AI stock analysis platforms simplify trading by processing vast market data into actionable insights. They help traders save time, reduce errors, and make informed decisions through features like technical analysis, pattern recognition, and risk management tools. Below are three popular platforms:

-

StockioAI: Focused on U.S. equities and ETFs, it offers real-time Buy/Sell/Hold signals, risk calculators, and market news. Pricing starts at $0 (free) or $79.99/month for premium features.

-

Trade Ideas: Designed for intraday traders, its AI engine, Holly, generates daily trade setups and adapts in real time. Pricing starts at $89/month, with no free plan.

-

TrendSpider: Automates technical charting with AI-driven pattern recognition and trading bots. Best for experienced traders, starting at $99.51/month.

These platforms cater to different trading styles and budgets, offering tools that complement human judgment for better decision-making.

Quick Comparison

| Platform | Key Feature | Best For | Starting Price |

|---|---|---|---|

| StockioAI | Real-time signals + risk tools | U.S. retail traders | $0 (free), $79.99/month |

| Trade Ideas | Intraday trade setups via Holly | Momentum day traders | $89/month |

| TrendSpider | Automated technical charting | Experienced technical traders | $99.51/month |

Each platform offers unique strengths for different trading needs, helping you choose based on your goals and workflow.

8 Powerful Ways I use AI to Research, Screen & Invest in Stocks (with demo)

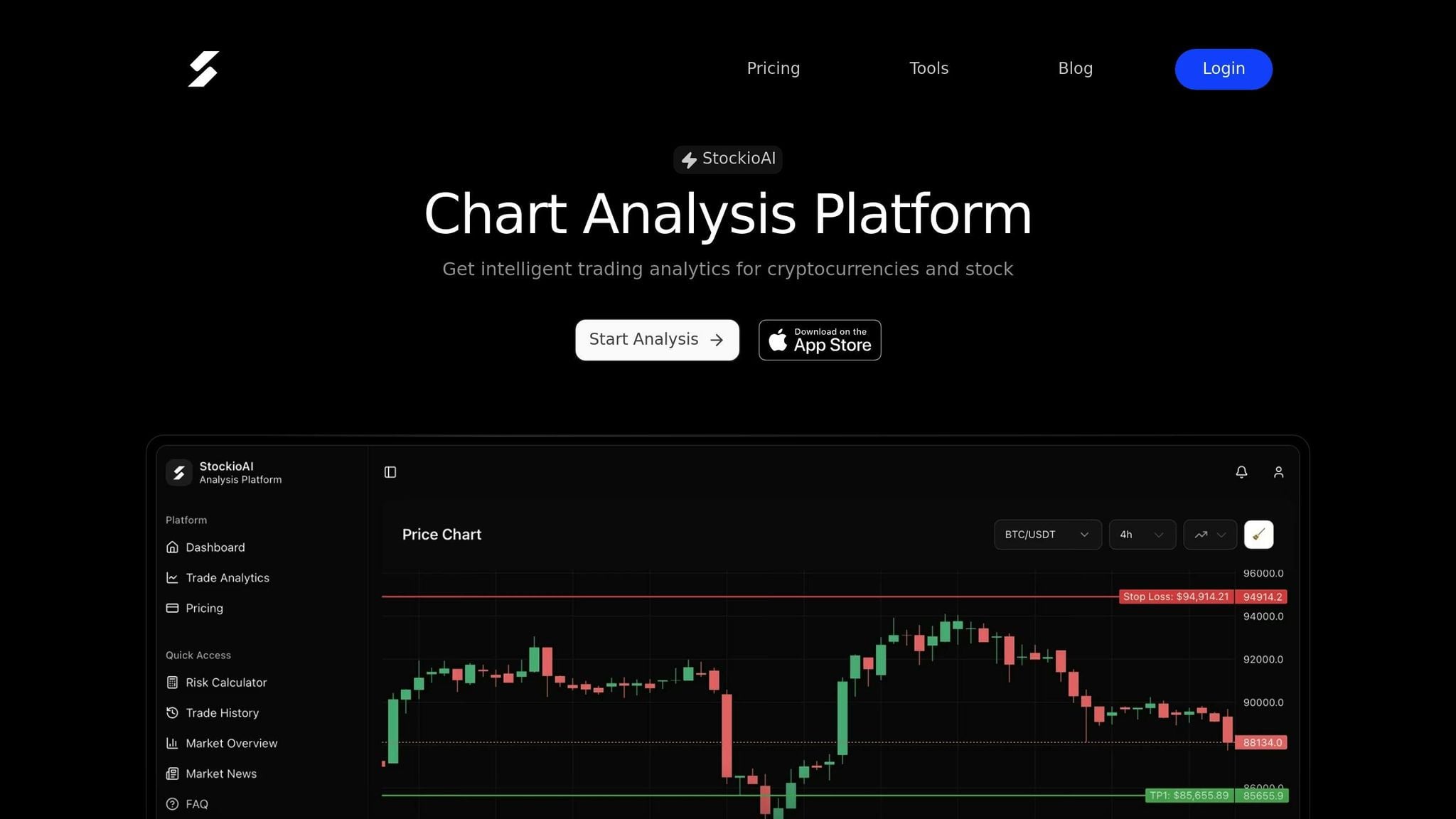

1. StockioAI

StockioAI is a cutting-edge analytics platform designed specifically for U.S. traders who need fast and actionable market insights. The system processes over 60 data points per second, such as price movements, trading volume, market sentiment, and large trades, to generate clear Buy, Sell, and Hold signals. Each signal comes with entry prices, profit targets, and confidence scores, making it easier for traders to act quickly without compromising on risk management. For those with busy schedules, this real-time intelligence simplifies research while maintaining a disciplined approach to trading. Below, we’ll break down StockioAI’s key features, including its trading signals, market coverage, risk tools, and pricing.

AI Trading Signals

StockioAI’s signal engine combines technical indicators like moving averages, RSI, and MACD with AI-driven pattern recognition to identify complex trading setups. These include breakouts, consolidations, and volatility squeezes across thousands of U.S.-listed stocks and ETFs. Each signal provides suggested entry and stop-loss levels, allowing traders to validate setups directly on their charts. The system updates continuously during regular market hours (9:30 a.m.–4:00 p.m. ET), making it suitable for both short-term intraday momentum trades and longer swing trades based on daily charts.

Jordan Martinez, Quantitative Trader, shared: "StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."[1]

Market Coverage

StockioAI focuses exclusively on U.S. equities and ETFs, ensuring alignment with domestic market trends and trading rhythms. The platform prioritizes liquid stocks from major sectors like technology, healthcare, and financials, helping traders stay in sync with earnings cycles and broader economic themes. Additionally, its market news feed compiles headlines, earnings updates, and macroeconomic developments, giving traders essential context for each AI-generated signal. Before acting on a Buy signal, traders can quickly check for upcoming earnings reports or potential regulatory issues, reducing the risk of trading during volatile events.

Risk Management Tools

Risk management is a core feature of StockioAI. The platform offers risk calculators that help traders determine position sizes, stop-loss levels, and risk-reward ratios based on their account balance (in USD) and preferred loss tolerance, typically 1–2% per trade. By inputting your account size and risk preferences, you’ll receive tailored recommendations for how many shares to trade and where to set stop-loss levels. These tools are designed to promote disciplined trading and minimize emotional decision-making.

Pricing (USD)

StockioAI provides two subscription options:

-

Free Plan: Includes 5 AI signals, basic market insights, and access to educational materials.

-

Premium Access: Priced at $79.99/month or $24.99/week, this plan unlocks unlimited AI signals, daily stock insights (e.g., AAPL, TSLA), advanced pattern recognition, recurring crypto analysis, real-time alerts, portfolio tracking, and priority customer support.

2. Trade Ideas

Trade Ideas takes a different approach compared to StockioAI, focusing on fast-paced, intraday trading opportunities. This AI-powered stock analysis platform is tailored for active traders who need quick decision-making tools. At its core is Holly, an advanced AI engine that conducts nightly backtests on thousands of U.S. stocks to identify potential trade setups for the next trading day. During market hours, Holly processes live data to refine predictions and offers updated stop-loss and take-profit levels. To streamline trading, the platform integrates with brokerages, allowing users to execute trades directly from charts with just one click.

AI Trading Signals

Holly’s strength lies in generating actionable stock picks and trade signals. Each night, it analyzes thousands of stocks, and during the trading day, it adjusts its recommendations based on real-time market data. This makes it perfect for day and swing traders who thrive on momentum and volatility. The platform also includes Money Machine, a feature that recalibrates strategies daily. Signals come with dynamic stop-loss and take-profit levels that adapt to market conditions as they unfold. Many users appreciate Holly’s ability to adapt in real time and deliver precise short-term opportunities, making it a standout for traders focused on quick gains.[2]

Market Coverage

Trade Ideas specializes in U.S. stocks, with a primary focus on intraday momentum plays. Its tools are designed for traders looking to capitalize on short-term market movements rather than those interested in long-term or international investments.

Pricing (USD)

Trade Ideas offers its advanced AI tools at a monthly subscription rate of $89.[2] However, the platform does not provide a free plan, so traders must commit to a paid subscription to unlock Holly’s full features, including real-time scanning and trade execution tools.

3. TrendSpider

TrendSpider takes the hassle out of manual technical analysis by automating tasks that typically consume hours of traders' time. Using AI, the platform identifies trendlines, candlestick patterns, and analyzes multiple timeframes with precision. Beyond its powerful charting tools, TrendSpider also offers trading bots that can automatically execute trades when specific conditions are met. For example, a bot could trigger a trade during a breakout above resistance or after an earnings surprise. With backtesting features included, users can test their strategies across various market conditions. While many platforms utilize AI for analysis, TrendSpider stands out by focusing on automating the intricate work of technical charting.

AI Trading Signals

TrendSpider's approach to trading signals is rooted in pattern recognition rather than simple buy/sell recommendations. Its AI scans charts to uncover technical setups like head-and-shoulders patterns, ascending triangles, and key support or resistance breaks. Traders can also create custom scans to pinpoint stocks breaking out of consolidation with strong volume. This feature simplifies the analysis process, especially for seasoned traders who rely on technical patterns for decision-making.

Market Coverage

TrendSpider specializes in U.S. equities, offering the historical data and intraday pricing needed for in-depth technical analysis and strategy backtesting. The platform covers stocks listed on the NYSE and Nasdaq, catering to the needs of many American traders. Unlike platforms that focus on direct signal generation, TrendSpider's emphasis on automated chart analysis showcases the variety of approaches in AI-driven trading tools.

Pricing (USD)

TrendSpider's subscription starts at $99.51 per month, providing access to advanced technical analysis tools and trading bot automation. However, it does not offer a free plan.

Strengths and Weaknesses

Let’s break down the standout features and drawbacks of each platform, summarizing how they meet the needs of different trading styles - from casual retail traders to seasoned technical analysts.

| Platform | Primary Strength | Key Weakness | Best For | Starting Price |

|---|---|---|---|---|

| StockioAI | Combines real-time Buy/Sell/Hold signals, interactive charts, risk calculators, and market news in one place | Free plan limits to 5 AI trading signals; stock analysis updates daily vs. crypto every 4 hours | U.S. retail traders seeking actionable insights with built-in risk tools and no coding needed | $0 (free), $79.99/month (premium) |

| Trade Ideas | In-depth factor analysis with 115 metrics; A-rated stocks delivered 32.52% annual returns since 2003[2] | Requires premium subscription for full access; focuses more on ratings than execution tools | Long-term investors and swing traders looking for reliable, data-driven stock ratings | $234/year[2] |

| TrendSpider | AI-powered technical charting with pattern recognition and customizable trading bots with backtesting | High cost ($99.51/month) and steep learning curve for advanced features | Experienced technical traders needing automated chart analysis and multi-timeframe insights | $99.51/month |

Focused Insights on Each Platform

StockioAI stands out for its all-in-one design, offering traders a seamless workflow with integrated signals, charts, risk management tools, and market news. It processes over 60 data points per second to deliver clear Long, Short, or Hold recommendations, complete with entry prices and confidence scores. While the free plan provides a taste of its capabilities, serious traders will need the premium option for unlimited analysis and frequent updates.

Platform B shines in fundamental analysis, leveraging 115 factors and a neural network trained over 20 years to deliver A-rated stocks with a proven track record - 32.52% annual returns since 2003[2]. This makes it ideal for investors focused on long-term strategies. However, its emphasis on stock ratings over execution tools and the need for a premium plan to unlock all features may limit its appeal to more active traders.

TrendSpider caters to advanced technical traders by automating chart analysis with AI. It identifies trendlines, candlestick patterns, and multi-timeframe setups, saving users from manual charting. The backtesting tool lets traders test strategies in various market conditions before committing real funds. However, its high monthly cost of $99.51 and steep learning curve make it a better fit for experienced users rather than beginners.

Conclusion

Here’s a quick recap of what each platform brings to the table, helping you match the right tool to your trading style and budget.

For U.S. retail traders who want an all-in-one platform that provides fast, actionable insights without requiring coding skills, StockioAI offers a streamlined solution. At $79.99 per month - or free with 5 signals - it delivers reliable signals and a smooth workflow.

If you’re a long-term investor, Platform B might be your go-to. Its factor-based approach and track record make it an affordable choice at $234 per year. However, its daily updates and limited execution tools cater more to a hands-off strategy.

For experienced technical traders, Platform C focuses on automating advanced chart analysis. Priced at $99.51 per month, it’s ideal for frequent traders needing in-depth technical insights.

Ultimately, each platform highlights the importance of disciplined trading and careful risk management. The best choice is the one that complements your trading habits and sharpens your decision-making.

FAQs

Why is StockioAI a great choice for U.S. retail traders?

StockioAI caters specifically to U.S. retail traders, providing real-time market data, AI-driven insights, and advanced tools such as technical analysis and risk calculators. Everything is designed to fit U.S. currency formats, market norms, and trading habits, helping traders confidently navigate the stock market.

With features like AI-powered pattern recognition, interactive charting, and precise Buy, Sell, and Hold signals, StockioAI equips traders with the tools they need to make smarter, data-backed decisions while staying updated on market trends.

What features does StockioAI offer for technical charting and stock analysis?

StockioAI transforms technical charting and stock analysis by offering AI-driven tools that make trading decisions easier. With real-time trading signals, it automatically identifies Buy, Sell, and Hold opportunities while using advanced pattern recognition to highlight market trends.

The platform also includes features like interactive chart analysis, customizable risk calculators, and integrated market news feeds. These tools help traders stay updated, assess risks effectively, and make smarter, data-backed decisions.

What features does the AI engine Holly offer for intraday trading?

The details about Holly, the AI engine for intraday trading, aren't specified in the available information. For a deeper understanding and accurate insights, it's best to consult the official platform or review its documentation directly.