AI is transforming cryptocurrency trading by automating chart analysis, identifying patterns like Head and Shoulders, Triangles, and Flags. These systems process vast data in real-time, delivering precise entry and exit signals, stop-loss levels, and profit targets. Platforms like StockioAI stand out, boasting a 75% win rate and advanced features like multi-timeframe analysis, risk management tools, and conflict resolution for trading decisions.

Key takeaways:

-

Manual chart analysis is slow and error-prone, while AI tools eliminate bias and identify opportunities faster.

-

Popular patterns detected by AI include Head and Shoulders (82% success rate), Double Bottom (82%), and Pennants (56%).

-

StockioAI integrates real-time analytics, market phase detection, and professional-grade risk tools for better decision-making.

AI's ability to scan multiple timeframes and validate signals with technical indicators like RSI and MACD makes it a powerful tool for both day and swing traders. As crypto markets evolve, AI-driven platforms will continue to simplify trading and improve accuracy.

Common Crypto Chart Patterns AI Can Detect

Popular Chart Patterns in Crypto Markets

AI-driven platforms are capable of identifying 26 chart patterns in cryptocurrency markets, ranging from simple shapes to intricate harmonic configurations[2]. These patterns provide insights into market behavior and can hint at possible price changes.

Some of the most trusted reversal patterns detected by AI include Head and Shoulders and Inverse Head and Shoulders, both known for their reliability. Double Bottom patterns are also effective for spotting trend reversals.

Triangle patterns - such as Ascending, Descending, and Symmetrical Triangles - often signify consolidation phases before significant price movements. AI tools excel at pinpointing these patterns by analyzing converging trendlines and identifying likely breakout points.

Flag and Pennant patterns reflect brief consolidation within strong trends. Market data suggests that Flags are generally more dependable, while Pennants show a lower success rate, around 56%[2].

Wedge patterns, including Rising and Falling Wedges, can indicate potential reversals as price action narrows between converging lines. These subtle formations are easily missed during fast market shifts, but AI systems are adept at catching them.

For more advanced setups, harmonic patterns like Butterfly and Gartley stand out. These patterns rely on precise Fibonacci ratios and geometric alignments, making them challenging to detect manually[2][7].

Lastly, Rectangle patterns, which represent sideways price movement between defined support and resistance levels, tend to have a moderate success rate of about 58%[2].

| Pattern Type | Success Rate | Complexity Level |

|---|---|---|

| Inverse Head & Shoulders | 84% | Medium |

| Head & Shoulders | 82% | Medium |

| Double Bottom | 82% | Low |

| Rectangle | 58% | Low |

| Pennant | 56% | Medium |

Analyzing these patterns across different timeframes enhances traders' ability to make well-informed decisions. This concept is explored further in the next section.

Multi-Timeframe Pattern Detection

AI pattern recognition goes beyond single charts, seamlessly analyzing data across timeframes ranging from 15 minutes to one week[2]. This flexibility allows traders to adapt their strategies for both short-term and long-term goals.

For example, while a 15-minute chart might highlight a bullish Flag pattern, a 4-hour chart could reveal a larger Descending Triangle. By presenting both perspectives, AI platforms provide traders with a more comprehensive view, helping them align their actions with their trading preferences.

When patterns, such as a Double Bottom, appear consistently across multiple timeframes - like both 1-hour and 4-hour charts - the likelihood of successful trades increases. This multi-timeframe approach helps filter out false signals and boosts confidence in decision-making.

AI systems also offer customizable alerts. Platforms like StockioAI constantly scan market data, notifying users when high-probability patterns emerge, ensuring they don’t miss potential opportunities.

The ability to move seamlessly between timeframes is a game-changer. Day traders can focus on shorter intervals for quick moves, while swing traders can monitor longer intervals to plan bigger positions. Adding volume analysis into the mix further validates patterns, helping traders distinguish between real breakouts and fake ones.

For instance, during Bitcoin's price fluctuations in early 2025, AI platforms identified a Double Bottom on 4-hour charts. This signal preceded a major upward trend, giving traders a chance to act on the opportunity[2].

AI Integration with Charting Tools

Improving User Experience with AI

Modern crypto charting platforms are reshaping how traders analyze markets, thanks to the seamless integration of AI into their interfaces. These platforms now allow traders to harness AI engines for instant data analysis and actionable insights.

One standout improvement is the use of multi-timeframe analysis. AI systems can automatically scan charts across different intervals - ranging from 15-minute charts for short-term opportunities to daily charts for long-term strategies. This eliminates the need to manually switch between timeframes, helping traders stay on top of both immediate market movements and broader trends.

AI tools also speed up the process of analyzing complex data. What once took minutes or even hours can now be done in seconds. Real-time data processing means traders are always up to date, with AI continuously monitoring price action to identify emerging patterns. Platforms like StockioAI take these advancements further by integrating sophisticated features that enhance the overall trading experience.

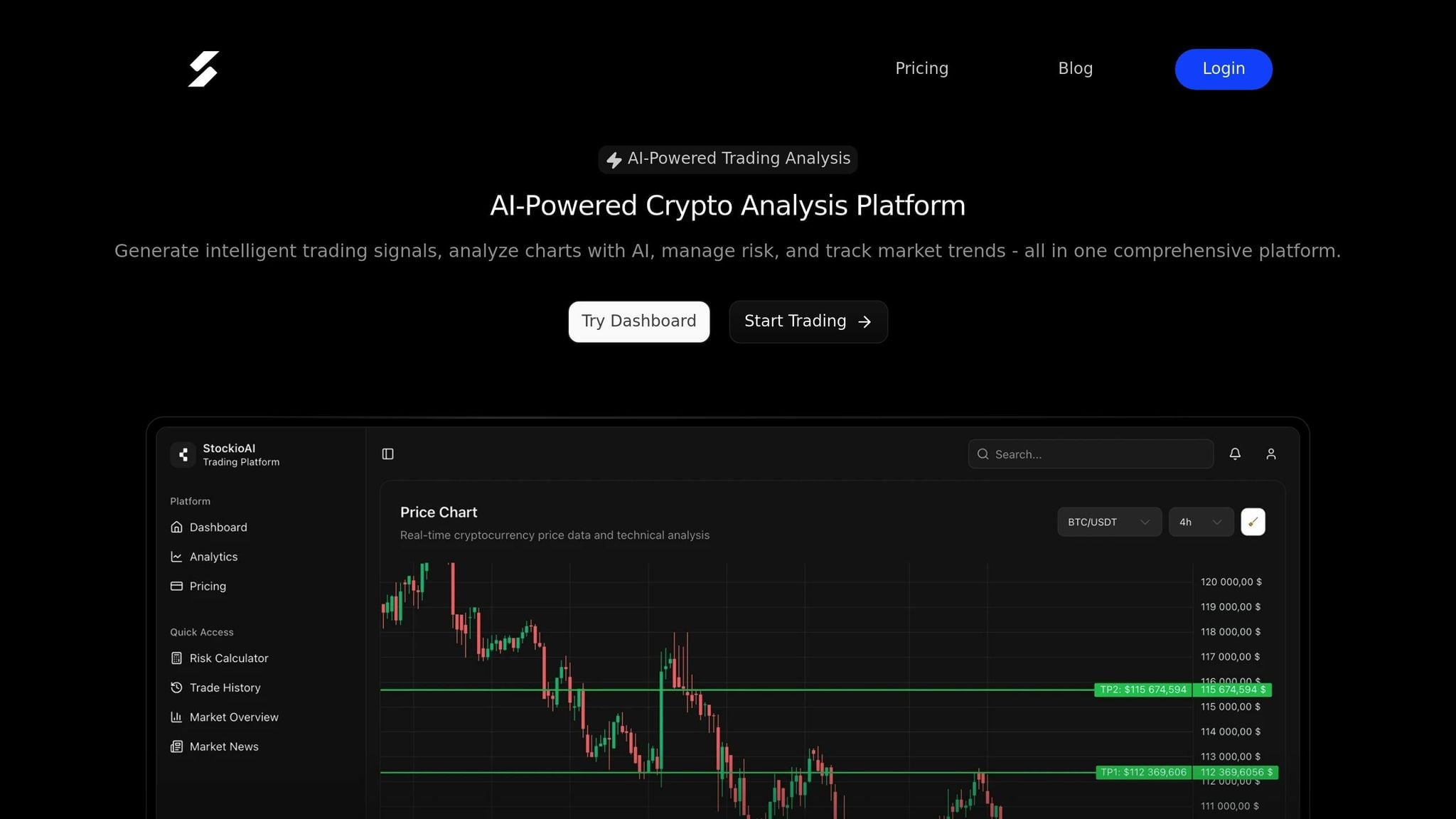

StockioAI's Advanced Features

Building on the capabilities of AI-driven pattern recognition, StockioAI brings a new level of precision to trading with its real-time analytics. The platform processes over 60 data points per second, analyzing technical indicators, volume patterns, market sentiment, and even whale movements to provide comprehensive insights[1].

At its core, StockioAI centers around interactive chart analysis. By combining advanced TradingView charts with AI-generated trading levels, support and resistance zones, and technical indicators, the platform offers a seamless blend of familiar tools and cutting-edge insights - all in one place.

One of StockioAI's standout features is its market regime classification system. This tool automatically identifies whether the market is trending, ranging, volatile, or quiet, enabling traders to adjust their strategies to match current conditions. Another innovative addition is the conflict resolution matrix, which evaluates multiple signals - even those that conflict - by analyzing their strength, timeframe, and historical reliability. The result? Clear, prioritized recommendations that traders can trust.

The platform also employs a 7-tier priority system to organize market analysis. This hierarchy includes key factors like market structure, volume and liquidity, market phase, RSI and MACD, EMA ribbon, SMA context, and price momentum. When paired with the conflict resolution matrix, these tools ensure that traders focus on the most critical elements for decision-making.

StockioAI doesn’t stop at analysis - it integrates professional risk management tools directly into its system. A built-in risk calculator helps traders determine optimal position sizing, stop-loss levels, and leverage. Each trading signal comes with detailed reasoning, clear entry points, predefined stop-loss levels, profit targets, and confidence scores, giving traders a complete picture before they act.

To further refine trading strategies, StockioAI prioritizes higher timeframe momentum over lower ones, reducing the risk of conflicting signals. The conflict resolution matrix is particularly useful during volatile periods, managing 15 different scenarios for position sizing under varying conditions.

| Feature | Description | Benefit |

|---|---|---|

| Real-time Data Processing | 60+ data points per second | Faster signal generation |

| Market Regime Classification | Identifies trending, ranging, volatile, or quiet markets | Strategy adaptation |

| Conflict Resolution Matrix | Analyzes 15 scenarios for conflicting signals | Clear decision-making |

| 7-Tier Priority System | Hierarchical market analysis | Focus on critical factors |

| Risk Calculator | Optimizes position sizing and stop-loss levels | Professional risk management |

StockioAI reports an impressive 75% win rate with a Profit Factor of 2.95, showcasing the effectiveness of its AI-powered approach[1]. By combining advanced pattern recognition, detailed market analysis, and integrated risk management, StockioAI delivers a comprehensive trading solution that goes far beyond basic charting tools.

Practical Uses of AI-Driven Pattern Recognition

Using Patterns for Entry and Exit Points

AI-powered pattern recognition has revolutionized how traders pinpoint the best times to enter or exit their crypto positions, eliminating the tedious process of manually scanning charts. These systems analyze more than 60 data points per second, identifying profitable opportunities in real time[1].

For example, when AI detects patterns like the Inverse Head and Shoulders (with an 84% success rate) or Head and Shoulders (82% success rate), it generates precise BUY or SELL signals. These signals include clear entry points, stop-loss levels, and profit targets[2]. To ensure accuracy, the AI also evaluates other factors such as technical indicators, trading volume, support levels, market sentiment, order book depth, and large-scale trader movements (commonly referred to as whale activity)[1].

These signals act as a starting point for traders, who can then seek further confirmation, as outlined in the next section.

Combining Patterns with Technical Indicators

While AI excels at recognizing patterns, the most effective traders go a step further, combining these insights with additional technical indicators to confirm the signals. After all, not every pattern leads to a successful trade. Layering multiple indicators helps create more reliable decisions.

For instance, when AI detects a breakout, it cross-verifies the signal using tools like RSI, MACD, and volume analysis. StockioAI employs a sophisticated 7-tier priority system to automate this confirmation process. It evaluates elements such as market structure, liquidity, market phase, RSI and MACD signals, EMA ribbon alignment, SMA context, and price momentum. Additionally, a conflict resolution matrix weighs factors like signal strength, timeframe, and historical reliability to deliver clear, prioritized recommendations.

Multi-timeframe analysis further strengthens these signals. If a bullish pattern appears on both the 1-hour and daily charts, the signal gains more credibility[2].

| Pattern Type | Success Rate | Best Confirmation Indicators |

|---|---|---|

| Inverse Head and Shoulders | 84% | RSI, MACD, Volume |

| Head and Shoulders | 82% | RSI, MACD, Volume |

| Double Bottom | 82% | RSI, MACD, Volume |

| Pennant | 56% | RSI, MACD, Volume |

| Rectangle | 58% | RSI, MACD, Volume |

Risk Management with StockioAI

Once clear entry and exit signals are established, risk management becomes essential. StockioAI integrates advanced tools to refine every trade decision. Its built-in risk calculator helps traders determine position sizes, set stop-loss levels, and choose leverage based on the identified patterns and current market conditions[1].

Each signal includes predefined risk parameters. For high-probability patterns, the system calculates the risk–reward ratio and suggests position sizes tailored to the trader’s risk tolerance. StockioAI’s conflict resolution matrix addresses 15 different scenarios to adjust position sizing for varying market conditions, ensuring traders avoid overexposure to volatile assets.

Real-time position tracking allows traders to monitor active trades, keeping tabs on profits and losses as new patterns emerge. With a reported 75% win rate and a 2.95 Profit Factor across 35 closed trades, StockioAI demonstrates how combining AI-driven pattern recognition with systematic risk management can lead to consistent results[1].

What sets StockioAI apart is its ability to adapt to different market regimes. Whether the market is trending, ranging, volatile, or quiet, the platform adjusts position size recommendations accordingly. For instance, during volatile periods, it might propose smaller positions even for high-confidence signals. Conversely, in stable trending markets, it may suggest larger positions for stronger signals.

This systematic approach helps traders avoid emotional decision-making. Instead of guessing how much to risk on a trade, they receive data-backed recommendations based on pattern reliability, market conditions, and their own risk profile. The result? More consistent performance and better protection of capital over the long term.

How Has AI Changed Crypto Chart Pattern Recognition? - Crypto Trading Strategists

Future Trends in AI Pattern Recognition for Crypto

AI has already proven its value in crypto markets, delivering impressive success rates in pattern recognition. Building on this foundation, the future promises even more advanced tools and techniques that will reshape how traders analyze and interact with the ever-evolving crypto landscape.

Advancements in AI-Powered Tools

Emerging AI tools are taking a leap forward with custom model training and expanded pattern recognition capabilities. These next-generation models can now learn and adapt using minimal data[4]. This means platforms can quickly adjust to new market trends and crypto-specific patterns.

One exciting development is the expansion of pattern libraries to include more complex formations, like advanced harmonic patterns and multi-timeframe setups[2][3]. For example, StockioAI is leading the charge by enhancing its pattern recognition capabilities while using a sophisticated 7-tier priority system. This system evaluates multiple factors - market structure, liquidity, and technical indicators - simultaneously, ensuring a well-rounded analysis.

Models like YOLOv8 are also making waves by providing real-time, high-accuracy detection for both traditional and crypto markets[5]. These tools can process massive amounts of data at lightning speed, scanning thousands of charts simultaneously and uncovering opportunities that would otherwise go unnoticed by manual analysis.

What’s even more exciting? These advanced analytics are no longer exclusive to institutional traders. Retail traders now have access to these powerful tools, leveling the playing field in ways that were unimaginable just a few years ago[4].

The Growing Role of AI in Crypto Markets

As the crypto market becomes more intricate and volatile, AI systems are stepping in to handle the heavy lifting. With the 24/7 nature of cryptocurrency trading, it’s impossible for humans to monitor markets around the clock. AI, however, thrives in this environment, processing vast amounts of data and generating actionable insights in real time[4][6].

AI-driven platforms are not just faster - they’re smarter. They reduce cognitive strain, minimize human error, and enable traders to act quickly on fleeting opportunities[4][6]. Automated pattern recognition systems now continuously scan the entire crypto market, identifying setups that would be nearly impossible to spot manually[2][4].

User-friendly interfaces and real-time analytics are also making these tools more accessible to everyday traders[4][5]. Features like instant notifications and mobile access ensure that traders can act on AI-generated signals without delay. StockioAI is a prime example of this evolution, offering a platform that integrates pattern recognition, risk management, and position tracking. Its adaptability to different market conditions - whether trending, ranging, or volatile - demonstrates how AI is becoming more refined and versatile.

Looking ahead, experts anticipate that AI will continue to revolutionize crypto trading. Advancements in deep learning, real-time analytics, and integration with other financial technologies are expected to drive this progress[4][5]. The ability of AI to learn from minimal data, adjust to shifting market conditions, and deliver personalized trading strategies will likely accelerate adoption across the board.

As these systems grow more advanced, they could even interpret market sentiment and fine-tune their pattern recognition accordingly. Such innovations will further close the gap between professional and retail traders, fundamentally transforming how people engage with cryptocurrency investing.

FAQs

How does AI pattern recognition help traders make better decisions in cryptocurrency markets?

AI-powered pattern recognition is transforming trading by analyzing cryptocurrency charts using advanced machine learning techniques. These systems excel at spotting critical patterns, anticipating trend reversals, and pinpointing optimal moments to enter or exit trades.

With its ability to deliver clear insights into market behavior, AI equips traders to seize profitable opportunities while managing risks more efficiently. In the ever-changing landscape of crypto trading, it’s a game-changer for making informed decisions.

What are the advantages of using multi-timeframe analysis with AI in crypto trading?

Multi-timeframe analysis gives traders the ability to examine cryptocurrency price trends across various time intervals, providing a broader view of market dynamics. When paired with AI, this method becomes even more powerful, uncovering patterns and trends that might not be obvious when focusing on a single timeframe.

Here’s why it matters:

-

Sharper decision-making: AI can sift through data from multiple timeframes to highlight actionable details, like the best moments to enter or exit a trade.

-

Smarter risk management: By combining insights from short-term price swings with long-term trends, traders can make better choices to reduce potential risks.

-

Enhanced precision: AI-driven tools, such as those from StockioAI, leverage multi-timeframe data to deliver accurate BUY, SELL, and HOLD signals, giving traders a competitive edge in the fast-moving crypto market.

This combination of AI and multi-timeframe analysis equips traders with the tools they need to navigate market volatility with greater confidence.

How does StockioAI improve trading strategies during volatile crypto market conditions?

StockioAI steps up during turbulent market times by using AI-driven tools to deliver real-time insights and actionable data. With features like precise BUY, SELL, and HOLD signals, alongside interactive chart analysis, traders can quickly spot patterns and trends to stay ahead.

The platform also provides tools such as risk calculators and technical analysis, giving traders the confidence to navigate unpredictable markets. Its advanced pattern recognition technology uncovers potential opportunities while helping users keep risks under control.