AI tools are transforming cryptocurrency trading by making market depth analysis faster, more precise, and actionable. They process real-time data from order books, technical indicators, and market sentiment to help traders make informed decisions in volatile markets.

Here’s what you need to know:

- AI speeds up analysis: Processes data in 0.01 seconds, detecting shifts in liquidity, order clusters, and volume spikes.

- Pattern recognition: Identifies hidden tactics like iceberg orders and signals potential market manipulation or trend reversals.

- Sentiment integration: Analyzes social media and news to connect sentiment shifts with order book activity.

- Risk management: Recommends position sizes, stop-loss levels, and profit targets dynamically.

Platforms like StockioAI provide tools for U.S. traders to track market depth, analyze trends, and execute trades with precision. These systems offer features like AI-generated trading signals, real-time updates, and automated risk calculators, helping traders reduce slippage and improve profitability. AI isn’t just a tool - it’s reshaping how traders navigate crypto markets.

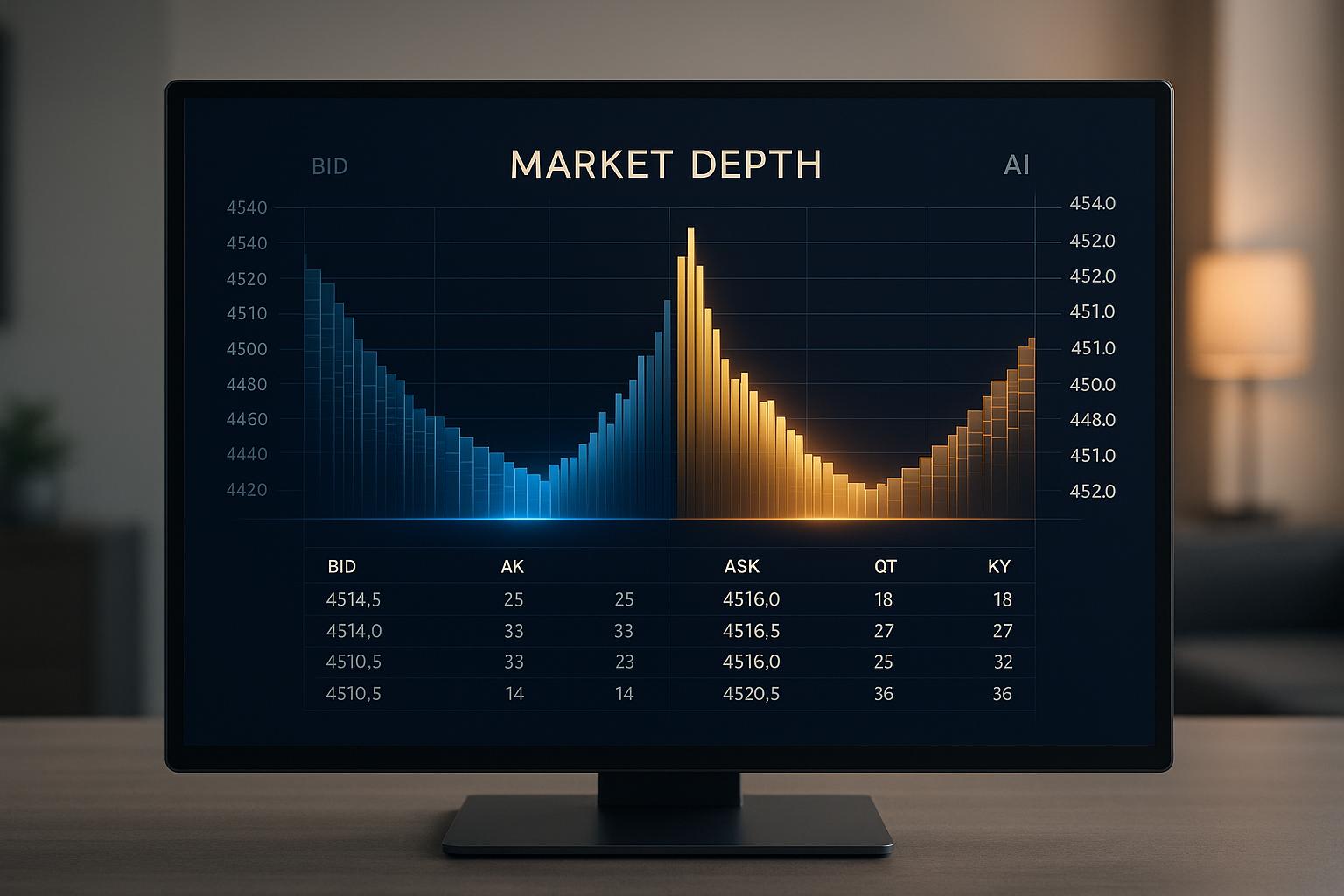

Visualize and Analyze Crypto Trading in Real-Time

How AI Improves Market Depth Visualization

AI is transforming how traders analyze market depth by handling massive amounts of data at speeds that traditional methods simply can't match. Unlike older systems that often lag or rely on manual interpretation, AI-powered tools offer real-time insights. These insights can make the difference between profit and loss, especially in the unpredictable world of cryptocurrency trading. By refining order tracking, identifying patterns, and incorporating sentiment analysis, AI enables traders to make smarter, faster decisions.

Real-Time Order Book Analysis

AI processes order book data with incredible speed and precision, uncovering details that manual methods might overlook. For example, StockioAI uses real-time data to highlight subtle shifts in order book activity, giving traders a clearer picture of liquidity flows and market imbalances. This capability eliminates the delays that often plague traditional systems.

The speed factor is a game-changer. While human reaction times range from 0.1 to 0.3 seconds, AI systems can respond in just 0.01 seconds. This allows traders to detect critical changes - like bid-ask shifts, order clusters, and volume spikes - long before manual analysis catches up.

AI's real-time processing doesn't just show the current market state; it reveals how the market is evolving. Traders can track large orders moving through the book, spot institutional buying or selling, and observe market makers adjusting their quotes. This dynamic view provides a depth of understanding that static displays can't offer.

What makes AI even more powerful is its ability to integrate multiple data streams. It combines order book data with technical indicators, market sentiment, and trading volume, offering a context-rich analysis that manual methods often miss. This seamless blend of speed and insight naturally leads into AI's advanced pattern recognition capabilities.

Pattern Recognition and Anomaly Detection

AI's ability to spot patterns and anomalies is unmatched. Using deep learning models and reinforcement learning agents, AI analyzes historical price data, order flow, and technical indicators to uncover connections that aren't obvious to human traders.

This technology can identify iceberg orders or detect unusual activity that might signal market manipulation or upcoming volatility. For instance, AI can pick up on sudden shifts in order book shapes or volume spikes at specific price levels - signals that often precede major price movements.

AI goes beyond basic technical analysis by recognizing non-linear relationships between market variables. For example, it can link volume surges to price changes across different timeframes, helping traders anticipate market behavior rather than just reacting to it.

"Our AI continuously evaluates current positions, analyzes sideways trends, correlation patterns, and market microstructure in real-time."

- StockioAI

Anomaly detection acts as an early warning system for potential market disruptions. Whether it's unusual institutional activity or rapid shifts in the order book, AI can flag these events before they escalate. This is especially valuable in cryptocurrency markets, where sudden news or large trades by "whales" can cause dramatic price swings.

StockioAI showcases the effectiveness of these techniques, boasting a 75.0% win rate and a 2.95 Profit Factor[1]. Its platform identifies ideal entry and exit points by analyzing resistance levels, momentum indicators, and institutional flows. Traders receive actionable insights like stop-loss levels and profit targets, complete with confidence scores. By combining these insights with sentiment analysis, traders gain a deeper understanding of market dynamics.

Market Sentiment Analysis Integration

AI takes market depth analysis to another level by incorporating Natural Language Processing (NLP) to gauge sentiment from news, social media, and market commentary. This sentiment data is then merged with quantitative order book analytics, creating a more complete picture of market conditions.

The integration works by linking sentiment shifts to order book patterns. For instance, when positive news about a cryptocurrency breaks, AI can instantly assess its impact on order placement, liquidity, and trading volume. This holistic approach helps traders understand not just what’s happening in the market, but why.

Social media sentiment analysis plays a crucial role in cryptocurrency trading, where platforms like Twitter and Reddit can heavily influence market behavior. AI continuously monitors these platforms, analyzing thousands of posts and comments to gauge the market's mood and predict how sentiment changes might affect trading activity.

By combining sentiment analysis with order book data, traders can anticipate moves that might not be immediately visible. For instance, if sentiment analysis detects growing negativity around a cryptocurrency while the order book still shows strong support, this could indicate an upcoming price drop that traditional analysis might miss.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."

- Jordan Martinez, Quantitative Trader

This integrated approach to market depth visualization marks a dramatic shift from traditional methods. By uniting real-time order book analysis, advanced pattern recognition, and sentiment integration, AI equips traders with insights that were once limited to institutional players. The result? Faster decisions, better risk management, and more profitable trades in the ever-changing cryptocurrency market.

Key Features of AI-Powered Market Depth Tools

AI-powered market depth tools are transforming the way traders interact with cryptocurrency markets. By processing millions of data points in milliseconds, these platforms bring a level of precision and speed that was once exclusive to institutional trading floors. With real-time updates, intelligent signal generation, and automated risk management, these tools create a trading environment that keeps pace with rapidly changing market conditions. Traders can make faster decisions, adapt to market shifts, and manage risks more effectively.

Dynamic Order Book Updates

AI-driven platforms excel at updating order books in real time, processing massive amounts of data almost instantly. Trades can be executed in as little as 0.01 seconds - significantly faster than the human reaction time of 0.1 to 0.3 seconds [3][7].

This speed gives traders access to the most up-to-date market depth, allowing them to react quickly to liquidity changes and execute trades with reduced slippage and better price accuracy. Continuous updates also reveal where large orders are clustering and how market makers adjust their quotes throughout the day.

Take StockioAI, for example. This platform analyzes over 60 real-time data points every second, including order book depth, technical indicators, volume trends, market sentiment, whale activity, and even social media chatter. This extensive data processing ensures traders always have an accurate view of market conditions, making it easier to identify opportunities and potential risks.

One standout feature of these dynamic updates is their ability to detect iceberg orders - large trades broken into smaller chunks to conceal their size - and spot unusual activity that could signal upcoming volatility. Interactive charting tools further enhance this capability by overlaying technical indicators and AI-predicted support and resistance levels, giving traders a clear and actionable view of the market.

AI-Generated Trading Signals

AI-powered platforms take trading signals to the next level by combining real-time market data, historical price patterns, and sentiment analysis to generate actionable Buy, Sell, and Hold recommendations. StockioAI, for instance, delivers trading signals with detailed reasoning, including entry points, stop-loss levels, profit targets, and confidence scores. These signals incorporate insights from resistance levels, momentum indicators, and institutional flows to provide a complete picture.

What makes these signals particularly effective is their adaptability. Unlike static, rule-based systems, AI models learn continuously from market behavior, adjusting their recommendations as conditions evolve. This flexibility allows traders to seize opportunities across a variety of market scenarios - whether trending, ranging, volatile, or quiet.

StockioAI's 7-Tier Priority system is a great example of this. It processes signals through multiple layers, such as System Market Structure, Volume & Liquidity, RSI & MACD, and Price Momentum. This layered approach ensures that broader market trends take precedence over shorter-term fluctuations, resulting in more reliable trading advice.

To handle conflicting signals, StockioAI employs a Conflict Resolution Matrix that evaluates 15 different scenarios for position sizing based on current market conditions. This ensures consistent guidance, even when multiple indicators suggest different strategies. These intelligent signals, when paired with automated risk management tools, help optimize trading outcomes.

Risk Management and Position Sizing

Effective risk management is critical in volatile crypto markets, and AI-powered tools excel in this area. These platforms analyze market volatility, order book depth, and trade-specific parameters to recommend optimal position sizes and stop-loss levels. By dynamically adjusting trade sizes based on real-time risk assessments, they help traders minimize losses and avoid overexposure [3][7].

StockioAI’s Risk Calculator is a prime example. It calculates position sizes, stop-loss levels, and appropriate leverage by analyzing resistance levels, volatility patterns, and institutional flows. This ensures that every SELL position is backed by a thorough risk assessment.

But the capabilities don’t stop there. AI systems continuously monitor open positions, evaluate sideways trends, and analyze correlation patterns and market microstructures. This ongoing assessment helps traders maintain disciplined risk management, even in rapidly changing markets.

For instance, if StockioAI detects a sudden surge in buy-side order book depth combined with positive sentiment on social media, its Risk Calculator immediately suggests an optimal position size based on current volatility. This integrated approach ensures that risk management isn’t an afterthought but a core part of the trading process.

During periods of high volatility, the automation becomes even more valuable. AI systems can instantly recalculate position sizes, adjust stop-loss levels, and recommend portfolio rebalancing as conditions change. This allows traders to maintain appropriate risk exposure without missing out on critical trading opportunities.

Practical Benefits for Cryptocurrency Traders

AI-powered market depth visualization isn't just about advanced technology - it brings tangible advantages to cryptocurrency traders. These tools go beyond theory, offering results that directly influence trading decisions and profitability.

Faster and More Accurate Decision-Making

AI tools cut out the delays of manual processing, making decision-making both quicker and more precise. While human traders can only handle a limited amount of information at a time, AI systems can process countless real-time data points every second. This ability means traders receive actionable insights exactly when they need them - whether it's during sudden market swings or when new trends start to emerge.

Take StockioAI, for example. It provides traders with detailed BUY, SELL, and HOLD recommendations, complete with reasoning, entry points, stop-loss levels, profit targets, and even a confidence score. This level of analysis helps traders make informed choices, even in highly volatile markets.

Another key benefit is the elimination of emotional bias. Unlike humans, AI systems don’t experience fear or greed, which often cloud judgment. This objectivity ensures consistent analysis, helping traders avoid common mistakes like poor timing or impulsive decisions. The result? Faster, more reliable choices that can improve both strategy and risk management.

Better Risk Assessment

AI platforms take risk management to the next level by shifting it from reactive to proactive. These systems constantly monitor market conditions, spotting potential risks before they become actual problems. This foresight gives traders the chance to adjust their positions early, staying ahead of the curve.

AI doesn’t just focus on individual trades - it provides a complete view of portfolio exposure. Traders can see how different positions interact and understand how broader market events might impact overall risk. This continuous monitoring ensures that risk management becomes an integral part of the trading process, rather than an afterthought.

Optimized Trade Execution

When it comes to timing, AI algorithms are unmatched. By analyzing real-time order book data and predicting short-term price movements, these systems pinpoint the best entry and exit points. This precision helps traders avoid thin liquidity zones and execute trades during the most favorable conditions, reducing slippage.

AI also minimizes delays between generating a trading signal and executing the trade, preserving any timing advantage. StockioAI’s impressive 75% win rate highlights how effective AI-driven execution can be when paired with in-depth market analysis[1]. These improvements streamline the entire trading process, making AI an essential tool for traders aiming to maximize efficiency and results.

How to Use AI-Powered Market Depth Tools

AI-powered tools are taking market depth analysis to the next level, making it more accessible and actionable for traders. These tools are designed with user-friendly interfaces and flexible integration options, allowing traders to incorporate real-time AI analytics into their workflows seamlessly. With simple steps like account creation, API integration, and personalized settings, traders can tap into a wealth of data to inform their decisions.

Platform Integration and Features

Getting started with an AI-powered tool typically involves creating an account, connecting via an API, and setting up preferences. Many platforms simplify this process with clear documentation to guide users.

Take StockioAI, for example. This platform stands out with its robust feature set, offering AI-generated Buy, Sell, and Hold signals. These signals come with detailed insights, including entry points, stop-loss levels, profit targets, and confidence scores. Behind these insights is real-time analysis of over 60 data points, such as order book depth, market sentiment, and whale movements[1]. The platform also integrates with advanced TradingView charts, enabling users to visualize AI-driven insights directly on their preferred charting tools.

StockioAI supports various integration methods to suit different trading approaches. For most traders, web-based dashboards provide an interactive, visual interface with drag-and-drop widgets and real-time charting. For more advanced users or institutions, API integrations allow AI analytics to be embedded into custom trading systems, enabling automation and tailored workflows[2][6][4].

The platform’s pricing caters to a range of needs. A free plan includes 3 AI trading signals and basic market insights, while professional plans at $99/month offer 300 AI signals, advanced pattern recognition, priority support, portfolio tracking, and full API access[1]. Additional features like a risk calculator and real-time alerts help traders fine-tune their strategies and stay updated on market shifts.

Use Cases for AI in Market Depth Visualization

AI tools are not just about integration - they offer practical applications that can significantly enhance trading strategies.

One key feature is detecting liquidity events. For instance, if an AI-enhanced heatmap shows a spike in large buy orders at a specific price level, the tool might flag this as a potential liquidity event, indicating a price support zone. Traders can use this information to adjust their strategies, such as entering positions near the support level or setting tighter stop-losses to manage risk[5][2].

Another valuable application is predicting market reversals. AI analyzes historical patterns, current order book activity, and market sentiment to identify potential turning points before they become obvious. StockioAI’s pattern recognition capabilities help traders pinpoint trend reversals and optimal entry or exit points, improving timing and decision-making[1].

AI also excels at optimizing trading strategies by continuously processing real-time order book data. It identifies the best entry and exit points, anticipates large order flows, and even suggests the ideal times for trade execution. This reduces slippage by avoiding low-liquidity or high-volatility periods[2][6]. Some platforms take it a step further by automating order splitting to minimize market impact.

Market sentiment integration is another game-changer. AI combines order book data with insights from social media trends and news sources, giving traders a broader perspective. This approach helps anticipate market shifts that might not be immediately visible through price action alone[6][4].

For advanced users, API integrations open the door to creating custom automated strategies. AI trading bots can process and act on market data in as little as 0.01 seconds - far faster than the average human reaction time of 0.1–0.3 seconds. This speed advantage can be a significant edge in fast-moving markets[3].

To get the most out of these tools, start with demo accounts, customize alerts to suit your trading style, and review AI-generated reports. Combining AI-driven insights with your own market experience is often far more effective than relying on either one alone[2][6].

Conclusion: The Future of Market Depth Analysis with AI

AI is reshaping how cryptocurrency traders analyze market depth, marking a major leap forward from traditional manual methods. These advanced systems process enormous volumes of real-time data, offering insights and opportunities at speeds that human analysis simply can't match. We're talking milliseconds - an advantage that's changing the game for traders worldwide[1].

To put things into perspective, in 2023, global algorithmic crypto trading crossed an astounding $94 trillion. This staggering figure was driven by AI systems capable of processing millions of data points almost instantaneously. These systems not only pinpoint arbitrage opportunities but also optimize liquidity like never before[3].

Platforms like StockioAI are leading this transformation. By integrating real-time order book analysis, advanced pattern recognition, and sentiment analysis, they deliver comprehensive trading tools. And the results speak for themselves: a 75.0% win rate and a profit factor of 2.95[1]. These aren't just numbers - they're proof of how effective AI-powered trading has become.

Consider the speed difference: while human traders take 0.1–0.3 seconds to react, AI systems execute trades in as little as 0.01 seconds[3]. Pair that speed with cutting-edge predictive analytics, and it's clear why AI is creating opportunities that traditional methods just can't replicate.

Looking ahead, the potential for AI in market depth analysis is massive. Innovations in machine learning, deep learning, and reinforcement learning are set to refine predictive analytics even further. Expect deeper integration of on-chain and off-chain data, making these tools even more accessible to retail traders. With the market for AI-driven financial tools projected to grow into the billions in the coming years, the trajectory is unmistakable[2].

For traders navigating the ever-evolving cryptocurrency landscape, embracing AI-powered tools isn't just an option - it's a necessity. These technologies are the key to staying competitive and thriving in this rapidly advancing market.

FAQs

How does AI enhance the speed and precision of market depth analysis?

AI has transformed market depth analysis by offering real-time insights that traditional methods often fall short of delivering. With advanced algorithms, it can sift through massive volumes of market data in just seconds, spotting trends and patterns that would take humans far longer to uncover.

This combination of speed and precision enables traders to make smarter, faster decisions, minimizing the risks tied to outdated or incomplete information. Plus, AI tools adjust to shifting market dynamics, ensuring the analysis stays current and practical when it matters most.

How does sentiment analysis in AI-driven market depth visualization impact trading decisions?

Sentiment analysis plays a key role in AI-powered market depth visualization, offering traders a clearer picture of the emotions and attitudes influencing market behavior. By examining sources like news articles, social media chatter, and trading patterns, these AI tools can determine whether the market leans bullish, bearish, or remains neutral.

This kind of analysis equips traders with valuable insights to align their strategies with prevailing market trends. For instance, spotting a sentiment shift early on can help traders tweak their positions to seize potential opportunities or reduce exposure to risks.

How do AI trading signals and risk management tools improve decision-making in volatile cryptocurrency markets?

AI-driven trading signals and risk management tools play a crucial role in helping traders handle the ever-changing cryptocurrency markets. These tools process enormous amounts of market data to deliver real-time Buy, Sell, and Hold signals, allowing traders to act swiftly and with greater confidence.

On top of that, tools like risk calculators assist in fine-tuning trade sizes, setting precise stop-loss levels, and managing leverage effectively. This helps minimize the risks tied to market fluctuations. By using these advanced tools, traders can refine their strategies and make decisions rooted in solid data.