AI-driven allocation strategies are transforming how investors manage cryptocurrency portfolios. These systems use machine learning, reinforcement learning, and real-time data to make smarter, faster decisions compared to older methods. Here's what you need to know:

-

Machine Learning-Based Index Systems: These analyze vast datasets to build and rebalance portfolios, offering better diversification and risk control. Popular among long-term investors.

-

Reinforcement Learning Agents: These adapt in real-time, using trial-and-error to optimize returns and manage risks dynamically. Ideal for active traders in volatile markets.

-

StockioAI: A user-friendly platform blending machine learning and reinforcement learning to provide actionable trading signals, real-time risk management, and tailored portfolio recommendations.

Quick Comparison

| Strategy | Risk Management | Return Potential | User Accessibility | Best For |

|---|---|---|---|---|

| Machine Learning Index | Monitors volatility, rebalances periodically | High (304% over 6 years) | Moderate | Long-term, passive investors |

| Reinforcement Learning Agents | Dynamic, real-time adjustments | Very High (1,640% over 6 years) | Low (requires expertise) | Active traders |

| StockioAI | Real-time alerts, automated tools | Strong (75% win rate) | High (beginner-friendly) | Retail and professional investors |

Each approach has strengths and trade-offs. Whether you're a passive investor or an active trader, selecting the right strategy depends on your goals, risk tolerance, and market understanding.

Build THE BEST Crypto Portfolio with AI (ChatGPT, Grok)

1. Machine Learning-Based Index Systems

Machine learning-based index systems are reshaping how portfolios are managed, especially in the fast-moving world of cryptocurrency. These systems showcase the power of AI to adapt quickly to the unpredictable nature of crypto markets. By leveraging advanced algorithms, they can analyze massive datasets and make automated decisions about which assets to include, how to weight them, and when to rebalance portfolios. Unlike traditional indices that often rely on straightforward rules like market cap weighting, AI-driven systems evaluate over 80 metrics per token. These metrics range from technical analysis and fundamental data to sentiment indicators, providing more nuanced portfolio recommendations [6].

To understand their effectiveness, it’s crucial to delve into the technology behind these systems and how they operate.

Technology and Logic

At the heart of these systems is a mix of supervised and unsupervised learning models. Supervised approaches, like regression and decision trees, work alongside unsupervised techniques such as clustering for grouping assets [3][5]. More advanced platforms also implement ensemble methods like random forests and gradient boosting to improve accuracy. Some even incorporate deep learning for forecasting and natural language processing to assess sentiment [5][4].

These systems are constantly processing real-time data from markets, macroeconomic trends, and alternative sources. This allows them to detect patterns that might escape human analysts and adjust portfolio allocations using predictive analytics. In the crypto space, the integration of on-chain and market metrics plays a key role in this process.

One common strategy used by these systems is the core-satellite portfolio model. For crypto markets, this might mean allocating 60% to core assets like Bitcoin and Ethereum, 30% to diversifiers such as altcoins and DeFi tokens, and 10% to stablecoins or tokenized yield products [2]. This model has gained traction among institutional investors in the U.S., proving its effectiveness in dynamic markets.

Beyond their technological capabilities, these systems are particularly adept at managing risk.

Risk Management Effectiveness

Machine learning-based index systems excel in managing risk dynamically. They continuously monitor factors like market volatility, asset correlations, and tail risks. Techniques such as Value-at-Risk (VaR), volatility targeting, and stress testing are built into their allocation logic. These systems can automatically detect unfavorable market conditions and rebalance portfolios in real time to maintain desired risk levels [2][3].

This adaptability is especially critical in cryptocurrency markets, where prices can swing dramatically within minutes. By analyzing multiple risk indicators at once, these systems can identify potential issues before they escalate. For example, they use correlation matrices to adjust allocations, ensuring diversification remains optimal even as market relationships shift. This helps spread investments across various assets, reducing the risk tied to any single one [3].

Return Optimization

When it comes to returns, machine learning-based indices often outperform traditional strategies. For instance, Token Metrics’ AI-selected crypto baskets have reported returns of 8,000% since their inception. While past performance doesn’t guarantee future results, these numbers highlight the potential of AI-driven strategies [3].

Research suggests that allocating just 1–3% of a portfolio to AI-powered crypto indices can significantly improve overall portfolio efficiency. This is achieved through higher Sharpe ratios and limited drawdowns [3]. Backtests also show that these indices consistently outperform Bitcoin-only strategies, particularly when rebalanced weekly [3]. The key lies in their ability to remove underperforming assets, capitalize on outperformers, and spot emerging trends before they gain widespread attention [3][6].

From 2015 to 2024, portfolios using machine learning-driven allocations have consistently delivered better risk-adjusted returns compared to static models, especially during volatile periods [2][3]. These algorithms are skilled at exploiting short-term market inefficiencies while adapting to changing conditions.

Market Suitability

Machine learning-based index systems thrive in liquid, data-rich markets like U.S. equities and cryptocurrencies [2][3]. Their strength lies in navigating fast-paced, interconnected markets by analyzing diverse data sources to make informed allocation decisions [2].

Cryptocurrencies, with their 24/7 trading cycles, high volatility, and wealth of on-chain data, are an ideal playground for these systems [3][4]. They can simultaneously process blockchain analytics, social media sentiment, and traditional technical indicators to optimize portfolios.

These systems are particularly appealing to investors who want consistent, long-term growth rather than speculative, high-risk returns. For U.S.-based investors, they can be customized to align with local market practices and regulatory requirements, offering transparency and robust analytical insights [3].

2. Reinforcement Learning Trading Agents

Reinforcement learning (RL) trading agents are reshaping the landscape of AI-driven portfolio management. Unlike traditional machine learning models that depend heavily on historical data, RL agents thrive on real-time market interactions. They learn by trial and error, refining their strategies based on feedback from their actions - whether it’s buying, selling, or holding. In cryptocurrency trading, this means these agents adjust their decision-making policies to maximize cumulative returns as they observe how their actions impact portfolio performance and market conditions.

This continuous evolution makes RL agents particularly effective in the unpredictable world of cryptocurrency, where market conditions can shift rapidly. Unlike static strategies that rely on past patterns, RL systems adapt dynamically, offering a fresh approach to tackling market volatility.

Technology and Logic

RL trading agents rely on advanced algorithms like Deep Q-Networks (DQN), Policy Gradient methods such as PPO, and Actor-Critic models. These tools enable them to process a wide range of market data, including prices, trading volumes, volatility, technical indicators, portfolio composition, and available capital. The reward functions used by these agents are designed to balance returns with risk, often incorporating metrics like the Sharpe ratio or penalties for excessive drawdowns to ensure steady performance.

Neural networks power these agents, allowing them to analyze complex market data and make allocation decisions across various cryptocurrencies. They adjust position sizes based on patterns of risk and reward they’ve learned, continuously evolving as new market data flows in. This level of sophistication helps them identify opportunities and patterns that might go unnoticed by human traders.

Risk Management Effectiveness

One area where RL agents excel is risk management. They integrate risk-adjusted metrics, such as the Sharpe ratio, directly into their reward functions, which naturally discourages excessive volatility relative to returns [3].

These agents also employ dynamic position sizing, reducing exposure during periods of high volatility and increasing allocations when markets stabilize [2]. Portfolio-level risk constraints, like maximum drawdown limits and Value-at-Risk (VaR) thresholds, are built into their systems to guard against major losses.

To further ensure diversification, RL agents analyze correlations between assets, avoiding over-concentration in highly correlated cryptocurrencies [3]. Some implementations even simulate stress scenarios - like sharp Bitcoin price drops or significant protocol exploits - during their training. This prepares them to react effectively to extreme market conditions before they happen in real trading environments [2].

This proactive approach to managing risk gives RL agents an edge over traditional, more reactive methods, offering investors a more consistent way to protect against significant downside risks.

Return Optimization

When it comes to optimizing returns, RL agents stand out with their dynamic rebalancing strategies. Unlike fixed schedules, these agents adjust allocations in real time based on current market conditions. This allows them to capitalize on momentum, trim positions in overperforming assets, and allocate more to undervalued opportunities [2].

RL agents are also adept at multi-objective optimization, working to maximize returns while minimizing risks like volatility and drawdowns. This results in better risk-adjusted returns compared to static approaches [3]. They identify ideal entry and exit points by recognizing patterns across multiple timeframes, executing trades when the likelihood of favorable outcomes is highest.

Their strategies evolve with market conditions. For example, during bull markets, they may adopt aggressive growth-oriented approaches, while shifting to defensive positions during market corrections [3]. Their ability to process high-dimensional data helps them uncover complex relationships among various assets, technical indicators, and market sentiment - insights that traditional models often fail to capture.

Market Suitability

RL agents are particularly well-suited to volatile and fast-changing markets like cryptocurrency, where traditional strategies often struggle to keep up [4]. They perform best in medium to large-cap portfolios, where liquidity supports frequent rebalancing without incurring excessive slippage costs [3].

These agents excel in diversified portfolios spanning multiple sectors - such as DeFi, Layer 1s, Gaming, AI, and Real World Assets (RWA). This variety allows them to develop effective sector rotation strategies while avoiding the pitfalls of over-diversification [3].

For investors looking for systematic, data-driven decision-making with minimal oversight, RL agents are a great fit. They can be tailored to match different risk preferences, from conservative portfolios with higher stablecoin allocations to aggressive strategies focused on altcoins. However, they are less effective for highly concentrated portfolios with just a few tokens or for strategies focused on illiquid small-cap assets, where transaction costs can outweigh potential benefits [3].

The 24/7 nature of cryptocurrency markets, combined with their high volatility and abundant on-chain data, creates the perfect environment for RL agents to showcase their ability to adapt and thrive.

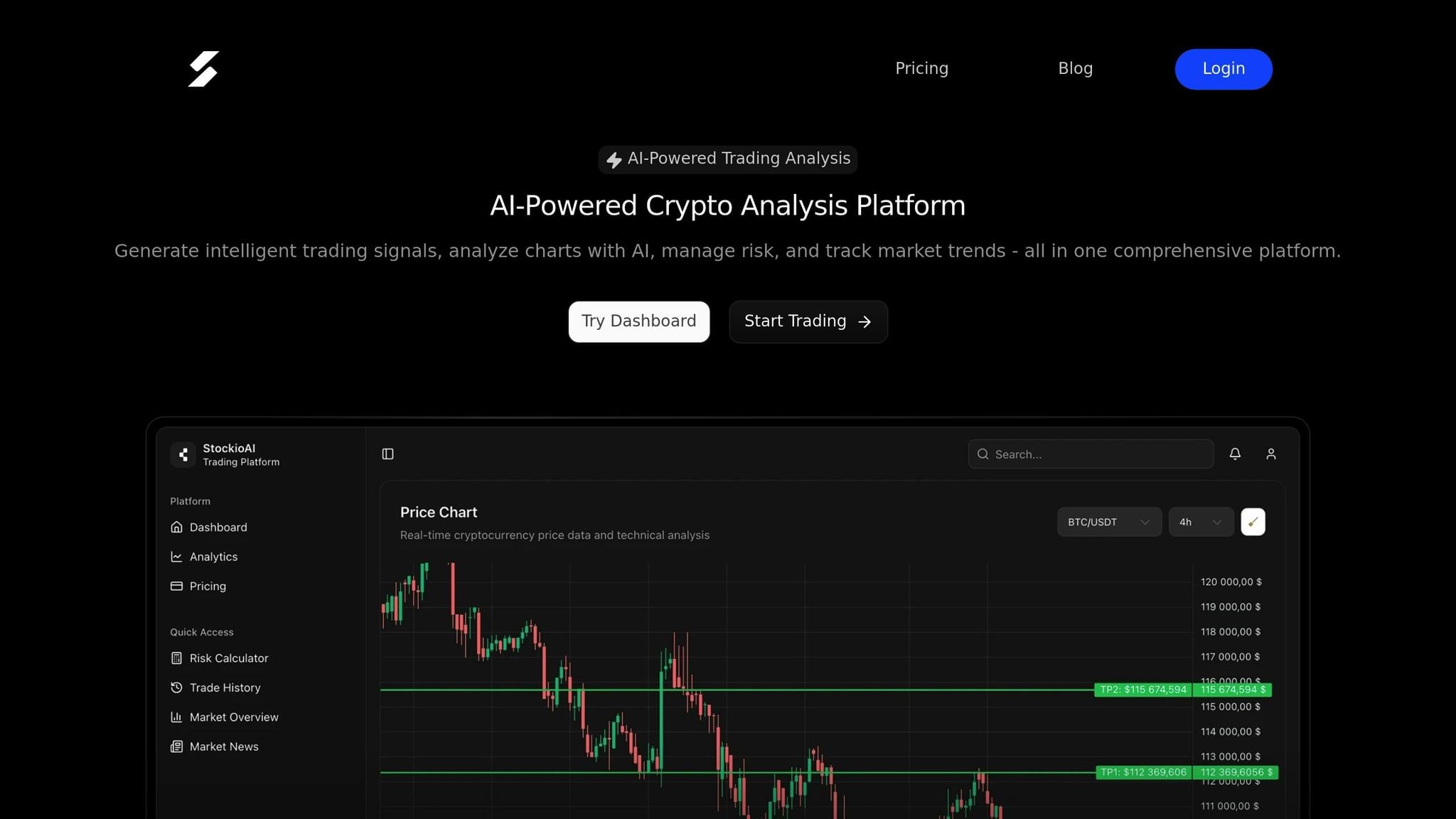

3. StockioAI

StockioAI takes cryptocurrency allocation to the next level by blending advanced machine learning (ML) and reinforcement learning (RL) techniques with specialized analytics. This platform delivers real-time market insights and allocation strategies, processing over 60 data points every second. These include technical indicators, trading volume patterns, support and resistance levels, market sentiment, order book depth, whale activity, and even social media trends. The result? Precise trading signals and tailored allocation recommendations.

Technology and Logic

At its heart, StockioAI relies on cutting-edge machine learning and pattern recognition to sift through massive amounts of market data. It generates actionable BUY, SELL, and HOLD signals, complete with clear entry points, stop-loss levels, profit targets, and confidence scores.

The platform uses a 7-Tier Priority system to evaluate factors like market structure, liquidity, RSI and MACD indicators, EMA ribbon analysis, SMA context, and price momentum. This multi-layered approach is further enhanced by a Conflict Resolution Matrix, which outlines 15 scenarios for position sizing. Together, these tools ensure that allocation decisions adapt seamlessly to shifting market conditions.

StockioAI also incorporates Multi-Timeframe Analysis, prioritizing momentum on higher timeframes over shorter-term signals. Additionally, its Market Regime Classification identifies whether the market is trending, ranging, volatile, or quiet, enabling precise allocation adjustments across various cryptocurrency sectors and market caps.

Risk Management Effectiveness

Risk management is a core feature of StockioAI, seamlessly integrated into its allocation framework. Using a built-in Risk Calculator, the system determines optimal position sizes, stop-loss levels, and leverage based on real-time AI analysis.

For exits, the platform continuously evaluates resistance levels, momentum indicators, market trends, and volatility patterns to pinpoint the best exit opportunities. It also factors in institutional flows to mitigate risks that could impact portfolio performance.

The effectiveness of StockioAI's risk management is backed by data: a 75% win rate and a 2.95 Profit Factor based on 35 completed trades. Starting with $1,000 and no leverage, these trades generated $744.22 in total revenue [1]. For those on the Professional plan, advanced features like real-time market alerts help users stay ahead of significant market changes or breaches in risk thresholds, allowing for proactive adjustments.

Return Optimization

StockioAI’s approach to maximizing returns is rooted in its intelligent signal generation system, which processes real-time market data to uncover profitable opportunities. By focusing on risk-adjusted returns, the platform provides precise position-sizing recommendations combined with market timing signals to boost profitability.

Its AI Pattern Recognition technology identifies chart patterns, trend reversals, and optimal entry/exit points that traditional strategies might overlook. By analyzing whale movements, institutional activity, and social media sentiment alongside technical indicators, StockioAI can spot opportunities before they become widely recognized. It also tracks portfolio performance and offers rebalancing advice, helping users shift between core assets like Bitcoin and Ethereum and high-growth altcoins based on market conditions and risk tolerance.

Market Suitability

StockioAI is specifically designed for cryptocurrency investors, offering tailored analytics for Bitcoin, Ethereum, stablecoins, and altcoins with practical applications. It also considers U.S. regulations, ETF products, and liquidity requirements, making it particularly appealing for American investors.

The platform is ideal for managing diversified cryptocurrency portfolios that benefit from sector rotation and multi-asset analysis. A typical allocation might include 60% in Bitcoin and Ethereum, 30% in large-cap altcoins, and 10% in high-risk AI/Web3 tokens. Weekly rebalancing and dollar-cost averaging are recommended to minimize timing risks.

With 24/7 market monitoring and high-frequency data processing, StockioAI is perfectly suited for the always-on nature of crypto trading. It caters to a range of users through tiered pricing plans: a Free plan offering 2 AI trading signals for beginners, a Professional plan at $99/month with 300 AI signals and advanced features, and an Enterprise plan at $199/month with multi-user access and custom AI training options. These flexible options highlight the platform’s ability to meet diverse investor needs while setting the stage for a deeper discussion on the pros and cons of AI-driven allocation strategies.

Advantages and Disadvantages

Each AI-driven strategy comes with its own set of strengths and challenges, giving investors the flexibility to choose an approach that aligns with their risk tolerance and investment goals. Here's a closer look at the key aspects of these strategies and how they compare.

Machine learning-based index systems are exceptional at analyzing large amounts of historical data to uncover patterns and construct optimized portfolios. These systems rely on data-driven decisions, which help remove emotional biases while maintaining diversification across multiple assets. From January 2018 to January 2024, these systems delivered a return of 304.77%, outperforming the 223.40% return from a standard buy-and-hold approach [7]. However, a major drawback is their tendency to overfit historical data. When markets experience sudden or unprecedented changes, these systems may struggle to adapt quickly, leading to potential underperformance during volatile periods [3].

Reinforcement learning trading agents shine in their ability to adapt dynamically. Using a trial-and-error learning method, they adjust their strategies based on real-time market feedback. These agents achieved a remarkable return of 1,640.32%, and even after accounting for 0.5% trading costs, returns stayed impressive at 1,589.32% [7]. On the downside, these systems are computationally demanding and can be unstable during training phases. Additionally, their lack of interpretability may deter investors who value transparency in decision-making.

StockioAI offers a user-friendly platform that combines institutional-grade analytics with accessible execution tools. By processing over 60 real-time data points, it generates actionable trading signals and boasts a 75% win rate with a 2.95 Profit Factor based on completed trades [1]. Its intuitive interface and built-in risk management tools make it especially appealing to retail investors, even those without programming expertise. However, its performance depends heavily on data quality and may still require human oversight during extreme market conditions.

| Strategy | Technology Complexity | Risk Management | Return Potential | Market Adaptability | User Accessibility |

|---|---|---|---|---|---|

| ML Index Systems | Moderate | Statistical models, periodic rebalancing | High (304% over 6 years) | Slow to adapt to new patterns | Moderate |

| Reinforcement Learning | High | Dynamic, learns from feedback | Very High (1,640% over 6 years) | Superior real-time adaptation | Low (requires expertise) |

| StockioAI | Low (user-facing) | Real-time calculators, automated alerts | Strong (75% win rate) | Good with continuous updates | High |

Cost, Market, and Regulatory Considerations

The cost of implementing these strategies varies widely. Traditional AI systems often require significant upfront investments in infrastructure and specialized expertise. In contrast, platforms like StockioAI offer flexible pricing options, ranging from free basic plans to $199/month for enterprise-level features, making advanced AI strategies more accessible to a broader range of investors.

Market suitability is another key factor. Machine learning index systems are ideal for long-term, low-maintenance portfolios but may falter during sudden market shifts. Reinforcement learning agents thrive in fast-paced, high-frequency trading environments but demand constant monitoring and expertise. StockioAI, with its focus on cryptocurrency markets, is particularly suited for investors targeting digital assets.

Regulatory trends also play a pivotal role. As the financial industry moves toward greater compliance and transparency, platforms that align with U.S. market standards are better positioned for success. StockioAI, for instance, emphasizes clear reporting and compliance-oriented features, making it a strong contender in this evolving landscape.

Ultimately, the choice of an AI-driven strategy depends on balancing these trade-offs with your investment goals and market conditions. Each approach offers distinct advantages, but understanding their limitations is key to making informed decisions.

Conclusion

AI allocation strategies have reshaped the way US-based traders manage their portfolios. These strategies cater to different investor needs, ranging from the structured precision of machine learning-based index systems to the dynamic problem-solving of reinforcement learning agents and the accessible yet advanced tools offered by platforms like StockioAI.

By leveraging these cutting-edge approaches, AI strategies deliver improved risk-adjusted returns through diversification and responsive adjustments to market conditions. They consistently outperform traditional buy-and-hold methods, offering passive investors a reliable option for steady returns without the need for constant oversight. For these investors, machine learning-based index systems are a game-changer.

Meanwhile, active traders with a higher appetite for risk can explore reinforcement learning agents or platforms like StockioAI. With a 75% win rate and the ability to analyze over 60 real-time data points per second, StockioAI combines institutional-grade analytics with features accessible to retail investors [1].

The regulatory environment in 2025 is expected to further support US-based traders, thanks to a well-established market infrastructure that encourages the use of AI-driven strategies. Platforms like StockioAI stand out with their cost-effective options, ranging from free basic plans to enterprise-level features at $199 per month. This scalability makes advanced AI strategies more attainable compared to traditional systems that often require significant upfront investments.

The key to success lies in aligning the complexity of the strategy with the trader’s level of expertise. Beginners can benefit from intuitive, automated platforms, while seasoned traders may find reinforcement learning approaches more rewarding. This balance ensures that traders at all levels can effectively harness the power of AI.

Looking ahead, hybrid strategies that blend multiple AI methodologies are likely to dominate as technology evolves and markets grow more complex. Continuous monitoring with clear performance metrics will remain essential to navigating this ever-changing landscape.

FAQs

What makes machine learning-based index systems different from traditional strategies in managing portfolios and controlling risk?

Machine learning-based index systems rely on sophisticated algorithms to sift through massive datasets, uncover patterns, and adjust portfolios dynamically. Unlike traditional methods that depend on fixed rules and historical data, these AI-powered systems react in real-time to shifts in the market.

This adaptability can improve risk management by spotting signs of market volatility early and fine-tuning asset allocation to boost potential returns. Using predictive analytics and ongoing learning, machine learning systems strive to deliver sharper and more agile approaches to portfolio management.

What are the benefits and challenges of using AI reinforcement learning for cryptocurrency trading?

Reinforcement learning (RL) brings some intriguing possibilities to cryptocurrency trading. Unlike traditional approaches, RL can adjust to ever-changing market conditions by learning from past trades, allowing it to refine strategies on the fly. This adaptability can help traders aim for better returns while keeping risks in check. Plus, RL agents can process and analyze massive datasets, uncovering patterns that might go unnoticed by even the most experienced human traders.

That said, RL isn’t without its hurdles. These models demand extensive training and rely heavily on high-quality data to deliver reliable results. They can also falter when faced with sudden, unpredictable market shifts or extreme price swings. On top of that, setting up and maintaining RL systems requires significant resources and a blend of expertise in AI and trading. Still, when applied thoughtfully, RL has the potential to become a game-changer for making smarter, data-driven decisions in the volatile world of crypto trading.

How does StockioAI use AI to deliver real-time trading signals and portfolio insights?

StockioAI uses the power of machine learning and reinforcement learning to sift through market data, spotting patterns and trends that might otherwise go unnoticed. This enables it to deliver precise BUY, SELL, and HOLD signals, all fine-tuned to match the current market landscape.

On top of that, StockioAI offers tailored portfolio recommendations by evaluating individual risk tolerance and fine-tuning asset allocation. With its cutting-edge algorithms and access to real-time data, traders can rely on StockioAI for smarter, more confident decision-making.