AI trading signals thrive on real-time data - and here's why it matters. Cryptocurrency markets operate 24/7, with prices shifting rapidly. AI systems process live feeds like price movements, order book depth, and social sentiment to generate precise trading signals. This capability helps traders act on opportunities within seconds, avoiding delays that could lead to losses.

Key takeaways:

- Real-time data ensures AI systems respond instantly to market changes, unlike delayed data.

- AI bots using live data have shown win rates of 60–65% in trending markets.

- Combining multiple data streams - technical indicators, on-chain metrics, and sentiment - improves signal quality.

- Advanced models execute trades in under 100 microseconds, outperforming manual analysis.

For traders, leveraging platforms that integrate live data with AI tools is critical in fast-moving markets. Missed signals due to delayed data could mean missed profits.

AI Crypto Trading: 70% Accurate Buy and Sell Signals Using RSI & Python (MUST WATCH)

How Real-Time Market Data Improves AI Signal Accuracy

The key advantage of real-time data over delayed data lies in its ability to reflect current market conditions as they unfold. AI models that analyze live price feeds, order book depth, and volume spikes can recalibrate technical indicators like RSI, VWAP, and Bollinger Bands with every tick. This allows them to detect momentum shifts and breakout patterns as they happen, rather than reacting after the fact. Even a delay of just a few seconds can mean entering trades too late or missing crucial exit signals, making immediate data access essential for precise, adaptive risk management.

Here’s an example: an AI bot leveraging Long Short-Term Memory (LSTM) networks, trained on 1-minute candle data and real-time funding rates, achieved an 18% reduction in drawdown during volatile news events compared to static RSI-based bots [1]. This highlights the importance of real-time data in fast-paced crypto markets, where trading opportunities can disappear in seconds, especially during periods of heightened volatility.

Real-Time Data vs. Delayed Data

Real-time data offers a level of adaptive risk management that delayed data simply can't match. AI systems equipped with live data can instantly react to sudden volume surges or price-volume divergences, which often signal impending market breakouts. These systems can adjust strategies dynamically - tweaking trailing stops, entry thresholds, and position sizes based on shifting volatility and liquidity. This eliminates the delays associated with manual intervention and enhances trading precision.

The timeliness of data is especially critical for high-frequency trading, where even millisecond delays can impact profitability. For instance, in early 2025, a trading desk used a specialized crypto arbitrage bot to exploit 0.3% spreads on stablecoin pairs between Binance and Kraken during high inflow events, achieving consistent daily profits with almost no drawdown [1]. Such opportunities would evaporate with even minimal data lags. Additionally, incorporating multiple real-time data sources can further sharpen AI-driven trading signals.

Integration of Multi-Source Data Streams

Beyond risk management, combining diverse real-time data streams can significantly enhance AI signal accuracy. Price action alone provides limited insight, but when paired with live order book depth, sentiment analysis from social media, and on-chain activity, a more comprehensive picture emerges. This multi-source approach helps reduce false positives and improves trading outcomes.

For example, a mid-sized quant fund deployed a bot integrating on-chain alerts and NLP-driven sentiment analysis. Over four months in early 2025, this strategy outperformed traditional MACD-based systems, delivering a 9.3% increase in net PnL when applied to the BTC/USDT pair [1].

Live order book depth plays a critical role in identifying liquidity walls, bid-ask spreads, and iceberg orders - factors that often signal short-term price reversals or continuations. At the same time, Natural Language Processing tools analyze news and social media to gauge market sentiment in real time. By combining these varied data sources, traders can uncover correlations that single-source data might overlook, gaining a measurable edge in fast-moving markets.

How AI Systems Generate Signals Using Real-Time Data

AI trading systems blend multiple layers of market data to generate actionable insights. Many advanced platforms now rely on Financial Learning Models (FLMs), which are tailored specifically for analyzing market behavior. These models process a mix of price movements, trading volume, market sentiment, and macroeconomic indicators, achieving accuracy rates between 80% and 96% [3][4]. The systems often combine different machine learning techniques: supervised learning for predicting prices, unsupervised learning to uncover hidden patterns, and reinforcement learning to adapt trading strategies based on outcomes. Impressively, these AI systems can analyze data and execute trades in under 100 microseconds [3].

Natural Language Processing (NLP) tools add another layer of sophistication by scanning news feeds, social media, and corporate earnings calls in real time. By quantifying sentiment and combining it with traditional technical indicators, these tools can predict market moves with up to 87% accuracy [3]. This seamless integration of various analyses feeds directly into adaptive intraday trading models.

"Financial Learning Models (FLMs) analyze vast data like Large Language Models process text, ensuring adaptive strategies." – Sergey Savastiouk, CEO, Tickeron [4]

Intraday Updates and Adaptive Models

In 2025, trading platforms shifted from hourly updates to much shorter intervals of 5 and 15 minutes, allowing AI systems to respond more quickly to market shifts. This change helps capture microstructure elements like order flow imbalance, bid–ask spreads, and sudden volume surges - factors that are often overlooked in daily or delayed data [4][7][8]. One leading platform upgraded its FLMs to accommodate these shorter intervals, resulting in a 50% boost in responsiveness and a 30% drop in drawdowns compared to older models [4]. These adaptive systems analyze rapid market changes to gauge the intensity and direction of price movements in real time [5].

For example, a high-frequency BTC/USDT strategy tested between July 27 and August 13, 2025, used an XGBoost regression model that retrained every 24 hours based on a rolling 7-day window of minute-level data. By incorporating microstructure features and employing volatility gates during extreme market conditions, the strategy delivered an 8.39% return with a Sharpe ratio of 0.38 over 17 days. In comparison, simply holding BTC in the same period yielded a 3.80% return [8]. Continuous walk-forward training ensures that trading signals are always accompanied by updated probability scores [4][6]. This constant refinement enhances the system's ability to recognize patterns and adapt to real-time market dynamics.

AI Pattern Recognition and Market Phase Analysis

AI-driven pattern recognition has moved far beyond traditional chart formations. Modern systems use a multi-agent framework, where different agents specialize in analyzing specific market signals. For instance:

- Indicator Agents focus on tools like RSI and MACD to summarize signals.

- Pattern Agents simplify candlestick charts to detect features like structural symmetry or reversal patterns.

- Trend Agents apply regression techniques to recent highs and lows, identifying trend channels and classifying market phases as uptrend, downtrend, or sideways [9].

In September 2025, this multi-agent approach improved directional accuracy for Nasdaq futures by 26.5% [9]. One notable example involved the Pattern Agent, which identified a descending triangle in crude oil markets by isolating swing pivots and mapping a declining resistance line. This analysis accurately predicted a bearish breakdown [9].

AI systems also utilize Market Profile or TPO charts to pinpoint "value areas" - price ranges where about 70% of trades occur. These charts help distinguish fair value levels from irrational price movements [5]. A study on Taiwan's weighted index futures revealed that neural network models using these market activity structures achieved a peak accuracy of 73.17% at a 15-minute holding interval [5]. Additionally, adaptive models adjust their signal weighting in real time, using measures of volatility and trend strength to fine-tune predictions based on current market conditions [8].

"Short-horizon market dynamics are already encoded in OHLC bars, a more direct approach is to align LLM reasoning with structured price-based signals." – Fei Xiong et al., QuantAgent [9]

This combination of real-time data, advanced modeling, and adaptive strategies transforms raw market information into clear, actionable insights for traders.

Case Studies: Real-Time AI Signals in Practice

These examples demonstrate how real-time data and AI-driven strategies are reshaping trading, turning theoretical advantages into tangible results.

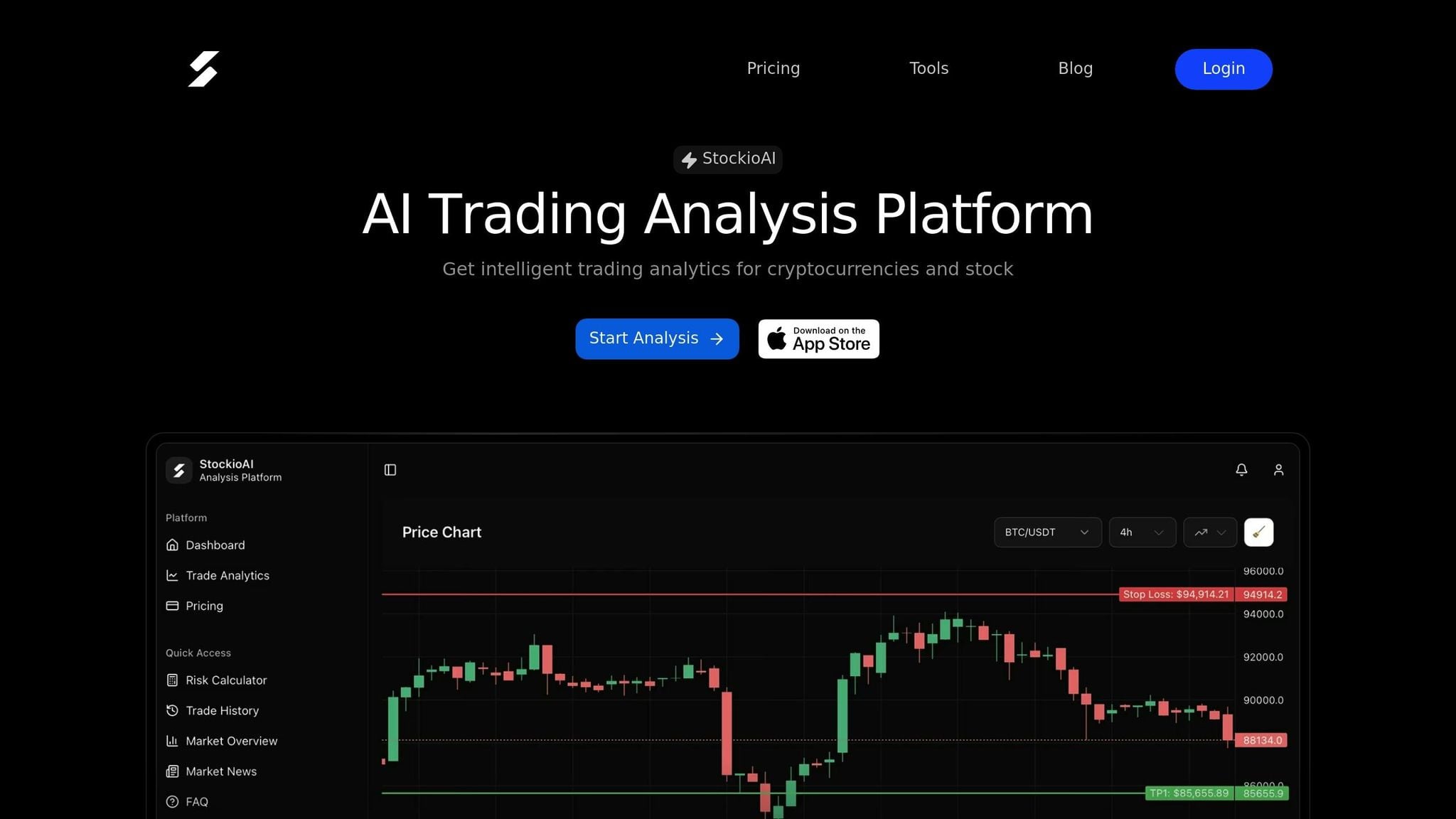

StockioAI's Real-Time Signal Capabilities

StockioAI uses real-time multi-timeframe analysis to combine data from price movements, order book depth, trade volume, and on-chain activity. By screening over 1,000 coin pairs, it generates precise Buy, Sell, and Hold signals. Its multi-timeframe approach ensures that signals from higher timeframes take precedence over those from lower ones, reducing the risk of acting on short-term market noise. Additionally, the platform identifies market conditions - such as trending, ranging, volatile, or quiet phases - to refine its signal accuracy.

Premium users benefit from unlimited AI-generated signals, updated every four hours for major cryptocurrencies like BTC, ETH, SOL, and XRP. The system processes inputs to eliminate noise, normalizes data, and prioritizes signals based on confidence scores. This streamlined pipeline delivers actionable insights with minimal delay, allowing traders to act quickly and effectively [1].

Thanks to its ability to execute trades in milliseconds - compared to the 30+ seconds it typically takes for human analysis - StockioAI captures shifts in institutional activity and social sentiment before they impact prices.

Performance Metrics and Success Stories

The platform's real-world performance highlights the benefits of real-time AI. By analyzing live streams of market data, including order book depth and trade volume, StockioAI delivers faster reaction times and more accurate entry and exit points in volatile markets. This capability enables traders to identify trends and act on opportunities with minimal lag, providing a strategic advantage in fast-moving environments [1].

Challenges and Future Directions for Real-Time AI Signals

Tackling Data Latency and Scalability Problems

Real-time AI trading constantly grapples with a tough balancing act: larger models offer better precision but slow down processing, while smaller models trade off accuracy for speed. In May 2025, researchers from Georgia Tech, Stanford, and Harvard introduced the FPX framework, a system designed to address this trade-off. By combining FP8 and FP4 inference kernels and applying lower precision selectively to compression-friendly layers, they managed to boost daily yield in high-frequency trading benchmarks by 26.52% [10].

"Faster agents are more likely to stay synchronized with environmental changes and maintain an advantage, while slower agents may fall behind while processing outdated observations." - Hao Kang et al., Georgia Tech [10]

This speed challenge is especially critical in cryptocurrency markets, where price gaps between exchanges often close within 2 to 15 seconds [12]. Without scalable systems, even millisecond delays can lead to missed opportunities or subpar trade execution, undermining the edge real-time data provides. To counter these challenges, modern frameworks are adopting agentic orchestration. This approach uses specialized AI agents - each focused on tasks like indicators, patterns, or risk management - that work simultaneously rather than one after another, significantly improving efficiency.

These advancements in addressing latency and scalability issues are paving the way for the next generation of AI-driven trading systems.

Key Trends Shaping AI Trading in 2025 and Beyond

The rise of agentic trading marks a shift from rigid, rule-based algorithms to adaptive, multi-agent systems. These frameworks rely on the Model Context Protocol (MCP), which standardizes communication between specialized agents. By reducing operational overhead, MCP enables quicker decision-making, a critical advantage for generating accurate real-time AI signals [8].

Another game-changer is Retrieval-Augmented Generation (RAG), which grounds AI signals in verified, timestamped sources like news reports and on-chain data. This approach minimizes the risk of errors or "hallucinations" - a common issue in volatile markets [11].

Real-time sentiment analysis is also making waves. In March 2024, AI tools identified a 12.2% price surge in the PEPE cryptocurrency following an Elon Musk meme post, flagging the social activity before most manual traders could react [13]. Similarly, in April 2024, sentiment-driven AI predicted a 22% rally in the TURBO token about 36 hours ahead of the move, based on developer discussions and social trends [13]. These examples highlight how multimodal fusion - integrating text, social media signals, and price data - is shaping more precise predictive tools for the future of trading.

Conclusion

Real-time market data has become the cornerstone of accurate AI trading signals. Without live data feeds, AI systems are left relying on outdated information, which can lead to missed opportunities during key trend reversals or sudden volatility. Recent studies reveal that AI now handles the majority of equity trades, with sentiment analysis achieving accuracy rates nearing 90% [3].

The move from delayed data to real-time streams has transformed AI trading from reactive to predictive. Modern AI systems can execute trades in microseconds, a stark contrast to the seconds it takes for manual analysis [3]. Platforms like StockioAI are at the forefront, integrating multiple data sources - price action, volume trends, on-chain metrics, and sentiment signals - to produce Buy, Sell, and Hold recommendations with an impressive 80–90% accuracy. This level of precision simply isn’t possible with historical data alone.

StockioAI and similar platforms highlight how the blend of live market data, technical indicators, and sentiment analysis is reshaping trading strategies. Real-time data isn't just an edge - it's essential, especially in markets that react to events like Federal Reserve minutes in as little as 15 seconds [14]. These developments are paving the way for the next era of AI-driven trading.

"Real-time market data is more than an advantage - it's a foundational necessity." - Dwight Sproull, Content Lead, 3Commas [2]

Looking ahead, the future of AI trading lies in the collaboration of specialized AI agents - working together to identify patterns, manage risks, and execute trades with speed and precision. To remain competitive in these fast-moving markets, reducing latency while ensuring accuracy will be critical.

For traders aiming to stay ahead, the approach is clear: focus on platforms that process live data streams, test strategies through paper trading, and combine technical analysis with real-time sentiment insights. As market speeds continue to increase, the divide between those leveraging real-time AI and those relying on outdated data will only grow wider.

FAQs

How does real-time market data improve the accuracy of AI trading signals?

Real-time market data offers instant updates on prices, trading volumes, news, and overall market sentiment. This constant flow of information allows AI models to process multiple data streams at once, respond swiftly to market shifts, and improve their predictions through ongoing learning.

By minimizing delays and sharpening decision-making accuracy, real-time data plays a key role in enhancing the precision of AI-generated signals. Platforms such as StockioAI take advantage of this to provide dependable buy, sell, and hold alerts, giving traders the tools they need to make smarter decisions.

How does real-time market data improve the accuracy of AI trading signals?

Real-time market data is essential for improving the precision of AI-driven trading signals. By pulling information from diverse sources - like live price updates, order-book depth, news sentiment, and even social media trends - AI models can cross-check patterns. For example, a spike in trading volume combined with positive sentiment provides a more reliable signal than relying on just one data type. This multi-source approach helps minimize the risk of errors.

Take platforms like StockioAI, for instance. They specialize in advanced data aggregation, delivering up-to-the-second updates on prices, sentiment, and risk metrics. This real-time feed equips AI with a complete picture of market activity, enabling it to produce sharper Buy, Sell, or Hold signals. The result? More accurate predictions and better-informed trading decisions.

Why is minimizing latency important for AI-powered trading systems?

Reducing latency is essential for AI-driven trading systems because it enables them to react to market changes almost instantly - often in just milliseconds. This speed can lead to more precise order execution, access to better trading opportunities, and potentially higher profits.

In fast-moving markets, even a tiny delay can mean missed chances or less optimal trade results. Lower latency ensures that AI systems can keep up with sudden price shifts, helping traders make timely decisions based on the latest data.