AI is transforming crypto trading by enabling real-time data ingestion and analysis, helping traders make faster, data-driven decisions in volatile markets. Here's what you need to know:

- What is Real-Time Data Ingestion? It involves continuously collecting and processing live data from sources like exchanges, blockchains, and social media to provide instant insights.

- Challenges in Crypto Data Processing: Issues like fragmented data sources, high data volumes, latency, and inconsistent quality make real-time analysis difficult.

- How AI Helps: AI automates data processing, integrates multiple data streams, and identifies actionable patterns using tools like Natural Language Processing (NLP) and machine learning.

- Key Benefits: Faster signal generation, improved trade timing, and reduced false positives. For example, AI-powered bots have achieved up to 9.3% higher profits and 62% win rates in trading tests.

- Core Components of AI Systems: These include data ingestion engines, feature engineering layers, signal generation models, and risk management tools.

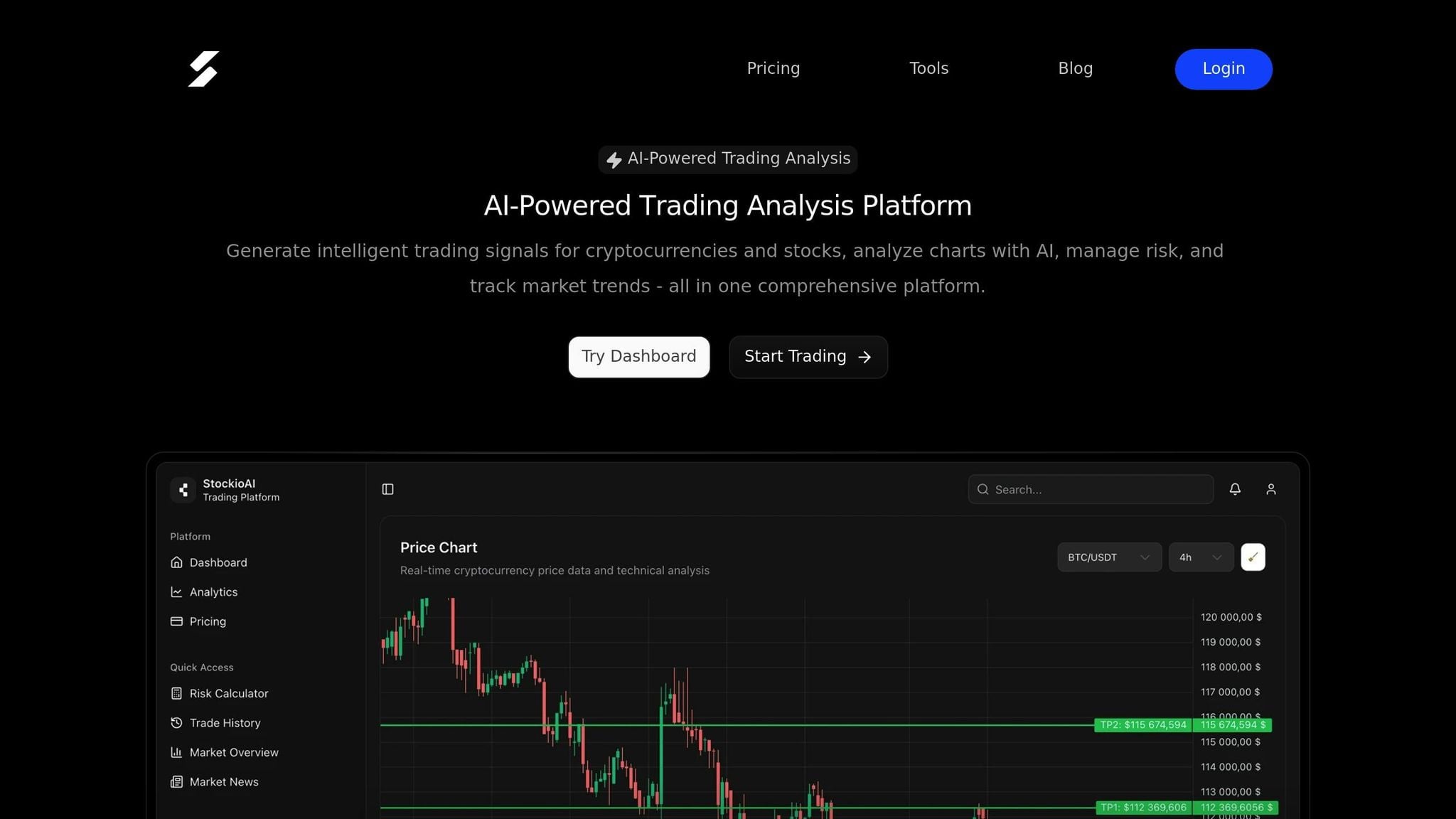

AI-powered platforms like StockioAI analyze over 60 data points per second, combining technical, sentiment, and on-chain data to deliver precise trading recommendations. As crypto markets evolve, integrating AI-driven tools is becoming critical for staying ahead.

How AI Improves Real-Time Data Ingestion in Crypto

AI-Powered Automation in Data Processing

AI has reshaped the traditionally cumbersome ETL (extraction, transformation, and loading) process into a smooth, automated workflow. It connects directly to exchange APIs, on-chain analytics platforms, and sentiment feeds, ensuring data is standardized and free from inconsistencies.

By leveraging low-latency infrastructures like Redis and RabbitMQ, AI enables rapid signal processing, which is essential for timely trade execution in the fast-paced world of crypto trading. This speed can mean the difference between profit and loss in markets where prices can shift in mere seconds.

Take StockioAI, for example. It processes over 60 data points per second, achieving a 75% win rate across 35 trades with a profit factor of 2.95 [1]. While traditional systems might take minutes to gather and process data from multiple sources, AI-powered automation completes these tasks in milliseconds. This speed advantage not only saves time but also provides traders with a more reliable foundation for market analysis.

AI-Driven Market Analysis Features

Modern AI systems excel at identifying patterns in order books, spotting subtle signals that human traders could easily miss. These systems can detect liquidity walls, iceberg orders, and price-volume divergences - clues that often indicate upcoming market movements.

Natural Language Processing (NLP) takes this a step further with sentiment analysis. AI tools monitor social media, news outlets, and online forums to gauge market sentiment, turning these insights into actionable trading signals. Unlike basic keyword matching, NLP can understand context, sarcasm, and nuanced opinions, providing a more accurate read on market psychology.

AI also shines in anomaly detection, identifying unusual trading activity or potential market manipulation in real time. By learning what "normal" market behavior looks like, these systems can instantly flag deviations, signaling possible price shifts or security risks.

StockioAI demonstrates the potential of AI-driven analysis by automatically recognizing chart patterns, trend reversals, and ideal entry or exit points. It evaluates a wide range of metrics, including resistance levels, momentum indicators, volatility patterns, and institutional flows. This real-time analysis generates precise trading recommendations by integrating insights from multiple data sources.

Combining Multiple Data Sources

AI's real power in crypto lies in its ability to merge and analyze data from multiple sources simultaneously. Exchange APIs provide real-time price data, order book details, and trading volumes. On-chain analytics reveal wallet movements, smart contract interactions, and network activity. Meanwhile, sentiment feeds track market psychology on platforms like Twitter, Reddit, and trusted news outlets.

Sophisticated algorithms filter out irrelevant noise, ensuring that meaningful signals - like a sudden spike in social mentions - are cross-referenced with on-chain data for accuracy.

StockioAI exemplifies this multi-source approach by analyzing technical indicators, market sentiment, order book depth, and whale movements all at once. This comprehensive analysis produces robust trading signals with higher confidence levels.

"The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader

This integrated approach represents a major shift from traditional trading methods. Instead of relying on isolated data points or intuition, traders now have access to AI systems that continuously assess the entire market landscape. These insights, nearly impossible to gather manually, are transforming how decisions are made in the crypto world.

Build a Python Trading Bot for Algorithmic Trading Using AI

| Full Tutorial

Core Components of an AI-Optimized Data Pipeline

An AI-driven pipeline for crypto trading connects data collection to trade execution, processing over 60 real-time data points every second. Each layer has a specific role, turning raw market data into precise, actionable trading decisions.

Data Ingestion and Processing

Everything starts with efficient data ingestion, pulling in information from various sources to create a comprehensive view of the market. Exchange APIs supply real-time price updates, order book snapshots, and trading volumes from platforms like Binance and Bybit. Persistent connections via WebSockets ensure instant updates, while tools like Apache Kafka manage high-speed data streams with reliability.

At this stage, low-latency processing is critical. Technologies like RabbitMQ and Redis help process data in milliseconds, an essential factor in crypto markets where even tiny delays can lead to missed opportunities or losses [3].

The ingestion engine plays a vital role in collecting, validating, and standardizing data. It aligns timestamps, filters out anomalies, and reduces noise, ensuring that only clean, reliable data moves forward [3].

Take StockioAI as an example. This platform processes over 60 data points per second, including technical indicators, trading volumes, market sentiment, order book depth, and even whale movements. Thanks to its real-time data handling, StockioAI maintains a 75% win rate across 35 trades, achieving a profit factor of 2.95 [1].

This clean data serves as the foundation for the next step: feature engineering.

Feature Engineering for AI Models

Once data is normalized, it’s transformed into meaningful features for AI models. Raw market data gains value when converted into indicators like RSI, MACD, Bollinger Bands, and custom momentum metrics. On-chain analytics, such as active wallet addresses and token velocity, add another layer of context to these technical indicators.

Natural Language Processing (NLP) also plays a key role, analyzing sentiment from social media posts, news, and forums. Advanced NLP models capture subtle nuances and context to produce accurate sentiment signals [2]. Additionally, time-based features - such as 5-minute, 1-hour, and 24-hour volatility metrics - help models identify patterns that might not be obvious from raw data.

For instance, in 2024, a mid-sized quant fund created an automated trading bot that combined on-chain alerts with NLP sentiment analysis. When tested on the BTC/USDT pair over four months, it delivered a 9.3% net profit, outperforming traditional MACD strategies [3].

| Component | Function | Key Technologies |

|---|---|---|

| Data Ingestion Engine | Collects live market, sentiment, and on-chain data via APIs | Exchange APIs, WebSockets, streaming platforms |

| Feature Engineering Layer | Converts raw data into actionable inputs for AI models | Data normalization, smoothing, outlier detection |

| Signal Generation Engine | Predicts trade direction or market volatility | Machine Learning, NLP, Deep Learning (e.g., LSTM networks) |

| Execution Module | Executes and manages trades using exchange APIs | Order management systems, exchange APIs |

| Risk Control System | Implements risk limits and capital management | Automated risk tools, position sizing algorithms |

Risk Management and Trade Execution

Building on the signals generated, the final stage integrates risk management with trade execution. This system continuously monitors market conditions, adjusts stop-loss and take-profit levels dynamically, and fine-tunes position sizes based on real-time data. Unlike static systems, AI-powered risk management adapts to shifting market environments [4] [5].

Position sizing algorithms calculate trade amounts by considering account balance, risk tolerance, and signal confidence. This dynamic method protects capital during volatile periods and capitalizes on favorable market conditions.

Trade execution involves more than just placing orders. AI systems optimize timing, pricing, and venue selection to reduce slippage and boost profitability. Advanced systems might also execute arbitrage strategies across exchanges or use market-making algorithms to capture spreads [6].

The risk management layer includes constant monitoring for unusual activity or potential manipulation. This proactive approach flags irregularities, offering early warnings of price shifts or security threats.

StockioAI’s risk calculator is a great example of this integration. It helps traders determine position sizes, stop-loss thresholds, and leverage levels. The platform also provides clear entry points, profit targets, and confidence scores for both BUY and SELL decisions.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader

Together, these components form a seamless loop: data flows from ingestion to feature engineering and signal generation, while risk management and execution systems act on the insights with safeguards in place. This interconnected approach offers a more advanced alternative to traditional methods that rely on isolated indicators or manual decisions.

Case Studies and Applications

AI-powered data ingestion is transforming trading strategies by seamlessly integrating multiple data sources. Let’s explore some real-world examples that showcase how this technology is making a difference.

Case Study: On-Chain Alerts and Sentiment Signals

In early 2025, a mid-sized quant fund developed an automated trading bot that combined on-chain alerts with NLP-based sentiment analysis. The goal? To detect market movements before they reflected in price action. The system continuously monitored blockchain activity - such as transaction volumes, wallet movements, and smart contract interactions - while analyzing sentiment data from platforms like Twitter, Reddit, and news feeds [3].

Here’s how it worked: the bot correlated live sentiment data with price trends. For example, when bearish sentiment spiked - indicated by a surge in negative tweets about a cryptocurrency - the system issued sell signals before the broader market caught on.

The results were impressive. Backtesting the BTC/USDT pair over four months showed a 9.3% net profit increase compared to traditional MACD strategies. This gain came from the bot’s ability to identify sentiment-driven shifts early, allowing the fund to exit positions before downturns and enter ahead of upward momentum [3].

What made this system stand out was its ability to validate social sentiment with blockchain activity. By focusing on signals backed by real capital flows, the bot filtered out noise and false positives, delivering more reliable trading insights.

Case Study: AI-Driven Order Book Analysis

AI also shines in high-frequency trading. A Bybit-based operation implemented a system using reinforcement learning to analyze order book imbalances. The AI monitored order book depth across exchanges, identifying patterns that hinted at price movements within milliseconds.

The system excelled at spotting anomalies created by large institutional orders. For instance, when an order imbalance occurred, the bot executed offsetting trades to capture price gaps before manual traders could respond. The reinforcement learning model continuously adapted to market feedback, which proved essential during volatile periods.

The performance was outstanding. Over 30,000 trades, the system achieved a 62% win rate, showcasing the power of AI in high-frequency strategies [3]. Unlike static rule-based bots that struggled with changing market conditions, the adaptive AI maintained profitability across trending, ranging, and volatile market phases.

StockioAI in Action

StockioAI takes these advancements further, offering traders a comprehensive AI-powered platform. It processes over 60 data points per second, including technical indicators, trading volumes, sentiment analysis, order book depth, and whale movements, to generate precise BUY, SELL, and HOLD signals [1].

For BUY signals, StockioAI evaluates multiple factors simultaneously - technical trends, volume patterns, support levels, sentiment shifts, and even social media activity. Each signal includes detailed entry points, stop-loss levels, profit targets, and confidence scores.

The platform also features a dynamic risk calculator, helping traders optimize position sizes based on real-time market conditions and personal risk tolerance. This adaptive tool outperforms static risk management systems by responding to changing market volatility and sentiment.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader [1]

StockioAI’s pattern recognition capabilities are another game-changer. By blending on-chain and sentiment data with traditional technical analysis, it identifies chart patterns and trend reversals that single-source tools often miss. This is especially useful during market transitions, where price action diverges from underlying sentiment and blockchain activity.

Interactive charts further enhance the user experience, integrating AI-generated trading levels, support and resistance zones, and alerts. This ecosystem empowers traders to make informed decisions, bridging the gap between institutional-grade tools and individual investors. With StockioAI, sophisticated trading strategies become accessible to everyone, improving trade execution and risk management through advanced data processing.

Best Practices and Future Trends in AI-Driven Data Ingestion

Best Practices for AI-Powered Data Pipelines

Creating dependable AI-powered data pipelines requires a strong foundation in infrastructure and ongoing maintenance. For crypto trading systems, low-latency processing is critical. Tools like RabbitMQ for message queues and Redis for real-time databases ensure that signals are delivered in milliseconds - an essential feature in markets where even small delays can result in substantial losses [3].

Equally important is data integrity. Effective systems employ audit trails and detailed logging for all data transformations, allowing issues to be identified and resolved quickly. Steps like normalizing inputs, applying smoothing techniques to reduce noise, and flagging outliers help ensure that trading decisions are based on clean, reliable data [3].

To keep up with the fast-changing nature of crypto markets, frequent model retraining is a must. Market patterns shift rapidly, and yesterday’s models can quickly become outdated. Automated pipelines that gather fresh data, update feature sets, and validate model outputs before deployment are essential for staying competitive [2][4].

Security measures are another cornerstone of robust pipelines. Protect sensitive trading data by encrypting it during transit, securing API endpoints, and monitoring for unauthorized access attempts [4]. Stress testing the system also ensures it can handle extreme market conditions. These practices lay the groundwork for adopting the future innovations discussed below.

Future Trends in AI for Crypto

The landscape of AI in crypto trading is rapidly evolving, with emerging trends promising to enhance efficiency and insight. These advancements build on existing best practices to push the boundaries of what’s possible in data processing.

Federated learning is one such trend, enabling secure collaboration between exchanges without compromising privacy. This approach allows platforms to share insights and improve AI models without exposing raw trading data, reducing the risk of breaches and helping platforms meet regulatory requirements [4].

Another game-changer is Edge AI, which processes data directly on trading devices and exchange nodes. By handling computations locally, Edge AI reduces latency - a critical advantage for high-frequency traders, where even microsecond improvements can lead to better execution prices. It also enhances system resilience by minimizing reliance on network connections [4].

Explainable AI (XAI) is gaining traction as traders demand greater transparency in AI-driven decisions. XAI provides insights into how models arrive at their recommendations, helping users understand the logic behind specific trades. This clarity not only builds trust but also allows traders to identify potential biases or errors in their systems [4].

Lastly, multimodal data integration is set to revolutionize market analysis. Future systems will combine diverse data types - like text, images, and blockchain events - for a more comprehensive view. For instance, social media images, videos from crypto conferences, and visual chart patterns can be analyzed alongside traditional data streams, offering richer insights into market sentiment and trends.

Key Takeaways and Final Thoughts

The integration of these best practices with cutting-edge innovations highlights the transformative role of AI in crypto trading. Today’s systems can process over 60 data points per second, blending technical indicators with emerging sources like sentiment analysis and whale activity [2][4]. This multifaceted approach enables traders to react instantly to market shifts and uncover opportunities that would otherwise go unnoticed.

The shift from rigid, rule-based systems to adaptive AI models marks a significant evolution. Unlike traditional strategies that struggle with changing conditions, AI systems continuously learn and adapt. The results are striking - sentiment-driven trading bots have shown profit improvements of 9.3%, while reinforcement learning systems boast win rates of 62% [3].

Success in this fast-paced environment hinges on adopting best practices like low-latency infrastructure, robust data integrity measures, and regular model updates. As technologies like federated learning, Edge AI, and Explainable AI mature, early adopters will gain a decisive edge.

The crypto market’s around-the-clock activity and intense volatility make it an ideal testing ground for AI advancements. Platforms like StockioAI are already making sophisticated data processing tools accessible to individual traders, leveling the playing field once dominated by institutional players. As these technologies continue to evolve, the gap between human and AI-assisted trading will grow, making AI integration not just an advantage but a necessity for staying competitive in future markets.

FAQs

How does AI improve the speed and precision of crypto trading decisions?

AI plays a powerful role in transforming crypto trading by offering real-time data processing and analysis. It can quickly sift through massive amounts of market data, spotting trends, patterns, and irregularities that human analysis might overlook.

Using features like technical analysis, AI-powered pattern recognition, and advanced risk management tools, traders can make quicker and more precise decisions. This is especially crucial in the fast-paced cryptocurrency market, where both timing and accuracy can make all the difference.

What challenges might arise when using AI in cryptocurrency trading platforms?

Integrating AI into cryptocurrency trading platforms offers exciting opportunities, but it doesn’t come without its hurdles. A major issue lies in the quality and reliability of data. AI systems thrive on accurate, real-time information, and any glitches or inconsistencies in data streams can lead to flawed predictions or misguided decisions, which no trader wants.

Then there’s the issue of market volatility. The crypto market is notorious for its wild swings, and sometimes these shifts happen faster than AI algorithms can adjust. This lag can result in outcomes that traders didn’t anticipate, highlighting the need for careful monitoring.

Another concern is the risk of over-relying on AI tools. While these systems can improve decision-making by analyzing vast amounts of data, traders should still use their own judgment. Blindly trusting automated systems can lead to mistakes that could have been avoided with a human touch.

Lastly, security and privacy are critical considerations. AI platforms often deal with sensitive financial information, making them attractive targets for cyberattacks. Implementing strong security measures is non-negotiable to protect both the data and the users.

How does AI use sentiment analysis to forecast market trends and enhance cryptocurrency trading strategies?

AI uses sentiment analysis to gauge market emotions by examining data from sources like news articles, social media, and other online platforms. This approach uncovers trends in how traders and investors perceive specific cryptocurrencies, which can play a role in shaping market behavior.

StockioAI takes this a step further with its advanced AI-driven sentiment analysis tools. By interpreting these market sentiments, the platform equips traders with insights that can refine their strategies, enhance decision-making, and minimize risks in the trading process.