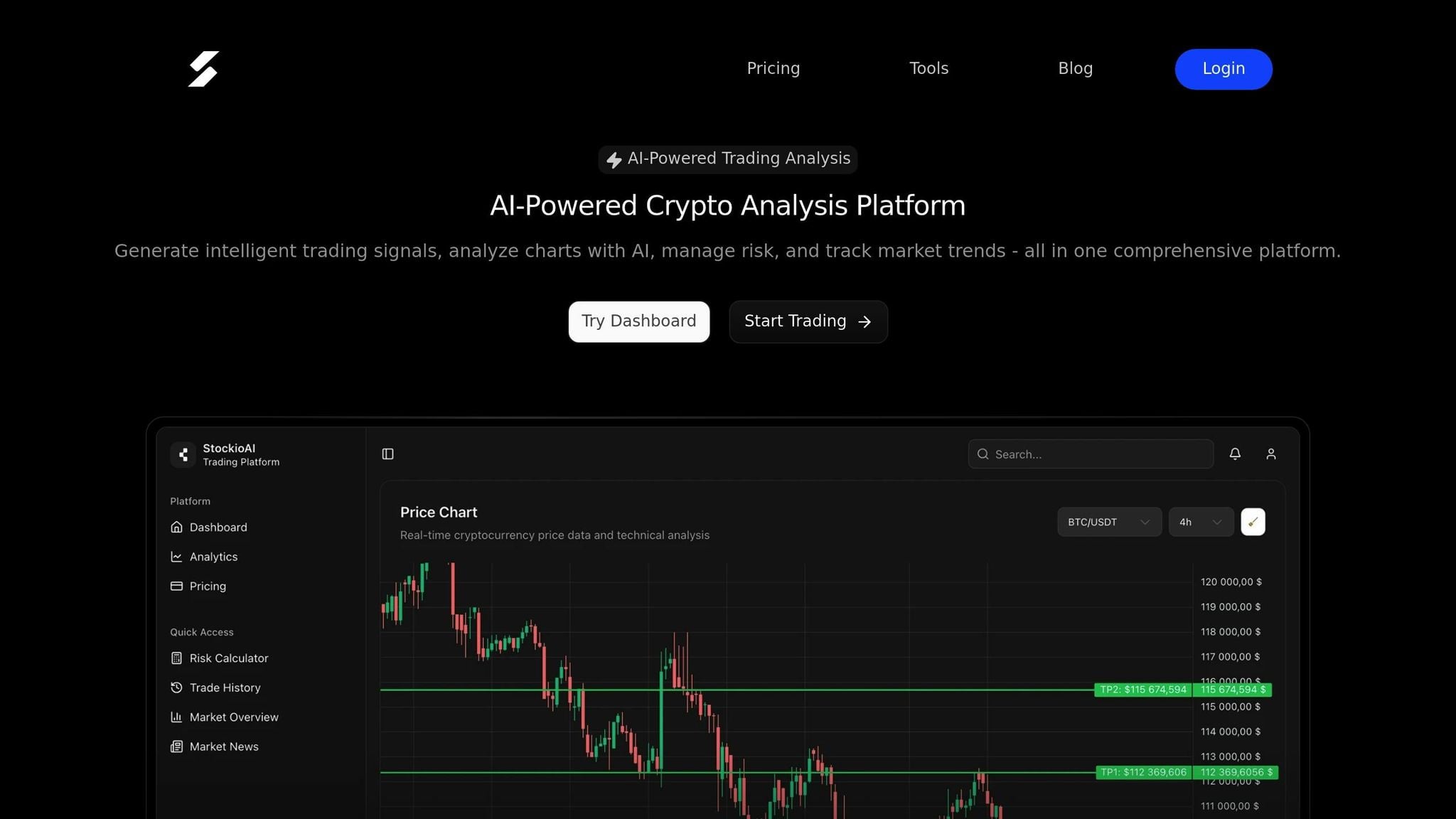

AI is transforming cryptocurrency trading by analyzing vast amounts of market data in real time. It identifies patterns, predicts price movements, and assists traders in making better decisions. Advanced models like LSTMs and hybrids (e.g., CNN-LSTM) outperform older methods by handling complex, fast-changing crypto data. Tools like StockioAI process over 60 data points per second, offering actionable insights such as BUY, SELL, and HOLD signals, while also explaining the reasoning behind them. This combination of precision and clarity is helping traders navigate the volatile crypto market more effectively.

Key Points:

- AI Models: LSTMs excel in time-series analysis, while hybrids like CNN-LSTM combine spatial and temporal data for better accuracy.

- Challenges: Crypto markets are volatile and operate 24/7. AI must frequently retrain to stay relevant.

- Real-Time Insights: Platforms like StockioAI analyze market sentiment, whale transactions, and technical indicators to provide clear trading signals.

- Explainability: Features like SHAP values and attention mechanisms make AI predictions transparent and actionable.

AI tools are reshaping crypto trading by offering data-driven strategies, improved risk management, and enhanced forecasting accuracy.

I made an AI to Predict Stock Market Patterns

AI Models and Techniques for Pattern Recognition

The cryptocurrency market is a beast of its own - operating non-stop with wild swings in volatility. This makes it a perfect playground for cutting-edge AI models designed to handle its unpredictable nature. These models not only adapt swiftly to detect meaningful trends but also set the stage for advanced strategies and data preparation techniques.

Main AI Models for Crypto Time-Series Analysis

Recurrent Neural Networks (RNNs) have been a staple for sequential data, but they struggle with longer sequences due to vanishing gradient issues. Enter Long Short-Term Memory networks (LSTMs), which solve this problem by retaining information over longer periods. This makes LSTMs particularly effective in crypto markets, where price trends can unfold over days or weeks[2][3][4].

For those seeking something faster and simpler, Gated Recurrent Units (GRUs) deliver solid performance in real-time trading scenarios. However, research shows that LSTMs often excel at capturing the intricate patterns in crypto price data, leading to more profitable strategies[7].

Hybrid models take things a step further by combining the strengths of different AI architectures. One standout example is the CNN-LSTM model, which merges convolutional layers for identifying spatial patterns in price charts with recurrent layers for analyzing temporal dependencies in historical data. These models have shown exceptional results, particularly in Bitcoin price prediction, outperforming standalone models by a wide margin[4].

Another powerful combination is LSTM paired with XGBoost, where LSTMs handle sequential data like price and volume, while XGBoost processes non-sequential features such as market sentiment or external events. Together, they create a comprehensive approach to crypto market analysis.

The performance of these models speaks for itself. LSTM-driven trading systems have consistently outperformed traditional models in real-time long-short strategies, while machine learning algorithms like XGBoost and SDA have achieved accuracy rates of 66% and 65.3%, respectively, in high-frequency Bitcoin price predictions[7][8].

Data Preprocessing and Feature Selection

Raw crypto data is messy - filled with noise and inconsistencies. To make sense of it, preprocessing is essential. For starters, normalization ensures that variables like prices and volumes, which can vary drastically in scale, are brought into comparable ranges. This prevents any single variable from dominating the model's learning process[2][3].

Another key technique is time decomposition, which breaks down complex time-series data into trend, seasonality, and residual components. This helps models differentiate between genuine market cycles and short-term fluctuations, improving their ability to identify meaningful patterns.

Feature selection is equally critical. Studies show that Bitcoin prices are heavily influenced by their own historical values, with minimal impact from traditional financial assets[2]. The most predictive features typically include historical price data, trading volume, order book stats, market sentiment, and external factors like regulatory announcements[2][3].

Platforms like StockioAI take this a step further by leveraging an extensive set of real-time data and technical indicators to refine forecasting accuracy[1]. Adding sentiment analysis into the mix - by analyzing social media, news, and commentary - further enhances predictive power. This approach captures market dynamics that purely numerical models might miss, making it a valuable addition to any AI-driven strategy[2][7].

Hybrid Models and Their Benefits

Hybrid models are the powerhouse of crypto analysis, combining the best of multiple techniques for superior performance. Take CNN-LSTM hybrids, for example. Convolutional layers identify local spatial patterns like support and resistance levels, while LSTM layers capture long-term dependencies across various time frames[3][4].

The results speak volumes. Hybrid models consistently outperform single-model setups, delivering better metrics like RMSE, Mean Absolute Error (MAE), and R-squared values[3][4]. They also adapt quickly to changing market conditions, making them ideal for volatile environments.

The combination of LSTM and XGBoost is a prime example of this versatility. LSTMs process sequential data, while XGBoost excels at handling categorical inputs like market sentiment or regulatory events. Together, they create a well-rounded system for analyzing the crypto market.

These models are also practical for real-time applications. StockioAI, for instance, uses a multi-model approach to generate precise BUY, SELL, and HOLD signals, along with interactive chart analyses and risk calculators tailored for the fast-paced crypto world[1]. By integrating multiple AI techniques, these platforms provide insights and analytics that single algorithms simply can't match.

As the crypto market evolves, hybrid models remain a step ahead. They can seamlessly incorporate new data sources and adjust their parameters without requiring a complete overhaul - an essential feature in an industry where staying current is the key to success.

Explainable AI and Advanced Techniques

Advanced techniques like explainability and attention are game-changers for traders navigating the fast-paced crypto market. These tools help translate complex AI predictions into actionable insights, ensuring traders can better understand and trust the models they rely on.

Explainable AI for Clear Decision-Making

Explainable AI (XAI) takes the mystery out of AI models, making their decision-making processes more transparent. In the volatile world of cryptocurrency, this clarity is crucial. It allows traders to see what factors are influencing a model’s predictions, which can build trust and lead to more confident decisions [2][6].

Take SHAP (SHapley Additive exPlanations) values, for example. They quantify how much each input feature contributes to a model's prediction. Imagine an AI system issuing a buy signal for Bitcoin. SHAP values might reveal that the decision was influenced by historical price trends, trading volume, and market sentiment. This level of detail helps traders understand why the model made its call [2].

Platforms like StockioAI are already leveraging this approach. Their intelligent trading system analyzes over 60 real-time data points every second, covering everything from technical indicators to order flows. When the platform suggests a BUY position, it doesn’t stop there - it provides detailed reasoning, entry points, stop-loss levels, profit targets, and even confidence scores. With this kind of transparency, traders can make informed decisions even in unpredictable markets [1].

This openness isn’t just a nice-to-have - it’s essential. When traders can see the logic behind AI recommendations, they’re more likely to trust and act on them, even in the face of changing market conditions.

Attention Mechanisms in Crypto Pattern Recognition

Attention mechanisms are another tool that’s making waves in crypto trading. These systems help AI models focus on the most critical data points, like sudden price spikes or dips, which can significantly improve accuracy and pattern recognition [6].

For instance, attention-based LSTMs have shown impressive results in predicting Bitcoin price movements. Unlike standard LSTMs, these models dynamically prioritize key events, reducing errors and adapting better to shifts in market trends [2][6].

Consider a scenario where Bitcoin’s price drops sharply due to regulatory news. An attention-based model would zero in on this event and adjust its predictions accordingly. Traditional models, on the other hand, might treat it as just another data point. What’s more, attention mechanisms can visualize these focus areas, showing traders exactly which events or time periods influenced the prediction. This not only boosts accuracy but also provides traders with insights they can act on.

Comparison of Advanced Techniques

Different AI approaches come with their own strengths and weaknesses. Understanding these can help traders choose the right tools for their strategies.

| Model Type | Accuracy | Interpretability | Use Cases | Pros | Cons |

|---|---|---|---|---|---|

| LSTM | High | Moderate (with XAI) | Price forecasting, volatility prediction | Captures long-term patterns effectively | Less transparent without XAI tools |

| CNN | Moderate-High | Moderate | Pattern detection, anomaly identification | Excels at identifying local features | Limited in modeling temporal dependencies |

| Hybrid (LSTM+CNN) | Very High | Low-Moderate (with XAI) | Complex pattern recognition, multi-timeframe analysis | Leverages both temporal and spatial patterns | More complex and computationally demanding |

| With Attention | Very High | Moderate-High | Regime shift detection, adaptive forecasting | Focuses on critical data with improved interpretability | Requires additional computation and complex implementation |

For example, a CNN-LSTM hybrid model recently achieved an R² of 0.98219, MSE of 0.00151, RMSE of 0.0388, and MAE of 0.02519 in Bitcoin price prediction - an impressive level of accuracy [4]. While standalone LSTMs excel at capturing long-term dependencies, they often need tools like XAI to improve interpretability. CNNs, meanwhile, are great at spotting local patterns but struggle with the time-sensitive nature of crypto data [3][4][6].

Hybrid models that combine LSTM and CNN architectures offer the best of both worlds, capturing both short-term fluctuations and long-term trends. However, their complexity can make them harder to interpret. That’s where tools like SHAP and attention visualizations come in, helping traders understand the reasoning behind these sophisticated systems [3][4][6].

Ultimately, the best choice depends on your trading goals. High-frequency traders might prefer simpler models with XAI for speed and clarity, while long-term investors could lean toward hybrid models for their accuracy, even if it means dealing with added complexity.

Practical Applications of AI in Crypto Trading

After exploring AI models and techniques, let’s dive into how these advanced methods turn complex patterns into actionable decisions for crypto trading.

AI in Real-Time Trading Signals

AI-powered trading systems are constantly at work, analyzing massive amounts of market data to generate BUY, SELL, and HOLD signals. These systems process over 60 data points every second, including technical indicators, volume patterns, support levels, market sentiment, and even whale movements [1].

What sets these systems apart is their transparency. They don’t just give signals - they explain them. Each recommendation comes with detailed reasoning, entry points, stop-loss levels, profit targets, and confidence scores. This clarity helps traders understand the logic behind the suggestions, making it easier to trust the process.

Research backs up the effectiveness of AI in crypto trading. For instance, studies show that recurrent neural networks outperform standard neural networks in predicting Bitcoin prices. These models reveal that Bitcoin’s price is more influenced by its own historical values than by traditional financial assets [2]. In one experiment, a CNN-LSTM hybrid model delivered impressive accuracy metrics: MSE = 0.00151, RMSE = 0.0388, MAE = 0.02519, and R² = 0.98219 over a five-month period [4].

Technical Analysis and Risk Management

AI takes traditional technical analysis to the next level by automating the detection of complex chart patterns like head and shoulders, double tops, and trend reversals. It also calculates technical indicators in real time, offering a more dynamic approach to market analysis [2][3].

When it comes to risk management, AI tools go far beyond basic stop-loss orders. They estimate potential drawdowns, suggest optimal position sizes based on current volatility, and send real-time alerts about emerging risks. For instance, some platforms use Value at Risk (VaR) or Conditional Value at Risk (CVaR) metrics to give traders a clearer picture of their exposure.

AI systems can also adapt to changing conditions. If volatility is expected to rise, these tools might recommend scaling back position sizes to minimize potential losses. Additionally, they excel at backtesting strategies against historical data, helping traders refine their approaches under various market scenarios. Platforms like StockioAI integrate these capabilities, turning analytical insights into actionable strategies.

How StockioAI Uses AI for Crypto Analytics

StockioAI is a prime example of how AI can transform raw data into actionable trading insights. Its system processes multiple data streams simultaneously, analyzing factors like technical indicators, volume patterns, market sentiment, whale movements, social media trends, and more.

These insights lead to precise trading signals backed by solid data. For instance:

- BUY signals are based on support levels, momentum indicators, and market sentiment.

- SELL signals consider resistance levels, volatility patterns, and institutional flows to determine the best exit points while managing risk.

StockioAI boasts a 75.0% win rate and a profit factor of 2.95, demonstrating the real-world effectiveness of its AI-driven approach [1]. Beyond generating signals, the platform offers tools like interactive chart analysis, AI-generated trading levels, and support/resistance zones. Its risk calculator helps traders determine optimal position sizes, stop-loss levels, and leverage, all based on real-time risk assessments.

The platform uses a 7-tier priority system to evaluate factors such as market structure, volume and liquidity, RSI and MACD indicators, EMA ribbon, SMA context, and price momentum. Combined with its ability to analyze multiple timeframes, StockioAI can identify when higher timeframe trends should take precedence over lower timeframe signals. It also classifies market regimes - trending, ranging, volatile, or quiet - helping traders decide not just what to trade, but also when and how to trade effectively in current market conditions.

Research Findings and Future Directions

AI-powered tools for cryptocurrency analysis are showing impressive results, but they still face significant hurdles.

Research Results and Model Performance

Recent research highlights how deep learning models are outperforming traditional statistical methods in predicting cryptocurrency prices. For instance, Giudici et al. (2024) observed that recurrent neural networks (RNNs) achieved exceptional accuracy and stability, with R² values often exceeding 0.95 and MAPE values as low as 0.016 in some configurations [1][3].

Hybrid models have also demonstrated strong performance, particularly for Bitcoin predictions. In comparison, traditional ARIMA models generally fall short, showing weaker R² values and higher error rates. Bitcoin-focused models tend to be more reliable than those aimed at altcoins, largely because Bitcoin's higher liquidity, trading volume, and market maturity create more consistent patterns for AI to analyze [1][2].

One standout example is the SDAE-B model, which achieved a MAPE of 0.016, RMSE of 131.643, and a directional accuracy of 81.7% for Bitcoin forecasting [4]. These metrics underscore that modern AI systems can not only predict price movements with remarkable precision but also correctly identify market trends more than 80% of the time.

| Model Type | R² | MAPE | RMSE | Directional Accuracy |

|---|---|---|---|---|

| LSTM (Deep Learning) | 0.98219 | N/A | 0.0388 | N/A |

| SDAE-B (Deep Learning) | N/A | 0.016 | 131.643 | 0.817 |

| ARIMA (Traditional) | Lower | N/A | Higher | N/A |

These findings highlight the practical applications of AI-driven tools like StockioAI, which utilize these advanced models for real-time market analysis.

Current Limitations and Research Challenges

Despite their promise, AI models still face key challenges in the volatile world of cryptocurrency. One major hurdle is market regime shifts - sudden changes caused by regulatory updates, technological advancements, or significant market events. These shifts can quickly render existing AI patterns and predictions irrelevant [1][4].

Another challenge lies in multi-asset modeling. While Bitcoin data is relatively well-understood, altcoins often exhibit lower liquidity and higher volatility, making them harder to predict with the same level of accuracy [1][2].

Incorporating external data sources, like social media sentiment, news updates, and transaction patterns, remains a complex task. The nonstop nature of cryptocurrency markets, combined with their extreme volatility, further complicates the development of real-time, adaptive AI systems [5].

These obstacles are driving researchers to explore new methodologies aimed at improving both accuracy and adaptability in crypto analysis.

Future Trends in AI-Driven Crypto Analysis

Looking ahead, several exciting advancements are shaping the future of AI in cryptocurrency analysis. Hybrid models, such as CNN-LSTM combinations and ensemble methods, are gaining traction for their ability to capture both spatial and temporal patterns effectively [4].

Explainable AI (XAI) is becoming increasingly important as users demand more transparency in how AI systems make predictions. Future models are expected to provide not just accurate forecasts but also clear explanations of their decision-making processes.

Researchers are also focusing on creating adaptive AI systems capable of detecting market regime changes and dynamically adjusting their models to maintain accuracy across different conditions [1][4][5].

The introduction of specialized benchmarks like CTBench marks another step forward. This framework evaluates models across 452 tokens and 13 metrics, including forecasting accuracy, trading performance, and risk assessment, offering practical insights for deploying AI tools in trading scenarios [5].

Future advancements will likely include synthetic time series generation and the integration of multiple data sources. By combining technical indicators, sentiment analysis, whale movement data, and macroeconomic factors, these unified models aim to provide a more comprehensive view of the market. This mirrors the growing trend in advanced crypto analytics, where platforms now process over 60 real-time data points for better decision-making.

Conclusion

The rise of AI in cryptocurrency time-series analysis has reshaped how traders navigate the unpredictable world of digital assets. Advanced deep learning models like LSTM and RNN have proven their ability to identify complex, nonlinear patterns, offering high levels of predictive accuracy. These breakthroughs don’t just remain in academic circles - they translate into practical tools that can make or break trading outcomes in the fast-paced crypto market. Below are the key insights that highlight the impact of these advancements.

Main Takeaways

Improved accuracy is a standout benefit of using AI for pattern recognition in crypto trading. Traditional models like ARIMA often falter when faced with the extreme volatility of cryptocurrencies. In contrast, deep learning models excel by capturing intricate temporal patterns, with some achieving directional accuracy rates exceeding 80%.

Greater transparency comes from explainable AI, which sheds light on the factors driving trading signals. Modern AI systems clarify how variables such as historical prices, trading volumes, and sentiment data influence recommendations, whether it’s a buy, sell, or hold decision.

Actionable insights are made possible by AI’s ability to analyze massive amounts of real-time data. Processing over 60 data points per second - covering whale transactions, social media sentiment, and order book depth - AI delivers a comprehensive view of the market. These insights help traders pinpoint ideal entry points, set stop-loss levels, and establish profit targets, enabling better risk management.

The Role of Platforms Like StockioAI

Platforms like StockioAI take these insights and turn them into tools that traders can use daily. By deploying deep learning models with a 75.0% win rate and a profit factor of 2.95[1], StockioAI provides institutional-grade analytics tailored for individual traders. Its ability to process real-time market data and generate clear BUY, SELL, and HOLD signals, complete with detailed explanations, bridges the gap between complex AI research and practical trading strategies.

StockioAI also integrates features like risk management tools, interactive chart analysis, and AI-driven pattern recognition. These capabilities address challenges across the trading spectrum, from determining optimal position sizes to spotting trend reversals. By simplifying advanced algorithms into easy-to-use tools, the platform empowers traders to make informed decisions.

As the cryptocurrency market evolves, the fusion of cutting-edge AI technology and user-friendly platforms ensures that traders of all experience levels can stay ahead. Those who embrace AI’s potential will be better equipped to navigate the complexities of crypto trading with confidence.

FAQs

How do hybrid AI models like CNN-LSTM enhance crypto price predictions compared to traditional methods?

Hybrid AI models like CNN-LSTM bring together the strengths of different machine learning approaches to enhance cryptocurrency price predictions. Convolutional Neural Networks (CNNs) are particularly skilled at spotting intricate patterns in data, while Long Short-Term Memory (LSTM) networks excel at analyzing sequential data and capturing long-term dependencies.

When combined, CNN-LSTM models can identify detailed patterns in historical price data while also accounting for time-series trends. This dual capability makes them well-suited for tackling the complexities of the crypto market, where short-term volatility and long-term trends both play crucial roles. By leveraging these models, traders gain more dependable insights to navigate this unpredictable market with greater confidence.

How does explainable AI build trust in trading signals for the unpredictable crypto market?

Explainable AI (XAI) is essential for building trust in AI-generated trading signals, particularly in the unpredictable world of cryptocurrency. By simplifying intricate algorithms into clear, actionable insights, XAI helps traders understand the logic behind recommendations like BUY, SELL, or HOLD.

This clarity empowers traders by letting them evaluate the dependability of AI-driven decisions and grasp how market trends are being analyzed. Knowing why a specific signal is generated enables traders to make smarter, more confident decisions in the fast-paced crypto market.

How does AI, like StockioAI, help crypto traders manage risks effectively?

AI tools like StockioAI are transforming risk management by equipping traders with tools to make more informed decisions. These tools can assist in calculating position sizes, setting stop-loss levels, and identifying the best leverage for trades - tailored to both market conditions and a trader's personal risk tolerance.

With advanced analytics and pattern recognition at its core, StockioAI helps traders navigate the unpredictable cryptocurrency market, aiming to reduce potential losses while uncovering new opportunities.