AI trading signals are tools that predict market movements using algorithms. Platforms like StockioAI analyze real-time data, including whale movements and news sentiment, to generate Buy, Sell, or Hold recommendations. Accuracy rates for top providers range between 60–80%, with better results in highly liquid assets like Bitcoin and Ethereum.

Key insights:

-

Accuracy matters: Higher accuracy improves trading outcomes, but no system is foolproof.

-

Risk management: Tools like stop-loss and position sizing are crucial to limit losses.

-

Market conditions: Performance varies with volatility and asset liquidity.

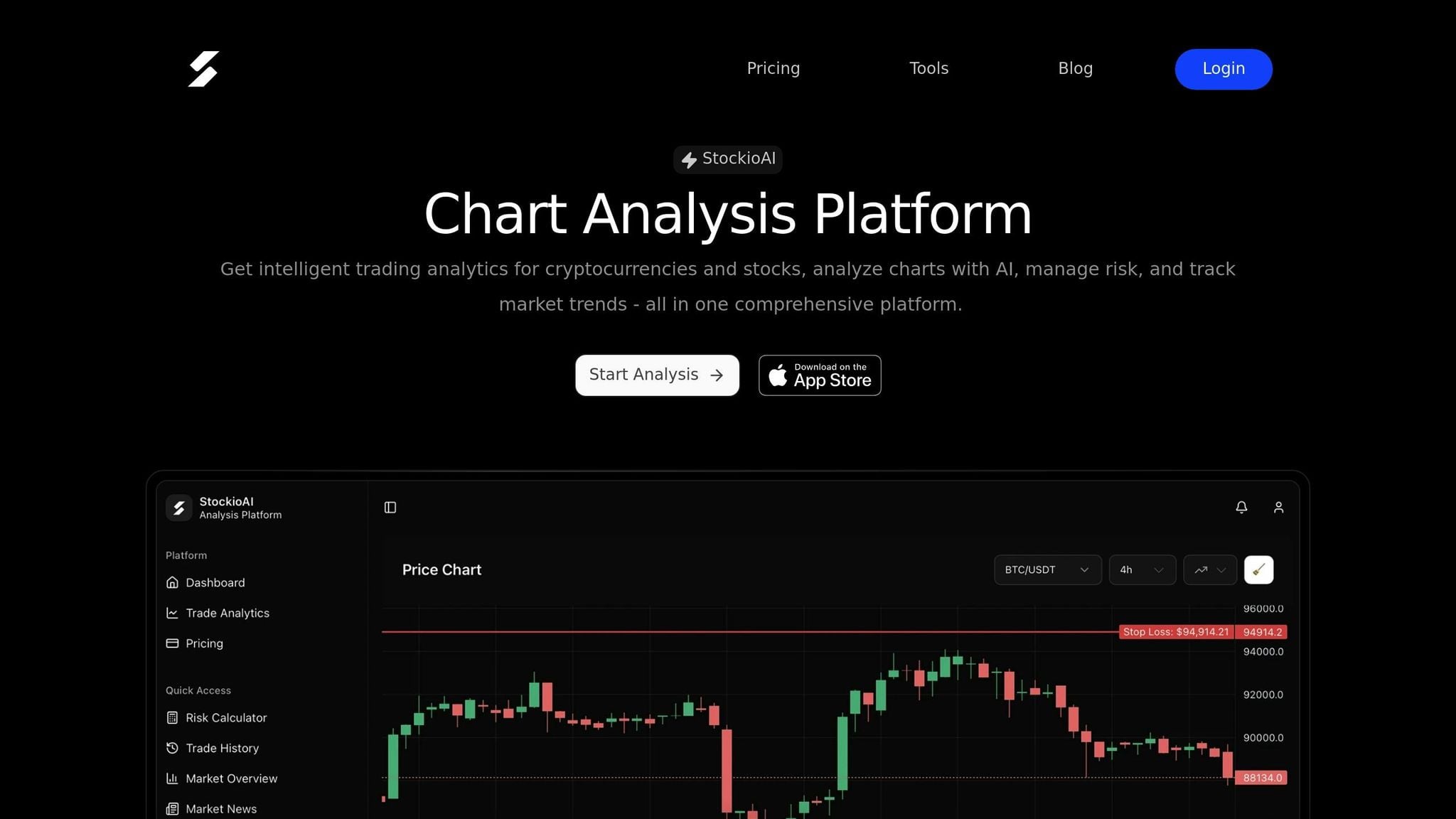

StockioAI stands out with its real-time analysis of 60+ metrics per second and risk management features, offering U.S. traders automated tools for BTC, ETH, and other major coins at $79.99/month for Premium access. However, all platforms emphasize that AI trading signals are probabilistic, not guarantees.

1. StockioAI

Signal Accuracy

StockioAI dives deep into over 60 daily market metrics, analyzing everything from whale movements and volume distributions to order flow and market sentiment. Using this data, it generates Buy, Sell, and Hold signals with precise entry points and confidence levels. Its signal accuracy typically falls within the 60–80% range, a standard among top-tier AI signal providers across various market conditions. Instead of guaranteeing wins, StockioAI focuses on giving traders a probabilistic edge by identifying high-probability setups. This is achieved through a combination of technical indicators, pattern recognition, and real-time data analysis. For U.S. traders, strict risk management is essential when using these signals, as the platform emphasizes tools that support informed trading decisions.

Asset Coverage

StockioAI zeroes in on major cryptocurrencies like BTC and ETH, along with prominent altcoins that boast significant market capitalization. Its primary focus is on highly liquid USD and USDT trading pairs, where deep order books and robust data ensure reliable signal generation. For those using the Premium Access plan, the platform automates four-hour analyses for key assets like BTC, ETH, SOL, and XRP. This constant monitoring allows traders to stay on top of multiple coins without needing to watch the markets 24/7. By scanning for opportunities across a range of assets, the platform ensures comprehensive coverage of major market pairs. However, no matter the asset, robust risk management remains critical to maintaining performance in fluctuating markets.

Risk Management Features

Every signal from StockioAI comes equipped with built-in risk management tools. These include AI-calculated stop-loss and take-profit zones, which are based on recent volatility and key support/resistance levels. The platform also features a risk calculator that helps traders control their exposure on each trade. For instance, it can limit potential losses to around 0.5–2.0% of the trader's total portfolio value and convert these limits into precise position sizes. By combining signal precision with tailored risk controls, StockioAI ensures traders can navigate volatile markets more confidently. This integrated system allows U.S. traders to consistently apply predefined risk rules, ensuring that even high-accuracy signals are paired with essential safeguards.

Market Regime Adaptability

StockioAI’s AI models are built to recognize and adjust to various market regimes - whether trending, ranging, volatile, or calm. By analyzing multi-timeframe indicators, volatility bands, and volume profiles, the platform tailors its strategies to the current market structure. For example, during bull trends, it leans toward momentum setups with wider stop-loss levels, while in sideways markets, it favors short-term mean-reversion strategies with tighter controls. This adaptability ensures that the platform can respond effectively to shifting market conditions, giving traders an edge regardless of the market’s mood.

2. Other AI Signal Providers

Signal Accuracy

AI platforms in the trading space often aim for a signal accuracy rate between 60% and 80%. They achieve this by using advanced machine-learning engines to detect trend reversals, breakouts, and shifts in market momentum. For example, altFINS employs sophisticated algorithms to identify market patterns, while AltSignals' ActualizeAI continuously learns from historical trading data to fine-tune its predictions [3]. These systems typically rely on a mix of technical indicators like RSI, MACD, and EMAs, combined with price action analysis. Some even incorporate sentiment or liquidity data to enhance their predictions. However, the reliability of these signals often hinges on the quality of the data and how frequently the models are retrained to align with current market dynamics [2]. These differences can lead to variations in asset coverage and risk management approaches among providers.

Asset Coverage

The range of assets analyzed varies widely among leading signal providers. For instance, altFINS scans over 3,000 cryptocurrencies across more than 30 exchanges, using over 120 technical indicators. It also offers curated trade setups for the top 50 coins [3]. On the other hand, many platforms focus on major assets like BTC, ETH, and large-cap altcoins, prioritizing deep liquidity and reliable data for USD and USDT pairs. For U.S.-based traders, platforms with broader asset coverage are most useful when paired with filters for minimum trading volume and market capitalization. This is because smaller tokens with thin liquidity can lead to slippage and less reliable trade execution. Beyond asset selection, these platforms also stand out in how they handle risk management.

Risk Management Features

A key feature of many AI platforms is the integration of risk management tools within their alerts. These tools often recommend stop-loss and take-profit levels based on recent volatility and key support or resistance levels [3]. For example, altFINS allows users to execute risk-managed trades via API, automatically placing stop-loss and take-profit orders. Many platforms also include position sizing calculators to help traders manage risk, often limiting potential losses to 1–2% of total account equity per trade [2]. For U.S. traders managing portfolios in USD, these tools ensure consistent application of risk parameters, making portfolio management more straightforward.

Market Regime Adaptability

Top-tier AI platforms are designed to adapt to changing market conditions. Their algorithms can shift between trend-following and mean-reversion strategies as needed, adjusting the weight of technical indicators or modifying risk thresholds in response to changes in volatility, correlation, and liquidity [2]. Platforms that incorporate continuous learning and walk-forward optimization tend to deliver more consistent accuracy during both bullish and bearish markets. While all platforms claim to adapt to market conditions, the specifics of how they retrain algorithms and reweight indicators often differ. This creates a noticeable advantage over static systems that rely solely on fixed indicators, particularly when market structures evolve.

AI Crypto Trading: 70% Accurate Buy and Sell Signals Using RSI & Python (MUST WATCH)

Pros and Cons

When evaluating AI signal providers, it's crucial to weigh the trade-offs between features like signal accuracy, automation, risk tools, transparency, and ease of use. Below is a comparison of StockioAI and other leading AI platforms.

| Aspect | StockioAI | Other AI Signal Providers |

|---|---|---|

| Data Quality & Precision | Real-time precision. Monitors 60+ data points per second, including sentiment and whale movements. Delivers clear entry, exit, and confidence scores based on what is happening now. |

| Volume over value. Often analyzes thousands of coins using historical data. This creates "signal noise" and lag, as indicators react to past price action rather than current market flow. | | Risk Management | Integrated safety. Risk-reward ratios and stop-loss levels are built into every signal. Capital preservation is part of the algorithm, not an optional setting.

| Manual effort. Often relies on third-party calculators or complex API setups to manage risk. The burden of protecting capital is left entirely to the user. | | User Experience | Institutional tools, simplified. Access professional-grade features like Volume Profile, VPOC, and Order Flow in a clean web dashboard. No technical setup required.

| High friction. Frequently relies on disjointed Telegram bots or requires technical API configuration. The interface is often cluttered or difficult for non-developers to navigate. | | Market Coverage | Multi-asset intelligence. Automates analysis for both Crypto (every 4 hours) and Stocks (daily). You get a holistic view of the market in one subscription.

| Fragmented. Usually specialized in only one asset class. To get similar coverage, a user would likely need multiple subscriptions or platforms. | | Transparency & Logic | Clear methodology. The AI identifies specific patterns and explains the trade logic. It aims for consistent, sustainable returns by filtering out low-confidence setups.

| The "Black Box" problem. Algorithms are often opaque, leaving traders to follow signals blindly. When the market shifts, users are left guessing why the system is failing. |

This comparison highlights the strengths and weaknesses of each option. It’s worth noting that no provider can predict extreme market events or compensate for incomplete data during rapid, low-liquidity conditions.

For U.S. traders, the choice often comes down to prioritizing integrated analytics with risk tools or opting for platforms that offer broader asset coverage and multi-exchange automation. Ultimately, AI signals should be treated as tools to support decision-making. Pair them with thorough research, clear risk management strategies, and a diversified portfolio for the best results.

Conclusion

StockioAI emerges as a robust AI analytics platform, combining AI-driven Buy, Sell, and Hold signals with tools like charting, risk calculators, and pattern recognition. User testimonials frequently highlight its effectiveness in delivering actionable insights and simplifying the trading process[1].

For swing traders and active position traders in the U.S., StockioAI offers a well-rounded solution. The platform excels at providing precise entry points, confidence scores, and integrated risk management tools - all in one place. This eliminates the hassle of juggling multiple tools. At $79.99 per month, the Premium plan provides unlimited signals and automated analysis every four hours, making it a practical choice for traders who need regular updates and comprehensive coverage[1].

While other AI signal providers may focus on different aspects like broader automation or unique features, most report accuracy rates between 60–80%. However, even the best AI-driven tools emphasize that no system can completely eliminate trading risks.

FAQs

How does StockioAI deliver accurate cryptocurrency trading signals?

StockioAI uses cutting-edge machine learning algorithms to sift through massive volumes of market data in real time. It pinpoints essential chart patterns, spots trend reversals, and identifies support and resistance levels to deliver precise Buy, Sell, and Hold signals tailored for a wide range of cryptocurrencies.

What sets it apart is its ability to adjust on the fly. Its AI-driven tools continuously respond to shifting market conditions, keeping trading signals sharp and actionable. This ensures traders have the insights they need to make confident, well-informed decisions.

What tools does StockioAI provide for managing trading risks?

StockioAI provides traders with powerful risk management tools to help make smarter decisions and safeguard their investments. With these features, users can calculate position sizes, set accurate stop-loss levels, and identify the best leverage for every trade. Incorporating these tools into their trading strategies allows users to handle potential risks more effectively while working toward their financial objectives.

How does StockioAI adjust its strategies for changing market conditions?

StockioAI leverages cutting-edge AI tools to fine-tune its strategies as market conditions evolve. By examining chart patterns, spotting trend reversals, and pinpointing the best entry and exit points, it adjusts dynamically to stay aligned with the shifting market landscape.

This adaptability is fueled by real-time data, sentiment analysis, and technical indicators, providing traders with the insights they need to make smart decisions - even during unpredictable market swings.