Candlestick pattern detection is critical for cryptocurrency traders in the U.S., where speed and precision can determine success. AI tools now simplify this process by analyzing price movements, identifying patterns, and providing actionable trading signals in real time. Here's what you need to know:

- Candlestick Patterns: Represent price movements using opening, high, low, and closing prices, helping traders predict reversals, trends, and entry/exit points.

- AI Advantage: AI tools use machine learning (CNNs, RNNs, LSTMs) to analyze charts faster and more accurately than manual methods, with accuracy rates up to 99.3%.

- Key Features: Look for real-time alerts, integration with major U.S. exchanges, multi-timeframe analysis, automated trading signals, and risk management tools.

Quick Comparison

| Tool | Monthly Price | Patterns Detected | Real-Time Signals | Crypto-Focused | Community Features |

|---|---|---|---|---|---|

| StockioAI | $39+ | AI-driven | Yes | Yes | No |

| TrendSpider | $54+ | 150+ | Yes | Yes | No |

| TradingView | $12.95+ | 39 | Yes | Yes | Yes |

| MetaStock | $39.50+ | 56 | Yes | Limited | No |

Key Takeaway

AI tools like StockioAI, TrendSpider, TradingView, and MetaStock offer various features tailored to different trading needs. Whether you're a beginner or an experienced trader, these tools can improve accuracy, save time, and help you make informed decisions in the volatile cryptocurrency market.

I trained an AI Model to Detect Trading Candlesticks (from scratch using ViTs)

Key Features to Look for in AI Candlestick Pattern Tools

When choosing an AI-powered candlestick pattern detection tool for cryptocurrency trading, certain features can make all the difference between smart, profitable decisions and costly errors. The ideal tool should blend advanced technology with practical features that cater to the fast-moving U.S. crypto markets.

Accuracy and Real-Time Analysis

When it comes to pattern recognition, accuracy is everything. Advanced AI models can outperform traditional manual methods by a wide margin, offering precision that directly impacts trading success. In the unpredictable world of crypto, this level of accuracy can mean the difference between consistent gains and significant losses.

Real-time analysis is just as important. Top-tier AI tools continuously process massive amounts of market data - technical indicators, volume trends, support and resistance levels, market sentiment, order book depth, and even whale activity. This constant evaluation allows these tools to spot patterns as they emerge, rather than after the opportunity has already passed.

"Our intelligent trading system generates precise BUY positions based on 60+ real-time data points analyzed every second... helping you make informed decisions in volatile crypto markets." - StockioAI[1]

In fast-moving markets, timely alerts are critical. Tools that send instant notifications give traders the edge they need to act quickly on high-probability setups before conditions shift. This combination of precision, speed, and reliability helps reduce the risk of false signals, a common issue with less sophisticated systems.

To make these insights actionable, the tool must also integrate seamlessly with cryptocurrency exchanges.

Integration with Cryptocurrency Markets

For serious traders, seamless integration with major U.S. cryptocurrency exchanges is essential. The best AI tools connect directly to platforms like Coinbase, Binance, and Kraken, providing live market data and enabling automated trade execution. This integration ensures that the insights generated by the AI translate into timely, profitable trades.

Another must-have feature is multi-timeframe analysis. Leading platforms can detect patterns across different time intervals, from short-term scalping opportunities to long-term trend formations. For instance, TrendSpider identifies over 150 candlestick patterns across multiple timeframes simultaneously[2][4], while TradingView supports automated analysis for 39 candlestick patterns across global markets[3].

What sets the top tools apart is their ability to analyze crypto-specific data. Unlike traditional stock market analyzers, these tools track factors like social media sentiment, institutional flows, order book dynamics, and whale activity - all of which can have a significant impact on cryptocurrency prices.

Additional Features and Pricing

Beyond detecting patterns, AI tools often enhance the entire trading process. Many offer automated trading signals with clear BUY, SELL, and HOLD recommendations, complete with suggested entry points, stop-loss levels, and profit targets. These signals often include confidence scores and risk assessments, giving traders the information they need to make smarter decisions.

Backtesting is another valuable feature, allowing traders to test strategies against historical data before putting real money on the line. Risk management tools, such as position sizing calculators and stop-loss optimizers, further help traders manage their exposure. Advanced platforms may also include portfolio tracking, market news feeds, and API access for more technical users.

| Feature | TrendSpider | TradingView | StockioAI |

|---|---|---|---|

| Monthly Price (USD) | $54 | $12.95 | $39-$119 |

| Patterns Recognized | 150+ | 39 | AI-powered recognition |

| Real-Time Analysis | Yes | Yes | 60+ data points/second |

| Backtesting | Yes | Yes | Advanced analytics |

| Risk Management | Yes | Yes | Comprehensive tools |

Clear pricing in U.S. dollars is another plus, making it easy for traders to plan their budgets. The best platforms avoid hidden fees or confusing currency conversions, which can eat into profits. Many also offer free trials, letting users test the features before committing to a subscription.

While not essential, educational resources and community features can add extra value. Tutorials, market analysis, and forums can help users sharpen their trading skills and stay updated on market trends, making the tool even more beneficial in the long run.

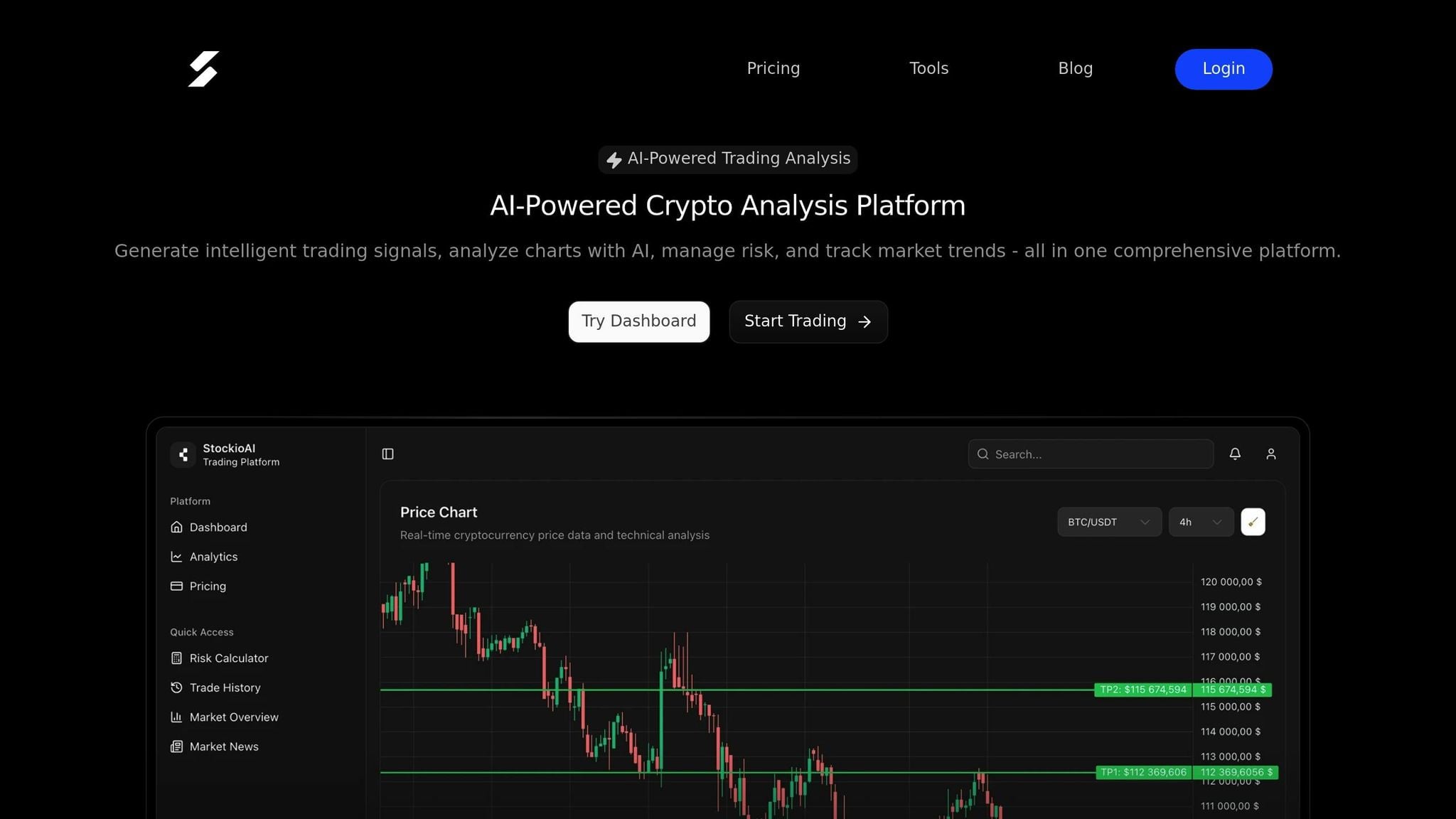

StockioAI: AI Tool for Crypto Traders

StockioAI is an advanced analytics platform designed for cryptocurrency traders, providing precise candlestick pattern detection and actionable trading insights. According to the platform, it achieved a 75% win rate and a profit factor of 2.95 over 35 closed trades. By processing more than 60 data points every second, StockioAI not only identifies patterns but also delivers consistent performance to enhance trade execution [1].

Real-Time Pattern Detection and Trading Signals

StockioAI delivers real-time trading signals by continuously analyzing market conditions:

- BUY signals: Generated when bullish candlestick patterns align with favorable conditions. Each signal includes recommended entry points, stop-loss levels, profit targets, and a confidence score.

- SELL signals: Designed to identify optimal exit points by evaluating resistance levels and momentum indicators.

- HOLD recommendations: Offered during consolidation phases, helping traders avoid premature exits caused by temporary market fluctuations.

These signals form the foundation of StockioAI's feature set, which is tailored specifically to the needs of U.S. traders.

Additional Features for U.S. Traders

StockioAI integrates seamlessly with TradingView charts, overlaying AI-generated levels to help traders visualize patterns and verify signals. Risk management tools, such as USD-based position sizing and stop-loss calculators, ensure traders can manage their exposure effectively.

The platform also supports multi-timeframe analysis, enabling users to examine candlestick patterns across different chart intervals - from short-term trades to longer-term trends. Additionally, an integrated news feed and AI-driven analytics provide sentiment analysis, trend predictions, and timely market updates relevant to U.S.-based cryptocurrency exchanges.

With these tools, StockioAI aims to simplify trading decisions while offering flexible pricing plans.

Pricing and Plans

StockioAI provides transparent pricing in U.S. dollars, with multiple tiers to suit different trading needs:

| Plan | Monthly Price | Key Features | Trading Signals |

|---|---|---|---|

| Free | $0 | Basic market insights, educational resources | 2 AI trading signals |

| Starter | $49 | Basic technical analysis, email support | 30 signals/month |

| Professional | $99 | Advanced pattern recognition, portfolio tracking, API access | 300 signals/month |

| Enterprise | $199 | Multi-user access, custom AI training, dedicated support | Unlimited |

The Starter plan is ideal for traders new to AI-powered tools, while the Professional plan caters to active traders seeking advanced features. The Enterprise plan is tailored for institutional users, offering benefits like multi-user access and custom AI model training.

"StockioAI revolutionized my trading strategy. The AI insights helped me achieve consistent 18% monthly returns."

- Jordan Martinez, Quantitative Trader [1]

Other AI Tools for Candlestick Pattern Detection

In addition to StockioAI, several other AI-driven platforms offer powerful tools for candlestick pattern detection tailored for U.S. traders. Each platform brings its own strengths, showcasing the diverse ways AI is shaping the trading landscape.

TrendSpider: Automated Multi-Timeframe Analysis

TrendSpider leverages advanced machine learning to identify over 150 candlestick patterns, trendlines, and Fibonacci levels across multiple timeframes. This feature is particularly handy for traders looking to analyze everything from short-term (1-minute) scalping opportunities to long-term weekly trends - an essential capability in the unpredictable crypto market [2][3]. Beyond pattern detection, TrendSpider includes automated backtesting and trading bots, which integrate seamlessly with brokers. This allows traders to execute trades based on identified patterns without needing to monitor the market constantly. The platform is priced at $54 per month (or $37.80 per month when billed annually) and boasts a 4.8/5 rating for its accuracy and ease of use [2][3].

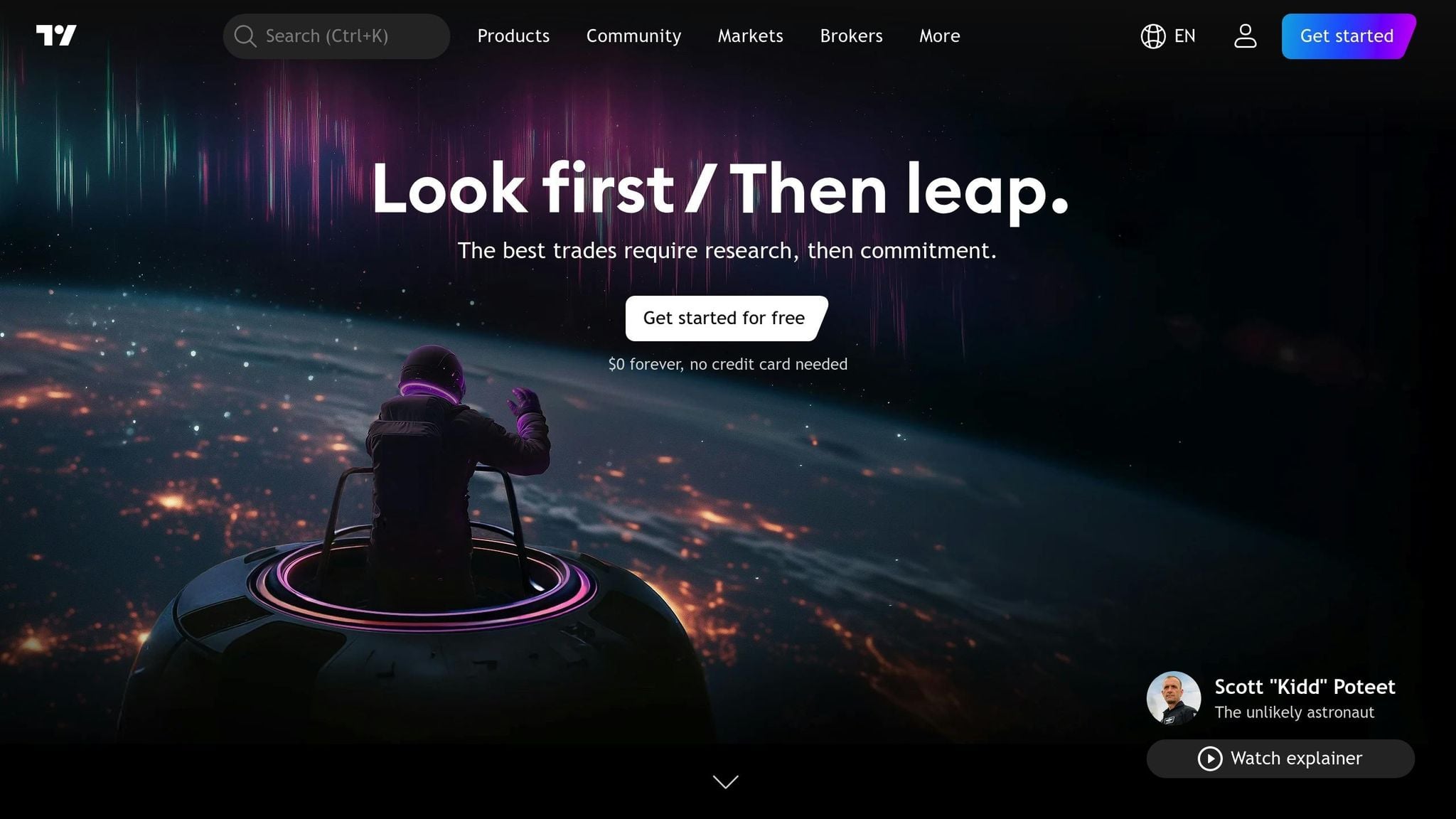

TradingView: Charting with a Community Focus

TradingView provides automated recognition for 39 candlestick patterns using AI algorithms that continuously scan charts. Its intuitive interface, extensive coverage of U.S. crypto exchanges, and built-in broker integration make it a go-to platform for many traders [3]. One of its standout features is its active trading community, where users share custom scripts, tools, and strategies. This collaborative environment fosters real-time feedback and improvement of pattern recognition methods. TradingView's pricing starts at $12.95 per month for basic plans (or $10.85 per month with annual billing), and it also offers a free tier with essential features. The platform is rated 4.8/5 for blending advanced detection capabilities with community-driven insights [3].

MetaStock: Professional-Level Technical Analysis

MetaStock is designed for professional traders who demand advanced analytical tools. It uses AI to detect 56 candlestick patterns while offering robust market scanning and real-time news integration [2]. The platform excels in combining pattern detection with a wide range of technical indicators, enabling traders to create sophisticated trading systems. Additionally, its news feeds provide sentiment analysis and updates relevant to U.S. crypto markets. With global market coverage and customizable indicators, MetaStock is ideal for traders seeking a deeper analytical edge. Pricing starts at $39.50 per month (or $25 per month with annual billing), and it holds a 4.3/5 rating for its pattern recognition capabilities [2].

| Tool | Monthly Price | Patterns Detected | Key Strength | Rating |

|---|---|---|---|---|

| TrendSpider | $54 | 150+ | Multi-timeframe automation | 4.8/5 |

| TradingView | $12.95 | 39 | Community insights | 4.8/5 |

| MetaStock | $39.50 | 56 | Professional analytics | 4.3/5 |

Comparison of AI Tools for Candlestick Pattern Detection

When it comes to selecting the right AI tool for candlestick pattern detection, cryptocurrency traders have a lot to consider. Each platform offers distinct features, including pattern recognition, real-time analysis, and tailored functionalities.

Let’s dive into how these tools handle pattern recognition. TrendSpider leads the pack with its ability to detect over 150 candlestick patterns using advanced machine learning algorithms, making it a standout choice for traders seeking extensive coverage. StockioAI, though designed specifically for cryptocurrency markets, does not disclose the exact number of patterns it recognizes but leverages AI-driven technology for detection. TradingView identifies 39 key patterns with dependable automated detection, while MetaStock covers 56 patterns and integrates them with its robust technical analysis tools.

In the fast-moving world of crypto trading, real-time analysis and speed are non-negotiable. StockioAI shines in this area, providing continuous data processing and instant BUY, SELL, and HOLD signals [1]. TrendSpider offers versatility with multi-timeframe analysis, ranging from 1-minute charts to weekly trends. TradingView and MetaStock also provide real-time capabilities, though MetaStock leans more toward traditional markets with some crypto support.

Pricing is another factor to weigh. TradingView offers a budget-friendly option starting at $12.95 per month, including a free tier. StockioAI’s plans begin at $39 per month (billed annually, with 30 signals), while TrendSpider starts at $54 per month. MetaStock’s pricing varies, starting at $39.50 per month and going as high as $265 per month for its advanced packages.

| Feature | StockioAI | TrendSpider | TradingView | MetaStock |

|---|---|---|---|---|

| Patterns Detected | AI-powered (count not specified) | 150+ | 39 | 56 |

| Monthly Price | $39+ | $54+ | $12.95+ | $39.50+ |

| Crypto-Specific | Yes (dedicated) | Yes | Yes | Limited |

| Real-Time Signals | Yes | Yes | Yes | Yes |

| Free Option | Yes (3 signals) | No | Yes | No |

| Risk Management | Yes | No | No | No |

| Community Features | No | No | Yes | No |

| Automated Trading | Yes | Yes | Yes | No |

| Rating | Not rated publicly | 4.8/5 | 4.8/5 | 4.3/5 |

Beyond the basics, specialized features make these platforms stand out for different types of traders. StockioAI includes risk management tools like risk calculators and portfolio tracking, designed to help traders navigate crypto market volatility. TradingView sets itself apart with its community-driven approach, giving users access to shared scripts and strategies from thousands of traders. TrendSpider appeals to systematic traders with automated backtesting and multi-timeframe analysis. On the other hand, MetaStock’s professional-grade tools cater to institutional traders, offering advanced technical analysis.

Market integration is another key differentiator. StockioAI connects directly with major cryptocurrency exchanges, providing crypto-specific analytics. TradingView integrates with both U.S. and global crypto exchanges. TrendSpider supports both crypto and traditional markets, while MetaStock primarily focuses on stocks and forex, with limited crypto options.

Ultimately, the right tool depends on your trading style, budget, and goals. StockioAI is a strong choice for crypto-focused traders, while TradingView’s social features might appeal to those seeking community insights. Systematic traders may lean toward TrendSpider for its automation, and professionals might find MetaStock’s advanced analytics worth the investment. Use this comparison to pinpoint the platform that aligns best with your needs.

Choosing the Right AI Tool for Your Trading Strategy

The cryptocurrency market moves at lightning speed, making it nearly impossible for manual analysis to keep up. For U.S. traders aiming to stay competitive in such a volatile environment, AI-powered candlestick pattern detection tools are becoming indispensable. These platforms can process massive amounts of data in real time, spotting patterns and opportunities that manual methods might take hours - or even days - to uncover.

Speed is only part of the equation, though. Precision matters just as much. Advanced AI models deliver a level of accuracy that traditional manual techniques simply can't match, leading to better outcomes for traders.

Take StockioAI, for example. Its real-time analytics are designed to support smarter trade decisions. By integrating these AI-driven insights into their strategies, traders gain a solid analytical foundation to navigate unpredictable markets with confidence.

Beyond analytics, StockioAI also offers robust risk management tools. These features help traders maintain discipline with position sizing and exit strategies. With a reported 75.0% win rate and a Profit Factor of 2.95, StockioAI showcases the practical benefits of AI-driven insights for improving trading performance[1].

For U.S. traders, StockioAI is tailored to meet local needs. It supports dollar formatting and complies with domestic trading regulations, making it both user-friendly and legally sound.

When it comes to pricing, StockioAI offers flexibility to suit different trading styles. Beginners might start with the free plan, which includes 2 AI trading signals and basic market insights. More experienced traders can opt for the Professional plan at $99 per month, which offers 300 AI trading signals, advanced pattern recognition, and portfolio tracking tools.

Ultimately, starting with a proven AI tool can transform your trading strategy. These platforms remove emotional bias, process vast amounts of data simultaneously, and provide objective, data-driven signals. For U.S. traders serious about succeeding in the cryptocurrency market, AI-powered pattern detection isn't just helpful - it’s becoming essential.

FAQs

How do AI tools make candlestick pattern detection faster and more accurate than manual analysis?

AI tools bring a new level of precision to candlestick pattern detection by using machine learning algorithms to analyze massive datasets with speed and accuracy. They can spot intricate patterns and trends that might slip past even the most experienced trader, minimizing the risk of human error.

With the ability to provide real-time insights and trading signals, these tools not only save time but also empower traders to make quicker, more informed decisions. Their efficiency and accuracy make them a powerful ally in the fast-paced world of cryptocurrency trading.

What key features should I look for in an AI tool for cryptocurrency trading in the U.S.?

When selecting an AI tool for cryptocurrency trading, it's important to focus on features that streamline your decision-making and improve efficiency. Key elements to look for include AI-powered pattern recognition to spot candlestick patterns, real-time market data for the latest insights, and technical analysis tools to help track trends and price movements.

It's also wise to choose tools that offer risk management features, such as stop-loss calculators, and support and resistance zone identification to fine-tune your trading strategies. These features are crucial for staying on top of the ever-changing cryptocurrency market.

How does real-time AI analysis improve trading decisions in the fast-moving cryptocurrency market?

Real-time AI analysis gives traders a crucial edge by delivering instant insights into market trends, price shifts, and potential turning points. This capability enables quicker, more informed decisions in the fast-moving world of cryptocurrency trading.

By spotting key patterns - such as emerging support and resistance levels - AI allows traders to act swiftly in response to market changes. This not only helps minimize risks but also opens the door to greater profit opportunities. With precise, up-to-the-minute data, AI tools simplify decision-making in an otherwise unpredictable trading landscape.