AI trading bots can help you trade cryptocurrencies automatically by analyzing market data, identifying patterns, and executing trades faster than humans. But not all bots are the same. The right choice depends on your trading goals, style, and experience level.

Key Takeaways:

-

StockioAI: Offers detailed features like advanced trading signals, risk management tools, and customizable AI models. Pricing starts at $0 (Free Plan) to $199/month (Enterprise Plan). Best for traders who want transparency and control.

-

BotX Crypto Trader: Automates trading but lacks public details about its features, signals, and pricing. Best for those willing to research further.

-

QuantumTrade AI: Minimal information available, making it hard to assess its usefulness.

Quick Comparison:

| Platform | Features | Risk Management | Pricing | Transparency |

|---|---|---|---|---|

| StockioAI | Advanced signals, portfolio tools | Yes | $0–$79.99/month | High |

| BotX Crypto | Automated trading | Unknown | Not disclosed | Low |

| QuantumTrade | Unknown | Unknown | Not disclosed | Very Low |

StockioAI stands out for its detailed tools and clear pricing, making it a reliable option for most traders. For more details, continue reading.

Best AI Trading Bots of 2025? (INSANE Profit)

1. StockioAI

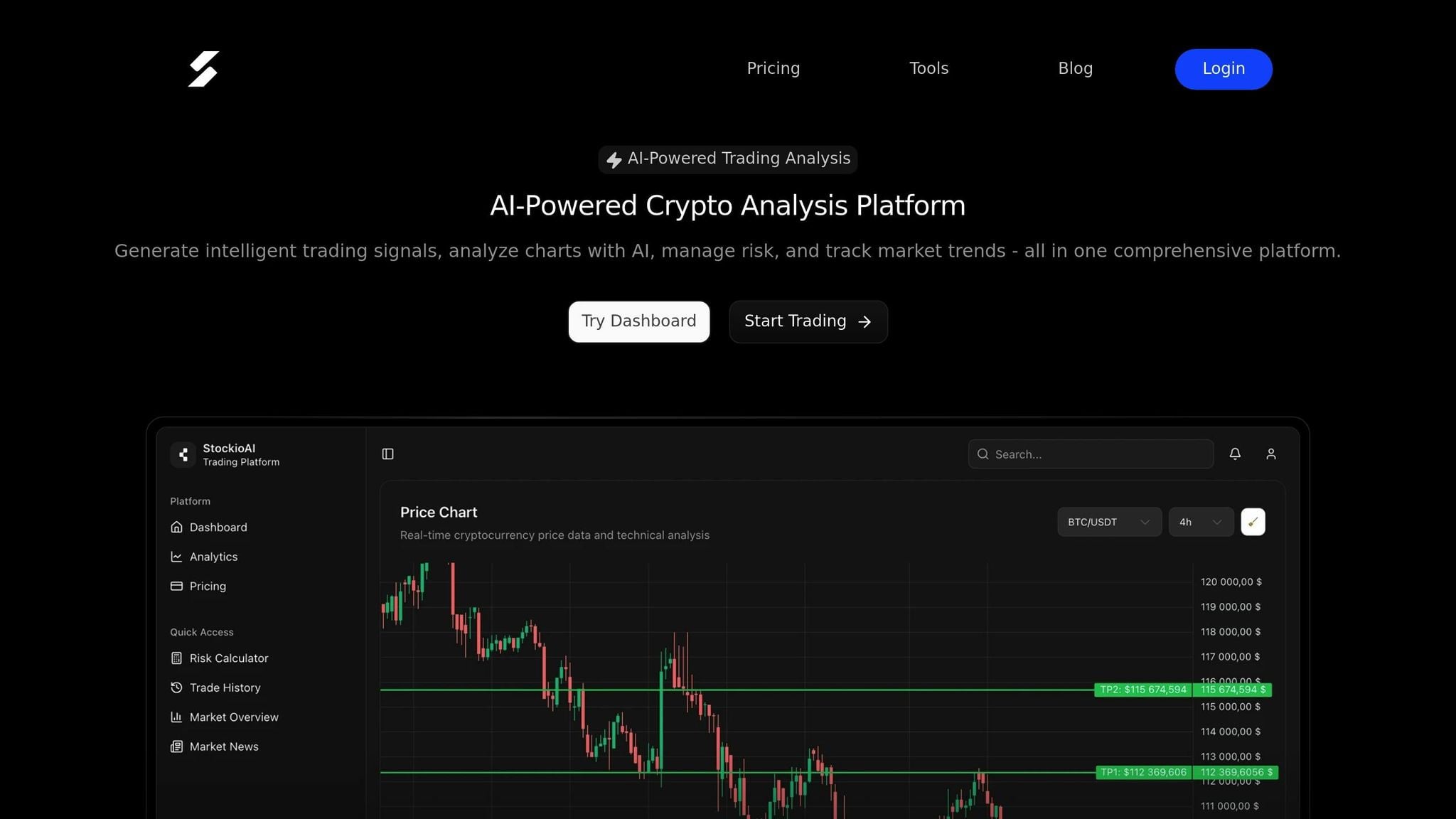

StockioAI is a powerful AI-driven trading bot designed to support a variety of trading strategies. This cryptocurrency analytics platform offers real-time signals, technical analysis, and tools for managing risk. Developed by a team of seasoned traders, data scientists, and AI experts, StockioAI goes beyond basic buy-and-sell recommendations to provide a more comprehensive approach to cryptocurrency trading.

Trading Signals

StockioAI employs a sophisticated 7-tier system to generate trading signals. This system evaluates a range of factors, including System Market Structure, Volume & Liquidity, Market Phase, RSI & MACD, EMA Ribbon, SMA Context, and Price Momentum. By layering these elements, the platform creates a hierarchy that guides its signal generation process.

One standout feature is the Multi-Timeframe Analysis, which prioritizes higher timeframe momentum over lower timeframe signals. This helps minimize short-term market noise and emphasizes long-term trends. Additionally, the platform includes a Market Regime Classification tool that identifies market conditions - whether trending, ranging, volatile, or quiet - allowing the AI to adapt its signals accordingly. With advanced AI pattern recognition and integrated TradingView charts, StockioAI delivers clear BUY, SELL, and HOLD signals, factoring in multiple market dynamics. On top of that, traders benefit from robust risk management tools to navigate market uncertainties.

Risk Management Tools

StockioAI offers several tools to help traders manage risk effectively. A built-in risk calculator lets users determine position sizes based on their risk tolerance and account balance. The Conflict Resolution Matrix is another key feature, addressing 15 different market scenarios to help optimize position sizing under varying conditions.

For broader oversight, the platform includes portfolio tracking to monitor exposure across multiple positions, along with real-time position tracking for up-to-the-minute trade insights. A market overview feature also provides a snapshot of overall market conditions, equipping traders with the context they need to assess risks before making decisions. These features are available through pricing plans designed to meet the needs of different trader profiles.

Pricing and Plan Flexibility

StockioAI offers four pricing tiers, catering to both individual traders and institutions:

| Plan Name | Price | Description | Features | Limitations |

|---|---|---|---|---|

| Free | $0/month | Ideal for beginners | 5 AI Analysis, basic market insights, community support, mobile app access, educational resources | Limited signals and insights |

| Weekly | $24.99 | For new individual traders | ∞ Unlimited AI trading signals, basic technical analysis, email support, standard indicators | Limited features |

| Monthly | $79.99 | Advanced tools for active traders | ∞ Unlimited AI trading signals, advanced pattern recognition, priority support, portfolio tracking, API access | None |

Customization and AI Model Training

StockioAI allows traders to tailor their experience through a variety of customization options. The platform includes advanced charting tools and a customizable market news feed, helping users focus on specific cryptocurrencies or market sectors. For institutional clients and experienced traders, the Enterprise plan offers custom AI model training. This feature enables the system to adapt to a trader's unique strategies and preferences.

Traders can also fine-tune multi-timeframe insights to match their trading style, whether they prefer scalping, day trading, or holding long-term positions. These customization options make StockioAI a versatile tool for traders at any level.

2. BotX Crypto Trader

BotX Crypto Trader is an AI-driven platform designed to automate cryptocurrency trading. It uses machine learning and real-time market analysis to pinpoint potential opportunities across various cryptocurrency exchanges. However, specifics about how it generates signals, manages risk, handles pricing, or allows for customization are not publicly shared. This lack of transparency sets it apart from platforms that offer more detailed insights into their operations.

If you're considering this platform, it's a good idea to contact the provider directly to ensure it aligns with your trading requirements.

3. QuantumTrade AI

QuantumTrade AI stands out for its lack of publicly available information compared to platforms like StockioAI and BotX Crypto Trader. Details about its operations remain scarce, leaving potential users with limited insights into its features or performance.

Trading Signals Accuracy

There is no publicly available information regarding how QuantumTrade AI generates its trading signals or any metrics to evaluate their accuracy.

Risk Management Tools

The platform has not disclosed whether it offers risk management features like stop-loss settings or portfolio management controls.

Pricing and Plan Flexibility

QuantumTrade AI has not shared any details about its pricing structure or subscription plans.

Customization and AI Model Training

Information about customization options or the ability to train AI models is not available.

For a deeper understanding of QuantumTrade AI's offerings, including its pricing, features, and capabilities, it’s best to reach out to the provider directly.

Pros and Cons Comparison

When evaluating AI trading bots, it's crucial to weigh platforms with verified features against those with limited transparency. Here's a breakdown of how these platforms compare in terms of feature clarity.

StockioAI stands out for its detailed and verified features. Its transparent pricing and strong analytical tools make it a reliable choice for traders. That said, the free plan might not be ideal for active traders, as it offers a limited number of signals.

On the other hand, BotX Crypto Trader and QuantumTrade AI lack the same level of transparency. These platforms provide little to no clear information about their pricing models, trading methodologies, or feature sets. This makes it harder to gauge critical aspects like signal accuracy, risk management capabilities, and customization options. Without this information, traders are left guessing about the platforms' actual performance and how well they align with specific trading strategies.

Conclusion

StockioAI stands out as a strong contender in the competitive world of crypto trading tools. Based on our review, it offers a straightforward and inclusive platform tailored to meet the needs of cryptocurrency traders, regardless of their experience level. Its pricing structure is easy to understand and provides flexibility, making it accessible to both beginners and seasoned traders.

For those just starting out, the free plan includes essential AI analysis tools to help navigate the market. The platform’s 7-tier priority system and conflict resolution matrix break down complex market dynamics, providing clarity in an otherwise overwhelming space.

More active traders benefit from features like portfolio tracking, API access, and multi-timeframe analysis, which help cut through short-term market noise. On the other hand, the Enterprise plan caters to institutional traders with perks like multi-user access, dedicated account management, and custom AI model training.

One of the standout features is StockioAI’s market regime classification system, which automatically identifies trending, ranging, volatile, or quiet market conditions. This allows traders to adapt their strategies with confidence. With its focus on clarity, powerful analytics, and comprehensive support, StockioAI proves to be a reliable ally for navigating the ever-changing crypto market.

FAQs

What are the benefits of StockioAI's Multi-Timeframe Analysis for traders?

StockioAI's Multi-Timeframe Analysis equips traders with the tools to make smarter decisions by offering a broad view of market trends across various timeframes. With this feature, users can evaluate both short-term fluctuations and long-term patterns at the same time, giving them a clearer picture of market behavior.

By spotting patterns and uncovering opportunities across multiple timeframes, traders can adjust their strategies to better match their objectives and risk preferences. This method helps cut down on uncertainty, improves decision-making, and supports more accurate trade execution.

What are the main differences between StockioAI's Free and Enterprise plans, and which traders are they best suited for?

StockioAI offers two distinct plans: Free and Enterprise, catering to traders with varying experience and needs.

The Free plan is perfect for beginners or casual traders who want to dip their toes into AI-powered cryptocurrency trading without any financial commitment. It provides access to essential features and allows for a limited number of trades each month - an excellent choice for those looking to learn and experiment with AI trading tools.

For professional or high-volume traders, the Enterprise plan delivers advanced capabilities. This plan includes unlimited trades, customizable strategies, real-time data analysis, and priority support. These features are designed to help experienced traders navigate fast-moving markets and achieve their trading goals with precision.

Whether you're exploring trading as a beginner or aiming to optimize your strategies as a seasoned pro, StockioAI has a plan to match your needs.

How does StockioAI provide transparency and control for users in cryptocurrency trading?

StockioAI puts a strong emphasis on giving users full transparency and control over their trading experience. It provides real-time insights into trading strategies and performance metrics, allowing users to stay updated on their bot's activities. With access to detailed reports, users can analyze performance and fine-tune settings to match their trading goals and preferred risk levels.

What sets StockioAI apart is its commitment to visibility and user empowerment. While many platforms limit what users can see or control, StockioAI ensures traders have complete oversight. Its customizable features and user-friendly interface make it easy to adjust strategies and make informed decisions, all while harnessing cutting-edge AI technology for cryptocurrency trading.