AI-powered volume pattern analysis is transforming cryptocurrency trading by making data-driven decisions faster and more precise. Here's what you need to know:

-

What it does: AI analyzes the relationship between trading volume and price to identify trends, reversals, and breakout points.

-

Why it matters: Crypto markets are 24/7, highly volatile, and data-heavy. AI processes this complexity in real time, removing emotional bias and improving accuracy.

-

Key benefits:

-

Detects subtle patterns like volume spikes and divergences.

-

Monitors multiple assets and timeframes simultaneously.

-

Generates fast, consistent BUY, SELL, or HOLD signals.

-

Enhances risk management with clear stop-loss and profit targets.

-

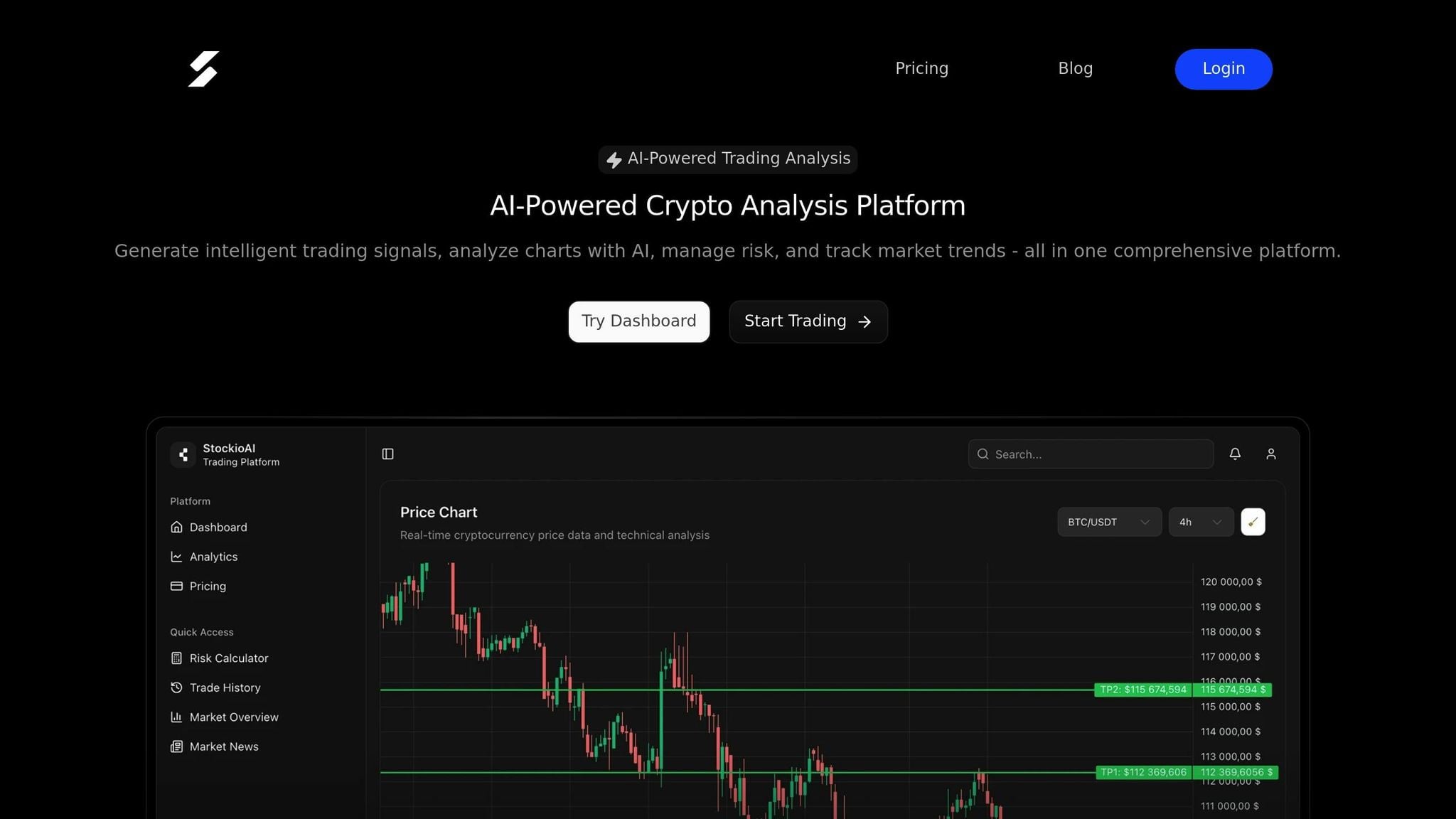

Platforms like StockioAI offer tools to simplify trading, providing actionable insights and reducing the guesswork. With features like real-time monitoring, multi-timeframe analysis, and automated signals, AI is helping traders achieve better outcomes in fast-moving markets.

Volume Spread Analysis with Python

| Algorithmic Trading Indicator

Problems with Manual Volume Pattern Analysis

Traditional volume analysis has been a staple for traders for decades, but when it comes to the fast-paced world of cryptocurrency, manual methods reveal significant shortcomings. These flaws can lead to missed opportunities and costly errors, especially in a market as dynamic as crypto.

Too Much Data, Too Little Time

The cryptocurrency market churns out an overwhelming amount of data every second - far more than any human can process effectively. Analyzing real-time market data, including technical and sentiment indicators, is simply beyond human capability [1].

AI systems, on the other hand, can analyze thousands of charts at once, spotting trends and patterns across multiple assets in real time. Compare that to a human trader, who might only track a handful of assets at a time. This disparity becomes especially problematic during periods of high volatility, where the best entry points can vanish in moments.

The 24/7 nature of cryptocurrency trading only adds to the challenge. Taking even a short break could mean missing critical volume patterns that signal major price shifts. High-frequency trading data and intraday volume fluctuations further complicate things, making manual analysis even harder [6].

But it’s not just the sheer volume of data that’s the problem - emotions play a big role, too.

Emotional Bias in Trading

The difficulty of managing vast amounts of data is compounded by the emotional pitfalls every trader faces. Emotions like fear and greed can cloud judgment, leading to inconsistent decisions and increased risk [2][8].

For instance, a sudden volume spike during a price rally might trigger FOMO (fear of missing out), causing traders to jump into a trade without proper analysis. On the flip side, fear of losses can lead them to exit profitable trades too early. These emotional reactions often override clear volume signals, turning logical strategies into impulsive decisions.

As Jordan Martinez, a quantitative trader, put it:

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." - Jordan Martinez, Quantitative Trader [1]

Unlike human traders, AI systems stick to consistent logic, unaffected by stress or second-guessing. Subjectivity also plays a role in manual analysis - two experienced traders might interpret the same volume pattern in completely different ways, influenced by their personal biases and past experiences [7]. This lack of consistency makes it nearly impossible to develop reliable strategies through manual methods alone.

The pressure of making split-second decisions only worsens the situation. When traders have mere seconds to decide if a volume breakout is legitimate, stress and anxiety can easily lead to poor choices that hurt long-term profitability.

Missing the Bigger Picture

Beyond data overload and emotional bias, manual analysis struggles to identify the complex, multi-asset patterns that are crucial for success in today’s markets. Human cognitive limits become glaringly obvious when dealing with subtle volume patterns that require in-depth, sophisticated analysis [5][6].

Take multi-timeframe analysis, for example. Studies show that incorporating multiple timeframes can boost trade success rates by 40%–50%, but doing this manually is nearly impossible [9]. Patterns like accumulation and distribution phases - often the most profitable opportunities - are particularly tricky. These phases unfold gradually, with subtle changes in volume that can go unnoticed in manual analysis. By the time a trader confirms the pattern, much of the profit potential may already be gone.

Real-world examples show how manual analysis often misses key signals. For instance, volume patterns in Bitcoin can hint at movements in altcoins, but tracking these correlations across multiple cryptocurrencies is far too complex for manual methods. Add in the constant "noise" of the crypto market, and distinguishing between random fluctuations and actionable signals becomes a near-impossible task [9].

| Manual Analysis Limitations | Impact on Trading |

|---|---|

| Inability to process large-scale real-time data | Missed opportunities, delayed reactions |

| Emotional decision-making | Inconsistent results, higher losses |

| Overlooks subtle, complex patterns | Missed accumulation phases, reduced success rates |

| Limited to single or few timeframes | Incomplete analysis, lower accuracy |

| Struggles with market noise | False signals, poor decisions |

These challenges explain why many traders are shifting toward AI-driven tools. With their ability to process massive amounts of data and detect patterns that humans often miss, these systems offer a level of precision and consistency that manual methods simply can’t match.

AI Solutions for Volume Pattern Analysis

AI technologies are stepping in as game-changers for volume pattern analysis. The challenges of manual analysis - like data overload and emotional decision-making - have paved the way for AI-powered systems to transform how traders interpret volume patterns and market trends. These tools address the inefficiencies of traditional methods, offering a smarter, faster, and more reliable approach.

Machine Learning for Volume Pattern Recognition

AI harnesses machine learning to identify historical volume patterns that often precede major price movements [5]. By analyzing vast amounts of data, these algorithms learn to connect specific volume behaviors with potential future price trends, improving prediction accuracy [6].

Unlike human traders, who may struggle to spot subtle patterns buried in years of market data, AI processes this information in seconds. A prime example is StockioAI, which uses advanced processing to analyze market data and uncover profitable opportunities [1].

Machine learning is particularly adept at detecting key patterns like volume spikes during breakouts, volume-price divergences that hint at reversals, and accumulation phases [5]. For instance, when a sudden volume increase accompanies a price breakout, AI can instantly validate the move’s strength. Case studies featuring major assets like Tesla and Amazon highlight how AI-detected volume spikes during pivotal moments allowed traders to act decisively and achieve higher profits [5].

Real-Time Monitoring and Signal Generation

In fast-paced markets like cryptocurrency, speed is everything. AI-powered platforms excel by continuously scanning live market data, analyzing price and volume patterns in real time, and generating actionable signals - BUY, SELL, or HOLD - within seconds [6]. This rapid response enables traders to seize opportunities while juggling multiple assets at once [6].

By eliminating delays inherent in manual analysis, AI reduces the risk of missed opportunities. StockioAI exemplifies this by delivering precise trading signals with clear reasoning and well-defined targets. Impressively, it reports a 75.0% win rate across 35 closed trades, with a profit factor of 2.95 [1]. Achieving this level of consistency manually, especially across multiple assets and timeframes, would be nearly impossible.

Beyond speed and precision, AI’s automation enhances decision-making by removing human biases, ensuring that trades are based purely on data.

Removing Emotional Bias Through Automation

One of the most transformative aspects of AI in volume pattern analysis is its ability to eliminate emotional interference. AI systems rely on data-driven algorithms, applying predefined rules consistently without the fear, greed, or hesitation that often clouds human judgment [7].

By automating pattern recognition and signal generation, AI minimizes impulsive decisions that can harm trading accounts. For example, during a price rally accompanied by a volume spike, human traders might succumb to FOMO (fear of missing out) and enter trades without proper analysis. In contrast, AI evaluates the situation using historical data and established patterns, leading to more disciplined and reliable outcomes [7].

Consistency is a major advantage. Where two experienced traders might interpret the same volume pattern differently due to personal biases, AI provides uniform, data-backed insights every time. This consistency is especially valuable in high-stress market conditions, where emotions often run high [7].

Take Jordan Martinez’s experience: by relying on AI-driven automation, he achieved consistent 18% monthly returns, proving how data-based strategies outperform emotion-driven decisions [1].

AI also brings patience to the table - a quality human traders often lack. During periods of market consolidation, when volume patterns suggest waiting rather than acting, AI sticks to the plan, recommending HOLD positions with clear justifications. This prevents the overtrading that occurs when traders feel compelled to act constantly.

Benefits of AI Volume Pattern Analysis for Traders

Switching from manual analysis to AI-driven volume analysis can elevate trading performance and simplify decision-making.

Improved Accuracy and Predictive Insights

AI shines in identifying intricate signals, such as accumulation phases and volume-price divergences, which often indicate market reversals. These subtle patterns, buried within thousands of data points across various timeframes, are pinpointed by AI in mere seconds.

Take StockioAI, for example. It processes over 60 real-time data points every second to deliver highly accurate trading recommendations, including entry points, stop-loss levels, and profit targets. Its impressive track record - featuring a 75.0% win rate across 35 closed trades and a profit factor of 2.95 - demonstrates the power of AI-driven analysis[1].

In addition to accuracy, AI allows traders to monitor and analyze multiple markets at once, a task nearly impossible for humans to perform effectively.

Simultaneous Multi-Asset Analysis

AI’s ability to analyze multiple assets simultaneously is a game-changer. Unlike human traders, who typically focus on one or two cryptocurrencies at a time, AI systems can scan countless assets and timeframes in parallel[6]. This is particularly valuable in the fast-moving cryptocurrency markets, where asset correlations can shift in an instant. For example, when Bitcoin displays unique volume patterns, AI can quickly evaluate the potential ripple effects on altcoins and generate actionable signals across an entire portfolio.

StockioAI takes this capability further with its multi-timeframe insights feature, offering a complete market overview through real-time cryptocurrency data and trending coin analysis. By continuously assessing resistance levels, momentum indicators, market trends, and volatility patterns across multiple assets, the platform enables traders to:

-

Diversify strategies effectively

-

Reduce portfolio risk through better correlation analysis

-

Capitalize on market-wide opportunities

All of this is achieved while automating previously tedious manual tasks, giving traders a broader, more strategic perspective and improving decision-making consistency.

Enhanced Risk Management and Stability

AI-powered volume pattern analysis also revolutionizes risk management by generating consistent, emotion-free signals based on advanced algorithms[7]. This objectivity eliminates the influence of fear, greed, or hesitation - common pitfalls that can lead to costly mistakes. Unlike human traders, who might interpret the same volume patterns differently depending on their emotional state, AI applies a standardized approach, ensuring reliability even during volatile market conditions.

StockioAI strengthens risk management further with its professional risk calculator. This tool determines optimal position sizes, sets precise stop-loss levels, and adjusts leverage according to market conditions[1]. By analyzing over 60 real-time indicators, the platform identifies ideal exit points, minimizing losses with timely SELL signals. For HOLD positions, it evaluates market dynamics, tracks sideways trends, and monitors correlation patterns, providing clear, data-backed explanations for maintaining positions as conditions evolve. Additionally, by recommending HOLD strategies during periods of market stagnation, AI helps traders avoid overtrading and unnecessary risks.

This combination of precision, efficiency, and emotional detachment supports smarter trading decisions and steadier portfolio growth.

StockioAI: A Solution for AI Volume Pattern Analysis

StockioAI is reshaping how traders approach volume pattern analysis by harnessing the power of real-time AI data processing. Designed to tackle the challenges of manual analysis, this platform delivers the speed and precision that today's fast-paced cryptocurrency markets demand.

StockioAI's Key Features for Volume Analysis

At the core of StockioAI lies an advanced trading system that processes over 60 real-time data points every second. Using cutting-edge machine learning, it identifies chart patterns, trend reversals, and optimal entry and exit points instantly [1]. By analyzing volume patterns alongside technical and sentiment indicators, it generates precise BUY, SELL, and HOLD signals.

What sets StockioAI apart is its ability to detect subtle accumulation and distribution phases - those quiet moments that often signal major price movements. This ensures traders receive accurate insights, no matter the market conditions.

The platform also integrates AI-powered TradingView charts, offering a clear visual representation of trading levels, support/resistance zones, and technical indicators. Each signal comes with detailed guidance, including entry points, stop-loss levels, profit targets, and confidence scores. This transparency helps traders not only execute trades but also understand the reasoning behind each recommendation.

Additionally, the Professional Risk Calculator fine-tunes position sizes, stop-losses, and leverage based on current market conditions, while instant alerts for significant volume events ensure traders stay ahead. Features like the Market Overview and Market News Feed provide further context for informed decision-making.

Practical Benefits for Traders Using StockioAI

StockioAI's features translate into real-world advantages for traders. The platform boasts a 75.0% win rate with a 2.95 profit factor [1], achieved through its ability to process vast amounts of data free from emotional bias.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."

- Jordan Martinez, Quantitative Trader [1]

By utilizing multi-timeframe analysis, StockioAI enhances trade success rates by 40%–50% compared to single-timeframe strategies. Aligning data from multiple perspectives allows traders to pinpoint high-probability setups and improve risk management [9].

The platform also excels at confirming breakout opportunities. For example, it identifies volume patterns that exceed 50% above the 20-day average, paired with candlestick signals like bullish engulfing or hammer patterns when volume surpasses 150% of the average. These indicators are statistically more likely to result in successful trades [10]. What might take hours to analyze manually is completed in seconds with StockioAI, giving traders a critical edge in time-sensitive markets.

How to Get Started With StockioAI

StockioAI's combination of powerful features and proven results makes it an invaluable tool for traders eager to leverage AI in volume analysis. Getting started is straightforward - simply visit the StockioAI website and choose "Try Dashboard" or "Get Started Free." The Free Plan is available at $0/month and requires no credit card.

For those seeking more advanced tools, StockioAI offers tiered subscription plans:

| Plan | Monthly Price | Annual Price | Key Features |

|---|---|---|---|

| Free | $0 | $0 | 3 AI signals, basic insights, and education |

| Starter | $49 | $39 | 30 AI signals/month, email support |

| Professional | $99 | $79 | 500 AI signals/month, advanced pattern recognition, priority support, API access |

The Professional Plan unlocks a full suite of tools, including advanced AI pattern recognition, real-time alerts, a custom indicator library, portfolio tracking, and API integration for automated trading. Opting for annual billing provides a 20% discount on all paid plans.

New users can find helpful resources in the "Common Questions" section on the website, along with educational materials included in every plan. With its intuitive interface, interactive charting, and real-time alerts, StockioAI is designed to meet the needs of both beginners and seasoned traders looking to enhance their strategies with AI-driven volume analysis.

Conclusion: Using AI for Smarter Trading

Artificial intelligence has revolutionized volume pattern analysis, marking a new era in cryptocurrency trading. What once required painstaking manual effort can now be accomplished in seconds, with AI offering a level of precision and consistency that's hard to match.

Key Takeaways

AI-driven volume pattern analysis stands out by delivering advantages that traditional methods simply can’t replicate. With the ability to process over 60 real-time data points per second, AI identifies subtle volume trends that often signal major market moves. This data-driven approach eliminates emotional decision-making, allowing traders to make more disciplined and informed trades [1][3].

Another game-changer is AI's capacity to monitor multiple assets simultaneously. While a human trader might struggle to keep up with just a few cryptocurrency charts, AI can scan thousands in mere moments, pinpointing the most promising opportunities across the market [6][7].

Statistically, AI strategies have proven to increase trade execution efficiency by as much as 30% compared to manual methods [5][6][7]. This boost not only improves risk management but also leads to more consistent returns and less stress for traders. These advancements are setting the stage for the next wave of AI-powered trading strategies.

Future of AI in Cryptocurrency Trading

As AI technology continues to advance, the potential for even smarter trading solutions grows. Machine learning algorithms are becoming more sophisticated, enabling deeper market insights, faster decision-making, and more adaptive risk management. Future developments are also expected to enhance regulatory compliance and market transparency [2][4].

Sentiment analysis is another area gaining traction. By incorporating data from news outlets and social media, AI systems can develop a broader understanding of market conditions beyond traditional technical indicators [6]. Platforms like StockioAI are already integrating these features, showcasing the practical benefits of these innovations today while pointing toward the possibilities of tomorrow.

For traders eager to stay ahead, tools like StockioAI provide the resources needed to thrive in an increasingly complex and fast-paced trading environment. The question is no longer whether AI will reshape trading but how quickly traders can adapt and take advantage of these powerful tools.

FAQs

How does AI enhance volume pattern analysis for cryptocurrency traders?

AI takes volume pattern analysis to the next level by pinpointing chart patterns, trend reversals, and critical entry or exit points with precision and speed. It processes massive amounts of market data in real time, offering traders a clearer understanding of market behavior - even during periods of high volatility.

By minimizing human error and delivering actionable insights, AI empowers traders to anticipate market shifts more effectively and refine their strategies with greater confidence.

How does AI simplify volume pattern analysis for traders?

Analyzing volume patterns manually can be a slow and error-prone process, particularly in fast-moving markets. AI-powered tools, such as those provided by StockioAI, simplify this task by accurately detecting intricate chart patterns and spotting trend reversals.

By automating these processes, AI enables traders to make quicker and more informed decisions. This not only minimizes the emotional and mental stress that often comes with manual analysis but also allows traders to concentrate on refining their strategies and staying competitive in ever-changing market environments.

How does StockioAI use AI to deliver trading signals and improve risk management for traders?

StockioAI uses cutting-edge AI-driven pattern recognition to sift through market data, identifying important chart patterns, trend changes, and ideal entry or exit points. This empowers traders to make faster and smarter decisions in ever-changing market conditions.

For better risk management, StockioAI includes a risk calculator. This feature helps traders evaluate potential exposure and fine-tune their strategies as needed. Together, these tools aim to streamline the trading process and minimize uncertainty for users.