AI is transforming cryptocurrency trading by automating trade execution, analyzing market data in real time, and reducing delays. Here's how it works:

-

Speed: AI executes trades within microseconds, far faster than humans, which is critical in volatile cryptocurrency markets.

-

Data Analysis: It processes vast amounts of data, like price movements, trading volumes, and social media sentiment, to identify opportunities.

-

Automation: AI eliminates human emotions, ensuring disciplined, data-driven decisions around the clock.

-

Risk Management: Systems automatically adjust position sizes, stop-loss levels, and portfolio exposure to minimize losses.

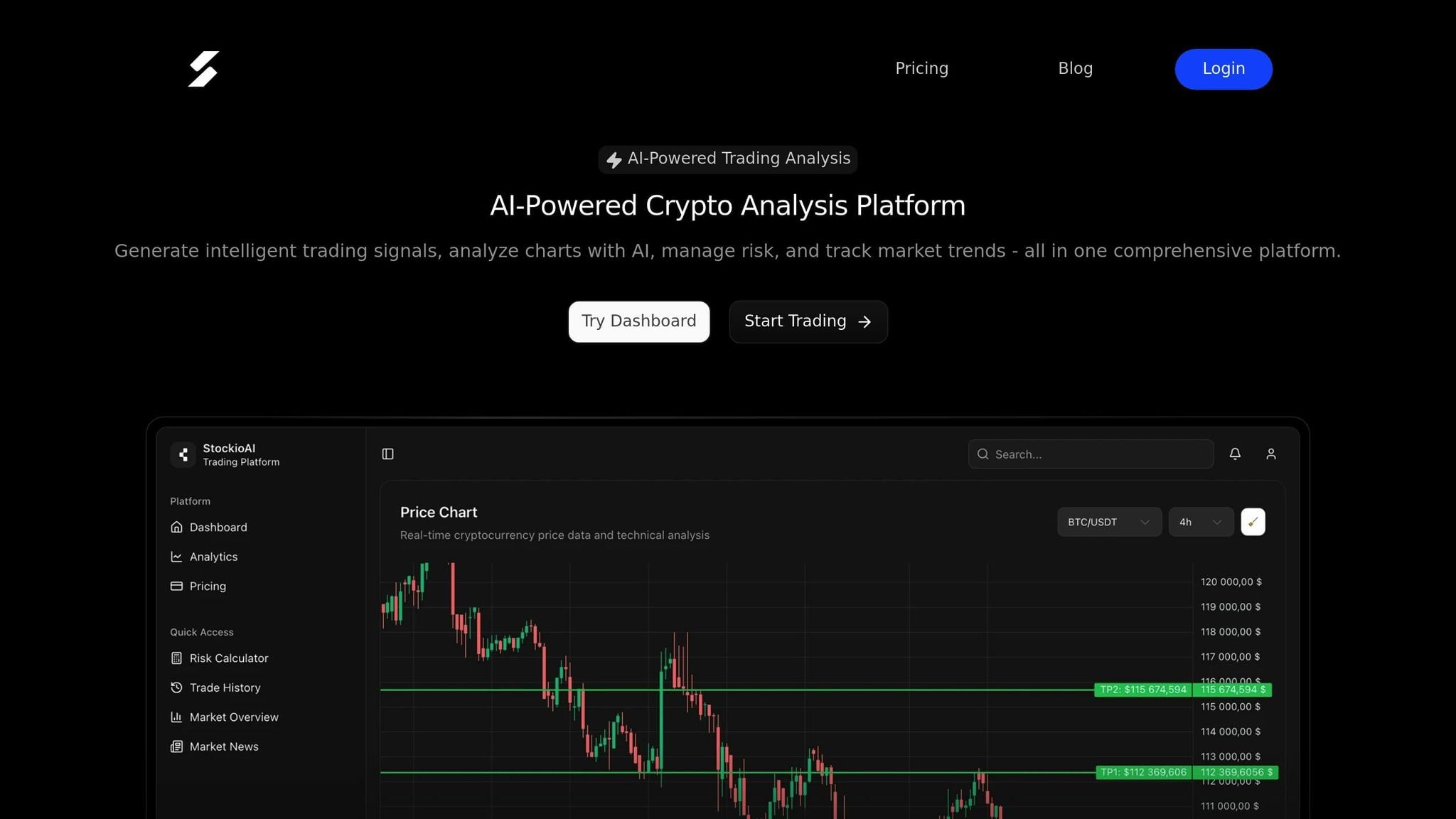

AI tools like StockioAI simplify this process by providing real-time signals, automated risk controls, and performance tracking. With cryptocurrency markets operating 24/7, leveraging AI ensures traders can act quickly and efficiently, even during rapid price swings.

Copy Trading Bot SPEED TEST (SOLANA)

Core Components of AI-Driven Trade Execution

AI has become a game-changer in trading, primarily by cutting down delays and fine-tuning trade execution. It achieves this through three essential components: real-time data analysis, machine learning, and automated execution with risk control. Together, these elements are reshaping the way trades are executed.

Real-Time Data Collection and Analysis

At the heart of any AI-powered trading system is its ability to gather and process massive amounts of market data instantly. These systems track price movements, order books, trading volumes, social media sentiment, news updates, and technical indicators - all happening across multiple exchanges at the same time.

This capability allows AI to instantly spot even the slightest price changes or volume spikes, uncovering subtle trends and opportunities that might escape human traders. The speed of this analysis ensures quicker and more informed decision-making.

What sets AI apart is its ability to connect seemingly unrelated data points. For example, an AI system might notice a sudden increase in trading volume coinciding with a surge in social media chatter about a specific asset. This could hint at an upcoming price movement, giving traders an edge. This rich data feed serves as the backbone for identifying patterns and making forecasts.

Machine Learning and Predictive Analytics

The second pillar of AI-driven trading is its use of machine learning to detect patterns and predict market behavior. These algorithms learn continuously, drawing from both historical data and real-time market activity to refine their predictions.

AI can identify technical patterns - like head-and-shoulders formations or support and resistance levels - across multiple timeframes simultaneously. While human traders may focus on a single timeframe, AI’s ability to analyze several intervals at once reduces delays and enhances precision.

Predictive analytics takes this a step further by forecasting price movements based on current conditions. For instance, under specific technical setups, the system might predict a high likelihood of a short-term price reversal, allowing trades to be positioned ahead of time.

What makes this component even more powerful is its adaptability. During volatile market periods, the system can adjust its sensitivity to rapid price swings. In quieter markets, it focuses on capturing smaller, more subtle opportunities. These dynamic adjustments feed directly into the system’s ability to execute trades and manage risks effectively.

Automated Trade Execution and Risk Management

The third and final component handles the actual execution of trades while keeping risks in check. AI systems are capable of executing trades in microseconds, which is crucial in fast-paced markets.

Automated execution ensures optimal order placement by carefully selecting exchanges, timing entries, and using advanced order types to minimize market impact. For example, instead of placing a large order all at once - which could disrupt the market - AI might break it into smaller orders spread across different exchanges.

Risk management is built into the process and operates in real time. The system monitors position sizes, tracks profit and loss, and adjusts stop-loss levels as trades progress favorably. If a trade starts moving against expectations, the system can exit immediately to limit losses.

Additionally, position sizing algorithms calculate the ideal trade size based on market volatility and account balance. The system continuously rebalances positions to maintain target allocations while ensuring trades are executed swiftly and efficiently.

Methods for Improving Execution Speed with AI

Understanding the core elements of AI-driven trading is just the start. Let’s dive into practical steps to boost execution speed. These strategies focus on reducing delays, refining infrastructure, and keeping performance in check - all essential for staying ahead in the fast-paced cryptocurrency markets.

Reducing Latency with AI Techniques

AI offers several tools to minimize delays and improve reaction times in trading:

-

Reinforcement Learning: By learning from past outcomes, reinforcement learning refines strategies to shorten the gap between receiving a signal and executing an order. This means traders can act faster and more effectively.

-

AI-Driven Sentiment Analysis: By scanning huge volumes of social media posts and news articles, AI can spot market trends before they lead to price changes. Acting on this early insight significantly reduces the time between recognizing shifts and making trades.

-

Neural Network Optimization: These systems enhance order routing by pinpointing the best venues for execution. This ensures orders are processed faster by avoiding unnecessary delays.

-

Predictive Caching: Pre-calculating execution strategies based on potential market conditions allows instant action when those conditions arise. This approach cuts decision-making time during volatile moments, giving traders an edge.

While these AI methods are powerful, they rely on a strong infrastructure to perform at their best.

Infrastructure Setup for Faster Execution

A well-optimized infrastructure is the backbone of low-latency trading. Here’s how infrastructure can be fine-tuned for speed:

-

Low-Latency APIs: APIs, especially those using WebSocket connections, provide real-time data streams with minimal delays - far superior to traditional methods.

-

Server Location: Placing servers close to exchange centers reduces communication lag, speeding up order transmissions.

-

Hardware Optimization: High-performance components like SSDs, multi-core processors, and fast RAM improve data access and multitasking capabilities.

-

Network Optimization: Reliable internet connections with minimal packet loss are essential. Many traders opt for premium connectivity services with guaranteed low-latency performance to ensure smooth, real-time trading.

Backtesting and Performance Monitoring

Once latency is reduced and infrastructure is optimized, rigorous testing and monitoring become key to maintaining improvements and ensuring strategies remain effective.

-

Historical Simulation: Testing AI-driven methods against historical market data helps traders evaluate their effectiveness before putting real money on the line. Detailed simulations, including bid-ask spreads and order book depth, provide a clear picture of potential performance.

-

Real-Time Monitoring: Tracking metrics like fill times, slippage, and order rates in real time allows traders to spot and address execution slowdowns immediately.

-

A/B Testing: Comparing different AI execution techniques under live conditions helps identify the most effective strategies. Allocating a portion of capital to test new algorithms while relying on proven ones ensures a balanced approach.

-

Continuous Learning: AI systems that adjust parameters in real time can adapt to varying trading sessions and market volatility, ensuring execution strategies stay relevant.

-

Cost-Benefit Analysis: Assessing whether the gains in execution speed justify the technological investments is crucial. Even small improvements can translate into meaningful returns in competitive markets, making these upgrades worthwhile.

Benefits and Drawbacks of AI in Trade Execution

AI-powered trade execution brings both opportunities and challenges to cryptocurrency trading. Its impact on trading performance depends on factors like how well it's implemented, the current market environment, and the specific strategies used by traders.

Benefits of AI-Driven Execution

Speed and Precision are at the heart of AI's trading advantages. AI systems can process market data and execute trades in microseconds, far outpacing human reaction times. This speed is especially critical during periods of high market volatility when prices can change in an instant. By removing delays caused by human hesitation or emotion, AI ensures trades are executed at optimal moments.

24/7 Market Monitoring is another key strength for cryptocurrency markets, which never close. AI systems can continuously scan multiple exchanges, identifying opportunities at any time of day or night. This ensures traders don't miss out on potential profits due to sleep, work, or other commitments, as the system operates consistently across all time zones.

Emotion-Free Trading eliminates the psychological pitfalls that often plague human traders. Fear, greed, and panic can lead to poor decision-making, especially during market crashes or euphoric surges. AI, in contrast, follows data-driven rules and parameters, maintaining discipline even in chaotic market conditions.

Advanced Pattern Recognition allows AI to detect complex market trends that humans might overlook. By analyzing thousands of data points - such as price movements, trading volumes, social media sentiment, and news events - AI can uncover trading opportunities that would be impossible to spot manually.

Risk Management Automation provides an added layer of security, as AI systems can instantly adjust risk parameters in response to market volatility, helping to safeguard trading capital.

While these benefits can significantly enhance trading performance, they come with their own set of challenges.

Limitations and Risks

Despite its advantages, AI in trading is not without flaws, and these issues require careful attention.

Technology Dependence makes traders vulnerable to system failures, internet outages, and software glitches. A malfunctioning AI system can lead to significant losses, particularly if manual overrides aren't in place. For instance, a server crash during a critical market event could result in missed opportunities or uncontrolled losses.

High Implementation Costs are another barrier. Building and maintaining a quality AI trading system demands a significant investment in hardware, software, data feeds, and ongoing maintenance. These costs can be prohibitive for individual traders, limiting access primarily to institutions with deeper pockets.

Model Overfitting poses a risk when AI systems are overly tailored to historical data. If market conditions change - especially in the fast-evolving cryptocurrency space - these systems may fail dramatically, as they struggle to adapt to new dynamics influenced by regulations or technological advancements.

Security Vulnerabilities are a constant concern. AI trading systems require internet connectivity and often store sensitive data, making them attractive targets for hackers. A breach could lead to stolen funds or compromised strategies, posing serious financial and operational risks.

Regulatory Uncertainty adds another layer of complexity. Financial regulators are still developing rules for AI-driven trading, and sudden regulatory changes could necessitate costly adjustments or even render certain strategies illegal.

Market Impact is a growing issue as AI adoption increases. When many traders rely on similar AI strategies, competition intensifies, reducing the effectiveness of these approaches and driving up execution costs.

Comparison Table: AI Trade Execution Pros and Cons

Here's a quick summary of the advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Microsecond processing speeds | High upfront technology costs |

| Continuous market monitoring | Vulnerability to system failures |

| Emotion-free decision making | Risk of model overfitting |

| Advanced pattern recognition | Security and hacking risks |

| Systematic risk management | Regulatory compliance challenges |

| Multi-exchange simultaneous trading | Reduced effectiveness as adoption increases |

| Consistent strategy execution | Dependence on data quality |

| Reduced human error | Limited adaptability to unprecedented events |

The effectiveness of AI in trade execution hinges on thoughtful implementation, regular system updates, and a clear understanding of its strengths and weaknesses. To succeed, traders must balance the benefits of automation with the need for human oversight and robust risk controls.

StockioAI: Improving Real-Time Trade Execution

StockioAI tackles the speed challenges that often hinder traders by providing instant AI-driven insights, cutting out manual delays. With its real-time processing capabilities and automated risk management tools, the platform allows traders to act quickly and accurately, especially in the fast-moving and unpredictable world of cryptocurrency markets.

Real-Time Signals and Pattern Recognition

StockioAI takes full advantage of AI's strengths to deliver precise, actionable market signals. The platform processes over 60 real-time data points every second, transforming complex information into clear guidance. It continuously tracks key metrics like support levels, market sentiment, order book depth, large-volume trades, and volatility patterns to generate BUY, SELL, and HOLD signals.

-

BUY Signals: These come with detailed entry points, stop-loss levels, and profit targets, all supported by confidence scores to help traders make informed decisions.

-

SELL Signals: Advanced AI monitors resistance levels, momentum, trends, volatility, and institutional activity to pinpoint the best exit opportunities. This ensures traders can lock in profits or cut losses at the right time.

-

HOLD Signals: By analyzing sideways trends, correlation patterns, and market microstructure, the platform helps traders maintain positions when the market conditions are favorable, avoiding hasty exits.

The platform also incorporates AI-powered pattern recognition, using machine learning algorithms to automatically identify chart patterns, trend reversals, and optimal entry or exit points. This eliminates the need for manual chart analysis, enabling traders to act with speed and precision. As a result, StockioAI has demonstrated strong trading performance, achieving a 75.0% win rate across 35 closed trades, delivering a total return of +2.9% and a profit factor of 2.95 [1].

Risk Management and Market Insights

Speed alone isn’t enough - effective trading also requires robust risk management. StockioAI integrates automated risk calculators directly into its signal generation process. These tools quickly evaluate position sizing, potential drawdowns, and portfolio exposure, ensuring that trades are executed rapidly without exceeding acceptable risk levels.

The platform also keeps traders informed with a real-time market news feed, offering updates on events that could impact cryptocurrency prices. This allows users to adjust their strategies on the fly. Additionally, its multi-timeframe analysis ensures that signals align across different time horizons, with higher timeframe trends taking precedence over shorter-term fluctuations to avoid conflicting decisions.

To further enhance adaptability, StockioAI classifies market conditions in real time, identifying whether the market is trending, ranging, volatile, or quiet. This allows traders to fine-tune their strategies instantly without the delays of manual analysis.

Performance Metrics for U.S. Traders

StockioAI ensures that its tools and metrics are tailored specifically for U.S.-based cryptocurrency traders. All performance tracking is displayed in U.S. dollars, eliminating the hassle of manual currency conversions. Profit and loss, return metrics, and risk assessments are all presented in a straightforward, USD-denominated format.

The platform’s position tracking dashboard provides real-time updates on active trades, showing current profit or loss, trade duration, and exit recommendations. Additionally, its portfolio tracking feature offers a comprehensive overview of trading performance across various digital assets. Traders can easily monitor their portfolio value, track returns over different timeframes, and assess risk exposure at a glance.

One trader, Jordan Martinez, shared how StockioAI transformed their trading approach:

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns." – Jordan Martinez, Quantitative Trader

For experienced traders, StockioAI offers the ability to customize its AI models, allowing them to fine-tune signal generation based on their unique strategies and risk preferences. Institutional users can also take advantage of API access to integrate the platform with their existing trading systems, enabling fully automated trades with minimal latency.

Conclusion: The Future of AI in Trade Execution

Cryptocurrency trading today demands a level of speed, precision, and risk management that only AI-driven systems can deliver. With digital asset markets running 24/7 and experiencing intense volatility, the traditional, manual trading methods of the past simply can't keep up with the split-second decisions required to stay ahead.

Key Highlights

AI has revolutionized trade execution by reducing latency and processing massive amounts of market data in real time. It eliminates the delays caused by human decision-making and can simultaneously analyze diverse data sources - like order book depth and market sentiment - while maintaining consistent performance, no matter the time or market conditions.

Machine learning algorithms have also brought a new level of accuracy to cryptocurrency trading. These systems uncover patterns and correlations that human traders might overlook, leading to better-timed entry and exit points. The result? Improved returns that are adjusted for risk and minimized exposure to unfavorable market shifts.

One of the standout advantages of AI in trading is its ability to manage risk automatically. These systems continuously monitor portfolio exposure, position sizes, and market volatility, making real-time adjustments to strategies without waiting for human input. This capability is particularly crucial during periods of high market stress, where quick, informed decisions can mean the difference between profit and loss.

The accessibility of AI-powered trading tools has also expanded significantly. Thanks to cloud-based solutions, even individual traders can now achieve execution speeds that were once reserved for institutions. This shift allows more traders to compete effectively without needing to invest heavily in expensive hardware or data services.

Gaining a Competitive Edge with AI

As AI technology continues to evolve, traders who embrace it gain a clear advantage in the increasingly competitive cryptocurrency market. Relying solely on manual analysis and execution is becoming a liability, as AI-assisted strategies consistently outperform in both speed and reliability. The gap between these approaches will only grow as algorithms become more advanced and market dynamics become even more intricate.

Platforms like StockioAI demonstrate how accessible AI trading solutions have become. By offering features like real-time signal generation, automated risk management, and performance tracking, the platform empowers both retail and institutional traders to leverage AI without needing deep technical knowledge.

Looking ahead, the future of AI in trading promises even more sophisticated tools. Advances in natural language processing, reinforcement learning, and even quantum computing are on the horizon, offering new ways to optimize portfolios and refine strategies. Traders who adopt AI now will be better positioned to capitalize on these advancements as they emerge.

Ultimately, success in volatile markets will come from blending human intuition with AI’s speed and analytical power. This partnership allows traders to navigate uncertainty, seize opportunities, and build a sustainable edge in the ever-changing world of cryptocurrency trading.

FAQs

How does AI help manage risks during volatile cryptocurrency markets?

AI plays a crucial role in navigating the unpredictable world of cryptocurrency markets by analyzing real-time data and spotting potential risks before they become serious issues. By studying historical trends alongside current market conditions, AI systems can anticipate sudden shifts and adapt trading strategies on the fly.

It also streamlines essential risk management tasks, including dynamic position sizing, stop-loss orders, and portfolio diversification. These automated tools keep a constant eye on market activity, helping traders react swiftly and make smart decisions - even when volatility is at its peak.

What setup is needed to maximize AI-driven trade execution speed?

Maximizing the speed of AI-driven trade execution starts with a high-performance infrastructure built for lightning-fast data processing and decision-making. This means using top-tier hardware like GPUs - think NVIDIA A100 or H100 - and AI-focused processors that can handle massive computations with ease.

To keep communication swift and dependable, ultra-low latency networks are a must. Whether it’s 5G or specialized high-speed connections, these networks ensure data moves without delay. On top of that, robust storage systems with high throughput and rapid access times are key for quickly managing and retrieving the immense volumes of market data involved.

For scalability and efficiency, tools like Kubernetes can simplify resource management by automating container orchestration. And to keep everything running smoothly and within regulatory standards, secure data handling processes are essential. When all these elements come together, they create an environment where AI can execute trades smarter and faster than ever.

What are the risks of using AI for trade execution?

AI has the potential to make trade execution faster and more efficient, but it’s not without its challenges. Technical problems, like system glitches or breakdowns, can lead to unexpected financial losses. On top of that, AI algorithms might unintentionally develop biases or become overly fine-tuned, creating trading strategies that are unrealistic or producing predictions that miss the mark.

Another major concern is cybersecurity. AI-powered systems can become targets for hackers and other malicious actors. And without proper oversight, these systems could even amplify market volatility. To address these risks, it’s crucial to adopt strong risk management strategies and consistently monitor AI systems to ensure they’re functioning as expected. Regular checks and balances can make all the difference in maintaining stability and trust.