Buy, sell, and hold signals are tools that help traders decide when to enter, exit, or maintain their positions in cryptocurrency markets. These signals are generated using technical indicators like moving averages, RSI, and MACD, or through AI-driven systems such as StockioAI, which analyze real-time data and market patterns.

Key points:

- Buy signals suggest favorable conditions for purchasing an asset.

- Sell signals indicate it might be a good time to exit a position.

- Hold signals recommend staying put when market direction is unclear.

- AI platforms like StockioAI process data faster and adapt to market changes better than manual methods.

Understanding how these signals work and their limitations is crucial. While they can improve decision-making, they are not foolproof. Combining signals with broader market analysis and sound risk management is essential for success.

5 On-Chain Signals Smart Crypto Traders Never Ignore

How Trading Signals Are Created

Trading signals are crafted through a mix of mathematical models, market data analysis, and artificial intelligence. Gaining insight into how these signals are generated can help traders make informed decisions about which ones to rely on.

Technical Indicators for Signal Creation

Buy, sell, and hold signals are essential tools for timing trades, and their creation often hinges on technical indicators. These indicators use mathematical formulas to analyze price trends, trading volume, and market momentum, forming the backbone of many trading strategies.

Take moving averages, for example. When a price moves above the 50-day moving average, it typically signals a buying opportunity. Conversely, a drop below it suggests selling. The Relative Strength Index (RSI), ranging from 0 to 100, helps traders determine if an asset is overbought or oversold.

Another popular tool, MACD (Moving Average Convergence Divergence), tracks the interaction between two moving averages. A bullish trend is signaled when the MACD crosses above its signal line, while a bearish trend is indicated by a cross below. Support and resistance levels are also key - breaking through resistance often triggers buy signals, while falling below support levels prompts sell alerts.

Bollinger Bands offer insights into potential market reversals. When prices touch the upper band, it may suggest overbought conditions, while hitting the lower band points to an oversold market.

While technical indicators provide a solid foundation, artificial intelligence adds a layer of speed and precision to signal generation.

AI-Powered Signal Creation

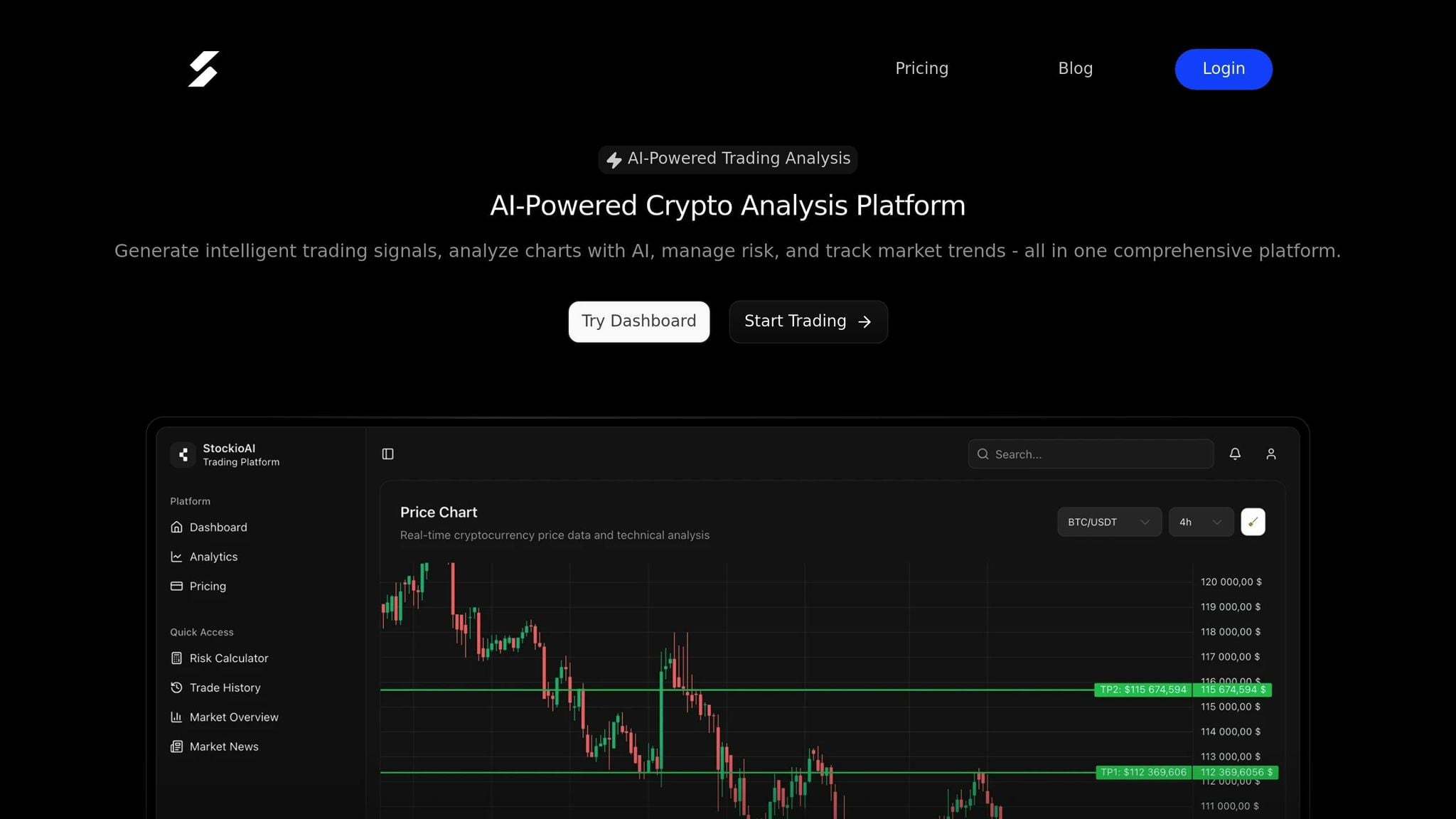

AI platforms like StockioAI bring a new level of sophistication to signal creation. By processing vast amounts of real-time data, these systems detect patterns that even the most experienced traders might overlook.

StockioAI’s algorithms handle multiple data streams at once, including price trends, trading volume, social media sentiment, news events, and historical data. This allows the system to uncover complex market patterns across various timeframes.

Unlike static technical indicators, AI-powered systems adapt to changing market conditions. For example, they adjust their analysis based on current volatility, trading volume, or shifts in sentiment. This flexibility makes them especially effective during unpredictable market events or periods of high stress.

Machine learning algorithms play a critical role in this process. By analyzing thousands of historical trading scenarios, these algorithms identify factor combinations that have led to successful trades in the past. StockioAI uses this knowledge to generate signals tailored to the unique dynamics of cryptocurrency markets.

Real-time data processing gives AI systems a decisive edge. When sudden news impacts cryptocurrency prices or when large trades cause abrupt price shifts, AI algorithms can incorporate this information almost instantly to refine their signals.

Manual vs Automated Signals

Traders often face a choice between manual and automated signal generation, each offering distinct benefits and challenges.

Manual signals are created by skilled traders who combine technical analysis, market intuition, and fundamental research. These experts spend extensive time studying charts, analyzing news, and interpreting market conditions. This approach excels in identifying unique situations and adapting to unusual events.

However, manual signal creation has its downsides. Human analysts can only monitor a limited number of assets at a time, and they’re constrained by the need for rest. Emotions, such as fear during a market crash or excitement during a rally, can also cloud judgment and lead to less-than-ideal decisions.

Automated signals, like those from StockioAI, eliminate these limitations. Operating 24/7, they can monitor hundreds of cryptocurrencies across multiple exchanges simultaneously, identifying opportunities that manual analysts might miss. Automated systems process market changes in seconds, offering a level of speed and consistency that humans simply can’t match.

One of the biggest advantages of automated signals is their reliability. Unlike humans, who might interpret conditions differently depending on the day, automated systems apply the same criteria every time. This consistency helps traders build systematic, data-driven strategies.

StockioAI strikes a balance by combining the strengths of both approaches. Its AI algorithms are trained with input from seasoned traders, ensuring that the signals benefit from human expertise while maintaining the speed and precision of automated analysis. This hybrid approach enhances the system’s effectiveness, blending technology with human insight to deliver well-rounded performance.

Next, we’ll examine how these signals influence trading decisions and risk management strategies.

How to Use Trading Signals

Effectively applying trading signals can mean the difference between smart trades and costly errors. Rather than treating these signals as strict instructions, think of them as essential pieces of information that complement your overall trading strategy.

Using Signals for Entry and Exit Points

Trading signals are invaluable tools for determining when to enter or exit a position. Typically, a signal includes details like the asset name, a recommendation (buy or sell), stop loss, and take profit levels [2].

A buy signal often suggests that an asset is oversold and may be primed for a short-term rebound [1]. Conversely, a sell signal might arise from technical indicators. For example, if an asset’s price is hitting higher highs while the Relative Strength Index (RSI) shows lower highs, this divergence could indicate it’s time to sell [1].

Experienced traders don’t act on signals blindly - they wait for confirmation. Let’s say a signal recommends buying Bitcoin at $45,000 with a stop loss at $43,500 and a take profit at $48,000. Before jumping in, it’s wise to check if the current market conditions align with the signal’s assumptions.

Exit strategies are just as critical. For instance, if a crypto alert suggests selling Bitcoin after it drops below a key support level, it’s a sign that bearish price action might follow [3]. The signal not only highlights the rationale but also offers guidance for managing your position effectively.

To make the most of these entry and exit points, combine them with a broader market analysis for a more informed approach.

Combining Signals with Market Analysis

Relying solely on technical signals without considering the bigger picture can lead to poor decisions. Successful traders pair these signals with a thorough analysis of market trends, news, and economic factors.

Fundamental analysis adds valuable context to a signal. For example, when President Trump signed an executive order to establish a strategic Bitcoin reserve, the news was seen as bullish and could have supported a Bitcoin buy signal [3]. By understanding such events, you can assess whether a signal aligns with market dynamics.

Market sentiment is another key factor. During periods of extreme fear or greed, technical signals might behave unpredictably. Tools like StockioAI take this into account by incorporating data from social media trends, news updates, and market volatility to provide more context-aware signals.

Marc Guberti emphasizes the importance of blending signals with broader market knowledge:

"You should never blindly follow any investing advice. So it's advisable to familiarize yourself with the macro environment and some of the technical indicators that can factor into crypto signals before basing your investment decisions on them" [3].

Since cryptocurrency markets run 24/7, staying informed about global developments is crucial. Major news can directly impact the reliability of signals [2], and confirming signals with trading volume can further enhance their credibility [2].

Practical Examples with StockioAI

StockioAI simplifies the process of interpreting and acting on trading signals by offering tools that integrate signals with in-depth analysis and portfolio management features.

For instance, if StockioAI issues a buy signal for Ethereum, you can access technical analysis, interactive charts, and a risk calculator to better understand the reasoning behind the suggestion. This consolidated view helps clarify the signal’s potential.

Portfolio tools within StockioAI also allow traders to see how a new signal fits into their existing positions. If the platform recommends buying a cryptocurrency that already makes up a large portion of your portfolio, the position tracking feature can help you decide whether adding more aligns with your diversification goals.

Real-time monitoring ensures you can track how a signal performs as market conditions evolve. Features like a live news feed provide instant updates, helping you determine whether recent developments support or contradict the suggested trade.

Risk management tools are another key feature. These tools let you simulate potential outcomes based on your position size, ensuring that each trade aligns with your overall risk tolerance.

Additionally, StockioAI’s AI-powered pattern recognition can spot complex market trends that might be missed through traditional analysis. When multiple patterns align with a signal, it often points to a higher-probability trade.

To streamline decision-making, custom alert settings allow you to filter signals based on criteria like risk-reward ratios or specific cryptocurrencies. This reduces unnecessary noise and helps you focus on the most relevant opportunities.

Signal Accuracy and Limitations

While earlier sections explained how trading signals are created and used, it's equally important to understand their accuracy and the risks involved. No signal system is flawless, and knowing the factors that influence their reliability can help traders set realistic goals and develop solid risk management strategies.

What Affects Signal Accuracy

Several factors can impact how reliable a trading signal is. For starters, market volatility and poor-quality data can lead to false signals or delayed responses. This issue is especially pronounced in cryptocurrency markets, which operate 24/7 and are notoriously volatile.

The quality of data plays a huge role in signal generation. Signals based on outdated or incomplete market data are more likely to lead to unreliable recommendations. In contrast, real-time data feeds with minimal delay provide better inputs, whether you're relying on manual analysis or AI-driven systems.

The timeframe you choose also matters. Short-term signals, often based on very brief intervals, tend to generate a lot of noise. On the other hand, signals based on longer timeframes may miss shorter, fleeting trading opportunities. It’s a trade-off that traders need to balance based on their strategy.

Market conditions are another major factor. Trending markets often produce clearer signals, while sideways or choppy markets can cause technical indicators to flip-flop between buy and sell signals without offering a clear direction.

For AI systems, the importance of robust training data can't be overstated. Algorithms trained on historical data may struggle when market conditions shift dramatically or when unexpected events occur.

Combining multiple technical indicators can improve signal reliability, but overloading your analysis with too many indicators can lead to "analysis paralysis", where decision-making becomes delayed and less effective.

These challenges highlight the risks and limitations of relying solely on trading signals.

Signal Limitations and Risks

One of the main limitations of trading signals is their reliance on lagging indicators, which are based on historical price data. This means signals often confirm trends rather than predict them, potentially causing traders to act after the best opportunities have already passed.

Erroneous signals are another risk, particularly during periods of high market volatility. These false signals can lead traders to enter positions just as the market is about to reverse, resulting in potential losses.

Blindly following signals without considering the broader market context is a recipe for trouble. Events like economic shifts, regulatory updates, or breaking news can quickly render technical signals irrelevant.

For AI-generated signals, overfitting is a common challenge. Algorithms that are overly tailored to past data may perform well in testing but fail in live markets if the same patterns don’t reappear.

Market manipulation is another concern. Large players can intentionally move prices to trigger technical indicators, only to reverse their actions once smaller traders take the bait.

Additionally, emotions like fear or greed often lead traders to exit trades too early or hold onto losing positions for too long, undermining even the most reliable signals.

Finally, delays in signal transmission or execution can make a big difference in fast-moving markets. A slight lag between generating a signal and placing a trade can significantly impact outcomes.

Manual vs AI Signal Comparison

When it comes to generating signals, both manual and AI-driven methods have their pros and cons. Here's how they stack up:

| Aspect | Manual Signals | AI-Generated Signals |

|---|---|---|

| Speed | Slower due to human limitations | Real-time analysis across multiple data streams |

| Emotional Bias | Prone to human emotions and biases | Free from emotional influence |

| Market Context | Can factor in news and events intuitively | Limited unless specifically programmed |

| Adaptability | Quickly adjusts to market changes | Requires retraining for new patterns |

| Consistency | Varies with trader's focus and decisions | Applies rules consistently |

| Complex Pattern Recognition | Limited by human capacity | Excels at recognizing intricate patterns |

| Cost | Time-intensive and requires constant attention | Operates continuously, 24/7 monitoring |

| Learning Curve | Takes years to master | Offers instant access to advanced analysis |

| Customization | Easy to adjust intuitively | May need technical expertise for modifications |

Choosing between manual and AI-generated signals largely depends on your trading style, available time, and technical know-how. Many traders find success by blending both approaches - using AI signals as a starting point and adding manual analysis for a more comprehensive view.

StockioAI Features for Signal Trading

Let’s take a closer look at how StockioAI’s features tackle signal limitations and refine cryptocurrency trading.

Core StockioAI Features

StockioAI combines AI-driven signals with practical tools to help traders navigate the unpredictable cryptocurrency market. By analyzing real-time market data, the platform translates intricate patterns into actionable BUY, SELL, and HOLD signals. These signals are generated continuously, giving traders the ability to seize opportunities without needing to monitor the markets around the clock.

The platform’s TradingView integration enhances chart analysis, allowing users to dive deeper into market trends. Traders can overlay technical indicators, draw trend lines, and examine price movements across various timeframes - from minute-by-minute fluctuations to long-term trends.

A built-in risk calculator helps traders manage their position sizes based on their risk tolerance and account balance. This tool can reduce the likelihood of emotional trading decisions, which often lead to costly mistakes.

AI-powered pattern recognition is another standout feature. It identifies complex trends, pinpoints support and resistance levels, and detects reversal patterns across multiple cryptocurrencies simultaneously.

With real-time market news feeds, traders stay informed about developments that could impact their positions. Given how sensitive cryptocurrency markets are to news and regulatory updates, this feature ensures traders can act quickly - whether it’s capitalizing on a new trend or adjusting their strategies.

Portfolio tracking and position management tools make it easier to monitor performance and maintain proper risk management. The platform provides real-time profit and loss tracking, helping traders stick to their strategies and make informed decisions.

For advanced users, API access enables integration with external trading platforms and the creation of custom strategies. This feature is especially useful for those looking to automate their trades while retaining control over execution.

Together, these features address common challenges with trading signals, offering tools that enhance decision-making and strategy development. StockioAI’s offerings are available through flexible pricing plans that cater to traders at all levels.

Pricing Plans and Features

StockioAI provides four pricing tiers, each tailored to different types of traders - from beginners just starting out to institutions requiring advanced solutions.

| Plan | Price | Monthly Signals | Key Features | Best For |

|---|---|---|---|---|

| Free | $0/month | 5 AI signals | Basic market insights, mobile app access, educational resources, community support | Beginners exploring AI trading |

| Starter | $29/month | 30 AI signals | Basic technical analysis, email support, standard indicators | Individual traders starting with AI |

| Professional | $49/month | 300 AI signals | Advanced pattern recognition, priority support, portfolio tracking, API access | Active traders needing advanced tools |

| Enterprise | $199/month | Unlimited signals | Multi-user access, dedicated account manager, custom AI training, white-label solutions | Institutions and trading teams |

The Free plan is a great way for beginners to dip their toes into AI-powered trading. With five signals per month, new users can test the platform’s capabilities and see how AI recommendations align with their strategies - without spending a dime.

The Starter plan at $29/month is a step up, offering 30 monthly signals and basic technical analysis tools. This tier is perfect for individual traders who are ready to incorporate AI signals into their routine but don’t require advanced features.

For $49/month, the Professional plan caters to more experienced traders. It provides 300 monthly signals, advanced pattern recognition, and API access for automating strategies. Priority support ensures that any technical hiccups are resolved quickly.

At the top end, the Enterprise plan costs $199/month and is designed for institutional needs. It includes unlimited signals, multi-user access, and custom AI model training. With features like a dedicated account manager and white-label solutions, this plan is ideal for trading firms, hedge funds, or financial advisors looking to integrate AI-powered tools into their services.

All plans come with mobile app access, ensuring traders can monitor signals and market conditions anytime, anywhere. Additionally, educational resources are available across all tiers, helping users unlock the full potential of StockioAI’s features.

Conclusion

Trading signals - buy, sell, and hold - are the cornerstone of cryptocurrency trading, translating complex market data into actionable steps. They simplify decision-making in a market that's as dynamic as it is unpredictable.

The effectiveness of trading signals hinges on understanding their strengths and limitations. While manual analysis demands significant time and expertise, AI-driven platforms bring a different edge. They process massive datasets in real-time, spotting patterns that might escape even the most experienced human traders. This blend of human insight and AI capability reflects the changing landscape of crypto trading.

Take StockioAI, for instance. It combines real-time signal generation with advanced risk management tools, offering traders a comprehensive toolkit. By integrating pattern recognition, continuous market monitoring, and risk management, it empowers users to make decisions free from emotional bias.

What’s more, StockioAI's pricing caters to a wide range of traders. Whether you're exploring with the free plan's five monthly signals or diving in with unlimited enterprise-level access, the focus remains the same: simplifying the complexities of the crypto market.

As discussed earlier, these tools lay the groundwork for a disciplined and informed trading approach. With the cryptocurrency market operating around the clock, AI-powered platforms are becoming indispensable. Still, the ultimate responsibility for decisions rests with the trader.

FAQs

How can traders identify reliable buy, sell, or hold signals for better investment decisions?

To spot trustworthy trading signals, pay attention to their consistency across different indicators like price trends, trading volume, and market sentiment. Signals that show a proven history of reliability and operate with transparency tend to be more dependable. Testing these signals in a demo account is a smart way to gauge their effectiveness without putting your actual money on the line.

It's also crucial to look for signals that include solid risk management practices, such as setting stop-loss and take-profit levels. These measures help limit potential losses if the market takes an unexpected turn. Combining careful analysis with a cautious approach will help you make well-informed trading decisions.

What are the benefits of using AI-powered platforms like StockioAI instead of manual trading?

AI-powered platforms, such as StockioAI, bring notable benefits to trading that manual methods simply can't match. These systems can process enormous amounts of market data in real-time, execute trades with lightning speed, and eliminate the emotional biases that often result in costly mistakes. By automating these crucial tasks, traders can maintain consistency and handle risks more efficiently.

On top of that, AI tools excel at monitoring multiple markets at once and responding swiftly to shifting conditions. This ability to stay ahead in the fast-paced cryptocurrency landscape gives traders a clear advantage. With their blend of speed, precision, and adaptability, AI-driven platforms have become essential for anyone looking to make well-informed trading decisions.

How do market conditions and volatility affect the accuracy of buy, sell, and hold signals?

Market conditions and volatility greatly influence how trustworthy buy, sell, and hold signals are in cryptocurrency trading. When volatility is high, prices can shift dramatically in a short time, increasing the likelihood of false signals or delayed responses. This makes it challenging to rely on these signals for precise trading decisions.

In calmer markets with lower volatility, signals are generally more stable and easier to trust since price movements are more predictable. To navigate this, many traders turn to tools like volatility indicators - such as Bollinger Bands - to gauge market conditions. These tools help traders refine their strategies, aiming to enhance signal accuracy and manage risks in this constantly shifting market.