flexibility is crucial. Crypto markets can pivot from technical patterns to sentiment-driven movements in a matter of hours. AI-powered platforms that integrate both analyses allow you to adapt quickly. Whether it’s a sudden regulatory announcement causing a sentiment shift or a technical breakout signaling a new trend, you’ll be equipped to respond swiftly and confidently.

Bitcoin & Ethereum

| Sentiment vs Technical Analysis

FAQs

How can combining sentiment analysis and technical analysis improve cryptocurrency trading strategies?

Combining sentiment analysis with technical analysis offers traders a way to navigate the unpredictable cryptocurrency market with greater confidence. Sentiment analysis focuses on gauging the market's mood by examining sources like news articles, social media chatter, and other public data to understand investor emotions. On the other hand, technical analysis dives into historical price data and charts to uncover trends and patterns.

When used together, these methods provide a more rounded approach to trading. Sentiment analysis can detect shifts in public opinion that might not yet show up in price charts, offering an early warning system. Meanwhile, technical analysis helps pinpoint precise entry and exit points by interpreting these emotional shifts through a data-focused lens. This blend of emotional and analytical perspectives creates a well-rounded strategy for tackling the highs and lows of the crypto market.

What challenges do traders face with sentiment analysis in crypto trading, and how can they overcome them?

The rapid pace of the crypto market and the flood of unreliable or misleading information on social media and forums make sentiment analysis a tough nut to crack. Traders often find it difficult to separate the noise from the signals that genuinely matter.

To navigate these hurdles, it’s essential to depend on reliable data sources and leverage tools designed to process and analyze sentiment effectively. Platforms like StockioAI offer a solution by delivering real-time market analytics paired with AI-driven insights. These tools empower traders to make better-informed decisions and reduce the risks of relying solely on unfiltered sentiment data.

When does technical analysis have limitations in crypto trading, and how can traders address them effectively?

In highly volatile markets like cryptocurrency, technical analysis can sometimes struggle to keep up. Sudden news events or shifts in market sentiment can trigger unpredictable price changes, making it hard to rely solely on historical price data and patterns. After all, technical analysis is built on past trends, which don’t always account for real-time external influences.

To address these challenges, traders can turn to sentiment analysis to understand the market's emotional pulse. Additionally, AI-powered platforms offer real-time insights and trading signals, providing a more immediate perspective. By blending these methods, traders can build a more adaptable strategy, equipping themselves to navigate even the most dynamic market conditions with greater confidence.