Timing the crypto market is hard, but AI tools can help. They analyze data, predict trends, and execute trades faster than any human. Here's what they do:

- Real-time analysis: AI processes price charts, trading volumes, news, and social media to spot opportunities.

- Emotion-free trading: AI avoids fear or greed, sticking to logic-based strategies.

- 24/7 operation: Crypto never sleeps, and AI ensures you don’t miss trades, even while you’re offline.

- Regulatory help: For U.S. traders, AI tracks transactions for taxes and ensures compliance with laws.

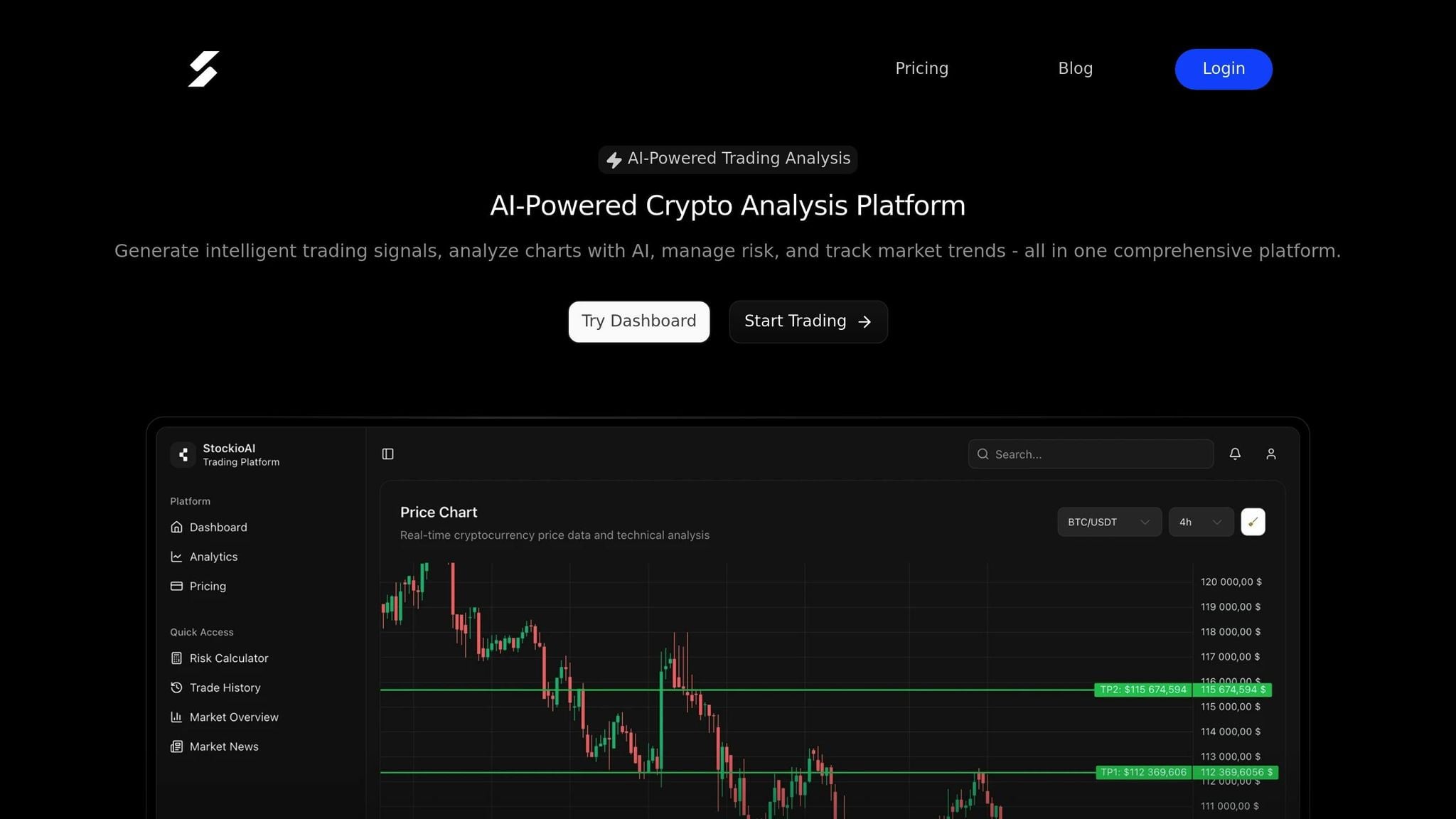

AI tools like StockioAI offer features like trading signals, risk management, and portfolio tracking. They integrate with major U.S. exchanges like Coinbase Pro, Kraken, and Gemini, making trading easier and more efficient. While AI has limitations, like reliance on past data and technical complexity, it can give traders a significant edge when combined with human oversight.

If you're overwhelmed by crypto's volatility, AI might be the solution you need to make smarter, faster, and more informed trading decisions.

Create AI Crypto Trading Bots (Bitcoin, Ethereum, Dogecoin & more)

AI-Powered Tools for Market Volatility

The crypto market never sleeps. With its 24/7 nature and unpredictable price swings, it often challenges traditional trading methods. This is where AI-powered tools come into play, offering swift and precise responses to the chaos of market volatility. Let’s delve into how algorithmic platforms, predictive analytics, and trading bots leverage AI to thrive in such an environment.

Algorithmic Trading Platforms

Algorithmic trading platforms rely on predefined rules and AI-driven analysis to automatically execute buy and sell orders. By removing emotional biases from trading decisions, these platforms shine during periods of sudden price changes in the crypto market.

Here’s how it works: you set specific trade conditions, such as buying Bitcoin if its price drops 5% below a moving average or selling Ethereum when trading volume spikes. The AI continuously monitors market conditions and executes trades instantly when the criteria are met.

What sets these platforms apart is their ability to process multiple market indicators simultaneously and act within milliseconds. While a human trader might focus on price charts, AI can factor in trading volume, market sentiment, technical signals, and even breaking news. This multi-layered approach uncovers opportunities that manual analysis might overlook.

Beyond executing trades, these platforms also forecast market trends - something we’ll explore in the next section.

Predictive Analytics for Market Trends

Predictive analytics tools use historical data, machine learning, and statistical models to anticipate future price movements in crypto markets [1][2]. They analyze blockchain data - such as transaction history and trading volume - to identify patterns that hint at where prices might head next.

For example, these tools can detect that certain wallet activities or transaction spikes often precede significant price shifts. Recent research highlights their accuracy: the Support Vector Machine (SVM) model achieved an 87.034% accuracy in predicting Bitcoin prices, outperforming other methods like Quadratic Discriminant Analysis (64.37%) and Random Forest (52.90%) [3]. Linear Regression also performed well, with a Mean Squared Error of 587,365.9181 and an R-squared of 0.99791977 [3].

These tools don’t stop at analyzing blockchain data. They also monitor social media, news outlets, and community discussions to gauge market sentiment. By identifying fear or greed in the market, they adjust predictions to reflect potential price shifts. Additionally, time series models like ARIMA and Prophet help identify long-term trends, signaling whether the market is leaning bullish or bearish [1][2].

On-chain analytics adds another layer of insight. By examining wallet transactions, token flows, and trading volumes, predictive tools can spot early signs of major market moves. This blockchain-specific data often proves more reliable than traditional financial indicators.

Automated Trading Bots

Trading bots take automation to the next level, executing trades around the clock based on AI-powered logic and real-time market data. These bots continuously scan multiple exchanges and currency pairs, seeking profitable opportunities while adapting to changing market conditions.

Unlike basic buy-low-sell-high strategies, modern bots use machine learning to adjust their tactics. For instance, they might adopt conservative strategies during periods of high volatility or become more aggressive during stable market conditions.

Risk management is built into these bots. They automatically set stop-loss limits, take-profit targets, and position sizes based on your risk tolerance. To further reduce exposure, they can diversify trades across various cryptocurrencies and exchanges.

For traders in the U.S., integration with platforms like Coinbase Pro, Kraken, and Gemini ensures that trades are executed on regulated and compliant exchanges. Secure API connections provide peace of mind while managing your assets.

Perhaps the most appealing feature is their 24/7 operation. Whether you’re asleep, at work, or away from your computer, these bots tirelessly monitor the market and execute trades according to your strategy. This ensures you never miss a potential opportunity, no matter the time of day.

Using StockioAI for Better Trading Results

StockioAI makes cryptocurrency trading more manageable with its integrated AI platform. By combining smart signal generation and in-depth analytics, it tackles one of the biggest challenges traders face: timing the market. Let’s dive into the platform’s features, how to set it up, and its secure integration with US exchanges.

Key Features of StockioAI

At the heart of StockioAI are its AI Trading Signals, which analyze over 60 real-time data points to deliver accurate BUY, SELL, and HOLD recommendations. These signals don’t just rely on price trends. They factor in technical indicators, volume patterns, market sentiment, order book depth, whale activity, and even social media buzz to provide a detailed picture.

Each signal comes with entry points, stop-loss levels, profit targets, and confidence scores. This means you’re not just told what to do - you also get the reasoning behind the recommendation, taking much of the guesswork out of trading.

The platform also offers interactive TradingView charts, packed with professional-grade technical analysis tools. These charts sync perfectly with the AI signals, helping you visualize market patterns and confirm opportunities before taking action.

Risk management is another standout feature. Built-in tools help you calculate position sizes based on your risk tolerance and account balance. The system even accounts for market volatility and conditions when suggesting trade parameters. This approach is designed to help traders navigate the unpredictability of market timing with more confidence.

Additionally, StockioAI includes market news feeds and portfolio tracking. The news feed filters relevant updates that might affect your investments, while the portfolio tracker keeps tabs on your positions and performance in real-time. Everything is tailored for USD trading pairs, which are widely used by American traders.

Step-by-Step Guide to StockioAI

Getting started with StockioAI is simple. First, choose a plan that fits your trading style. Options include:

- Free Plan: 2 signals per month

- Starter Plan: $49/month for 30 signals

- Professional Plan: $99/month for 300 signals

After selecting a plan, set your risk parameters - typically 1–3% per trade. The AI then adjusts its suggestions to align with your preferences.

Next, configure your signal preferences. You can specify the cryptocurrencies you’re interested in, your preferred trading timeframes (from quick scalping to longer swing trades), and the minimum confidence score for signals. A higher confidence threshold means fewer signals but potentially more reliable ones.

The StockioAI dashboard displays all active signals, complete with their performance status. Green indicators highlight profitable trades, while red ones flag positions that may need attention. These updates happen in real-time, so you can monitor your trades throughout the day.

For traders on the go, the mobile app ensures you stay in the loop. Push notifications alert you to high-confidence signals, major price changes, and when targets or stop-loss levels are hit.

Connecting StockioAI with US Exchanges

Once your StockioAI account is ready, linking it to US exchanges is a straightforward process. The platform uses secure, low-latency API connections to major US exchanges, all through encrypted protocols that ensure regulatory compliance.

To enhance security, you may need to configure DNS settings for exchange connectivity. While StockioAI provides detailed guides for this, most users find the automated setup quick and hassle-free.

For US traders, regulatory compliance is a major priority. StockioAI ensures its recommendations align with SEC guidelines by distinguishing between cryptocurrencies classified as securities and those that are not. It only works with regulated US exchanges that meet federal requirements, adding an extra layer of security for your trades.

For larger trading operations, the Enterprise Plan ($199/month) offers additional perks like dedicated account management and custom AI model training. This allows businesses to fine-tune the AI based on their trading strategies and risk management needs.

Advanced users can also take advantage of API access to integrate StockioAI signals with their existing trading systems or automated execution tools. This flexibility is ideal for professional traders who want to keep their current workflows while leveraging StockioAI’s advanced analytics.

Managing Risks and Improving Decisions with AI

Effective risk management is what sets successful crypto traders apart from those who face significant losses. AI has revolutionized this process by analyzing massive amounts of data in real time, enabling smarter and more informed decisions.

AI-Driven Risk Assessment

Modern AI systems go beyond traditional risk analysis by evaluating a wide range of factors like market volatility, liquidity, correlation patterns, and external events. By doing so, they provide a more comprehensive view of potential risks under varying market conditions.

Take StockioAI's risk assessment engine, for example. It continuously calculates metrics like Value at Risk (VaR). For instance, a 95% confidence VaR of $500 over one day means there's only a 5% chance of losing more than that amount. This kind of insight allows traders to gauge the potential downside of their positions.

Another critical feature is the tracking of concentration risk. If you're overly invested in a single cryptocurrency or related assets, AI sends alerts before correlation risk becomes a problem. This proactive approach can save traders from catastrophic losses.

Real-time stress testing is another tool in the AI arsenal. These simulations model scenarios ranging from flash crashes to prolonged bear markets, giving traders a clearer picture of potential outcomes before they occur. For USD-denominated trading, the system also accounts for risks tied to regulatory changes, exchange stability, and liquidity patterns unique to the U.S. market. Since crypto markets operate 24/7 but U.S. liquidity can fluctuate, AI adjusts its risk calculations accordingly.

Portfolio Optimization Strategies

Building on its risk assessment capabilities, AI also helps optimize portfolio allocations to strike the right balance between returns and risk. By enhancing Modern Portfolio Theory with machine learning, AI dynamically adjusts portfolios based on evolving market conditions and correlation patterns.

Unlike traditional rebalancing strategies that operate on monthly or quarterly schedules, AI can fine-tune your portfolio daily - or even hourly. For example, if Bitcoin starts moving in sync with traditional assets during times of market stress, AI might lower your crypto exposure to maintain your desired risk level.

AI's volatility forecasting models are another game-changer. If the system predicts a spike in Ethereum's volatility due to network congestion or upcoming protocol changes, it might recommend reducing your position before the turbulence hits. Similarly, correlation analysis ensures you're not overexposed to assets that tend to move together, offering diversification suggestions when needed.

Liquidity is another key consideration. AI monitors order book depth and trading volumes to ensure you can exit positions quickly. If liquidity dries up for a particular cryptocurrency, the system might suggest shifting to more liquid alternatives.

AI even automates tax-loss harvesting. By identifying opportunities to realize losses for tax purposes while maintaining market exposure through similar assets, traders can potentially save a significant amount during tax season.

Best Practices for Risk Configuration

To make the most of AI-powered tools, it's crucial to configure your risk settings carefully. Tailor these settings to reflect your financial situation and trading goals.

- Position sizing: Limit individual trades to 1-3% of your total portfolio. For short-term trades, set tight stop-loss limits (2-3%), while long-term positions can have wider stops (8-10%). AI can enforce these rules automatically, helping you avoid emotional decisions during market swings.

- Correlation limits: Avoid overconcentration by capping allocations to specific asset categories, like DeFi tokens or meme coins. If AI detects high correlation among your holdings, it can suggest diversification options.

- Time-based controls: If you're unavailable to monitor trades, configure the system to adopt more conservative settings. AI can reduce risk exposure automatically during these periods.

- Drawdown limits: Protect your portfolio from catastrophic losses by setting maximum drawdown thresholds (e.g., 10-20%). When these limits are reached, AI can automatically reduce your positions to prevent further damage.

- Backtesting: Use AI to simulate how your risk settings would have performed during past market events. While past performance isn't a guarantee of future results, this can help fine-tune your strategy.

- Regulatory compliance: For U.S.-based traders, staying compliant with reporting requirements is essential. AI can assist by tracking large transactions and maintaining records for tax purposes while still optimizing performance.

Pros and Cons of AI Trading Solutions

AI-powered platforms bring both strengths and challenges to the table. Knowing these trade-offs is crucial when deciding whether to incorporate AI into your crypto trading strategy. Below, we break down the key benefits and limitations to help you make an informed choice.

Benefits of AI Trading Tools

One of the standout advantages of AI trading systems is their speed and accuracy. While it might take a human several minutes to analyze charts and execute trades, AI can process vast amounts of data and place orders within milliseconds. This speed is especially critical in volatile markets, where prices can shift dramatically in seconds.

Another major benefit is emotionless trading. Human emotions like fear and greed often lead to poor decisions, such as panic selling during market crashes or impulsive buying during rallies. AI systems stick to pre-programmed logic and strategies, ensuring consistent decision-making even in chaotic conditions.

AI also offers round-the-clock operation, solving a common challenge in cryptocurrency trading. These systems monitor markets, spot patterns, and execute trades 24/7, ensuring you don’t miss opportunities while you're offline.

With advanced data analysis, AI can simultaneously process technical indicators, news sentiment, and even social media trends. This holistic approach can uncover trading opportunities that a human might overlook.

AI platforms also provide backtesting and optimization tools, allowing traders to test strategies using historical data. By simulating thousands of scenarios across different market conditions, traders can refine their plans and identify weaknesses before implementing them in live markets.

Drawbacks of AI Solutions

Despite their advantages, AI systems have limitations. A key issue is their dependence on historical data. While AI learns from past market behavior, cryptocurrency markets often face unprecedented events - like the COVID-19 crash or Terra Luna collapse - that don’t follow historical patterns, making predictions less reliable.

For less experienced traders, the technical complexity of these systems can be intimidating. Setting risk parameters, understanding algorithm outputs, and troubleshooting issues require a certain level of expertise, which could lead to mistakes or missed opportunities for those without the necessary skills.

Another challenge is the "black box" problem. AI systems often operate with opaque logic, making it hard for traders to understand why a particular recommendation or decision was made. This lack of transparency can erode trust, especially during critical moments.

AI systems can also struggle with adapting to market changes. Crypto markets evolve quickly, and a strategy that works in a bull market might fail in a bear market unless the system is regularly updated and recalibrated.

Costs are another consideration. Many AI trading platforms charge monthly fees, typically ranging from $49 to $199, in addition to exchange fees and API costs. For smaller traders, these expenses can outweigh the benefits.

Finally, there’s the risk of false signals and overfitting. AI systems might identify patterns in historical data that don’t hold up in real-world trading, leading to poor performance when applied live.

Balancing these pros and cons is essential to using AI tools effectively in the unpredictable world of crypto trading.

Summary of AI Trading Advantages and Limitations

| Advantages | Limitations |

|---|---|

| Processes data faster than humans | Relies on historical patterns that may not repeat |

| Operates 24/7 without breaks | Requires technical expertise for setup and monitoring |

| Eliminates emotional decision-making | Opaque decision-making processes ("black box") |

| Analyzes multiple data sources simultaneously | Monthly fees range from $49 to $199, plus additional costs |

| Allows for thorough backtesting | Can produce false signals during unprecedented events |

| Executes trades in milliseconds | Strategies may fail in rapidly changing markets |

| Maintains consistent risk management | Overfitting can harm real-world performance |

| Detects patterns humans might miss | Requires ongoing adjustments and monitoring |

Your decision to use AI trading tools should depend on your level of experience, technical skills, and available capital. For those with the right expertise and resources, AI can deliver speed, consistency, and deeper data insights. However, combining these tools with human oversight is crucial to navigate their limitations effectively.

Conclusion: Why AI Is the Future of Crypto Trading

Crypto markets are notoriously unpredictable, making traditional timing strategies less effective. Enter AI-powered tools - game-changers for traders navigating these volatile waters. By offering unmatched speed, accuracy, and emotional neutrality, AI systems address many of the challenges human traders face.

These tools excel at processing massive amounts of data in milliseconds, enabling consistent and informed decision-making even during market turbulence. While there are hurdles, such as dependence on historical data and technical complexity, the advantages they bring often outweigh these limitations for traders seeking a competitive edge.

The real magic happens when AI insights are paired with human judgment. This combination creates a powerful synergy, allowing traders to approach market uncertainty with a balance of precision and intuition that neither humans nor machines can achieve alone.

Platforms like StockioAI illustrate the potential of this integration. Whether you're a beginner exploring the free plan's basic AI features or an institutional trader leveraging advanced tools on the Enterprise plan, these platforms make AI accessible and actionable for all experience levels.

At its core, the future of crypto trading isn't about chasing the perfect market entry or exit. It's about leveraging intelligent systems to make consistently better decisions. As markets evolve and data becomes even more central to trading, adopting AI-powered strategies will set traders apart from those clinging to traditional methods.

The real question isn't if AI will dominate crypto trading - it's how soon you'll start using it to refine your strategy.

FAQs

How does StockioAI use AI to reduce risks in cryptocurrency trading?

StockioAI uses advanced AI technology to help reduce risks in cryptocurrency trading. By analyzing market trends, historical data, and real-time signals, the platform can identify potential threats early and adjust strategies to safeguard your investments.

With AI-powered tools, StockioAI automates essential risk management tasks like setting stop-loss orders, diversifying portfolios, and keeping an eye on market volatility. By taking emotions out of the equation and allowing for swift adjustments to market shifts, it helps traders limit losses, handle unpredictable markets, and trade with more confidence.

What challenges do AI tools face in crypto trading, and how can traders address them?

AI tools in crypto trading come with their own set of hurdles. One major issue is limited transparency - it’s often unclear how these algorithms arrive at their decisions. This can make traders hesitant to fully trust or rely on them. Another challenge is that AI systems are only as good as the data they’re fed. If the input data is poor or biased, the resulting predictions can be way off. Additionally, AI struggles to perform reliably in highly unpredictable markets or when faced with manipulation tactics.

So, how can traders navigate these challenges? The key lies in combining AI with human oversight. Critical decisions should always be double-checked by a human to ensure sound judgment. It’s also crucial to work with high-quality, well-validated data to minimize errors. Lastly, implementing strong risk management strategies can help safeguard against potential losses. By blending AI capabilities with thoughtful planning, traders can make the most of these tools while keeping risks in check.

How does StockioAI stay compliant with U.S. cryptocurrency regulations?

StockioAI operates within the framework of U.S. cryptocurrency regulations by meeting crucial federal licensing requirements. This includes securing Money Transmitter Licenses (MTL) for crypto-to-fiat transactions and maintaining Money Service Business (MSB) registration for crypto-to-crypto exchanges.

The company also complies with Anti-Money Laundering (AML) guidelines issued by FinCEN and keeps pace with changes in securities and tax reporting laws. These efforts ensure that all activities remain fully aligned with U.S. legal standards governing digital assets.