Crypto markets are unpredictable, with prices swinging 24/7 due to news, sentiment, and trading activity. AI is transforming how traders handle this volatility by offering real-time insights, faster decision-making, and improved risk management. Here's what you need to know:

- Why Real-Time Tracking Matters: Crypto prices can change in seconds. AI systems process data instantly, helping traders respond quickly to price spikes or drops.

- How AI Works: Advanced algorithms like LSTM and Random Forest analyze price trends, trading volumes, and sentiment from multiple sources simultaneously.

- Proven Results: Studies show AI-driven strategies outperform passive trading, with Bitcoin trades yielding +15.6% profit vs. a -44.8% loss for buy-and-hold.

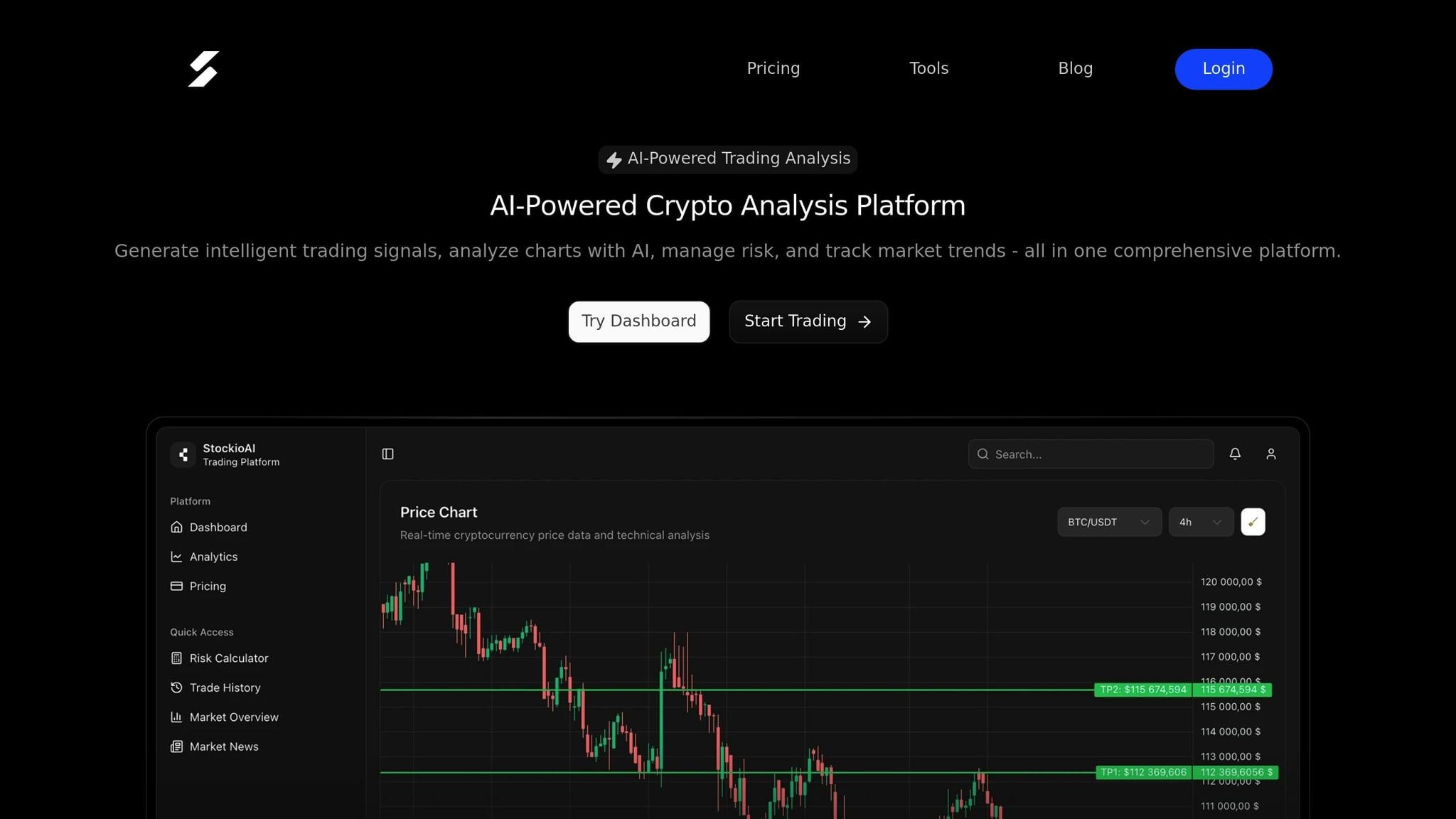

- Tools Like StockioAI: Platforms use AI to provide actionable signals (Buy, Sell, Hold), pattern detection, and risk management tools, making trading decisions faster and more precise.

AI isn't just a tool; it's becoming a necessity for navigating the complexities of crypto markets. Keep reading to see how it works and its real-world performance.

Core AI Methods for Tracking Intraday Volatility

Key AI Algorithms for Volatility Prediction

Tracking crypto market volatility depends heavily on advanced AI algorithms designed to tackle the unique dynamics of cryptocurrency trading. Among these, Long Short-Term Memory (LSTM) networks are particularly effective. These neural networks are built to capture temporal dependencies, making them ideal for analyzing the sequential price movements that define intraday volatility. Their ability to retain and process information over time gives them a distinct edge in predicting short-term market shifts.

Another key player is Random Forests, a type of ensemble learning method. These algorithms excel at identifying patterns in complex, non-linear data, which is a hallmark of crypto markets. By combining multiple decision trees, Random Forests create more reliable predictions while minimizing the risk of overfitting - a common issue with single-model approaches.

The real game-changer, however, comes from hybrid models that merge different AI techniques. For instance, a hybrid system might use LSTM layers to analyze sequential price data while employing Random Forests to interpret technical indicators and sentiment scores. The combined outputs result in more accurate volatility forecasts, leveraging the strengths of each approach. Studies have shown that these hybrid models consistently outperform traditional methods, setting a new standard in volatility prediction [5].

Using Real-Time Data and Technical Indicators

Modern AI systems for tracking volatility pull data from a wide range of sources to create a comprehensive view of the market. These systems process real-time price data, a variety of technical indicators like moving averages, RSI, and Bollinger Bands, and sentiment analysis derived from news, social media, and order book data.

Technical indicators play a crucial role in this process. They serve as engineered features that help AI models identify key market events, such as trend reversals or volatility spikes. Commonly used indicators include moving averages (MA), Relative Strength Index (RSI), Bollinger Bands, Average True Range (ATR), and MACD [5][6].

What sets these AI systems apart is their ability to combine technical indicators with behavioral signals. For example, by integrating sentiment scores with traditional indicators, AI can fine-tune its volatility predictions to account for shifts in market sentiment. This leads to more accurate and timely forecasts [4][6].

One standout example is StockioAI, which processes over 60 real-time data points, including price, volume, technical indicators, sentiment, and order book data. This allows the platform to deliver precise trading signals, complete with entry points, stop-loss levels, profit targets, and confidence scores - all in real time.

High-Frequency Data Processing and Low Latency

To make the most of cutting-edge algorithms, efficient data processing is critical. Handling the vast amounts of high-frequency data generated by crypto markets requires systems that can process information with minimal delay. This is where AI systems shine, overcoming challenges like large data volumes, market noise, and the demand for low-latency computation [6].

These systems rely on advanced streaming architectures, in-memory databases, and optimized pipelines to analyze data in real time. Techniques like feature engineering and dimensionality reduction help minimize computational load while maintaining accuracy [6].

Key data inputs for these systems include tick-by-tick price data, order book snapshots, trade volumes, historical volatility measures, and external sentiment data from news and social media. Preprocessing steps such as data cleaning (to remove outliers), resampling (to align data to consistent intervals like 1-minute or 5-minute bars), feature extraction (for technical indicators), and normalization (to ensure comparability across assets) are essential [4][5][6].

The ability to process this data in milliseconds gives AI systems a significant edge over manual analysis. This speed ensures that models can respond to market changes fast enough to support effective intraday trading and risk management.

Recent research highlights another breakthrough: machine learning models that account for cryptocurrency volatility commonality - the relationships between different crypto assets - consistently outperform those that focus on individual assets. For example, in January 2025, researchers found that models incorporating cross-asset relationships achieved better Profit & Loss outcomes in cryptocurrency options trading compared to models that analyzed assets in isolation [4].

Research Results: AI Model Performance in Crypto Volatility

Performance of AI Models in Volatility Prediction

Recent research highlights how AI models are outperforming traditional methods in predicting intraday volatility within cryptocurrency markets. Techniques like Long Short-Term Memory (LSTM) and Bidirectional LSTM (BiLSTM) networks excel at recognizing temporal dependencies and nonlinear patterns in high-frequency trading data. These models consistently achieve lower Mean Absolute Error (MAE) and higher predictive accuracy compared to traditional approaches such as ARIMA [7].

In a six-month live trading study, a PAR model demonstrated strong profitability across various cryptocurrencies:

- Bitcoin: 15.58% net profit compared to –44.8% for traditional methods

- Ethereum: 16.98% versus –33.6%

- Binance Coin: 9.33% versus 0.28%

- Cardano: 4.26% versus –41.8% [5]

Additionally, ensemble learning models like Random Forest and Stochastic Gradient Descent have shown superior performance in generating profits and managing risks. These models effectively identify patterns in the complex, nonlinear data that characterizes crypto markets [7]. This progress opens the door to exploring how sentiment analysis and multi-source data can further refine predictions.

Impact of Sentiment Analysis and Multi-Source Data

AI models that incorporate sentiment analysis and cross-asset volatility commonality outperform those relying on isolated data sources [3][4]. By integrating real-time sentiment data, these algorithms can anticipate market shifts influenced by trader psychology or breaking news.

Cross-asset volatility commonality - shared volatility trends among different cryptocurrencies - has proven particularly effective for options trading. Research shows that cluster-based and pooled machine learning models deliver better profit and loss outcomes than those analyzing assets individually [4].

This approach underscores how combining diverse data sources leads to more accurate and actionable volatility forecasts, surpassing the capabilities of traditional single-source methods.

Comparison of AI Models and Metrics

The performance of various AI models is evaluated using key metrics, including accuracy percentage, MAE, Mean Absolute Percentage Error (MAPE), Root Mean Squared Error (RMSE), and trading-specific measures like profit and loss percentages and the Sharpe Ratio [7].

| Model | Accuracy (%) | MAE | MAPE | Sharpe Ratio |

|---|---|---|---|---|

| LSTM | 87.5 | 0.021 | 2.8 | 1.45 |

| BiLSTM | 88.2 | 0.019 | 2.5 | 1.52 |

| Random Forest | 85.9 | 0.023 | 3.1 | 1.38 |

| ARIMA | 80.4 | 0.029 | 4.2 | 1.10 |

Among these, BiLSTM stands out with the highest accuracy (88.2%), the lowest MAE (0.019), and the best Sharpe Ratio (1.52) [7]. In contrast, traditional ARIMA models fall behind with accuracy below 81% and higher error rates.

AI-driven volatility predictions empower traders to fine-tune their entry and exit points, manage risks more effectively, and achieve better profitability with reduced losses. These models provide a significant edge, especially during periods of extreme market volatility, where traditional methods often fail to adapt quickly enough [2][7]. By responding to real-time market changes, AI systems help mitigate losses and enhance risk-adjusted returns [2].

Cryptocurrency Price Volatility and Anomaly Detection

Real-Time Volatility Tracking Using AI-Powered Platforms

AI research is no longer just theoretical - it's actively shaping the trading world. Platforms like StockioAI are taking AI insights and turning them into actionable tools, helping traders make smarter, faster decisions in real time.

StockioAI's AI-Powered Features for Traders

StockioAI combines advanced AI capabilities with a simple, user-friendly interface. The platform processes over 60 real-time data points every second, analyzing everything from technical indicators and order book data to sentiment trends. The result? Highly accurate trading signals.

These signals - categorized as Buy, Sell, or Hold - come with detailed guidance, including entry, exit, and risk parameters. For Buy signals, the AI evaluates technical indicators and market sentiment to pinpoint the best entry points. Sell signals are determined by analyzing resistance levels, momentum, and institutional activity. Hold recommendations are based on real-time assessments during market consolidations, ensuring traders stay informed about their positions.

StockioAI also integrates seamlessly with TradingView, embedding AI-generated trading levels and key support/resistance zones directly into its charts. Its AI-powered pattern recognition tools go a step further, identifying chart patterns, spotting trend reversals, and suggesting optimal entry and exit points. These features are especially helpful during periods of high market volatility. Impressively, the platform reports a 75% win rate with a profit factor of 2.95 across 35 closed trades [1].

Real-Time Alerts and Market Regime Classification

StockioAI keeps traders ahead of the curve with real-time alerts that adapt to changing market conditions. One standout feature is its market regime classification, which continuously monitors conditions and notifies users of significant shifts - whether the market transitions from trending to ranging or moves into a highly volatile state.

The platform's multi-timeframe analysis ensures traders receive alerts tailored to different time horizons, whether intraday, daily, or longer-term. By analyzing momentum across multiple timeframes, StockioAI helps traders understand the current market environment and select strategies that align with it.

For instance, when the market shifts from a calm, low-volatility phase to a high-volatility breakout, StockioAI immediately sends an alert. These notifications include explanations of the signal and highlight any associated risks. The platform's 7-tier priority system evaluates factors like market structure, volume, liquidity, RSI and MACD indicators, EMA ribbon, SMA context, and price momentum to provide a comprehensive view of the situation.

Improving Risk Management with AI

Navigating volatile markets requires smart risk management, and StockioAI delivers on that front. Its risk calculator helps traders determine the ideal position size based on their risk tolerance and current market dynamics. Automated position tracking offers real-time performance analytics, and during turbulent periods, the system may recommend tighter stop-loss levels or smaller position sizes to limit potential losses.

StockioAI also features a conflict resolution matrix that addresses 15 different scenarios for position sizing in various market conditions. This dynamic tool integrates risk assessments into the broader AI analysis, giving traders a clear understanding of potential risks for each position. By continuously monitoring active trades and adjusting recommendations as market conditions evolve, the platform helps traders avoid emotional decision-making. This disciplined approach ensures that even in extreme volatility, traders can act decisively and stay on track with their strategies.

Challenges and Future Directions in AI-Driven Volatility Analysis

AI has undeniably reshaped how we track and analyze crypto market volatility, but it’s not without its hurdles. These challenges impact trading outcomes and highlight areas where future improvements are needed.

Limitations of Current AI Models

One of the most pressing issues is overfitting. While AI models may excel during testing, they often stumble in live markets when faced with unfamiliar patterns. This happens because models can become overly reliant on historical data, making them less effective in dynamic, real-world scenarios.

Another significant challenge lies in predicting rare events. Sudden market shocks, like flash crashes or unexpected regulatory announcements, are notoriously hard to forecast. These events occur so infrequently that there’s limited training data available, leaving AI systems ill-prepared to handle the extreme volatility that follows.

Data quality and latency also pose considerable challenges. Even a delay of just a few seconds in data feeds can cause AI systems to miss rapid price swings, leading to less-than-ideal trading decisions. Inconsistent data streams or exchange-specific quirks can further degrade the accuracy of volatility estimates, undermining even the most advanced models.

Then there’s the "black box" problem - a common issue with deep learning models. These systems often operate without offering clear explanations for their predictions, leaving traders in the dark about how signals are generated. This lack of transparency can cause hesitation, especially during critical trading moments.

These obstacles underscore the need for continuous innovation in AI-driven volatility analysis.

Future Research Opportunities

Overcoming these limitations opens up exciting possibilities for advancing AI in volatility tracking.

One promising direction is the integration of alternative data sources. Future models could combine insights from social media sentiment, blockchain analytics, news feeds, and on-chain metrics, going beyond traditional price data. This approach could help detect early signs of market shifts that might otherwise go unnoticed.

The development of explainable AI (XAI) is another key area gaining traction. With increasing calls for transparency from both traders and regulators, researchers are working on models that clarify not just what the AI predicts but also why. This added layer of understanding could build trust and improve decision-making.

There’s also growing interest in cross-asset volatility analysis. A 2025 study found that models accounting for shared volatility patterns across multiple cryptocurrencies outperformed those that analyzed assets in isolation, regardless of market conditions [4]. By leveraging these interconnections, AI systems could achieve more accurate predictions.

Another area showing promise is the creation of hybrid models that blend machine learning with econometric techniques. These models aim to improve generalization across various market conditions. Additionally, real-time adaptive learning - where systems continuously update themselves with fresh market data - could enable quicker, more dynamic responses to evolving market trends.

These advancements could not only refine crypto-specific models but also have broader implications for other financial markets.

Potential for Broader Applications

The tools and techniques developed for crypto volatility tracking are already finding applications in other financial markets. For instance, methods like high-frequency data processing, multi-source sentiment analysis, and cross-asset modeling are just as relevant for equities, forex, and commodities.

In the stock market, algorithms designed for crypto analysis could help equity traders navigate volatile conditions with greater precision. These systems, capable of processing over 60 real-time data points per second, could provide actionable insights for stock trading.

Similarly, the 24/7 nature of crypto markets has driven innovations that align well with the continuous data demands of forex and commodities trading. Risk management tools originally designed for crypto could also assist institutional investors in managing diverse portfolios more effectively.

Another exciting prospect is the democratization of advanced analytics. As AI tools become more accessible, retail traders in all asset classes could gain access to analysis tools that were once reserved for large financial institutions.

While current limitations in AI-driven crypto volatility tracking present challenges, they’re far from insurmountable. Ongoing research and technological advancements are paving the way for more reliable, transparent, and adaptable AI systems. These improvements promise to enhance platforms like StockioAI, helping traders across all financial markets make better-informed decisions and manage risks more effectively.

Conclusion: Advancing Crypto Volatility Tracking with AI

AI is revolutionizing how traders approach intraday volatility in cryptocurrency markets. By moving from theoretical concepts to practical applications, AI has proven its ability to enhance trading outcomes and refine risk management strategies. These advancements are reshaping decision-making for traders in a way that traditional methods simply cannot match.

Key Takeaways for Traders

AI-driven volatility tracking has shown to outperform older, conventional methods. Research highlights that traders using AI systems achieve far better net profits compared to passive strategies during the same trading periods [5]. This is largely because AI can adapt quickly to changing market conditions and identify volatility patterns that might go unnoticed by human traders.

One of the most powerful advantages of AI is its real-time, multi-source data analysis. AI systems can process technical indicators, trading volumes, sentiment trends, and order book data simultaneously to deliver actionable insights. This speed becomes a game-changer during highly volatile moments when markets can shift in mere seconds.

Another standout benefit is improved risk management. AI tools provide precise entry and exit points, stop-loss recommendations, and confidence scores for trading decisions. By removing emotions from the equation, these systems help traders avoid costly mistakes that often arise during periods of intense market fluctuations. For instance, machine learning models like Random Forest and Stochastic Gradient Descent have consistently delivered strong results in Bitcoin trading, maintaining profitability across various market scenarios [7].

The Role of Platforms Like StockioAI

Platforms like StockioAI are making these advanced tools accessible to a broader audience. StockioAI integrates features like pattern recognition, risk analysis, and sentiment tracking to produce actionable signals. With its ability to analyze real-time data streams and generate intelligent BUY, SELL, and HOLD recommendations, the platform empowers traders to act swiftly, even without extensive technical knowledge.

StockioAI also offers flexible pricing options, ranging from free basic plans to enterprise-level solutions. This ensures that traders at all experience levels can benefit from AI's capabilities. Additionally, features like interactive charting and portfolio tracking allow users to implement and monitor AI-driven strategies with ease, turning complex data into practical trading decisions.

Looking Ahead in AI-Driven Analytics

The future of AI in trading holds immense potential. While current innovations focus on crypto volatility tracking, these advancements are already being applied to other markets like stocks, bonds, and commodities. The 24/7 nature of crypto trading has pushed the boundaries of real-time data processing, paving the way for AI systems that can adapt across various financial sectors.

One exciting development is cross-asset volatility analysis, where AI models examine shared patterns across multiple cryptocurrencies. Studies show that such approaches consistently outperform single-asset models, regardless of market conditions [1, 3]. As AI becomes more sophisticated, it will likely uncover deeper connections between different asset classes, enhancing trading strategies across the board.

Transparency is another area of focus. The rise of explainable AI aims to address concerns about how these systems make decisions, building trust among traders and regulators alike. As these tools become more understandable, adoption is expected to grow both in institutional and retail trading environments.

Finally, hybrid models that combine machine learning with traditional econometric methods are showing promise in delivering consistent performance across diverse market scenarios. With computational costs declining and algorithms becoming more efficient, platforms like StockioAI are leading the charge in making these cutting-edge tools accessible to everyone. This trend is set to redefine how traders of all levels analyze volatility and manage risk in the years to come.

FAQs

How do AI algorithms like LSTM and Random Forest improve crypto trading strategies compared to traditional methods?

AI algorithms like LSTM (Long Short-Term Memory) and Random Forest are transforming crypto trading by processing massive amounts of market data in real time. LSTM, a specialized neural network, shines when it comes to identifying patterns in time-series data. This makes it particularly well-suited for predicting short-term price changes in the fast-moving and unpredictable cryptocurrency market.

Meanwhile, Random Forest stands out for its ability to handle complex datasets. By combining multiple decision trees, it enhances accuracy and minimizes overfitting. Together, these tools offer traders a significant edge by uncovering insights that traditional methods often overlook. They can detect subtle market trends, assess risks, and generate precise buy, sell, or hold signals. Platforms like StockioAI harness these cutting-edge algorithms to deliver real-time, actionable trading strategies tailored for crypto investors.

How does sentiment analysis help AI predict crypto market volatility, and why is it important for trading decisions?

Sentiment analysis is a key tool in predicting cryptocurrency market volatility using AI. By examining data from sources like news outlets, social media platforms, and other channels, AI can assess the market's mood and opinions in real time. This helps pinpoint potential price fluctuations and emerging trends.

With this information, traders gain a clearer understanding of how emotions and public perception might impact market movements. For instance, sudden changes in sentiment can highlight opportunities to buy, sell, or hold assets, offering traders a better way to navigate the unpredictable nature of the crypto market.

What challenges does AI face when tracking intraday volatility in cryptocurrency markets, and how is current research addressing them?

Tracking intraday volatility in cryptocurrency markets presents a unique set of hurdles for AI systems. The unpredictable swings in crypto prices, the scarcity of consistent historical data, and sudden events - like regulatory announcements or massive trades - create a chaotic environment that challenges the accuracy and timeliness of AI-driven insights.

To tackle these obstacles, researchers are refining AI models using advanced techniques like deep learning and reinforcement learning. These approaches allow AI to respond more effectively to rapid market shifts. By incorporating real-time data streams and sharpening pattern recognition capabilities, AI systems are becoming better equipped to provide traders with actionable insights in the ever-changing crypto landscape.