Feature engineering in crypto trading transforms raw data - like price, volume, and order book details - into inputs for machine learning models. Tools like RSI, MACD, and Bollinger Bands are widely used, but AI-powered platforms like StockioAI can optimize their use. Here's what you need to know:

- Standalone Indicators: Simple to use, but require manual interpretation and are prone to delays in fast-moving markets.

- AI Platforms: Automate feature selection, process real-time data, and deliver detailed signals, improving accuracy by up to 76.7%.

AI platforms streamline decision-making but come with subscription costs ($49–$199/month). Combining manual and AI approaches can balance control with precision, helping traders navigate crypto's 24/7 volatility effectively.

BEST TradingView Indicators & Tools for Crypto Trading (+Special Settings)

1. Standalone Technical Indicators

Standalone technical indicators play a central role in crypto feature engineering. They transform raw price and volume data into actionable trading signals through mathematical calculations. Let’s break down their accuracy, real-time performance, and how they integrate into trading strategies.

Accuracy of Trading Signals

Studies reveal that combining momentum and volatility indicators can improve prediction accuracy by up to 76.7% compared to basic models[2]. Momentum indicators like the Relative Strength Index (RSI) highlight overbought or oversold conditions, helping traders anticipate short-term price movements. On the other hand, volatility indicators, such as Bollinger Bands, are better suited for identifying potential breakouts over a longer timeframe.

Streamlining the selection process - narrowing down from over 130 indicators to about 20 - can maintain or even enhance accuracy[2]. Volume-based tools like On-Balance Volume (OBV) and trend-focused indicators like the Exponential Moving Average (EMA) also add value, though their effectiveness can fluctuate depending on market dynamics[2]. While these standalone indicators are powerful, their individual use lacks the depth needed for more comprehensive trading strategies, paving the way for AI-driven solutions.

Real-Time Feature Engineering

Real-time feature engineering involves converting live market data into updated indicator values as quickly as possible. This requires pulling trade data from exchanges and recalculating indicators continuously, often every minute or even faster[3]. Low latency is key here - indicators like RSI and MACD must be computed in seconds to support timely trades. Simpler calculations, such as moving averages, are quicker to process, while more complex measures like Bollinger Bands demand greater computational effort. This rapid processing capability is essential for integrating these indicators into larger trading frameworks.

Integration and Usability

Standalone indicators are straightforward to implement using standard programming libraries, which makes them accessible to traders. However, interpreting individual indicators manually can complicate workflows, especially when trying to combine multiple signals. Additionally, users must regularly update and assess the relevance of these indicators to adapt to shifting market conditions.

Despite these limitations, standalone indicators remain a go-to choice for creating clear, rule-based trading strategies. They offer transparency and control, making them a reliable foundation for building more advanced systems that align with professional trading needs.

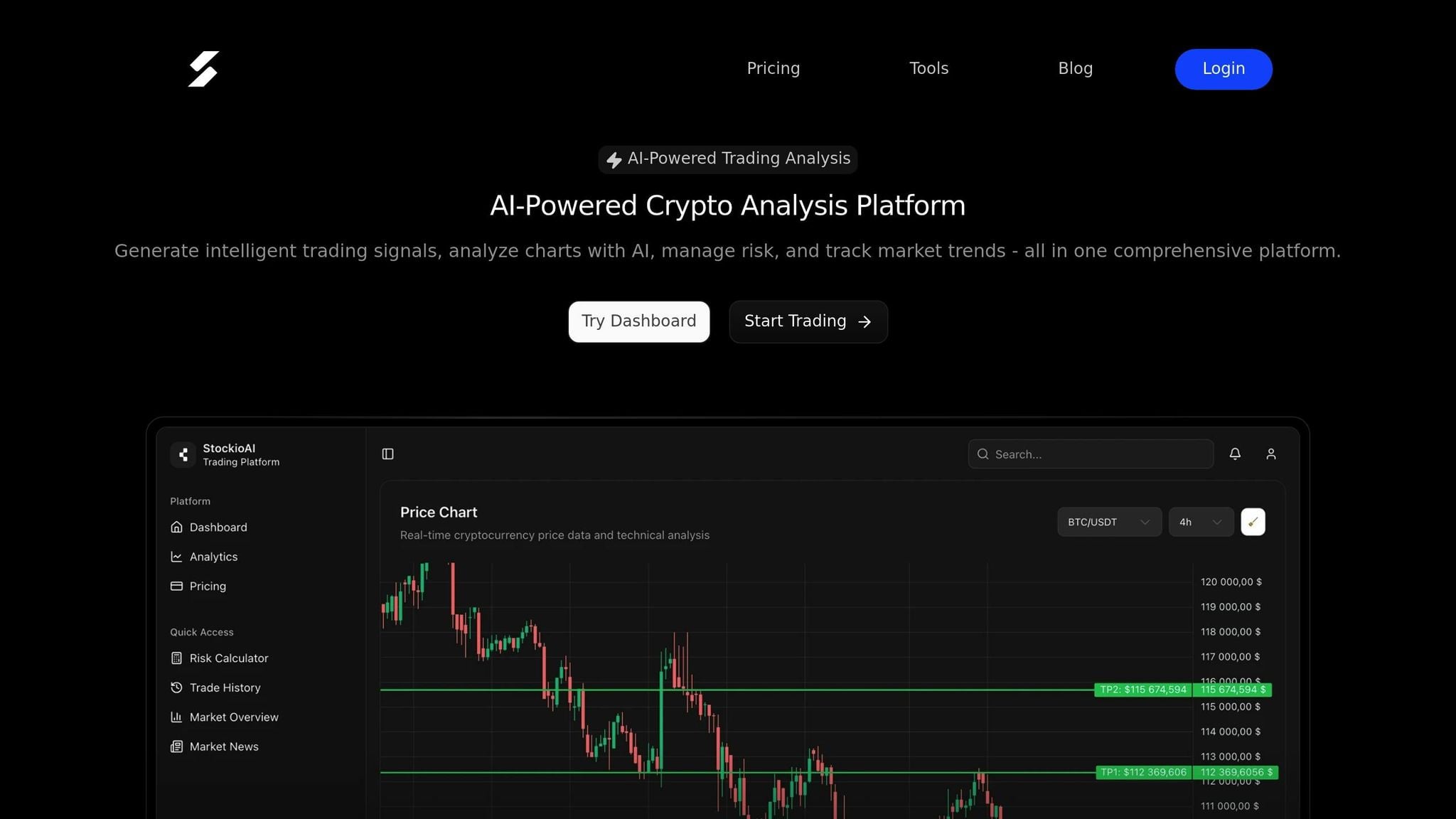

2. AI-Powered Platforms like StockioAI

AI-powered platforms have taken trading to a whole new level, moving beyond traditional technical indicators by automating the process of feature engineering. These platforms use machine learning and advanced data processing to deliver sharper, faster trading signals. Take StockioAI, for example - it processes over 60 data points every second to generate actionable insights. This transition from manually analyzing indicators to relying on AI-driven systems is a game-changer for traders.

Accuracy of Trading Signals

One of the standout features of AI-based platforms is their ability to improve signal accuracy by fine-tuning which technical indicators to use. StockioAI employs techniques like Mutual Information (MI), Recursive Feature Elimination (RFE), and Random Forest Importance (RFI) to zero in on the most relevant indicators for predicting cryptocurrency prices[2].

The platform doesn't just spit out BUY, SELL, and HOLD signals. It provides detailed reasoning, including entry and exit points, stop-loss levels, profit targets, and confidence scores. This level of detail helps traders navigate the unpredictable crypto market with better risk management strategies. Machine learning models optimized with these indicators have achieved impressive AUC scores of 0.90 and 0.93 for different cryptocurrencies, showcasing their high classification accuracy[2].

Another benefit is the ability of these platforms to reduce the number of indicators by 80%–85% - from over 130 down to about 20 - without sacrificing performance. By cutting out redundant data, the models become more efficient and less prone to overfitting, making their trading signals more reliable[2].

Real-Time Feature Engineering

AI platforms don’t just refine accuracy - they also excel at processing live market data in real time. StockioAI, for instance, converts continuous streams of market data into actionable indicators in just seconds[3]. It pulls live trade data from multiple exchanges, computes optimized indicator combinations, and equips traders to act on short-term price movements or arbitrage opportunities.

What makes StockioAI particularly advanced is its 7-tier priority system, which integrates signals from market structure, volume, momentum, and trends all at once. This ensures that trading signals account for the full complexity of market dynamics.

Beyond crunching numbers, the platform can classify market regimes - identifying whether the market is trending, ranging, volatile, or quiet. This contextual awareness allows the system to adapt its signal generation to current conditions, making its recommendations even more relevant.

Integration and Usability

StockioAI builds on traditional trading methods by presenting its insights in a user-friendly format. The platform simplifies complex data with tools like interactive chart analysis, risk calculators, and customizable dashboards. These features let traders see technical indicators and signals in real time, all formatted in ways familiar to U.S. users, such as USD currency symbols and MM/DD/YYYY dates[3].

To address the challenge of conflicting signals, StockioAI uses a conflict resolution matrix that handles 15 different scenarios for position sizing based on market conditions. It also employs multi-timeframe analysis, ensuring that larger trends take precedence over short-term fluctuations, giving traders clearer guidance.

For professional traders and institutions, the platform offers API access for seamless integration into existing workflows. It also keeps its models up-to-date with walk-forward validation and continuous retraining, adapting to the ever-changing cryptocurrency market without requiring manual adjustments. Real-time alerts and portfolio tracking features ensure traders are always in the loop about critical developments.

Pros and Cons

When deciding between standalone technical indicators and AI-powered platforms for cryptocurrency trading, it's important to weigh the strengths and weaknesses of each approach. Both offer unique benefits and challenges that can influence your trading outcomes. Here's a closer look at how they compare across key factors.

Standalone technical indicators are popular for their simplicity and transparency. Tools like RSI, MACD, and Bollinger Bands are straightforward and easy to grasp, making them ideal for traders who prefer manual control. These indicators are often free or come with minimal costs, requiring no expensive subscriptions or platform commitments. They also allow users full control over their setup, offering flexibility in combining and interpreting signals.

However, standalone indicators have their drawbacks - especially in the fast-paced world of crypto trading. They rely on manual interpretation and adjustments, which can lead to slower reactions during volatile market conditions. Using multiple indicators without careful selection can result in conflicting signals or overfitting, potentially causing missed opportunities in a market that operates 24/7.

AI-powered platforms like StockioAI tackle these limitations with automation and advanced analytics. For example, StockioAI streamlines the process by reducing indicator sets by 80–85% - narrowing over 130 options down to about 20 - helping to minimize redundancy and improve performance[2]. Its 7-tier priority system integrates data from market structure, volume, momentum, and trends, producing more reliable trading recommendations.

One major advantage of AI platforms is their ability to adapt in real time. Unlike static standalone indicators, StockioAI continuously evaluates market conditions - whether trending, ranging, volatile, or quiet - and adjusts its signal generation accordingly. This adaptability ensures traders stay aligned with the latest market dynamics.

Cost and complexity are also key considerations. While standalone indicators are typically free or low-cost, AI platforms often come with subscription fees. For instance, StockioAI's pricing ranges from $49/month for the Starter plan to $199/month for Enterprise access. Additionally, the advanced algorithms behind these platforms can make their decision-making processes feel less transparent compared to manual methods.

| Criteria | Standalone Technical Indicators | AI-Powered Platforms (StockioAI) |

|---|---|---|

| Accuracy | Variable; prone to delays and overfitting | 76.7% improvement over baseline models with optimized feature selection[2] |

| Real-Time Processing | Manual; slower to react to market changes | Processes 60+ data points per second automatically[1] |

| Cost | Free or low-cost | $49–$199/month subscription required |

| Learning Curve | Moderate; requires knowledge of technical analysis | Easier; user-friendly with automated insights |

| Adaptability | Limited; manual adjustments needed | High; continuously retrains models and detects market regimes |

| Integration | Requires multiple tools and manual setup | All-in-one platform with risk management and portfolio tracking |

Ultimately, the choice between these options depends on your trading style, budget, and level of comfort with technology. Standalone indicators are a great starting point for traders who want to build foundational skills and maintain hands-on control. On the other hand, AI-powered platforms like StockioAI provide a significant edge for those looking to enhance accuracy, streamline decision-making, and stay competitive in fast-moving crypto markets.

Many successful traders find value in combining both approaches - using standalone indicators to develop a solid understanding of market behavior while leveraging AI tools for precision, efficiency, and automation.

Conclusion

When it comes to trading, you have options: stick with standalone indicators for greater transparency and control, or dive into AI-powered platforms for automated, real-time insights. Each approach has its own strengths, depending on your trading style, market conditions, and level of expertise.

Take AI-powered tools like StockioAI, for example. This platform simplifies the process by automating feature selection and signal generation. It processes live data quickly, offering clear entry and exit points along with robust risk management tools. With a reported 75.0% win rate, StockioAI shows how combining technical indicators with advanced analytics can significantly improve trading performance[1].

StockioAI’s plans start at $49/month, catering to everyone from beginners to seasoned traders. Day traders and scalpers will appreciate the platform’s real-time data processing, while swing traders can find success using either AI platforms or standalone indicators. Long-term investors, on the other hand, may benefit more from standalone indicators paired with fundamental analysis.

Research suggests that carefully chosen technical indicators can improve prediction accuracy by up to 76.7% - a process that AI platforms like StockioAI automate through optimized feature selection[2]. While AI tools make this process seamless, manual approaches demand continuous refinement and in-depth market knowledge.

If you’re curious, try StockioAI’s free plan to explore AI-enhanced analysis. For the best results, consider a hybrid approach: combine the transparency of standalone indicators with the precision of AI-driven tools. This blend of manual and automated strategies can give you a sharper edge in navigating today’s unpredictable cryptocurrency markets.

FAQs

How do AI-powered platforms like StockioAI improve the accuracy of cryptocurrency trading signals compared to using only technical indicators?

AI-powered platforms like StockioAI bring a new level of precision to trading signals by using advanced machine learning to sift through market data, uncover patterns, and anticipate trends. Unlike traditional technical indicators that operate in isolation, AI can handle massive datasets in real-time, catching subtle market movements and fine-tuning entry and exit strategies.

What sets StockioAI apart is its ability to merge conventional technical indicators with AI-generated insights. It provides traders with detailed analysis, including support and resistance levels, potential trend reversals, and clear BUY, SELL, or HOLD recommendations. This blend of technology and traditional tools equips traders with the confidence and clarity they need to navigate the fast-changing cryptocurrency market.

How can combining technical indicators with AI-powered platforms improve crypto trading?

Combining technical indicators with AI-powered platforms can elevate crypto trading by refining decision-making and boosting precision. Platforms like StockioAI blend traditional market indicators with cutting-edge AI tools to evaluate market trends, spot patterns, and produce actionable trading signals.

With capabilities like AI-driven pattern recognition and interactive charting, traders can uncover deeper insights into potential market shifts. This synergy simplifies strategy creation, minimizes emotional decision-making, and enhances the dependability of BUY, SELL, and HOLD signals, empowering traders to make more informed and confident choices.

How does real-time AI-driven feature engineering influence trading decisions in the fast-moving cryptocurrency market?

Real-time AI-powered feature engineering is a game-changer for traders tackling the ever-shifting cryptocurrency market. By instantly processing and analyzing data, platforms like StockioAI empower traders to react swiftly to market trends and pinpoint potential opportunities with greater accuracy.

Tools such as AI-driven pattern recognition and real-time technical analysis provide traders with actionable insights that sharpen decision-making. In a market where prices can swing dramatically in mere seconds, this combination of speed and precision is crucial for staying competitive in high-stakes trading environments.