In AI trading, data quality directly impacts performance. High-quality data - accurate, complete, consistent, relevant, and timely - enables AI to generate reliable trading signals. Poor data, on the other hand, leads to errors, missed opportunities, and financial losses.

Key Takeaways:

-

Accurate and complete data ensures AI reflects real market conditions.

-

Consistency and relevance prevent misleading signals caused by conflicting or irrelevant data.

-

Timely data is critical for fast-moving markets like cryptocurrency.

StockioAI addresses these challenges by processing over 60 real-time data points per second, validating data for accuracy, and using AI to identify patterns and correct errors. This approach has resulted in a 75% win rate for its trading signals, helping traders make better decisions while managing risks effectively.

Bottom Line: Reliable data is the foundation of successful AI trading systems. Without it, even advanced algorithms fail to deliver results.

Unlocking 🔓 the Full Potential of Your AI Stock Trading App 📈

What Makes Data High-Quality for AI Trading

For AI trading systems to succeed, the quality of the data they rely on is everything. Five key traits define high-quality data: accuracy, completeness, consistency, relevance, and timeliness [3]. These elements ensure that AI-generated trading signals align with actual market conditions, giving traders a reliable foundation for decision-making.

When any of these attributes falter, the result can be flawed data that leads to poor signals [4]. That's why understanding and prioritizing these dimensions of data quality is essential for traders aiming to optimize their AI tools.

Accuracy and Completeness

Accuracy and completeness are the cornerstones of reliable trading data. Accurate data mirrors real market conditions, allowing AI systems to generate predictions that align with reality [3]. If stock prices, trading volumes, or market metrics are inaccurate, AI algorithms can misfire, producing incorrect predictions and unreliable trading signals.

Completeness complements accuracy by ensuring that datasets are free from gaps. Missing data - such as incomplete historical stock prices - can cripple financial models, leading to flawed predictions because the AI lacks the full picture of market patterns and relationships [3]. When forced to work with partial information, AI systems are more likely to make errors.

StockioAI addresses this issue by integrating a wide range of real-time indicators, creating a comprehensive dataset that gives the AI a full understanding of market conditions. This approach minimizes the risk of decisions based on incomplete data.

The importance of accuracy and completeness becomes evident in trading outcomes. Gaps in data or inconsistencies in feeds can skew analysis, leading to false patterns and signals. For instance, missing information about specific stocks could result in AI systems identifying trends that don't actually exist, ultimately producing signals that fail to yield profitable trades [2].

Consistency and Relevance

Consistency and relevance play a critical role in refining the reliability of AI-driven trading. Consistency ensures that data remains uniform across sources and time periods, preventing AI systems from being confused by conflicting formats or definitions [3]. For example, if one data provider reports stock prices in decimals and another uses fractions, or if timestamps vary by time zone, the AI might struggle to connect the dots and identify trends accurately.

Consistent data translates to uniform AI outputs, while inconsistencies can lead to contradictory signals [3]. This is especially important when data is sourced from multiple exchanges or brokers, where variations in formatting can undermine the AI's decision-making process.

Relevance, on the other hand, ensures that the data used is directly tied to the trading task. Adding irrelevant information can dilute accuracy and mislead AI models [3]. For instance, if an AI system incorporates unrelated economic indicators or data from different asset classes, it might develop trading rules based on coincidental patterns rather than meaningful relationships.

StockioAI prioritizes relevance by zeroing in on data points that directly influence cryptocurrency and stock trading. Instead of overwhelming the system with extraneous market noise, the platform focuses on specific indicators, such as support and resistance levels, whale movements, and institutional flows, which have a proven impact on price movements [1].

Timeliness: Real-Time Data for Quick Decisions

Timeliness is another critical factor. Timely data ensures that AI systems operate on the most current market information, enabling them to react swiftly to changes [3]. In fast-moving markets like cryptocurrency, where prices can shift within minutes, relying on outdated data can lead to poor decisions and missed opportunities [3].

Real-time data processing offers a clear advantage. Modern AI systems can retrieve data 2x to 50x faster, improving both speed and predictive accuracy [4]. This capability allows traders to act on emerging opportunities before market conditions change.

StockioAI exemplifies the power of real-time data by continuously analyzing a broad range of up-to-the-minute indicators. This constant monitoring enables the platform to produce precise Buy, Sell, and Hold signals with confidence scores, ensuring decisions are based on the latest market conditions rather than outdated information.

During periods of market volatility, the difference between real-time and delayed data becomes especially pronounced. Real-time data empowers AI to react immediately to opportunities, while delayed data can create a lag, causing the system to base its decisions on outdated information. In high-stakes trading, this lag can mean the difference between capitalizing on a trend and missing it entirely [3].

Common Data Quality Problems in AI Trading

Even the most advanced AI trading systems can falter when faced with poor-quality data. As discussed earlier, the accuracy of AI systems heavily depends on the quality of the data they process. Unfortunately, trading environments are rife with data issues that can transform even the most promising algorithms into unreliable decision-makers. Understanding these challenges is a crucial step toward creating more reliable trading systems. Let’s explore some of the most common data quality problems.

Poor data quality has a significant impact on AI performance. For instance, a mere 1% error rate in data entry can slash the predictive accuracy of AI trading models by up to 15%. This happens because AI systems rely on historical data for training, and inaccuracies in this data can lead to flawed predictions and unreliable performance.

Human Errors and Mixed Data Sources

Manual data entry is one of the biggest culprits behind data quality issues in AI trading. Errors such as incorrect stock symbols, inaccurate price entries, mislabeled timestamps, and duplicate records frequently occur. For example, a simple data entry mistake that multiplies a value tenfold can cause AI models to misinterpret market volatility or trend direction. This, in turn, can result in false buy or sell signals.

The problem gets worse when multiple data sources are involved. Different exchanges and providers often use varying formats, units, or definitions. For instance, one exchange might report trading volume in shares, while another uses contracts. Time zone differences add another layer of complexity - price data in UTC from one source and EST from another can confuse AI models, leading to errors in identifying intraday trends or generating signals during market open and close periods. These inconsistencies can disrupt the accuracy of AI-driven analyses.

Data Delays and Missing Information

Timing issues and missing data are additional hurdles that AI systems face. In high-frequency trading, even a delay of a few seconds can mean missing out on the best entry or exit points. Such delays are often caused by slow API feeds, network latency, or inefficient data pipelines. Research shows that latency exceeding 100 milliseconds can significantly degrade the performance of real-time trading algorithms.

Missing data - whether it’s historical market trends or real-time news - also creates problems. For example, if a stock’s earnings report is missing from the dataset, the AI may fail to recognize typical post-earnings price movements, leading to incorrect predictions for similar events in the future. Incomplete datasets can also cause models to overfit to the available data, reducing their ability to adapt to new market conditions.

Data Quality Problems and Their Effects

These data challenges - ranging from human errors to delays and missing information - can severely undermine the effectiveness of AI trading systems.

| Data Quality Problem | Description | Impact on AI Trading Signals |

|---|---|---|

| Human Data Entry Errors | Mistakes in manual data input (e.g., wrong prices) | Skewed model training, false signals |

| Mixed Data Formats | Inconsistent units or timestamps across sources | Misaligned analysis, unreliable pattern detection |

| Data Delays | Slow or late data feeds | Missed opportunities, outdated signals |

| Missing Information | Gaps in historical or real-time data | Incomplete analysis, reduced predictive power |

| Outdated Data | Use of stale or old datasets | Invalid decisions, poor market adaptation |

| Irrelevant Data | Inclusion of unrelated or noisy data | Reduced accuracy, increased false positives |

The principle of "garbage in, garbage out" applies directly to AI-driven trading. Poor-quality data doesn’t just lower performance - it can actively mislead AI systems, creating systematic errors that persist until the underlying issues are addressed.

To tackle these challenges, StockioAI employs rigorous data validation processes and ensures consistent formatting across all data sources. Its real-time processing capabilities help reduce the impact of data delays, while comprehensive data coverage minimizes the risk of missing critical market information.

How to Improve Data Quality for AI Trading

Improving data quality is a game-changer in AI trading. By addressing common data issues, you can transform data from a potential weakness into a powerful asset. Better data quality means more accurate AI trading signals and smarter decision-making. Here are three strategies to help you achieve this.

Automate Data Collection and Checking

Manual data entry often leads to errors and inconsistencies, but automation can tackle these issues head-on. By automating data flows, you reduce human involvement, ensuring a smoother, more reliable process. For instance, APIs can pull real-time market data directly from exchanges and providers, minimizing transcription errors and standardizing formats.

Automation doesn’t stop at data collection - it also plays a crucial role in validation. Automated tools can continuously monitor data for anomalies like unrealistic price spikes, duplicate timestamps, or missing values. For example, if a stock price suddenly skyrockets by 1,000% without a corresponding volume increase, these tools can flag it as a potential error before it disrupts your analysis.

A great example of this in action comes from 2023, when a high-frequency trading firm adopted a centralized data intelligence platform. This system integrated real-time trade data, market metrics, and latency monitoring, leading to data retrieval speeds that were 2 to 50 times faster. The result? Better predictive accuracy, lower infrastructure costs, and fewer trading inefficiencies [4].

Another key step is ensuring your data sources are trustworthy. Always vet providers to confirm that crucial information - like market news - comes from reliable, established channels. By automating these processes, you lay the foundation for cleaner data and sharper trading signals.

Schedule Regular Data Reviews and Cleaning

Even with automation, data maintenance is an ongoing task. Regular reviews help identify and fix errors, duplicates, and missing data that could compromise your AI models.

Audits are essential for spotting inconsistencies across time periods and data sources. These reviews can uncover systematic issues that might otherwise go unnoticed. Automated deduplication tools can clear out redundant entries, while statistical methods like Z-score or IQR (Interquartile Range) help filter out outliers that don’t reflect real market movements.

Missing data points are another challenge. Imputation techniques can fill these gaps, but it’s important to approach this carefully. Sometimes, it’s better to acknowledge missing data rather than risk misleading your models with inaccurate estimates.

The benefits of thorough data cleaning are clear. For instance, a major investment bank saw a 7% increase in profitability within just two quarters after implementing a robust data-cleaning pipeline [3][5]. This demonstrates how regular maintenance of data quality directly impacts trading performance, ensuring your AI systems work with accurate, dependable information.

Use AI Tools for Data Management

AI-driven tools are reshaping how we manage data. These systems not only automate complex tasks but also adapt to new challenges, making them invaluable for maintaining clean and reliable datasets.

AI tools excel at real-time anomaly detection and normalization, ensuring consistency across all data sources. Unlike basic rule-based systems, they can detect subtle inconsistencies that might otherwise slip through the cracks. For example, pattern recognition systems learn what "normal" data looks like under various market conditions, allowing them to flag and even suggest corrections for problematic data points.

This approach is part of a larger trend toward continuous monitoring and improvement. Modern platforms integrate AI tools to adapt to changing market conditions, creating a feedback loop that links data quality directly to trading success. Instead of being a one-time effort, managing data quality becomes an ongoing process that evolves alongside your trading strategies.

How StockioAI Uses Data Quality to Improve Trading Signals

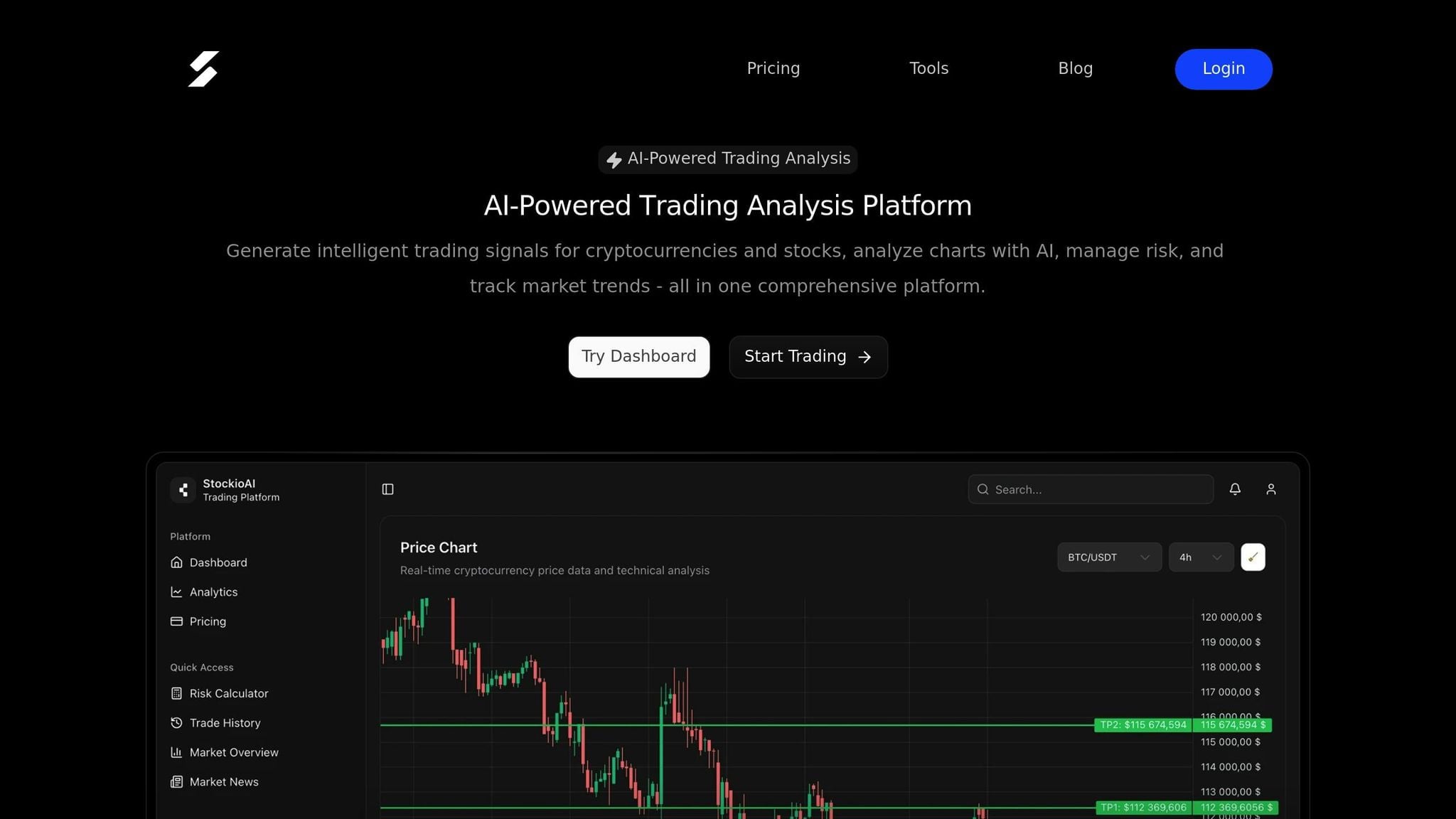

StockioAI takes raw market data and turns it into actionable trading signals by maintaining high standards for data quality. This process ensures traders can make informed decisions in real time, with the help of a reliable framework for processing and validating market information.

Real-Time Data Processing and Validation

StockioAI processes over 60 real-time data points every second, delivering a steady stream of reliable market insights. But it’s not just about speed - it's about making sure every piece of data is accurate and trustworthy before it impacts trading decisions.

The platform pulls data from a variety of sources: technical indicators, volume patterns, support and resistance levels, market sentiment, order book depth, whale movements, and even social media trends. Each data stream undergoes a thorough validation process to filter out errors and anomalies in real time.

When StockioAI issues a BUY, SELL, or HOLD signal, it doesn’t just leave you guessing. Each recommendation comes with detailed reasoning. For example:

-

BUY signals include entry points, stop-loss levels, and profit targets, all backed by confidence scores.

-

SELL signals highlight risk factors and the specific market conditions that triggered the recommendation.

-

HOLD signals provide live updates on support and resistance levels, upcoming catalysts, and evolving market trends.

This instant validation ensures that every signal reflects the most up-to-date market intelligence available.

AI Pattern Recognition and Error Detection

StockioAI goes beyond real-time validation by using advanced AI to identify deeper market patterns. Through machine learning and deep learning algorithms, it analyzes both historical and real-time data to detect trends, reversals, and anomalies.

The system continuously monitors for inconsistencies, missing data, or anomalies. When issues arise, StockioAI can flag or fix them automatically, preventing errors from affecting trading signals. This proactive approach has reduced the number of false signals during volatile market conditions, leading to more consistent results for traders.

The platform uses a 7-tier priority system to ensure that reliable signals always take precedence. This system evaluates factors like market structure, volume, liquidity, RSI and MACD indicators, EMA ribbons, SMA trends, and price momentum. By classifying market conditions - such as trending, ranging, or volatile - it filters out unnecessary noise and enhances the accuracy of its signals.

StockioAI's Data Quality Features and Benefits

The platform’s focus on data quality directly benefits traders by improving accuracy and risk management. Here’s how its features translate into better trading outcomes:

| StockioAI Feature | Focus | Benefit to Traders |

|---|---|---|

| Real-Time Data Processing | Timeliness, Accuracy | Delivers actionable signals based on live data |

| Automated Data Validation | Completeness, Consistency | Ensures insights are free from gaps or errors |

| AI Pattern Recognition | Relevance, Error Detection | Highlights profitable opportunities while reducing noise |

| Risk Calculators | Data Integrity, Accuracy | Empowers smarter risk management |

| Interactive Chart Analysis | Data Consistency, Relevance | Enhances technical analysis with reliable data |

| Market News Feeds | Timeliness, Relevance | Provides up-to-date context from verified sources |

One standout feature is the platform’s multi-timeframe analysis, which prioritizes higher timeframe momentum signals when conflicts arise. This ensures that the most reliable trends guide trading decisions, even in complex market conditions.

The results speak for themselves. By combining real-time validation and AI-driven error detection, StockioAI has improved users’ risk-adjusted returns. Backtesting and live trading data show measurable gains, echoing broader industry trends where better data validation has boosted profitability. For example, a leading investment bank saw a 7% increase in profits within just two quarters after adopting more rigorous data-cleaning practices [5].

StockioAI’s Market Overview feature is another example of how quality data leads to actionable insights. It provides real-time updates on cryptocurrencies, stocks, trending assets, and market sentiment, all processed with the same rigorous validation systems that power its trading signals.

Conclusion: Why High-Quality Data Gives AI Trading an Edge

In AI trading, success often hinges on one key element: data quality. Accurate, complete, and timely information allows AI systems to identify real market trends and generate dependable trading signals. On the other hand, poor-quality data leads to false alerts, missed opportunities, and potential financial setbacks. Streamlined data pipelines have been shown to improve both execution speed and profitability, making them a critical component of effective trading strategies [4].

This highlights a simple but crucial reality: bad data leads to bad results.

High-quality data doesn’t just improve trading signals - it also strengthens risk management, sharpens reaction times to market shifts, and supports more consistent performance. When traders rely on validated, real-time data, their decisions are guided by objective insights rather than emotional impulses. Take StockioAI as an example: the platform processes over 60 real-time data points every second, applying strict validation to ensure accuracy. This dedication to reliable data has consistently delivered strong outcomes for traders, as noted earlier [1].

FAQs

How does StockioAI ensure its trading signals are accurate and reliable?

StockioAI uses cutting-edge machine learning algorithms to sift through and analyze massive volumes of market data, delivering reliable and precise trading signals. These algorithms are designed to spot critical patterns, forecast trend shifts, and pinpoint the best times to enter or exit trades.

By constantly enhancing its data processing methods, StockioAI ensures traders have access to timely, actionable insights. This empowers them to make well-informed decisions with greater confidence.

What happens if AI trading systems rely on outdated or poor-quality data?

Using old or poor-quality data in AI trading systems can spell trouble. It often leads to inaccurate predictions and unreliable trading signals, which can hurt decision-making, cause missed opportunities, or even lead to major financial losses.

For AI algorithms to effectively spot trends, patterns, and market movements, they need access to high-quality, up-to-date data. Without it, the system might struggle to keep up with real-time market shifts, limiting its accuracy and profitability. By focusing on data quality, you can ensure your AI trading tools stay sharp and give you a much-needed edge in the competitive trading world.

How can traders enhance data quality to improve AI-driven trading signals?

High-quality data plays a crucial role in boosting the performance of AI trading models. To achieve this, traders need to ensure their datasets are accurate, complete, and current. This means eliminating duplicate or irrelevant entries, addressing any missing values, and confirming the reliability of the data sources.

Equally important is the process of normalizing and structuring the data so that it works seamlessly with AI systems. For instance, aligning time zones, standardizing units, and maintaining consistent formatting help the AI process information more effectively. By focusing on clean, well-organized data, traders can improve the precision and reliability of AI-generated trading insights.