The crypto market is fast-paced and complex, making manual analysis nearly impossible. AI-powered pattern recognition tools have become essential for traders, providing real-time alerts, automated analysis, and actionable insights. This article compares five leading platforms - StockioAI, Token Metrics, Cryptohopper, Altrady, and 3Commas - based on signal accuracy, customization, market analysis depth, and pricing.

Key Takeaways:

- StockioAI: Focuses on AI-driven trading signals, customization, and portfolio tracking. Plans range from free to $199/month.

- Token Metrics: Prioritizes fundamental research for long-term investments, offering detailed project evaluations.

- Cryptohopper: Combines automated bots with customizable strategies for hands-free trading. Plans start at $0 and go up to advanced tiers.

- Altrady: Offers advanced charting and portfolio management tools ideal for multi-exchange trading.

- 3Commas: Specializes in automated bots and portfolio rebalancing, with plans starting at $29/month.

Quick Comparison:

| Platform | Focus | Key Features | Price Range |

|---|---|---|---|

| StockioAI | AI trading signals | Real-time alerts, portfolio tracking | Free - $199/month |

| Token Metrics | Fundamental research | Project evaluations, risk assessments | Varies by plan |

| Cryptohopper | Automated trading bots | Customizable bots, paper trading | Free - Paid Plans |

| Altrady | Charting & management | Multi-exchange support, real-time analysis | Free Trial + Paid |

| 3Commas | Automation & rebalancing | DCA bots, portfolio tools | $29 - $99/month |

Each platform suits different needs, from beginners to advanced traders. Start with a free plan or trial, then upgrade as your skills and trading demands grow.

Top 5 AI Trading Tools You Need in 2025!

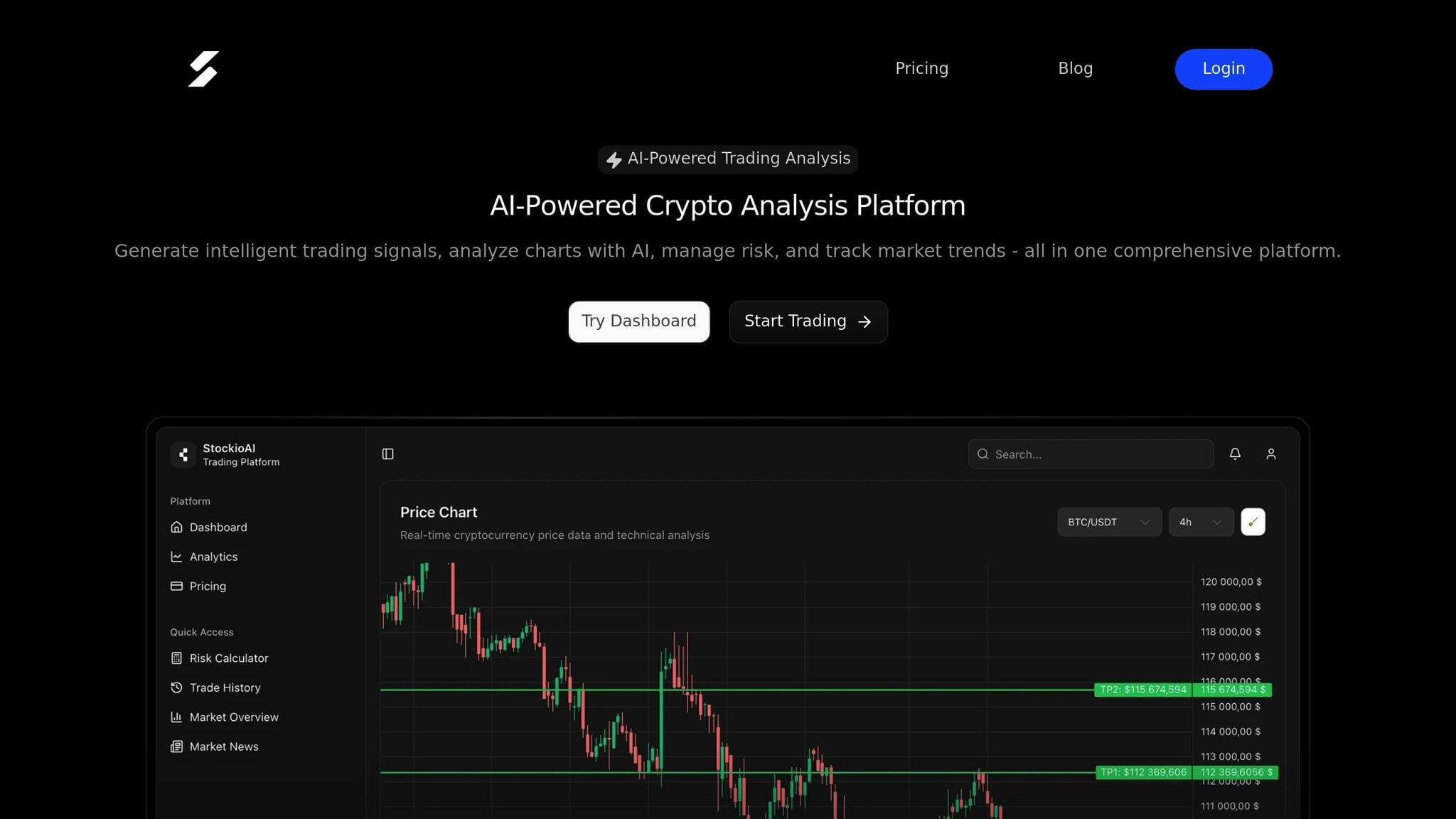

1. StockioAI

StockioAI is a cryptocurrency analytics platform that uses AI to provide real-time trading signals and identify patterns across different timeframes.

AI Trading Signals

StockioAI’s trading signal system leverages AI to analyze both historical and live market data. It delivers clear BUY, SELL, and HOLD recommendations, even during volatile market conditions. By offering insights across multiple timeframes, it helps traders align short-term moves with long-term strategies. Plus, the platform allows for further customization to suit individual trading styles.

Customization and Automation

For those looking to take things a step further, higher-tier plans include features like custom AI model training and API access. These tools let traders integrate StockioAI’s signals into their own trading systems or automated bots.

Market Analysis

StockioAI doesn’t stop at trading signals. It also offers tools for pattern recognition, interactive chart analysis, and portfolio tracking. A real-time market news feed keeps users informed about developments they might otherwise miss, helping them stay ahead of market trends.

Pricing and Features

StockioAI provides a range of pricing options to fit different needs and experience levels:

- Free Plan: Includes 2 trading signals per month.

- Starter Plan ($49/month): Offers 30 signals per month alongside basic technical tools.

- Professional Plan ($99/month): Provides 300 signals, advanced features, and API access.

- Enterprise Plan ($199/month): Includes unlimited signals, multi-user support, dedicated account management, and custom AI training.

Additionally, a built-in risk calculator helps traders manage position sizes and exposure effectively, adding another layer of support to their decision-making process.

2. Token Metrics

Token Metrics takes a different path compared to StockioAI's real-time signal approach. Instead of focusing on immediate trade signals, this platform leans heavily into fundamental research, making it a great fit for traders who value detailed, research-backed evaluations.

At its core, Token Metrics is an AI-powered cryptocurrency research platform. It blends artificial intelligence with traditional analysis to dive deep into the essential aspects of various cryptocurrency projects. This means it doesn’t just skim the surface - it examines the underlying fundamentals that drive these projects.

The platform provides research reports covering project fundamentals, risk evaluations, and market insights, all designed to support long-term investment strategies. For the latest updates and insights, check out Token Metrics directly.

3. Cryptohopper

Cryptohopper is a trading automation platform that combines AI-driven market analysis with advanced tools for automated trading. By blending AI trading signals with customizable bots, it enables users to execute trades automatically, streamlining the trading process.

Customization and Automation

Cryptohopper offers a variety of options for tailoring automated trading strategies. Users can access advanced bot types like Market Making, Exchange Arbitrage, Triangular Arbitrage, and AI-driven strategies, depending on their subscription level. Beyond basic buy-and-sell functions, the platform allows traders to set detailed rules, including stop-loss, take-profit, and dollar-cost averaging. With compatibility across 18 major exchanges such as Binance and Coinbase, users can trade on their preferred platforms. All paid plans also include a paper trading feature, making it easier to test strategies without risking real funds.

Pricing and Value

Cryptohopper's pricing structure is designed to cater to both newcomers and seasoned traders. It uses a tiered subscription system, starting with a free plan for beginners and scaling up to paid plans with more advanced features. Recent price adjustments reflect the addition of new tools like AI capabilities, backtesting, and enhanced strategy-building options. Higher-tier plans unlock perks such as more active trading positions, faster strategy updates, and access to a wider range of bot types. Opting for an annual subscription provides a better deal compared to monthly billing, and the Explorer package includes a 3-day free trial. Additionally, the Explorer, Adventurer, and Hero plans come with a two-week refund policy. While Cryptohopper itself doesn't charge trading fees, users should account for exchange and processing fees that may apply.

4. Altrady

Altrady stands out as a powerful tool for crypto traders, combining advanced charting features with streamlined portfolio management. It’s designed to help traders navigate multiple exchanges with ease and precision.

Market Analysis

With Altrady, traders gain access to multi-timeframe charting and a suite of technical indicators. Its real-time scanning feature helps pinpoint key market patterns, making it easier to identify trading opportunities. This focus on detailed market analysis ensures traders are well-equipped to make informed decisions.

Customization and Automation

Altrady offers a high level of flexibility through its automation features. Traders can set up custom rules and choose from various order types to suit their strategies. The platform’s integrated dashboard simplifies portfolio management, making it easier to monitor and adjust positions. These tools are designed to save time and enhance efficiency.

Pricing and Value

Altrady provides subscription plans tailored to different trading needs, along with a free trial for those who want to explore its features before committing.

5. 3Commas

3Commas is a platform designed for automated trading, using bots to help traders stick to their strategies without needing to watch the markets constantly.

AI Trading Signals

3Commas integrates alerts from TradingView and third-party providers to execute trades efficiently. These signals work across various timeframes, from fast-paced scalping strategies to longer-term trades. Its SmartTrade terminal is particularly powerful, automating complex, conditional orders with multiple steps. Traders can set up triggers based on specific market scenarios, ensuring they don’t miss opportunities even when they’re away from their screens.

Customization and Automation

The platform offers extensive customization for bot settings, allowing users to define parameters like take profit, stop-loss, and trailing strategies. A standout feature is the DCA (Dollar-Cost Averaging) bots, which can adjust positions during market dips while staying within preset risk limits.

3Commas also offers automated portfolio rebalancing. Users can set allocation percentages for different cryptocurrencies, and the platform ensures these allocations remain consistent without manual adjustments. Additionally, it supports trading across multiple exchanges simultaneously, including Binance, Coinbase Pro, and Kraken, making it versatile for traders managing diverse portfolios.

These features, combined with its seamless signal integration, make executing trading strategies more efficient.

Market Analysis

To support informed decision-making, 3Commas includes backtesting tools. Traders can test their strategies against historical market data, analyzing metrics like win rates, maximum drawdown, and profit factors under various conditions before committing real funds.

The platform also features a marketplace where users can explore and replicate successful bot strategies from other traders. Each strategy comes with historical performance data, helping users choose configurations that align with their goals.

Pricing and Value

3Commas uses a subscription-based pricing structure with three levels:

- Starter Plan: $29 per month, offering basic bot functionality and limited simultaneous trades.

- Advanced Plan: $49 per month, including additional bot types and higher trading limits.

- Pro Plan: $99 per month, featuring unlimited bots and advanced tools like portfolio management.

A free trial with paper trading is available, giving users the chance to practice with virtual funds and explore the platform’s features before committing to a plan.

Pros and Cons Comparison

Here's a quick rundown of the strengths and weaknesses of StockioAI, summarizing its features to help traders make an informed choice.

Pros:

- Provides AI-driven analysis with real-time trading signals and interactive charting tools.

- Includes a free plan, offering basic insights for those starting out.

- Offers scalable pricing options for active traders, with premium plans adding features like advanced pattern recognition, portfolio tracking, and API access.

- Adapts its AI approach to shifting market conditions, aiming to support smarter decision-making.

Despite these advantages, there are a few drawbacks to consider.

Cons:

- The free plan is limited, offering only 2 AI trading signals, which may not be enough for those needing deeper market insights.

- Advanced features can be complex and may require time and effort to fully understand and use effectively.

StockioAI combines AI-powered analytics with flexible pricing, making it a compelling option for cryptocurrency traders looking for both entry-level access and robust market tools.

Final Thoughts

Selecting the ideal trading tool comes down to your specific needs, level of experience, and budget. The five tools we've reviewed cater to a range of traders, from beginners to seasoned professionals, each with unique preferences for automation and sophistication.

Here’s how these tools align with different trader profiles:

- Beginners: StockioAI's free plan is a solid starting point, offering basic AI trading signals and market insights to help you get your footing.

- Active Traders: Professional plans unlock more signals and advanced analytics, ideal for those trading frequently.

- Institutions: Custom, multi-user solutions provide seamless integration and scalability for larger operations.

The balance between educational resources and advanced analytics is a key factor. StockioAI stands out by not only delivering AI-driven insights but also explaining the rationale behind its signals, empowering traders to make informed decisions rather than simply following recommendations.

When choosing a plan, consider your trading habits. Casual traders can manage with basic signal limits, while day traders often require unlimited real-time pattern recognition and in-depth market analysis. Starting small and scaling up as your expertise grows is a smart, cost-effective strategy.

A practical approach is to begin with a free or starter plan, take the time to master its features, and then decide if upgrading to a more advanced plan is worth the investment. This gradual progression allows you to build your skills in pattern recognition and market analysis without overspending during your learning phase.

FAQs

How can AI-powered pattern recognition tools improve crypto trading strategies?

AI-driven pattern recognition tools are transforming crypto trading by processing massive datasets in real time to pinpoint patterns and trends that might escape human observation. These tools can anticipate potential price shifts, giving traders valuable insights to make smarter decisions.

By automating tasks such as risk assessment and chart analysis, these tools not only boost efficiency but also minimize human errors. This frees up traders to concentrate on crafting strategies while relying on AI for quicker, data-backed insights to refine their trading performance.

What should I look for in a pattern recognition tool for cryptocurrency trading?

When choosing a pattern recognition tool for cryptocurrency trading, it's crucial to prioritize its ability to analyze real-time market data with precision and speed. In the volatile world of crypto, a dependable tool should leverage advanced algorithms to spot profitable patterns and deliver actionable insights that can help you stay ahead of the competition.

Look for tools that offer customization options to align with your unique trading strategy, include risk management features to safeguard your investments, and can process large datasets without slowing down. These qualities ensure the tool remains practical, easy to use, and capable of keeping up with the ever-changing crypto market.

Is StockioAI’s free plan suitable for beginners to analyze the crypto market effectively?

StockioAI’s free plan offers a simple way for beginners to dip their toes into the crypto market, though it does come with some restrictions. For instance, it provides just 1 image credit per month, which can limit how much users can explore pattern recognition and analysis.

While the free plan can help new traders get a basic grasp of market trends, its features aren’t robust enough for those looking to implement consistent or more advanced trading strategies. It’s a good starting point to get acquainted with StockioAI’s tools, but for deeper insights and more actionable data, upgrading to a paid plan might be necessary.