AI sentiment analysis is reshaping how traders manage risks in the volatile crypto market. By analyzing social media, news, and market data in real time, AI tools help identify market mood shifts, early risks, and trading opportunities. Here's how it works:

- Tracks Public Sentiment: AI scans platforms like Twitter, Reddit, and Telegram to gauge market emotions.

- Handles Data Volume: Processes vast amounts of 24/7 crypto discussions that humans can't manage alone.

- Detects Patterns: Identifies trends where sentiment shifts preceded price movements.

- Filters Noise: Removes irrelevant or manipulative data for accurate insights.

Key Benefits for Risk Management:

- Spot market euphoria or panic selling early.

- Detect manipulation and sentiment contagion between cryptocurrencies.

- Adjust portfolios dynamically based on sentiment trends.

Challenges:

- Social media noise, crypto slang, and manipulation campaigns can distort results.

- Sentiment data alone isn't foolproof - combining it with technical indicators is essential.

Platforms like StockioAI simplify this process by delivering actionable trading signals, real-time sentiment updates, and risk management tools tailored for crypto traders. While AI can't eliminate all risks, it equips traders with better tools to navigate the unpredictable crypto landscape.

How To Use AI For Market Sentiment Analysis? - CryptoBasics360.com

How AI Sentiment Analysis Works: Data Sources and Methods

AI sentiment analysis turns a mix of data into insights that can guide decisions. Its success relies on using high-quality, varied data and advanced techniques to decode human emotions on a large scale.

Main Data Sources for Sentiment Analysis

Social media platforms are a treasure trove for crypto sentiment analysis. Twitter alone generates millions of crypto-related posts daily, with hashtags like #Bitcoin, #Ethereum, and #DeFi sparking continuous discussions. On Reddit, communities like r/cryptocurrency, r/Bitcoin, and r/ethtrader host in-depth conversations, where users share market insights and personal reactions.

Platforms like Discord and Telegram also play a crucial role. These channels, often centered around specific projects, offer real-time chatter among developers, investors, and enthusiasts. Conversations here provide rich emotional context, helping AI systems pick up on subtle tones and patterns.

News outlets and financial publications add another layer by delivering structured sentiment. Articles, press releases, and analyst reports from sources like CoinDesk, CoinTelegraph, and Bloomberg Crypto shape public opinion. AI tools analyze these for tone, keyword trends, and sentiment clues that often align with market shifts.

On-chain metrics provide hard data to balance subjective sentiment. Transaction volumes, wallet activity, exchange flows, and network usage reveal actual user behavior. These metrics, when paired with sentiment analysis, help confirm whether emotional trends translate into real trading actions.

Market data feeds bring in real-time stats like price changes, trading volumes, and volatility. This data allows AI systems to connect sentiment shifts with market performance, spotting which emotional trends might signal big price movements.

Together, these sources fuel the AI methods described below, enabling real-time insights and better risk management.

AI Methods Used in Sentiment Analysis

Natural Language Processing (NLP) is the backbone of sentiment analysis. Using advanced models like transformers and machine learning algorithms, NLP tools analyze historical data to detect shifts in sentiment. They can pick up industry-specific language, distinguishing between phrases like "Bitcoin is going to the moon" (positive) and "Bitcoin is crashing to the moon" (negative but using crypto lingo).

Deep learning neural networks take this a step further by combining text analysis with market data. These systems uncover complex relationships between the intensity of sentiment, timing, and market impact - patterns that simpler models might miss.

Real-time processing systems are essential for handling the constant flow of data. By using distributed computing, these systems analyze thousands of posts, articles, and market stats every minute, delivering sentiment updates almost instantly.

Sentiment scoring algorithms turn qualitative sentiment into measurable scores. These scores make it easier to track sentiment trends across different cryptocurrencies and compare market segments over time.

Despite these advancements, several challenges make extracting reliable sentiment data tricky.

Problems in Getting Useful Sentiment Data

Data noise is a major hurdle. Social media platforms are filled with spam, bot activity, and irrelevant content that can distort sentiment readings. Filtering out this clutter requires advanced tools capable of recognizing genuine human interactions.

Language complexity in crypto circles adds another layer of difficulty. Traders often use slang, memes, and niche terms like "diamond hands", "HODL", and "wen moon", which carry emotional weight. AI systems need specialized training to interpret this jargon accurately.

Coordinated sentiment campaigns can skew analysis by artificially inflating positive or negative sentiment through organized posts. Detecting these efforts and separating them from organic sentiment is a constant challenge for AI systems.

Geographic and cultural differences further complicate things. People around the world express emotions differently, using unique phrases and references. AI models must adjust for these variations to provide accurate global sentiment insights.

Temporal sensitivity is another tricky aspect. In the fast-paced crypto world, sentiment from just a few hours ago can lose relevance. Balancing the weight of recent versus older sentiment data requires careful tuning based on market conditions.

Data quality inconsistencies across sources also pose problems. A short social media post is very different from a detailed news article, and AI systems need to fairly interpret signals from both while maintaining accuracy.

These challenges highlight the complexity of using AI for sentiment analysis, but they also underscore the importance of refining methods to improve reliability.

Using AI Sentiment Analysis for Risk Management

AI sentiment analysis turns emotional market data into practical strategies for managing risk. By interpreting sentiment patterns, traders can identify potential market dangers, safeguard their portfolios from sudden downturns, and seize opportunities that traditional analysis might overlook. Here’s a closer look at how sentiment insights can be applied to risk controls.

Finding Risks Through Sentiment Analysis

AI sentiment analysis offers several ways to uncover market risks:

-

Spotting market euphoria: When sentiment shows extreme positivity across multiple sources, it often signals an overheated market. AI monitors sentiment intensity to flag unsustainable peaks that historically precede corrections or crashes.

-

Detecting panic selling: Sudden shifts from neutral or positive sentiment to negative can indicate an impending crash. These rapid changes act as early warnings for traders.

-

Identifying manipulation: AI can uncover coordinated efforts, such as groups posting to manipulate prices, helping traders avoid falling prey to artificial market moves.

-

Tracking sentiment contagion: Negative sentiment in one cryptocurrency, like Bitcoin, often spreads to others. AI uses historical correlations and current sentiment flows to predict how altcoins might react.

-

Assessing regulatory fears: By scanning news and social discussions for regulatory keywords, AI measures market anxiety about potential government actions. This early detection helps traders adjust before official announcements trigger sell-offs.

These tools complement traditional risk indicators, giving traders a more comprehensive approach to protecting their investments.

Adding Sentiment Analysis to Risk Management Plans

Sentiment data can also be integrated into broader risk management strategies, offering dynamic and adaptive approaches to market conditions:

-

Dynamic position sizing: Adjust trade sizes based on sentiment. For instance, reduce positions during uncertain market conditions and increase them when sentiment suggests stability.

-

Dynamic stop losses: Replace fixed percentage stops with sentiment-driven ones. Tighten stops when sentiment turns negative and loosen them during positive sentiment periods to better manage profits and avoid premature exits.

-

Portfolio rebalancing triggers: When sentiment analysis detects risks in specific sectors, like DeFi, the system can reduce exposure to those assets and shift allocation to more stable options.

-

Risk budget allocation: Allocate trading capital based on sentiment-derived risk scores. High-risk periods get smaller allocations, while low-risk periods allow for larger exposures, maintaining consistent risk levels.

-

Correlation-based hedging: During extreme sentiment events, normal correlations between cryptocurrencies may break down. AI identifies these moments and suggests appropriate hedging strategies.

These sentiment-driven adjustments ensure traders remain agile and prepared for sudden market shifts.

Combining Sentiment Analysis with Technical Indicators

Blending sentiment analysis with technical indicators enhances decision-making for entry, exit, and hedging strategies:

-

Sentiment-confirmed breakouts: A breakout above resistance is more reliable when sentiment turns positive simultaneously, reducing false signals and improving accuracy.

-

Divergence detection: If prices rise while sentiment weakens, it could signal an upcoming correction. Conversely, improving sentiment during price declines may indicate a bottom.

-

Volume validation: Positive sentiment alongside high trading volume strengthens bullish technical patterns, while negative sentiment confirms bearish formations.

-

Moving average crossovers: Sentiment adds weight to crossovers like the golden cross (bullish) or death cross (bearish), confirming broader market psychology.

-

RSI signals: Overbought RSI paired with extreme positive sentiment suggests selling, while oversold RSI with negative sentiment signals a buying opportunity.

-

MACD confirmation: When MACD buy signals align with improving sentiment, traders can enter positions with greater confidence, filtering out weak signals.

-

Support and resistance levels: Sentiment analysis makes these levels more reliable. When key technical levels align with sentiment shifts, they provide stronger entry and exit points.

AI Tools for Crypto Sentiment Analysis: StockioAI Platform

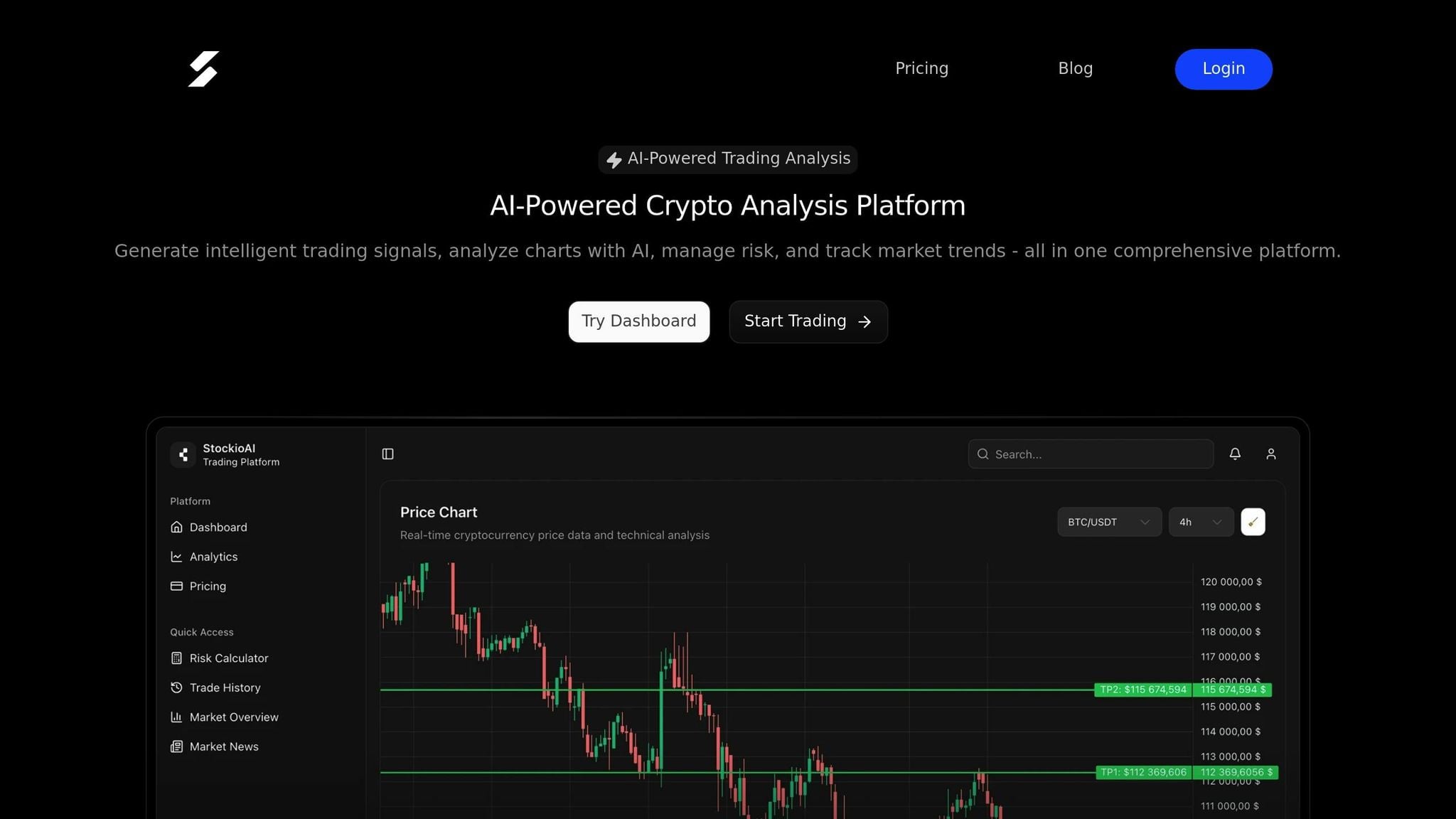

StockioAI is a cryptocurrency analytics platform powered by artificial intelligence, offering tools that combine market sentiment analysis with risk management. Built for traders navigating the unpredictable world of crypto, StockioAI provides data-driven trading signals and a robust suite of analytical features. By integrating sentiment insights with risk management, the platform empowers users to make smarter trading decisions.

StockioAI Platform Features

StockioAI brings a variety of AI-powered tools to the table, enhancing both technical analysis and risk management. Its AI trading signals provide actionable recommendations - BUY, SELL, or HOLD - based on a blend of market sentiment and technical indicators.

The platform also features AI pattern recognition, which takes chart analysis to the next level by identifying emerging patterns and signals. This boosts the reliability of trading recommendations. Additionally, its real-time market analysis aggregates data from multiple sources, ensuring traders stay informed as market conditions shift.

To help traders manage risk effectively, StockioAI includes advanced tools like multi-timeframe analysis, which evaluates market signals across different time horizons. This approach sheds light on short-term price swings as well as longer-term trends. The platform's 7-Tier Priority system synthesizes factors such as market structure, volume, liquidity, RSI, MACD, EMA ribbons, SMA context, and price momentum to deliver comprehensive trading signals.

Another standout feature is the Market Regime Classification, which categorizes markets as trending, ranging, volatile, or quiet. This helps traders focus on the most relevant signals based on current market conditions, further strengthening the platform’s risk management capabilities.

StockioAI Benefits for Risk Management

By leveraging these features, StockioAI bridges the gap between sentiment analysis and effective risk management. Its Conflict Resolution Matrix addresses 15 unique scenarios for position sizing, enabling traders to adjust their strategies based on varying market conditions.

The platform’s portfolio tracking feature gives a broad overview of multiple positions, helping users monitor risk exposure across their entire portfolio. For experienced traders, custom AI model training allows fine-tuning of parameters to align with specific strategies and risk tolerance. Moreover, API access ensures smooth integration with existing trading systems, enabling automated risk management.

Traders also benefit from priority support during high-stakes market activity. A dedicated support team, equipped with expertise in technical analysis, is available to guide users through complex situations. This seamless integration of tools and support highlights how AI can play a central role in managing crypto trading risks.

StockioAI Pricing Plans Comparison

StockioAI offers four pricing tiers designed to suit traders at various experience levels and capital requirements:

| Plan | Monthly Price | AI Trading Signals | Key Features | Best For |

|---|---|---|---|---|

| Free | $0 | 2 signals | Basic market insights, community support, mobile app access, educational resources | New traders learning the basics |

| Starter | $49 | 30 signals | Basic technical analysis and email support | Individual traders starting with AI tools |

| Professional | $99 | 300 signals | Advanced pattern recognition, priority support, portfolio tracking, API access | Active traders managing larger portfolios |

| Enterprise | $199 | Unlimited signals | Multi-user access, dedicated account manager, custom AI model training, white-label solutions | Institutions and professional trading teams |

The Free plan is a great entry point, offering AI-driven risk management tools and basic insights for beginners. The Starter plan steps up with 30 monthly signals and essential technical tools, making it ideal for individual traders just starting with AI. For those managing larger portfolios, the Professional plan provides advanced features like pattern recognition and API access. Finally, the Enterprise plan caters to institutions and professional teams, offering unlimited signals, custom training, and dedicated account management.

Each plan is powered by StockioAI's core analysis engine, with higher tiers unlocking more advanced features and a greater frequency of trading signals. This tiered structure ensures that traders can scale their tools as their experience and portfolio size grow.

Best Practices and Limits of AI Sentiment Analysis

Best Practices for AI Sentiment Analysis

Use Multiple Data Sources to ensure well-rounded results. Combine sentiment data with technical, fundamental, and market analyses. This layered approach helps minimize noise and offers a more complete view of market conditions.

Incorporate Human Oversight to spot anomalies that algorithms might miss. While AI can process vast amounts of data quickly, human judgment is essential for interpreting results, especially when dealing with crypto-specific slang, emerging trends, or unusual market shifts. Regularly review sentiment analysis outcomes to ensure they align with your broader market understanding.

Define Entry and Exit Rules based on sentiment thresholds. Set clear criteria for when sentiment data will trigger trades. This disciplined approach helps avoid emotionally driven decisions influenced by short-term market noise.

Monitor Data Quality Regularly to maintain reliability. Sentiment analysis is only as effective as the quality of the data it processes. Audit data sources frequently to ensure they’re relevant and free from manipulation. Watch for sudden sentiment shifts that could signal bot activity.

Backtest Sentiment Strategies using historical data before applying them to live trading. Testing allows you to identify which sentiment indicators perform best under various market conditions and timeframes. Document your findings to refine your strategy over time.

These practices help establish a strong foundation, but it’s equally important to recognize the limits of sentiment analysis in managing crypto-related risks.

Limits of Sentiment Analysis

Understanding the limitations of sentiment analysis is key to using it effectively as part of a broader risk management strategy.

Data Quality Challenges can compromise results. Misleading posts, sarcasm, or manipulative campaigns are difficult for AI to interpret accurately, leading to unreliable insights.

Susceptibility to Market Manipulation is a concern, particularly in smaller cryptocurrencies. Bots and fake accounts can create artificial sentiment waves, skewing analysis.

Accuracy Issues arise from crypto-specific language that general tools may misinterpret. Phrases like "diamond hands", "HODL", or "to the moon" carry unique meanings that require specialized training to decode.

Real-Time Adaptation Difficulties are common in fast-moving crypto markets. By the time sentiment insights are processed, market conditions may have already shifted significantly.

Overfitting Risks occur when AI models are overly tailored to historical data. While these models may perform well under past conditions, they often fail to adapt to new market dynamics or unexpected events.

Common Mistakes in Sentiment-Based Risk Management

Relying Only on Sentiment Data can be a major pitfall. Sentiment should be combined with other indicators, as markets can behave irrationally longer than traders can remain solvent.

Overlooking Market Context leads to misinterpreted signals. For example, bullish sentiment during a market downturn may not hold the same weight as it would in stable conditions. Always factor in macroeconomic trends, regulatory updates, and the overall market environment.

Reacting Emotionally to Sentiment Extremes often results in poor timing. FOMO during sentiment spikes or panic selling during crashes typically leads to buying high and selling low. Stick to predetermined risk management rules, such as stop-loss orders and position sizing limits.

Failing to Filter Noise can overwhelm traders with unnecessary information. Focus on high-quality sentiment sources, such as insights from influential figures, major news outlets, or large trading communities, rather than random social media chatter.

Neglecting Portfolio Diversification increases risk unnecessarily. Even the most accurate sentiment analysis can’t predict every market movement. Spreading investments across different assets and strategies is essential for long-term stability.

Skipping Risk Management Basics often leads to avoidable losses. Without clear rules for position sizing, stop-loss levels, and maximum drawdowns, sentiment-based trading can spiral out of control during unexpected market moves. Always set a maximum acceptable loss before acting on sentiment signals.

Conclusion

Key Points from AI Sentiment Analysis

AI's ability to process social media, news, and market discussions in real time gives traders a powerful edge. By identifying risks before price movements occur, it helps protect portfolios from sudden market downturns.

When combined with traditional technical indicators, sentiment analysis offers a more complete picture of market dynamics. While technical analysis reflects past market behavior, sentiment analysis uncovers what traders are thinking and feeling about the future. This blend can reveal mismatches between market psychology and price trends, often pointing to potential reversals or continued movements.

For accurate sentiment analysis, quality data from diverse sources is critical. Platforms must pull insights from places like Twitter, Reddit, news outlets, and trading forums to get a balanced view. However, users should be cautious of potential manipulation, such as coordinated campaigns or bot-driven activity, which can distort signals.

By integrating these insights, advanced platforms can incorporate sentiment data into their overall risk management strategies.

StockioAI's Role in Crypto Trading

StockioAI tackles many of the hurdles traders face when using sentiment-based strategies. The platform processes over 60 real-time data points, including social media trends, technical indicators, trading volume, order book depth, whale activity, and overall market sentiment. It generates detailed trading signals complete with entry points, stop-loss levels, profit targets, and confidence scores. For SELL positions, StockioAI provides clear explanations for its recommendations.

Additionally, its Market Overview feature delivers a detailed, real-time analysis of market sentiment across various timeframes and cryptocurrencies, giving traders a broader understanding of market psychology [1].

Final Thoughts on AI and Crypto Risk Management

AI sentiment analysis has proven to be a valuable tool for managing risks in the crypto market, especially when paired with disciplined trading strategies and realistic expectations. While it excels at processing vast amounts of data and spotting patterns that might go unnoticed, it’s not a magic solution. AI cannot eliminate market risks or guarantee success.

For the best results, traders should rely on systematic approaches rather than reacting impulsively to every sentiment signal. High-confidence signals, when used within a structured trading plan, tend to deliver more consistent results.

As the crypto market evolves, AI sentiment analysis must also adapt. By staying informed about market changes and regularly refining their strategies, traders can better navigate challenges and opportunities.

That said, even the most advanced AI systems have their limits. Factors like market manipulation, poor data quality, and unexpected events can influence the accuracy of sentiment analysis. Recognizing these challenges and applying strong risk management practices allows traders to make the most of AI’s capabilities while minimizing potential downsides.

FAQs

How can AI sentiment analysis help manage risks in cryptocurrency trading more effectively than traditional methods?

AI sentiment analysis is transforming risk management in cryptocurrency trading by delivering real-time insights into market sentiment - something traditional methods often struggle to achieve. Instead of relying solely on static patterns or historical data, AI processes massive streams of information from sources like news outlets, social media platforms, and market behavior to detect sentiment shifts as they happen.

This real-time adaptability allows traders to identify emerging trends, steer clear of misleading signals, and guard against risks like pump-and-dump schemes. When sentiment analysis is paired with traditional metrics, it empowers traders to make more well-informed decisions, better manage market volatility, and strengthen their overall risk management strategies.

What challenges come with using AI for sentiment analysis in crypto trading, and how can they be addressed?

AI-powered sentiment analysis in cryptocurrency trading comes with its fair share of hurdles. For one, the extreme market volatility and noisy data in the crypto world make it tough for AI models to generate consistently accurate insights. On top of that, natural language processing (NLP) tools often stumble when dealing with the unique jargon and context of the crypto industry, which can result in misinterpretations. Another sticking point is the "black box" nature of many AI systems - traders often find it hard to understand how these models arrive at their conclusions, which can undermine trust.

Tackling these issues requires a focus on improving data quality and crafting NLP tools tailored specifically to the crypto domain. Additionally, making AI models more transparent and easier to interpret can empower traders to trust and act on AI-driven insights with greater confidence in this fast-moving market.

How can traders use AI sentiment analysis with technical indicators to improve their crypto trading strategies?

Combining AI-driven sentiment analysis with traditional technical indicators can significantly refine crypto trading strategies. Sentiment analysis focuses on gauging market mood and investor behavior, while technical tools like RSI, Bollinger Bands, and Moving Averages provide insights into price trends. Together, these methods create a broader perspective on market conditions.

When traders merge sentiment data with technical signals, they gain the ability to validate forecasts, spot potential risks, and make better-informed decisions. AI-powered platforms simplify this process by analyzing both types of data in real time, offering actionable insights and trading signals that can boost both accuracy and profitability.