AI simplifies multi-timeframe market analysis by automating the tracking of price movements, technical indicators, and patterns across different time intervals. This saves traders from the challenge of manually reconciling conflicting signals, reduces the time spent on analysis, and helps avoid decision fatigue caused by information overload. AI-powered systems deliver real-time alerts, integrate multiple data sources, and adapt to various trading strategies, making them a key tool for navigating fast-moving markets like cryptocurrency.

Key takeaways:

- Conflicting signals resolved: AI unifies data from multiple timeframes, improving decision-making.

- Faster analysis: AI processes data in milliseconds, compared to manual efforts that take much longer.

- Customizable alerts: Tailored notifications match specific trading styles and preferences.

- Improved accuracy: AI systems backtest strategies and provide clear entry/exit points with confidence scores.

- 24/7 monitoring: AI tracks markets continuously, ensuring no opportunity is missed.

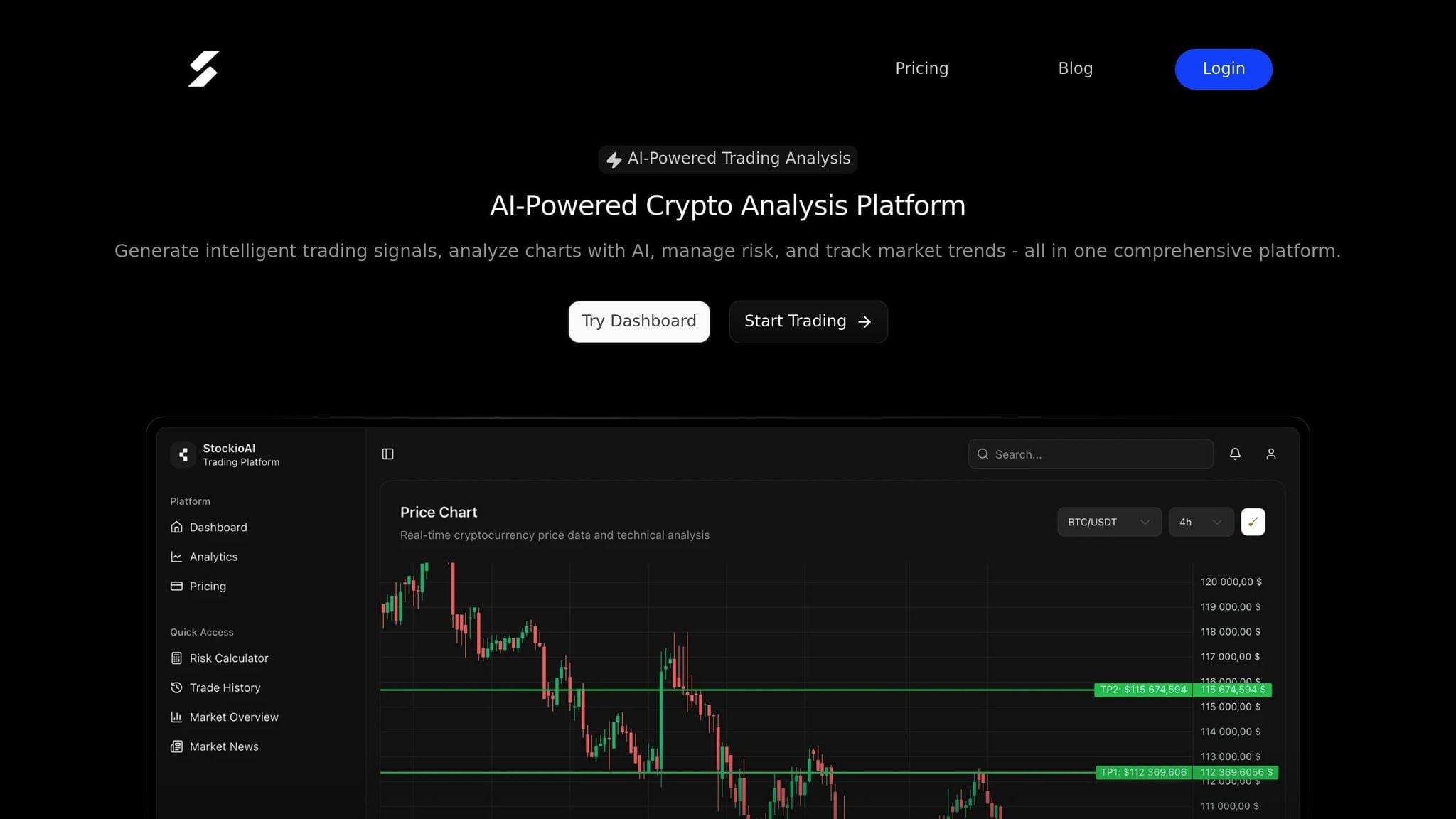

AI tools like StockioAI offer advanced features such as multi-timeframe pattern recognition, risk management tools, and instant notifications, starting at $39/month. While AI excels at speed and precision, human oversight remains critical for interpreting unexpected market events. Combining AI with human judgment creates a balanced trading approach that leverages technology while maintaining flexibility.

AI Crypto Trading: 70% Accurate Buy and Sell Signals Using RSI & Python (MUST WATCH)

Problems with Multi-Timeframe Market Monitoring

Multi-timeframe analysis can uncover market trends, but it comes with its fair share of challenges. The biggest hurdle? Making decisions when signals from different timeframes contradict each other.

Conflicting Signals Between Timeframes

Each timeframe captures a unique slice of market activity. Long-term trends may suggest one direction, while short-term fluctuations point in the opposite. This divergence can leave traders scratching their heads, unsure of which signal to trust.

"A common issue in using Multi Timeframe Analysis is conflicting signals. A buy or sell signal may appear in one timeframe, while an entirely opposite signal appears in another timeframe."

Take the USDJPY market in early January 2022 as an example. On the daily chart, a bull flag pattern hinted at upward momentum. Yet, the 4-hour chart displayed a bear flag, suggesting downward pressure instead [4]. To complicate matters further, lower timeframes often react faster to market changes, potentially signaling new trends before they’re visible on higher intervals [5]. Starting an analysis with shorter timeframes can also skew a trader’s perspective, leading them to overlook confirmations from longer-term charts [2].

Inconsistent signals are tough enough, but when combined with the manual effort of monitoring charts, the process becomes even more daunting.

Manual Analysis Takes Too Much Time

Manually reviewing multiple timeframes is a grind. Cryptocurrency markets, which operate 24/7, demand quick reactions to rapid changes. Constantly switching between charts not only eats up time but can also cause traders to miss critical opportunities.

Information Overload and Poor Decision Making

Adding to the chaos, the sheer volume of data from multiple timeframes can overwhelm even the most seasoned traders. Each chart brings more information than can be processed in real time, leading to decision fatigue. This overload often tempts traders to either chase after every minor signal or spend too much time searching for the perfect one.

Studies have shown that when faced with too much information, decision quality takes a nosedive. Instead of logical, well-thought-out moves, traders may resort to emotional decisions, which can derail their strategies.

"Ultimately, conflicting signals can offer valuable insights. They often precede significant market moves or reveal hidden trends."

- CPA Agnes Oyagi [6]

These challenges highlight the need for smarter tools - ones that can simplify analysis, cut through the noise, and provide timely, accurate market alerts.

How AI Fixes Multi-Timeframe Market Problems

Artificial intelligence takes the often chaotic process of multi-timeframe market analysis and turns it into a streamlined, cohesive approach. Instead of traders struggling with conflicting signals or drowning in endless data, AI systems can analyze complex market movements across different timeframes simultaneously. This creates a unified perspective, setting the stage for the features outlined below.

Combined Analysis Across All Timeframes

AI simplifies the challenge of conflicting signals by analyzing data from multiple timeframes all at once. Rather than manually switching between charts and trying to reconcile conflicting information, algorithms bring everything together in a single, unified view. Technical indicators, trendlines, candlestick patterns, and classic chart formations are overlaid and analyzed collectively.

This approach doesn’t just simplify things - it makes them more effective. AI assigns confidence levels to patterns and forecasts, providing clarity across weekly, daily, and hourly charts. The result? A potential increase in trade success rates by 40%–50% compared to strategies that rely on single-timeframe analysis [11].

Instant Alerts and Market Monitoring

AI eliminates the need for constant manual monitoring by keeping an eye on the market 24/7 and sending instant notifications when significant patterns or movements occur across any timeframe. This is especially valuable in fast-moving markets like cryptocurrency, where opportunities can disappear in minutes.

These tools also perform rigorous backtesting, ensuring that the trade signals they deliver meet strict criteria - such as a historical win rate above 60% and a 2:1 risk-to-reward ratio [9]. What once took weeks or months to analyze can now be accomplished in just minutes or hours [8].

Custom Settings for Different Trading Methods

AI platforms go beyond one-size-fits-all solutions by offering customizable settings tailored to various trading styles. Whether you’re a day trader working with 5-minute charts or a position trader analyzing weekly trends, these systems allow you to adjust alerts, indicators, and conditions based on your preferences, risk tolerance, and historical trading behavior.

What’s more, AI can simultaneously identify chart patterns and detect divergences across multiple timeframes. It adapts its analysis to match current market conditions, whether the market is trending or choppy [7]. Through reinforcement learning, these systems continuously refine their strategies, learning from past data and evolving without requiring constant manual input.

"AI-driven algorithms have the ability to analyze vast amounts of data and identify patterns that are difficult for humans to detect." - Incite AI [10]

With its speed, precision, and ability to adapt, AI transforms multi-timeframe analysis into a powerful tool for traders looking to gain a competitive edge.

Main Features of AI-Powered Multi-Timeframe Alert Systems

AI has revolutionized multi-timeframe analysis by introducing advanced alert systems designed to boost trader efficiency. These platforms simplify the complex process of analyzing markets across various timeframes, providing traders with clear, actionable insights to keep up with fast-moving markets.

AI Scoring and Technical Analysis Integration

One of the most impressive features of AI-powered alert systems is their ability to combine a vast array of technical indicators into a single, easy-to-understand score. Instead of juggling conflicting signals from multiple indicators, traders are presented with a straightforward number that summarizes overall market conditions. For example, StockioAI consolidates numerous technical and fundamental metrics into a single confidence score. This approach eliminates much of the guesswork traditionally involved in technical analysis by correlating and weighing signals across different timeframes.

This scoring method is backed by years of market data, showing that assets with high ratings often outperform average market returns[12][14]. StockioAI's system stands out in this regard, offering traders a streamlined way to interpret complex data and make informed decisions.

Fast Alert Delivery and Notifications

In trading, timing is everything. AI-powered systems excel in delivering alerts within seconds of identifying significant market movements or patterns. StockioAI, for instance, scans thousands of assets in real time and sends instant alerts, ensuring traders can act quickly when specific conditions arise across multiple timeframes.

These alerts are delivered through various channels, including mobile push notifications, email, or direct trading platform integrations. For example, if a breakout pattern is detected on both short-term and long-term charts, traders receive immediate notifications complete with detailed entry points, stop-loss levels, and profit targets. This rapid response capability is crucial for seizing opportunities in volatile markets.

Pattern Recognition and Market Condition Detection

AI brings unmatched precision to identifying chart patterns and assessing market conditions. These systems can detect a wide range of patterns, from simple candlestick formations to intricate multi-timeframe trends, while also classifying market conditions as trending, ranging, volatile, or quiet. This ensures that traders apply the right strategies for the current market environment, reducing the likelihood of acting on false signals during periods of consolidation.

The accuracy of AI in pattern recognition is extraordinary. Sentiment classification achieves 92% accuracy, while technical signal generation aligns with backtesting results 98% of the time[13]. StockioAI's capabilities include identifying bullish divergence patterns and managing trades from start to finish, offering a comprehensive solution for multi-timeframe alerts.

"AI transforms technical analysis by bringing speed, consistency, and pattern recognition capabilities that humans can't match." - WallStreetZen[12]

Benefits and Drawbacks of AI in Multi-Timeframe Alerts

AI has undeniably reshaped multi-timeframe market analysis, offering traders both incredible opportunities and notable challenges. To make the most of this technology, it's important to weigh its strengths alongside its limitations.

Benefits vs. Drawbacks Comparison

AI-powered multi-timeframe alerts bring a host of advantages that have made them a go-to tool for many traders. One standout feature is their speed and precision. These systems can process massive amounts of data and execute trades in milliseconds, a crucial capability in a world where 60-73% of U.S. equity trading volume is now driven by automated trading[1].

Advanced AI platforms can analyze thousands of stocks daily, using strategies with proven success rates above 60%. By processing millions of scenarios, these systems help traders refine their approaches and make informed decisions. Another major advantage is their emotional neutrality - AI doesn’t experience fear or greed, which allows it to make consistent decisions even in volatile markets. And since these systems operate 24/7, they provide uninterrupted market coverage that human traders simply can’t match.

But there are limitations. Flexibility issues arise when markets face unexpected events like breaking news, geopolitical shifts, or sudden policy changes. In such cases, AI systems may struggle to interpret events that fall outside their training data, requiring human intuition to fill the gap.

Cost is another factor to consider. While these systems can reduce operational expenses in the long run, their initial setup and subscription fees can be steep. Plus, they require ongoing monitoring to stay effective as market conditions change.

| Aspect | AI Benefits | AI Limitations |

|---|---|---|

| Speed | Executes trades in milliseconds and processes vast data instantly[1] | Limited ability to adapt to real-time, unforeseen events[1] |

| Data Analysis | Tracks multiple markets and identifies complex patterns[1] | Struggles with interpreting nuanced or unexpected news[1] |

| Emotions | Removes fear and greed, ensuring consistent decisions[1] | Lacks the intuition to gauge market sentiment[1] |

| Availability | Operates around the clock for comprehensive coverage[1] | Still requires human oversight for strategic decisions[1] |

| Costs | Reduces some operational costs over time[1] | High initial setup and subscription fees[1] |

These factors highlight when AI can be most effective and when human involvement is essential.

When to Use AI vs. Manual Analysis

Knowing when to rely on AI and when to lean on human expertise is key to creating an effective trading strategy. AI is best suited for repetitive tasks that demand speed and consistency, such as high-frequency trading, systematic execution, and scanning multiple timeframes for opportunities.

For example, platforms like StockioAI excel at identifying breakout patterns in real time and automating risk management, making them perfect for generating technical signals.

On the other hand, human analysis is critical during periods of uncertainty, major news events, or when interpreting complex market sentiment. Earnings reports, Federal Reserve announcements, or geopolitical tensions often require a level of nuance and adaptability that AI systems can’t provide.

"Manual trading is like driving a car – you have direct control over every action, feeling the market's pulse through your own analysis and decision-making." - SSA Group[1]

The hybrid approach combines the strengths of both AI and human judgment. Use AI tools for data collection, signal generation, and routine monitoring, but rely on your own expertise for final decisions and strategic adjustments. This approach ensures you can leverage AI’s processing power while staying flexible enough to respond to unpredictable market conditions.

It’s also worth noting that AI should never be given full control, especially during volatile periods caused by unforeseen events. As Dmitriy Tarchishnikov, CBDO at WorkBooth, aptly puts it:

"Solid take, using AI as a tool, not a shortcut. The smartest trades still start with human judgment, just faster and sharper with the right tech." [15]

If you’re new to AI-powered alerts, start with a hybrid strategy. Test automated signals alongside manual analysis to find the right balance for your trading goals, risk tolerance, and time. And always be ready to adapt as markets evolve.

StockioAI: Advanced Multi-Timeframe Market Alert Solution

StockioAI offers cryptocurrency traders a platform that combines AI-driven automation with human oversight, creating a balanced hybrid approach. The system processes over 60 real-time data points per second to generate trading signals, making it highly effective for multi-timeframe analysis in the dynamic world of crypto trading [16][17].

Real-Time AI Trading Signals

StockioAI takes its hybrid model a step further with its powerful signal generation features. The platform provides clear BUY, SELL, and HOLD signals across multiple timeframes, complete with detailed explanations, entry points, stop-loss levels, profit targets, and confidence scores.

To simplify multi-timeframe analysis, StockioAI uses a 7-Tier Priority System. This system prioritizes higher timeframe momentum over conflicting lower timeframe signals, minimizing confusion. It evaluates key metrics such as market structure, volume, liquidity, market phases, RSI, MACD, EMA ribbons, SMA context, and price momentum.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader [16]

Integration with TradingView further enhances the platform’s usability. Traders gain access to interactive charts, AI-generated trading levels, and customizable filters. These tools allow users to focus on signals that match their specific strategies, filtering by cryptocurrency pair, timeframe, or confidence level.

Risk Management and Custom Alert Tools

Effective trading isn’t just about signals - it’s also about managing risk. StockioAI tackles this with its Conflict Resolution Matrix, which handles 15 position-sizing scenarios based on current market conditions. This system helps traders adjust their positions when signals from different timeframes conflict.

The platform’s Market Regime Classification identifies whether the market is trending, ranging, volatile, or quiet. This feature helps traders adapt their strategies during periods of high volatility. Additionally, advanced risk calculators assist in determining position sizes based on account balance and risk tolerance. For $79/month (billed annually), the Professional Plan includes these advanced risk management tools along with real-time market alerts [16].

Advanced Analytics and Pattern Detection

StockioAI also excels in analytics. Its AI-powered pattern recognition automatically detects chart patterns, trend reversals, and optimal entry and exit points - critical tools for navigating the fast-paced cryptocurrency market.

The platform monitors significant market movements, including whale activity, institutional flows, and shifts in market microstructure. These insights, often exclusive to large trading firms, are now accessible to retail traders through StockioAI.

To accommodate various trading needs, StockioAI offers three service tiers:

- Free Plan: Includes 3 AI trading signals and basic market insights.

- Starter Plan: Priced at $39/month (billed annually), it provides 30 AI trading signals per month along with basic technical analysis.

- Professional Plan: At $79/month (billed annually), this plan offers up to 500 AI trading signals per month, advanced pattern recognition, and portfolio tracking capabilities.

These options allow traders to choose the plan that best suits their experience level and trading goals.

Conclusion: The Future of AI-Powered Multi-Timeframe Alerts

By 2025, the cryptocurrency market is expected to operate at a pace and complexity that makes manual monitoring impractical [19]. Enter AI-powered multi-timeframe alerts, a game-changer in market analysis once accessible only to institutional investors. These tools are reshaping how traders navigate the ever-evolving crypto landscape.

The numbers tell a compelling story. The AI trading market is projected to grow from $21.59 billion in 2024 to $24.53 billion in 2025, reflecting an annual growth rate of 13.6% [21]. Moreover, AI-driven forecasting models can reduce prediction errors by up to 35% compared to traditional methods [18]. This accuracy becomes critical when deciphering conflicting signals across multiple timeframes.

Speed is another area where AI shines. While human traders might juggle a handful of charts at once, AI systems can process up to 10,000 charts per second [21]. What once required hours of effort can now be achieved in an instant, providing traders with a comprehensive market view at unparalleled speeds.

Beyond speed, AI is evolving to make advanced trading tools more accessible. Multi-agent systems now handle tasks like sentiment analysis, scalping, and backtesting, while no-code platforms empower traders to design their own AI strategies without needing programming expertise [21]. This democratization of complex trading tools is leveling the playing field.

AI systems also stay ahead of market trends by learning and adapting. With frequent retraining on fresh data - daily or weekly - they adjust to changes in market behavior, token utility, and investor sentiment [18]. This adaptability ensures traders are equipped with the most up-to-date insights.

Platforms like StockioAI bring these advancements to life for everyday traders. For just $49 per month, StockioAI offers institutional-grade analysis, including its 7-Tier Priority System for multi-timeframe alerts, making cutting-edge tools accessible to a broader audience.

Looking forward, AI adoption in cryptocurrency trading seems inevitable. Global investment in AI solutions is expected to reach $307 billion by 2025 and surge to $632 billion by 2028 [20]. The benefits are already evident: a Mumbai-based trading firm reported that using agentic AI for managing BankNIFTY straddles reduced trade drawdowns by 28% and improved weekly exit timing by an average of 9 minutes [21].

In this fast-paced, 24/7 market, the question isn’t whether to adopt AI-powered multi-timeframe alerts, but how to integrate them into your trading strategy. These tools are no longer a luxury - they're a necessity for staying competitive and achieving long-term success.

FAQs

How does AI handle conflicting signals in multi-timeframe market analysis?

AI tackles the challenge of conflicting signals in multi-timeframe market analysis by synthesizing data from various technical indicators like EMA crossovers, RSI, MACD, Bollinger Bands, and VWAP. It employs an AI-driven scoring system that assigns specific weights to each indicator based on its importance and reliability. For instance, RSI might account for 30%, MACD for 40%, and VWAP for the remaining 30% of the overall score.

When signals from different timeframes don’t align, the AI focuses on indicators with higher confidence levels and calculates a weighted score to identify the most probable market direction. This approach reduces noise, enhances precision, and equips traders with the insights needed to make more confident buy or sell decisions.

What are the key advantages of using AI for round-the-clock cryptocurrency market monitoring?

AI brings major advantages when it comes to monitoring the cryptocurrency market, which operates non-stop. It can process enormous volumes of data in real time, spotting subtle patterns and forecasting price shifts with impressive speed and precision. This empowers traders to make well-informed, data-backed decisions.

On top of that, AI provides uninterrupted market surveillance, allowing automated trading systems to function 24/7. This ensures traders can seize opportunities even while they’re away, staying agile in a volatile market and ensuring trades are executed promptly in this ever-changing landscape.

How can traders effectively combine AI tools with human judgment to improve their trading strategies?

Traders can reach improved outcomes by blending the precision and speed of AI with the nuanced experience and intuition that only humans bring to the table. While AI is exceptional at processing vast amounts of data, spotting patterns, and delivering insights almost instantly, it’s human expertise that ensures these signals are interpreted correctly within the broader market landscape.

To achieve this synergy, traders should actively validate AI-generated insights, keep a close eye on performance metrics, and retain control over critical elements like risk management and trade execution. This partnership between AI and human judgment allows traders to make decisions that are both well-informed and confident.