Managing crypto investments during market volatility requires a clear plan and disciplined execution. Here are the key takeaways to help you navigate unpredictable price swings effectively:

-

Adjust Risk Exposure with Volatility Scaling: Reduce position sizes when markets are turbulent and increase them during calmer periods.

-

Diversify Your Portfolio: Spread investments across major cryptocurrencies, altcoins, and stablecoins to balance risk and returns.

-

Leverage AI Tools: Platforms like StockioAI analyze real-time data and offer actionable signals to help you make informed decisions.

-

Rebalance Regularly: Monitor your portfolio to maintain target allocations and reduce overexposure to any single asset.

-

Track Key Metrics: Use metrics like drawdowns and Sharpe ratios to measure risk and evaluate portfolio performance.

-

Stay Updated: Follow market analytics and news to anticipate shifts and respond quickly.

-

Align with Risk Tolerance: Match your crypto exposure to your financial goals and emotional limits.

-

Use Proven Allocation Models: Apply ratios like 70/20/10 (Bitcoin, Ethereum, altcoins) or 60/30/10 (blue-chip, altcoins, stablecoins) for structured investing.

-

Learn from Institutional Strategies: Adopt techniques like dynamic rebalancing and sector rotation to manage risk.

-

Keep Evolving: Continuously refine your strategies based on market trends and personal experience.

Cryptocurrency Portfolio Construction

1. Use Volatility Scaling to Adjust Risk Exposure

Volatility scaling helps you manage risk by adjusting your position sizes based on how volatile the market is. When volatility spikes, you reduce your exposure; when things calm down, you can increase it.

It’s like driving: you slow down in heavy rain to stay safe and speed up when the road is clear. This method offers a practical way to handle the unpredictable nature of crypto markets.

Why It Works for Risk Management

Sticking to fixed position sizes can leave you exposed to inconsistent risk. For instance, a $5,000 Bitcoin position becomes far riskier during a volatility spike than in quieter times. Volatility scaling keeps your risk exposure steady, regardless of market swings.

Here’s some context: Bitcoin and Ethereum have shown annualized volatility of about 70% in recent years, with drawdowns exceeding 80% [11]. Research also shows that allocating just 2.5% to Bitcoin using volatility scaling can improve a portfolio's Sharpe ratio [11].

For example, say Bitcoin's Average True Range (ATR) doubles from $1,000 to $2,000. To maintain consistent dollar risk, you’d cut your position size in half. This approach proved effective during the 2021 crypto bull run, when rapid price changes required swift adjustments to avoid significant losses [2].

Tools for Real-Time Adjustments

To apply volatility scaling effectively, you need real-time data. Indicators like Bollinger Bands, Average True Range (ATR), and standard deviation help measure volatility. A rising ATR, for instance, signals increased market turbulence, prompting you to scale back your trade size to reduce risk [3][4].

Platforms like StockioAI make this process easier. They provide live updates on volatility metrics, trading signals, and risk calculators, allowing you to respond quickly to changing conditions [6]. These tools are invaluable for fine-tuning your strategy and staying ahead of market shifts.

Staying Flexible in Volatile Markets

Volatility scaling enhances your ability to adapt as market conditions evolve. This is especially important in crypto, where sudden spikes in volatility can be triggered by news, regulatory updates, or major trades [2][3]. The strategy works well across different trading styles, particularly momentum-based approaches [7].

By adjusting your position sizes to match market volatility, you can reduce drawdowns and stabilize returns. To make this work, calculate each asset’s volatility using technical indicators, set a target risk level (usually 1–2% of your total capital per trade), and adjust your positions to keep dollar risk consistent. Regular updates to these calculations are essential as market conditions shift.

Keep an eye on key metrics like portfolio drawdown, Sharpe ratio, and win/loss consistency to ensure your strategy is effectively managing risk and improving your overall performance.

2. Diversify Your Portfolio with Balanced Allocation

Balanced allocation is a smart way to lower risk by spreading your crypto investments across multiple assets. Think of it as a safety net - when one cryptocurrency takes a hit, others in your portfolio might hold steady or even rise. This approach not only helps cushion against losses but also creates a more stable return over time.

Why Diversification Matters

Cryptocurrencies don’t all move in the same direction. While one might drop sharply, another could stay steady or even climb. This lack of correlation helps smooth out your overall returns[9][11].

For example, a portfolio could look like this:

This setup combines established assets like Bitcoin and Ethereum with growth-focused altcoins, while stablecoins add a layer of stability.

Managing Risk Effectively

Diversification plays a key role in stabilizing portfolios, especially during market recoveries. While many cryptocurrencies have lost value over time, Bitcoin and Ethereum have shown resilience, bouncing back from major drops[11]. Pairing diversification with volatility scaling helps manage risk across unpredictable markets. Setting limits on how much you invest in any single asset ensures no one position dominates your portfolio. For instance, many high-net-worth investors follow this principle, with 37% avoiding crypto entirely and most keeping their crypto exposure under 10%[8].

Using Real-Time Tools for Better Decisions

To make the most of a diversified portfolio, staying informed is crucial. Platforms like StockioAI offer real-time analytics to track performance, flag potential risks, and fine-tune your allocations. With features like AI-powered pattern detection and risk calculators, you can make more data-driven decisions to keep your portfolio on track.

Adapting to Market Conditions

Diversification isn’t static - it needs to change with market conditions. During periods of high volatility, you might want to shift more funds into stablecoins and reduce exposure to riskier altcoins to protect your capital. Regular rebalancing, whether monthly or quarterly, is key. For instance, if Bitcoin’s share of your portfolio grows significantly, it might be time to take profits and redistribute funds. Keep an eye on key metrics to adjust your strategy as the market evolves[3].

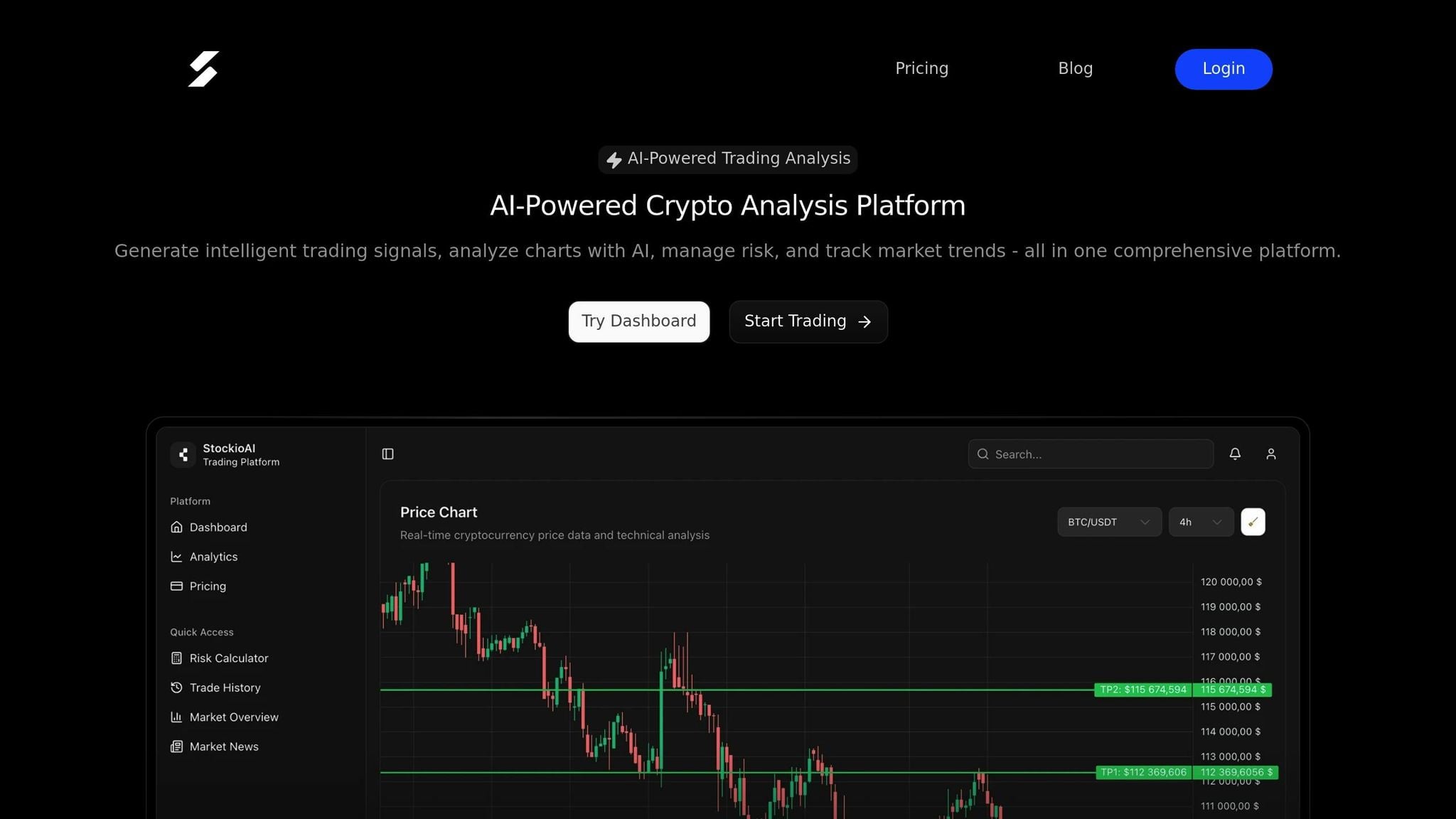

3. Use AI Tools Like StockioAI for Real-Time Insights

In the unpredictable world of crypto markets, having access to real-time data and smart analysis can be the key to seizing opportunities before they pass you by. AI-powered platforms like StockioAI can process massive amounts of market data faster than any human, turning complex information into actionable insights.

Real-Time Analytics and Decision-Making Tools

StockioAI evaluates more than 60 data points - such as technical indicators, volume trends, market sentiment, and order book depth - to generate precise BUY, SELL, and HOLD signals. Each signal comes with clear entry points, stop-loss levels, and profit targets, as well as a confidence score that indicates the signal's reliability. For instance, if a breakout pattern is identified, the AI pinpoints the best entry point while defining risk management levels.

The platform’s interactive TradingView charts overlay AI-generated support and resistance zones, making it easier to identify market structures at a glance. On top of that, a real-time news feed keeps you updated on events that could influence your trades, ensuring you're always equipped with the latest information to adapt to changing conditions.

Risk Management Without Emotional Bias

One of the biggest challenges in trading is keeping emotions out of decision-making. StockioAI helps with this by offering tools like a risk calculator that tailors position sizes based on your risk tolerance and current market volatility. When prices swing sharply, the platform adjusts its recommendations to protect your capital.

The system also fine-tunes its stop-loss suggestions to match market volatility. For example, during Bitcoin's turbulent periods, it might recommend wider stop-losses to prevent being prematurely stopped out by normal fluctuations. Conversely, in calmer markets, it tightens stop-loss levels to lock in profits more effectively.

Adapting to Market Volatility

StockioAI doesn’t just react to market changes - it anticipates them. By monitoring trends across multiple timeframes, the platform ensures that higher timeframe momentum takes precedence over conflicting short-term signals. This approach keeps your trading strategy aligned with the bigger picture.

The AI also classifies market conditions - such as trending, ranging, volatile, or quiet - and adjusts strategies accordingly. For example, during a volatile market, it might suggest reducing exposure to high-risk altcoins while shifting focus to more stable assets. This adaptability helps traders navigate even the most unpredictable scenarios with confidence.

Smarter Portfolio Diversification

Diversification isn’t just about spreading investments - it’s about spreading risk effectively. StockioAI analyzes correlation patterns between cryptocurrencies, uncovering relationships that might not be immediately obvious. This allows you to build a portfolio that minimizes risk by avoiding overexposure to assets that move in sync.

The platform’s pattern recognition algorithms also identify when specific sectors of the crypto market are overbought or oversold. For instance, it might recommend increasing exposure to undervalued DeFi tokens or focusing on large-cap cryptocurrencies during uncertain times. By making these tactical adjustments, you can position your portfolio to take advantage of shifting market dynamics.

4. Monitor and Rebalance Your Portfolio Regularly

The crypto market is notorious for its rapid shifts, which can quickly throw your portfolio off balance. This phenomenon, known as portfolio drift, happens when one asset gains disproportionate weight due to market volatility. When this occurs, your risk exposure changes, potentially leading to larger losses. That’s why regular rebalancing is essential - it helps you maintain your intended risk levels while leveraging strategies like diversification and volatility scaling.

Risk Management in Action

Take the 2021 Bitcoin bull run as an example. During this period, Bitcoin's value surged, causing its share in many portfolios to rise above 60%. Traders who monitored their portfolios daily noticed this shift and rebalanced by selling some Bitcoin to invest in Ethereum or stablecoins. This not only locked in profits but also reduced risk. When Bitcoin's price later dropped sharply, those who rebalanced were better protected, highlighting the importance of active monitoring.

The process begins with tracking asset allocation percentages and comparing them to your target weights. For instance, if you started with 40% in Bitcoin and 30% in Ethereum, but Bitcoin's surge pushes its share to 55%, your portfolio is now overly dependent on Bitcoin’s price movements. To avoid this, many traders rebalance when an asset strays 5–10% from its target. Others prefer a time-based approach, rebalancing monthly or quarterly regardless of market conditions.

The Role of Diversification

Rebalancing isn’t just about managing risk - it’s also a way to balance returns. Monthly rebalancing is a practical choice, as it keeps your portfolio aligned with your target allocations without incurring excessive transaction costs. This frequency strikes a good balance between being responsive to market changes and minimizing fees.

Diversification is another key benefit. By spreading your investments across multiple cryptocurrencies, you reduce the impact of sharp price swings in any single asset. Gains in one area can offset losses in another, leading to more stable returns and less emotional stress during turbulent markets.

Research backs this up: adding a modest 6% crypto allocation to a traditional 60/40 portfolio can improve the Sharpe ratio - a measure of risk-adjusted returns - while having only a small impact on drawdown. However, these benefits depend on consistent rebalancing to maintain target allocations.

Using Real-Time Tools for Better Decisions

Tools like StockioAI make rebalancing easier and more precise. For example, StockioAI’s risk calculator helps determine position sizes, stop-loss levels, and optimal leverage for your trades. If your portfolio becomes overweight in a particular asset, the platform calculates exactly how much to sell and where to reinvest.

Beyond just numbers, real-time analytics and sentiment analysis can refine your timing. Instead of selling a top-performing asset too early, you can use AI-driven insights to identify optimal exit points. This approach can prevent you from rebalancing right before a continued rally or just after a temporary dip.

StockioAI processes over 60 real-time data points, including technical indicators, trading volumes, and whale movements, to help you spot rebalancing opportunities that align with broader market trends. This data-driven approach can improve both timing and execution.

Adjusting for Volatile Markets

In times of extreme volatility, rebalancing strategies may need to adapt. For example, Bitcoin and Ethereum have historically shown annualized volatility around 70%, with drawdowns exceeding 80% during severe market corrections. In such conditions, weekly or even daily monitoring might be necessary.

Tactical rebalancing can be particularly useful in these scenarios. During a market crash, you might temporarily shift more of your portfolio into stablecoins to protect your capital. Once the market stabilizes, you can gradually reinvest in cryptocurrencies.

Key metrics to track during this process include portfolio volatility, drawdowns (peak-to-trough declines), the Sharpe ratio, and correlations between assets. These indicators help you evaluate whether your rebalancing strategy is effective and guide adjustments to align with changing market conditions. By staying proactive, you can better navigate the unpredictable nature of crypto markets.

5. Track Key Metrics Like Drawdowns and Sharpe Ratios

When navigating the crypto market, focusing on more than just price movements is essential. Metrics like drawdowns and Sharpe ratios offer deeper insights into risk and return, helping you make informed decisions about adjusting your portfolio strategy, especially during turbulent times.

Understanding Risk Through Drawdowns

A maximum drawdown measures the largest loss your portfolio experiences from its peak to its lowest point. This metric gives you a clear picture of the worst-case scenario you might face - an important consideration given the crypto market's notorious volatility. For instance, if your portfolio drops from $100,000 to $75,000, that’s a 25% drawdown. Many experts recommend keeping drawdowns below 20–25% to avoid excessive risk exposure.

The Sharpe ratio, on the other hand, evaluates how much return you're earning for the risk you're taking. A ratio above 1.0 is generally seen as desirable for active crypto portfolios, signaling efficient returns relative to the risk. Together, these metrics provide a framework for assessing your portfolio’s performance and identifying areas for improvement.

The Role of Diversification

Tracking drawdowns and Sharpe ratios also sheds light on how diversification impacts your portfolio. By monitoring drawdowns for individual assets, you can identify high-risk holdings and rebalance before losses escalate.

However, during market stress, correlations between crypto assets often increase, temporarily reducing the benefits of diversification. This makes it even more critical to keep an eye on individual positions. Additionally, the history of total loss events in crypto emphasizes the importance of spreading investments across multiple assets to mitigate risk.

Tools for Real-Time Insights

Incorporating real-time analytics into your strategy can significantly improve your decision-making. Platforms like StockioAI offer tools for tracking drawdowns and Sharpe ratios in real time, giving you immediate feedback on your portfolio’s risk metrics.

StockioAI also features an integrated risk calculator that helps you determine optimal position sizes based on your drawdown thresholds. Plus, its AI-powered pattern recognition can alert you when performance metrics start to decline, signaling it’s time to rebalance. These tools take much of the guesswork out of managing your portfolio, especially during volatile periods.

Adjusting to Market Volatility

Crypto markets are unpredictable, and being flexible is key to navigating them effectively. During periods of extreme volatility, your usual risk thresholds may no longer apply. For example, a portfolio that typically performs well in stable conditions might see its Sharpe ratio drop significantly during a downturn, indicating the need for tactical adjustments.

To manage this, consider scaling back your crypto exposure when drawdowns exceed your comfort level. Once the market stabilizes and performance metrics improve, you can gradually increase your exposure. Successful traders continuously refine their strategies, adapting their risk and return targets to align with current market conditions.

6. Stay Updated with Market Analytics and News

The crypto market moves fast - sometimes within minutes or seconds. Staying on top of analytics and news is essential to protecting your portfolio, and it ties directly into earlier strategies like managing risk and adjusting positions.

Real-Time Analytics and Decision-Making Tools

Crypto trading thrives on data. AI platforms analyze real-time metrics like technical indicators, trading volume, and market sentiment to guide decisions. These insights form the backbone of the strategies discussed earlier, offering clear signals on entry points, stop-loss levels, and profit targets.

Take StockioAI as an example. It delivers real-time trading signals backed by strong performance data from closed trades without leverage[1]. Using advanced algorithms, the platform evaluates market indicators, resistance levels, momentum patterns, and volatility to pinpoint the best exit strategies and minimize risk.

Speed and accuracy are the standout benefits here. Where manual analysis might take hours to sift through multiple data streams, AI tools process this information in seconds. That’s a game-changer in markets that can pivot dramatically in moments.

Staying Ahead in Risk Management

Keeping up with market analytics also sharpens your ability to manage risks. Major events like regulatory changes, security breaches at exchanges, or institutional moves can cause big market swings in a short amount of time. For instance, during the 2021 China crypto ban, traders who acted on real-time news managed to exit risky positions before the fallout.

Analytics can also help you spot trouble before it fully unfolds. Metrics like exchange inflows, large wallet (or “whale”) movements, and derivatives positioning often hint at selling pressure before it impacts prices. These early warnings let you adjust your exposure or hedge your bets, complementing tactics like volatility scaling or portfolio rebalancing.

Adapting to Market Volatility

As discussed earlier, adaptability is key in crypto’s volatile environment. Staying informed with high-quality analytics and up-to-the-minute news lets you shift strategies, rebalance holdings, and manage risks effectively. Missing or delayed information, on the other hand, can leave you vulnerable to losses or missed opportunities.

Consider this: Bitcoin and Ethereum have shown annualized volatility of around 70%, with drawdowns topping 80% in recent years[11]. In such a turbulent market, quick adjustments are critical. Real-time alerts can notify you about volume spikes, price breakouts, or sentiment shifts that demand action.

Platforms like StockioAI enhance this adaptability. Its AI-powered tools recognize chart patterns, trend reversals, and ideal entry or exit points, giving you the edge in managing risks. Additionally, its curated news feed keeps you updated on market-moving events as they happen.

Continuous monitoring can be overwhelming, but automated analytics platforms fill the gap. They provide 24/7 surveillance and instant alerts for significant developments, ensuring you’re always in the loop and ready to act when it matters most.

7. Match Crypto Allocations with Your Risk Tolerance

Your risk tolerance forms the backbone of a smart crypto allocation strategy. It’s about understanding how much market volatility you can handle without losing your cool or making impulsive decisions. With Bitcoin and Ethereum showing annualized volatility of around 70% and capable of drawdowns exceeding 80%[11], knowing where you stand is critical in navigating the crypto world.

Understanding Risk Management

Effective risk management starts with an honest look at yourself. Risk tolerance isn’t just about how much financial loss you can endure - it’s also about how you emotionally react when your portfolio takes a hit[3]. If wild swings in value leave you anxious or sleepless, it’s a sign to adjust your approach.

Many seasoned traders stick to a simple rule: they limit their risk to 1-2% of their total capital per trade[3]. This disciplined approach ensures that even during volatile times, no single trade can wipe out their portfolio. Tools like stop-loss orders and careful position sizing are essential for staying within your comfort zone.

Your broader financial situation and investment timeline also play a role. If you need quick access to cash or can’t afford a significant loss, keeping your crypto exposure minimal is a smart choice. Some cryptocurrencies have suffered total losses, so assessing your personal circumstances helps shape not only how much you invest but also how you spread that investment across different assets.

The Role of Diversification

Tailoring your diversification strategy to match your risk tolerance is another key step. While diversification won’t eliminate overall market risk, it can help balance the wild price swings of individual cryptocurrencies[11][13]. For a conservative approach, focus on Bitcoin and stablecoins. If you’re more aggressive, you might lean toward altcoins. The mix you choose should reflect your comfort with risk.

Even a small allocation to Bitcoin can improve your portfolio’s risk-return profile, provided it aligns with your tolerance[11]. If picking individual cryptocurrencies feels daunting, consider index strategies or diversified baskets. These options provide exposure to the market while reducing the risk tied to selecting individual assets - similar to how early investors approached the tech sector.

Tools for Smarter Decision-Making

Platforms like StockioAI offer AI-powered tools to help you align your crypto allocations with your risk tolerance[3]. These tools analyze market data in real time, providing actionable insights like risk assessments and stop-loss recommendations.

Position sizing calculators and portfolio monitoring features also help track your exposure, making it easier to adjust your holdings as needed. By taking the guesswork out of the equation, these tools allow you to make more precise decisions that stay within the boundaries of your risk tolerance.

Adjusting to Market Volatility

Crypto markets can shift dramatically, so your allocation strategy needs to be flexible. During periods of extreme volatility, it’s wise to reduce exposure to speculative altcoins and increase your holdings in stablecoins. This approach helps preserve capital while keeping you in the market.

Regular rebalancing is essential to ensure your portfolio stays aligned with your risk profile, even as market conditions evolve[14]. Emotional reactions - driven by fear or greed - can lead to poor decisions[3]. A clear trading plan with predefined risk limits, supported by automated tools, can help you stick to your strategy and avoid impulsive moves during turbulent times.

While it’s important to adapt your allocations to changing markets, your core risk boundaries should remain steady, reflecting both your financial capacity and emotional resilience.

8. Apply Proven Portfolio Composition Ratios

Creating a successful crypto portfolio often hinges on using well-established composition ratios to balance risk and reward. These ratios provide a structured approach to allocating your investments across different asset types and risk levels, making it easier to manage your portfolio effectively.

Portfolio Diversification Benefits

Using widely accepted composition ratios can help spread risk more efficiently. Take the 70/20/10 model, for example: 70% of your portfolio is allocated to major cryptocurrencies like Bitcoin and Ethereum, 20% to mid-cap coins, and 10% to speculative altcoins[3]. This setup reduces over-reliance on any single asset while still allowing you to tap into growth opportunities. It also naturally encourages the use of advanced tools for ongoing adjustments.

For those incorporating crypto into a traditional portfolio, studies suggest that adding 2.5% to 6% in cryptocurrency to a standard 60/40 stock-bond mix can significantly boost the Sharpe ratio - improving risk-adjusted returns without drastically increasing potential losses[12][11]. VanEck's analysis spanning 2015 to 2024 found that a crypto-only portfolio optimized with 71.4% Bitcoin and 28.6% Ethereum delivered the best risk-adjusted returns[12].

Risk Management Effectiveness

Portfolio composition ratios are essential for managing crypto's notorious volatility. With Bitcoin and Ethereum showing annualized volatility around 70% and historical drawdowns exceeding 80%[11], having a structured allocation is key to weathering market swings.

A practical approach is the 1-2% position sizing rule, which limits the impact of any single trade on your overall portfolio[3]. For instance, if you allocate just 10% of your portfolio to speculative altcoins, even a complete loss in this segment won't derail your entire investment strategy.

Tools like StockioAI's Risk Calculator can help you fine-tune your position sizes and set appropriate stop-loss levels based on your chosen ratios[3]. The platform uses AI to monitor risk factors and generate sell signals when necessary, ensuring your portfolio stays aligned with your target allocations - even during turbulent market periods.

Real-Time Analytics and Decision-Making Tools

Keeping your portfolio ratios on track requires constant monitoring and adjustments. StockioAI simplifies this by analyzing over 60 real-time data points, including technical indicators, volume trends, and market sentiment. This helps you identify when your allocations deviate from target ratios and signals when rebalancing is needed.

Similar to traditional rebalancing strategies, these tools ensure your portfolio remains aligned with your goals. Multi-timeframe insights and AI-driven pattern recognition offer actionable recommendations for adjusting ratios. For example, during market upheavals, the platform can suggest increasing your stablecoin allocation or reducing exposure to speculative altcoins, helping you stay within proven frameworks.

Adaptability to Market Volatility

Effective portfolio ratios are not fixed - they adapt to changing market conditions while maintaining their core structure. During periods of extreme volatility, you might consider a more conservative 50/30/20 ratio: 50% in Bitcoin and Ethereum, 30% in stablecoins, and 20% in select altcoins[3].

Dynamic adjustments are crucial as market conditions evolve. Monthly rebalancing is often recommended to maintain your target allocation and reduce the impact of crypto price swings[12]. Another useful strategy is volatility scaling, where portfolio weights are adjusted based on recent market turbulence. Combining this with momentum-based strategies can further improve risk-adjusted returns[7].

The StockioAI platform continuously monitors market trends, offering hold recommendations during sideways movements to minimize unnecessary trading. By analyzing correlations and market structures, it helps you decide when to adjust ratios and when to hold steady.

The key is to choose ratios that match your risk appetite and adjust them as needed. Whether you rely on institutional-grade models or simpler percentage-based strategies, consistency and regular monitoring are what ultimately drive long-term success.

9. Learn from Institutional Volatility Strategies

Institutional investors have long employed advanced methods to weather the unpredictable nature of the crypto market. These strategies focus on systematic risk management, dynamic portfolio adjustments, and leveraging analytics to make informed decisions during volatile periods. Individual traders can take cues from these approaches to fine-tune their own trading practices.

Effective Risk Management

Institutions are known for enforcing strict risk controls, often limiting their exposure to just 1–2% per trade and relying heavily on stop-loss orders. Individual traders can adopt similar measures using tools like StockioAI's Risk Calculator to manage their risk with precision.

The Role of Portfolio Diversification

To spread risk effectively, institutional portfolios typically include a mix of cryptocurrencies such as Bitcoin, Ethereum, Cardano, and Solana, alongside traditional assets like stocks and bonds [2][3]. Additionally, many institutions employ sector rotation - shifting investments between different crypto categories depending on market trends - to further balance risk [9].

Leveraging Real-Time Analytics

StockioAI provides high-quality tools that mirror institutional resources, offering features like BUY, SELL, and HOLD signals, interactive charting, and up-to-the-minute market news. These capabilities allow traders to stay informed and act swiftly as market conditions evolve.

Adapting to Volatility

Institutions frequently adjust their risk exposure through techniques like volatility scaling and dynamic rebalancing. These practices are designed to seize short-term opportunities while minimizing potential losses. By incorporating these structured, data-driven methods, individual traders can better navigate the ups and downs of the crypto market and make more strategic decisions about their capital allocation.

10. Keep Learning and Adapting Your Approach

The crypto market moves fast - what's hot today might be irrelevant tomorrow due to regulatory updates, technological breakthroughs, or shifting investor sentiment. Staying ahead means being ready to learn and adjust constantly. Sticking to outdated strategies can leave you unprepared for the rapid shifts that define this space.

Adapting to Market Volatility

Adjusting to changing market dynamics is essential in crypto trading. Successful traders frequently revisit their strategies, tweaking them based on fresh data and emerging trends. This might mean recalibrating your position sizes, reassessing your risk tolerance, or switching up your asset mix as volatility ebbs and flows.

Unlike traditional markets, crypto can pivot within hours. A bullish strategy that worked wonders last week could backfire during a bearish downturn or a stagnant market. Beyond the usual technical indicators like moving averages or Bollinger Bands, reviewing your past trades can offer valuable insights into where adjustments are needed.

The trick is finding the sweet spot between being flexible and staying disciplined. While it’s important to respond to market changes, knee-jerk reactions to short-term fluctuations can derail your long-term goals. Establish clear rules for when and how you’ll adjust your strategy, and stick to them - even when emotions threaten to take over. Advanced tools can also play a big role here, helping you align your strategy with actionable market intelligence.

Real-Time Analytics and Decision-Making Tools

Real-time data is the backbone of modern crypto trading. With the market running 24/7, opportunities can appear and vanish in minutes. Platforms like StockioAI offer traders the real-time insights they need to act quickly, analyzing over 60 live data points.

These tools go beyond simple price tracking. Advanced platforms provide actionable BUY, SELL, or HOLD signals, complete with entry points, stop-loss recommendations, and profit targets. They also analyze market sentiment, keep an eye on social media trends, and assess order book depth to give you a well-rounded view of the market.

AI-powered features, such as pattern recognition, can identify trend reversals and pinpoint entry and exit opportunities that even experienced traders might overlook. Combining these insights with your judgment can significantly enhance your decision-making process.

Sharpening Risk Management

Continuous learning enhances your ability to manage risk effectively. Over time, as you analyze your trading history and gain experience, you’ll develop a sharper instinct for managing position sizes, placing stop-loss orders, and allocating your portfolio more wisely.

This ongoing refinement ties back to the earlier point about adaptability, ensuring your strategy evolves with market conditions. Tools like StockioAI’s risk calculator can be incredibly helpful, offering guidance on optimal position sizes and leverage based on current volatility, your risk appetite, and your portfolio's structure.

Smarter Portfolio Diversification

Expanding your knowledge also improves how you approach portfolio diversification. By staying informed about new cryptocurrencies and sectors, you can fine-tune your diversification strategy over time. The crypto landscape is always introducing fresh projects and investment opportunities.

Diversification isn’t just about spreading your bets across different coins. It’s about understanding how assets interact, spotting sector rotation trends, and recognizing how various crypto categories react to market events. This deeper understanding helps you build a portfolio that’s better equipped to handle market swings.

Rebalancing plays a key role here. As certain assets outperform while others lag, your portfolio’s balance naturally shifts. Regular adjustments ensure you maintain the risk distribution that aligns with your goals.

Top crypto traders treat learning as a lifelong journey. They stay informed by reading financial news, engaging with trading communities, taking online courses, and reflecting on their own performance. This dedication to growth strengthens every aspect of their trading - risk management, capital allocation, and strategy refinement - keeping them ahead of the curve in an ever-changing market.

Conclusion

Managing crypto volatility isn’t about luck - it’s about having a clear plan. The ten strategies discussed earlier offer a solid framework for handling your investments when the market takes unpredictable turns. Techniques like volatility scaling - which adjusts your risk exposure based on recent price fluctuations - and creating diversified portfolios that spread risk across various assets can help you craft a more stable and effective trading approach.

For example, research shows that allocating just 3% of your portfolio to Bitcoin can optimize the Sharpe ratio. Additionally, the 60/30/10 core-satellite model (60% in blue-chip cryptocurrencies, 30% in altcoins or DeFi projects, and 10% in stablecoins or yield-generating assets) has become a go-to strategy for institutional investors [5][10].

Tools like StockioAI, which analyzes over 60 real-time data points per second, provide actionable trading signals with a 75% win rate and a profit factor of 2.95 [1]. These kinds of insights highlight the growing role of advanced analytics in navigating crypto markets.

It’s important to remember that your allocation strategy should evolve alongside market conditions and your own experience. Strategies that thrive in a bull market may need to be adjusted during bearish or sideways phases. Regular portfolio rebalancing - whether monthly or quarterly - helps keep your risk levels in check, particularly when one asset outpaces others significantly.

Unlike traditional markets, crypto never sleeps. Opportunities and risks can surface at any time, which makes round-the-clock risk management essential. Whether you’re using volatility scaling to fine-tune your position sizes or applying institutional methods like Value-at-Risk, the objective remains the same: protect your capital while staying positioned for growth. Tools like risk calculators can simplify decisions about position sizes and leverage, taking the guesswork out of trade allocation. Automated tools and real-time analytics that deliver clear BUY, SELL, or HOLD signals, complete with entry points and stop-loss levels, are invaluable during periods of heightened volatility.

Ultimately, your success hinges on your ability to adapt and execute consistently. Whether it’s scaling positions, diversifying across sectors, or leveraging AI-driven insights for better timing, a systematic approach will guide you toward long-term rewards.

FAQs

What is volatility scaling in crypto trading, and how can it help manage risk?

Volatility scaling is a trading approach where you adjust your position sizes depending on how volatile the market is. The idea is simple: when the market is highly volatile, you take smaller positions to limit risk. On the flip side, when things are calmer, you can afford to take larger positions. This helps you manage risk more effectively and safeguard your capital.

Platforms like StockioAI can make implementing this strategy much easier. They offer tools like risk calculators to help you figure out the best position sizes, set stop-loss levels, and decide on leverage. These features give traders the ability to make smarter choices and quickly adapt to shifting market conditions.

How can AI tools like StockioAI improve decision-making in crypto trading during volatile markets?

AI tools like StockioAI equip traders with real-time insights and actionable data, making it easier to navigate the unpredictable crypto market. With features like precise trading signals (BUY, SELL, HOLD), interactive charting tools, and risk calculators, users can make smarter decisions even as market conditions shift rapidly.

StockioAI also uses AI-driven pattern recognition to spot critical trends and pinpoint the best entry and exit points. Additionally, it provides access to the latest market news and analytics, helping traders minimize guesswork, allocate their capital more effectively, and trade with greater confidence.

Why is rebalancing your crypto portfolio important, and how can you manage asset allocation during market volatility?

Maintaining balance in your crypto portfolio is key to sticking to your target asset allocation and keeping risks under control, especially in the face of market volatility. Over time, price swings can shift your portfolio away from its intended structure, potentially increasing your exposure to certain assets and changing your overall risk level.

Rebalancing involves selling assets that have exceeded your target allocation and purchasing those that have fallen below it. This realignment helps ensure your portfolio stays aligned with your investment goals. Platforms like StockioAI can simplify this process by offering real-time insights, risk management tools, and actionable signals, making it easier to navigate even the most unpredictable market conditions.