Looking for the best crypto analysis platforms in 2025? Here's what you need to know:

Crypto trading tools have advanced significantly, with AI now playing a central role in providing real-time market insights, trend detection, and risk management. For US traders, platforms must meet high standards for regulatory compliance, security, and data precision.

Key features to prioritize:

-

AI Signals & Automation: Platforms use machine learning to generate actionable trading signals (BUY, SELL, HOLD) and automate risk settings.

-

Technical Analysis: Tools like multi-timeframe charts, TradingView integration, and custom indicators help traders make informed decisions.

-

Risk Management: Built-in calculators, real-time profit tracking, and portfolio rebalancing simplify trading in volatile markets.

-

US Compliance: Adherence to KYC/AML regulations and tools for tax reporting (e.g., Form 1099-DA) are critical.

-

Pricing: Plans range from $0 (basic) to $199/month (institutional), with features scaling based on user needs.

Example: StockioAI offers AI-driven trading signals, portfolio tracking, and compliance tools tailored for US traders. Plans include:

-

Free: 2 signals/month for beginners.

-

Starter ($49/month): 30 signals, basic tools.

-

Professional ($99/month): 300 signals, API access, advanced tracking.

-

Enterprise ($199/month): Unlimited signals, multi-user access, custom AI training.

For US traders, platforms like StockioAI simplify compliance and provide powerful tools to navigate the evolving crypto market.

10 BEST Crypto Research Tools: The 2025 Guide

How to Evaluate Crypto Analysis Platforms

Choosing the right crypto analysis platform is all about finding tools that align with your trading goals and help you succeed in a fast-moving market. The US crypto market, for instance, saw a massive $1.3 trillion in on-chain transaction volume from July 2023 to June 2024, making it the largest in the world. Interestingly, about 70% of this activity involved transfers over $1 million, highlighting the rise of institutional-level trading. This trend emphasizes the importance of platforms that deliver professional-grade analytics but remain accessible for individual traders. Here's what to consider when evaluating these platforms.

AI Trading Signals and Automation

AI-powered trading signals are a game-changer for crypto analysis. These systems process market data in real time to deliver actionable BUY, SELL, and HOLD signals. The effectiveness of these signals depends heavily on the quality of the machine learning models and the data used to train them.

When assessing platforms, look for those that provide clear metrics on signal accuracy and historical performance. Many top-tier platforms use multiple AI models to cross-check signals, which helps reduce false positives. Automation features are another must-have, allowing you to customize risk levels and position sizes to match your trading strategy.

Another standout feature is pattern recognition. Advanced AI systems can detect trends across multiple timeframes simultaneously - something that would be nearly impossible to achieve manually. This capability is especially useful as markets become increasingly complex.

Technical Analysis Tools and Market Data

Interactive charting tools are essential for any serious trader. Platforms that integrate with solutions like TradingView give users access to a wide variety of technical indicators and drawing tools. Real-time data feeds should include key metrics like order book depth, trading volume, and price movements across multiple exchanges.

Multi-timeframe analysis is another critical feature. Leading platforms let you view synchronized charts across different timeframes, helping you spot trends that might be invisible on a single chart. The ability to create custom indicators and backtest strategies can also set advanced platforms apart.

Accurate market data is the backbone of informed trading. Platforms should pull data from multiple sources to ensure precise price discovery, especially since crypto markets are often fragmented. Additionally, integrated news feeds can help you understand the factors driving price changes.

Risk Management and Portfolio Tracking

Managing risk is crucial in the volatile world of crypto trading. Look for platforms with built-in risk calculators that automatically determine position sizes based on your account balance and risk tolerance. Advanced tools may even include scenario analysis, showing potential outcomes under different market conditions.

Portfolio tracking should go beyond the basics. A good platform will handle the complexities of crypto trading, including staking rewards, DeFi investments, and holdings spread across multiple exchanges. With new IRS rules like Form 1099-DA for digital assets taking effect on January 1, 2025, accurate transaction tracking is more important than ever for US traders to stay compliant.

Position monitoring tools are also key. These should provide real-time profit and loss calculations and send alerts for major price movements. Automated rebalancing features can help you maintain your target portfolio allocation, which is especially valuable in volatile markets.

Pricing and Platform Access

Crypto analysis platforms often use tiered pricing models, with entry-level plans starting around $49/month and professional packages ranging from $99 to $199/month. When comparing plans, consider the cost per signal, whether API access is included for automation, and the overall value offered.

Full functionality across desktop, mobile, and web platforms is essential. Mobile apps should provide more than just basic portfolio tracking - they should allow you to monitor markets and execute trades on the go. API access is increasingly important for traders who rely on automation or need to integrate multiple tools.

Free plans can be a good way to test a platform’s features, but serious traders will likely need a paid subscription to unlock advanced AI tools and data access. Strong security measures and responsive customer support are also critical factors to consider.

Security, Compliance, and Customer Support

Regulatory compliance is non-negotiable for US-based platforms. They must adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations enforced by FinCEN, which include robust identity verification and transaction monitoring processes.

Data security should be a top priority. Look for platforms with end-to-end encryption, two-factor authentication, and secure API key management. In light of incidents like the FTX collapse, self-custody options are becoming more important to protect assets from hacks or exchange failures.

Finally, reliable customer support can make a big difference, especially when dealing with complex AI-driven tools. The best platforms offer multiple support channels - like live chat, email, and phone support during US trading hours - along with educational resources and onboarding help. Premium plans often include perks like priority support, faster response times, and dedicated account managers, ensuring a smoother trading experience.

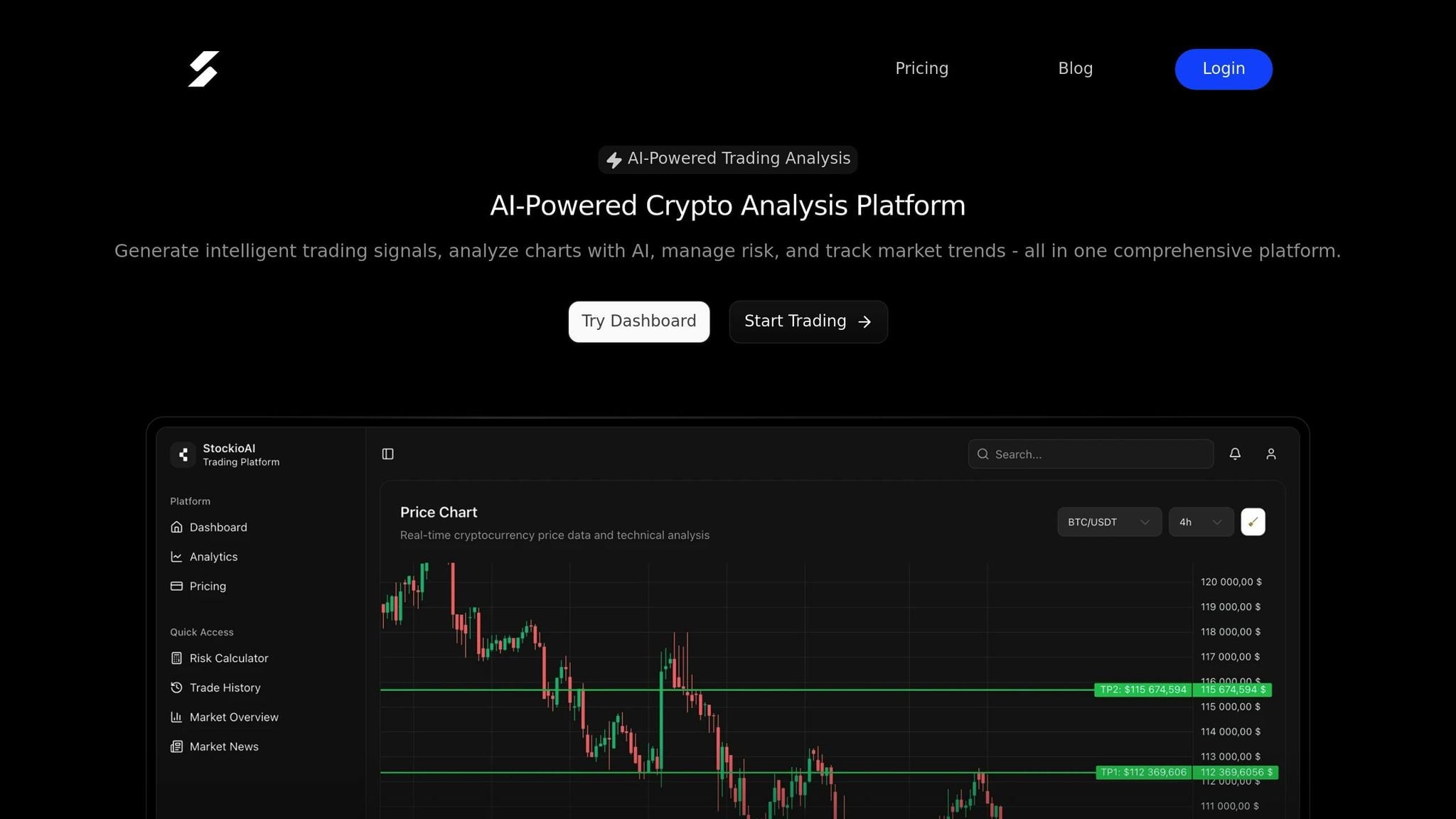

StockioAI Platform Review

StockioAI stands out as a platform crafted specifically for US crypto traders, bringing together the expertise of seasoned traders, data scientists, and AI researchers. The result? A tool that merges cutting-edge AI signals with a clean, easy-to-navigate interface. Let’s break down how StockioAI performs in key areas like AI signals, risk management, pricing, and compliance for US users.

AI Trading Signals and Market Analysis

StockioAI's foundation lies in its ability to generate accurate BUY, SELL, and HOLD signals. These signals are powered by advanced AI and pattern recognition, offering traders actionable insights. The platform also integrates seamlessly with TradingView, making it easy to visualize trends through multi-timeframe charting. This combination ensures traders have professional-grade tools to make informed decisions and time their market entries and exits effectively.

Risk Management and Portfolio Features

Risk management is a standout feature of StockioAI. The platform includes proprietary risk calculators designed to tailor position sizes based on individual portfolios. Real-time profit and loss tracking keeps traders updated on their performance, while its portfolio tracking feature consolidates investments across various exchanges. For those concerned about tax season, the platform’s transaction tracking simplifies compliance. On top of that, integrated market news feeds provide timely updates, helping traders stay ahead of market shifts.

Pricing and Features

StockioAI offers four pricing tiers, each designed to meet the needs of different types of traders:

| Plan | Monthly Price | AI Signals | Key Features | Best For |

|---|---|---|---|---|

| Free | $0 | 2 signals | Basic market insights, mobile app, educational resources | Beginners exploring AI trading |

| Starter | $49 | 30 signals | Basic technical analysis, email support, standard indicators | Individual traders starting with AI |

| Professional | $99 | 300 signals | Advanced pattern recognition, priority support, portfolio tracking, API access | Active traders needing advanced tools |

| Enterprise | $199 | Unlimited | Multi-user access, dedicated account manager, custom AI training, white-label solutions | Institutions and professional trading teams |

The Free plan is perfect for those curious about AI trading, offering a no-cost way to explore the platform's basic features. For $49 a month, the Starter plan provides 30 signals and essential tools for new traders. The Professional plan, priced at $99, is ideal for active traders, offering 300 signals, API access, and advanced tracking tools. Finally, the Enterprise plan delivers unlimited signals, along with features tailored for institutions, such as multi-user access and white-label solutions.

US Compliance and Local Features

StockioAI ensures it meets the specific needs of US traders by adhering to local regulatory and security standards. The platform offers resources to help users navigate US regulations, and its customer support aligns with US trading hours, offering live chat, email, and phone assistance. For those automating their strategies, API access integrates smoothly with US-based exchanges, while built-in tracking tools simplify tax reporting requirements.

StockioAI Plans Comparison Table

StockioAI provides four subscription levels designed to cater to a wide range of traders, from beginners exploring the market to institutional teams managing complex strategies. These plans are tailored for US traders, ensuring they align with local regulations and market standards. Here's a detailed comparison of what each plan offers:

| Feature | Free | Starter | Professional | Enterprise |

|---|---|---|---|---|

| Monthly Price | $0 | $49 | $99 | $199 |

| AI Trading Signals | 2 signals | 30 signals | 300 signals | Unlimited |

| Technical Analysis | Basic insights | Basic tools | Advanced pattern recognition | All Professional features |

| Portfolio Tracking | ❌ | ❌ | ✅ | ✅ |

| API Access | ❌ | ❌ | ✅ | ✅ |

| Support Level | Community | Priority | Dedicated account manager | |

| Multi-User Access | ❌ | ❌ | ❌ | ✅ |

| Custom AI Training | ❌ | ❌ | ❌ | ✅ |

| White-Label Solutions | ❌ | ❌ | ❌ | ✅ |

| Mobile App Access | ✅ | ✅ | ✅ | ✅ |

| Educational Resources | ✅ | ✅ | ✅ | ✅ |

| TradingView Integration | Limited | ✅ | ✅ | ✅ |

What Sets Each Plan Apart

-

AI Trading Signals: The Free plan offers 2 signals, ideal for testing the platform. The Starter plan provides 30 signals, perfect for individual traders. Professional users get 300 signals, meeting the needs of active strategies, while the Enterprise plan unlocks unlimited signals for institutional teams.

-

Support Levels: Support scales with each tier. Free users rely on community forums, Starter users receive email support, Professional subscribers enjoy priority assistance, and Enterprise users benefit from a dedicated account manager.

-

Advanced Features: Professional and Enterprise plans stand out with API access for automating trading strategies. Enterprise users also gain exclusive perks like multi-user access, custom AI training, and white-label solutions for branding flexibility.

Each plan progresses logically, offering tools and features that match the needs of traders at different levels of expertise. Whether you're just starting or managing institutional portfolios, there's a plan designed for you.

Key Considerations for US Crypto Traders in 2025

The cryptocurrency landscape in the United States continues to evolve, and picking the right platform has never been more important. For US-based traders, navigating the unique challenges and opportunities of this market requires careful attention to specific factors. These considerations go beyond general platform features, focusing on the needs of American traders to help them avoid costly mistakes and maximize their trading potential.

Here’s a closer look at the key aspects US traders should prioritize in 2025.

Regulatory Compliance and Security

Staying compliant with US regulations is non-negotiable for crypto traders in 2025. Regulatory bodies like the SEC and CFTC enforce strict rules, and platforms that fail to comply risk sudden shutdowns, leaving traders stranded. To protect your investments, choose platforms that meet these standards and offer robust security features like bank-grade encryption, two-factor authentication, and US-based data storage.

Tax reporting is another critical area. The IRS requires detailed cryptocurrency transaction records, and platforms that provide automated Form 8949 reporting can save you a lot of time and help you avoid compliance headaches. Look for platforms that allow you to export transaction data in formats compatible with popular tax software - it’s a simple way to streamline your tax filing process.

US Financial System Integration

Platforms that integrate seamlessly with the US financial system can make a big difference in trading efficiency. Direct connections to major US-based exchanges ensure real-time data synchronization and faster execution of trades, reducing the errors and delays that often come with manual data handling.

Banking compatibility is equally important. Platforms that support ACH transfers with established US banks offer quicker deposits and withdrawals, while integration with popular digital payment services adds flexibility to funding options.

Time zones also matter. Platforms designed with Eastern Standard Time (EST) in mind align better with US trading patterns, offering features like pre-market analysis, real-time alerts during peak trading hours, and customer support when you need it most.

Displaying account balances and profits in US dollars ($) simplifies decision-making by eliminating the need for currency conversions. Combined with these financial integrations, platforms that offer responsive support and targeted learning resources can significantly enhance your trading experience.

Customer Support and Learning Resources

Having access to US-based customer support can make a world of difference. Teams that operate during American business hours (9:00 AM to 6:00 PM EST) and provide toll-free phone support are better equipped to address urgent issues when they arise.

Educational tools tailored to US-specific needs are equally valuable. Webinars, tutorials, and guides that focus on American tax laws and regulations can help traders stay compliant while improving their strategies.

Clear communication is key, too. Support teams familiar with US trading terminology and market conventions can minimize misunderstandings, especially when accounting for factors like US market holidays, standard trading hours, and common trading strategies.

For traders on the go, mobile app optimization is essential. Features like push notifications and calendar integration ensure you stay updated on market movements. Additionally, platforms offering demo accounts and paper trading options allow beginners to practice under US market conditions without risking real money.

Conclusion

Choosing the right crypto analysis platform in 2025 is no small task. For US-based traders, it means balancing trading goals, experience levels, and specific needs in a market that's becoming more complex by the day. Platforms like StockioAI have emerged as essential tools, offering AI-powered features to help traders stay ahead.

What makes StockioAI stand out is its flexibility and accessibility. With a Free Plan at $0/month for beginners and an Enterprise Plan at $199/month for institutional traders, the platform caters to a wide range of users. This tiered pricing approach allows traders to start small and scale up as they gain experience and confidence.

Beyond pricing, StockioAI focuses on data-driven decision-making and reducing emotional biases - two critical aspects of successful trading. From 2 AI signals for beginners to unlimited signals for enterprise users, the platform provides real-time insights to guide traders toward informed entry and exit points. These tools are designed to help users avoid common emotional pitfalls, making it suitable for traders at any experience level.

StockioAI also tackles key concerns like regulatory compliance and market integration, ensuring a secure and efficient environment for US traders. Its advanced technical analysis tools, risk management features, and US-specific focus create a platform that aligns with American financial regulations while meeting the demands of today's volatile crypto markets.

FAQs

How do AI-powered trading signals improve crypto analysis platforms in 2025?

AI-powered trading signals bring a new level of sophistication to crypto analysis platforms, offering real-time insights that help traders make informed decisions. By leveraging advanced algorithms, these signals sift through massive datasets - like market trends, technical indicators, and sentiment analysis - to deliver actionable recommendations with speed and precision.

These tools also play a crucial role in risk management by accurately forecasting potential market changes. This allows traders to better protect their investments while identifying profitable opportunities. With these signals in place, crypto analysis platforms become more adaptive and dependable, giving traders a competitive advantage in the ever-changing world of cryptocurrency.

What features should US crypto traders prioritize in an analysis platform to stay compliant with regulations?

US-based crypto traders should prioritize platforms committed to regulatory compliance. This means choosing services that incorporate KYC (Know Your Customer) and AML (Anti-Money Laundering) processes, which are essential for legal operation within the United States. For platforms dealing with securities-like assets, compliance with SEC regulations and adherence to both federal and state licensing requirements are crucial.

In addition, it's wise to select platforms that offer features like secure asset custody, transparent transaction tracking, and compliance reporting. These tools not only help traders stay within the bounds of US laws but also provide an added layer of security and confidence in navigating the ever-changing regulatory environment.

How does StockioAI's pricing adapt to the needs of beginner traders and large institutional teams?

StockioAI offers a pricing model tailored to suit traders across all experience levels, from beginners dipping their toes into trading to seasoned professionals and institutional teams. For newcomers, the platform provides free or low-cost plans that include essential AI-driven tools. This way, users can explore its capabilities without making a hefty financial commitment.

For more experienced traders and institutional teams, premium plans are available. These plans come packed with advanced features, increased data limits, and robust analytics designed to handle complex trading strategies. This tiered structure ensures there’s an option for everyone, no matter their trading expertise or goals.