Trading can be risky without proper tools to manage losses and secure profits. AI-powered stop-loss and take-profit tools help traders reduce emotional decisions, improve risk management, and optimize exits. These tools analyze real-time data like market trends, news sentiment, and volatility to dynamically adjust trading strategies, ensuring better outcomes.

Key Takeaways:

- Stop-Loss Orders: Automatically sell to limit losses when prices drop to a set level.

- Take-Profit Orders: Lock in gains by selling when prices hit a target.

- AI Advantages: AI eliminates emotional bias, operates 24/7, and adjusts strategies using data like volatility, sentiment, and market conditions.

- Risk Management: Use AI to calculate position sizes, set volatility-based stops, and monitor portfolio-wide risk.

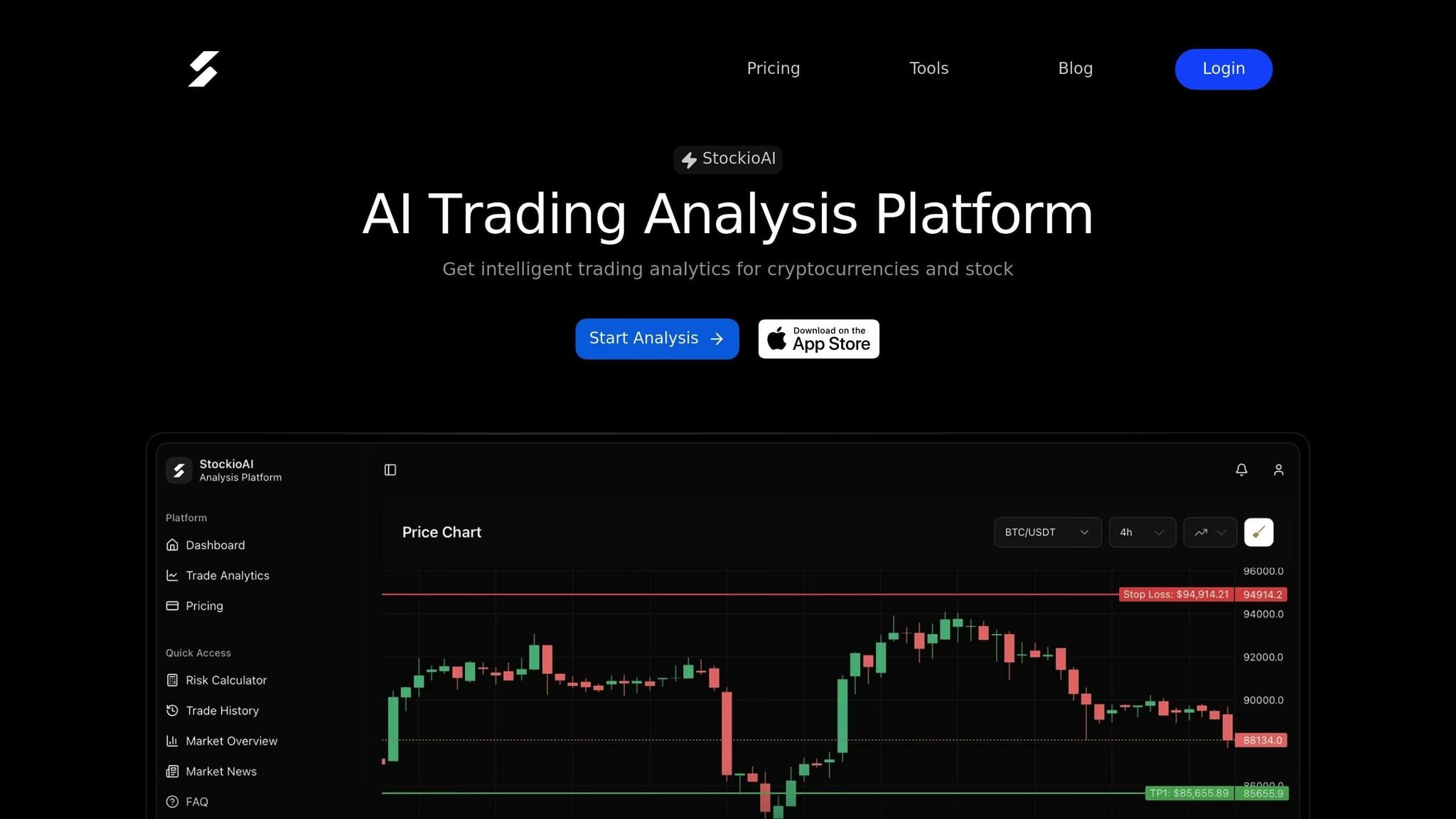

Platforms like StockioAI streamline this process with tools for precise stop-loss and take-profit levels, offering features like confidence scores, risk calculators, and real-time monitoring. Whether you're a day trader or long-term investor, AI tools can help protect your capital and improve trade execution.

Smart Take Profit & Stop Loss Strategies for Daily Trading – Powered by AI

Stop-Loss and Take-Profit Strategy Basics

Before diving into AI-driven exit strategies, it’s essential to understand the fundamentals of stop-loss and take-profit orders. These tools are the backbone of disciplined trading, each with its own mechanics and trade-offs.

Types of Stop-Loss and Take-Profit Orders

A fixed stop-loss order sets a specific price below your entry point to automatically close a trade and limit losses. For instance, if you buy a stock at $50 and place a stop-loss at $47.50, your maximum loss would be $2.50 per share. On the flip side, a take-profit order locks in gains by automatically selling when the price hits a predetermined target, such as $55.00 in this example.

Trailing stops offer a more flexible approach, adjusting upward as the price moves in your favor, helping to secure profits while allowing the trade to continue. OCO (One-Cancels-the-Other) orders link your stop-loss and take-profit orders, ensuring that triggering one automatically cancels the other. Bracket orders go even further by setting an entry point along with both stop-loss and take-profit levels, creating a fully automated trading plan.

When it comes to execution, Stop Market orders guarantee the trade will execute but not at a specific price, leaving room for slippage. In contrast, Stop Limit orders ensure a price threshold but may not execute if the market moves too quickly. Scalpers generally use tight stop-losses (0.2%–0.5%), while swing traders prefer wider stops (5%–10%) to account for market fluctuations [2].

These variations form the foundation of effective risk management.

Risk Management Fundamentals

A key metric in trading is the risk-to-reward ratio, often set at 1:2. This means for every $1 you risk, you aim to make $2. For instance, if you enter a trade at $100.00 with a stop-loss at $95.00 (risking $5.00), your take-profit target should be around $110.00.

To manage risk effectively, limit the amount you risk per trade to a small percentage of your account. A simple formula for position sizing is:

Position Size = (Account Balance × Risk per Trade %) / (Entry Price - Stop Loss Price)

Instead of using a fixed percentage for every trade, consider adjusting for volatility. Tools like the Average True Range (ATR) can help you set stop-losses that align with typical price movements. For example, multiplying the current ATR by 1.5 or 2 provides a buffer that accounts for the asset's volatility. Additionally, placing stop-losses slightly away from round numbers or obvious support levels can help avoid being caught by stop-hunting strategies.

Once you’ve mastered these manual methods, it’s time to weigh them against AI-driven strategies.

Manual Methods vs. AI Optimization

Manual stop-loss and take-profit strategies often rely on static chart levels, such as support and resistance, or fixed percentage rules. While straightforward, these methods are slower to adapt and can be influenced by emotions. As Investopedia highlights:

"Stop-loss orders remove emotion from the equation - a crucial advantage given that behavioral finance research has long shown that investors typically hold losing positions too long while selling winners too early."

– Investopedia

Manual trading can also lead to poor decisions, like moving stop-loss levels further away when trades go against you, which can amplify losses. AI systems, on the other hand, execute predefined rules instantly and without hesitation. They monitor the market 24/7, dynamically adjusting stop-losses and take-profits based on real-time volatility data and advanced models like LSTM. AI can even apply techniques like the Kelly Criterion to optimize position sizing and refine exit strategies.

Here’s a comparison of manual and AI-driven approaches:

| Feature | Manual SL/TP Strategies | AI-Driven SL/TP Optimization |

|---|---|---|

| Execution | Prone to hesitation and emotional bias | Instant, rule-based execution |

| Market Monitoring | Limited by human attention | Continuous, 24/7 market surveillance |

| Adaptability | Static and slow to adjust | Dynamic, real-time adjustments |

| Risk Calculation | Based on fixed rules or intuition | Uses advanced models for precision |

As ChartsWatcher wisely notes:

"A triggered stop loss isn't a failed trade; it's a successful execution of your risk management plan." [8]

How AI Improves Stop-Loss and Take-Profit Decisions

AI has revolutionized how traders approach exit strategies, turning rigid, static rules into flexible systems that adapt to real-time market conditions. Instead of relying on fixed percentages, AI-powered tools analyze factors like market volatility, structure, and sentiment to fine-tune decisions. This level of precision goes far beyond what manual traders can achieve, creating a more dynamic and responsive approach to managing trades.

AI Methods for Trading Optimization

Modern AI systems employ a variety of techniques to optimize exit points, making trading decisions smarter and more efficient. Supervised learning models like Gradient Boosted Trees and Random Forests analyze historical data to determine when to adjust stop-loss levels. Meanwhile, Long Short-Term Memory (LSTM) networks identify time-based patterns to forecast volatility, helping traders anticipate when the market might turn turbulent or calm.

Reinforcement learning adds another layer of sophistication by using feedback from past trades to refine strategies. Clustering algorithms also play a key role, categorizing market conditions - such as high or low volatility - and applying tailored risk strategies for each scenario. On top of that, Natural Language Processing (NLP) interprets market news and social sentiment, transforming these into actionable insights. For instance, if negative sentiment around an asset spikes, AI can tighten stop-losses or speed up exits to protect gains.

As Dwight Sproull, Content Lead at 3Commas, puts it:

"AI-driven exit systems in 2025... use real-time volatility, sentiment, and multi-indicator convergence to adjust exit parameters. Gone are the days of static percentage thresholds." [3]

Dynamic Adjustments with AI

AI doesn’t just improve existing methods - it completely redefines how traders manage stop-loss and take-profit strategies. One standout feature is its ability to recalibrate exit parameters continuously based on current market conditions. For example, volatility-based adaptations use the Average True Range (ATR) to measure market noise. During calm periods, stop-losses tighten to lock in profits, while in volatile markets, they widen to avoid premature exits.

AI also leverages market structure analysis to identify key support and resistance levels. Instead of using fixed percentages, stops are placed just outside these zones, ensuring they’re only triggered if the trade’s underlying logic no longer holds. Intelligent trailing strategies further enhance this approach. For example, a trailing stop might start at 8% but tighten to 3% as profits grow, effectively securing gains during strong market trends.

Some systems even include stop-loss timeouts to counteract short-term market noise, such as flash wicks or liquidity spikes. In these cases, the AI waits to see if the price recovers within a set timeframe before executing the stop-loss. A practical example of this was seen in Q2 2023, when an ETH/USDT Grid Bot on 3Commas used ATR and RSI indicators to pause trading during extreme price swings. This approach helped the bot achieve a 9% ROI in a range-bound market [1].

Data Sources and System Limitations

AI’s ability to process vast amounts of data is a game-changer for trading. It analyzes historical price trends, order book depth to assess liquidity, funding rates in derivatives markets, and even on-chain wallet activity for cryptocurrencies. On top of that, it integrates real-time sentiment from social media and news, adjusting exit strategies dynamically based on events like CPI announcements.

However, speed is critical - especially for intraday trading models. Delays due to slippage or latency can negate any advantage, making fast execution a top priority. Another challenge is overfitting, where models excel on historical data but struggle in live markets. To counteract this, advanced systems use techniques like walk-forward validation and purged cross-validation to ensure reliability.

As one expert succinctly notes:

"An AI signal is only as good as its execution." – Obside [9]

While AI enhances exit strategies in powerful ways, traders must remain mindful of its limitations and the realities of the market.

Practical Uses of AI Stop-Loss and Take-Profit Tools

AI-driven tools for managing risk have become essential for traders looking to protect their capital and optimize profits. These systems work by integrating advanced algorithms into trading routines, allowing traders to select the level of automation that best suits their style. Let’s break down how these tools adapt to different trading strategies, compare automation levels, and explore how they help manage risk across multiple positions.

Strategies for Different Trading Styles

Risk management isn’t one-size-fits-all - it depends on your trading approach. For scalpers and day traders, speed is everything. These traders often rely on fully automated systems with stop-losses set as tight as 0.5–1%, ensuring quick responses to market shifts. On the other hand, swing traders, who hold positions for longer periods, typically use wider stop-losses ranging from 5–10%. This allows them to ride out broader market movements while avoiding emotional decision-making. For example, some AI systems have shown improved returns during volatile markets, even when conditions are less favorable.

Swing traders often benefit from automated trailing stop-losses, which lock in profits as trends progress. Experienced traders in this category might tweak their stops using ATR (Average True Range) multipliers - commonly 2.0–3.0× ATR - to account for daily price fluctuations [6]. Position traders and long-term investors, meanwhile, may turn to Dollar Cost Averaging (DCA) bots to spread out entry prices and use volatility-adjusted stops. Whether you’re cautious or aggressive, the choice of tools depends on your risk tolerance. Conservative traders may prefer semi-automated systems that allow manual input, while those with less time or higher risk appetites might lean toward fully automated bots. Many traders also aim for setups with a reward-to-risk ratio of at least 2:1 or 3:1 before committing to a trade [10].

Semi-Automated vs. Fully Automated Systems

The main difference between semi-automated and fully automated systems lies in how much control you want over your trades. Semi-automated tools are great for discretionary traders, offering AI suggestions for exits while leaving the final decision in your hands. Fully automated systems, however, take over completely, making them ideal for fast-moving markets and strategies that require constant monitoring [5][7].

Fully automated systems often come with built-in safeguards to minimize losses. For example, during the March 2020 market crash, a high-frequency bot equipped with a 5% drawdown circuit breaker successfully paused all trading activity, preventing significant losses [1]. Ultimately, the choice boils down to your trading priorities - whether you value hands-on control or prefer a set-it-and-forget-it approach.

Managing Risk Across Multiple Positions

When juggling multiple positions, it’s crucial to think beyond individual trades and focus on portfolio-level risk management. Advanced AI systems can monitor overall exposure, ensuring that combined losses don’t spiral into large drawdowns [1]. For instance, if you’re running bots across various cryptocurrency pairs, the system can enforce a maximum drawdown limit - typically around 7–10% - to safeguard your account.

It’s also wise to limit the amount of capital allocated to any single bot, usually no more than 1–2% of your total funds. This approach minimizes the impact of a single trade on your portfolio. Many modern AI systems also include cooldown timers, which prevent bots from re-entering trades too quickly after a loss. This feature helps traders avoid the pitfalls of revenge trading during volatile times. In one simulation, when Bitcoin lost 30% of its value over two days in 2023, a trader using an AI-powered DCA bot with tight stop-losses and averaging order caps limited their losses to just 8%. In contrast, a trader without such controls faced a staggering 45% drawdown [2].

By layering multiple risk controls - such as per-trade stop-losses, portfolio-wide drawdown limits, and automated circuit breakers - you can protect your account from catastrophic losses. As the trading adage goes:

"Watch the downside, and the upside will take care of itself" [10].

These risk management strategies not only secure individual trades but also pave the way for efficient, portfolio-wide automation with advanced platforms like StockioAI.

Using StockioAI for Stop-Loss and Take-Profit Optimization

StockioAI Risk Management Features

StockioAI uses advanced AI tools to help traders pinpoint accurate stop-loss and take-profit levels. By processing over 60 data points every second - including technical indicators, volume trends, market sentiment, order book depth, and even social media activity - it generates actionable trading signals [4]. Each signal includes detailed entry points, stop-loss and profit targets, and a confidence score that indicates the strength of the recommendation.

The platform’s Risk Calculator takes into account your account balance, risk tolerance (commonly set at 1% or 2% per trade), and market volatility to determine the best position size, reducing the risk of over-leveraging. Additionally, StockioAI’s machine learning capabilities identify chart patterns and potential trend reversals, offering insights into exit points that might go unnoticed during manual analysis. For added convenience, the platform integrates with TradingView, displaying AI-detected support and resistance zones directly on interactive charts [4]. Together, these tools create a streamlined and effective trading workflow.

Complete Trading Workflow with StockioAI

Using StockioAI involves a step-by-step process designed to maximize efficiency and minimize risk. Start by reviewing the Signals section, where you’ll find pre-calculated stop-loss and take-profit levels alongside confidence scores. Next, apply StockioAI’s AI-driven indicators on TradingView to validate support and resistance zones. Use the Risk Calculator to fine-tune your trade size based on your risk tolerance. Finally, track your positions through a user-friendly dashboard that provides profit-and-loss analytics and alerts, ensuring you can act quickly when optimal exit opportunities arise [4]. This structured approach helps keep every trade aligned with your risk preferences while continuously monitoring market conditions.

StockioAI Benefits for U.S. Traders

StockioAI is designed with U.S. traders in mind, addressing their specific needs and preferences. As of late 2025, all of the platform’s traffic comes from the United States [4]. It supports popular trading pairs like BTC/USD and ETH/USD, with risk calculations conveniently displayed in U.S. dollars. The platform’s multi-timeframe analysis is particularly valuable in volatile markets, as it ensures that short-term stop-loss levels align with long-term support and resistance zones.

The pricing model makes StockioAI accessible to traders at various experience levels. The Professional plan, priced at $39 per month (billed annually), includes up to 500 AI-generated signals each month, along with risk management tools, portfolio tracking, and API access. For beginners, the Free plan provides 5 signals per month, while the Starter plan, at $23 per month, offers 30 signals and basic technical analysis features. This tiered pricing ensures that traders can choose a plan that fits their needs and budget.

Conclusion: Better Trading Results with AI Tools

AI-powered stop-loss and take-profit tools have reshaped the way traders safeguard their investments and lock in gains. By analyzing technical indicators, market sentiment, and order book depth, these tools remove emotional decision-making from the equation. With 70% of all trading volume now managed by AI-driven algorithms [11], retail traders can tap into risk management strategies that were once exclusive to institutional players.

The shift in exit strategies highlights how AI has transformed trading. These tools dynamically adjust exit parameters using real-time data like Average True Range (ATR), sentiment analysis, and the convergence of multiple indicators [3][1]. This approach filters out routine market fluctuations while guarding against significant trend reversals. Dwight Sproull, Content Lead at 3Commas, captures this transformation:

"In 2025, bots now use real-time volatility, sentiment, and multi-indicator convergence to adjust exit parameters. Gone are the days of static percentage thresholds" [3].

Platforms like StockioAI bring these advancements directly to U.S. traders. With tools designed for precise risk management, the platform performs calculations in U.S. dollars and supports popular trading pairs such as BTC/USD and ETH/USD. Its user-friendly interface and detailed analytics help traders stick to their strategies, even in fast-moving markets. These features make StockioAI a standout choice for combining advanced AI tools with practical trading needs.

The results speak for themselves: Algorithmic tools deliver a 10% boost in productivity [11], while market sentiment analysis improves prediction accuracy by up to 20% [11]. By automating position sizing, using volatility-based stop-losses, and continuously monitoring markets, AI ensures trades remain aligned with your risk tolerance, adapting seamlessly to market shifts in real time.

FAQs

How can AI tools optimize stop-loss and take-profit strategies?

AI tools process enormous amounts of real-time market data, using machine learning to pinpoint the best stop-loss and take-profit levels. These tools adjust seamlessly to evolving market conditions, like changes in volatility or price trends, ensuring your trading strategies stay sharp and relevant.

By eliminating emotional decision-making and focusing entirely on data-driven insights, AI strengthens risk management. It helps traders strike a better balance between potential gains and losses, enabling more informed and confident trading decisions.

How does manual trading differ from AI-powered trading?

Manual trading depends heavily on a trader's judgment, experience, and ability to monitor markets in real time. While this method offers adaptability, it often falls prey to emotional influences like fear or greed. Additionally, it’s constrained by a trader’s capacity to process large amounts of data and act quickly.

In contrast, AI-powered trading automates both decision-making and execution by analyzing massive volumes of real-time data, including technical patterns, market sentiment, and trading volume. Platforms like StockioAI leverage machine learning to deliver accurate Buy, Sell, and Hold signals, along with optimized stop-loss and take-profit levels. These systems eliminate emotional errors, execute trades almost instantly, and handle multiple positions across various assets simultaneously - achieving a speed and scale that manual trading simply can’t rival.

How does StockioAI support traders in managing risk effectively?

StockioAI equips traders with cutting-edge AI tools designed to make risk management simpler and more effective. By analyzing over 60 real-time indicators - including technical patterns, volume trends, support and resistance levels, order book data, social sentiment, and market volatility - it delivers accurate Buy, Sell, and Hold signals. These signals are paired with recommended stop-loss levels, profit targets, and confidence scores, all tailored to reflect current market conditions.

The platform also includes risk calculators that factor in market volatility and account size to recommend ideal position sizes and leverage ratios. This helps traders cap their potential losses and maintain better control over their exposure. StockioAI’s user-friendly dashboard further enhances the experience by visually mapping stop-loss and take-profit zones directly onto price charts. For U.S. traders, this means risk can be managed in dollar amounts (e.g., $500 risk per trade). By automating these critical calculations, StockioAI minimizes emotional decision-making and safeguards capital during unpredictable market swings.