AI chart pattern tools are transforming cryptocurrency trading by identifying patterns within seconds, offering traders an edge in fast-moving markets. These tools, like StockioAI, analyze market data in real-time to detect setups such as Head and Shoulders or Triangles, and provide actionable signals like BUY, SELL, or HOLD recommendations. But how reliable are they?

Key insights from the article:

-

Accuracy: StockioAI reports a 75% win rate and a Profit Factor of 2.95, outperforming industry averages.

-

Features: It processes 60+ data points per second, evaluates multiple timeframes, and includes tools like confidence scores and risk management.

-

Performance: Reliable in various market conditions, though accuracy may drop during extreme volatility or low liquidity.

-

Limitations: Relies on historical data and may produce false positives in choppy markets.

While tools like StockioAI can improve trading efficiency, they are best used alongside human judgment and additional analysis to validate signals.

1. StockioAI Performance Analysis

Accuracy

StockioAI showcases impressive performance metrics in real-world trading scenarios. The platform boasts a 75.0% win rate across 35 closed trades and a Profit Factor of 2.95, meaning profitable trades outpace losses significantly. This highlights the system's ability to consistently recognize effective trading patterns.

For a $1,000 account without leverage, StockioAI generated a +2.9% return ($744.22 profit). While this may not seem dramatic, it reflects a cautious, risk-aware trading approach rather than high-risk speculation. This balance between profitability and capital preservation underscores the platform's precision in timing both trade entries and exits.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader

Next, let’s dive into how StockioAI’s advanced pattern detection contributes to these results.

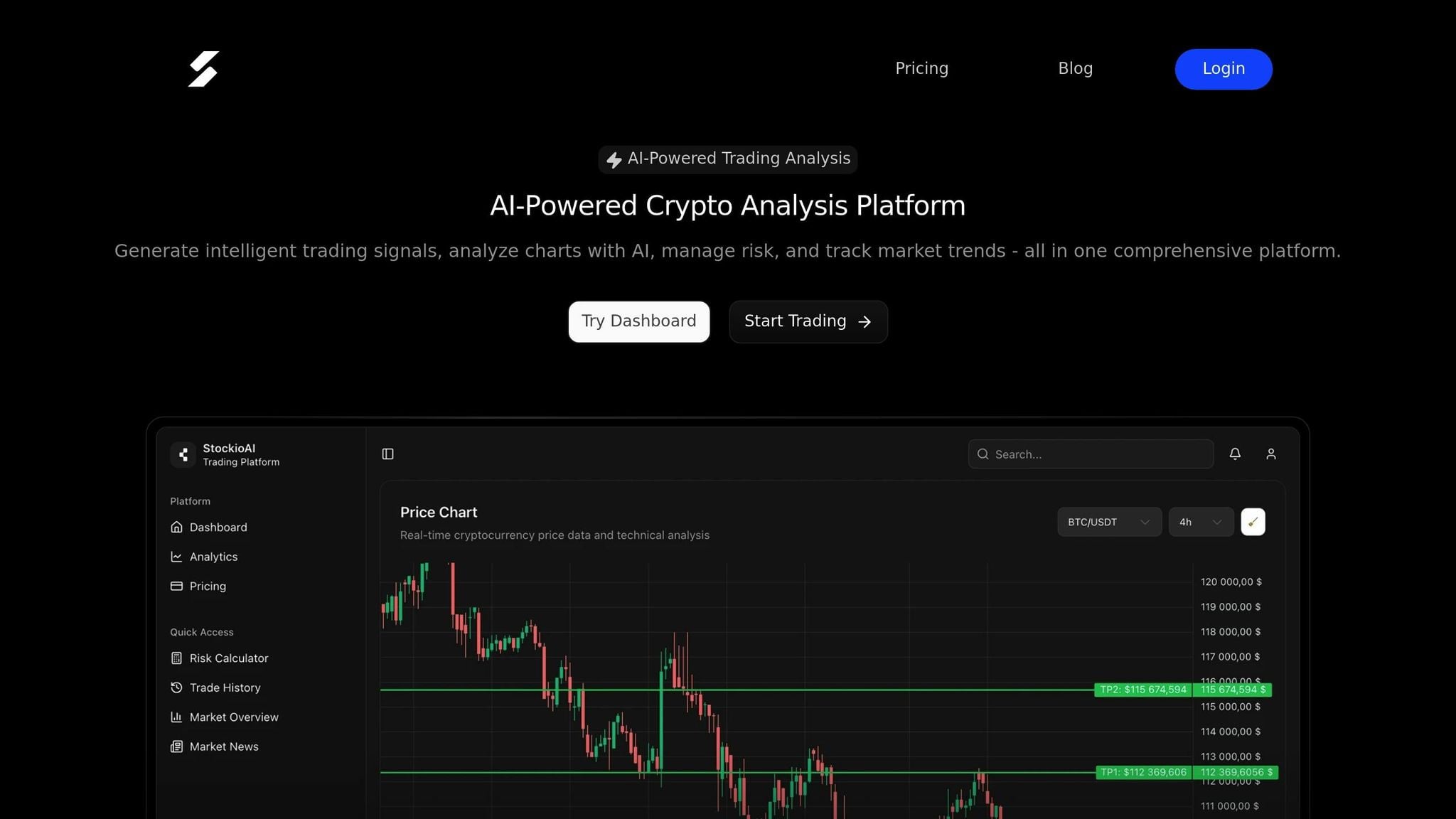

Pattern Detection Features

StockioAI processes over 60 real-time data points every second to spot chart patterns and create actionable trading signals. These data points encompass a range of technical indicators and market signals, ensuring a thorough analysis.

The platform evaluates multiple timeframes simultaneously, prioritizing higher timeframe momentum over shorter-term signals. It classifies market environments into four types: trending, ranging, volatile, and quiet. This adaptability allows the AI to fine-tune its pattern detection based on current market conditions.

Using a 7-tier system, StockioAI ranks signals based on key factors such as System Market Structure, Volume & Liquidity, Market Phase, RSI & MACD, EMA Ribbon, SMA Context, and Price Momentum. This structured approach ensures that the most reliable patterns take precedence over weaker ones.

For BUY positions, StockioAI provides clear entry points, stop-loss levels, profit targets, and confidence scores, all backed by detailed reasoning. SELL positions include risk assessments and real-time market insights, while HOLD recommendations analyze sideways trends, correlation patterns, and microstructure to determine whether maintaining a position is optimal.

Reliability in Market Conditions

StockioAI goes beyond detection by ensuring dependable performance across various market conditions. It continuously monitors resistance levels, momentum indicators, trends, and volatility to identify the best exit points. This real-time adaptability helps the platform stay effective even during rapid market changes.

The Conflict Resolution Matrix tackles 15 distinct scenarios, optimizing position sizing during periods of high volatility or conflicting signals - situations where traditional methods might falter.

During low liquidity periods, StockioAI incorporates order book depth analysis, one of its 60+ data points, to avoid false breakouts that often occur when trading volume is thin. This feature enhances its reliability in less active markets.

Additionally, the AI assesses whale movements and institutional flows, offering extra context for validating patterns. Large-scale activity can disrupt traditional chart patterns, but StockioAI’s comprehensive data processing helps distinguish between genuine breakouts and price manipulations.

Practical Integration

StockioAI’s tools are designed to fit seamlessly into traders’ workflows. The platform includes Interactive Chart Analysis, which pairs TradingView charts with AI-generated levels, support/resistance zones, and technical indicators. This integration allows traders to visualize AI recommendations directly within familiar charting tools.

Traders receive instant alerts with precise entry points, stop-loss levels, and profit targets, removing guesswork and making it easy to act on AI-driven signals.

For those on the Professional plan, API access enables integration with automated trading systems. The platform also features portfolio tracking and position monitoring tools, allowing users to manage multiple trades while benefiting from ongoing AI analysis.

The ULTIMATE AI Trading Tool - Beat 99% of Investors with THIS

Pros and Cons

Building on the performance analysis, here’s a closer look at the strengths and challenges of StockioAI's pattern recognition capabilities. While it offers impressive features, there are also areas where caution is warranted.

Key Strengths

Speed and Automation

StockioAI processes data at lightning speed, scanning markets continuously - something no human could match. This is particularly valuable in the fast-moving cryptocurrency markets, where opportunities can disappear in seconds.

Wide Range of Pattern Detection

The platform recognizes both classic chart patterns (like Head and Shoulders, Double Bottoms, and Triangles) and advanced harmonic patterns (such as Butterfly and Gartley). This broad coverage ensures traders have access to diverse setups across various market conditions.

Built-In Risk Management Tools

StockioAI doesn’t just identify patterns - it delivers actionable trade setups, complete with entry points, stop-loss levels, and profit targets. Confidence scores and a Conflict Resolution Matrix (covering 15 scenarios) further enhance its utility, especially during volatile periods, by helping traders adjust position sizes effectively.

Multi-Timeframe Analysis

By evaluating patterns across different timeframes and prioritizing higher timeframe momentum, StockioAI reduces market noise. This approach improves the reliability of detected patterns and helps traders make better-informed decisions.

While these strengths are noteworthy, there are some limitations to consider.

Limitations

Variable Pattern Accuracy

Not all patterns are equally reliable. For example, Inverse Head and Shoulders formations have shown accuracy rates as high as 84%, while others, like Pennants, may drop to about 56%. This variability means traders must weigh the confidence level of each signal.

Sensitivity to Market Conditions

The platform’s accuracy can be affected by extreme volatility or low liquidity. During such times, traders should exercise caution and consider additional analysis to validate signals.

Dependence on Historical Data

Like most AI-based systems, StockioAI relies on historical market behavior to make predictions. This reliance can be a limitation when dealing with new patterns or unprecedented market events.

Risk of False Positives

In sideways or choppy markets, incomplete patterns can appear, leading to false signals. Traders are advised to use supplementary confirmation methods rather than relying solely on AI-generated alerts.

| Performance Metric | StockioAI Result | Industry Benchmark |

|---|---|---|

| Overall Win Rate | 75.0% | ~68% average |

| Profit Factor | 2.95 | Varies by platform |

| Data Processing | 60+ points/second | Platform dependent |

| Market Coverage | 24/7 crypto focus | Varies by asset class |

StockioAI’s 75.0% win rate significantly outperforms the industry average of around 68%, showcasing its strong performance in live trading. However, as with any tool, it’s essential to remember that past success doesn’t guarantee future results.

Integration Challenges

Although StockioAI provides API access for automated trading, integrating it into existing systems requires technical know-how. It’s best used as a supplement to a trader’s own judgment and strategies.

Conclusion

AI chart pattern tools are reshaping cryptocurrency trading by delivering unmatched speed and precision in detecting patterns and managing risks. Among these tools, StockioAI stands out, consistently identifying actionable patterns in the ever-shifting crypto markets.

However, the reliability of patterns can vary. This is where features like confidence scores and detailed signal analysis become essential. Platforms that provide thorough reasoning behind their trading recommendations empower traders to make smarter decisions, regardless of market volatility.

StockioAI excels in addressing the unique demands of U.S. traders. With features like its Conflict Resolution Matrix and multi-timeframe analysis, the platform offers clarity during turbulent market conditions. Its advanced risk management tools and ability to convert pattern recognition into actionable strategies ensure traders can navigate even the most unpredictable scenarios.

It's worth noting that AI tools aren't without their flaws - they can occasionally produce false positives, especially in erratic markets, and are limited by their reliance on historical data. Yet, when used as a supplement to human judgment rather than a replacement, their advantages far outweigh these drawbacks. U.S. traders who pair AI-driven insights with their own expertise and additional confirmation strategies are better equipped to make sound trading decisions.

As cryptocurrency trading evolves, AI-powered platforms like StockioAI are leading the charge, offering features specifically designed for the American market. By combining AI capabilities with informed human insight, traders can maximize their success in this fast-paced and complex landscape.

FAQs

How does StockioAI ensure accuracy during periods of extreme market volatility?

StockioAI is built to handle the rapid and unpredictable shifts of cryptocurrency markets. When volatility spikes, its AI algorithms dive into real-time data, spotting patterns and fine-tuning predictions to deliver actionable BUY, SELL, and HOLD signals right when traders need them.

What sets StockioAI apart is its use of advanced machine learning models that constantly evolve to better understand market dynamics. Paired with tools like risk calculators and interactive chart analysis, it equips traders with the insights they need to make smart, calculated decisions, even when the market gets rough.

What are the risks of relying only on AI-generated trading signals, and how can traders reduce them?

Relying solely on AI-generated trading signals comes with its own set of challenges. These include becoming too dependent on technology, overlooking subtle market dynamics, or encountering unexpected errors in predictions. While AI tools can offer helpful insights, they might fall short when it comes to accounting for sudden market changes or unusual external factors.

To navigate these risks, traders should blend AI tools with their personal analysis and a well-thought-out trading strategy. Platforms like StockioAI provide features that go beyond basic signals, including AI-driven pattern recognition, interactive chart analysis, and a risk calculator. These tools can support traders in making better-informed decisions and managing potential losses. By using a mix of tools and strategies, traders can maintain a more balanced and cautious approach to the market.

How does StockioAI improve pattern detection accuracy using multi-timeframe analysis?

StockioAI improves the precision of pattern detection by utilizing multi-timeframe analysis alongside cutting-edge machine learning algorithms. This method enables the platform to assess chart patterns across various timeframes, delivering a broader perspective on market trends and potential reversals.

With real-time trading signals seamlessly integrated into interactive chart analysis, StockioAI empowers traders to make informed, data-backed decisions. Its AI-driven tools are built to swiftly pinpoint patterns and trends, giving traders a dependable advantage in the ever-changing cryptocurrency market.