When trading crypto, position sizing and risk exposure are two pillars of risk management. Here's the difference:

- Position Sizing: Determines how much money you allocate to a single trade. It ensures you stick to your risk tolerance, like risking 1% of your portfolio on one trade.

- Risk Exposure: Looks at the overall risk in your portfolio. It considers factors like the correlation between assets and total potential losses if the market moves against you.

Key Takeaways:

- Position sizing protects you from losing too much on one trade.

- Risk exposure ensures your entire portfolio isn't overly vulnerable.

- Both are essential for managing risk and achieving consistent results in volatile markets.

Example: If you risk 1% on five trades in correlated assets (e.g., Bitcoin and Ethereum), your position sizing might be fine, but your risk exposure could be too high if all assets drop together.

Quick Comparison:

| Aspect | Position Sizing | Risk Exposure |

|---|---|---|

| Focus | Single trade | Entire portfolio |

| Goal | Limit loss on one trade | Assess and control overall portfolio risk |

| Calculation | Based on account size, stop-loss, etc. |

| Considers correlations and aggregate risk | | Adjustment | Per trade | Continuous monitoring |

Combining both strategies is key to protecting your capital and thriving in unpredictable markets.

The ONLY Position Sizing Guide You'll EVER Need!

Position Sizing: Methods and Impact

Getting the position size right is a critical part of managing a crypto portfolio. It directly affects your ability to handle market downturns while staying ready to take advantage of opportunities. These techniques form the backbone of effective diversification and maintaining emotional discipline.

Common Position Sizing Methods

One of the most widely used methods is fixed percentage risk. This approach involves risking a consistent percentage of your total portfolio on each trade, often 1-2% [2]. For example, if you have a $15,000 portfolio and risk 2% per trade, that's $300. If you're buying Ethereum at $2,500 with a $5 risk per unit, you could purchase 60 units.

Another method is volatility-based sizing, which tailors your position size to an asset’s price swings. In the highly volatile crypto market, where some coins can experience dramatic daily movements, this method helps you avoid overexposing your portfolio to riskier assets.

Then there’s stop-loss-based sizing, which starts by defining your maximum acceptable loss and works backward to determine position size. For instance, if you’re comfortable risking $100 and your stop-loss is set at 10%, your position size would be $1,000.

Many traders combine these methods to fine-tune their risk management. Blending these strategies ensures that each trade aligns with your overall portfolio goals and risk tolerance.

How Position Sizing Affects Portfolio Management

Position sizing plays a huge role in diversification, as it prevents overloading your portfolio with a single asset. By capping individual trades at 1-2% of your portfolio [2], you spread your risk across multiple positions, reducing the impact of any one trade going south.

It also helps you manage emotions. Imagine two traders with $10,000 portfolios: Trader A risks 2% ($200) per trade, while Trader B risks 20% ($2,000). If both suffer five consecutive losses, Trader A would lose $1,000, or 10% of their capital, leaving plenty of room to recover. Trader B, on the other hand, could wipe out their account entirely [4]. This comparison underscores how disciplined position sizing can protect your capital over time.

In volatile markets - where daily swings of 5-20% are common - consistent position sizing helps limit drawdowns. Regularly recalculating your position sizes as your portfolio balance changes ensures you’re making the best use of your available capital. Smaller positions also give you the flexibility to adapt quickly when market conditions shift.

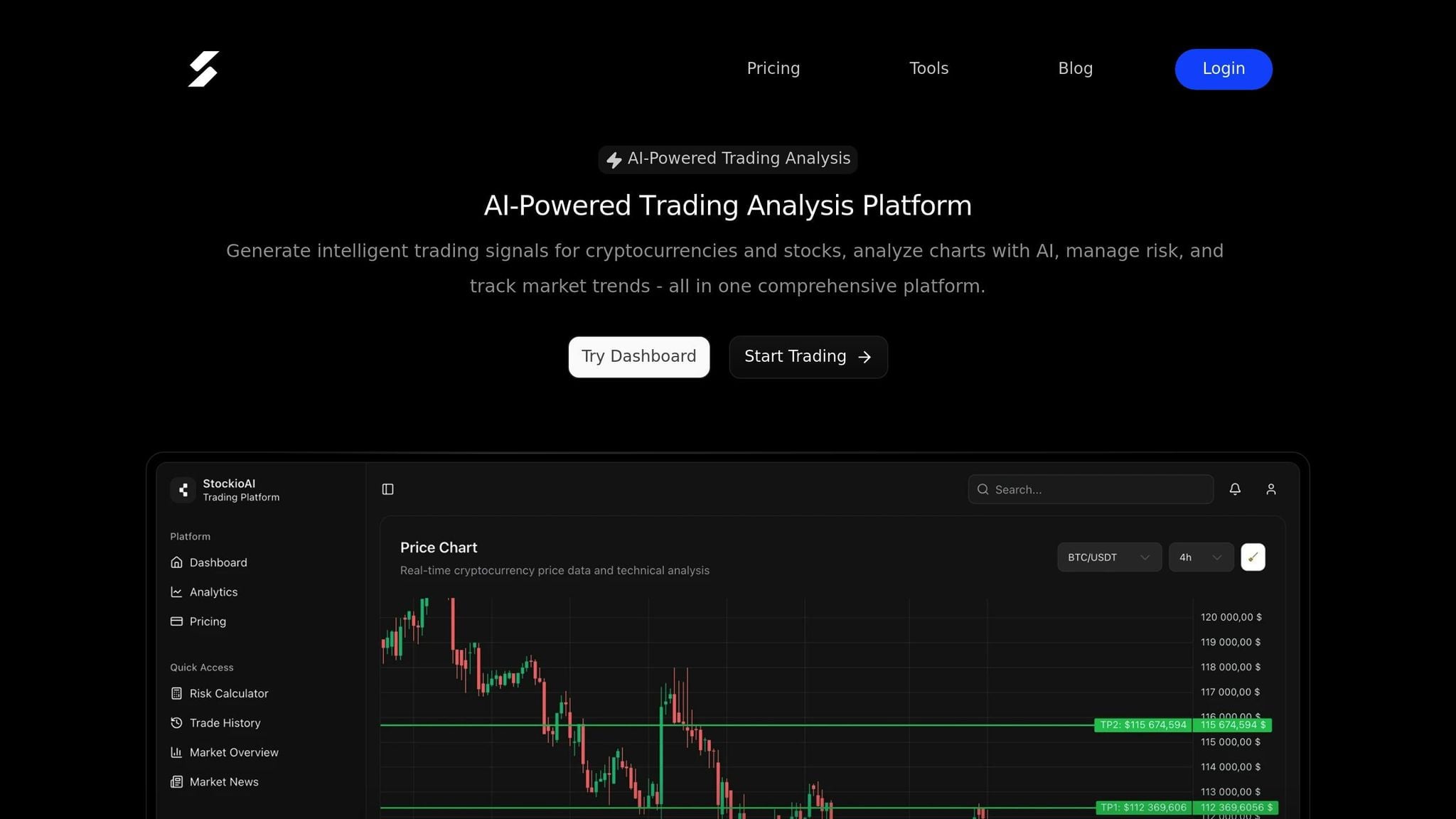

Modern tools like StockioAI's Risk Calculator make these calculations easier. By leveraging AI to analyze volatility patterns and set precise stop-loss levels, the platform helps traders make systematic, emotion-free decisions about position sizing. This kind of automation can be a game-changer for staying disciplined in unpredictable markets.

Risk Exposure: Measurement and Management

Once you've nailed down position sizing, it's time to zoom out and assess the bigger picture - your overall risk exposure. While position sizing focuses on managing the risk of individual trades, understanding risk exposure ensures your entire crypto portfolio stays balanced and resilient against market-wide swings.

How to Measure Risk Exposure

At its core, measuring risk exposure starts with aggregate exposure. This means summing up the dollar value you're risking across all your positions. For example, if you're risking $200 on Ethereum and $100 on Solana in a $10,000 portfolio, your aggregate exposure is 3% [2][4].

Another critical factor is asset correlation. Assets that move together - like Bitcoin and Ethereum during major market events - can amplify losses when markets dip. To counteract this, diversifying into uncorrelated assets, such as stablecoins or tokens from different sectors, can help spread out risk [2][4].

Portfolio volatility is another key metric. It reflects how much your portfolio's value fluctuates over time. Wider price swings signal greater risk exposure and the potential for larger losses.

For a more detailed analysis, tools like StockioAI come in handy. By processing over 60 real-time data points, StockioAI evaluates volatility, correlation, and other market indicators to provide a clear snapshot of your risk levels [1].

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader [1]

Once you’ve got a handle on measuring risk exposure, it’s time to tackle the next step: managing it effectively.

Managing Risk Exposure in Trading

Managing risk exposure begins with diversification. Spreading your portfolio across uncorrelated assets, using hedging strategies, and setting stop-loss orders to limit losses to 1–2% per trade are essential steps [2][4]. These strategies help you avoid impulsive decisions during volatile periods.

Real-time monitoring is just as important. Advanced tools like StockioAI continuously track your exposure levels and send automated alerts when risks exceed your set thresholds. Its AI algorithms analyze key indicators - such as resistance levels and institutional trading flows - to help you exit positions before losses snowball [1].

Another key tactic is setting strict risk limits. Risking only 1–2% of your portfolio on any single trade protects your capital. Combine this with regular portfolio rebalancing to ensure no single trade can derail your overall wealth, even during sharp market downturns [2][4].

For more experienced traders, a tiered approach to risk management can be effective. This involves dividing a planned position into smaller entries at different price levels. By doing so, you reduce exposure while still capturing profits as your trades move in your favor [2].

With these tools and strategies, you can keep your portfolio steady, even when the market gets rocky.

Position Sizing vs Risk Exposure: Main Differences

Position sizing and risk exposure are both essential components of a solid crypto trading strategy, but they address different aspects of risk management. Understanding how they differ can help you create a portfolio that stands up to market volatility.

Position sizing is all about managing risk on a trade-by-trade basis, while risk exposure looks at the bigger picture - your portfolio as a whole. For example, risking $100 on a Bitcoin trade when you have a $10,000 portfolio is position sizing. On the other hand, risk exposure calculates how much of your total portfolio is at risk if all your trades go south. Even if you limit risk to 1% per trade, opening multiple positions in highly correlated assets could expose you to far greater losses if the market takes a downturn.

The way these concepts are calculated also varies. Position sizing involves straightforward formulas, often based on your account size, risk tolerance, and stop-loss levels. Risk exposure, however, requires a deeper analysis, including asset correlations and the combined potential losses from all open positions. Timing is another key difference: position sizing is calculated per trade, while risk exposure requires ongoing monitoring as your portfolio evolves.

Take this scenario: you open five trades, each risking 1%, in assets like Bitcoin, Ethereum, Solana, Cardano, and Polygon. While your position sizing might be spot-on, if these assets are closely correlated, a market downturn could lead to a total risk exposure far exceeding 5%.

Comparison Table: Position Sizing vs Risk Exposure

| Aspect | Position Sizing | Risk Exposure |

|---|---|---|

| Definition | Allocating a specific amount of capital to a single trade | Measuring the potential loss across your entire portfolio |

| Purpose | Manage risk for individual trades | Evaluate and control overall portfolio vulnerability |

| Calculation | Based on account size, risk tolerance, and stop-loss levels | Combines risks from all positions, factoring in correlations |

| Impact | Limits losses on single trades | Assesses the portfolio's susceptibility to major drawdowns |

| Adjustment Frequency | Adjusted per trade as conditions change | Continuously monitored as positions and markets shift |

| Tools | Position size calculators, stop-loss orders | Portfolio analysis tools, diversification strategies, AI-based analytics |

| Example | Risking $100 on a $10,000 account (1% per trade) | Evaluating total portfolio risk if all positions move against you |

The consequences of neglecting either concept can be severe. An oversized trade can wipe out a significant portion of your account - imagine risking 50% on a single volatile altcoin. On the flip side, even well-sized trades can lead to disaster if your risk exposure isn’t managed, especially when correlated positions tumble together.

To succeed in crypto trading, it’s essential to use both strategies in tandem. Focusing on position sizing without considering risk exposure might leave you vulnerable to market-wide selloffs. Similarly, monitoring overall exposure but ignoring proper position sizing could result in catastrophic losses from a single bad trade. Balancing these two approaches is key to navigating the dynamic world of crypto markets effectively.

Combining Position Sizing and Risk Exposure in Crypto Trading

Bringing together the principles of position sizing and risk exposure creates a powerful framework for managing risk in crypto trading. When done right, this combination helps traders optimize returns while keeping losses in check. The idea is simple: by aligning individual trade decisions with broader portfolio goals, you can build a strategy that supports long-term resilience.

This approach is not just helpful - it’s essential for sustained success in the volatile world of crypto trading. The goal is to ensure that every position sizing decision aligns with your overall risk exposure strategy, considering how each trade fits into the bigger picture.

Balancing Position Sizing and Risk Exposure

Start by defining clear risk limits. Many experienced crypto traders stick to risking no more than 1–2% of their total portfolio on a single trade while keeping an eye on their overall exposure. For example, if you have a $20,000 portfolio and decide to risk 2% ($400) per trade, buying Bitcoin at $40,000 with a $1,000 risk per coin would mean a position size of 0.4 BTC. It’s equally important to monitor the total risk across all your open trades to avoid overexposure.

Market conditions can change quickly, so it’s crucial to adjust your positions accordingly. During periods of high volatility, you might reduce position sizes or tighten stop-loss levels to maintain consistent dollar risk. This kind of flexibility can protect you from significant losses during sharp market downturns.

Diversification also plays a critical role in this integrated approach. Opening trades in several highly correlated assets may seem like a smart move, but it can actually increase your risk. If the market moves against you and these assets drop in tandem, what appeared to be a manageable 5% total risk could spiral into something far more dangerous.

Traders who master this balance tend to experience much smaller drawdowns - up to 40% less - during turbulent market periods compared to those who focus on just one aspect of risk management. This disciplined, manual approach lays the groundwork for automation, where tools like StockioAI can take precision and adaptability to the next level.

Using AI Tools Like StockioAI for Better Results

As your portfolio grows and the market evolves, managing both position sizing and risk exposure manually can become overwhelming. This is where AI-powered platforms like StockioAI come into play, automating complex calculations and providing real-time insights that align with your integrated risk management strategy.

StockioAI’s Risk Calculator simplifies the process by instantly determining optimal position sizes, stop-loss levels, and leverage based on your account balance and risk tolerance. For instance, instead of manually calculating your Bitcoin position within a 2% risk limit, the platform does it for you while factoring in current market volatility.

The platform also generates AI-driven trading signals, offering precise entry points, stop-loss settings, and profit targets - key details for managing risk effectively. By analyzing over 60 real-time data points per second, including technical indicators, whale movements, and market sentiment, StockioAI ensures no critical risk factors are overlooked.

Tracking your portfolio becomes effortless with StockioAI’s monitoring tools. It continuously updates you on active trades, profit and loss, and overall portfolio performance, highlighting how your position sizing choices affect your total risk exposure. You’ll even receive alerts when your aggregate risk nears dangerous levels.

The numbers speak for themselves. StockioAI boasts a 75.0% win rate and a 2.95 Profit Factor based on 35 closed trades, turning a $1,000 starting capital into $744.22 in revenue - without using leverage. Quantitative trader Jordan Martinez shared:

"The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader [1]

This consistency is rooted in the platform’s disciplined risk management, which holds steady even during market crashes or euphoric rallies.

For those seeking even more control, StockioAI’s Professional plan offers advanced risk management tools and real-time market alerts. When volatility spikes or asset correlations increase, the platform can recommend adjusting position sizes or reducing overall exposure to minimize potential losses.

While automation simplifies the math and logistics, it doesn’t replace the trader’s judgment. Instead, tools like StockioAI allow you to focus on strategy and market analysis. The result? More consistent performance, reduced stress, and the confidence to tackle whatever challenges the crypto market throws your way.

Conclusion: Using Position Sizing and Risk Exposure Together

Position sizing and risk exposure are two powerful tools that can help traders protect their capital while aiming for steady returns. In the unpredictable world of crypto trading, combining these strategies is not just smart - it’s essential for long-term success.

These approaches work hand in hand. Position sizing is your first shield, limiting how much you stand to lose on a single trade. Risk exposure, on the other hand, is your portfolio-wide safety net, ensuring that multiple losses don’t spiral into catastrophic damage. Together, they create a framework that can weather even the roughest market conditions.

Research highlights their value: position sizing is a key driver of risk-adjusted returns[3]. This underscores why managing your position sizes effectively is non-negotiable. Here’s what traders need to keep in mind.

Key Points for Traders

Successful crypto traders follow a few essential principles to integrate position sizing and risk exposure:

-

Limit risk per trade. Never risk more than 1–2% of your portfolio on any single trade. This simple rule is the cornerstone of sustainable trading[2].

-

Track your total exposure. Even if individual trades are well-managed, multiple open positions can add up to significant overall risk. Monitoring this is critical.

-

Adapt to market conditions. When volatility spikes, reduce your position sizes to keep your dollar risk consistent[2]. This flexibility helps protect your capital during unpredictable times.

The numbers back this up: traders who stick to these principles see up to 40% smaller drawdowns in volatile markets. In contrast, poor position sizing can slash annual returns by 25%, even with effective trade signals[3].

Next Steps for Better Crypto Portfolios

To take your portfolio management to the next level, consider these actionable steps. Managing position sizing and risk exposure manually can become overwhelming, especially as your portfolio grows or market conditions shift rapidly. That’s where AI-powered platforms like StockioAI can make a difference.

Start by defining your risk tolerance. Decide how much of your portfolio you’re willing to risk per trade and set a maximum limit for total exposure across all positions. StockioAI’s Risk Calculator can handle the math for you, calculating optimal position sizes, stop-loss levels, and leverage based on your preferences.

StockioAI also offers AI-driven trading signals that eliminate guesswork. By analyzing over 60 real-time market indicators - like technical signals and market sentiment - it provides precise entry points, stop-loss settings, and profit targets. This ensures your trades align with both your position sizing and risk exposure rules.

For advanced tools, explore StockioAI’s Professional plan, which offers real-time alerts and suggestions. When volatility rises or asset correlations tighten, the platform can recommend immediate adjustments to your position sizes or overall exposure, helping to protect your portfolio.

Diversification is another key strategy. Spreading your investments across uncorrelated assets minimizes the risk of one market move wiping out your gains. Avoid opening multiple positions in closely related cryptocurrencies, as this can create hidden risks that surface during downturns.

Finally, review and refine your strategies regularly. What works in a bull market may need tweaking during a downturn or periods of high volatility. Staying adaptable is crucial.

The crypto market is full of both opportunities and challenges. Traders who combine disciplined position sizing with effective risk exposure management - whether manually or with AI assistance - are better equipped to achieve sustainable success. Protecting your capital today ensures you’re ready to seize tomorrow’s opportunities.

FAQs

What’s the difference between position sizing and risk exposure, and how can I balance them in my crypto trading strategy?

Position sizing is all about deciding how much of your capital to put into a specific trade, while risk exposure looks at how much you stand to lose if things don’t go your way. Both play a key role in keeping your crypto portfolio in check.

To strike the right balance, start by defining your risk tolerance. Many traders stick to risking only a small percentage - say, 1-2% - of their total portfolio on any single trade. Once you’ve set that limit, calculate your position size based on the risk you’re willing to take and the asset’s price volatility. Tools like risk calculators or platforms like StockioAI can make this process easier, helping you analyze your risk and fine-tune your position sizes for smarter trading decisions.

What are common mistakes traders make with risk exposure, and how can they avoid them?

One frequent misstep traders make is not defining their risk tolerance before jumping into a trade. If you don't have a clear idea of how much you're prepared to lose, you might end up taking positions that are too large, which can lead to serious losses. A good rule of thumb? Decide on a specific percentage of your portfolio - say 1-2% - that you're comfortable risking on any single trade.

Another common error is skipping stop-loss orders or placing them too far from your entry point. Stop-loss orders are essential tools for managing risk, as they automatically close your trade once a certain price level is hit. To use them effectively, set them at logical levels that reflect both market conditions and your personal risk tolerance.

Finally, many traders over-leverage their positions, especially in highly volatile markets like cryptocurrency. While leverage can boost your profits, it also magnifies losses. To stay on the safer side, stick to modest leverage ratios and ensure your position sizes fit within your broader risk management plan.

How can AI tools like StockioAI improve position sizing and risk management in crypto trading?

AI tools such as StockioAI make managing position sizing and risk exposure much easier by offering precise, real-time calculations. Take its risk calculator, for instance - it helps you figure out the optimal position size, stop-loss points, and leverage for each trade, all tailored to your risk tolerance and the current market environment.

By handling these complicated calculations automatically, StockioAI allows traders to act decisively and with confidence, cutting down on emotional or spur-of-the-moment errors. This leads to a more structured and efficient way to manage your crypto portfolio.