AI is transforming how traders use the Relative Strength Index (RSI) in cryptocurrency markets. RSI measures market momentum on a scale from 0 to 100, with values above 70 signaling potential overbought conditions and below 30 indicating oversold scenarios. While traditional RSI analysis relies on fixed thresholds and manual interpretation, AI goes further by analyzing real-time data, combining RSI with other indicators, and offering automated insights.

Key takeaways:

-

AI refines RSI signals by combining them with factors like trading volume, market sentiment, and whale activity.

-

Dynamic RSI thresholds adjust based on market conditions, reducing false signals.

-

AI trading bots automate RSI strategies, providing faster execution and real-time risk management.

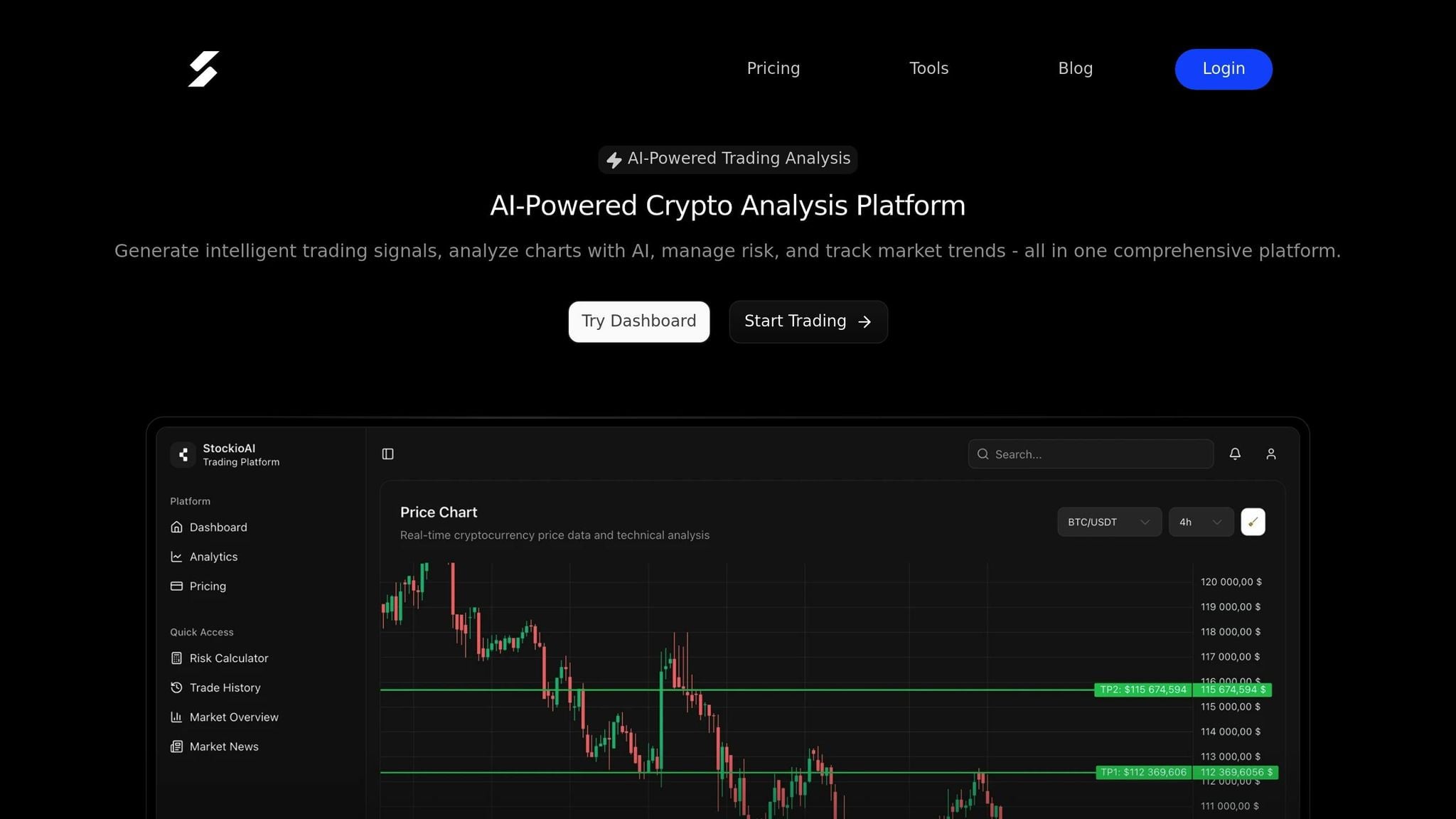

For example, platforms like StockioAI analyze over 60 data points per second, achieving a 75% win rate by delivering precise Buy, Sell, and Hold signals. This approach helps traders make objective, data-driven decisions while avoiding emotional biases.

AI-powered RSI analysis is reshaping cryptocurrency trading by offering faster, more detailed insights that help navigate volatile markets effectively.

New Version of RSI Uses Artificial Intelligence To Predict Entry Points

Key Benefits of AI in RSI Analysis

AI has revolutionized RSI analysis, bringing speed, precision, and objectivity to the table. Here’s a closer look at how it’s reshaping this critical trading tool.

Real-Time Data Processing and Signal Generation

The cryptocurrency market never sleeps, and its rapid pace can make traditional RSI analysis seem sluggish. AI-driven systems, however, excel at processing market data in real time. Instead of waiting for manual updates, these systems continuously analyze market movements and generate trading signals with lightning speed. For instance, StockioAI integrates multiple market indicators to deliver timely signals, boasting an impressive 75% win rate in trading performance [1]. When RSI crosses key thresholds, the system doesn’t stop there - it incorporates additional market data to refine Buy, Sell, or Hold signals, offering detailed trade criteria. This level of precision enables traders to detect patterns and act faster than ever before.

Automated Pattern Recognition

AI takes RSI analysis to the next level by identifying subtle patterns and signals that often go unnoticed by human traders. One standout feature is its ability to detect RSI divergences - when price trends and RSI movements don’t align, potentially hinting at a trend reversal. StockioAI's machine learning algorithms are constantly scanning for complex chart patterns and reversals, helping traders zero in on the best entry and exit points. Once opportunities are identified, the system evaluates multiple data streams to confirm Buy signals, assesses resistance and momentum for Sell signals, and monitors ongoing positions for Hold recommendations - all in real time [1]. This systematic, data-driven process ensures nothing slips through the cracks.

Reducing Emotional Bias in Trading

Beyond its technical prowess, AI offers a critical advantage: it removes emotion from the equation. Human traders often fall prey to fear, greed, or hesitation. For example, they might hold onto a position too long during overbought conditions or panic-sell in oversold markets. AI systems, on the other hand, operate purely on data and predefined algorithms. This consistency ensures that trading decisions remain disciplined and objective, even during volatile market conditions. By sticking to the numbers, AI helps traders avoid costly emotional mistakes and stay focused on their strategies.

How AI Tools Work with RSI Strategies

AI brings a fresh perspective to RSI (Relative Strength Index) strategies, making them more effective in navigating the unpredictable cryptocurrency market. By combining machine learning and real-time data analysis, AI tools transform RSI into a more flexible and intelligent trading approach.

Dynamic RSI Threshold Adjustments

Traditionally, RSI uses fixed thresholds - 30 for oversold and 70 for overbought conditions. AI takes this a step further by adjusting these thresholds dynamically in response to market conditions. For instance, during periods of high volatility, AI might widen the thresholds to reduce the likelihood of false signals.

This flexibility is particularly useful in cryptocurrency trading, where market conditions can change drastically within hours. AI algorithms analyze a mix of historical price data, current market sentiment, and volatility levels to determine the best RSI thresholds for each session. For example, in a strong upward trend driven by major news or institutional activity, AI might shift the overbought threshold from 70 to 75 or even 80, helping traders stay in the market longer and avoid premature exits.

By adapting to the market's rhythm, AI ensures RSI strategies remain effective, whether the market is calm or experiencing a breakout. This adaptability becomes even more powerful when combined with additional indicators for deeper analysis.

Combining RSI with Other Indicators

One of AI's strengths is its ability to perform multi-factor analysis, blending RSI with a variety of other market indicators to produce more reliable signals. Take StockioAI as an example - it integrates RSI with technical indicators, volume trends, support and resistance levels, market sentiment, order book depth, whale activity, and even social media trends. The result? Trading signals with clear reasoning, precise entry points, stop-loss levels, and profit targets [1].

This multi-layered approach addresses the shortcomings of relying on a single indicator. For instance, when RSI signals that a market is oversold, AI doesn't immediately recommend a buy. Instead, it checks other factors: Does the trading volume support a reversal? Are there strong support levels nearby? What’s the market sentiment? Are large investors (whales) showing interest? Only when multiple indicators align does the system suggest taking action.

The results speak for themselves. StockioAI's multi-indicator strategy, with RSI as a key component, has achieved a 75% win rate and a profit factor of 2.95 [1]. This demonstrates how combining RSI with other tools can significantly improve trading outcomes compared to using RSI alone.

AI-Powered Trading Bots for RSI Strategies

AI trading bots take RSI strategies to the next level by fully automating the process. These bots continuously monitor market data and execute trades based on RSI signals without requiring human intervention [4]. The speed advantage is undeniable - while a human trader might take minutes to analyze and act, AI bots do it in milliseconds.

Risk management is another area where AI bots excel. They use dynamic stop-loss and take-profit settings, adjusting these levels in real time as market conditions evolve [4][8]. For instance, if volatility spikes after a bot enters a trade, it might widen the stop-loss to prevent an early exit while still managing risk effectively.

Platforms like StockioAI provide API access, allowing traders to integrate AI-generated RSI signals directly into automated systems [1]. This means bots can leverage advanced analysis while maintaining the speed and consistency that automation offers.

AI bots also go beyond basic risk controls. They factor in market volatility, recent price movements, and historical performance when setting protective measures. By using risk calculators, they optimize position sizes based on RSI strength and current market conditions [4][8].

| Feature | Traditional RSI | AI-Enhanced RSI |

|---|---|---|

| Thresholds | Fixed (e.g., 30/70) | Dynamic, context-aware |

| Signal Reliability | Moderate | Higher, multi-factor |

| Automation | Manual | Fully automated (bots) |

| Risk Management | Manual | Automated (stop-loss, TP) |

| Market Adaptability | Low | High (real-time adjustment) |

This comparison highlights the clear benefits of AI-enhanced RSI strategies. While automation offers speed and precision, it doesn’t eliminate the need for oversight. Traders still need to monitor and adjust bot parameters based on market changes and performance feedback. However, the combination of advanced analysis, consistent execution, and robust risk management makes AI-powered bots an invaluable tool for implementing RSI strategies in the fast-paced world of cryptocurrency trading.

Using StockioAI for RSI Analysis

StockioAI takes RSI analysis to the next level by leveraging AI, real-time data, and machine learning to deliver actionable insights. With its tailored features, the platform empowers traders to make precise, informed decisions based on a wealth of data.

StockioAI's RSI Analysis Features

StockioAI doesn't just calculate RSI values. It processes over 60 real-time data points, analyzing technical indicators, volume patterns, market sentiment, and order book depth to generate Buy, Sell, and Hold signals. This layered approach ensures RSI signals are evaluated within the broader market context, offering traders a more comprehensive view [1].

The platform's AI-powered pattern recognition further enhances RSI analysis by spotting chart patterns, trend reversals, and optimal entry and exit points. For example, if the RSI signals an overbought condition, the AI can confirm this by identifying a bearish divergence, providing traders with added confidence in their decisions [1].

Interactive chart analysis adds another layer of functionality, allowing traders to visualize RSI across multiple timeframes - 1-hour, 4-hour, and daily. This feature helps traders capture both short-term and long-term market trends, offering a more complete market picture.

StockioAI also includes risk calculators that automatically suggest position sizes, stop-loss, and take-profit levels. These tools consider RSI readings and market volatility, tailoring recommendations to the trader's risk tolerance and current market conditions.

Practical Benefits for Cryptocurrency Traders

In the fast-paced world of cryptocurrency, StockioAI's real-time processing eliminates the delays associated with manual analysis - a critical advantage in volatile markets.

Another key benefit is the reduction of emotional bias. By automating signal generation, pattern recognition, and risk management, StockioAI minimizes subjective decision-making, helping traders avoid errors driven by emotions [6][7]. This objectivity is particularly valuable during periods of high market volatility, where discipline is crucial.

Here's an example: Imagine a trader monitoring Bitcoin. StockioAI's real-time RSI signal flags an overbought condition on the 1-hour chart. Simultaneously, the AI identifies a bearish divergence, and the risk calculator recommends a conservative position size based on current volatility. With this information, the trader can confidently set stop-loss and take-profit levels, balancing risk and reward effectively.

The multi-timeframe analysis feature also allows traders to compare short-term RSI movements with broader trends, offering a strategic advantage. For advanced users, API access enables seamless integration of StockioAI's RSI analysis into automated trading systems, combining advanced insights with consistent execution.

Feature-Benefit Summary Table

| Feature | Description | Practical Impact |

|---|---|---|

| Real-Time RSI Signals | AI-generated Buy, Sell, and Hold signals based on over 60 data points | Faster, more accurate trade decisions |

| AI-Powered Pattern Recognition | Detects chart patterns, reversals, and key entry/exit points | Early identification of market shifts |

| Interactive Chart Analysis | Multi-timeframe RSI visualization with detailed graphics | Deeper understanding of market trends and timing |

| Risk Calculators | Automated suggestions for stop-loss and take-profit levels | Enhanced risk management and position sizing |

| Multi-Timeframe Analysis | RSI insights across 1-hour, 4-hour, and daily charts | Broader market perspective for strategic planning |

| Automated Alerts | Real-time notifications for RSI-based signals | Reduced emotional trading and improved discipline |

StockioAI's approach to RSI analysis redefines traditional methods. By combining real-time data, advanced pattern recognition, and effective risk management, the platform equips cryptocurrency traders with the tools needed to make confident, data-driven decisions. These features address the limitations of conventional RSI analysis, paving the way for successful AI-driven trading strategies.

Best Practices for AI-Powered RSI Trading

Leveraging StockioAI's advanced analytics, these best practices can help you fine-tune your approach to AI-assisted RSI trading. This strategy combines automation with human oversight, ensuring you make informed decisions while addressing AI's limitations.

Steps for Successful Implementation

Start with reliable data sources.

Choose data providers that offer frequent updates and comprehensive market coverage. For instance, platforms like StockioAI refresh RSI values every few minutes, allowing you to make decisions based on up-to-date market conditions [5]. Always cross-check data accuracy across multiple sources to ensure reliability.

Backtest your strategies extensively.

Use historical data to evaluate how AI-driven RSI signals perform under varying market conditions. Focus on metrics like win rates and risk-reward ratios [4]. StockioAI offers robust backtesting tools, helping you fine-tune parameters and pinpoint weaknesses before committing real funds.

Deploy gradually.

Start with smaller trades to minimize risk as you get accustomed to the AI's decision-making process.

Regularly update your AI models.

Market conditions evolve, and your AI models need to keep up. Retrain them with fresh data to maintain accuracy [7]. While automated retraining is often available, manual reviews can ensure your models adapt effectively to new patterns.

Log and analyze every trade.

Keep detailed records of trade entries, exits, and outcomes. This practice helps you evaluate AI performance and identify areas for improvement [4].

Once you've implemented these steps, it's crucial to understand where AI might fall short to refine your strategy further.

Understanding AI's Limitations

AI systems are excellent at processing large volumes of data quickly, but they can falter during unexpected market events or rare scenarios [3]. Human oversight remains essential because AI might misinterpret unusual conditions, such as sudden regulatory changes, major news events, or technical anomalies.

StockioAI provides detailed explanations for its BUY, SELL, and HOLD recommendations, along with confidence scores that indicate how certain the system is [1]. If confidence scores are low, it’s a signal to scrutinize the recommendations more closely and consider reducing your position size. Additionally, regular monitoring is key, as AI performance can shift over time.

Recognizing these limitations sets the stage for effective risk management to protect your trades.

Risk Management Tips

Strong risk controls are essential to complement AI insights and guard against unexpected market shifts.

Set stop-loss and take-profit levels.

Always apply these levels as suggested by your AI system. StockioAI’s risk calculator can recommend optimal position sizes and stop-loss points [1].

Use position sizing calculators.

Determine trade sizes as a percentage of your portfolio to avoid overexposure on a single trade [1].

Diversify your trades.

Spread your investments across different assets and timeframes instead of focusing on a single cryptocurrency. For example, the average crypto market RSI currently hovers around 50.98, indicating neutral momentum across major cryptocurrencies [2]. However, individual assets may show significant variation.

Establish clear risk parameters.

Define limits for daily losses, position sizes, and overall portfolio exposure. While AI can execute millions of trades daily [3], this speed only works to your advantage when paired with solid risk controls.

Pay attention to SELL signals.

AI-generated SELL signals often include detailed explanations of the risks and market conditions triggering the alert [1]. Understanding these insights can help you decide when to exit a position or tweak your strategy.

Regularly review and adjust risk settings**.**

Keep your risk management parameters updated based on the AI’s performance and changing market conditions to maintain an effective trading approach.

Conclusion

AI has revolutionized how traders analyze RSI in the cryptocurrency market, moving beyond static thresholds to offer real-time, context-driven insights that adapt to shifting market dynamics. By addressing the key challenges of traditional RSI interpretation - like limited data processing and emotional bias - AI provides traders with a more reliable and objective framework for decision-making.

This approach delivers far more context than conventional RSI methods, empowering traders to make smarter decisions in the fast-moving crypto world. AI systems continuously process multiple data streams, delivering insights that manual analysis simply cannot achieve.

Platforms such as StockioAI highlight the potential of AI in refining RSI strategies. With tools like intelligent signal generation, automated pattern detection, and integrated risk management, these platforms bring a new level of precision to trading. Features such as accurate Buy, Sell, and Hold signals, along with interactive charting and AI-driven pattern recognition, help traders achieve consistent results. For instance, StockioAI boasts a 75.0% win rate, underlining how AI can complement traditional technical analysis [1].

By executing trades based on predefined rules and real-time data, AI helps traders stay disciplined and avoid the impulsive decisions that often undermine manual strategies.

For U.S.-based cryptocurrency traders, AI-powered RSI analysis offers a competitive edge. It provides faster signals, sharper execution, and stronger risk management, all while enhancing human decision-making rather than replacing it. This combination of adaptability and precision enables traders to respond effectively to market volatility and seize profitable opportunities.

As the crypto market continues to evolve, traders who incorporate AI into their RSI analysis will be better equipped to navigate its challenges. The blend of human expertise and AI-driven accuracy fosters a disciplined, systematic trading approach that adapts to market changes while maintaining steady performance. This partnership between human judgment and AI precision is setting a new benchmark for success in cryptocurrency trading.

FAQs

How does AI optimize RSI thresholds to improve trading decisions?

AI brings a fresh perspective to RSI (Relative Strength Index) analysis by tailoring thresholds to match real-time market conditions. With advanced pattern recognition, it spots trends and irregularities that traditional methods might overlook.

By fine-tuning RSI levels to align with current market behavior, this approach helps traders make smarter decisions about when to Buy, Sell, or Hold. The ability of AI to break down complex data into actionable insights allows traders to navigate fast-paced markets with greater confidence.

How can AI-powered trading bots improve RSI strategies in volatile markets?

AI-powered trading bots bring a new level of efficiency to RSI strategies by providing real-time insights and advanced pattern detection. These tools help traders spot market trends quickly, enabling data-driven decisions that are crucial in fast-moving, volatile markets. The ability to react swiftly and accurately can make a significant difference when it comes to managing risks and capitalizing on opportunities.

Take StockioAI, for instance. This platform leverages AI to generate precise Buy, Sell, and Hold signals, along with interactive chart analysis and robust risk management tools. By automating complex calculations and delivering actionable insights, AI empowers traders to tackle unpredictable market conditions with greater clarity and confidence.

How can combining RSI with other indicators improve trading accuracy?

Combining the Relative Strength Index (RSI) with other technical indicators can provide a clearer picture of market trends, making trading signals more reliable. For instance, pairing RSI with tools like moving averages, Bollinger Bands, or volume analysis helps confirm overbought or oversold conditions and spot potential reversals with added accuracy.

Using several indicators together minimizes the risk of false signals, enabling traders to make better decisions. Platforms like StockioAI take this a step further by using AI-powered pattern recognition to analyze RSI alongside other tools, delivering real-time insights that simplify data and enhance trading strategies.