Want to make your trading algorithms perform better? Tuning algorithm parameters is the key. By refining variables like moving averages, stop-loss thresholds, and entry/exit triggers, you can significantly improve profitability and reduce risks. But crypto trading comes with unique challenges - volatility, overfitting, and data quality issues. Here's a quick breakdown of what you need to know:

-

Set clear metrics: Focus on Sharpe ratio, maximum drawdown, and win rate to measure success.

-

Use quality data: Clean, accurate historical data is essential for reliable results.

-

Avoid overfitting: Test on unseen data and use techniques like walk-forward optimization.

-

Prioritize key parameters: Focus on variables with the most impact, like moving average periods.

-

Test across markets: Validate parameters with different assets and timeframes to ensure reliability.

-

Monitor and adjust: Regularly reassess parameters to stay effective in changing market conditions.

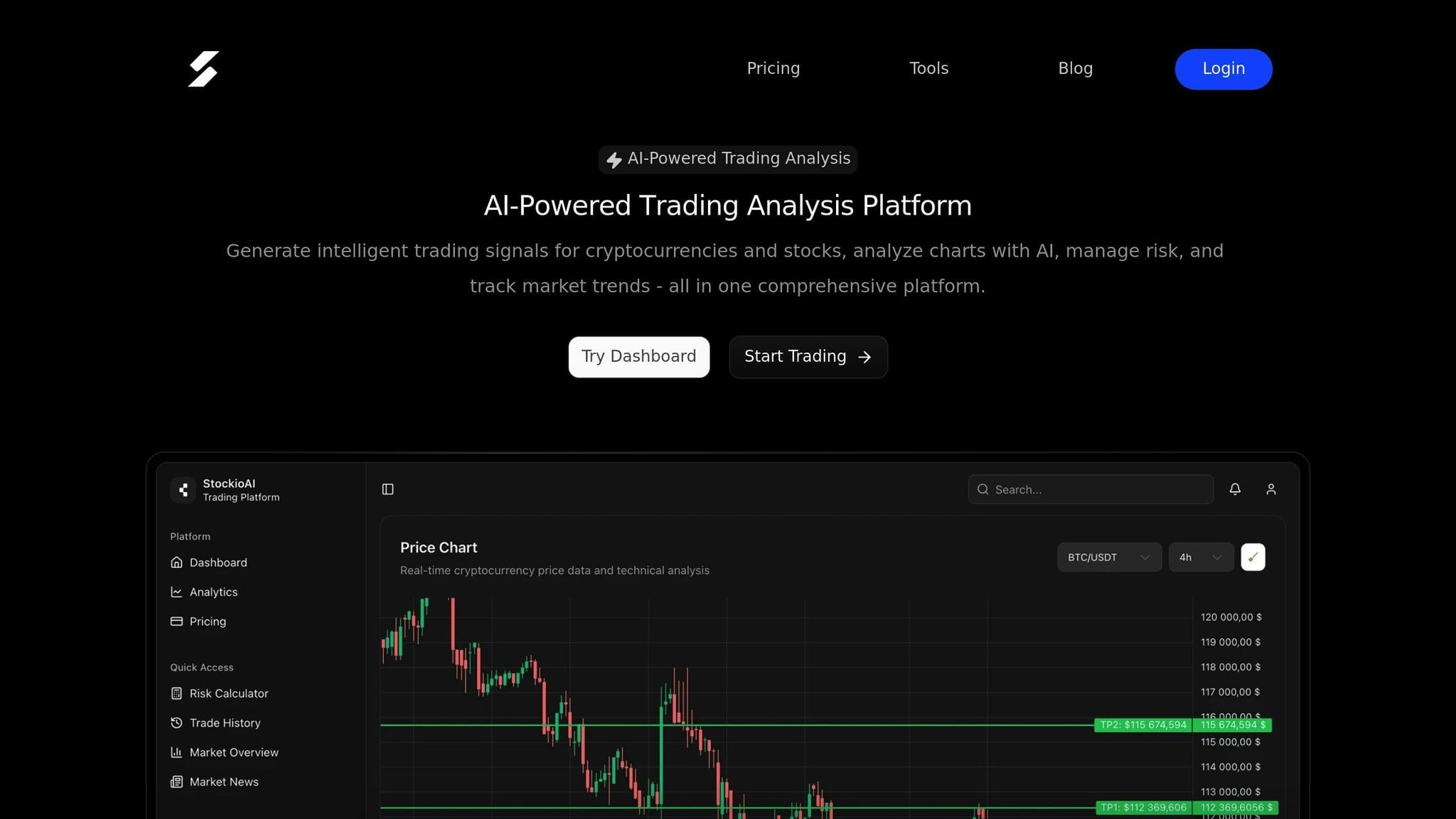

Tools like StockioAI simplify this process, analyzing over 60 real-time data points to fine-tune strategies efficiently. With disciplined tuning and continuous testing, you can transform underperforming algorithms into consistent winners.

Machine Learning for Algorithmic Trading

| Part 3: Hyper Parameter Tuning

Parameter Tuning Best Practices Checklist

When tackling the challenges of parameter tuning, following a structured checklist can make the process more efficient. By balancing performance goals with risk management, especially in the unpredictable crypto market, you can optimize your trading strategies effectively.

Set Clear Performance Metrics

Before tweaking any parameters, establish what success means for your trading strategy. Key metrics to consider include:

-

Sharpe ratio: Measures risk-adjusted returns.

-

Maximum drawdown: Highlights potential losses.

-

Win rate: Tracks the percentage of profitable trades[4].

Your priorities will depend on your trading style. For instance, risk-averse traders often focus on higher Sharpe ratios and lower drawdowns, while aggressive traders might aim for higher total returns, even if it means tolerating more volatility. These metrics, when aligned with your goals, form the foundation of your optimization process.

Another important metric is the profit factor, which divides total profits by total losses. When paired with a consistent win rate, it offers a clearer picture of long-term profitability. Documenting these target metrics ensures that your optimization efforts remain aligned with your objectives.

Prepare Quality Market Data

In the volatile crypto market, having reliable data is crucial. Start by collecting historical data, including price, volume, and order book information, from trustworthy sources[4]. Challenges like 24/7 trading, occasional exchange outages, and inconsistent timestamps can complicate analysis, so it’s essential to clean your data thoroughly.

This means removing anomalies, filling in missing values, and correcting timestamps. Cross-referencing data from multiple exchanges can also help identify and resolve discrepancies. For example, if your dataset shows Bitcoin trading at $30,000 when major exchanges list it closer to $50,000, investigate and address the inconsistency before proceeding.

Modern tools like StockioAI take this a step further by analyzing over 60 real-time data points every second, including technical indicators, sentiment analysis, and whale movements[1]. This level of detail captures market dynamics that basic price data might miss. Always verify your data by cross-checking it against known market events.

Split Data for Testing and Validation

To avoid overfitting - a common issue in algorithmic trading - split your data wisely. An 80/20 time-based split is a practical approach: use the first 80% of your data chronologically for training and reserve the most recent 20% for testing[2]. This method mimics real-world trading conditions and ensures your strategy is tested on unseen data.

During development, avoid peeking at test results to prevent data snooping. Use the training set to refine your parameter values and the test set to validate how well your strategy performs.

Choose and Prioritize Key Parameters

Not all parameters are created equal. Focus on those that have the greatest impact on your strategy's performance. Tools like sensitivity analysis can help identify which variables matter most by showing how performance shifts when individual parameters are adjusted[2].

For example, in a moving average crossover strategy, the periods for short (5–20) and long (50–200) moving averages are often critical. Similarly, stop-loss thresholds should reflect your risk tolerance and the volatility of the cryptocurrency you're trading. Keep your tuning efforts manageable by limiting adjustments to 3–5 key parameters at a time.

Documenting your choices - what you're tuning and why - helps maintain clarity and provides a valuable reference for future strategy refinements.

Apply Optimization Methods

The method you choose to optimize parameters depends on your computational resources and the complexity of your parameter space. Here’s a quick comparison:

| Optimization Method | Best For | Computational Cost | Thoroughness |

|---|---|---|---|

| Grid Search | Small parameter spaces | High | Complete coverage |

| Random Search | Medium parameter spaces | Medium | Good coverage |

| Bayesian Optimization | Complex parameter spaces | Medium | Efficient targeting |

| Genetic Algorithms | Large parameter spaces | High | Evolutionary improvement |

Start with simpler methods like grid or random search for initial exploration. For more complex scenarios, advanced techniques like Bayesian optimization or genetic algorithms can guide the process efficiently. Bayesian optimization uses probabilistic models to focus on promising areas, while genetic algorithms mimic natural selection to refine parameters[2].

Once you've optimized your parameters, continuously test and adjust your model to ensure it remains robust in live trading conditions.

Preventing Overfitting and Testing Parameter Strength

Fine-tuning parameters is just one part of the equation; ensuring they work in real-world trading conditions and avoiding overfitting is just as crucial. Overfitting happens when an algorithm becomes too tailored to historical data noise instead of capturing genuine market trends. The result? A strategy that looks great on paper but struggles in live trading, especially in the unpredictable crypto market, where volatility can lead to significant losses if your model isn't robust enough [2].

Test with Out-of-Sample Data

One of the best ways to prevent overfitting is by validating your parameters on data that wasn’t used during the tuning process. A proven method for this is walk-forward optimization, which uses a rolling window approach. For example, you might optimize your algorithm using data from months 1–12, test it on months 13–14, then shift the window to optimize on months 2–13 and test on months 15–16. This process continues across your entire dataset, ensuring that your parameters are tested in a variety of conditions [2].

This approach is particularly valuable in cryptocurrency trading, where markets can quickly alternate between trending, ranging, and high-volatility phases. By testing across multiple out-of-sample periods, you can better assess whether your parameters are reliable under different conditions.

When analyzing out-of-sample results, pay close attention to metrics like the Sharpe ratio and maximum drawdown. A red flag is when these metrics significantly decline compared to your training period. For instance, if your live trading Sharpe ratio drops below 70% of your backtested Sharpe ratio, it’s a sign that the parameters may no longer be effective.

Before risking real money, validate your strategy through paper trading for 2–4 weeks. This step allows you to account for real-time factors like market volatility, execution delays, and liquidity constraints [4]. Only after confirming that live performance aligns with your backtested results should you consider deploying real capital.

In addition to temporal validation, testing your parameters across different assets can further strengthen their reliability.

Test Across Multiple Markets

Relying solely on one asset for parameter tuning can lead to overfitting. To avoid this, test your strategy on a variety of markets. For example, if you’ve optimized parameters for Bitcoin using 4-hour candles, try applying them to Ethereum, Solana, or other cryptocurrencies, using similar or even different timeframes, such as 1-hour or daily candles [2]. Each asset comes with unique characteristics like volatility, liquidity, and trading patterns, so cross-asset testing ensures your parameters aren’t overly specific to one market.

Market conditions also play a significant role. Parameters fine-tuned during a bull market might struggle in bear markets or during periods of low volatility. Using dynamic parameters - such as a stop-loss set at twice the 20-period rolling standard deviation - can help your strategy adapt to changing conditions [2].

Monitor Live Performance and Adjust

Even after rigorous testing, ongoing monitoring is essential to ensure your parameters remain effective. Reassess your parameters monthly using recent out-of-sample data, and consider a complete re-tuning every three to six months [4]. Adjustments may also be necessary when there are significant market changes, such as regulatory shifts or performance deviations. For example, an algorithm optimized for trending markets might fail during a prolonged consolidation phase.

Platforms like StockioAI can simplify this process by continuously analyzing market conditions [1]. StockioAI has reported impressive results, including a 75.0% win rate and a 2.95 profit factor over 35 closed trades [1].

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader [1]

Set up automated alerts to track key performance metrics and identify when adjustments are needed.

The crypto market is constantly evolving, and static parameters quickly lose their edge. A combination of thorough validation, real-time monitoring, and periodic adjustments is key to keeping your trading algorithm effective over the long term.

Using AI and Automation for Parameter Tuning

AI and automation take parameter tuning to the next level, especially in a fast-paced environment like cryptocurrency trading. The market's rapid fluctuations make manual tuning not only tedious but also prone to errors. With AI-powered automation, algorithms can be fine-tuned with incredible speed and precision. These systems can evaluate thousands of parameter combinations in mere minutes, adjusting to market shifts in real time. This capability lays the groundwork for creating more reliable and adaptive trading strategies, which will be explored further in the coming sections.

AI-Powered Optimization Tools

AI optimization tools use machine learning algorithms to sift through massive datasets, uncovering parameter combinations that boost performance metrics like the Sharpe ratio and profit factor. Unlike manual methods, these tools can detect intricate, non-linear patterns in the market that might otherwise go unnoticed.

The impact of AI is evident in documented cases where underperforming strategies were turned into profitable ones through automated iterations [3]. AI's ability to find hidden relationships between parameters is a game-changer for traders.

Another key advantage is real-time pattern recognition. Advanced AI tools can optimize strategies across multiple timeframes and assets simultaneously, fine-tuning parameters as market conditions evolve [2]. This dynamic adaptation keeps trading algorithms effective, even during volatile periods when static parameters would falter.

AI also excels in multi-asset optimization, testing parameters across various cryptocurrencies to ensure broader applicability. Instead of focusing solely on Bitcoin, these tools validate parameters for Ethereum, Solana, and other major cryptocurrencies, minimizing the risk of overfitting to one asset's unique characteristics.

Benefits of Automated Tuning

Automation eliminates the emotional biases that often cloud manual parameter tuning. Human traders might tweak parameters impulsively after a loss or a win, but automated systems rely solely on data-driven insights. Decisions are grounded in comprehensive backtesting, not gut feelings.

The time savings are immense. While manual tuning might take weeks, automated systems can evaluate thousands of parameter combinations in just hours. For example, tools like AlphaEvolve optimize trading algorithms through multiple generations, with each iteration refining the best-performing parameters from earlier tests [3].

This efficiency allows traders to shift their focus to higher-level tasks like developing new strategies, studying market trends, or enhancing risk management frameworks. Instead of spending hours adjusting stop-loss levels or position sizes, traders can dedicate their time to more strategic pursuits.

Automation also ensures thorough and consistent testing of every parameter combination, reducing the chance of overlooking promising setups due to human error or fatigue. This systematic approach provides a fair and reliable basis for comparison.

StockioAI Platform Features

StockioAI showcases the advantages of automation with its AI-driven platform. It processes over 60 real-time data points every second, covering technical indicators, volume trends, market sentiment, order book depth, whale movements, and even social media activity [1]. This extensive data analysis forms the backbone of effective parameter tuning.

The platform's AI-powered pattern recognition identifies chart patterns, trend reversals, and optimal entry/exit points. These insights help traders fine-tune parameters like stop-loss levels and profit targets based on current market conditions [1].

StockioAI also includes a Risk Calculator that aids in setting optimal position sizes, stop-losses, and leverage ratios [1]. This ensures that while optimizing for returns, traders don't compromise on risk management, maintaining a balanced approach to strategy development.

The platform's track record is impressive, with a 75.0% win rate and a 2.95 profit factor over 35 closed trades [1]. These results underscore its ability to optimize trading parameters effectively.

Additionally, real-time market alerts and multi-timeframe analysis allow for continuous parameter adjustments as market conditions change [1]. Whether the market is trending, ranging, or volatile, this adaptability keeps trading algorithms performing at their best.

StockioAI integrates signal generation, risk management, and performance tracking into one streamlined platform. By combining these features, it eliminates the need for multiple tools, simplifying the optimization process while delivering the advanced analysis capabilities required for modern cryptocurrency trading.

Key Takeaways for Parameter Tuning Success

Core Principles for Parameter Tuning

When it comes to parameter tuning in cryptocurrency trading, success hinges on using clear, measurable benchmarks like the Sharpe ratio, maximum drawdown, profit factor, and win/loss ratio [4]. Without these metrics, adjustments can become guesswork, potentially harming your algorithm's effectiveness.

The foundation of reliable parameter tuning lies in high-quality data and systematic testing. A proven strategy is the 80/20 rule: dedicating 80% of data for training and 20% for testing. This approach minimizes the risk of overfitting while ensuring your parameters can handle real-world market conditions [2]. It’s a practical way to avoid creating algorithms that perform well on paper but fail in live environments.

Systematic iteration plays a critical role in refining strategies. Real-world examples show how disciplined tuning can turn struggling algorithms into profitable ones with consistent optimization [3].

Risk management is equally important. By setting proper stop-loss levels, position sizes, and leverage ratios, you can protect your capital while still pursuing higher returns. This balance ensures that your strategy doesn’t sacrifice safety for potential gains [4][5].

These principles provide a roadmap for maintaining strong performance through ongoing refinement and careful adjustments.

Continuous Learning and Market Adaptation

Beyond systematic tuning, adapting to ever-changing market conditions is key to long-term success. Cryptocurrency markets operate 24/7, demanding consistent monitoring and parameter updates. Regularly comparing backtested results to live outcomes and setting alerts for significant deviations can help you identify when adjustments are needed [4][6].

Market dynamics shift quickly. Strategies that thrive in a bull market might falter in a bear market. To stay ahead, traders conduct rolling reviews of their algorithms, adjusting parameters to account for evolving factors like volatility, liquidity, and market structure [4]. This proactive approach keeps strategies effective across different market cycles.

Platforms like StockioAI demonstrate how technology simplifies this process. By analyzing over 60 real-time data points per second - including technical indicators, sentiment, volume trends, and even social media insights - such tools provide actionable analytics for fine-tuning parameters. StockioAI’s impressive 75.0% win rate and 2.95 profit factor underscore the value of AI-driven optimization [1].

Documenting every parameter change is another essential step. Keeping a detailed record of why adjustments were made, the market conditions at the time, and the resulting performance metrics creates a valuable resource for future refinements [4]. With platforms like StockioAI, traders can integrate real-time monitoring with systematic adjustments, streamlining the entire optimization process.

FAQs

What are the best ways to avoid overfitting when adjusting parameters in a cryptocurrency trading algorithm?

When fine-tuning your crypto trading algorithm, avoiding overfitting is key to ensuring it performs well in real-world scenarios. A good starting point is splitting your dataset into training, validation, and testing sets. This separation allows you to evaluate the algorithm on data it hasn’t seen before, giving you a clearer picture of its actual performance.

To keep your model from becoming overly complex, consider reducing the number of parameters or applying regularization techniques. These approaches help the algorithm focus on broader patterns rather than overfitting to the noise in the data. Another useful method is cross-validation, which evaluates your model across different subsets of data. This provides a more reliable assessment of how well your algorithm generalizes.

Lastly, keep a close eye on performance metrics. Avoid the temptation to optimize solely for short-term gains, as this can backfire in live trading. A well-rounded, balanced approach will set you up for more consistent results over time.

How does AI enhance the tuning of algorithm parameters for better performance?

AI brings a fresh edge to fine-tuning algorithm parameters in cryptocurrency trading by using pattern recognition to spot trends, chart formations, and the best moments to enter or exit trades. By processing massive amounts of market data in real time, AI can pick up on subtle details that manual analysis might overlook.

This ability empowers traders to make smarter decisions, minimize risks, and boost overall trading outcomes. AI-driven tools also simplify the process, enabling quicker and more accurate adjustments to algorithm settings.

Why should you test algorithm parameters across different markets and timeframes?

Testing algorithm parameters in various markets and over different timeframes is a key step in building a dependable trading strategy. Markets can vary widely due to factors like volatility, liquidity, and trading volume. By running tests across a range of market conditions, you can determine if your algorithm delivers consistent results or if its performance is limited to specific scenarios.

Timeframe testing is equally important. Analyzing your strategy using daily, weekly, or monthly data offers insights into how it handles both short-term fluctuations and long-term trends. This method not only helps minimize the risk of overfitting but also boosts the chances of your strategy succeeding in real-world trading environments.