AI-powered multi-timeframe signals simplify crypto trading by analyzing price movements across multiple timeframes - like 1-minute, 15-minute, 4-hour, and daily charts. This approach provides a well-rounded view of market trends, combining short-term and long-term data for better decision-making. Unlike manual analysis, which is slow and error-prone, AI processes vast datasets in milliseconds, identifying patterns and correlations that human traders often miss.

Key Takeaways:

- Multi-Timeframe Analysis (MTFA): Examines various time intervals to detect trading opportunities.

- AI Advantages: Automates analysis, aligns signals across timeframes, and adapts to market conditions.

- Improved Accuracy: Combines short-term signals with longer-term trends for reliable insights.

- Risk Management: AI adjusts strategies based on market phases (bullish, bearish, volatile).

- Methods Used: Machine learning, neural networks (e.g., LSTM), and reinforcement learning.

Challenges:

- Relies on high-quality data.

- Requires constant monitoring to avoid overfitting.

- Demands significant computing power, which can be costly.

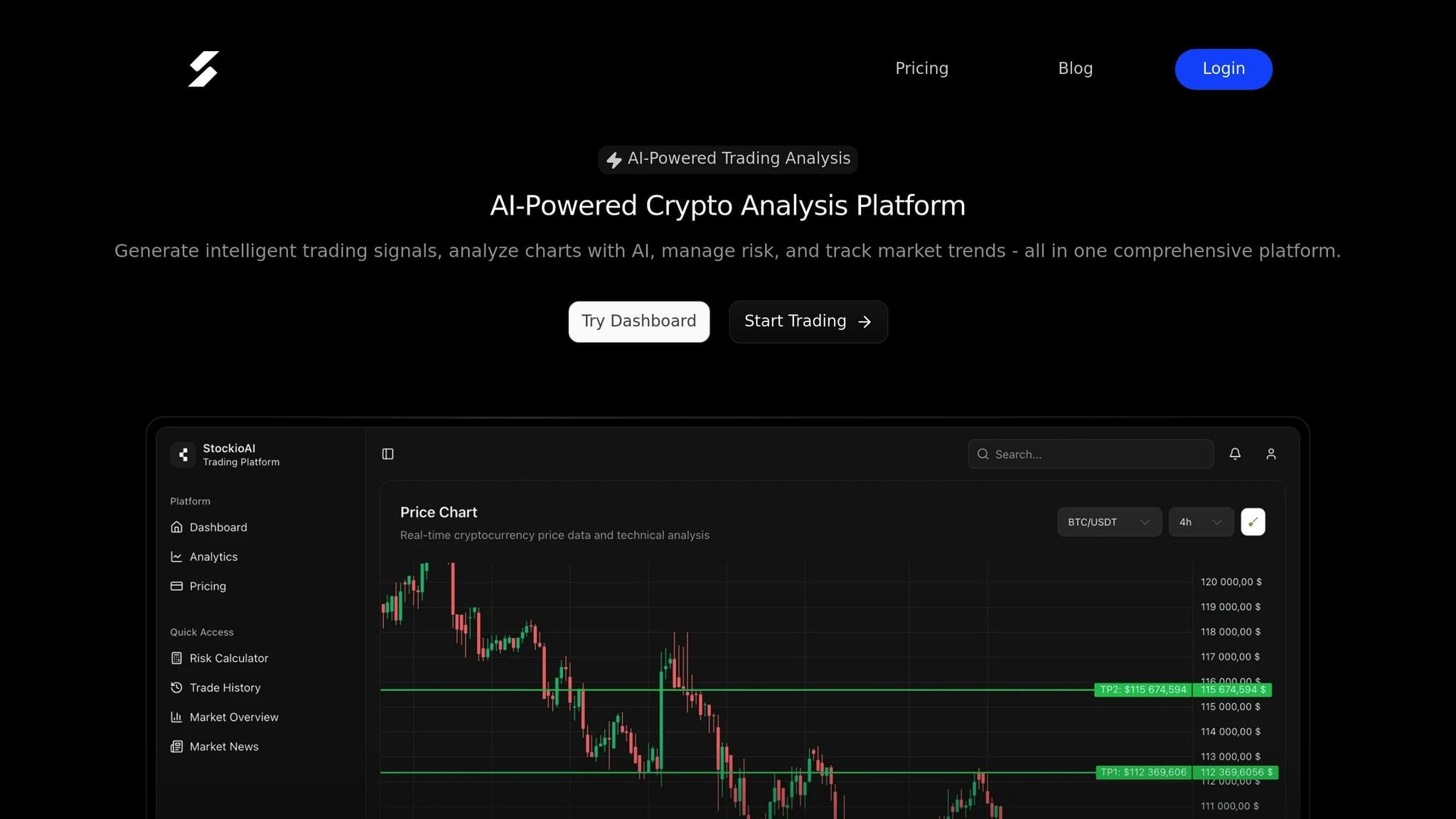

AI-driven tools, like StockioAI, showcase how multi-timeframe signals can enhance trading by aligning short-term movements with broader trends, reducing false signals, and improving decision-making speed. While there are challenges, the benefits of integrating AI in multi-timeframe analysis are clear for traders looking to navigate complex crypto markets more efficiently.

AI Crypto Trading: 70% Accurate Buy and Sell Signals Using RSI & Python (MUST WATCH)

Recent Research on AI Multi-Timeframe Signal Performance

Recent studies suggest that using AI for multi-timeframe analysis can significantly improve trading accuracy compared to single-timeframe methods. By incorporating data from multiple time horizons, these systems can deliver more reliable signals and quicker responses than traditional manual analysis. This approach lays the groundwork for understanding how combining signals across timeframes can lead to better trading decisions.

Signal Confluence and Accuracy

Signal confluence - where multiple timeframes align to confirm a trading opportunity - has become a key concept in AI-driven trading systems. For example, when short-term price movements align with longer-term trends, AI algorithms can pinpoint high-confidence opportunities with greater precision. This cross-referencing of signals helps eliminate market noise. A short-term buy signal, for instance, might be disregarded if longer timeframes suggest a conflicting trend.

Research also highlights the importance of adjusting the weight given to different timeframes depending on market conditions. During periods of high volatility, algorithms might lean more heavily on shorter timeframes to fine-tune entry points, while relying on longer timeframes to confirm overarching trends. This adaptive approach can lead to more consistent and reliable trading outcomes.

AI Response to Market Conditions

Building on the idea of signal confluence, AI systems are designed to adapt their analyses based on changing market conditions. Studies show that these systems can identify market phases - such as bullish, bearish, or sideways - and adjust their signal generation accordingly. For example, in a bull market, AI models may prioritize signals that align with the prevailing upward trend, while in more volatile conditions, the focus often shifts toward managing risk.

AI algorithms are also capable of detecting shifts in market regimes, such as transitions between trending and ranging markets. By monitoring correlations across multiple timeframes, these systems can reduce the frequency of signals and demand additional confirmation during uncertain periods. This strategy helps to minimize the impact of erratic market movements. Furthermore, during downtrends, AI-driven multi-timeframe systems can identify short-term rebounds within broader declines, aiding in strategic position sizing and better risk management.

Another area where these systems excel is recognizing seasonal patterns and recurring market behaviors. Machine learning models can analyze historical data to determine when certain timeframe combinations are more or less effective, based on past market cycles. This allows for a more tailored approach to signal generation, one that takes into account the unique temporal characteristics of the market at any given time.

Methods for AI-Driven Multi-Timeframe Signal Generation

AI-powered multi-timeframe signal generation taps into advanced methodologies to analyze market data across various timeframes, uncovering trading opportunities that might go unnoticed with traditional techniques.

AI Models and Algorithms

At the heart of these systems are machine learning models. These models excel at spotting intricate patterns across different time horizons without relying on predefined rules. Common approaches include ensemble methods, which combine multiple algorithms to improve accuracy, and neural networks, which are adept at processing complex, non-linear relationships in market data.

Deep learning architectures have shown exceptional promise, especially in volatile markets like cryptocurrency. Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks are particularly effective because they retain context across multiple timeframes. For example, they can analyze data from 1-minute, 15-minute, 4-hour, and daily charts simultaneously to identify signals that align across these intervals.

Another powerful approach is reinforcement learning, where AI learns optimal trading strategies by trial and error. These systems adapt dynamically, uncovering trading patterns that aren't explicitly programmed, which can be invaluable in fast-changing markets.

While the models are critical, the ability to extract meaningful patterns from raw data is equally important for generating actionable signals.

Feature Extraction Across Timeframes

Extracting valuable insights from market data involves advanced preprocessing techniques. AI systems analyze candlestick patterns, support and resistance levels, and trends across different timeframes. This multi-layered analysis helps identify high-probability trading opportunities.

Volume analysis plays a key role in validating price movements. For instance, a breakout signal on a short-term chart becomes more reliable if supported by above-average volume on longer timeframes. Metrics like volume spikes, volume-weighted average price (VWAP), and volume profile distributions help confirm whether market interest is genuine or fleeting.

Technical indicator synthesis combines traditional tools like moving averages, RSI, MACD, and Bollinger Bands across various timeframes. Instead of applying these indicators uniformly, AI systems assign weights to them based on their historical performance under specific market conditions. For example, momentum indicators might carry more weight in trending markets, while mean-reversion indicators take precedence in ranging conditions.

Market microstructure features - such as order flow, bid-ask spreads, and trading activity - offer an early glimpse into potential trend shifts. These features are especially valuable in cryptocurrency markets, where sentiment can change rapidly across timeframes.

After extracting features and generating signals, rigorous testing ensures the system's reliability in diverse market conditions.

Backtesting and Validation

Validation is a crucial step to confirm the reliability of AI-driven signals. Techniques like historical simulation, walk-forward analysis, and cross-validation are commonly employed. Historical simulation evaluates performance against years of past data, factoring in trading costs, slippage, and execution delays. Walk-forward analysis uses a rolling window approach, training the model on 12-18 months of data and testing it on the subsequent 3-6 months. Cross-validation further ensures robustness by dividing historical data into multiple segments for comprehensive testing.

Out-of-sample testing is the final hurdle, where the model is tested on entirely new data that wasn't part of the training process. This step provides a realistic measure of how the system might perform in live trading, covering a range of market conditions such as bull markets, bear markets, and periods of high volatility.

Performance metrics go beyond simple profit calculations. They include measures like risk-adjusted returns, maximum drawdown, win rates, and consistency of returns across timeframes. These metrics also assess how quickly the system adapts to new market dynamics and its ability to maintain stable performance over time. Together, these validation methods ensure the system's reliability and practical value in trading scenarios.

Benefits and Drawbacks of AI Multi-Timeframe Signals

Building on earlier discussions, this section dives into the advantages and challenges of using AI-powered multi-timeframe signals in trading. For traders weighing this technology, understanding both its strengths and potential pitfalls is crucial. While these systems offer a leap forward compared to traditional methods, they also bring unique challenges that demand attention.

Benefits of AI-Driven Multi-Timeframe Analysis

Enhanced Pattern Recognition: AI excels at spotting patterns across multiple timeframes simultaneously - something human traders simply can’t do. This ability helps identify signal confluence, where signals from different timeframes align in the same direction, significantly improving reliability.

Reduced False Signals: By verifying signals across multiple timeframes, AI systems cut down on noise and conflicting indicators often seen in single-timeframe analysis. For instance, a buy signal on a 15-minute chart becomes more credible if it’s supported by bullish patterns on both 4-hour and daily charts.

Adaptive Learning: AI systems constantly evolve, adapting to changing market conditions. Unlike static trading strategies, they update their understanding of market trends, which is especially important in the high-volatility world of cryptocurrencies.

Comprehensive Risk Assessment: These systems consider risk factors across short- and long-term timeframes. For example, short-term price swings can be evaluated against longer-term trends, offering a more detailed view of potential trade outcomes. This layered approach helps traders make smarter decisions about position sizes.

Speed and Efficiency: AI processes vast amounts of data across multiple timeframes in seconds. For human traders, such an analysis would take hours - by which time, the market opportunity could be gone. This speed is particularly valuable in fast-moving markets like cryptocurrency, where prices can shift dramatically in minutes.

While the benefits are compelling, there are also challenges that traders need to address.

Challenges and Limitations

Data Quality Issues: AI systems rely on consistent, high-quality data. Problems like missing data points, exchange outages, or delayed feeds can undermine signal accuracy. This is especially tricky in cryptocurrency markets, which operate 24/7 across multiple exchanges, creating synchronization challenges.

Model Complexity and Maintenance: These systems require robust infrastructure and constant oversight. Regular retraining is necessary to ensure effectiveness, and performance can degrade gradually if not closely monitored.

Overfitting Risks: AI models that are too finely tuned to historical data may struggle in changing market conditions. This risk grows with multi-timeframe analysis, where complex interactions between timeframes can lead to misleading correlations.

High Computational Costs: Multi-timeframe analysis demands significant computing power and memory. For retail traders or smaller firms, the costs of cloud computing or maintaining high-performance systems can add up quickly.

Black Box Problem: AI systems often lack transparency, making it hard to understand why specific signals are generated. This lack of clarity can erode trust during drawdowns or when explaining decisions to stakeholders.

Market Regime Changes: Cryptocurrency markets are known for sudden shifts in volatility and trading behavior. AI models trained on one set of conditions may not adapt quickly enough to new market dynamics, reducing their effectiveness.

Comparison Table of Pros and Cons

Here’s a quick look at the advantages and limitations of AI multi-timeframe signals:

| Advantages | Limitations |

|---|---|

| Enhanced Pattern Recognition - Spots complex patterns across various timeframes | Data Quality Issues - Requires consistent and reliable data feeds |

| Reduced False Signals - Filters noise through multi-timeframe alignment | Model Complexity - Needs sophisticated infrastructure and ongoing maintenance |

| Adaptive Learning - Updates with changing market conditions | Overfitting Risks - May struggle with new market conditions |

| Comprehensive Risk Assessment - Balances short-term and long-term risks | High Computational Costs - Demands significant processing power |

| Speed and Efficiency - Analyzes data in milliseconds | Black Box Problem - Lacks transparency in signal generation |

| 24/7 Market Monitoring - Operates continuously without human input | Market Regime Sensitivity - Can falter during major market shifts |

Adopting AI multi-timeframe signals requires balancing these benefits against their challenges. Traders must carefully evaluate their data infrastructure, computational resources, and ability to maintain these systems. These considerations lay the groundwork for exploring practical applications, which will be covered in the next section.

Practical Applications and Examples

AI multi-timeframe signals offer practical benefits that can enhance trading strategies. By understanding how these systems operate, traders can better assess their potential to improve performance and refine decision-making. The StockioAI case study provides a clear example of these advantages in action.

Case Study: StockioAI

StockioAI employs AI-driven multi-timeframe analysis through a sophisticated 7-tier priority system. This system evaluates signals across various timeframes, giving more weight to higher timeframe momentum when conflicting signals arise. The platform is designed to automatically identify market conditions - such as trending, ranging, volatile, or quiet - and adjusts the weighting of signals accordingly. For example, in trending markets, long-term signals dominate, while in ranging markets, short-term mean reversion signals take precedence.

To handle conflicting signals, StockioAI uses a conflict resolution matrix that evaluates 15 different scenarios. For instance, if a 15-minute chart suggests a buy signal but the 4-hour chart shows bearish momentum, the platform doesn’t ignore the conflict. Instead, it adjusts the recommended position size to account for the mixed signals. This approach reflects modern research into adaptive signal weighting and cross-timeframe validation.

The platform also integrates layered analysis by combining market structure, volume data, and technical indicators. This helps filter out noise while remaining sensitive to genuine trading opportunities. Additionally, its real-time pattern recognition capabilities detect complex formations across multiple timeframes. This feature identifies scenarios like short-term breakouts aligning with longer-term trends or temporary pullbacks that create ideal entry points.

Impact on Traders

These advanced features translate into real benefits for traders, particularly in decision-making and risk management. Here’s how:

- Enhanced Decision Confidence: When signals align across timeframes, traders gain more confidence in their decisions, leading to better execution and fewer premature exits caused by market noise.

- Improved Risk Management: The nuanced analysis helps traders set stop-loss levels and position sizes that account for both short-term opportunities and the broader market direction.

- Time Efficiency: Automation reduces the need for manual chart analysis, allowing traders to focus more on execution and managing their portfolios.

- Reduced Emotional Trading: By offering objective, data-driven insights, AI systems help traders stick to their strategies and avoid emotional reactions during volatile market conditions.

- Better Market Timing: Aligning short-term signals with long-term trends enhances entry points, boosting profitability, especially in volatile cryptocurrency markets.

For traders, AI multi-timeframe signals are most effective when paired with solid risk management and a deep understanding of market behavior.

Conclusion

AI-driven multi-timeframe signal generation is reshaping how traders approach the complexities of crypto markets. Research consistently highlights that combining signals from multiple timeframes leads to more precise and dependable trading decisions compared to relying on a single timeframe. This method tackles a major hurdle in crypto trading: cutting through market noise to uncover real opportunities.

AI systems shine in handling the intricate nature of multi-timeframe analysis. They can sift through massive datasets, spot patterns, and adapt to shifting market conditions in real-time. A standout feature is their ability to dynamically adjust signal weighting based on market conditions - whether the market is trending, ranging, volatile, or calm - giving traders a significant advantage in the ever-changing cryptocurrency landscape.

Platforms like StockioAI bring these advanced concepts to life with tools such as 7-tier priority systems, conflict resolution matrices, and adaptive position sizing. These features bridge the gap between theoretical research and practical application, empowering traders to make smarter decisions while effectively managing risk. Such innovations directly enhance trading outcomes.

By boosting decision-making confidence, improving risk management, and minimizing emotional trading, these tools elevate overall trading performance. Additionally, they save time, allowing traders to focus on strategy and execution rather than getting bogged down in manual chart analysis.

As cryptocurrency markets grow more complex, AI-powered multi-timeframe analysis is poised to become essential. Platforms that seamlessly integrate these advanced tools while keeping interfaces user-friendly will play a key role in providing individual traders with access to institutional-grade capabilities. The future of crypto trading lies in the intelligent combination of multiple timeframes, and the evidence strongly supports AI's potential to make this sophisticated analysis both practical and impactful for traders at all levels.

FAQs

How does AI use multi-timeframe analysis to improve crypto trading signals?

AI-powered multi-timeframe analysis enhances the precision of crypto trading signals by merging data from different timeframes. This technique offers a more comprehensive view of market trends, cutting through the short-term fluctuations that often cloud judgment and delivering clearer insights.

By evaluating multiple timeframes at once, AI can detect more robust patterns and accurately determine the best entry and exit points. This dynamic approach often surpasses traditional methods, which typically depend on static indicators or single-timeframe data, giving traders a noticeable advantage in making informed decisions.

What challenges might traders face when using AI-powered multi-timeframe signals, and how can they address them?

Traders leveraging AI-powered multi-timeframe signals can face hurdles like model overfitting, technical malfunctions, and increased risks during volatile market conditions. These challenges can occasionally lead to inaccurate signals or unexpected errors in the system.

To mitigate these risks, traders can verify signals by comparing data across different timeframes, which helps improve accuracy and reduce the chances of false signals. Implementing AI strategies that can adjust dynamically to shifting market trends is another way to address issues like overfitting and technical errors. Consistent monitoring and periodic adjustments of AI models are also key to improving their reliability and overall performance.

How do AI systems adapt signal weighting to changing market conditions, and why does this matter for traders?

AI systems fine-tune signal weighting by analyzing critical market factors like volatility, trend strength, and market sentiment on an ongoing basis. Using these insights, the AI adjusts the importance it places on various signals to better match current market conditions. For example, during a strong trending market, it emphasizes trend-following signals. On the other hand, in sideways or choppy markets, it shifts focus toward managing risk and filtering out unnecessary noise.

This constant recalibration is crucial because markets are always evolving. By aligning signal weighting with the current environment, AI minimizes false signals, sharpens decision-making, and boosts overall trading performance. This adaptability gives traders an edge in navigating fast-changing and unpredictable markets.