AI trading is reshaping cryptocurrency markets by automating decisions and analyzing massive data in real-time. With tools like machine learning, natural language processing (NLP), and reinforcement learning, AI systems can predict price movements, assess market sentiment, and optimize strategies faster than any human trader.

Here’s the core idea:

-

AI trading systems analyze trends, volumes, news, and social media to spot opportunities instantly.

-

They execute trades within milliseconds, avoiding emotional biases that often affect human traders.

-

Features like backtesting, risk management tools, and real-time signals make AI platforms indispensable for navigating crypto’s 24/7 volatility.

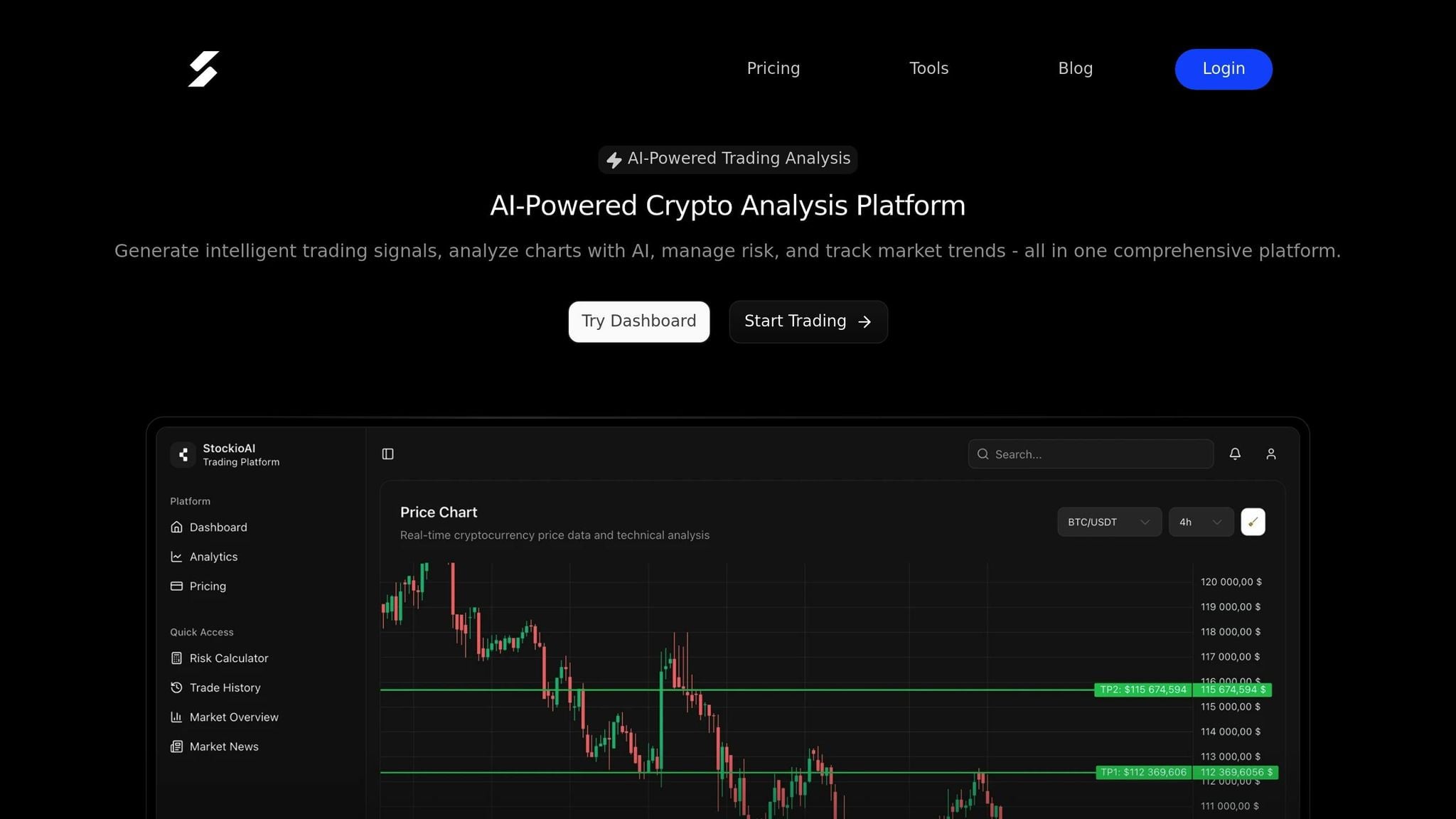

Platforms like StockioAI provide AI-driven insights, offering buy/sell/hold signals, portfolio tracking, and customizable strategies. While AI can boost efficiency, combining it with human oversight and disciplined risk management is key for long-term success.

AI Crypto Trading Bots: Which One Is Best?

Core AI Technologies in Crypto Trading

Cryptocurrency trading platforms rely on advanced AI technologies to analyze market trends and guide decision-making. These tools are designed to handle massive data streams and keep up with the fast-paced, ever-changing crypto market. At the heart of these systems is machine learning, a key player in predicting price movements by studying historical trends.

Machine Learning for Price Prediction

Machine learning forms the backbone of AI-driven trading systems. By leveraging algorithms, these systems can identify historical price patterns and use them to predict future trends. Methods like supervised learning and time series forecasting (such as models using LSTM networks) allow these systems to refine their predictions as they process fresh market data. This continuous learning process ensures trading strategies remain relevant and responsive.

Natural Language Processing for Sentiment Analysis

Natural Language Processing (NLP) plays a crucial role in transforming text-based information into actionable insights. By analyzing data from sources like social media, news outlets, and forums, NLP systems can assess market sentiment and predict its influence on cryptocurrency prices. Unlike basic keyword searches, modern NLP tools understand context, humor, and even crypto-specific slang. For example, when phrases like "diamond hands" or "to the moon" show up, these systems interpret them as indicators of optimistic market sentiment.

One advanced sentiment analysis system, for instance, processes crypto-related news in multiple languages and delivers sentiment insights in under a second[1]. These tools can handle thousands of data points every minute, identifying subtle shifts in market sentiment before they become obvious to human traders[2]. Additionally, NLP systems can detect warning signs, such as a sudden increase in terms like "sell everything." When combined with pattern analysis, these insights provide a powerful edge for traders.

Reinforcement Learning for Strategy Optimization

Reinforcement learning takes trading strategies to the next level by enabling systems to adapt based on real-time market feedback. This technology allows AI systems to "learn" from their trading outcomes, fine-tuning decisions and adjusting parameters as conditions evolve. By continuously balancing potential gains with associated risks, reinforcement learning ensures strategies remain effective across various market cycles. It’s a dynamic approach that keeps trading systems agile and responsive, even in volatile markets.

Features of an Effective AI Trading Platform

When selecting an AI-driven trading platform for cryptocurrency markets, it's essential to focus on features that go beyond basic automation. The top platforms combine advanced technology with intuitive interfaces, helping traders make smarter decisions while keeping risks under control.

Real-Time Trading Signals

In the fast-paced world of cryptocurrency, where prices can change in the blink of an eye, real-time trading signals are a must. The best AI platforms provide updated buy, sell, and hold recommendations, backed by clear confidence levels and detailed analysis. This transparency allows traders to understand the reasoning behind each signal, which builds trust and enables more informed decision-making.

These platforms analyze multiple data streams at once - such as price trends, trading volume, and market sentiment - giving users a comprehensive view of the market. They also let traders fine-tune alerts to match their unique styles. For example, a cautious trader might prefer notifications for signals with confidence levels above 80%, while a risk-tolerant trader might opt for a broader range of recommendations.

In addition to delivering timely signals, advanced platforms incorporate risk management tools to support smarter trading decisions.

Risk Management and Portfolio Tools

Effective risk management is critical in trading, and AI platforms simplify this with tools like position sizing calculators. These calculators allocate capital based on portfolio size and risk preferences, ensuring that even during volatile market conditions, traders don’t overextend themselves.

Automated stop-loss features add another layer of protection. Rather than relying on static stop-loss levels, the best platforms use dynamic trailing stops. These adjust as trades progress, locking in profits while still allowing room for growth.

Portfolio tracking tools also play a key role. They provide real-time updates on performance metrics such as profit and loss, win rates, and risk-adjusted returns. Some platforms even include visual aids like heat maps, which highlight portfolio concentration and help traders spot overexposure to certain cryptocurrencies or market sectors.

Backtesting and Custom AI Models

To refine trading strategies, backtesting is indispensable. This feature allows traders to test ideas using historical data while factoring in real-world variables like transaction fees, slippage, and market impact. Platforms that omit these considerations often paint an overly optimistic picture of strategy performance, leading to unrealistic expectations.

For traders seeking more control, customizable AI models are a game-changer. These tools enable users to design strategies tailored to their specific goals. Whether it’s adjusting technical indicators, timeframes, or risk thresholds, advanced platforms offer flexibility for traders to align AI behavior with their personal trading philosophies.

Even those without programming expertise can benefit. Some platforms feature user-friendly visual interfaces, allowing traders to build models by combining analysis techniques and setting rules for how the AI should react to various market scenarios.

To test these strategies safely, paper trading environments simulate live market conditions without putting real money at risk. The best platforms ensure these simulations closely mirror actual trading conditions, giving users confidence when transitioning to live trading.

Once custom models are deployed, ongoing performance monitoring becomes essential. Top-tier platforms track metrics like drawdown periods, recovery times, and consistency across different market environments. They’ll even alert users when adjustments or replacements are needed, ensuring strategies remain effective over time.

StockioAI: AI-Driven Crypto Trading Platform

StockioAI transforms intricate market data into actionable trading signals by processing over 60 live data points every second. These include technical indicators, volume patterns, market sentiment, order book depth, whale movements, and even social media trends. This real-time analysis ensures the speed and precision that are critical for success in cryptocurrency trading. With a reported 75% win rate and a 2.95 profit factor based on 35 closed trades from a $1,000 starting capital, StockioAI is designed to cater to traders of all experience levels [3].

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."

– Jordan Martinez, Quantitative Trader

Key Features of StockioAI

StockioAI’s intelligent trading system offers three core signal types, each powered by AI-driven analysis using advanced machine learning and natural language processing. Here’s how it works:

-

BUY signals: The system evaluates technical indicators, volume trends, support levels, market sentiment, order book depth, whale activity, and social media buzz to suggest entry points, stop-loss levels, profit targets, and confidence scores.

-

SELL signals: For exits, it assesses resistance levels, momentum shifts, trend changes, volatility patterns, and institutional flows to recommend the best timing for selling.

-

HOLD recommendations: During market consolidation, it analyzes sideways trends, correlation patterns, and market microstructure to guide traders on when to stay patient and hold their positions.

In addition to these signals, StockioAI provides a comprehensive trading dashboard packed with professional-grade tools. For example:

-

Interactive chart analysis: Integrates TradingView charts with AI-generated trading levels, support/resistance zones, and technical indicators.

-

Risk calculator: Helps users determine optimal position sizes, stop-loss levels, and leverage based on their risk tolerance.

-

AI pattern recognition: Uses machine learning to detect chart patterns, trend reversals, and ideal entry/exit points, continuously improving its accuracy as it adapts to market changes.

The platform also offers real-time market overviews with trending coins, sentiment analysis, performance tracking for open positions, and a curated news feed that highlights key market events from reliable sources.

Pricing and Plans

StockioAI offers flexible pricing plans tailored to different trader needs. Whether you’re just starting out or are an experienced investor, there’s an option for you:

-

Free Plan: Includes 3 AI trading signals, basic market insights, standard indicators, and educational resources - perfect for new users to try the platform risk-free.

-

Starter Plan: Priced at $39 per month (billed annually to save 20% off the $49 monthly rate), this plan offers 30 AI trading signals per month, basic technical analysis, email support, and standard indicators. It’s ideal for individual traders exploring AI-driven strategies.

-

Professional Plan: At $119 per month (billed annually to save 20% off the $149 monthly rate), this tier is designed for active traders. It includes 150 AI trading signals monthly, advanced pattern recognition, priority support, risk management tools, real-time alerts, a custom indicator library, portfolio tracking, and API access for integration with other tools.

| Plan | Monthly Price (Annual) | AI Signals | Key Features | Best For |

|---|---|---|---|---|

| Free | $0 | 3 total | Basic insights, standard indicators, education | Testing the platform |

| Starter | $39 (save 20%) | 30/month | Basic analysis, email support | Individual traders starting out |

| Professional | $119 (save 20%) | 150/month | Pattern recognition, priority support, API access | Active traders and investors |

Choosing the annual billing option across paid plans not only reduces costs but also ensures access to the platform's full potential for long-term users. It’s a smart choice for those looking to enhance their trading strategies with AI-powered tools while keeping expenses manageable.

Best Practices for AI Crypto Trading

Navigating the world of AI-driven crypto trading requires a thoughtful approach to maximize returns while keeping risks in check. Traders who succeed often stick to proven methods that enhance performance and safeguard their capital.

Backtesting and Strategy Validation

Before putting your money on the line, test your AI trading strategy using historical data. This step helps you understand how your system might perform across different market conditions - whether it’s a bull run, a bear market, or a sideways trend.

For meaningful insights, use at least two years of data to capture a mix of volatile and stable periods. Pay attention to key metrics like maximum drawdown, win rate, and profit factor to assess your strategy's reliability.

Don’t overlook transaction costs and slippage during backtesting. Many strategies that look profitable on paper fail in real trading because they ignore exchange fees, bid-ask spreads, and market impact. To stay realistic, factor in trading costs, which typically range from 0.1% to 0.25% per trade, depending on your exchange and trading volume.

Another useful technique is walk-forward analysis. This involves splitting your data into segments, training your AI on one segment, and testing it on the next. This method better reflects real-world conditions, where your system needs to adapt to ever-changing markets.

Once your strategy is validated, you can move toward automation - but don’t forget to keep a human eye on things.

Balancing Automation and Human Oversight

AI systems are great at crunching numbers and spotting patterns, but they still need human supervision to avoid costly mistakes. The best traders use automation for repetitive tasks while stepping in when judgment calls are needed.

Start by setting clear boundaries for your AI. Define parameters like maximum position sizes, daily loss limits, and the specific assets your system is allowed to trade. These safeguards ensure your AI doesn’t spiral out of control during unexpected market events.

Keep an eye on daily metrics such as trade frequency, holding periods, and market correlation. If your system suddenly starts behaving differently - like trading more often or holding positions longer than usual - dig into the cause before the issue escalates.

Be ready to adjust your oversight as market conditions change. AI models trained in trending markets often falter in range-bound or highly volatile environments. If performance metrics begin to slip, consider pausing automated trading to reassess.

Finally, maintain a trading journal to track your AI’s decisions and any manual interventions. This record will help you identify what works and refine your approach over time.

With automation under control, the next step is to focus on managing risks and avoiding common pitfalls like overfitting.

Managing Risks and Avoiding Overfitting

One of the biggest challenges in AI trading is preventing overfitting - when your model becomes too tailored to historical data and fails to perform in live markets.

Simpler models often yield better results. Reserve 20–30% of your data for out-of-sample testing to check if your model can generalize beyond the patterns it was trained on. Complex models with too many parameters may look impressive in backtests but often underperform in real-world scenarios. Instead, prioritize robust signals that work across a variety of market conditions.

If your model’s performance drops significantly during out-of-sample testing, it’s a sign that overfitting is an issue.

Diversification is another key to managing risks. Use a mix of strategies - like trend-following, mean-reversion, and momentum approaches - to create a more balanced performance. Also, limit your risk to 1–2% per trade. Remember, position sizing and risk management are often more important than prediction accuracy. Even a system with a 60% win rate can be profitable with proper controls, while one with an 80% win rate can fail without them.

To keep your AI system aligned with current market trends, retrain it regularly. However, avoid overdoing it - frequent retraining can make your system overly reactive to short-term patterns. Monthly or quarterly updates usually strike the right balance between staying relevant and maintaining stability.

Conclusion: AI's Role in Crypto Trading Success

Artificial intelligence has completely transformed the way traders interact with cryptocurrency markets. Gone are the days when trades relied solely on lengthy manual analysis and gut instincts. Now, advanced algorithms can process vast amounts of data in mere milliseconds, bringing a new level of precision and speed to trading.

AI trading enhances human decision-making. Machine learning models can spot patterns across multiple timeframes and market conditions - patterns that would be impossible for any human to track simultaneously. Tools like natural language processing analyze market sentiment by sifting through news articles and social media chatter, while reinforcement learning refines strategies based on real-time market feedback. In a trading world where every millisecond matters, AI has become a critical tool for staying competitive.

That said, success in AI-powered trading isn’t just about automation. It requires combining automated data processing with active human oversight. Traders still need to set clear risk parameters and adapt strategies as markets evolve. Crypto markets never sleep, and AI systems can seize opportunities 24/7, executing trades even during hours when human traders are offline.

Risk management remains at the heart of profitable AI trading. Strategies like proper position sizing, stop-loss orders, and diversification are essential for protecting capital while pursuing aggressive opportunities. These principles ensure that traders can take advantage of AI's capabilities without exposing themselves to unnecessary risks. Long-term success comes from using AI to sharpen your edge while safeguarding your investments.

As AI tools continue to advance, the fundamentals of successful trading won’t change. Rigorous backtesting, disciplined risk management, and sound judgment will remain essential. AI might not guarantee profits, but when used wisely, it offers a powerful advantage in navigating the fast-moving and unpredictable world of cryptocurrency trading.

The traders who thrive will be those who can balance AI's analytical power with the human intuition to know when to intervene. This combination of automation and sound decision-making will be the key to long-term success in this ever-evolving market.

FAQs

How does AI improve decision-making and efficiency in cryptocurrency trading?

AI is transforming cryptocurrency trading by streamlining processes, analyzing market trends, and predicting price shifts with impressive speed and precision. Unlike traditional approaches, AI systems can sift through massive amounts of data in real time, uncovering patterns and opportunities that human traders might overlook.

Using tools like machine learning models and automated trading bots, AI empowers traders to make informed decisions, minimize emotional bias, and fine-tune strategies for improved outcomes. This not only boosts efficiency but also strengthens risk management, providing a steadier hand in the unpredictable world of cryptocurrency trading.

What AI technologies are used in crypto trading, and how do they help predict market trends?

AI technologies are transforming crypto trading by leveraging machine learning algorithms to process and analyze massive amounts of market data. These algorithms detect patterns and predict price movements by studying historical trends, offering traders more precise insights. Their ability to adapt to shifting market conditions makes them particularly useful in the fast-paced world of cryptocurrency.

On top of that, AI-powered automated trading bots are revolutionizing trade execution. These bots follow predefined strategies to execute trades with speed and efficiency that surpass human capabilities. By eliminating emotional biases and improving risk management, they help traders optimize their performance.

In short, AI simplifies market trend analysis, empowering traders to make quicker, more informed decisions in the ever-changing crypto landscape.

How can traders combine AI automation with human oversight to create effective and secure trading strategies?

AI-powered tools bring a lot to the table in cryptocurrency trading. They can sift through massive datasets, spot patterns, and execute trades with incredible speed and accuracy. This allows traders to fine-tune their strategies and respond to market movements more efficiently. One big advantage? AI removes the risk of emotional decision-making, which can often lead to costly mistakes. But let’s be clear - AI isn’t perfect. Its effectiveness heavily relies on the quality of the data it’s trained on, and errors can still occur.

For traders to get the most out of these tools, constant oversight is essential. Monitoring AI performance, tweaking its parameters when necessary, and keeping up with market trends are all key steps. Human judgment also plays a vital role in interpreting complex market dynamics, managing risks, and making decisions where AI might fall short. When traders combine the analytical power of AI with their own expertise, they can create a more balanced and effective approach to navigating the unpredictable world of cryptocurrency trading.