AI-powered chart alerts are transforming how traders analyze markets. These tools use artificial intelligence to monitor real-time and historical data, providing automated BUY, SELL, or HOLD signals. With over 60 data points analyzed every second, they detect patterns, track market sentiment, and identify optimal entry and exit points faster than human traders.

For cryptocurrency traders, these alerts are especially helpful in managing the 24/7 market's volatility. They remove emotional bias, deliver actionable insights instantly, and offer customizable settings to fit different trading strategies.

Key features include:

-

Real-time notifications via email, mobile, and platforms like Telegram.

-

Customizable parameters like price thresholds, volume spikes, and technical indicators.

-

Built-in risk management, including stop-loss levels and position-sizing suggestions.

-

Transparency with confidence scores and detailed explanations for each signal.

While AI chart alerts reduce manual effort and improve decision-making, they aren't foolproof. False signals, over-reliance on automation, and technical issues can occur. However, when combined with sound strategies and manual analysis, they can be a powerful tool for traders.

Platforms like StockioAI offer tiered plans, starting with a free option for beginners and scaling up to advanced features for professionals. With a reported 75.0% win rate and tools like backtesting, portfolio tracking, and market regime classification, StockioAI stands out as a comprehensive solution for crypto traders. These tools are no longer optional - they’re becoming a necessity for staying competitive in fast-moving markets.

How AI Detects and Sends Chart Signals

AI Technology Behind Chart Alerts

AI-driven alerts rely on machine learning and statistical models to sift through market data, uncovering patterns and trends in price movements, trading volume, technical indicators, news sentiment, and social activity [5][2]. These systems are designed to map out market conditions with precision.

Deep learning models, trained on years of historical market data, excel at spotting intricate chart patterns. Meanwhile, statistical models step in to validate these findings, ensuring the alerts are based on genuine signals rather than coincidental fluctuations [5]. This combination creates a system that's not only accurate but also flexible enough to adapt to evolving market dynamics.

Take StockioAI, for example. Its system processes over 60 real-time data points every second, analyzing everything from technical indicators and volume trends to support levels, market sentiment, order book depth, whale movements, and social media chatter - all at once [1]. This level of analysis happens far faster than any human could manage, giving traders a significant edge.

As the system ingests new data, its machine learning algorithms continually refine their ability to recognize patterns. This constant learning process ensures that the system remains sharp and capable of identifying a wide range of chart formations.

Chart Patterns AI Can Identify

With its advanced capabilities, AI can pinpoint key chart patterns that often signal trading opportunities. These systems excel at identifying both classic patterns and more nuanced formations. Familiar patterns like head and shoulders, triangles (ascending, descending, and symmetrical), double tops and bottoms, and flags and pennants are easily recognized by modern algorithms [5][2][6].

But AI doesn’t stop there. It can also detect subtler formations, such as support and resistance levels, candlestick patterns, volume spikes, and divergence signals - patterns that might take human traders a significant amount of time to identify [2][4]. What's more, these systems can monitor thousands of cryptocurrency pairs simultaneously, scanning for breakout patterns, trend reversals, and consolidation phases across multiple time frames.

What sets AI apart is its ability to spot pattern combinations, where several technical signals align to create high-probability setups. For instance, an AI might notice a triangle formation coinciding with rising volume and positive sentiment indicators. This layered analysis results in more reliable signals than relying on any single pattern alone.

Real-Time Signal Delivery

The final step in the process is ensuring traders receive actionable insights instantly. Modern AI systems send BUY, SELL, and HOLD signals through a variety of channels, making sure traders stay informed no matter where they are or what device they're using.

Alerts are delivered via email, mobile push notifications, desktop alerts, and platforms like Telegram, Slack, and Discord [6]. This multi-channel approach ensures traders won't miss critical updates, even if one method fails.

Each alert provides clear details, including entry points, stop-loss levels, profit targets, and confidence scores, giving traders a solid understanding of the rationale behind every recommendation. StockioAI, for instance, emphasizes this transparency by offering detailed reasoning for each alert [1].

"Our intelligent trading system generates precise BUY positions based on 60+ real-time data points analyzed every second. Technical indicators, volume patterns, support levels, market sentiment, order book depth, whale movements, and social media trends are processed instantly." [1]

In the fast-paced world of cryptocurrency trading, speed is everything. AI systems can detect significant patterns or breakouts and send alerts within milliseconds, giving traders the chance to act before market conditions shift.

For those who prefer tailored insights, many platforms offer customizable alert formats. These range from simple notifications with just the asset, action, and price level to in-depth alerts that include charts, detailed analysis, and risk metrics. This flexibility ensures that traders get the level of detail they need to make informed decisions.

How I Use AI For Trading To Build My Best Indicators

Customization Options for AI Chart Alerts

AI-powered chart alerts stand out because they’re highly adaptable. Instead of offering rigid, one-size-fits-all notifications, these systems let traders tweak settings to suit their individual trading styles and risk tolerance. This adaptability shines through in customizable parameters, strategy-specific alerts, and intuitive interfaces.

Setting Alert Parameters

Traders can define specific parameters to control when they get notified. For instance, you might set an alert to trigger when Bitcoin climbs 5% in a single day[7]. Volume thresholds add another layer, ensuring alerts only activate when trading activity surpasses typical levels - helping you avoid low-confidence signals. You can also leverage technical indicators, like receiving a notification when the RSI crosses a certain level or a moving average crossover occurs[7]. For even sharper insights, combine conditions - such as pairing price thresholds with volume spikes - to filter out noise and focus on meaningful movements[7].

For advanced users, StockioAI’s Professional plan includes a custom indicator library priced at $119 per month when billed annually. This tool offers specialized technical analysis features, enabling traders to craft more sophisticated alert conditions[1].

These customizable triggers ensure that your alerts sync perfectly with your trading approach.

Matching Alerts to Trading Strategies

AI alerts can be tailored to match various trading styles and time horizons. Day traders, for example, often prioritize alerts for rapid price changes, intraday breakouts, or short-term technical setups[7]. Swing traders might configure alerts to track multi-day trends, focusing on key support or resistance levels, reversals, or volume surges that signal momentum shifts over days or weeks[7]. Long-term investors, on the other hand, may set alerts for significant market events or major price movements - like a 10% dip in a cryptocurrency, which could indicate a broader market shift[7]. By aligning alert sensitivity with your trading strategy, you can ensure that every notification is relevant and actionable.

Simple Setup for All Skill Levels

Modern AI alert platforms are designed with simplicity in mind, making them accessible to everyone. Beginners can rely on pre-built templates and easy-to-use toggles, while experienced traders can dive into advanced settings using no-code, drag-and-drop tools. Guided wizards walk users through setup, offering recommendations tailored to their trading goals[7].

StockioAI caters to a range of skill levels with its tiered plans. The Free plan offers basic features at no cost, ideal for those just starting with AI-driven analysis. For $39 per month (billed annually), the Starter plan includes 30 AI trading signals and basic technical analysis. Advanced traders can opt for the Professional plan, which provides custom indicators, API access, and other premium features[1].

Backtesting tools are another valuable addition, allowing traders to test their alert configurations against historical data before using them in live markets[4]. Alerts are also delivered through multiple channels, ensuring you stay informed no matter where you are. Receive urgent notifications via SMS, detailed reports through email, or join community discussions on platforms like Telegram, Slack, or Discord[7].

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."

– Jordan Martinez, Quantitative Trader[1]

StockioAI also incorporates risk management into its alerts. Traders can customize notifications to include position-sizing recommendations, stop-loss suggestions, and risk-reward calculations. These features help reinforce disciplined trading by keeping alerts aligned with pre-defined risk parameters[5][8].

Risk Management and Decision Support with AI Alerts

AI-powered alerts bring a new level of precision to risk management by analyzing over 60 key data points. These tools provide traders with actionable insights to safeguard their capital, especially in the unpredictable world of cryptocurrency trading.

Built-in Risk Management Tools

Modern AI platforms come equipped with advanced risk management features that are seamlessly integrated into their alert systems. These tools automatically calculate stop-loss levels based on historical volatility and recent price trends, offering traders clear exit points [2] [8]. For instance, StockioAI includes detailed entry points, stop-loss recommendations, and profit targets for its BUY positions. These are backed by confidence scores derived from analyzing real-time data such as technical indicators, trading volumes, and market sentiment [1].

Risk calculators within these platforms further refine trading strategies. By factoring in account balance and individual risk tolerance, they help traders determine the optimal position size. For example, if a trader adheres to a 2% risk limit per trade, the AI adjusts the position size based on the stop-loss distance and current market conditions. This ensures consistent risk exposure while avoiding overexposure during volatile periods.

This structured, data-driven approach not only protects traders' capital but also minimizes the chances of making impulsive, reactive decisions.

Reducing Emotional Trading Decisions

One of the standout benefits of AI-driven alerts is their ability to curb emotional trading. Instead of relying on gut feelings, traders receive clear, data-backed recommendations. For example, an alert like "Buy BTC at $64,200 – Confidence Level: 82%" provides actionable insights rooted in algorithmic analysis [2]. Such guidance helps traders avoid common mistakes, like chasing losses or overtrading during market turbulence [5].

Platforms like StockioAI go a step further by offering detailed explanations for every BUY, SELL, and HOLD signal. These explanations break down the market factors influencing each recommendation, fostering a deeper understanding of market dynamics. Over time, this transparency helps traders build confidence and reduce emotional reactions. For instance, HOLD signals during periods of market consolidation are particularly valuable, as they use live support and resistance data to encourage patience when trends are unclear [1].

StockioAI's systematic methods are backed by performance metrics, reporting a 75.0% win rate and a 2.95 profit factor for its professional trading signals [1]. This structured approach not only reduces emotional decision-making but also builds trust in the system's reliability.

Adjusting to Market Conditions

AI alert systems shine in their ability to adapt to ever-changing market conditions. StockioAI’s algorithms process over 60 data points every second, including technical indicators, market sentiment, order book depth, whale activity, and even social media trends. This real-time analysis allows the system to identify shifts in market behavior - whether trending, ranging, or highly volatile - almost instantly [1].

In trending markets, the AI emphasizes momentum indicators and breakout patterns, identifying opportunities for strong trend reversals or aggressive entries. During ranging markets, the focus shifts to support and resistance levels, generating alerts for bounce plays and mean reversion setups. When volatility spikes, the algorithms adjust stop-loss distances and position sizes to account for larger price swings, ensuring risk remains controlled even in unpredictable conditions.

Additionally, the system tracks institutional flows and whale movements, offering traders deeper insights into significant market activity. This added layer of context helps align trading strategies with major market trends, enabling traders to make more informed decisions [1].

Pros and Cons of AI Chart Alerts

AI chart alerts offer a mix of exciting opportunities and notable challenges. To use them effectively, it’s important to weigh their strengths against their potential drawbacks.

Benefits of AI Chart Alerts

One of the biggest advantages of AI chart alerts is their speed and ability to monitor multiple markets at once. Unlike humans, AI can keep an eye on countless cryptocurrency pairs simultaneously, analyzing massive amounts of data in real time. This means traders can spot opportunities across various markets without missing a beat[5][4].

Another major perk is improved accuracy. AI doesn’t just skim the surface; it digs deep, analyzing historical trends, trading volumes, social sentiment, and even news events. This comprehensive approach helps uncover trends that might go unnoticed with manual analysis[5][2]. Top-tier platforms also enforce strict quality checks to ensure the signals they generate are reliable.

Then there’s the benefit of round-the-clock monitoring. Cryptocurrency markets don’t take a break, and neither does AI. While traders sleep, these systems keep scanning for breakouts, reversals, and other significant price movements. Alerts are sent via email, Telegram, Slack, or Discord, ensuring traders receive updates on their preferred platforms[3][9].

Perhaps one of the most underrated advantages is how AI can help reduce emotion-driven decisions. Trading can get emotional - panic selling during crashes or impulsive buys during spikes are common pitfalls. AI, however, operates purely on data and logic, helping traders stay disciplined[5].

Drawbacks of AI Chart Alerts

But AI chart alerts aren’t perfect. One key issue is model limitations. No AI system can account for every market anomaly or sudden news event, which means false alerts can happen. Even the most advanced systems can falter under unpredictable conditions, like sudden regulatory shifts[2].

Another risk is over-reliance on automation. Traders who depend entirely on AI signals might miss critical market fundamentals or fail to trust their own instincts when needed[5].

Then there are technology risks. System outages, delayed notifications, or connectivity issues can leave traders in the dark, especially during volatile market swings[2].

For beginners, the complexity of these tools can be daunting. Advanced features often require technical know-how, and setting up custom alerts or interpreting confidence scores can feel overwhelming without prior experience[4].

Lastly, there’s the challenge of long-term forecasting. AI shines when it comes to short-term pattern recognition, but its ability to predict long-term trends in the volatile world of cryptocurrency is limited. Frequent model retraining is often necessary to keep up with ever-changing market dynamics[2].

Here’s a quick comparison of the benefits and limitations:

| Benefits | Limitations |

|---|---|

| 24/7 market monitoring across multiple assets | Potential for false signals and model errors |

| Real-time data processing and trend detection | Over-reliance may overlook broader market fundamentals |

| Reduces emotional decision-making | Technology risks like outages or delays |

| Consistent, disciplined signal generation | Complex setup for advanced features |

| Identifies patterns humans might miss | Struggles with long-term predictions |

| Customizable for individual strategies | Requires ongoing updates and fine-tuning |

The trick is to strike the right balance. Savvy traders don’t rely solely on AI alerts - they use them as tools to enhance their decision-making. By combining automated insights with manual analysis and solid risk management, traders can harness the strengths of AI while minimizing its weaknesses[5][4].

StockioAI's AI Chart Alert Features

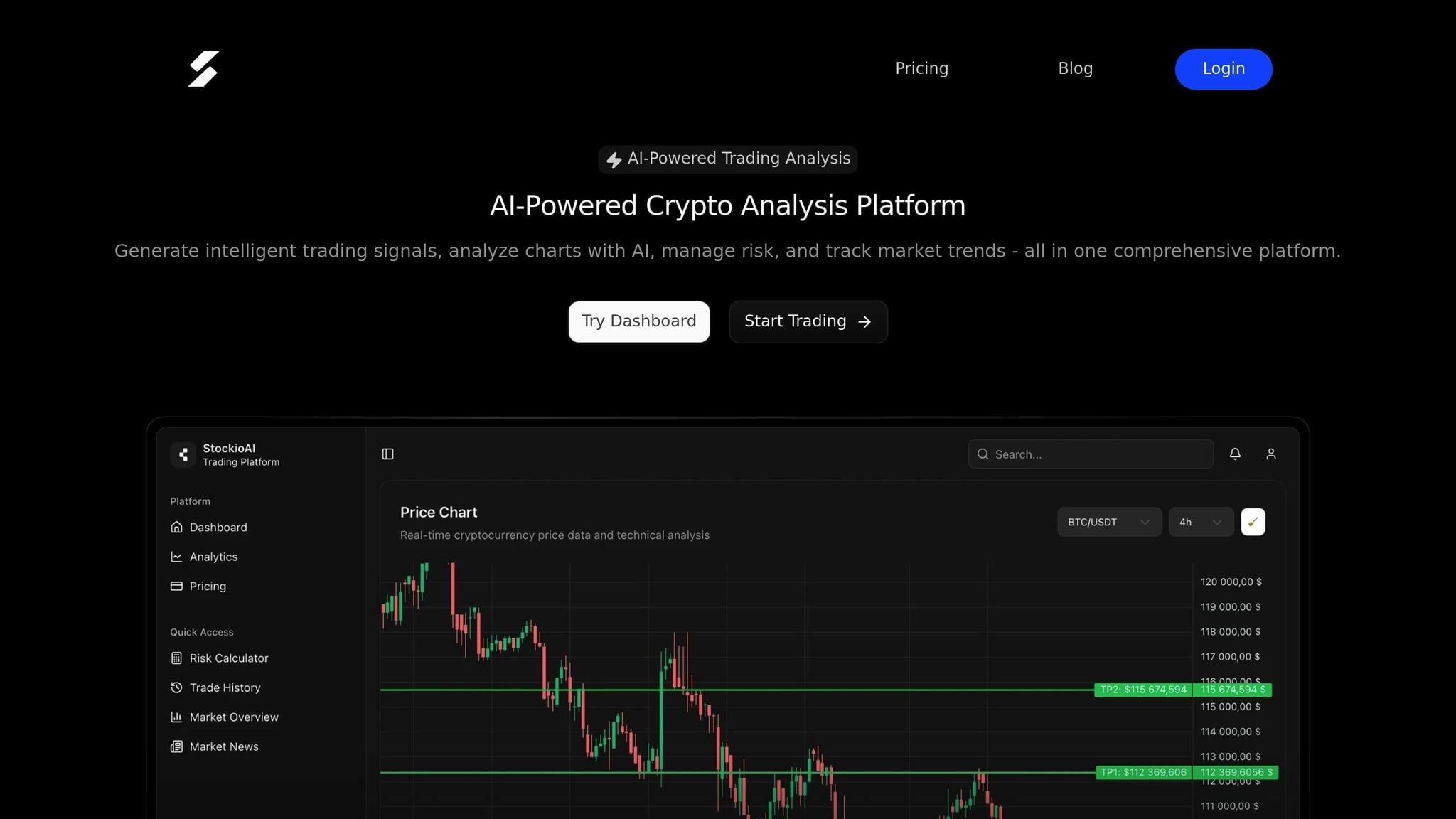

StockioAI is an AI-powered cryptocurrency analytics platform designed to simplify trading decisions. It combines real-time trading signals, in-depth technical analysis, and risk management tools, all accessible through a single user-friendly dashboard. With a focus on crypto market trends, the platform delivers precise BUY, SELL, and HOLD signals, complete with detailed entry points, stop-loss levels, profit targets, and confidence scores. Let's take a closer look at how StockioAI turns these capabilities into actionable trading tools.

Main Features of StockioAI

StockioAI’s advanced AI system excels at identifying complex chart patterns, trend reversals, and the best entry and exit points. Each signal comes with clear reasoning and specific trading parameters. The platform uses a multi-timeframe analysis approach with a 7-tier priority system. This system evaluates factors like market structure, volume, liquidity, RSI, MACD, EMA ribbons, SMA context, and price momentum. Signals from higher timeframes take precedence over lower ones, ensuring greater reliability.

Another standout feature is StockioAI’s market regime classification, which identifies whether the market is trending, ranging, volatile, or quiet. This allows traders to adjust strategies accordingly. Additionally, a conflict resolution matrix manages 15 different position-sizing scenarios based on varying market conditions.

The platform integrates seamlessly with interactive TradingView charts, offering AI-generated levels, a professional risk calculator, real-time market overviews, position tracking, and a live market news feed. Impressively, StockioAI reports a 75.0% win rate across 35 closed trades, boasting a profit factor of 2.95 [1].

Pricing Plans and Features

StockioAI provides flexible pricing options to cater to traders with different needs:

| Plan | Price | Monthly Signals | Key Features |

|---|---|---|---|

| Free | $0/month | 2 signals | Basic market insights, community support, mobile app access, educational resources |

| Starter | $49/month | 30 signals | Basic technical analysis, email support, standard indicators |

| Professional | $99/month | 300 signals | Pattern recognition, priority support, portfolio tracking, API access |

| Enterprise | $199/month | Unlimited | Multi-user access, dedicated account manager, custom AI training, white-label solutions |

The Free plan is ideal for beginners, while the Professional and Enterprise tiers are designed for serious traders and institutions requiring advanced features and tools.

What Makes StockioAI Different

StockioAI stands out by combining analytics, custom alert systems, and tailored risk controls into a single integrated ecosystem. Its platform is more than just a signal provider - it’s a complete trading solution. With tools for risk management, portfolio tracking, and real-time news feeds, all within an intuitive dashboard, StockioAI simplifies the trading process.

Specifically optimized for the fast-paced world of cryptocurrency, StockioAI’s algorithms handle the unique challenges of this market, such as 24/7 trading, high volatility, and sudden sentiment shifts. Its customizable alert system adapts to various trading styles, whether you’re day trading, swing trading, or holding long-term positions. Alerts are delivered via email, mobile notifications, or directly through integrated trading platforms, ensuring you stay informed about critical market movements.

Conclusion

AI-powered chart alerts are revolutionizing the way cryptocurrency traders approach volatile markets, offering a level of precision and confidence that would be difficult to achieve manually. These advanced systems process massive amounts of real-time data - analyzing over 60 market indicators every second - to generate actionable trading signals. This capability underscores StockioAI's mission to provide fast and accurate insights for traders.

With its ability to process such a high volume of data per second, StockioAI empowers traders to act decisively in a market that never sleeps. For cryptocurrency traders, this is especially critical. The crypto market operates 24/7, with extreme volatility and rapid sentiment shifts creating opportunities - or risks - within moments. AI-driven insights help traders maintain consistency, minimize emotional decisions, and adapt quickly to market changes[5].

However, the real advantage lies in customization and integration. Successful traders don’t rely on AI alerts passively. Instead, they fine-tune their alert parameters to align with their trading style, risk appetite, and goals. Whether you’re a day trader, swing trader, or long-term investor, platforms like StockioAI can be tailored to deliver signals that matter most to you.

StockioAI showcases how AI can transform trading. With a 75.0% win rate across 35 closed trades and a profit factor of 2.95[1], it highlights the power of combining real-time alerts, risk management tools, and AI-driven pattern recognition. This creates a comprehensive system that supports informed and effective trading decisions.

The future of cryptocurrency trading belongs to those who merge AI insights with their market expertise. While AI-powered chart alerts provide unmatched speed and consistency, the most successful traders use them as a complement to sound strategies and risk management - not as a substitute.

For traders considering this technology, the takeaway is simple: these tools are no longer optional - they’re essential for staying competitive in the fast-moving world of cryptocurrency trading. The real question is, how soon can you integrate them into your strategy?

FAQs

How do AI-powered chart alerts help traders avoid emotional decisions?

AI-powered chart alerts are a game-changer for traders, offering real-time insights based on data rather than emotions. By analyzing market trends, spotting patterns, and flagging potential opportunities, these alerts help traders stay focused and objective - free from emotional biases like fear or greed.

Take AI-driven pattern recognition, for instance. It can pinpoint critical chart patterns and signal trend reversals, giving traders the tools to make decisions rooted in analysis and hard data instead of gut reactions. This method encourages a disciplined trading approach and helps improve risk management along the way.

What customization features do AI chart alerts offer to match different trading strategies?

AI chart alerts come packed with customization options to suit different trading strategies. With tools like interactive chart analysis and AI-driven pattern recognition, traders can fine-tune alerts to match specific market conditions or their individual trading style.

These tools let you define criteria based on technical indicators, price changes, or other important metrics, ensuring that the alerts you get are perfectly aligned with your trading approach.

How does StockioAI ensure its trading signals are accurate and reliable?

StockioAI uses cutting-edge machine learning to process massive amounts of market data in real time. It pinpoints chart patterns, spots trend reversals, and highlights the best entry and exit points, giving traders clear, actionable insights.

What sets it apart is its ability to constantly learn and adjust to changing market conditions. This ever-evolving system ensures its signals stay accurate and dependable, empowering traders to make informed decisions with confidence.