Cryptocurrency trading signals simplify decision-making by offering buy, sell, or hold recommendations based on market data and analysis. Platforms like StockioAI leverage AI to deliver real-time, accurate signals, helping traders navigate volatile markets effectively. Here's what you need to know:

- AI-Driven Insights: Advanced algorithms analyze market trends to provide actionable signals.

- Accuracy Rates: Leading platforms report accuracy between 60%-80% depending on conditions.

- Key Features: Multi-timeframe analysis, risk management tools, and real-time alerts.

- StockioAI's Edge: Offers a 7-tier system for signal reliability and tools tailored for both individual traders and institutions.

- Pricing Plans: Ranges from a free plan (3 signals/month) to an enterprise plan ($199/month) with unlimited signals and custom AI training.

Quick Tip: Evaluate providers based on accuracy, transparency, and risk management to find one that matches your trading needs. While tools like StockioAI can enhance your strategy, no system can eliminate market risks entirely.

5 On-Chain Signals Smart Crypto Traders Never Ignore

1. StockioAI

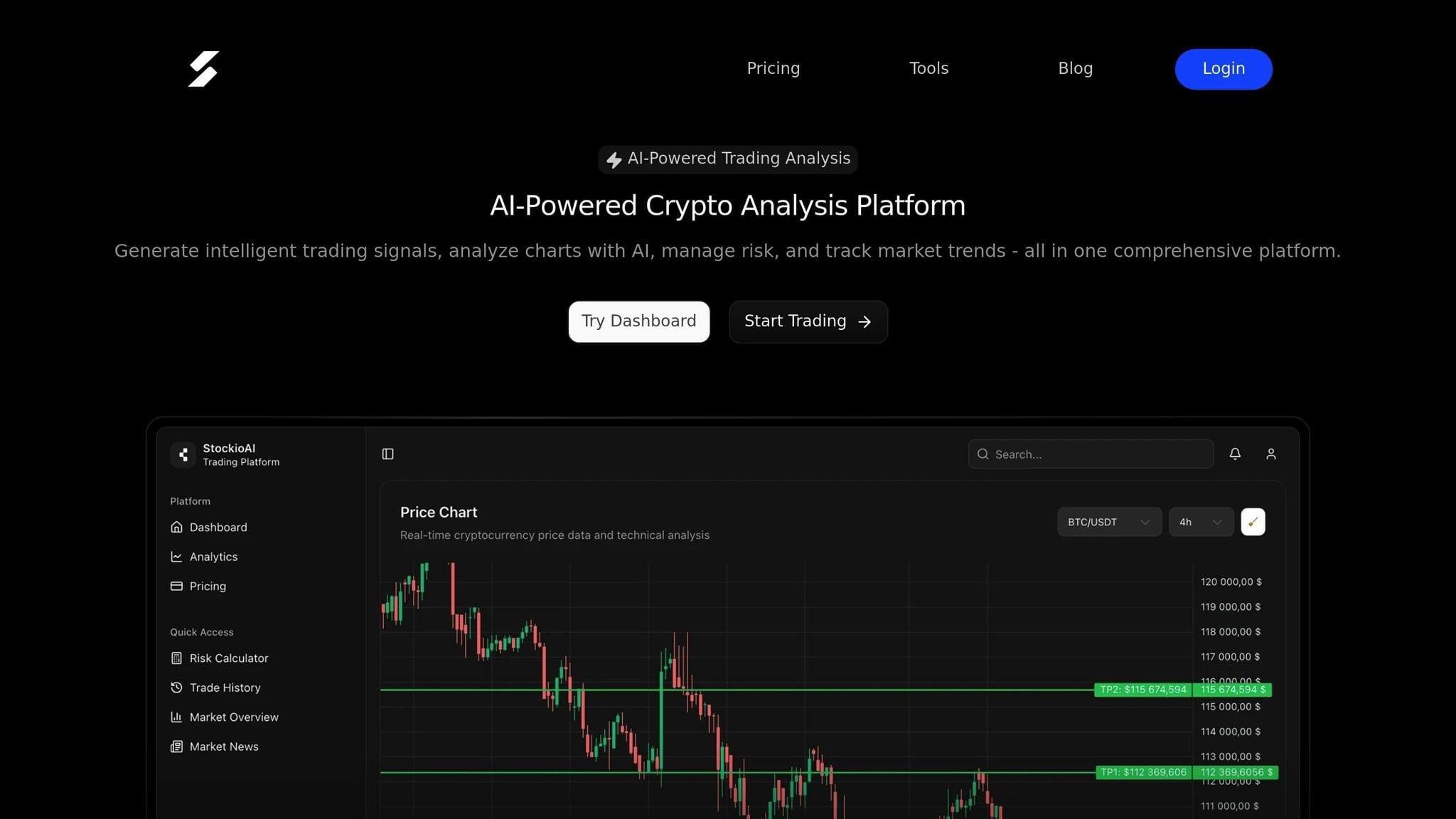

StockioAI builds on the advancements in AI trading signals to provide reliable and actionable market guidance. The platform delivers real-time buy, sell, and hold recommendations, tailored across multiple timeframes to suit traders' needs.

Accuracy

StockioAI uses a 7-tier system that focuses on market structure, volume, and key technical indicators to reduce false signals. Its multi-timeframe analysis ensures that signals from higher timeframes take precedence, improving overall reliability and reducing noise from lower timeframe fluctuations.

A conflict resolution matrix is at the core of its approach, accounting for 15 distinct market scenarios. This system adjusts position sizing recommendations dynamically, depending on whether the market is trending, ranging, volatile, or quiet. This structured process ensures consistent signal quality, seamlessly integrating advanced AI to enhance accuracy further.

AI Integration

StockioAI classifies market conditions - such as trending, ranging, volatile, or quiet - while simultaneously analyzing multiple technical indicators to identify profitable opportunities. This dual-layered approach ensures that the signals are aligned with current market behavior.

For enterprise users, StockioAI offers custom AI model training, enabling institutions to fine-tune the platform’s algorithms to match their unique trading strategies and risk profiles.

Risk Management

The platform includes built-in risk evaluation tools to assess potential downside exposure for every trade recommendation. This helps traders understand the risk-reward ratio before committing to a position. Users can also track active trades in real time and receive alerts when significant market changes occur.

StockioAI’s risk management system works hand-in-hand with its signal generation, ensuring that every recommendation includes tailored position sizing based on market volatility and the trader’s risk tolerance.

Pricing

StockioAI offers flexible pricing plans to cater to a variety of trading needs:

| Plan | Monthly Price | Signals Included | Key Features |

|---|---|---|---|

| Free | $0 | 3 AI trading signals | Basic market insights, community support, mobile app access |

| Starter | $49 | 30 AI trading signals | Basic technical analysis, email support, standard indicators |

| Professional | $99 | 300 AI trading signals | Advanced pattern recognition, priority support, portfolio tracking, API access |

| Enterprise | $199 | Unlimited signals | Multi-user access, dedicated account manager, custom AI training, white-label solutions |

For active traders, the Professional plan at $99/month offers great value, providing 300 monthly signals along with features like API access and portfolio tracking. The Enterprise plan, tailored for institutions and fund managers, includes unlimited signals, custom AI training, and multi-user access, making it ideal for large-scale trading operations.

Advantages and Disadvantages

Here's a balanced look at the platform's key strengths and areas where it falls short.

| Advantages | Disadvantages |

|---|---|

| Advanced AI Technology: Features a 7-tier priority system to generate structured signals tailored to various market scenarios. |

| Limited Free Plan: The free plan is restricted to just three AI trading signals per month, which may not meet the needs of active traders. | | Multi-Timeframe Analysis: Uses higher timeframe momentum to cut through market noise, aiding in more strategic decision-making.

| Subscription Requirement: Advanced features are only accessible through paid subscription plans. | | Built-in Risk Management: Includes tools to help manage trading exposure effectively.

| Market Volatility Reminder: Like all trading signal services, it cannot guarantee future results, especially in unpredictable markets. | | Market Condition Classification: Automatically identifies whether markets are trending, ranging, volatile, or quiet, offering signals based on current conditions.

| | | Flexible Pricing Structure: Provides a range of plans, from free to enterprise levels, catering to different trading needs and budgets.

| | | Real-Time Market Analysis: Continuously monitors markets to alert traders to significant changes.

| |

StockioAI's features are designed to help traders navigate complex market environments with greater confidence. The platform's conflict resolution matrix is particularly noteworthy, as it adjusts signals and position sizing dynamically depending on market conditions. However, while these tools are powerful, traders should always pair them with a solid risk management strategy - markets can shift unpredictably, and no system is foolproof.

Final Thoughts

StockioAI delivers an AI-driven solution tailored for cryptocurrency trading. The platform's 7-tier priority system provides a structured method for generating signals, while its multi-timeframe analysis prioritizes higher timeframe momentum, helping traders focus on broader trends instead of getting caught up in short-term market noise.

A standout feature is its conflict resolution system, which dynamically adjusts to different market conditions - whether trending, ranging, volatile, or quiet. This adaptability helps traders manage risks more effectively and make disciplined decisions.

When it comes to pricing, StockioAI caters to a range of users. Beginners can explore the platform through a free plan, while advanced traders and institutions can access premium features with higher-tier subscriptions. This tiered approach ensures flexibility, but accessing the platform's full potential does require a financial commitment.

Additionally, its real-time analysis tools help traders navigate market volatility with confidence. That said, no AI - no matter how advanced - can completely eliminate the inherent risks of trading.

FAQs

How does StockioAI's 7-tier priority system improve the accuracy of cryptocurrency trading signals?

StockioAI's 7-tier priority system takes trading signal accuracy to the next level by systematically analyzing and ranking multiple data points. This well-organized process ensures every signal is supported by thorough, real-time market analysis, cutting down on errors and irrelevant noise.

Using advanced AI algorithms, the system dives into key factors such as market trends, trading volume, and historical data. The result? Highly reliable signals that empower traders to make smarter decisions and adjust their strategies confidently, no matter the market conditions.

What are the advantages of using multi-timeframe analysis in crypto trading, and how does StockioAI support this feature?

Multi-timeframe analysis gives traders the ability to study cryptocurrency price trends across various time intervals, providing a broader perspective on market activity. This method is particularly useful for spotting long-term trends while also uncovering short-term trading opportunities, making it an essential tool for crafting effective strategies.

StockioAI takes this analysis to the next level by offering users smooth access to multi-timeframe data. With its advanced algorithms and AI-powered insights, StockioAI equips traders with the tools they need to understand market behavior thoroughly and make well-informed decisions.

How can traders use StockioAI's risk management tools to maximize profits while managing losses in unpredictable markets?

StockioAI offers a suite of risk management tools designed to give traders more control in unpredictable markets. With features like customizable risk settings, including stop-loss and take-profit levels, you can minimize losses while securing profits. These tools let you adjust your trading strategy to match shifting market conditions, all without needing to constantly monitor and tweak things manually.

On top of that, StockioAI delivers real-time insights and data-driven alerts, helping you react quickly and make well-informed decisions. When paired with a disciplined trading mindset, these tools can help you strike the right balance between risk and reward, setting the stage for consistent success in your trading endeavors.