AI is transforming cryptocurrency compliance by automating processes and enabling real-time monitoring. Here's how:

- 24/7 Monitoring: AI continuously tracks transactions, flagging suspicious activity instantly.

- Accuracy: False positives are reduced by up to 94%, saving time and focusing on real risks.

- Regulatory Updates: AI uses Natural Language Processing (NLP) to quickly process and implement new compliance rules.

- Speed: Automated systems resolve alerts in under a second, ensuring no delays in enforcement.

- Scalability: Handles millions of transactions across blockchains without requiring additional staff.

AI tools like StockioAI integrate compliance with trading analytics, offering both risk detection and actionable trading insights. These systems ensure crypto businesses stay compliant with U.S. regulations like AML and KYC while adapting to the fast-paced nature of the industry.

How AI and Crypto Are Reshaping Compliance - Ep. 158

AI Technologies That Power Compliance

Three advanced AI technologies form the backbone of an effective compliance monitoring system, working together to tackle various aspects of regulatory challenges. From spotting suspicious patterns to processing legal updates and taking immediate compliance actions, these technologies ensure round-the-clock vigilance.

Machine Learning for Detecting Unusual Patterns

Machine learning plays a critical role in crypto compliance by analyzing transaction data to uncover behaviors that deviate from the norm. These systems process vast datasets, including transaction histories, wallet addresses, customer profiles, and external risk sources like regulatory watchlists and sanctions lists [2][3][5].

What sets machine learning apart is its ability to evolve. Unlike rigid rule-based systems that need constant manual updates, machine learning models improve over time by analyzing new data and adapting to emerging fraud tactics. They excel at identifying subtle red flags - such as transactions timed oddly, amounts just below reporting thresholds, or intricate wallet-hopping schemes - that human analysts might miss.

One platform, for instance, covers 99% of the crypto market by analyzing 100 billion data points to link wallet addresses with verified entities. This reduces false positives and enhances accuracy across multiple jurisdictions [3]. Many systems also employ cross-chain risk detection, enabling them to monitor suspicious activity across various blockchain networks.

Frequent data updates are key to staying ahead. Some platforms refresh their data as often as every five minutes, incorporating newly sanctioned addresses and recently flagged entities into their monitoring systems [2]. This ensures that machine learning models remain current and can escalate complex cases to human analysts when necessary [2].

While machine learning focuses on pattern detection, other AI technologies address the challenge of keeping up with regulatory changes.

Natural Language Processing for Tracking Regulatory Updates

Navigating regulatory changes across different regions can be daunting. Natural Language Processing (NLP) simplifies this by analyzing, interpreting, and summarizing updates from regulatory bodies worldwide [1].

NLP systems sift through dense legal documents to extract key compliance requirements relevant to crypto businesses. They organize this information by topic, allowing compliance teams to quickly find what they need. When new rules are issued, these systems provide instant alerts, summarizing changes and highlighting actionable steps.

For example, NLP systems process announcements from agencies like FinCEN and OFAC, translating complex legal jargon into clear, actionable directives. They also monitor news outlets, regulatory websites, and industry publications to spot emerging trends or potential shifts in regulations before they become formal requirements.

This ensures compliance teams stay informed and prepared, while automated decision-making takes care of immediate responses.

Automated Decision-Making for Instant Compliance Actions

Automated decision-making enables quick responses to real-time risk assessments based on predefined rules. These systems can immediately halt transactions, block flagged wallets, or trigger alerts without waiting for human input [2][3][5].

By setting clear risk thresholds and protocols, automated systems act decisively. For instance, if a wallet address appears on a sanctions list, the system can block the transaction and issue an alert instantly. Similarly, if unusual transaction patterns hint at potential money laundering, the system flags the activity for review while allowing legitimate transactions to continue.

The benefits of this approach are speed and consistency. Automated systems respond in milliseconds and apply uniform standards, eliminating the variability often seen in manual reviews. One example involves a system where agents resolve alerts quickly while maintaining detailed logs with timestamps and searchable records, creating a regulator-ready audit trail [2].

These systems also handle escalation intelligently. Straightforward cases are resolved automatically, while more complex issues are routed to compliance analysts. Integration capabilities allow these systems to connect seamlessly with regulatory reporting platforms, customer databases, and transaction systems. This ensures compliance actions are not only swift but also consistent across all relevant channels, creating a streamlined and reliable compliance process.

Benefits of AI-Driven Crypto Compliance Systems

AI-driven compliance systems are transforming the way crypto firms handle regulatory challenges. By automating processes and enhancing operational efficiency, these systems go beyond basic automation to reshape how compliance risks are managed.

Real-Time Transaction Monitoring and Alerts

AI compliance platforms offer around-the-clock monitoring of cryptocurrency transactions, ensuring no activity goes unchecked. These systems can instantly detect suspicious behavior, generating alerts complete with risk scores and audit-ready documentation. This real-time vigilance significantly reduces the opportunity for illicit activities to go unnoticed.

Industry examples show that real-time alerts are invaluable for tracking illegal funds and avoiding high-risk customer onboarding[2]. Alerts are seamlessly integrated into workflows, whether through dashboards, email notifications, or push messages, keeping compliance teams informed of risks as they arise.

This immediacy not only enhances security but also sets the foundation for improved accuracy and efficiency.

Better Accuracy and Efficiency

Manual compliance processes are prone to errors and inconsistencies. AI systems address this by automating risk identification and classification using advanced machine learning models[2]. This automation ensures uniformity, eliminating the variability that comes with human analysis under different circumstances.

One major advantage is the significant reduction in false positives. By minimizing unnecessary alerts, teams can focus on genuine risks. Additionally, AI systems can handle Level 1 and Level 2 alerts - covering onboarding, transaction screening, and ongoing monitoring - in mere seconds. This speed clears backlogs that often plague manual systems and ensures compliance standards are applied consistently across all transactions.

The result? A streamlined process that not only saves time but also keeps pace with the increasing volume of crypto transactions.

Handling Growing Transaction Volumes

As transaction volumes grow, AI systems continue to deliver consistent performance, a feat manual systems struggle to achieve. These platforms are built to scale, processing vast amounts of data while maintaining efficiency[2].

AI systems can handle thousands of transactions per second, continuously updating risk data to reflect the latest threats. For example, some platforms refresh sanctions and risk data every five minutes, ensuring compliance checks remain up-to-date. This adaptability allows AI systems to integrate new data sources, adjust for emerging fraud tactics, and expand to cover additional blockchain networks - all without requiring a complete system overhaul.

As crypto products evolve - introducing features like cross-chain transactions, decentralized finance protocols, and layer-2 solutions - AI systems adapt by incorporating new analytical models and data sources. This flexibility ensures comprehensive compliance coverage, even in areas where traditional systems might falter.

| Compliance Aspect | Manual Systems | AI-Driven Systems |

|---|---|---|

| Monitoring Coverage | Periodic reviews | Continuous, 24/7 monitoring |

| Alert Response Time | Minutes to hours | Seconds |

| False Positive Rate | High | 94% reduction |

| Transaction Processing | Limited by human capacity | Thousands per second |

| Scalability | Requires more staffing | Handles growth seamlessly |

| Data Updates | Manual, periodic | Automated, every 5 minutes |

The scalability of AI systems also leads to long-term cost savings. Unlike manual systems, which demand more staff to handle increased transaction volumes, AI platforms maintain consistent performance regardless of growth. For crypto businesses looking to expand, this scalability is a game-changer, enabling them to manage compliance efficiently without ballooning operational costs.

How AI Enforces Compliance in Real Time

AI's ability to detect risks rapidly is matched by its capacity to enforce compliance almost instantly, addressing the ever-changing challenges of crypto trading. These systems don't just identify suspicious activity - they take immediate action to ensure compliance with regulations. By connecting detection with intervention, AI-powered platforms create automated workflows that respond to potential threats in seconds, not hours or days. Let’s dive into how these enforcement mechanisms work.

Automated Risk Response and Interventions

When AI systems flag high-risk transactions or unusual behavior, they don't wait for manual intervention - they act immediately. These actions can include freezing accounts, blocking transactions that match patterns of money laundering, or initiating enhanced due diligence for flagged users. For instance, platforms like Castellum.AI and Elliptic can resolve alerts and freeze accounts in under a second when necessary[2][3].

Every enforcement action is logged with precise timestamps, creating a detailed audit trail. These logs adhere to U.S. regulatory standards, including those set by FinCEN, OCC, and OFAC, ensuring that compliance actions are well-documented and regulator-ready.

Integration with Regulatory Reporting

AI systems not only respond to risks but also simplify the complex process of regulatory reporting. By automating the creation and submission of suspicious activity reports (SARs), these platforms reduce the need for manual paperwork. For example, Sardine's automated reporting system, implemented in 2022, cut manual compliance tasks by as much as 85%. Every alert, decision, and action is logged with detailed timestamps, ensuring adherence to U.S. compliance standards[7].

When regulatory notifications are required, AI compiles all necessary documentation, including transaction histories, risk assessments, and enforcement details, formatted to meet specific regulatory requirements. These comprehensive audit trails allow regulators to trace the entire compliance process, from detection to resolution. Castellum.AI, for example, updates its audit trails every five minutes, ensuring that compliance records reflect the latest regulatory information[2].

Continuous Wallet and Entity Monitoring

AI doesn't just monitor individual transactions - it provides ongoing surveillance of wallets and entities, continuously updating risk profiles. It screens wallets against thousands of watchlists, refreshed every five minutes. If a previously clean wallet becomes linked to sanctioned entities or suspicious activities, the system adjusts its risk score and triggers enforcement actions immediately.

Elliptic’s blockchain analytics platform exemplifies this capability. It enables cross-chain tracing and continuous risk profiling, allowing exchanges to track fund flows across multiple blockchain networks. Additionally, push notifications alert compliance teams the moment significant changes occur, such as a wallet being associated with sanctions, high-risk entities, or unusual transaction patterns.

Summary of Automated Enforcement Actions

Here’s a snapshot of how AI systems handle compliance enforcement, their response times, and how they integrate with regulatory processes:

| Enforcement Action | Response Time | Documentation | Regulatory Integration |

|---|---|---|---|

| Account Freeze | < 1 second | Timestamped with reasoning | Auto-filed with authorities |

| Transaction Block | Real-time | Complete audit trail | SAR generation ready |

| Enhanced Due Diligence | Instant trigger | Risk assessment included | Compliance officer alert |

| Sanctions Screening | Every 5 minutes | Updated watchlist data | Global regulatory coverage |

This continuous monitoring and enforcement framework ensures that crypto platforms remain compliant, even as regulations evolve and new risks emerge. By combining real-time detection, automated responses, and thorough documentation, AI creates a robust compliance system that works seamlessly while keeping human teams informed.

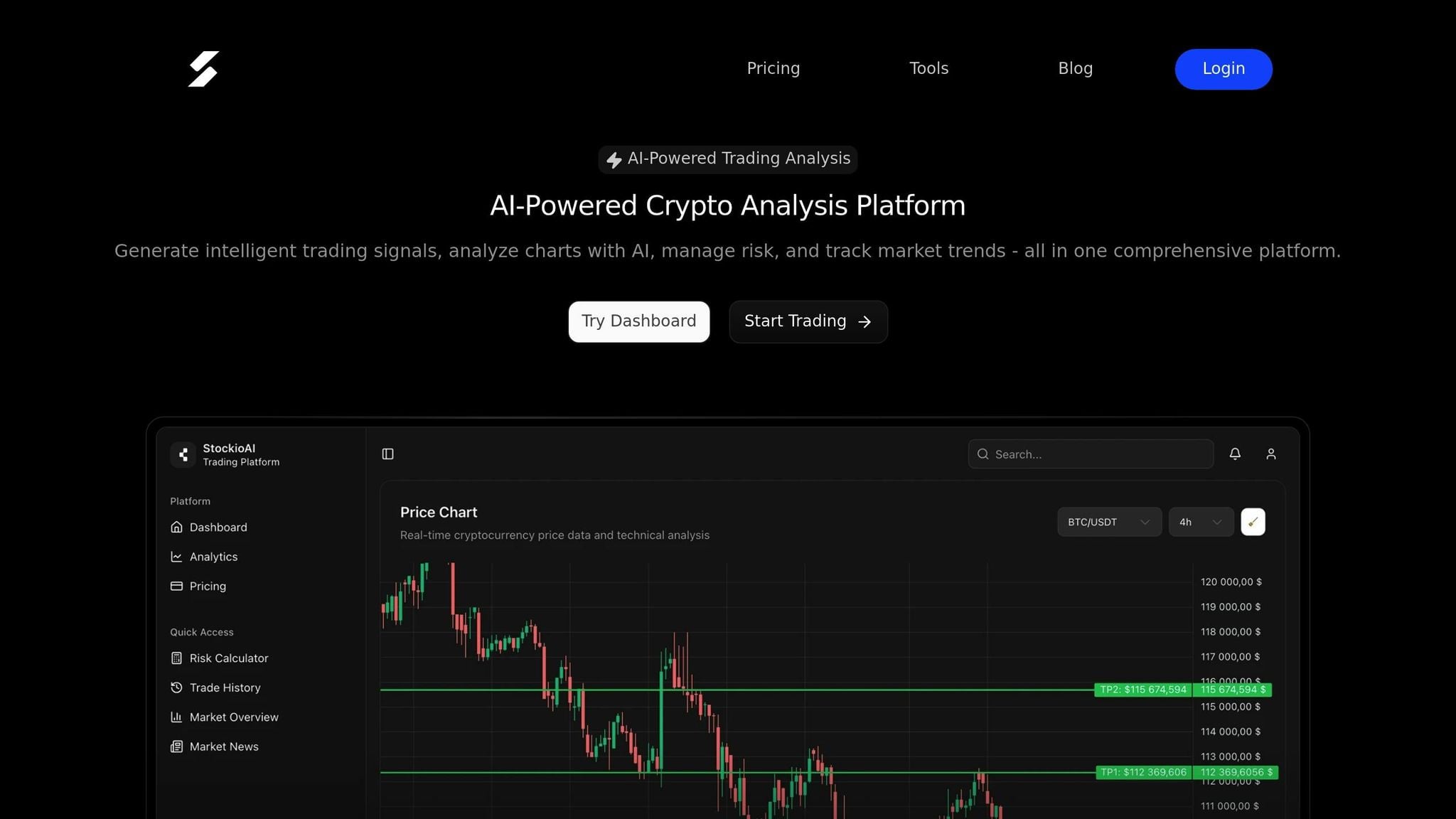

StockioAI: AI-Powered Compliance and Analytics

StockioAI stands out by blending real-time compliance monitoring with cutting-edge trading analytics, offering a dual advantage to traders. This combination is crucial for those juggling the demands of regulatory compliance while striving for market success. The platform’s AI-driven system processes over 60 data points per second, ensuring precise monitoring and informed decision-making. It’s a clear example of how AI can simultaneously support compliance and improve trading outcomes.

StockioAI's Compliance Features Overview

At the heart of StockioAI’s compliance tools is its AI-powered pattern recognition, which constantly evaluates trading behaviors and transaction flows. Using machine learning, the platform identifies unusual activities that could indicate fraud, money laundering, or other regulatory violations. When such anomalies are detected, automated alerts are generated, allowing for immediate action. This system not only reduces manual oversight but also speeds up responses to potential issues.

The platform is aligned with U.S. AML (Anti-Money Laundering) and KYC (Know Your Customer) standards, ensuring traders meet all legal obligations. It creates detailed audit trails and regulatory alerts, helping users maintain compliance effortlessly. Features like risk calculators and automated risk scoring further enhance its capabilities by analyzing transactions and wallets in real time to detect potential violations.

StockioAI also provides interactive chart analysis and real-time market news, giving traders the context they need to spot risky trading patterns. Its ability to handle high transaction volumes while maintaining accuracy ensures reliable compliance monitoring, even as trading activity scales up.

How StockioAI Supports Real-Time Compliance

StockioAI takes compliance a step further by enabling real-time enforcement. Its layered protocols automatically manage low-risk cases while escalating high-risk incidents for human intervention. This ensures resources are used efficiently without compromising oversight. Regular model audits and transparent decision documentation provide the accountability required by U.S. regulators.

When a compliance issue arises, the platform can halt transactions, generate detailed compliance reports, and compile the necessary documentation for submission. For instance, if a transaction is flagged for potential AML risk, the system’s risk calculator evaluates the situation and alerts the trader. This allows for a thorough review and submission of required documents before proceeding, helping traders avoid regulatory penalties.

StockioAI’s API integrations connect seamlessly with regulatory databases and analytics tools. This interoperability streamlines workflows, consolidates risk intelligence, and simplifies reporting, all without disrupting existing operations.

Benefits of Using StockioAI for Traders

Beyond its compliance tools, StockioAI offers a range of benefits that directly support traders. Acting like a 24/7 virtual compliance officer, it ensures reduced compliance risk through continuous monitoring and immediate alerts. This automation not only saves time but also keeps traders ahead of regulatory changes and emerging risks.

The platform also provides actionable insights that align compliance with profitable trading strategies. Its scalable AI infrastructure processes large transaction volumes in real time, updating risk models and compliance rules as needed. This adaptability reduces false positives, streamlining workflows and minimizing the burden of manual reviews.

| Compliance Benefit | StockioAI Feature | Outcome |

|---|---|---|

| Risk Reduction | Automated pattern recognition | Early detection of suspicious activities |

| Efficiency | Real-time alerts and reporting | Around-the-clock monitoring with instant updates |

| Accuracy | AI-driven risk scoring | Fewer false positives and more targeted reviews |

| Documentation | Automated audit trails | Comprehensive records for regulatory needs |

In addition to compliance, StockioAI enhances trading performance by delivering precise BUY, SELL, and HOLD signals, complete with entry points, stop-loss levels, and profit targets. This seamless integration of compliance and trading optimization makes StockioAI a powerful tool for traders, proving that strict regulatory adherence can go hand in hand with market success.

Challenges and Future of AI in Crypto Compliance

While platforms like StockioAI showcase the potential of AI in crypto compliance, there are still considerable challenges that limit their effectiveness. Understanding these hurdles and the innovations on the horizon is key for traders and compliance teams to stay ahead in this fast-changing space.

Current Challenges in AI-Driven Compliance

One of the biggest operational headaches for AI compliance systems is dealing with false positives. Even the most advanced models can mistakenly flag legitimate transactions, which then require manual review. This issue becomes even more pronounced as transaction volumes grow and the variety of crypto assets expands.

Another significant challenge is the constant need to update AI rule sets to keep up with changing regulations. When new sanctions are introduced or reporting standards shift, AI systems must adapt immediately. This is especially tough for firms operating across multiple jurisdictions, where the rules in the U.S., EU, and other regions can vary significantly.

Data privacy concerns add another layer of complexity. These systems deal with sensitive information, such as wallet addresses, transaction histories, and personal identification data, all while adhering to strict privacy laws like GDPR and CCPA [1][2]. Striking a balance between comprehensive monitoring and protecting user privacy requires strong encryption, access controls, and anonymization techniques.

The challenge of cross-border transactions further complicates compliance efforts. A single transaction might fall under the jurisdiction of several countries, each with its own set of standards and reporting requirements. Many AI systems aren’t designed to handle this level of complexity, leaving gaps in compliance.

Finally, there’s the issue of human oversight. While AI can handle many tasks, human experts are still essential for interpreting ambiguous scenarios, addressing ethical concerns, and managing complex cases [8]. Designing systems that effectively integrate human judgment with automation - and ensuring staff are trained to understand AI outputs - remains a crucial task.

Addressing these challenges is essential for the next phase of AI-driven compliance.

Future Trends in AI for Crypto Compliance

The need to tackle these issues is driving exciting advancements in compliance technology. For instance, predictive analytics is set to transform how AI systems handle compliance risks. Instead of just reacting to flagged transactions, these systems will analyze historical data and behavioral patterns to anticipate potential risks [6]. This proactive approach could significantly reduce regulatory violations and financial crimes.

As decentralized finance (DeFi) and decentralized exchanges gain traction, monitoring decentralized platforms is becoming increasingly important. New AI tools are being developed to track compliance across decentralized networks, which lack traditional centralized oversight [3][6]. These systems will need to adapt to the pseudonymous nature of participants and use advanced analytics to trace activity across multiple blockchains.

The push for regulatory standardization could simplify compliance processes. Unified anti-money laundering (AML) and know-your-customer (KYC) requirements, along with harmonized reporting standards, would allow AI systems to apply consistent rules across jurisdictions [1][2]. For U.S.-based crypto firms, this could ease the operational burden of navigating conflicting regulations while also improving efficiency.

Another promising development is cross-chain analytics integration, which allows compliance platforms to monitor transactions across multiple blockchains. This capability helps close loopholes that criminals have exploited by moving illicit funds between networks [3].

The evolving partnership between AI and human expertise is also worth noting. Future systems will better combine AI’s speed and scalability with human judgment for tackling ethical dilemmas and complex decisions [8]. This "human-in-the-loop" approach ensures that automated systems remain accountable and aligned with regulatory standards.

Lastly, real-time regulatory feeds and integration with global law libraries are set to enhance how quickly compliance systems respond to regulatory changes. Platforms that can automatically update their rule sets based on live updates will be better equipped to maintain accuracy and avoid falling behind [1].

Over the next few years, these advancements are poised to make AI-driven crypto compliance more efficient, proactive, and less intrusive for legitimate trading activities. As both regulations and technology continue to evolve, the future looks promising for traders and compliance teams alike.

Conclusion: AI's Role in Crypto Compliance

The cryptocurrency industry has reached a stage where AI-powered compliance systems are no longer optional - they’re essential. Companies leveraging these systems report 94% fewer false positives and have managed to process over 100 billion data points, significantly improving efficiency in risk management[2][3]. This means compliance teams can now focus their energy on genuinely suspicious activities rather than wasting time on endless false alarms.

AI offers 24/7 monitoring and keeps up with regulatory updates in real time, which is critical in a market that operates around the clock and faces ever-changing regulations across different regions. Acting like virtual compliance officers, these systems combine machine learning for spotting patterns, natural language processing to interpret regulatory changes, and automated decision-making for immediate responses to risks[4]. This setup allows organizations to scale their compliance operations alongside growing transaction volumes - without needing to expand their teams proportionally. Platforms like StockioAI embody these capabilities by seamlessly integrating compliance with trading analytics.

For traders and institutions in the United States, StockioAI demonstrates how AI can bridge the gap between compliance and trading. By combining real-time trading signals, risk management tools, and market analytics, StockioAI equips users to make smarter decisions while staying aligned with regulatory standards. This fusion of compliance and advanced analytics represents the future of crypto trading.

Looking ahead, AI is poised to play an even more proactive role in compliance. Predictive analytics and cross-chain monitoring are on the horizon, enabling systems to not just react to suspicious activities but also foresee potential risks and offer guidance to prevent violations[6]. As decentralized finance expands and regulations become more intricate, this shift from reactive to predictive compliance will be a game-changer.

The message is clear: embracing AI-driven compliance today positions organizations for long-term success in an increasingly regulated crypto environment. With its ability to cut costs, enhance accuracy, and maintain constant oversight, AI has become the backbone of effective cryptocurrency compliance. The combination of AI’s precision and human expertise now defines secure and compliant crypto trading.

FAQs

How does AI minimize false positives in crypto compliance, and why does it matter?

AI plays a key role in reducing false positives within crypto compliance. By leveraging advanced pattern recognition, it can differentiate between benign activities and actual risks. This ensures compliance teams aren't bogged down by unnecessary alerts and can concentrate on tackling genuine concerns.

Fewer false positives mean organizations save both time and resources while enhancing the precision of their regulatory efforts. This is especially important in the fast-moving cryptocurrency space, where maintaining trust, avoiding hefty penalties, and ensuring smooth compliance processes are essential.

How does Natural Language Processing (NLP) help crypto businesses stay compliant with evolving regulations?

Natural Language Processing (NLP) is a game-changer for crypto businesses aiming to stay on top of compliance requirements. It can sift through vast amounts of legal documents, regulatory updates, and news articles in real time, pinpointing relevant changes and pulling out actionable insights. This ensures companies are always prepared to adjust to new regulations as they emerge.

By automating these tasks, NLP minimizes the chances of overlooking important updates and frees up compliance teams to concentrate on making strategic decisions instead of spending hours on manual research.

How does AI help ensure compliance in cryptocurrency trading in real time, and what are the advantages?

AI plays a crucial role in maintaining compliance in cryptocurrency trading by leveraging advanced machine learning algorithms to keep a close watch on transactions and market activities. These systems can quickly spot suspicious activities or potential regulatory breaches without requiring any manual oversight.

This technology brings several benefits to the table: rapid response times, high precision in detecting compliance issues, reduced operational expenses, and the flexibility to adjust to evolving regulations. By automating these tasks, AI contributes to a safer and more efficient trading landscape.